|

Report from

North America

Indonesia, Ecuador and Malaysia see plywood market

weaken

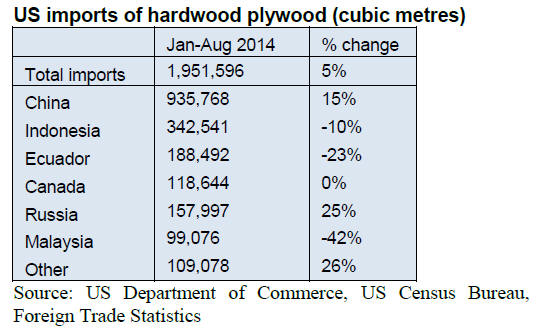

US imports of hardwood plywood fell by 11% in August

to 236,507 cu.m. Year-to-date imports were only slightly

higher (+5%) than in August last year.

The main decline was in imports from China and Canada.

The US imported 134,320 cu.m. of hardwood plywood

from China in August, down 22% from July. However,

imports from China remain higher than last year and

during the antidumping investigation.

Russian shipments of hardwood plywood grew by 17% in

August to 27,021 cu.m. Year-to-date imports from Russia

were 25% higher compared to the same time last year.

Hardwood plywood imports from Indonesia, Ecuador and

Malaysia increased as well, but year-to-date imports from

all three countries were lower than in August 2013.

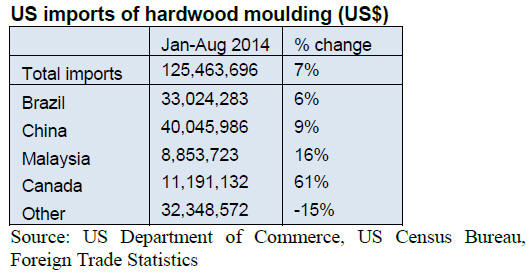

Hardwood moulding imports from China rise

US imports of hardwood moulding fell by 11% in August

following the high import levels earlier in the summer.

Imports were worth USUS$17.7 million in August.

China was the only major supplier that increased

hardwood moulding shipments to the US in August.

Imports from China grew by 6% to US$6.9 million from

the previous month.

Brazil‟s hardwood moulding shipments to the US were

worth US$5.0 million in August, down 4% from July.

Imports from Malaysia and Canada fell by about one third,

but year-to-date imports remain higher than in 2013.

Indonesia expands assembled flooring shipments to

US

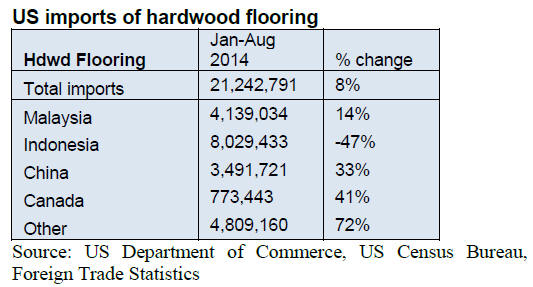

Hardwood flooring imports increased in August, while

imports of assembled flooring panels declined from the

previous month.

Year on year, imports of hardwood flooring increased by

13% to US$3.6 million in August. Indonesia was the

largest source of imports at US$716,846. August imports

from Malaysia declined by 5% to US$532,166 compared

to last year.

China‟s shipments of hardwood flooring were worth

US$596,265 in August, down 18% from July. However,

year-to-date imports from China were 33% higher than in

August 2013.

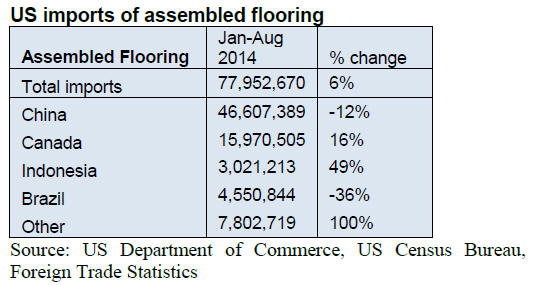

Total assembled flooring imports declined by 10% in

August to US$11.2 million, but year-to-date imports were

higher than last year. China remains the leading source of

imports, but imports from that country fell in August and

year-to-date imports were 12% lower than in August 2013.

Assembled flooring imports from Indonesia declined in

August, but were almost 50% higher year-to-date.

Canadian shipments were up in August, while imports

from Brazil declined.

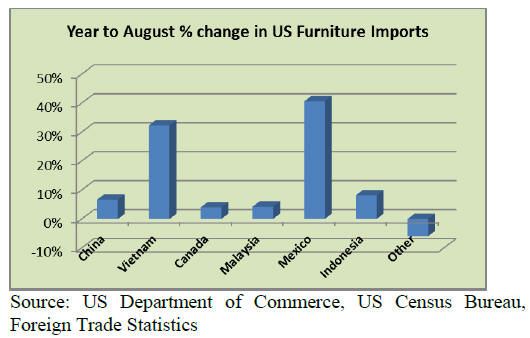

Vietnam grabs higher furniture market share

Wooden furniture imports declined in August marking the

first fall since March. US imports were worth US$1.25

billion in August, down 3% from July. Year-to-date

imports were 9% higher than in August 2013.

¡¡

Furniture imports from China fell by 8% to US$573

million and imports from most other major suppliers also

declined. Vietnam was the only major supplier to the US

which say an increase in shipments in August. Wooden

furniture imports from Vietnam grew by 3% to US$218.8

million in August.

Furniture imports from Italy and India continue to increase

following substantial growth in July. Poland shipped less

furniture to the US in August, but Poland‟s share in total

US wooden furniture imports has increased substantially

in the last two years.

Imports of wooden seats (upholstered and nonupholstered)

and office furniture declined in August, while

imports of wooden bedroom and kitchen furniture grew.

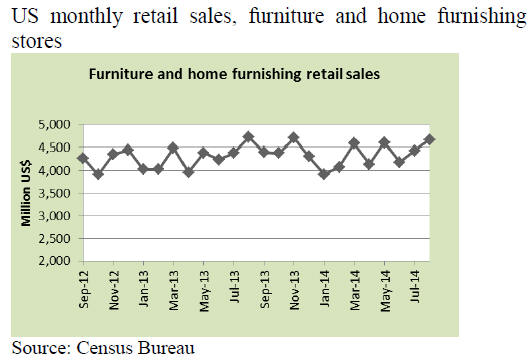

US Furniture retail sales up

US furniture retail sales were up in August, despite the

decline in furniture imports. Retail sales at furniture stores

in the US increased by 5% in August according to the

Census Bureau. However, sales were slightly lower (-1%)

than in August 2013.

GDP and unemployment data positive

The latest US economic data is positive, which should

support growth in demand. The latest estimate of GDP

growth in the second quarter of 2014 was 4.6%, some 0.4

percent higher than the previous estimate released by the

US Department of Commerce.

Unemployment in the US fell to 5.9% in September

according to the US Department of Labor. Employment

increased in professional and business services, retail

trade, and health care.

Wood products lead growth in US manufacturing

Economic activity in the US manufacturing sector

continued to grow in September according to the Institute

for Supply Management. Companies noted some labour

shortages and concern about geopolitical conflicts abroad.

The strongest growth in the manufacturing sector was in

the wood products industry. Furniture manufacturing also

expanded in September.

Consumers expect higher incomes

The recent positive economic news in the US is reflected

in higher consumer confidence. Consumer confidence

improved by 2.5% from August according to the Thomson

Reuters/University of Michigan index.

Most households expect higher incomes in the year ahead.

Job growth is also expected, but consumers believe the

improvement will continue to be moderate.

Home builders¡¯ confidence up across the country

Builders‟ confidence in the market for newly built singlefamily

homes increased for the fourth consecutive month

in September. The National Association of Home Builders

reported that home builders‟ confidence rose in all regions

of the country. Confidence is higher than any time since

2005.

Fall in multi-family housing starts in August

Multi-family housing construction fell by almost one third

in August. As a result, overall housing starts decreased by

14% to 956,000 units in August (seasonally adjusted

annual rate). Single-family housing starts declined by

2.4% to 643,000 units. Single-family starts remain higher

than at the same time last year.

The number of building permits also decreased in August,

mainly due to lower multi-family permits. Permits for

single-family construction were almost unchanged at

626,000 units at a seasonally adjusted annual rate. The

number of building permits issued is an indicator of future

building activity.

Buying homes as Investment loose shine

Sales of existing homes declined by 1.8% in August. The

decline was due to fewer investors buying homes,

according to the National Association of Realtors.

Individual investors accounted for 12% of total sales,

down from 16% last month.

The association expects better conditions for first-time

home buyers. The supply of homes on the market is

growing and the growth in prices may slow. The share of

first-time buyers in total homes sales was 29% in August.

Growth in office and commercial construction

Non-residential construction spending decreased slightly

in August at a seasonally adjusted annual rate. Private

construction declined by 1.4% and public spending by

1.1%.

However, the drop in public spending was mainly in

educational buildings. Public construction of office and

commercial buildings grew significantly by 11% and 8%,

respectively.

The American Institute of Architects reports a positive

outlook for the coming months. However, 76% of

architecture firms had major projects delayed or cancelled

for financing or economic reasons. The majority of

delayed projects were non-residential.

Decline in Canadian housing starts

Canadian housing starts declined by 3.3% on August to

196,000 at a seasonally adjusted annual rate. Both single

and multi-family starts decreased. The number of

residential building permits grew by almost 20%

compared to the same time last year. The growth was

mainly in permits for multi-family construction.

Growth in residential construction will be strongest in

Alberta in 2014, according to the Canadian Housing and

Mortgage Corporation. In 2015, housing starts are

predicted to increase in Quebec, British Columbia and

Manitoba due to improving economic conditions.

China¡¯s market share of Canadian hardwood flooring

imports increasses

Canada has extensive hardwood flooring manufacturing,

with most production facilities in the provinces of Quebec

and Ontario. As in the US, domestic manufacturing has

been increasingly replaced by flooring imports.

In 2013, hardwood flooring imports were worth US$219

million. The main sources of imports are China and the

US.

Much of Canada‟s production is solid hardwood flooring,

while engineered (multi-layer) wood flooring is mostly

imported from Asia. Engineered wood flooring imports

from China almost tripled in the last five years. In 2009

imports were worth US$6.3 million, increasing to

US$18.7 million by 2013.

Canadian imports from Indonesia grew from US$8.9

million in 2009 to US$14.2 million in 2013. Europe is the

third-largest source of engineered wood flooring, but the

growth in imports from Europe has been slow compared to

China and Indonesia.

Canadian imports of engineered wood flooring are likely

to continue growing in the coming years. The product has

only relatively recently gained recognition and acceptance

in the market in both Canada and the US.

Developers of multi-family housing, the most common

type of residential construction in Canadian cities,

increasingly use engineered flooring due to its lower cost

compared to solid hardwood flooring.

Engineered wood flooring is also becoming popular for

DIY renovations, although the less costly laminate

flooring still dominates this market.

Canadian media has recently focused on how Chinese

flooring imports threaten Canadian hardwood flooring

manufacturing. Manufacturing plants have closed, while

other producers have started trading flooring from China

under Canadian-sounding brand names.

One of the largest news networks in Canada, Global News,

reported on illegally cut timber from Russia, processed in

China and exported to Canada. Unlike the US, Canada

does not have a law like the Lacey Act that prohibits the

import and sale of illegally cut timber.

The media reporting also focused on the export of

hardwood logs from Canada for processing in China and

the possibility of higher formaldehyde emissions from

flooring made in China (see following story).

High levels of formaldehyde in some wood flooring

from China

The Canadian news network, Global News, reported in

October that six out of eight samples of Chinese-made

composite wood flooring had higher formaldehyde

emissions than allowed under California standards and

proposed US federal regulation.

The testing of the wood flooring samples was carried out

by the Hardwood Plywood and Veneer Association, which

represents North American manufacturers and about 90%

of all hardwood plywood and hardwood veneer produced

in the US and Canada.

While the US is introducing new strict regulation for

formaldehyde emissions from wood products, Canada

does not have similar regulation.

Canada has a voluntary agreement between government

and industry to limit formaldehyde. The agreement was

reached in 1986 and emission limits are higher than in

Europe and California.

|