|

Report from

North America

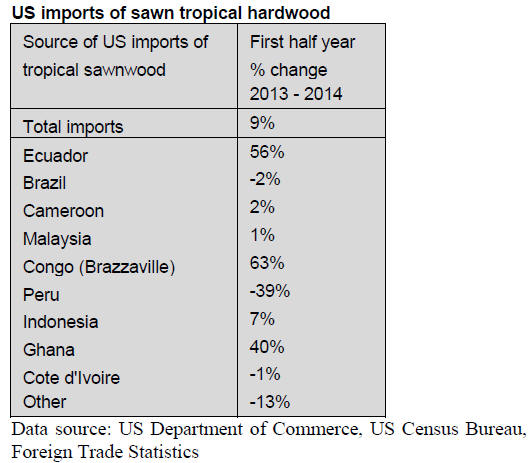

Steady growth in tropical sawnwood imports

While being up 9% for the first half of the year hardwood

sawnwood imports to the US fell by 50% in June,

following the high point reached in May when imports

were over 150,000 cu.m. In June, 75,742 cu.m of

temperate and tropical sawnwood were imported into the

US.

Tropical imports have gradually increased since the start

of the year, while temperate imports fluctuated.

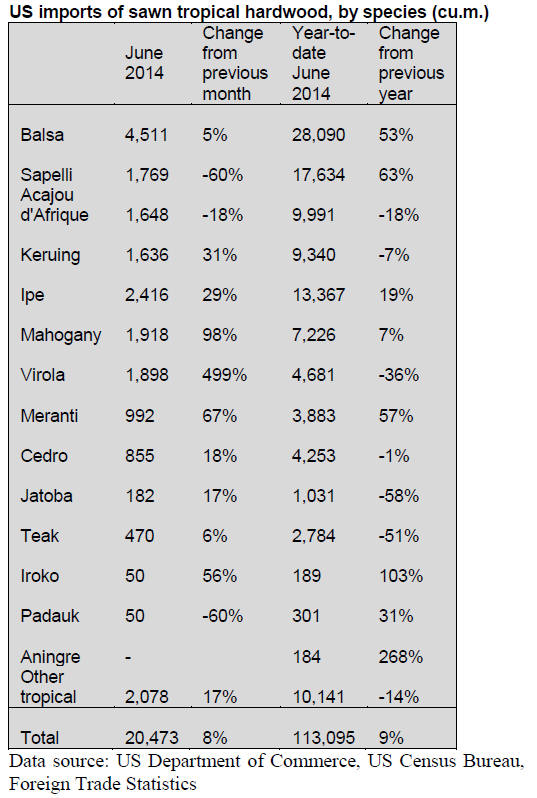

Imports of tropical species were 20,473 cu.m in June, up

8% from May. Year-to-date tropical sawnwood imports

were 9% higher than in May 2013.

Imports from Brazil increased by 40% to 3,350 cu.m in

June, but year-to-date imports remain below 2013 levels.

Brazilian shipments to the US of both ipe and virola

increased in June to 2,212 cu.m and 793 cu.m,

respectively.

Balsa imports from Ecuador were 4,511 cu.m in June, up

5% from May. Imports from Peru reached 1,604 cu.m with

a significant growth in virola sawnwood shipments.

Imports from Cameroon and Congo/Brazzaville fell due to

lower sapelli shipments from both countries. Ghana

shipped 1,669 cu.m of tropical sawnwood to the US in

June. The increase was mainly in acajou d‟Afrique

shipments.

Imports from both Malaysia and Indonesia grew by about

40% in June. Keruing exports to the US increased and

Malayisa also shipped more meranti (677 cu.m).

By species, the largest growth in US imports was in virola,

mahogany and meranti. Ipe and keruing imports grew by

about one third in June. Sapelli imports declined following

very high volumes in May.

Growth in Canadian tropical imports continues

Canadian imports of tropical sawn hardwood were worth

US$3.0 million in June, up 20% from May. On a year-todate

basis imports grew by 19% from 2013. The value of

Canada‟s imports represents 13% of total US tropical

sawnwood imports in June (US$22.1 million).

Much of the growth in imports was from Canada‟s two

main suppliers, Brazil and Cameroon. Both countries more

than doubled their shipments to Canada, but imports from

Congo/Brazzaville, Congo/Zaire and Indonesia also

increased. Balsa imports from Ecuador declined.

Sapelli remained the most significant tropical species

imported at US$703,655 and a 33% month-on-month

increase. The value of mahogany imports more than

doubled in June to US$120,382.

Demand for wood-plastic composites forecast to grow

US demand for wood-plastic composite and plastic lumber

is forecast to rise 9.8% annually through 2018, according

to a Freedonia market study (Wood Plastic Composite &

Plastic Lumber, Study 3145, June 2014). Demand is

expected to reach US$5.5 billion in 2018. In 2013, the

market was worth US$3.45 billion according to Freedonia.

The main end uses of wood-plastic composite and plastic

lumber are traditional wood product applications: decking,

mouldings and trim, fencing, landscaping and outdoor

products.

Decking is the largest market for wood-plastic composite

and to a lesser degree for plastic lumber. Demand for

wood-plastic composite and plastic decking was US$1.4

billion in 2013, accounting for 19% of the total decking

market. Demand is expected to grow 12% annually to

reach US$2.47 billion in 2018.

The second-largest market for wood-plastic and plastic is

mouldings and trim, worth US$1.0 billion in 2013. Annual

growth is forecast at 8.7%, with demand estimated at

US$1.5 billion by 2018.

Demand for wood-plastic composite and plastic in fencing

and outdoor products is expected to grow at a slightly

lower rate of under 8% annually. Other miscellaneous

applications will account for US$415 million in 2018, up

from US$285 million in 2013.

Wood-plastic composite decking that copy the appearance

of expensive wood species such as ipe and redwood are

increasingly available and popular. Wood-plastic

composite producers have also improved manufacturing

technologies in recent years to improve resistance to

fading and decay.

As wood-plastic products improve and consumers prefer

low maintenance products, wood-plastics will continue to

compete with wood in decking and other outdoor products.

Environmental group files lawsuit over formaldehyde

content in flooring made in China.

Environmental group files lawsuit against large retailer

Lumber Liquidator over formaldehyde levels in laminate

and engineered wood flooring imported from China.

California has stringent formaldehyde emission standards

governed by the California Air Resources Board.

Californian law allows citizens to file lawsuits to enforce

the emission standards.

The standards were exceeded in several tests of flooring

samples according to the environmental group. They claim

the samples tested showed that Lumber Liquidators sells

flooring from China with substantially higher

formaldehyde emissions than flooring made in the US or

Europe.

The US retailer, Lumber Liquidators has previously been

accused of importing illegally logged hardwood products.

Last year US authorities investigated the company over

alleged violations of the US Lacey Act.

* The market information above has been generously provided

by the Chinese Forest Products Index Mechanism (FPI)

|