Japan

Wood Products Prices

Dollar Exchange Rates of 10th

March 2016

Japan Yen 113.84

Reports From Japan

Five years on

March 11, 2016 marked five years to the day since the

massive 8.9 magnitude earthquake struck eastern Japan.

Five years on recovery work is still on-going but still

around 60,000 people are still living in ‘temporary’

housing units the condition of which has deteriorated over

the years.

Residents in the stricken area were evacuated because of

the damage caused by the quake and tsunami and because

of the radioactive contamination due to the nuclear melt

down. When surveyed everyone in the housing units said

they want to escape the cramped and inconvenient living

conditions as soon as possible.

Two factors have been cited for the delays in rehousing

the displaced, first a shortage of building materials (hard

to comprehend in a country like Japan) and secondly the

desire of those who lost everything to rebuild and reestablish

the community in which they lived before the

disaster.

The government has begun lifting the compulsory

evacuation orders for some communities in the former

radiation contaminated areas and plans to remove any

remaining restrictions in March of next year. However,

many evacuees are reluctant to return fearing radiation

remains high despite the years of decontamination effort.

To get a sense of the task facing Japan see:

https://www.google.co.jp/search?q=japan+earthquake+and+tsuna

mi&espv=2&biw=1034&bih=619&source=lnms&tbm=isch&sa=

X&ved=0ahUKEwjd44SiwLfLAhVCGqYKHfBYBn4Q_AUIBi

gB#imgrc=mKVJqG2DWnvn9M%3A

Consumer sentiment stalls

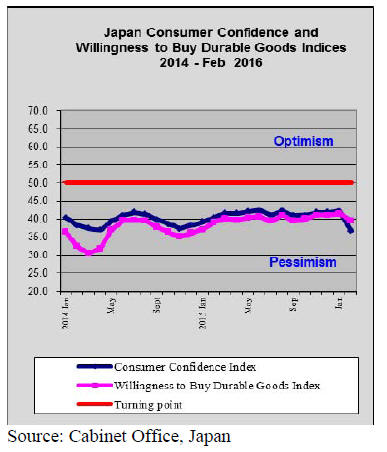

Japan’s consumer confidence index for February fell to a

one-year low setting another challenge for the government

and the central bank.

The overall index for February was 40.1 (50 marking the

transition from pessimism to optimism). This was the

sharpest decline for years. The livelihood index dropped

from 40.9 to 38.5 while the willingness to buy durable

goods, an indicator for manufactured wood product sales,

dropped to below 40.

The Cabinet Office statement with the data release said

consumer sentiment was stalling and that this prompted a

downward revision of forecasts. The Bank of Japan

introduced negative interest rates in January in a fresh

drive to reflate the economy out of stagnation and help

accelerate inflation - now hovering around zero - to its

ambitious 2 percent target.

See:

http://www.esri.cao.go.jp/en/stat/shouhi/shouhi-e.html

Concern that consumption tax increase could

trigger

another recession

Japan is set to raise the consumption tax by a further 2% to

10% in April 2017 which, because of the current economic

situation in the country, has many politicians worried that

an increase could trigger another protracted recession.

However, Bank of Japan (BoJ) Governor, Haruhiko

Kuroda, is a stanch advocate of the increase and has said

the impact on the economy of the proposed increase is

expected to be much less than that seen after the 3%

increase in 2014 which sent the Japanese economy into

recession. But still, one of the advisers to the Prime

Minister has called for a postponement.

In related news the BoJ Governor has defended the

decision to adopt a negative rate policy saying this will

take time to have an impact.

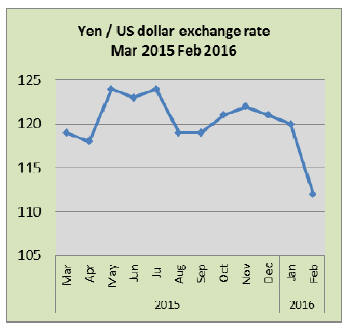

The main concern of the BoJ is to maintain the yen/dollar

exchange rate at end 2015 levels but the yen has

strengthened about 5.5 percent this year despite the

negative rate policy.

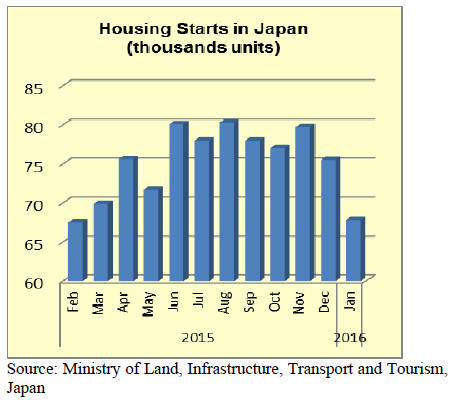

Housing starts drop in January despite fall in

mortgage interest rates

January housing starts were one of the lowest for the past

13 months and only just rose above the dismal

performance of the sector in the first two months of 2015.

Construction orders received by the top builders fell

sharply (-14%) in January in contrast to the rise seen at the

end of 2015. This decline in orders coupled with

weakening consumer sentiment does not bode well for the

sector which had expected to get a boost from the lower

mortgage rates being offered since the Bank of Japan

adopted negative interest rates.

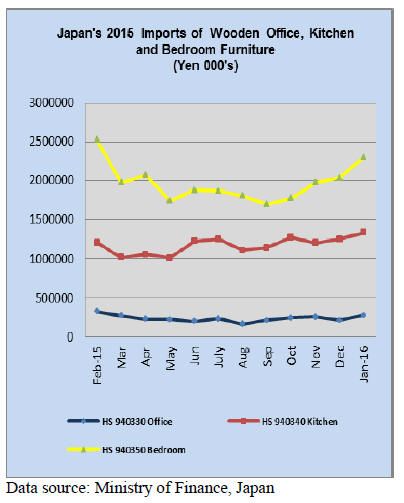

Japan’s furniture imports

The value of Japan’s 2015 imports of wooden office,

kitchen and bedroom furniture dipped in the first half of

the year and then began to rebound. Bedroom furniture

imports showed a strong performance in the last quarter of

2015 and this extended into January 2016.

There was an increase in kitchen furniture imports in the

second half of 2015 and, like bedroom furniture, this

upward trend continued into January 2016.

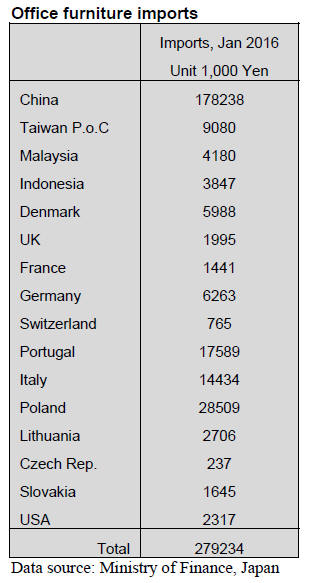

Office furniture imports (HS 940330)

Year on year January 2016 office furniture imports were

down 27% but were the highest since March 2015.

China, Poland and Portugal dominate Japan’s office

furniture imports accounting for around 80% of all imports

of this category of furniture. January 2016 imports from

China were down 15% year on year and there was a

massive decline in imports from Portugal. On the other

hand, imports from Poland were up by a factor of 4

compared to January 2014.

A year earlier imports from Italy lifted the country

to the

third raked supplier but in 2016 office furniture shipments

to Japan were significantly lower.

Kitchen furniture imports (HS 940340)

In contrast to the mixed performance of office furniture

shipments to Japan, January 2016 imports of kitchen

furniture were up 16% year on year with Vietnam,

Philippines and China the top three suppliers accounting

for around 80% of all shipments of kitchen furniture.

January 2016 shipment from Vietnam, the top supplier,

rose 6% while shipments from the second ranked supplier,

Philippines jumped 42%. China was the third ranked

supplier in January 2016 and saw shipments rise 24%.

In January 2016 suppliers in SE Asia accounted for 76%

of Japan’s kitchen furniture imports.

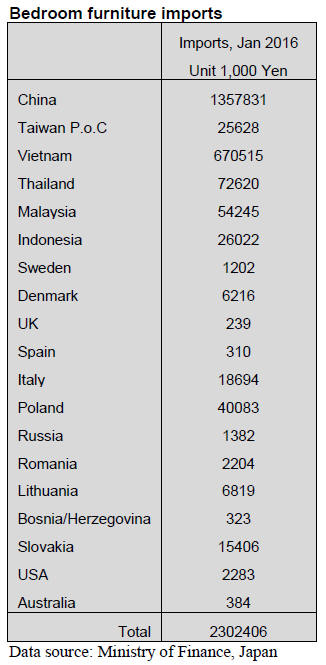

Bedroom furniture imports (HS 940350)

Japan’s imports of bedroom furniture continue to rise, a

trend that began in September 2015. Year on year,

January 2016 imports were down 2% but were the highest

since February 2015.

The main supplier at 59% of all bedroom furniture imports

was China, followed by Vietnam (29%) and Thailand, a

distant 3%.

China’s January shipments of bedroom furniture were

virtually unchanged from a year earlier whereas both

Vietnam and Thailand saw shipments fall.

Trade news from the Japan Lumber Reports (JLR)

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

Degree of self-sufficiency revised again

A degree of self- sufficiency of domestic wood is

reviewed and revised. The Forestry Agency disclosed a

draft of forest and wood industry basic plan for 2016.

Since the supply in 2015 does not seem to achieve an

initial target of 28,000,000 cbms, a target of 2020 is

reduced from initial target of 39,000,000 cbms down to

32,000,000 cbms and the target set for 2020 to make a

degree of self-sufficiency of 50% is postponed by five

years.

The forest and forest industry basic plan is the national

basic policy of measures on forestry, which is roughly

reviewed in every five years and suggests target of forest

conditions and wood use volume five, ten and twenty

years in future.

The plan made in July 2011 aimed a degree of

selfsufficiency

of 50% with target of wood supply of

28,000,000 cbms by 2015 and 39,000,000 cbms by 2020

but the supply in 2014 was 24,000,000 cbms, far from the

target although it increased significantly from 18,000,000

cbms in 2009 to 24,000,000 cbms. Therefore, the target is

revised based on reality.

Sumitomo Corporation’s capital participation in Brazil

Sumitomo Corporation (Tokyo) announced that it decided

to make capital participation to the world largest pellet

manufacturing company in Brazil. Raw material is waste

sugar cane.

Sumitomo has been enlarging biomass businesses and

thinks waste sugar cane is the most promising renewable

resource, which enlarges source of renewable energy.

The company Sumitomo invests is Cosan Biomassa S.A.,

a subsidiary company of the largest sugar company, Cosan

S.A. Industria e Comercio (San Paulo, Brazil).

Cosan Biomassa is fuel pellet manufacturing company

with raw materials of strained lees of sugar cane (pagas)

and stalks and leaves left in the field after harvest. It has

started the operation in last September.

North American lumber import in 2015

Total lumber import from North America in 2015 was

2,339,457 cbms, 1% less than 2014. This is two straight

year’s decline from previous year. Although new housing

starts in 2015 increased over 2014, import of both North

American and European lumber decreased.

Lumber import did not drop as much as logs from North

America but compared to recent peak year of 2013, it was

18% drop.

Log import from North America in 2015 decreased by

17% but lumber import dropped only by 1% because SPF

lumber increased by 3.1%. SPF lumber takes more than

half of lumber import. 99.7% of SPF lumber was from

Canada with 1,346,291 cbms, 3.2% more. Next to SPF,

hemlock lumber was the second largest from Canada at

291,090 cbms, 11.1% less then Douglas fir was third at

234,660 cbms, 3.6% more.

North American log import in 2015

Log import was 2,565,063 cbms, 17.1% less. This is the

lowest since 2010. Drop of log import from Canada was

30.8% with 802,687 cbms. It was the most noticeable

change while drop of log import from the U.S.A. was only

by 8.8% with 1,762,000 cbms so the share of logs from the

U,S.A. was 68.7% from 62.5% in 2014.

The reason of decline of Canadian log import is that

Japanese plywood mills had production curtailment

program in the second half of last year so the demand of

Canadian Douglas fir logs, which is used for long length

plywood, sharply decreased. Canadian Douglas fir log

volume was 623,000 cbms, 36.5% less.

Total Canadian log import volume of 802,000 cbms was

the lowest since 2009 when the housing starts dropped

down to 780,000 units after the Lehman shock.

Douglas fir logs from the U.S.A. was 1,693,000 cbms, 8%

less. Share of Douglas fir logs from the U.S.A. increased

to 66% but strong dollar, weak yen pushed import cost up

so import of all the other species from the U.S.A. largely

declined.

By species, hemlock import dropped by nearly 10%.

Canadian volume was 125,000 cbms, 6.3% less then

hemlock from the U.S.A. was only 4,136 cbms, 56.2%

less. Yellow cedar (cypress) logs decreased by 45.3% with

9,635 cbms from Canada, 34.7% less and 4,085 cbms from

the U.S.A,, 60.5% less. The demand for imported cypress

dropped after domestic cypress sill prices declined and

took imported cypress market.

Western red cedar increased by 72%. 2,559 cbms, 34.8%

less from the U.S.A. while 7,043 cbms from Canada,

325% more.

European lumber import in 2015

Import of European softwood lumber in 2015 was 2,384

M cbms, 4.6% down from 2014. Although the demand

was slow in Japan, European lumber supply exceeded that

of from North America of 2,268 M cbms and it kept the

top position of softwood lumber import for las tthree

years.

The market of structural laminated lumber and small

common lumber was in slump reflected by sluggish

demand in 2015. Import of main items of lamina and stud

failed to increase the volume but the volume did not drop

so much compared to 2014.

Lamina import did not drop so much because precutting

plants shied away from imported products in fear of

market price drop and shifted to use more domestic

laminated lumber, which has much shorter delivery period

so domestic laminated manufacturers were busy, which

supported rather steady import of lamina.

However, export prices of lamina stayed low, particularly

on whitewood. Sweden, which is one of major lamina

supplying sources, dropped the volume for Japan.

Finland is the largest supply source for Japan with 35%

share in total imported volume. The supply of lumber

including lamina from Finland is expanding as UPM

shifted to concentrate on lumber business.

Plywood

Shipment of domestic softwood plywood continues active.

Increase of shipment for precutting plants since last fall

continues.

The movement in distributing channel had been rather

quiet but in last December, the supply was short and

precutting plants looked for the supply in distribution

channel so wholesalers got busy and tried to secure the

supply.

Precutting plants accommodate small production items

like 28 mm thick panel, panel with tongue and groove with

each other but by last December, such tightness ended.

Until last December, delivery time from plywood mills

was uncertain but now ordered items are delivered in a

month.

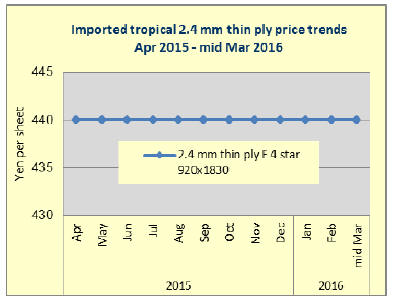

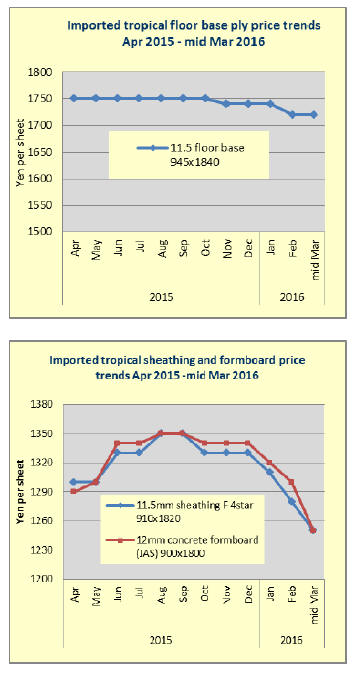

Compared to busy domestic softwood plywood market,

imported plywood market continues weak.

The movement of imported plywood slowed down since

last August then there were some movements in December

by some dumping prices.

Basically, the demand for imported plywood decreased so

the dealers buy minimum volume only so they have no

intention to buy with higher prices to secure the volume.

Actually buyers wait until the prices drop by inventory

disposition.

Lower prices stimulate the movement but the volume is

limited. The importers are anxious to have more sales

before the book closing but pushing sales mean loss. The

prices have been edging down little by little.

Russian logs and lumber import in 2015

Decline of softwood log import from Russia continues.

Total volume of log import of red pine, larch and

whitewood dropped less than 160 M cbms. Since export

duty rules on softwood logs started in 2007, sawmills in

Japan lost interest on Russian logs and closures have

continued and the market for Russian logs is practically

gone.

Meantime, Russian lumber has not established solid

market. Recovery of the demand in 2015 from drop by the

consumption tax hike did not stimulate the demand so the

total was less than 2014.

Import of whitewood logs was only four months of the

year. Larch is used for plywood and it has steady market

but it competes with North American Douglas fir and

domestic cedar.

|