|

Report from

North America

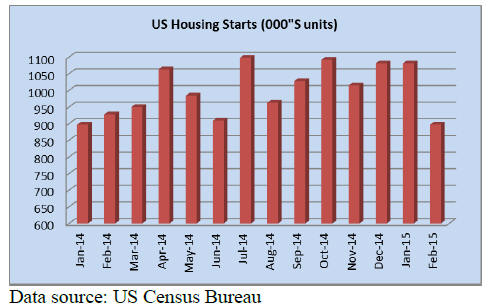

February residential construction down 15%

Housing starts fell by 17% to a seasonally adjusted annual

rate of 897 million units in February, according to data

from the Commerce Department. Single-family housing

starts decreased 15% from January, while multifamily

construction fell by 21%.

Home construction declined in all regions of the country.

Lower consumer confidence in the economy is affecting

new home construction, especially among lower and

middle income households.

The number of building permits was up in February at

1.092 million units. Permits for single-family homes

declined, while multi-family permits increased by 18%.

Builders‟ confidence in the market for newly built singlefamily

homes fell again in March. According to the

National Association of Home Builders, the drop in

confidence is mainly related to shortages in building lots

and labour shortages. The highest decline was in the West.

Slight cooling in Canadian housing market

Canadian housing starts fell 19% in February to 151,000 at

a seasonally adjusted annual rate. The decline was mainly

in multi-family construction, while single-family home

starts decreased by just 5%. At 36% the share of single

family in total housing starts was higher than average in

recent years.

Construction intentions decreased 7.5% in January from

the previous month, based on the number of approved

building permits.

Growth in US non-residential construction

Investment in non-residential construction increased

slightly in February at a seasonally adjusted annual rate

according to US Census Bureau data. Private investment

in non-residential construction was revised up for

December and January.

The largest growth in February was in public commercial

construction, which grew by 12% from the previous

months.

The American Institute of Architects reported slow growth

for commercial and industrial construction. The market for

institutional buildings (education, health care) has grown

for nine months.

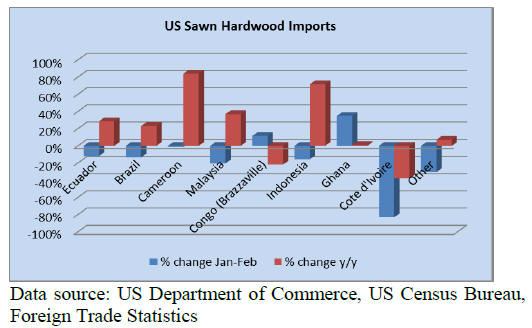

Temperate timber the only winner

With the exception of hardwood flooring and temperate

sawn hardwood, imports of other wood products declined

in February. Wooden furniture imports fell significantly

and were even slightly lower than at the same time in

2014.

The winter weather, a slow housing market and lower

consumer confidence contributed to the decline in imports.

February sawn hardwood imports more than doubled from

to 190,933 cu.m. However the growth was exclusively for

temperate species, tropical hardwood imports declined by

2% in the same period to 22,472 cu.m. But year-to-date

tropical imports were 32% higher than in February 2014.

Sapelli and virola sawnwood imports increased to 4,202

cu.m. and 2,868 cu.m., respectively. Imports of most other

tropical species were down in February from the previous

month.

Despite the overall decline in imports, shipments from

Peru, Ghana and Congo (Brazzaville) to the US increased

in February. Virola imports from Peru jumped to 2,731

cu.m. in February, according to US trade data.

Ipe sawnwood shipments from Brazil declined to 2,388

cu.m. in February. The volume of sawnwood from

Cameroon was nearly unchanged from January. Acajou

d‟Afrique imports from Cameroon fell but sapelli

shipments increased.

February imports from Malaysia declined from the

previous month to 2,367 cu.m., but compared to 2014,

year-to-date Malaysian shipments are up one third.

Canada¡¯s sapelli imports grow

Canadian imports of tropical sawn hardwood were valued

at US$1.25 million in January, up one third from

December. However, imports are only half of the import

values seen last summer. Africa remains the largest source

of imports for Canada, followed by South America

(mainly balsa) and then Asia.

Balsa imports from Ecuador were worth US$296,183 in

January. The second-largest source of imports was

Cameroon at US$208,387, although the value of imports

from Cameroon fell from December.

Imports from Indonesia declined slightly from December,

but at US$182,678 they were higher than in January 2014.

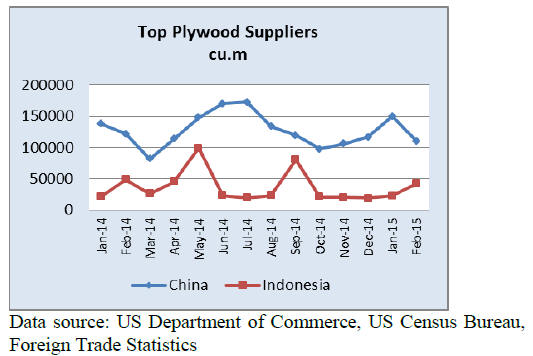

A drop in hardwood plywood imports from China

US imports of hardwood plywood at 212,044 cu.m. were

down 10% in February from the previous month.

The largest decline in hardwood plywood imports was

from China, following strong growth in January. February

imports from China fell 27% from the previous month to

109,937 cu.m. Year-to-date imports (January and

February) were unchanged from 2014.

On the other hand imports from Indonesia grew to 42,740

cu.m. in February, but year-to-date imports were lower

than at the same time in 2014.

Hardwood plywood imports from Canada and Malaysia

also increased in February, while Russian shipments

declined.

China remains largest hardwood mouldings supplier

While hardwood moulding imports from China declined in

February (US$5.1 million), year-to-date imports were 25%

higher than at the same time in 2014; but, imports from

Brazil increased by 9% from January to US$4.3 million.

Hardwood moulding imports from Malaysia fell by one

third to just over US$0.7 million in February and overall

shipments by Malaysia were also down compared to 2014.

Indonesia does well in assembled flooring market

Hardwood flooring imports increased slightly in February

to US$2.7 million. Import levels were almost unchanged

the same time last year. However, imports Malaysia grew

by 27% from January and year-to-date imports were 16%

higher than in February 2014.

Imports from Indonesia also increased from last year,

while shipments from China were down. China trails

Malaysia and Indonesia in hardwood flooring shipments to

the US to date in 2015.

Despite a slight decline in February, year-to-date imports

of assembled flooring panels increased by 22% from the

same time in 2014 and were worth US$10.5 million in

February, down 7% from the previous month. China

remained the main supplier at US$5.8 million, followed by

Indonesia (US$2.6 million).

Tropical suppliers see US furniture imports fall

US Wooden furniture imports declined in February

following a decrease in January. Total wooden furniture

imports were worth $1.02 billion, down 19% from

January. Year-to-date imports were 1% lower than in

February 2014.

Canada was the only major supplier that increased

furniture shipments to the US in February. The US

imported US$97.9 million of wooden furniture from

Canada, up 12% year-to-date from February 2014.

Canadian manufacturers benefit from a lower Canadian

dollar.

Furniture imports from China decreased by 22% from

January to US$484.1 million, the lowest since level of

imports since March 2014.

Imports from Vietnam, Malaysia and Indonesia also

declined in February. Year-to-date imports from Mexico

were up 10% compared to February 2014.

Almost all major supply countries saw a decline in

shipments to the US. Imports from China were worth

US$618 million, down 5% from December. Vietnam‟s

shipments fell by 6% to US$224.9 million. Only imports

from Malaysia remained unchanged at US$51.7 million.

Wooden furniture imports from Europe declined in

February, but they remain higher than at the same time last

year.

Wooden bedroom furniture imports fell the most in

February, followed by upholstered wooden seating

furniture and kitchen cabinets. The smallest decline was in

wooden office furniture imports.

Furniture market outlook positive for 2015 and 2016

The latest available data on furniture orders and shipments

were positive, especially compared to the same time in

2014.

However, international trade data shows a month-overmonth

decline in US furniture imports. Housing starts

decreased at the start of 2015, which usually slows

demand for furniture.

US furniture consumption is forecast to grow by 3% in

2015 and 2016, according to CSIL, the Center for

Industrial Studies in Milan. Overall economic conditions

are positive, with lower unemployment and low interest

rates. As the weather improves in spring both the housing

market and furniture sales are expected to grow.

Another positive sign for furniture manufacturers is the

record number of buyers at this month‟s High Point

Furniture show. Over 45,000 buyers from more than

14,000 companies registered for the largest furniture trade

fair in High Point, North Carolina.

Furniture orders, shipments and retail sales down

Both furniture orders and shipments were slightly down in

January from the previous month. However, new furniture

orders were 7% higher compared to January 2014,

according to the Smith Leonhard industry survey.

Furniture shipments declined from December. Compared

to January 2014, shipments were 10% higher this year.

Over 60% percent of companies reported higher shipments

in January.

Inventory levels at distributors and manufacturers were up

1% from September and 5% higher than in January 2014.

Retail sales at furniture stores in the US declined 4% from

January to February, according to US Census Bureau data.

The decline may be mainly seasonal, but sales are slightly

lower than expected for February. However, retail sales

were 4% higher than in February 2014.

Calls for finalisation of formaldehyde emission

standard

Following media reports about high formaldehyde

emissions in laminate wood flooring from China, industry

associations are asking that the draft national

formaldehyde emission standard be quickly finalised.

Because of the media reports, installers, residential and

commercial customers became concerned about

formaldehyde emissions from wood flooring. The new

standard when released would ensure consistent

formaldehyde emission standards for all wood products

sold in the US market.

The Environmental Protection Agency (EPA) has worked

on a national standard for composite wood products for

several years now. The standard is largely based on the

existing Californian standard.

However, a draft version of the standard was heavily

criticised by the industry. Unlike the Californian standard,

it would require furniture manufacturers who laminate inhouse

to test and re-certify panels purchased for

lamination.

The new emission rules will apply to hardwood plywood,

particleboard, MDF and finished products containing these

materials. Both imported and domestically produced

products must meet the standards.

Interest rate increase likely in second half of 2015

The US Federal Reserve board is split on whether to raise

interest rates in June or later as while employment has

improved, economic growth appears to slow. The first

increase in interest rates appears more likely in the second

half of 2015.

The US unemployment rate was unchanged at 5.5% in

March. The number of long-term unemployed (jobless for

27 weeks or more) accounted for almost one third of all

unemployed. Long-term unemployment change little from

February to March, but over the last year it declined

significantly.

Slower growth in US manufacturing

Economic activity in the manufacturing sector continued

to expand in March according to the Institute for Supply

Management. However, production was unchanged and

new orders slowed. Wood product manufacturers reported

growth in production while the furniture industry produced

less in March.

* The market information above has been generously provided

by the Chinese Forest Products Index Mechanism (FPI)

|