Japan Wood Products

Prices

Dollar Exchange Rates of

10th

August 2015

Japan Yen 124.4

Reports From Japan

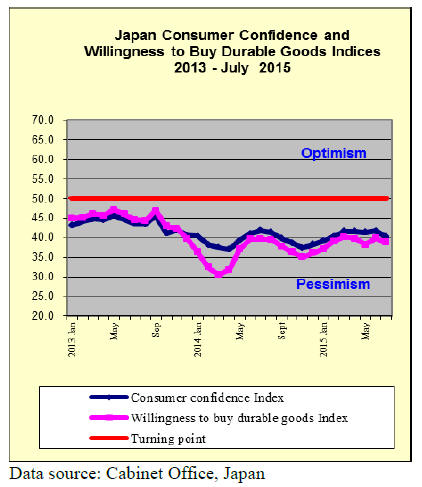

Negative long-term prospects brings down consumer

confidence index

The consumer confidence index released by Japan‟s

Cabinet Office shows there was a weakening of sentiment

in July, the index fell to 40.3 from the 41.7 in June, the

lowest in six months.

All associated indicators contributed to the negative trend

in sentiment in the July indices. The overall livelihood

index fell to 38.1, the income growth index fell to 39.6

from 40.3, the employment prospect index dropped

sharply and the willingness to buy durable goods index

also fell.

The main reasons cited for the poor second quarter data

are slow income growth, rising prices and negative long

term perceptions for economic recovery.

For more see:

http://www.esri.cao.go.jp/en/stat/shouhi/shouhi-e.html

GDP forecast lowered

The Bank of Japan (BoJ) has lowered its forecast for GDP

to a 1.7% year on year growth in the year to March 2016,

down from 2% forecast at the beginning of the year as the

latest figures show GDP growth was negative in the

second quarter of the year. As a result of the slowing of

the economy many in Japan are calling on the BoJ to come

with further stimulus measures. But the BoJ signaled it has

confidence the economy will turn-around which is defying

all current indicators.

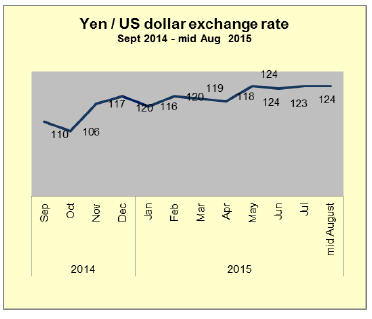

Yuan devaluation yet to impact yen exchange

rate

In early August the yen weakened after the US Federal

Reserve reaffirmed that the risks to the US economy from

an interest rate rise were receding. However, with the

latest round of yuan devaluations, the Federal Reserve

may decide to delay a rate hike.

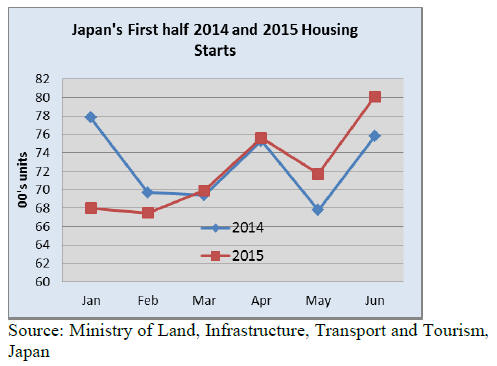

First half housing starts

Despite the swings in month housing start data for the first

quarter of 2015, overall starts for the six months to June

2105 are only marginally down on levels in the same

period in 2014. Reassuringly, the trend in starts in the first

half of each of the two years is following a similar pattern.

Japanese house buyers, especially those with young

families, are beginning to look at second hand as they can

get a good house at a reasonable cost.

Second hand homes are attracting those currently in rented

apartments as monthly repayments on housing loans are

turning out to be lower than the apartment rent in this time

of low interest rates. But sales of homes, especially second

hand homes are slow with around 10 homes available for

every buyer.

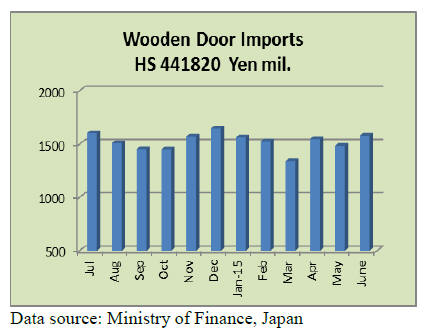

Import round up

Doors

June 2015 imports of wooden doors by Japan were slightly

up on levels in May however figures for the first half of

2014 and 2015 show that Japan‟s wooden door imports

fell around 18% in the first half of 2015.

China and the Philippines top the list of suppliers in June

(59% and 16% respectively) but imports from Malaysia

lifted the SE Asian nation into third place as a supplier of

doors to Japan.

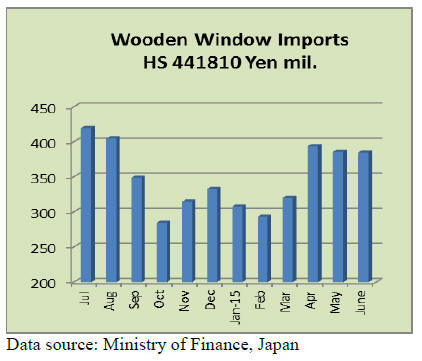

Windows

Japan‟s June 2015 imports of wooden windows were

unchanged from a month earlier but, compared to the first

half of 2014, 2015 imports were down a massive 28%.

Imports from China accounted for 32% of imports as did

imports from the Philippines. The third ranked supplier in

June 2015 was the US at 23%.

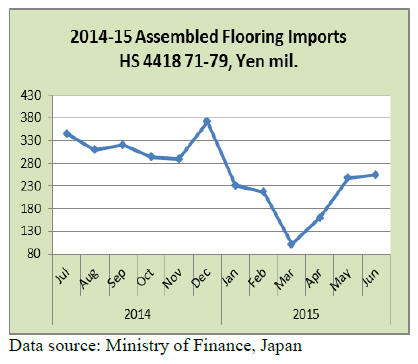

Assembled flooring

China 172126 Finland 16110 Indo 15723

June imports broke the firm upswing in imports of

assembled flooring recorded during the early part of this

year. First half 2015 imports of assembled flooring were

down 21% on the same period in 2014.

Suppliers in China hold a commanding position in Japan‟s

market for imported assembled flooring accounting for

around 68% of total imports of this product.

The other main suppliers in June were Indonesia and

Finland which each accounted for around 6% of

assembled flooring imports.

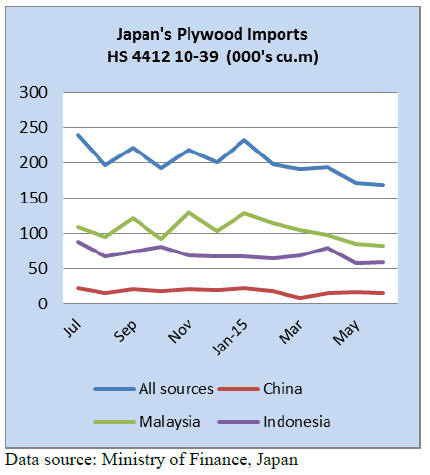

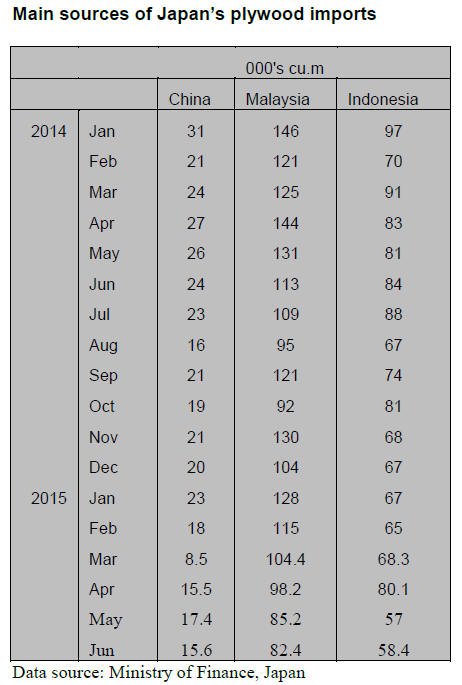

Plywood

There has been a steady decline in Japan‟s plywood

imports from the beginning of the year. First quarter 2015

plywood imports were down 26% on the first quarter of

2014 and all three major supply countries booked losses

for 2015.

First half 2015 imports of plywood by Japan from China,

Malaysia and Indonesia were down 36%, 21% and 22%

respectively. June 2015 imports from all 3 of the main

suppliers fell even more sharply than in the first half year.

Imports of plywood from China were down 33%,

Malaysia saw a 27% drop while Indonesia recorded a 31%

decline.

Trade news from the Japan Lumber Reports (JLR)

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

Demand projections for major wood products for the

second half

The Forest Agency made up demand projection of major

wood products for the second half of this year.

On domestic wood, demand for lumber increases while

that for plywood declines and total year figures would be

less than last year.

Imported lumber declines in the third quarter but increases

in the fourth quarter and imported logs increases. Imported

products will be less than last year. While new housing

starts are estimated to increase but total wood demand

would decline.

Domestic logs for lumber increased toward December but

less than last year. Logs for plywood decreases because

of plywood mills‟ production curtailment and rebound of

large volume of last year. Imported logs increases in the

second half of the year as they were low in the first half of

the year.

Imported lumber is low for the third quarter but the

demand increases in the fourth quarter after the inventories

decline.

Plywood declines because of market slump and mills

production curtailment programs plus decline of imported

plywood from South East Asian countries. Laminated

lumber domestic production decreases in the second half

while the imports increases for both third and fourth

quarters.

Shing Yang group reduces plywood production by half

The largest plywood manufacturer in Sarawak, Malaysia,

Shing Yang group decided to reduce the production by

half. The reasons are chronic shortage of log supply in

Sarawak and prolonging market slump of Japan market.

By this decision, plywood import from Malaysia to Japan

would be less than 100 M cbms a month.

Log production in Sarawak has been around eight million

cbms for last several years. Now further a decline is likely

in future. Shing Yang has been producing about 100 M

cbms of plywood out of which 60-80 M cbms has been

shipped forJapan.

Malaysian plywood import in June was 88,300 cbms, the

lowest in about four years. Shing Yang‟s volume has been

about 50% of total Malaysian import. After Shing Yang

decreases the production, total import from Malaysia will

further decline. There is no other sources to fill short fall

of Shing Yang.

South Sea (tropical) logs

In Sabah and Sarawak, Malaysia, dry weather continues

and rivers are drying up. This hampers barging logs from

upstream to log loading ports in some areas. Log

production continues low by this weather and tight control

by the government in Sarawak. The control is tightening

further and since July, measurement of logs and payment

of royalty are done at logging sites so this further reduces

log production.

India made log procurement more than usual in last May

then it slowed down in June but this does not ease log

market at all. On top of spiraling FOB prices, the yen is

getting weak to 122-125 yen per dollar so the arrived cost

of meranti regular is more than 13,000 yen per koku and

the users in Japan are facing final stage and lose interest to

keep buying. The log importers are desperately explaining

cornered situation to the suppliers to no avail.

Present FOB prices of Sarawak meranti regular are $285-

295 per cbm, small meranti are $260-270 and super small

are $250. They are unchanged from June. Due to

continuing high FOB prices and drop of log quality in

Sarawak, more are interested in PNG logs.

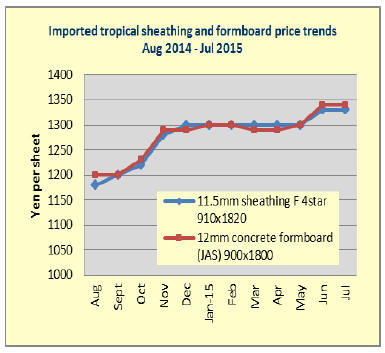

Imported plywood market

The market of imported plywood like concrete forming

panel is firming. The demand remains sluggish so despite

sharp drop of the supply, tight feeling is not serious.

Cost for the importers and wholesaler have been

increasing by higher FOB and weaker yen and the market

is catching up little by little but dealings are mainly among

dealers and the importers struggle to have enough sales.

With continuing measures to control illegal harvest in

Sarawak, Malaysia tightens log supply and the suppliers

face short log supply and higher log cost so that FOB

export prices stay up high.

With weak yen of 121-123 yen per dollar and depressed

market in Japan, it is hard to buy higher cost plywood than

present market so spot purchases continue. The importers

reduced future purchase due to large gap between the cost

and market prices so the arrivals since last May would stay

as low as 200 M cbms a month probably through August.

The importers hope that the market should react and

rebound since late August. Present prices of 3x6 concrete

forming panel are 1,500 yen per sheet delivered, which is

lower than the cost for theimporters so the importers are

asking 1,550 yen.

Nitori to build furniture plant in Vietnam

Nitori Holdings Co., Ltd. (Sapporo, Hokkaido) announced

to set up a subsidiary company in September to

manufacture furniture and home furnishings (cabinet, bed,

laundry and tableware related products) in Ba Ria Vung

Tau province in Southern Vietnam.

Total capital is 2.7 billion yen and Nitori will be sole

investor. This is the second manufacturing facility for

Nitori in Vietnam and total overseas subsidiaries are

twelve in total. New company‟s name is Nitori Furniture

Ba Ria-Vung Tau Co., Ltd. The president is Mr. S.

Matsukura, the president of Nitori Furniture Vietnam EPE,

Hanoi, Vietnam.

Nitori will build manufacturing plant by leasing 400,000

hectares of property in some industrial park.

Details of manufacturing products and production is not

decided yet. The plan is to start up the plant in 2017.

Manufactured products will be shipped to Japan, Taiwan

and China and will be marketed through Nitori‟s sales

network.

Log export promotion by Fukuoka prefecture

Prefecture of Fukuoka decided to promote export of local

logs as 2015 new business. Three prefectures of Kyushu,

Fukuoka, Saga and Nagasaki tie up together for log export,

which should make steady log procurement and strong

stand for overseas buyers in price negotiation.

Three prefectures have been discussing joint export

programme and Fukuoka prefecture plans to export local

logs mainly to China. It plans to export about 3,700 cbms

of cedar and cypress logs from Fukuoka prefecture from

port of Imari, Saga prefecture. Total budget is 3.1

milloion yen for 2015. The business is managed by the

conference formed by prefectural forest associations and

the prefecture will subsidize 700 yen per

cubic meter for local export logs.

Also the prefecture promotes to encourage entry of nonforest

industries such as landscape gardeners and

construction industry in an effort to stabilize forest

workers and to increase wages, which should vitalize

villages in the mountains.

To secure new comers by the forest conferences, the

prefecture subsidizes with total budget of 8.325 million

yen. Following last year, the prefecture will double the

harvest in the prefecture by promoting increasing main

harvest and also promotes building wooden structures. For

this, budget of 34.202 million yen is allocated.

|