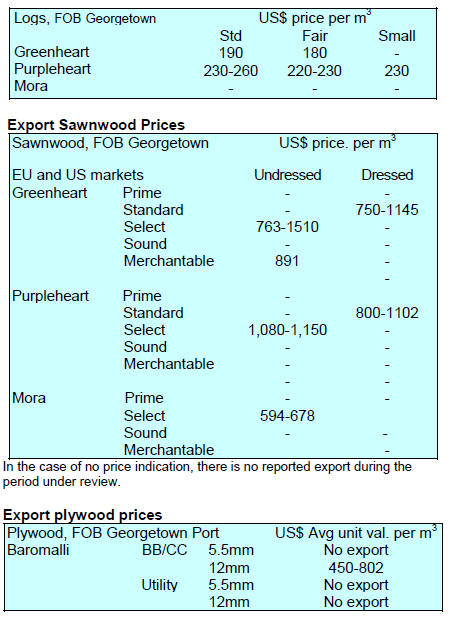

2. GHANA

Forestry features in 2016 budget

The Minister of Finance, Mr. Seth Terker, has presented

the 2016 budget to parliament. The targets for 2016 focus

on the following:

real GDP (including oil) growth of 5.4%;

non-oil real GDP growth of 5.2%;

an end year inflation target of 10.1%;

an overall budget deficit equivalent to 5.3% of

GDP; and

achieving international reserves of not less than 3

months of imports

The major highlights for the forestry and timber sectors

are as follows:

The new Public Wood Procurement Policy and

the revised Forestry Development Master Plan

will be implemented along-side the Forest and

Wildlife Policy of 2012.

The Forestry Commission (FC) will continue

with policy and legislative reforms in the forestry

sector.

The FC will in 2016, continue with the

maintenance and management of all forest

plantations (2314 ha established in 2015), under a

Public-Private Partnership (PPP).

The FC will continue the promotion of the

utilisation of lesser used timber species and the

development of the bamboo and rattan industry.

The FC will be well resourced to intensify law

enforcement and deployment of additional more

Rapid Response Teams (RRTs) across the

country to stem illegal activities, especially

chainsaw operations.

A Consolidated Wildlife Bill, which is expected

to make wildlife laws and management more

effective and efficient across the country, has

been approved by Cabinet.

Implementation of the Voluntary Partnership

Agreement (VPA) with the EU will continue.

Over 90 percent of the wood tracking system has

been completed and rolled out to ensure that only

legally produced timber is exported to the EU

market from Ghana, will continue.

The single eco-tourism facility project located in

the country*s capital will continue in 2016.

The 2016 budget avoids imposing new taxes but rather

focusses on tightening tax policies by streamlining

exemptions and avoiding revenue leakages.

Lack of business confidence holds back investment in

manufacturing

In another development the Monetary Policy Committee

(MPC) of the Bank of Ghana, after its 67th annual

meeting, increased its policy rate to 26%, up from the

previous 25%.

According to the Statistical Service, Ghana's producer

price inflation fell to 2.8% in October from a revised 4.8%

in September, continuing a downward trend. The fall

reflects apparent progress in stabilising the economy.

Ghana is following an International Monetary Fund aid

programme to resolve problems that include consumer

inflation persistently above target.

The Association of Ghana Industries (AGI) and

manufacturing companies have expressed concern on the

current state of the manufacturing industries and urged

government to focus on raising confidence in the private

sector to encourage higher investment.

3. MALAYSIA

Winners from weaker ringgit

Malaysian exporters, especially furniture makers, are

benefitting from the continuing weak ringgit. At the

current rate of over RM 4.25 to the US dollar the ringgit

has weakened around 27% in the year.

This year furniture exports are already up around 20%.

Sales in June were up 18%, they were up 20% in July and

almost 15% in August compared to the same months last

year. In terms of value, June exports were worth RM 755.9

million, RM 791 million in July and RM 835.6 million in

August. The USA was the biggest export market with

January to July exports worth RM 1.34 billion.

Plywood exports have laso been big winners as sales in the

first eight months totalled RM 3.4 billion, well up on the

RM 2.9 billion for the whole of 2014.

Standard for forest management up for review

The Malaysian Criteria and Indicators for Forest

Management Certification MC&I (Natural Forest), the

standard used for forest management certification of the

natural forest under the Malaysian Timber Certification

Scheme (MTCS) since July 2012, is now due for a review.

According to the MTCS a technical document &Rules on

Standard Setting Process for Development of Timber

Certification Standards*, the forest management standard

is to be reviewed at least every five years.

The review of the MC&I (Natural Forest) is scheduled for

conclusion in 2017 as it is anticipated that review process

would take 22 months.

MTCC has indicated that the upcoming review of the

MC&I(Natural Forest) will consider merging and

incorporating this with the MC&I Forest Plantation.

Heart of Borneo initiative gets Federal funding

The Natural Resources and Environment Minister, Wan

Junaidi Tuanku Jaafar, has said the Malaysian Federal

Government is committed to the Heart of Borneo (HoB)

initiative and will continue to support Sabah and Sarawak

in the implementation of various projects and activities

under this initiative.

The Minister said HoB initiative is important for the

national image and will directly contribute to improved

forest management. The Federal government has

reportedly allocated about RM34.46 million for HoB

support.

New era in Sarawak/NGO relationships

The state government is enhancing collaboration with nongovernmental

organisation*s that share the same agenda of

conserving the state*s rich forest resources to ensure not

only systematic management and conservation but also

one that is sustainable while upholding the state*s good

reputation internationally.

The chief minister also stressed the need for Sarawak to

intensify measures to ensure effective management and

conservation of forest resources as part of the global

efforts to counter global warming and degradation of the

environment.

Intensifying enforcement of forest laws and regulations to

stamp out illegal harvesting is a major objective in the

State. In this regard, the State Forestry Department has

achieved success since strengthening enforcement and

collaborating with other agencies.

Reduced import duties in S. Korea a boost to plywood

manufacturers

Plywood exports from Sarawak to South Korea increased

significantly after South Korea cut in anti-dumping duties

by more than half to 3.08% from 6.43%. One company,

Jaya Tiasa, saw an 11% rise in sales to South Korea, its

main market, over the twelve months to June this year.

The Korean Trade Commission (KTC) imposed antidumping

duties ranging from 5.12% to 38.1% on

Malaysian plywood for three years from February 2011.

Duties were placed on exports from 8 Sarawak plywood

manufacturers and one from Sabah after the Korean Wood

Panel Association argued these companies were selling

below cost and thus undermining South Korean producers

of plywood. Following a three-month review the South

Korean authorities decided to extend the duties but at a

reduced rates from the middle of last year.

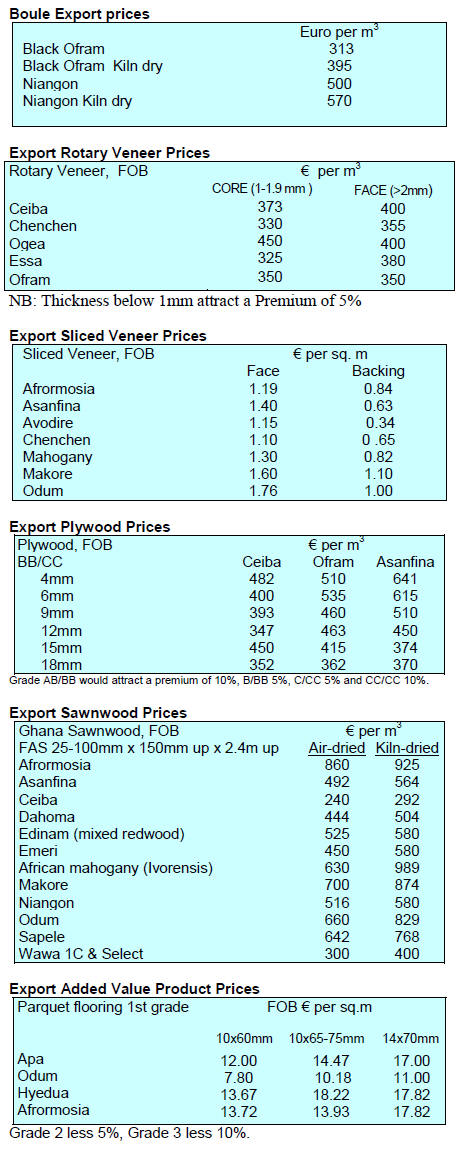

Plywood export prices

Plywood traders in Sarawak reported export prices:

Floor base FB (11.5mm) US$ 570/cu.m FOB

Concrete formboard panels CP (3* x 6*)

US$ 520/cu.m FOB

Coated formboard panels UCP (3* x 6*) US$ 600/cu.m

FOB

Standard panels

S Korea (9mm and up) US$ 400 每 410/cu.m FOB

Taiwan (9mm and up) US$ 410/cu.m FOB

Hong Kong US$ 420 FOB/cu.m

4. INDONESIA

Furniture exporters 每 No to relaxing

SVLK equirements

Wood product exporters in Indonesia have voiced concern

over the decision of the Ministry of trade to allow export

of a range of downstream wood products without SVLK

certification. This, say exporters, will undermine the

advances made in overseas markets.

The latest information from the Ministry of Environment

and Forestry shows that wood product exports to the end

of October were worth over US$10 billion well up on the

US$ 6 billion for the whole of 2014.

Putera Parthama, DG Sustainable Production and Forest

Management, said the increase in exports was due as much

to the implementation of reforms in the forestry sector as

to an improved global economy.

However, he did acknowledge that the SVLK issue is

of

concern to SMEs in the timber sector.

Many manufacturers and exporters say any relaxation of

the requirements for SVLK certification will undermine

their marketing efforts and set back Indonesian wood

product export growth.

The Indonesian Ministry of Trade recently revised

Regulation No. 97/2014 on industrial forest products

which requires all timber exporters to obtain SVLK

certification and issued Regulation No. 89/2015 as a

deregulation measure.

The head of the EU office in Jakarta, Vincent Gu谷rend,

has expressed dismay at the rolling back of the SVLK

regulation and has requested the government to stick to the

agreement reached on the VPA.

For more see:

http://www.thejakartapost.com/news/2015/11/18/furniture

-exporters-deem-svlk-relaxation-a-setback.html

and

http://m.thejakartapost.com/news/2015/11/17/timbercertification-

urgent-issue-global-market.html

Manufacturing competitiveness to get a boost

Coordination between Bank Indonesia and regional

governments is expected to boost the competitiveness of

the manufacturing and tourism sectors. The government is

promoting manufacturing to support economic resilience

and strong , sustainable and inclusive growth.

Manufacturers in Indonesia face many challenges arising

from the slide in commodity prices and weak global

demand. Economic growth in Indonesia can no longer

depend on exports of primary products says the Bank of

Indonesia in a press release on its initiative to boost

manufacturing.

Indonesia*s manufacturing industry, a leading and laborintensive

sector, is in decline and now contributes less to

GDP than in the past.

The Bank press release says the focus for the

manufacturing sector will be on ※strategies to enhance

competitiveness in the face of growing global competition,

specifically policy to strengthen industry structure, market

access and work force quality. ※

For more see: http://www.bi.go.id/en/ruang-media/siaranpers/

Pages/sp_178315.aspx

﹛

5. MYANMAR

Border trade up by US$500 million

According to the Ministry of Commerce there has been a

sharp rise in the value of cross-border trade. The trade in

logs and sawnwood across the border with China fell when

China implemented a ban on timber imports from

Myanmar but in other areas trade has grown.

Overall, up to November, a 14% rise in cross-border trade

has been recorded. Total trade in all products at the 15

border stations up to November stood at around US$4

billion and the busiest border crossing was Muse on the

Myanmar/China border.

Companies risk having operating licenses withdrawn

The Asian Development Bank (ADB) is assisting the

government to establish an electronic company register.

This is seen as the best way to identify which of the some

almost half million companies with registration certificates

are actually still in operation. The ADB and the

government estimate the number of active companies to be

in the region of 25-30,000.

All companies registered in Myanmar have been

approached for information on their operations but few

have responded and analysts report that failure to respond

to this request could result in registration certificates being

withdrawn.

Myanmar*s Directorate of Investment and Company

Administration (DICA) published a request for

information via state media in September but the response

has been slow. The DICA has published a list of

companies that face de-listing.

Foreign companies urge continuation of current

economic policies

It has been reported that foreign companies operating in

Myanmar have urged the new administration to keep in

place the existing economic policies. The reforms

introduced by the previous government resulted in a

steady inflow of investment especially in the oil and gas

exploration sectors.

Analysts suggest that continued US sanctions and the

risk

that the new government will take a different direction on

foreign investment has resulted in potential investors

adopting a &wait and see* attitude.

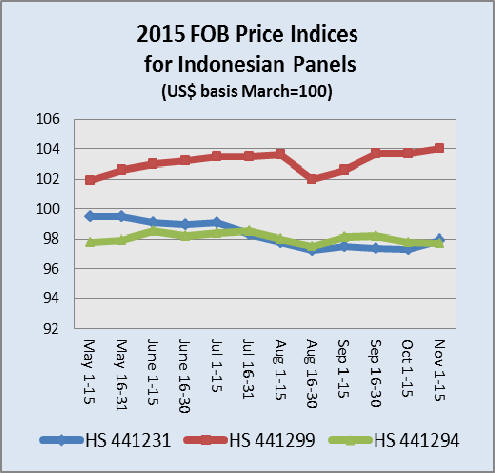

Special open tender sales for November

The Local Marketing Department of Myanma Timber

Enterprise (LMD/MTE) conducted a Special Open Tender

(SOT) at the end of October and the prices secured are

reported below.

Log volumes are expressed in hoppus tons (H.tons) while

the volume for &conversions* and sawn teak (including

hewn timbers) are shown in cubic tons (C.tons). Average

prices below are shown in Myanmar Kyats (MMK

thousands per ton).

Sales by the LMD/MTE are popular amongst local timber

buyers and the sales attract many buyers.

﹛

6.

INDIA

Inflation rate trends down

The Office of the Economic Adviser (OEA) to the Indian

government provides trends in the Wholesale Price Index

(WPI).

The official Wholesale Price Index for all commodities

(Base: 2004-05 = 100) for October rose 0.1% to 176.7

from 176.6 in September. The year-on-year annual rate of

inflation, based on monthly WPI, stood at 每3.81%

(provisional) for October 2015 compared to -4.54% for

September.

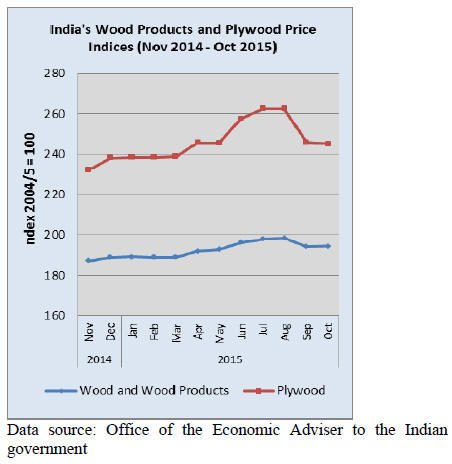

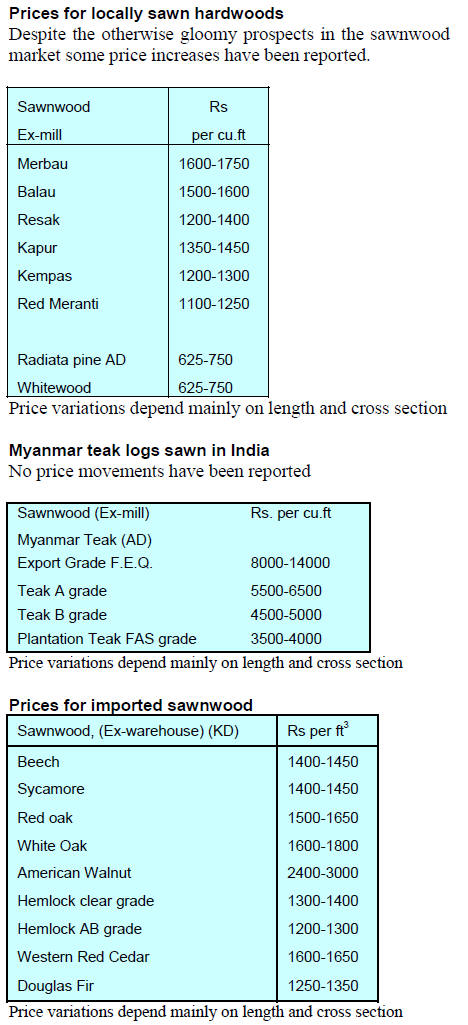

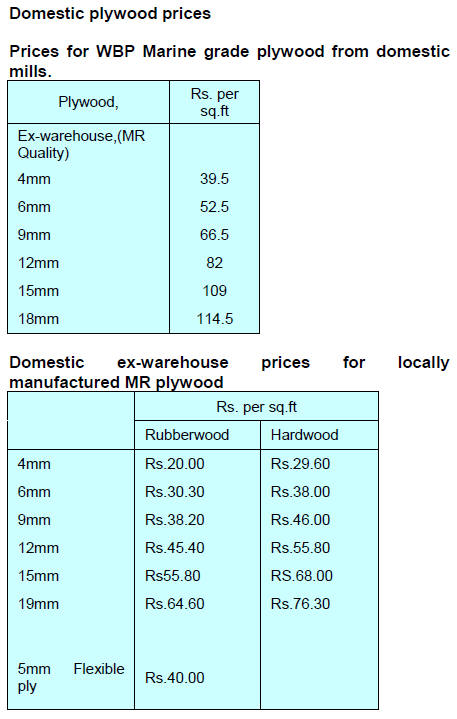

Timber and plywood price indices climb

The OEA also reports Wholesale Price Indices for a

variety of wood products. The Wholesale Price Indices for

Wood products and Plywood are shown below.

State land allocated for affordable housing

The Maharashtra Housing and Area Development

Authority (Mhada) plans to build 100,000 affordable

homes in two phases on state land.

It has been reported that 450 hectares of land with good

rail and road connections has been identified in the

Mumbai Metropolitan Region. This planned building

project is separate from the central government*s plan for

1.1 million affordable homes.

The focus of work will be in Ratnagiri, Raigad and some

parts of Thane districts and the aim is to build houses for

low income families. Speaking on this plan state officials

recommended that the central government should consider

encouraging private developers to participate in

implementation.

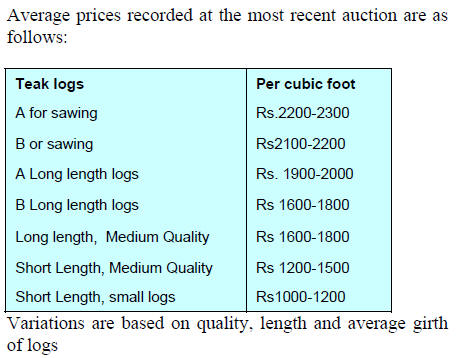

Teak auction prices firm

Auctions at forest depots in the South Dangs Division

have been concluded. Around 17,000 cubic metres of teak

and other hardwoods were offered for sale.

Participants in the auction commented that the quality of

the logs was good and most of the logs sold briskly. Only

a few lots remained unsold as the buyers felt that the

reserve prices for these lots were too high.

Good quality non-teak hardwood logs 3-4 metre long

having girths 91cms and up of haldu (Adina cordifolia),

laurel (Terminalia tomentosa), kalam (Mitragyna

parviflora) and Pterocarpus marsupium attracted prices in

the range of Rs. 800-900 per cubic foot. Medium quality

logs went for between Rs.300-350 per cubic foot.

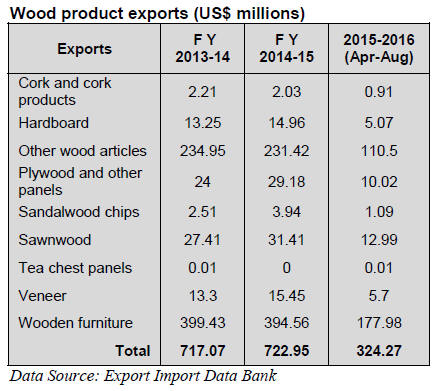

Wood product exports beat target

The Indian government set an export target of US$325

billion for the current financial year to March 2016 but

recent reports suggest there will be a shortfall of around

US$25 billion. October 2015 marked the 11th straight

decline this is worse than during the recent global

downturn.

In an effort to boost exports the government will introduce

an interest rate subsidy for exporters.

However, average monthly exports of wood products in

the first five months of the current fiscal year are higher

than the average for 2014-15.

7.

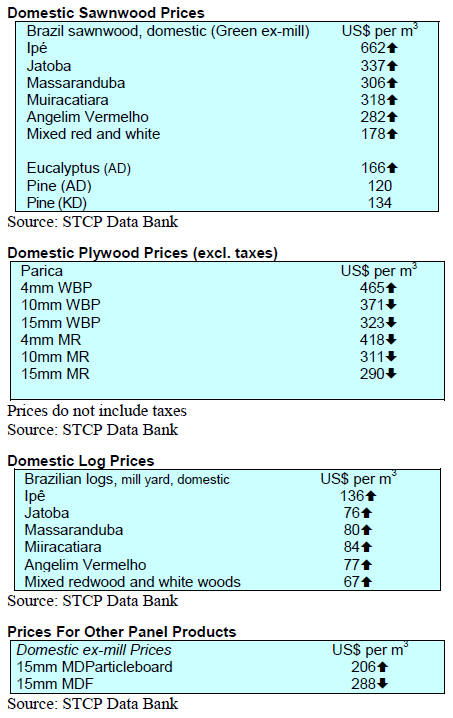

BRAZIL

Inflation continues upwards

Inflation, as measured by the National Consumer Price

Index (IPCA,) closed October up 0.82% on September, As

a result the cumulative rate for the year to October was

8.52% which, on an annualised basis, is well above the

government*s forecast. The Monetary Policy Committee

of the Central Bank of Brazil kept the Selic rate (Sistema

Especial de Liquidação e Custodia) at 14.25%.

Innovative alternative plywood raw material

The Brazilian Association of Mechanically-Processed

Timber Industry (ABIMCI) has published promotional

material on paric芍 (Schizolobium amazonicum) plywood.

The objective is to inform end-users and consumers on

new timber products from the timber industry. The

promotional material distributed by ABIMCI describes

products that are available and their suitability for various

markets.

The Amazon species paric芍 is grown in plantations and

can be harvested in 5-7 years.

Paric芍 plantations currently extend over

approximately

90,000 ha distributed in the states of Par芍, Maranhão and

Tocantins in the Amazon region.

In the southern region companies producing paric芍

plywood are mainly located in Paran芍 state, inluding

Imbituva, União da Vit車ria and Bituruna municipalities.

Paric芍 plywood is, says ABIMCI, an innovative alternative

product for many applications.

Rapid timber identification to control trade in illegal

timbers

The Brazilian Forest Service*s Forest Products Laboratory

has launched a course on rapid anatomical identification of

Brazilian timbers. The first participants were inspectors

from the Brasilia Environmental Institute (IBRAM). The

aim is to provide training on rapid identification using key

timber characteristics for us in the field under commercial

conditions.

By applying the ※Electronic Key Timber Identification§

programme inspectors can check if timber inspected is that

described in the Document of Forest Origin (DOF) issued

by the Brazilian Institute for Environment and Renewable

Natural Resources (IBAMA). Since June this year, the

control of DOFs was taken over by state environmental

agencies, including IBRAM.

The web-based Electronic Key Timber Identification

programme contains a list of 157 species commercial

timbers, such as ipe (Tabebuia sp.), cumaru (Dipteryx

odorata), mahogany (Swietenia macrophylla), and tauari

(Couratari oblongifolia). For dentification, appearance,

color, veining and porous structure of each timber species

and other characteristics are analyzed.

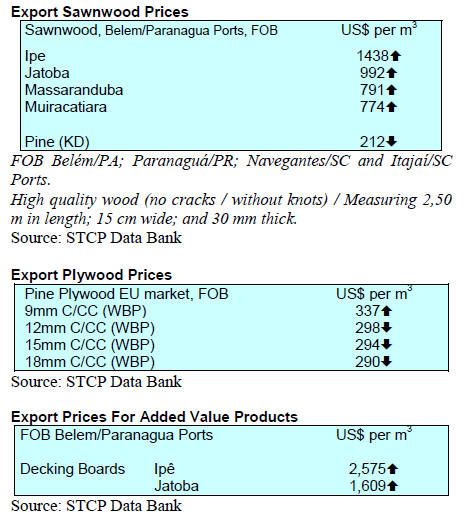

Export round-up

The value of Brazil*s October exports of wood-based

products (except pulp and paper) fell almost 24% year-onyear

from US$ 276.0 million to US$ 210.0 million.

Pine sawnwood export earnings dropped 12% in the

twelve months to October 2015 (US$25.7 mil. to US$ 22.9

mil,) but the volume of pine sawnwood exports increased

24% in the same period, from 98,400 cu.m to 121,900

cu.m as unit prices declined.

Tropical sawnwood exports also fell (-5.6%) in volume,

from 33,800 cu.m in October 2014 to 31,900 cu.m in

October 2015. This decline was mirrored by the fall in

export earnings over the same period (from US$ 18.8

million to US$ 15.1 million) a 19% drop.

The depressing performance continued with a 29% drop in

pine plywood exports in October 2015 compared with a

year earlier (from US$ 42.5 million to US$ 30.2 million).

The volume of exports also dropped but by only 2.8%,

from 112,600 cu.m to 109,400 cu.m.

Good news, but only for tropical plywood

Tropical plywood exports were the only bright spot in an

otherwise depressing picture increasing 63% in volume

(4,600 cu.m in October 2014 to 7,500 cu.m in October this

year). The value of these exports rose by around a third to

US$3.6 mil. from US$ 2.7 million in October 2014.

Brazil*s wooden furniture exports fell from US$ 50.6

million in October 2014 to US$ 36.7 million in October

this year, an almost 28% fall.

ABIMCI and TTF to promote certified plywood

ABIMCI and the UK Timber Trade Federation (TTF) have

signed a cooperation agreement to promote Brazilian

certified wood products in the UK, a major market for

plywood.

International cooperation of this type strengthens the role

ABIMCI can play in international marketing of Brazilian

wood based panels. Brazil is among the main suppliers of

plywood to international markets but according to

ABIMCI small and medium sized companies in Brazil

need to work on meeting international standards.

On its part the TTF stressed the importance of its growing

partnership with ABIMCI and the appreciation of

Brazilian certified products in Europe.

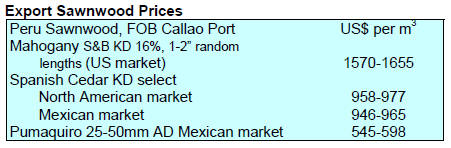

8. PERU

Peruvian wood arouses interest among

European buyers

Eight major European timber importers recently toured

Peru seeking to establish links with entrepreneurs able to

supply certified wood products.

The companies included Kloepferholz (with 21 outlets in

Germany), Hornbach (serving the DIY megastores

segment), IBI International, one of the main suppliers to

the construction sector in Europe and Dreitailer.

The buyer group visited processing plants in Iquitos,

Pucallpa, Puerto Maldonado and Lima.

This trade promotion effort was led by MINCETUR in

cooperation with Promper迆 and the Office of the

Commercial Office of Peru (OCEX) in Hamburg and the

German Cooperation Agency (GTZ), through its

programme &ProAmbiente*.

﹛

9.

GUYANA

Iwokrama*s model forestry project

The Iwokrama International Centre for Rain Forest

Conservation, according to a press release, has begun the

second phase of its model forestry operation. The Centre

was established in 1996 by the Government of Guyana

with the support of the Commonwealth Secretariat and is

charged with managing a unique reserve of 371,000

hectares of rainforest.

Recent work involved zoning resulting in the

establishment of a Wilderness Preserve and a Sustainable

Utilisation Area (SUA).

The SUA was delineated as the area where the centre*s

development work on experimental timber model and

other business strategies including tourism and training

will be conducted.

A 60 year cutting cycle which will yield a maximum of

1,800 ha per year for selective harvesting. None of the

logs harvested will be exported; only high grade

sawnwood and other added value products will be

produced.

The Centre expects to maintain its working partnership

with representatives from Amerindian communities within

the area. See: http://www.iwokrama.org/

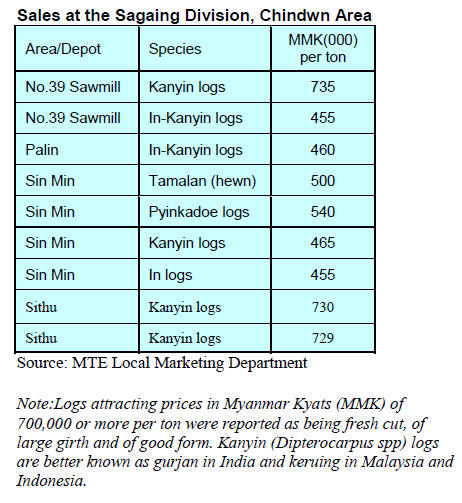

Export prices

There were no exports of greenheart or mora logs but

purpleheart logs were exported.