|

Report from

North America

Update on US wood flooring trade

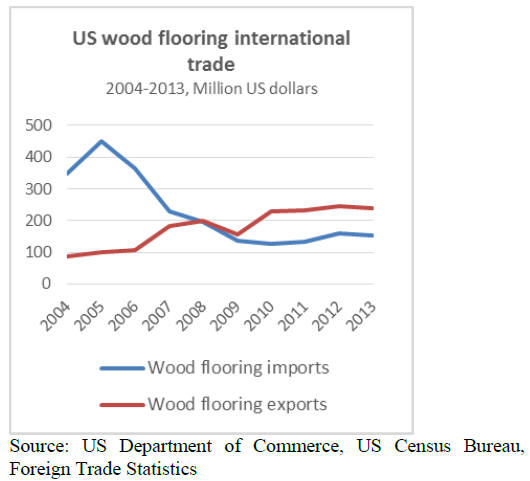

US net exporter of wood flooring

US imports of wood flooring have slowly recovered since

the financial crisis and economic recession. However,

even before the recession started imports had been

declining. 2013 imports were lower than in the years prior

to 2009.

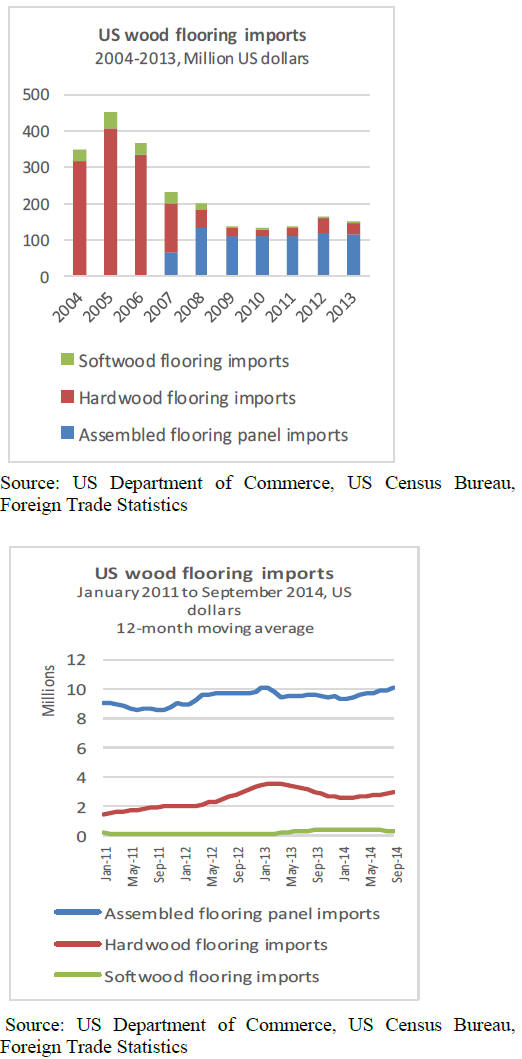

In 2004 imports of hardwood flooring, softwood flooring

and assembled flooring panels were worth US$349

million. Imports spiked in 2005 because of record new

housing starts before falling to just US$128 million in

2010. In 2013 wood flooring imports were worth US$152

million.

Exports of wood flooring have grown significantly over

the same period. US wood flooring exports surpassed

imports in 2009. Wood flooring exports grew by an

average 19% per year between 2004 and 2013, although

growth has slowed since 2010. Wood flooring imports

declined 6% annually between 2004 and 2013.

Both import and export data show the market‟s trend away

from solid strip flooring to engineered flooring. The

growth in flooring exports was mainly in assembled

flooring panels, while solid hardwood flooring exports

increased only slightly.

Imports of hardwood flooring declined from US$318

million ten years ago to US$41million in 2013. Its share in

total wood flooring imports fell from 91% in 2004 to just

25% in 2013.

Assembled flooring panel imports increased from zero to

US$114 million in the same period, accounting for 75% of

all wood flooring imports.

Despite the stronger housing market, wood flooring

imports have not markedly increased in the last two years.

Monthly import data, averaged over the previous twelve

months to remove seasonality effects, show that

September 2014 imports are almost unchanged from

summer 2012.

Hardwood flooring imports grew in late 2012 and early

2013, but fell back in the second half of 2013.

Domestic flooring production up

While wood flooring imports have not rebounded to prerecession

levels, domestic flooring production has

increased. Almost half of the wood flooring manufacturers

surveyed by the National Wood Flooring Association

reported higher production volumes in 2013.

Three quarters said their sales were up, with one third

reporting dramatically higher sales. No manufacturer

reported lower sales for 2013.

Flooring distributors surveyed by the National Wood

Flooring Association reported a similar growth in sales in

2013. 86% of distributors indicated higher wood flooring

sales compared to the previous year.

Sales of tropical species down

Unfinished solid wood flooring accounted for 48% of total

sales by the distributors surveyed, 24% was prefinished

solid and 23% prefinished engineered flooring. Red oak

remains the most popular species at over 40% of all wood

flooring sold and installed, followed by white oak, maple

and other.

US hardwood species. Domestic species accounted for

over 90% of the wood flooring market. Sales of tropical

species fell from 19% in 2008 to 6% in 2013, according to

the survey of distributors.

Home remodeling market

Homeowner spending on home remodeling grew by 2.3%

in the second quarter of 2014, according to US Census

Bureau data. Growth slowed from the previous quarters,

based on a four-quarter moving rate of change which

removes seasonality effects.

The Joint Center for Housing Studies of Harvard

University projects growth rates of 6.1% in the third

quarter and 7.9% in the fourth quarter (both are four

quarter moving rates of change, eliminating seasonal

effects).

However, the spending forecast was revised downwards

from expectations earlier this year. The recovery in the

housing market was slower than expected by many

analysts.

The rise in home prices and a slowdown in home sales had

a negative effect on remodeling activity. Many

homeowners also delay large remodeling projects because

credit remains tight.

Nonetheless spending on remodeling grew by 5% in 2013

from the previous year, according to estimates by financial

services provider Fitch. Total 2014 spending on home

improvement products is estimated at US$307.1 billion, up

from US$289.7 billion in 2013.

|