2. GHANA

Illegal chainsaw milling to be eliminated

A forum on the Forest Law Enforcement Governance and

Trade (FLEGT) and VPA processes was held in Sefwi-

Wiawso in the Western Region to inform timber

producing communities of related forestry management

practices.

The forum, organised by the Working Group on Forest

Certification Ghana with sponsorship from the EU,

targeted those who have committed to Social

Responsibility Agreements (SRA), timber firms, the

Forestry Commission and District Assembly personnel.

Mrs. Doreen Asumang-Yeboah, Coordinator of the

National Forestry Forum-Ghana, said all participants are

responsible for the successful implementation of the

Ghana-European Union Voluntary Partnership Agreement

(VPA).

She informed participants that to ensure all legal

requirements under the Agreement were complied with it

will be necessary to eliminate illegal chain sawmilling

operations in the country.

Mrs. Asumang-Yeboah reminded participants that

timber

will only be considered legal when its source, timber

rights allocation, harvesting operations, transportation,

processing, trade and fiscal obligations meet national

regulations.

Industries continue to suffer from power crisis

The country‟s power crisis continues to have a major toll

on the economy. The effect of the crisis has compelled

major industries, including timber manufacturing

companies, to make tough decisions to avert the collapse

of their businesses.

Companies are now faced with huge bills for generating

power from mobile generators but point out this cannot be

sustained for long. With no available power from the

national grid industries are desperate for a solution and

many are experimenting with alternative power generation

systems such as solar energy.

Analysts point out that GDP growth will be affected if a

solution is not found quickly. According to a press release

from the Ghana Statistical Service (GSS), the protracted

energy crisis, lower commodity prices, rising inflation and

lower government expenditure took a major toll on the

country‟s economy in 2014.

Encouraging studies on indigenous timber species

Scientists have been urged to intensify research into

Ghana‟s indigenous tree species so effective regeneration

methods can be developed.

This call was made by Ms Barbara Serwaah Asamoah,

Deputy Minister of Lands and Natural Resources at the

opening of a one week international conference organised

by FORIG with support from the International Tropical

Timber Organization (ITTO) and the Th¨¹nen Institute of

Forest Genetics in Germany.

The conference was held to share findings from a

collaborative research study funded by ITTO to improve

the sustainability of indigenous mahogany in Ghana‟s

forest reserves.

3. MALAYSIA

Year of the Goat off to a slow start

The Malaysian timber industry is slowly getting back to

business after the long Chinese New Year break, however

trading is reportedly slower than usual.

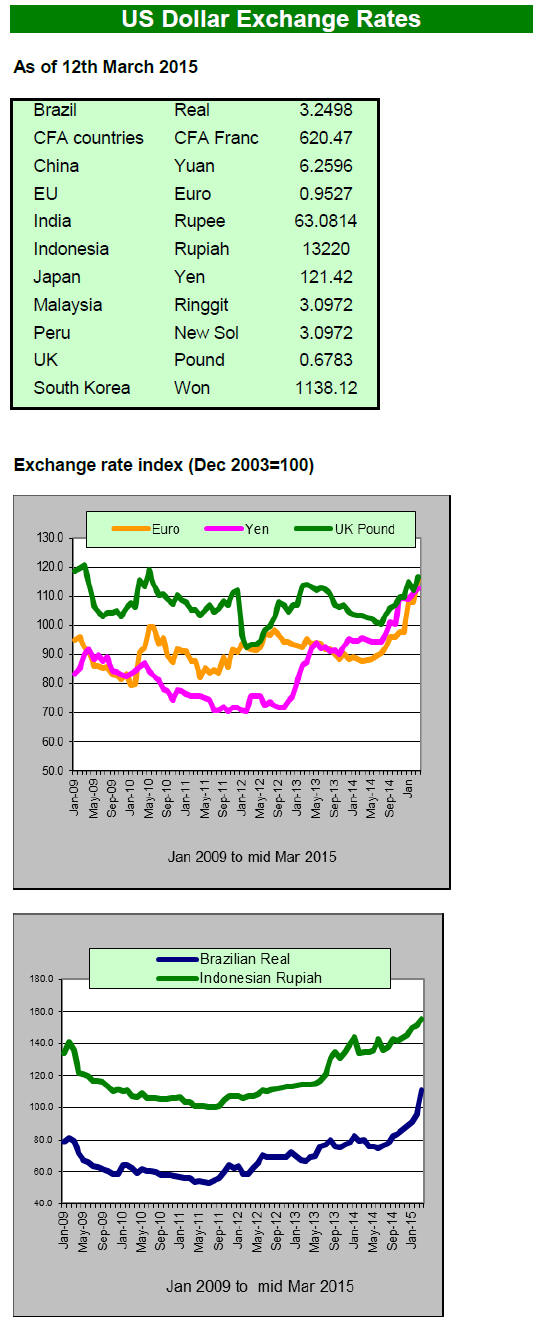

The ringgit:US dollar exchange rate has fallen to a twelve

month low as the dollar has strengthened on speculation

that the US Federal Reserve appears ready to raise interest

rates. The weaker ringgit has helped exports and Malaysia

registered a trade surplus of RM9.01 billion (approx. US$

2.44 billion) in January this year, a 42% increase

compared with the corresponding month last year. This is

the 207th consecutive monthly trade surplus.

Exports for January remained high at RM63.6 billion

(approx. US$17.2 billion) while imports fell by 5.3% to

RM54.59 billion (approx. US$14.8 billion) from a year

ago.

Growth in exports was recorded to major markets

such as

ASEAN (1.8%), European Union (3.7%), the US (18%)

and India (14.7 %). Exports also increased to Taiwan

P.o.C, Norway, Kenya and South Africa. On the other

hand, exports to Japan and China have been falling.

Designing with Malaysian sepetir

The Malaysian International Furniture Fair (MIFF) was

held in the first week of March in Kuala Lumpur. This

year MIFF featured over 508 exhibitors from 15 countries.

A new event ¡°Designing with Malaysian Hardwoods¡± took

centre stage in a first-time collaboration between the

Malaysian Timber Council and MIFF. Called ¡°Collection

Number One¡±, the design featured contemporary living

and bedroom sets made of Sepetir, a light golden brown

tropical hardwood.

In addition, a series of industry seminars highlighted

current trends and brought attendees face-to-face with

international industry experts. Among the speakers were

Italian industry consultant Enrico G. Cleva who shared his

views on new trends in furniture design while Roberta

Mutti and Franz Rivoira focused on products and lifestyle.

A two-member panel from the US Consumer Product

Safety Commission made a presentation on the

requirements for furniture sold in the US.

Universiti Putra Malaysia Professor Dr. Jegatheswaran

Ratnasingam, suggested Malaysian furniture exports may

not significantly increase from last year but the value of

the country‟s exports would increase due to the weakening

ringgit.

Strong demand for Sarawak logs in India

The general sentiment in Sarawak is that log prices are

expected to trend higher due to reduced availability.

The domestic press (Star newspaper), quoted Jaya Tiasa

Holdings senior manager Woung Lik Chiong as saying log

prices for the Indian market, the largest buyer of Sarawak

logs, had surged by between US$20 and US$25 per cu m

over a 12-month period.

India, which accounted for more than two-thirds of

Sarawak‟s export volume, was a stable market, said

Woung.

All out ¡®war¡¯ on illegal felling

Sarawak timber came under the spotlight last year when

authorities seized over 80,000 cu m of suspected illegal

logs. This was more than a six-fold increase in seizures

compared to 2013. In the first two months of this year,

some 16,000 cu.m illegally harvested logs had been

seized.

To underscore the seriousness of efforts to address illegal

logging Sarawak‟s Chief Minister cancelled or declined

renewals of about half of the 150 Occupation Tickets

(OTs) that allow holders to extract timber when preparing

land for plantation projects.

4. INDONESIA

Weaker rupiah good for exporters

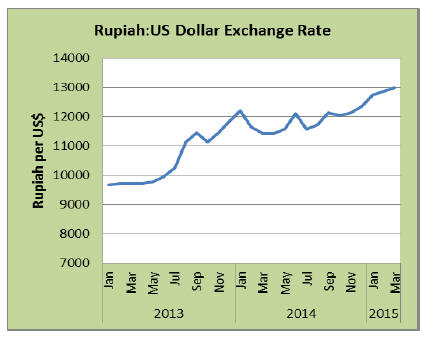

The Indonesia rupiah recently fell sharply against the US

dollar on fears Indonesia‟s trade with China, its biggest

trading partner, will decline as China settles for a slower

and more structured growth model.

In mid-March the rupiah fell to 13,222 to the US dollar,

the weakest level since August 1998.

The weaker rupiah has an upside in that it supports exports

but with only the US economy showing firm signs of

recovery there are risks to Indonesia‟s export growth

potential.

The Indonesian Central Bank governor said the Bank

is

comfortable with the weaker rupiah as this, along with the

recent interest rate cut, will help drive the economy

forward.

Agus Martowardojo, the Central Bank Governor, has said

he expects further depreciation of the rupiah as interest

rates in the US are likely to rise sometime in the near

future. In February this year Bank Indonesia cut interest

rates for the first time in three years as inflationary

pressures eased and deflation returned in February.

SMEs struggle to compete in international markets

In a meeting with the Industry Minister Saleh Husin,

Ms.Soewarni, chairwoman of the Indonesian Sawmill and

Wood Working Association (ISWA), called on the

government to review the procedures required for small

and medium enterprises to secure SVLK conformity selfdeclarations

(DKP).

These declarations include four-digit commodity

identification codes for the products, type and timber

volume and sources of timber to ensure their legality.

Soewarni also called for the quick cancellation of the 10

percent value-added tax (PPN) on forest products imposed

since the middle of last year as this is undermining

competitiveness in the industry.

In related news the chairman of the Indonesian Furniture

and Handicraft Association has told government officials

that the timber legality verification system is having a

negative effect on the competitiveness of SMFEs which

found the approximate US$7,000 cost to secure

certification too high.

According to the association several furniture producers in

East Java have been forced to close factories as they can

no longer compete in international markets with producers

in Vietnam and China.

Cloud Seeding to bring fires under control

The Agency for Assessment and Application of

Technology (BPPT) plans to attempt cloud seeding in

Riau in an effort to control forest fires. The Minister for

Environment and Forestry, Siti Nurbaya, said the

government has declared a state of emergency in Riau and

has called for a coordinated effort to bring the fires under

control.

Reports suggest that from January the Siak Kecil

Biosphere Nature Reserve in Bukit Batu has been affected

as has Rupat Island. Data from the Fire Department show

that there were more than 100 forest fires in the first two

and a half months of the year.

5. MYANMAR

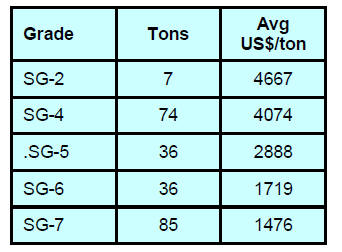

The following timber was sold by tender

on 23 February

2015 and on 9 March 2015at the Yangon depot by the

Myanma Timber Enterprise (MTE). Average prices for

logs are expressed in hoppus tons.

Observers say that most of the teak logs recently

sold were

those which remained up-shipped when the log export ban

came into force last year and as such they were of poor

quality and this was reflected in the prices secured.

Teak harvest to fall below 100,000 tons

Analysts have expressed concern that MTE will be unable

to meet its harvest target of 60,000 hoppus tons of teak

logs for this fiscal year.

As the end of the fiscal year approaches it seems likely

this will be the first time in decades for the teak harvest to

be below 100,000 tons. The lower than expected teak log

harvest is likely to impact price trends in the coming

months.

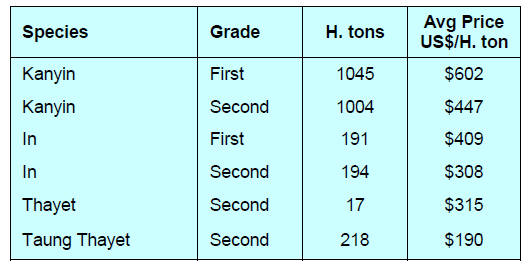

Ex-site open tender prices

At the 9 March open tender sale at Chindwin

(Sagaing)/Bago and Pathein (only for the timber Taung

Thayet) the following prices were secured.

Most of the Kanyin logs were from the Upper

Chindwin

River area in Homalin and Mawlike (Sagaing Division),

North West Myanmar.

Only about 600 tons were from the Sittang River Rafting

Agency and Bago North Area. Kanyin is Dipterocarpus

spp; and In is Dipterocarus tuberculatus. Kanyin is also

called Myanmar Gurjan. Thayet or Taw Thayet is

Mangifera caloneura. Taung Thayet is Swintonia

floribunda.

Kanyin logs are purchased for peeling veneer and In

logs

are for cutting into sawn timber. Gurjan is sought for

making container flooring.

Foreign investment rules relaxed

The domestic newspaper, Eleven Media, has reported that,

according to Directorate of Investment and Company

Administration (DICA), foreign investment in Myanmar is

expected to total just under US$7 billion for the current

fiscal year.

The Myanmar government is trying to attract investment

into its most labour-intensive sectors. Foreign investors

are now allowed to rent either privately owned or stateowned

land, they are also permitted to operate without

local partners and the process of fund repatriation has been

simplified.

6.

INDIA

CREDAI ¨C nothing in budget for real

estate sector

The 2015-16 Indian budgets has been applauded as it

attempts to address stagnated growth, the bloated public

sector and weak private investment. The main thrust will

be investment in infrastructure, stimulating capital

investment, devolution of finances to the States and a

range of initiatives for Indian‟s poor.

The business community has generally welcomed the

budget saying an immediate investment in improving

infrastructure will boost the economy in the short term and

will have a lasting impact on long term growth prospects.

A summary of the main points of the budget can be found

at:

http://indiabudget.nic.in/ub2015-16/bag/bag11.pdf

Despite overall positive view of the budget the real estate

sector has expressed disappointment. In the March

newsletter from the Confederation of Real Estate

Developers‟ Associations of India (CREDAI) an article

asks ¡°What Does the Union Budget 2015-16 mean for the

Real Estate Sector¡±.

The article goes on to say ¡°There is nothing in the budget

to give impetus to the sector although the sector provides

much needed employment. Yet, the only provisions in the

budget for the sector are pass through tax for investments

in the Real Estate Investment Trusts (REITs).

To top it all, contrary to our demands the service tax on

affordable housing has been increased from 12.36 per cent

to 14 per cent, adding to the cost of houses.¡±

CREDAI Chairman Lalit Jain, says the increase in service

tax could lead to an increase in home prices by as much as

half a percent and ¡°the only comfort to be derived from

real estate drawing a blank is that there are no provisions

adverse to the real estate sector¡±.

For more see:

http://credai.org/sites/default/files/Issue-24-Real-Estate-at-

Glance-02-03-2015.pdf

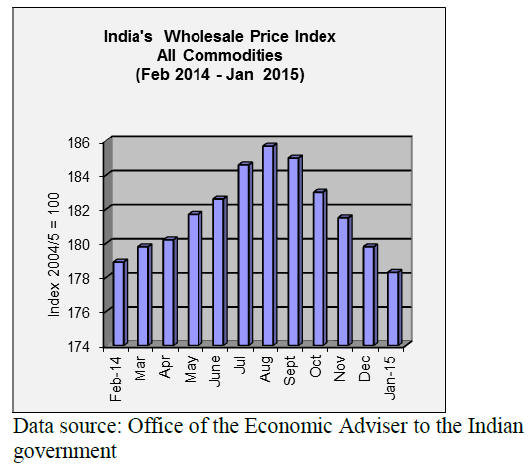

Welcome decline in inflation

The Office of the Economic Adviser (OEA) to the Indian

government provides trends in the Wholesale Price Index

(WPI).

The official Wholesale Price Index for „All Commodities‟

(Base: 2004-05 = 100) for January fell almost 1% to 178.3

from 179.8 for the previous month. The annual rate of

inflation, based on the monthly WPI, fell 0.4% in January

2015.

For more see:

http://eaindustry.nic.in/cmonthly.pdf

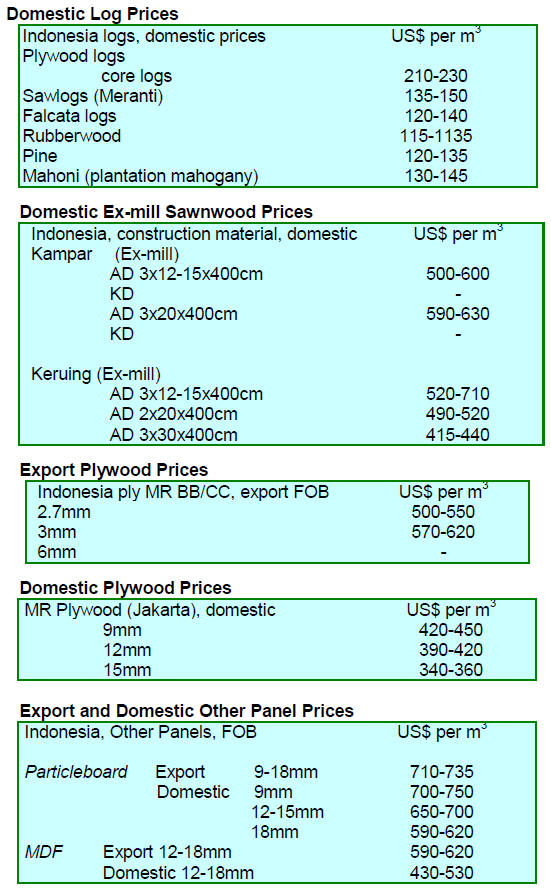

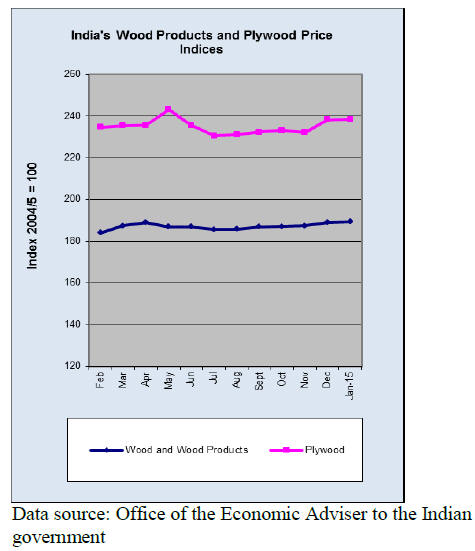

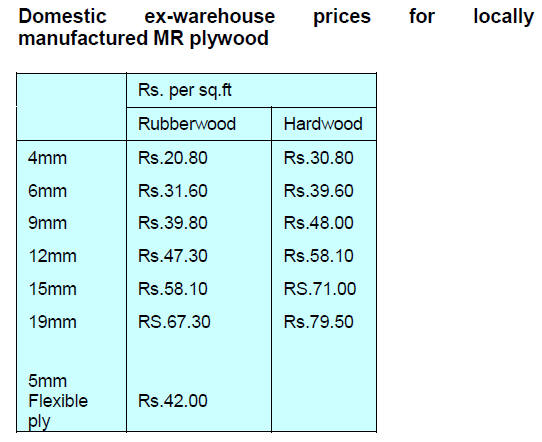

Timber and plywood wholesale price indices

The OEA also reports Wholesale Price Indices for a

variety of wood products. The Wholesale Price Indices for

Wood products and Plywood are shown below.

The January price index for wood and wood products

rose

slightly part of the rise may be explained by the increase in

Sarawak log prices.

Similarly the price index for plywood rose

reflecting the

price increases achieved by plywood manufacturers.

See:

http://eaindustry.nic.in/display_data.asp

E-Auction of teak in Western India

The disagreement over the e-auction means of sale is still

unresolved. A large volume of logs are ready for sale so it

is in the interest of the Forest Department and buyers to

find an amicable solution so sales can proceed.

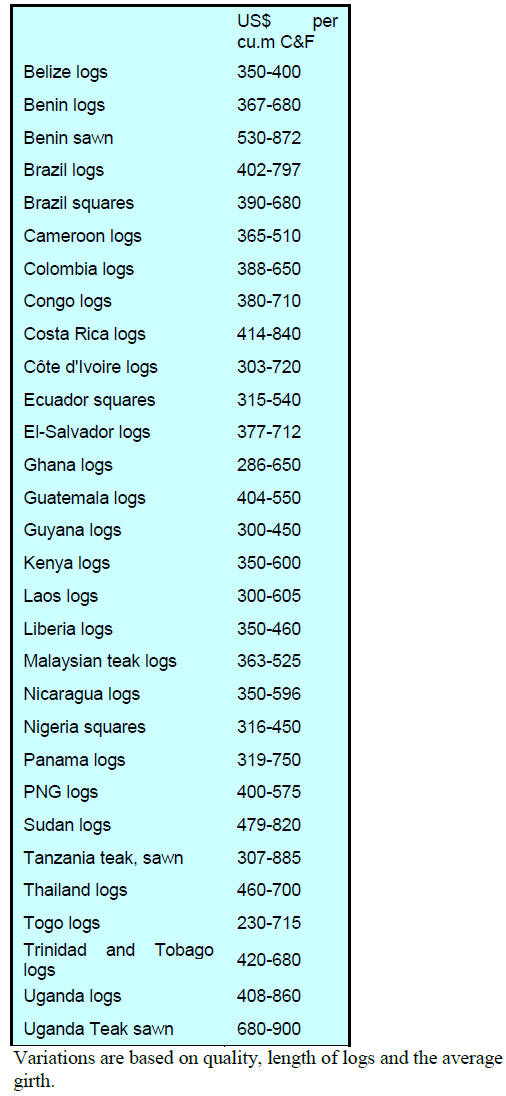

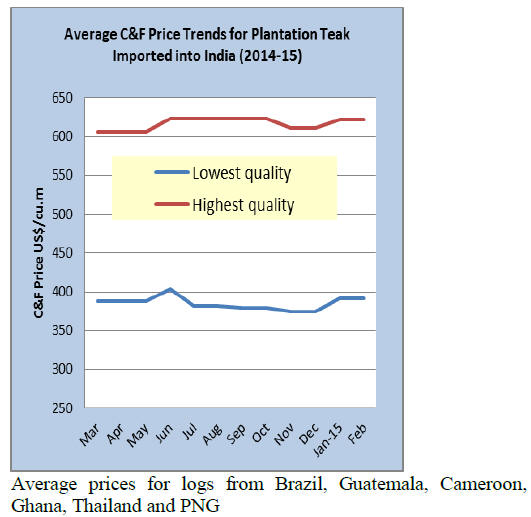

Current C&F prices for plantation teak

Traders report a steady flow of plantation teak.

In addition to the plantation teak arrivals,

natural forest

teak logs from Vietnam continue to arrive and prices are

unchanged at US$1349 per cubic metre.

Increased imports of logs from Sarawak

Since Myanmar implemented the log export ban Indian

traders have increased purchases from other sources.

Currently, Sarawak is the main supplier of non-teak

hardwoods to India. India‟s year on year log imports from

Sarawak increased by just over 13 % between January and

September last year.

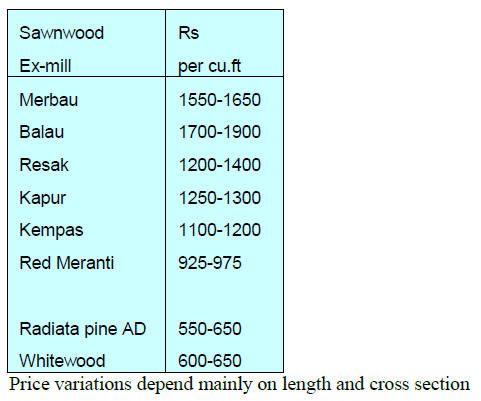

Prices for domestically milled sawnwood from

imported logs

Current exmill prices for air dried sawnwood are shown

below. As reported previously, prices have not changed

over the past two weeks.

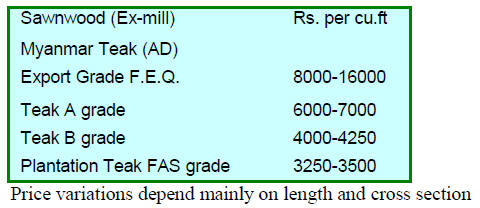

Prices for imported teak sawnwood

The volumes of sawn teak imports from Myanmar are

rising but analysts comment that the quality of the

sawnwood being shipped should be improved to meet the

demands of the market.

The rise in arrivals of sawn teak from Myanmar is

reflected in a slight easing of teak sawnwood prices.

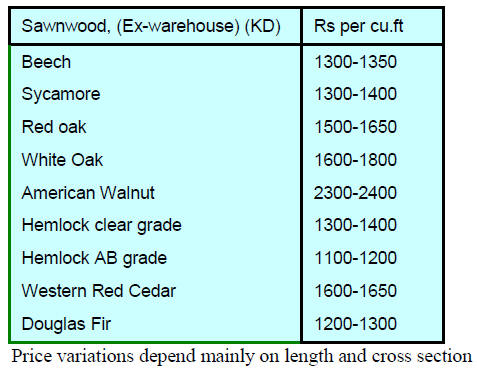

Imported 12% KD sawnwood prices

The prices below are per cu.ft ex-warehouse.

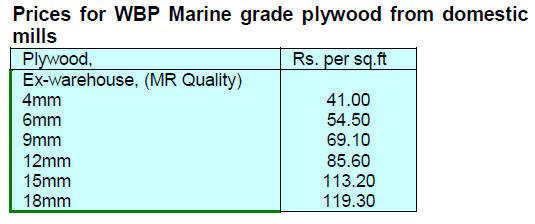

Acceptance of poplar a lifeline to plywood

industry

When Myanmar stopped exporting gurjan logs Indian

plywood manufacturers began experimenting with other

species and some positive results are emerging. Despite

the preference of end-users for plywood with red face

veneers, poplar logs are emerging as a source of veneer for

plywood manufacture.

In India poplar plywood is rapidly gaining acceptance

which has eased the problem of obtaining veneers faced by

plywood manufacturers and is also benefitting end-users

as poplar plywood is cheaper than panels previously made

with gurjan.

However, plywood manufacturers have been forced to

raise prices mainly due to rising wage bills which is

pushing up production costs. It is fortunate that the market

is accepting poplar faced plywood otherwise the price

increases would have been higher.

Bamboo development in NE India

India has one of the largest reserves of bamboo in the

world and 70% of this natural resource is found in the

North Eastern part of the country. The North East Centre

for Technology and Research is promoting bamboo for

various uses such as laminated beams, door and window

frames, chairs, and sofa sets, coffee tables as also flooring.

North Eastern states of India are priority areas for

development. Reforestation activities are continuing and

processing bamboo is being encouraged.

7.

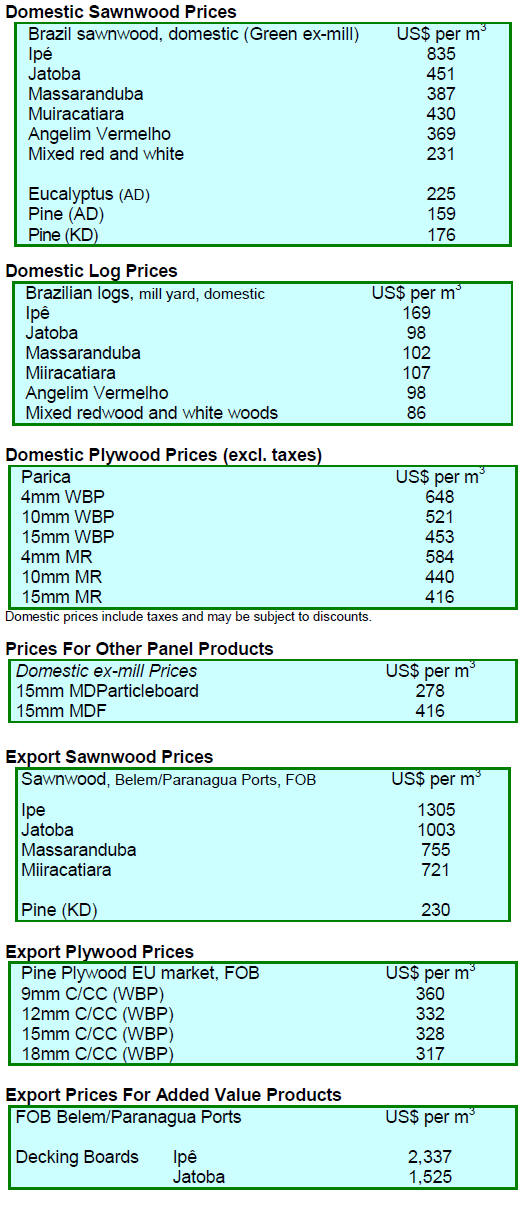

BRAZIL

Mato Grosso do Sul calls for review of

land acquisition

policy

During the recent State Forestry Congress the governor of

Mato Grosso do Sul called on the Attorney-General to

examine the restriction on the sale of land to foreigners.

Under the existing law, land acquisition by foreigners and

Brazilian companies controlled by foreigners is restricted

and this is limiting investment inflows.

Most business groups wishing to invest in forestry can

only do so through participation in Brazilian companies. A

change policy is likely to result in greater investments

which will benefit the state economy according to the

governor .

It has been reported that in Mato Grosso do Sul there are

some 9 million hectares of degraded land suitable for

forest plantations.

The area of planted forests in Mato Grosso do Sul has

expanded from around 90,000 hectares in 2003 to 800,000

today. The aim was to achieve 1 million hectares by 2020

but this target will be reached ahead of plan.

Prospects for the furniture sector

According to the Brazilian Market Intelligence Institute

(IEMI), prospects for the furniture sector in 2015 are

bright despite the disappointments of 2014.

IEMI estimates a 1.4% growth in revenues for

manufactures and a 10% growth in revenue to furniture

retailers.

2014 was the first year for a decline in furniture output

since IEMI started to compile data on the sector and the

main reasons behind the fall were weak domestic demand

and a tightening of domestic availability of credit.

IEMI was created to attend to the growing demand of

industries for statistics related to the market for different

sectors.

Initiative in support of exporters

The Ministry of Development, Industry and Foreign Trade

(MDIC) and APEX Brazil, (the Brazilian Agency for

Export and Investment Promotion) met with

representatives of the Brazilian Furniture Industry

Association (ABIMÓVEL) as well as representatives from

around 80 other national Industry associations. The

purpose of the meeting was to outline the government‟s

plan to support exporters.

The aim is to revive Brazil‟s foreign trade especially

manufactured goods exports through partnerships between

private and public agencies. The focus will be on trade

promotion, market access, exports financing, trade

facilitation, taxation and transparency and private sector

participation.

ABIMÓVEL presented data on the furniture industry

during the meeting and identified where action is required

such as:

a review of the Export

Financing Program

a review of the Export

Financing Program

(PROEX);

elimination of exports taxes,

particularly the

elimination of exports taxes,

particularly the

tax on circulation of goods and services

(ICMS);

guarantees to attract private capital

for longterm

guarantees to attract private capital

for longterm

financing;

revision of rules that restrict

back-to-back

revision of rules that restrict

back-to-back

operations;

trade agreements and

negotiations with

trade agreements and

negotiations with

Colombia, Peru, Chile and an effective

agenda for MERCOSUR;

addressing the negative impact from the

end

addressing the negative impact from the

end

of General System of Preferences (SGP) and

the importance of establishing an agenda of

negotiations with the United States;

reviewing double taxation agreements;

reviewing double taxation agreements;

assessment of logistics costs that undermine

the competitiveness of exporters;

the need to establish a foreign trade

policy.

the need to establish a foreign trade

policy.

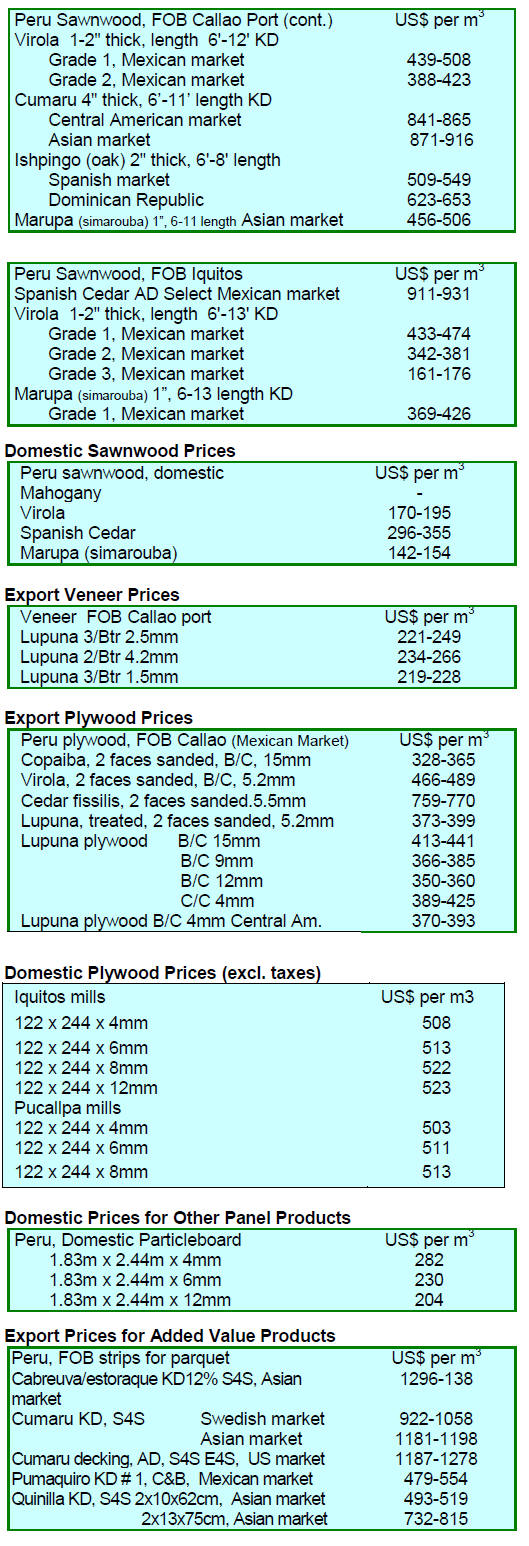

8. PERU

GPS locators for Amazon basin vessels

Authorities in Peru are considering requiring all boats

plying the Amazon basin to install GPS devices so they

can be tracked. This is part of the plan by the Commission

for the Fight Against Illegal Logging aimed at stopping

transport of illegally harvested logs and sawnwood

produced from such logs.

This proposal is being discussed with the National Forest

and Wildlife Service to devise new regulations requiring

the installation of GPS locators on river craft.

Currently, GPS locators are installed on Peru's

fishing

boats to monitor their movements and track if they enter

areas in the Pacific Ocean where fishing is banned.

Improved exports of non-traditional products

Peru‟s exports (excluding minerals) grew 4% in 2014

compared 2013 and earned US$10.5 bil. according to the

Center for Foreign Trade in the Lima Chamber of

Commerce.

The Center noted that ¡°over the past five years (2010-14)

the average growth in exports of non-traditional products

was 10% and that the performance in 2014 was a

disappointmen¡±t.

Peru has trade agreements with many countries or blocks

but just seven of these accounted for over 80% of all

export shipments of value-added products in 2014.

The main markets were the USA (US$2.8 billion); the

European Union(US$2.3 billion) and the Andean

Community of Nations.

Exports to Chile, Mercosur countries and China totalled

US$2.2 billion or around 20% of total exports. Imports by

the USA and EU increased in 2014 but it was imports by

Colombia and Bolivia that recorded the highest rate of

expansion.

Peru - levels of entrepreneurship down in 2014

The Institute of Economics and Business Development,

within the Lima Chamber of Commerce has reported that

according to the Global Entrepreneurship Monitor (GEM)

Peru is the fifth largest economy in Latin America and in

2014 achieved a high level of entrepreneurship.

In the GEM 2014 report Peru‟s entrepreneurial activity

rating at 28.8% was higher than that of Bolivia (27.4%)

and Chile (26.6%) but below that of Ecuador (32.6%), the

leader in the region.

However, compared to previous years labour productivity

in Peru declined in six of the eight sectors used to

determine the overall productivity rating. The most

dramatic declines were recorded in fishing (-16.6%),

electricity, gas and water (-15.4%) and construction (-

8.2%), while positive results were obtained in trade (2% )

and services (4.9%), says the Chamber.

See:

http://www.camaralima.org.pe/principal/noticias/3

9.

GUYANA

Challenges in shipping from Georgetown

Port

The main port in Guyana is Port Georgetown situated on

the north coast of Guyana along the East Bank of the

Demerara River. The port is run by a Maritime

Administration Department operating under the Maritime

Act.

Draft limitations have always been a problem in

Georgetown along with the 3-4 metre tide range. The

access channel to the port is always under threat from

heavy silting and this is a challenge for the authorities as

regular dredging is necessary.

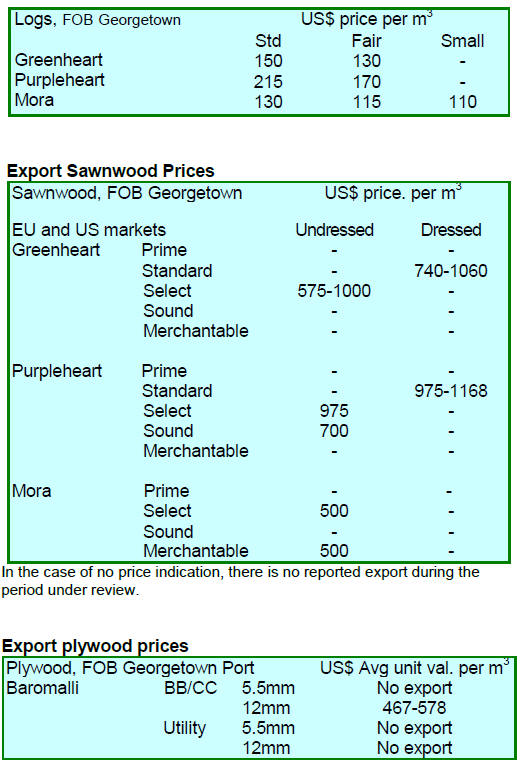

Export prices

There were exports of greenheart, purpleheart and mora

logs in the period reported.