2. GHANA

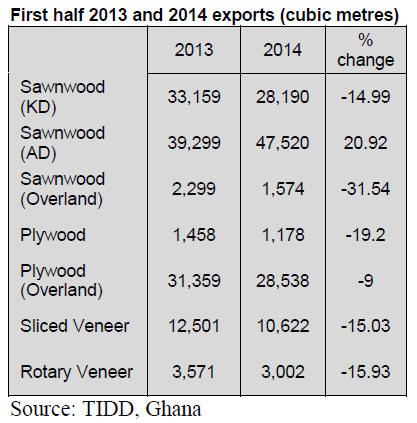

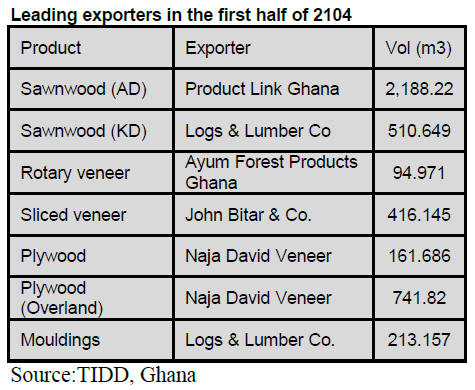

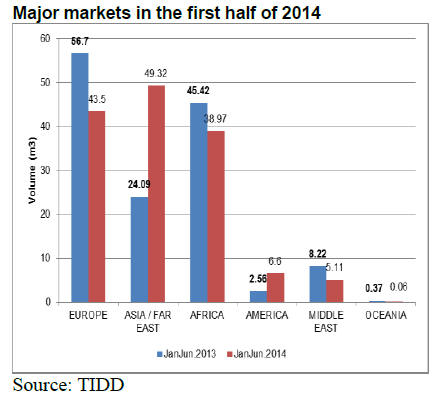

First half exports up 4.5%

Ghana‟s first half year wood product exports amounted to

143,541 cubic metres, up 4.5% on the 137,363 cubic

metres shipped in the first half of 2013. Export of three

products sawnwood, plywood and veneers accounted for

84% of the first half 2014 export volume.

The average unit value (AUV) dropped from euro 447

per

cubic metre in the first half of 2013 to euro 411 in the first

half of 2014, an 8% decline. Exports to Mali recorded the

highest AUV (Euro 455 per cubic metre) with exports to

Nigeria earning the lowest at euro 312 per cubic metre.

Ghana‟s wood exports in the first half of this year

were

shipped mainly to the Asian and Middle East markets

(India, China, Israel, Singapore, Lebanon and Vietnam)

34%,, Europe (Italy, France, Germany, Belgium and U.K.)

30% and Africa (South Africa, Egypt, Morocco, and the

ECOWAS countries) 27%.

Exports to ECOWAS countries totalled 31,741 cubic

metres valued at euro 9.75 million and comprised mainly

the overland export of plywood and sawnwood.

Finance Ministry revises 2014 targets

Projections for Ghana‟s economy have been revised

according to the Minister of Finance, Mr. Seth Terker. The

forecast GDP of 8% has been revised to 7.1 percent while

the annual inflation target of 9 percent has also been

revised up to 13%.

Ghana‟s annual inflation rate rose to a four-year high of

15.3% in July, up from 15.0 per cent in June, mainly

because of the increase in utilities and fuel.

3. MALAYSIA

Chief Minister declares certification is

the way forward

for Sarawak

On 20 August at a seminar on forest certification

Sarawak‟s Chief Minister, Tan Sri Datuk Amar (Dr.) Haji

Adenan Bin Haji Satem, declared that forest certification

is the way forward for the timber industries in Sarawak

and set targets and a timeline for the industry.

The following is an extract of the „Officiating

Speech by

the Chief Minister‟ delivered at the opening of a seminar

„Forest Management Certification (Natural Forest)‟.

Copies of the address were distributed to participants:

¡°I would like to draw your attention to the theme of the seminar

„FOREST MANAGEMENT CERTIFICATION - THE WAY

FORWARD".

Is it the way forward for the state and our timber industry in

Sarawak? Forest management certification is a voluntary market

based instrument to promote sustainable forest management. It

serves to inform the final consumer that they are buying the

product of a sustainably managed forest. Although it is mainly

driven by market actors there are equally important actors

involved in the processes.

Forest management certification‟s development over the years

has also drawn governments into discussion of how they should,

or should not intervene to promote their broader policy

objectives.

As a responsible government, the state has a major role to play

in setting out a policy and institutional framework, and as a

significant actor ourselves, for instance as forest owners, the

state as I emphasized earlier is fully committed to SFM. The state

government will adopt any best practices in forest management.

The state considers forest management certification as one of the

key tools to improve forest management standards and practices

in Sarawak.

The timber industry must co-operate fully with the government to

combat the negative perception that the state‟s forest policy is

poorly or ineffectively managed.

For the timber industry, the forest management certification is

the best available way forward.

Some benefits can be anticipated from the forest certification

especially in terms of improved market access, image and forest

management.

The forest certification has transformed forest products markets

over the last 15 years. Demand for certified forest products is

growing, driven by concern for the sustainability of supply,

either by companies up and down the wood chain, or by

purchasers of wood and paper products, especially business to

business and governments.

It is now difficult to export products from uncertified tropical

forests to environmentally sensitive markets, for example, to the

Netherlands and United Kingdom. Conversely, tropical timber

from certified forests in other parts of Malaysia is finding

improved export opportunities and strong market growth.

The state will assist the timber industry in Sarawak to achieve its

forest certification. We will contribute to capacity building in the

field of certification, provide support, guidelines and required

standards and provide assurance of a level playing field in

international trade and on domestic markets.

To ensure that the forest areas in Sarawak are sustainably

managed based on international standards and recognized by the

world communities, the Forest Department Sarawak will act as a

central facilitator and catalyst in the certification process. The

Forest department had already prepared action plan and develop

relevant guidelines and procedures for the implementation of

forest certification in Sarawak.

The state government is encouraging all major license holders

namely ShinYang, WTK, KTS, Samling, Rimbunan Hijau, Ta Ann

and STIDC to obtain international forest management

certification for their timber products.

The certification can be the Malaysian Timber Certification

Scheme (MTCS) of Forest Stewardship Council (FSC) or

Programme for the Endorsement of forest certification (PEFC)

schemes.

I had announced in June 2013, during my tenure as the Special

Functions Minister, in one of a state functions that the state

government wants concession areas within the heart of Borneo to

obtain sustainable forest management (SFM) certification by

July 2017.

I would like to reiterate here again that the major players as

mentioned is requested to get certification for at least one of

their licence areas by July 2017.

At the moment, the government is encouraging the timber

industry, especially the major licence holders to get certification.

The government will review this policy from time to time and in

the future we may make forest certification mandatory for all

licence areas.

Earlier this year, the Sarawak Timber Association (STA) has

highlighted and brought to my attention the challenges that are

facing the timber industry in Sarawak. I took note there are many

challenges in obtaining the forest certification but we must

pursue it now to become competitive.

I believe we can overcome the problems since we already have

certified forest management unit which is Anap Muput FMU in

Bintulu. Peninsula Malaysia and Sabah are doing well in forest

management certification.

I noted that one of the challenges is that many timber licenses

have short tenure periods which are not conducive for logging

operators to undertake forest management certification in view

of the high costs involved.

I acknowledge their concerns and would like to make a special

announcement here that the tenure of the license will be extended

up to 60 years. The 60 year tenure will be granted from the date

of the license issued. But one of the conditions that will be

imposed is that the license operators shall incorporate the

requirement for certification within three years from the date of

approval and failure to comply with the condition shall cause the

license to be terminated.¡±

The reaction of industry analysts is that this is a significant

change and will present major challenges to the Sarawak

timber industry. With such a strong push by the state

government and an equally attractive pull of a 60 year

license tenure, forest certification will come to Sarawak.

First half year exports disappoint

Exports of timber and timber products from Sarawak in

the first half of 2014 grew by just one percent compared to

the same period in 2013 (2014 first half RM 3.66 billion;

2013 first half RM 3.61 billion). Plywood was the main

export product, commanding 54% of total exports in the

first half (RM1.98 billion, approx. US$ 617 million).

The key market for the state‟s timber products was Japan

(RM1.548 billion; approx. US$482 million which

accounted for 40% of the state‟s total revenue from the

export of wood products.

India was the second major buyer (RM702 million;

approx. US$219 million) followed by Taiwan P.o.C (RM

379 million or US$118 million) and South Korea (RM253

million or US$79 million). Combined, the total revenue

from these three countries alone amounted to RM1,334

billion.

Awang Tengah Ali Hasan, Minister for Resource Planning

and Environment, was quoted by local newspapers as

saying ¡°We see the increase in export value of our timber

products in the first six months of this year as a positive

sign for the industry, despite the unstable global

economy.¡±

He said that, in addition to the traditional markets, the

state was trying to explore other markets such as Yemen

and Vietnam having examined the market in Kazakhstan

last year.

Traders based in Sarawak reported log FOB export prices

as follows:

Meranti SQ US$255 - 285/cu.m

Kapur SQ US$325 - 355 /cu.m

Keruing SQ US$325 - 365 /cu.m

Selangan Batu regular US$ 490 - 520 /cu.m.

Plywood traders based in Sarawak reported the following

FOB export prices:

Floor base FB (11.5mm) US$ 630

Concrete formboard panels CP (3‟ x 6‟) US$525

Coated formboard panels UCP (3‟ x 6‟) US$605

Standard boards

Middle East (9-18 mm) US$470

South Korea (8.5 ¨C 17.5 mm) US$465

Taiwan P.o.C (8.5 ¨C 17.5 mm) US$ 465

Hong Kong US$ 470

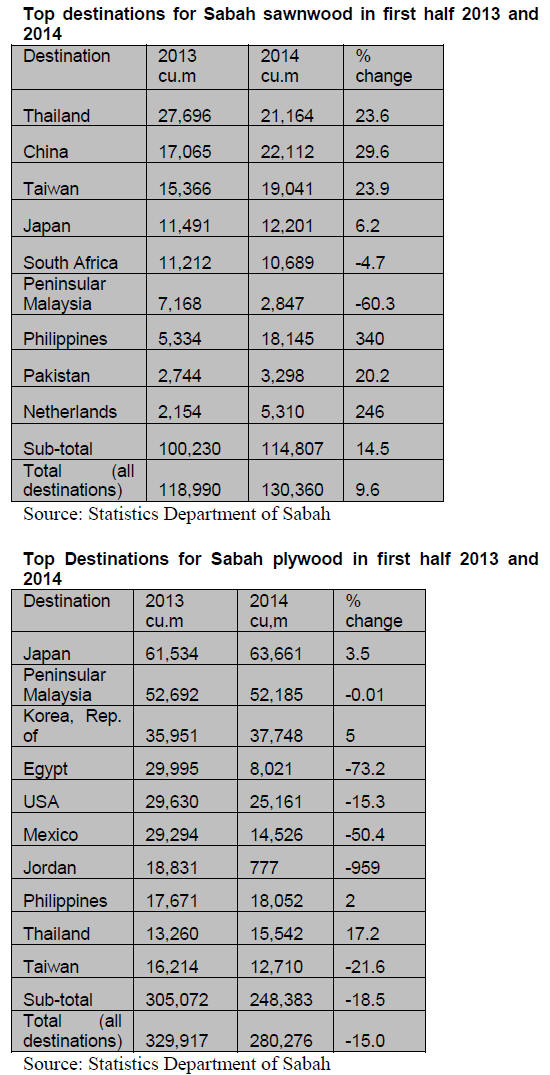

Correction

Apologies for omissions the tables for the export statistics

of Sabah provided in the previous issue of this report. The

following tables provide the complete data.

4. INDONESIA

Big jump in furniture exports to EU

According to recently released data from the Ministry of

Forestry wood product exports in the first half year were

almost 12% up on the same period in 2013.

Forestry Minister Zulkifli Hasan attributed the

improvement in exports as partly due to the conclusion of

the VPA with the EU which opened the way for an

increase in timber exports to the EU.

The latest data shows that wooden furniture exports more

than doubled to US$11 million in the first six months of

the year, up from the US$5.4 million in the first half of

2013.

In related news the Minister forecast furniture and

handicraft exports to exceed US$2 billion for the full year

as the pace of timber legality verification in Indonesia

accelerates.

IFEX encouraged investment in processing

Trade fairs, such as Indonesia‟s International Furniture

Expo (IFEX), provide a boost to both export sales and

domestic investment as new opportunities emerge from

exchange between fair participants.

The Chairman of the Association of Indonesian Furniture

and Handicrafts (AMKRI), said that buyers, manufacturers

and designers from many countries visited IFEX and

created an environment fostering innovation and

creativity. The second IFEX will be held in Jakarta 12-15

March 2015.

Satellite Imagery ¨C technology to identify forest fire

¡®hotspots¡¯

The newly created agency „Reduced Emissions from

Deforestation and Forest Degradation‟ (BP-REDD) has

introduced an online technology equipped with real time

high-resolution satellite imagery utilising NASA data.

This online system can be used to idnifiy the location of

track fires and relate them to land-use and concession

maps.

Information generated by the BP-REDD system can be

relayed to the National Disaster Mitigation Agency

(BNPB), the Ministry of Forestry as well as the fire

service and police.

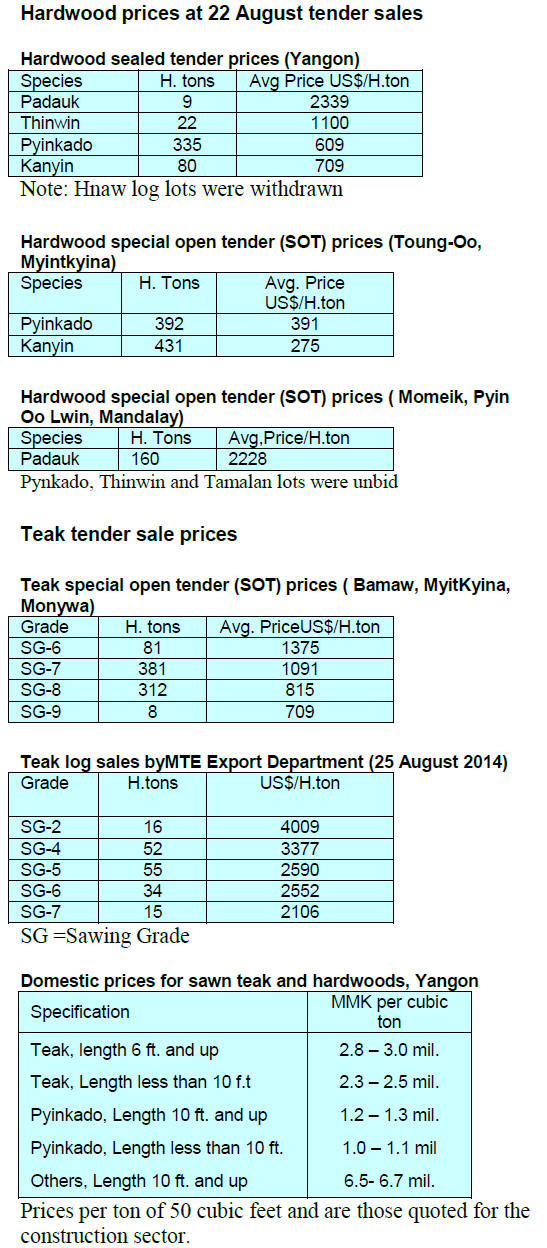

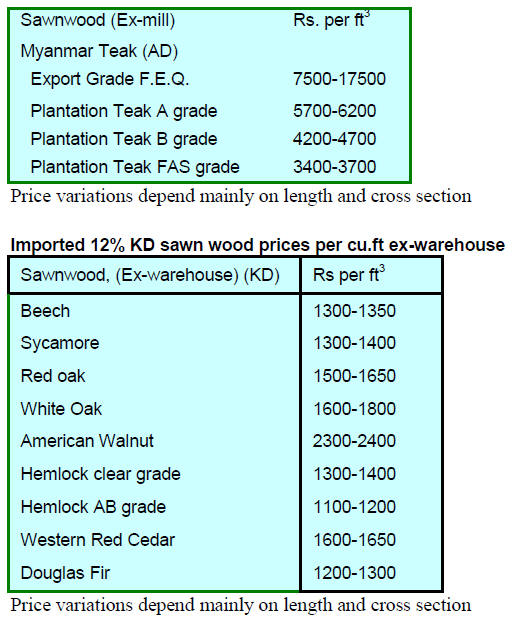

5. MYANMAR

Revenue from log sales down since log

export ban

Quoting an official from the Myanma Timber Enterprise

(MTE), Mizzima News has reported that, during this fiscal

year, MTE has sold over 30,000 tons of teak logs worth

Myanmar Kyats 11 billion as well as teak sawnwood

worth US$1.6 million.

The MTE Local Marketing Department sold logs and

sawnwood from depots in Mandalay and Yangon through

five open tenders and earned Kyats 11 billion.

The MTE Export Marketing Department also sold teak

and other hardwood logs and sawmwood from depots in

Yangon. Revenue from the sale of 588 tons of teak logs

totaled US$1.6 million. Revenue from log sales has fallen

sharply since the log export ban.

FJV auctions hardwoods

The Myanmar Forest Products Joint Venture Corporation

(FJV) has announced it put up for sale 2,172 hoppus tons

of hardwood logs by open tender during August.

FJV General Manager, Soe Moe Win, explained that these

logs were for the domestic industry and were sold with a

view to promote expansion of domestic milling.

IWPA initiative to spur SFM

Eleven News Media on 21 August reported that the

decision by the US to resume timber imports from

Myanmar could help save Myanmar forests.

The press was referring to the news that the US

government has granted a one year waiver of the sanctions

allowing members of the International Wood Products

Association (IWPA) to establish direct trade with

Myanmar.

The news of the one year waiver on has been welcomed by

the timber industry. Some analysts in Myanmar went as

far as suggesting this move could have a positive impact

on efforts to protect Myanmar‟s forests.

Analysts say the IWPA initiative could assist Myanmar

exporters in their efforts on timber legality verification and

in efforts towards the sustainable management.

¡¡

6.

INDIA

Wood product price index drops

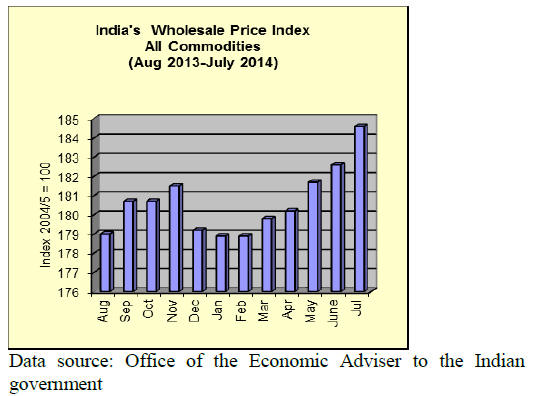

The Office of the Economic Adviser (OEA) to the Indian

government provides trends in the Wholesale Price Index

(WPI). The official Wholesale Price Index for All

Commodities (Base: 2004-05 = 100) for July 2014 rose to

184.6 (provisional) from 182.6 for the previous month.

The annual rate of inflation based on the July WPI was

5.19% compared to 5.43% for the previous month.

See

http://eaindustry.nic.in/cmonthly.pdf

The index for all wood and wood products declined by 0.9

percent to 185.4 (provisional) from 187.0 (provisional) for

the previous month due to lower price of plywood and

fibreboard.

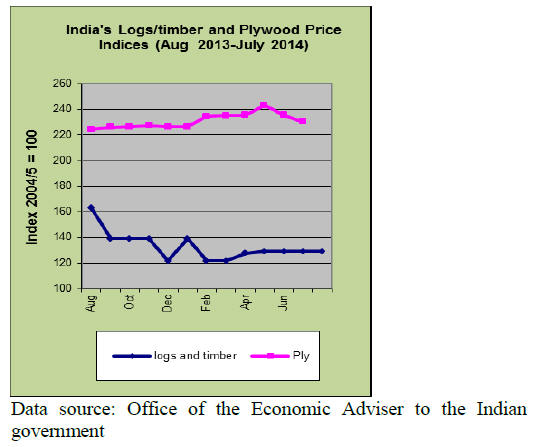

Timber and plywood wholesale price indices

The OEA reports Wholesale Price Indices for a variety of

wood products. The Wholesale Price Indices for

logs/timber and Plywood are shown below. The July 2014

logs/timber index continued almost unchanged but the

plywood price index slipped further in July.

Enthusiastic support for Van Mahotsav

Van Mahotsav, the annual tree-planting festival in India, is

celebrated in all states with the onset of the monsoon. This

year Gujarat State, for example, planned to raise and

distribute 10 million seedlings. Every citizen in India

dreams of planting saplings during Van Mahotsav week.

This movement was initiated in 1950 by India's then

Minister for Agriculture, Dr. K.M Munshi. This festival

has gained immense national importance and every year

millions of saplings are distributed and planted across the

country.

The planting of trees during the festival has a practical as

well as traditional purpose. The seedlings eventually

produce fuelwood, create farm shelter-belts, provide

fodder for farm animals, create shade and help soil

stability.

Sandalwood prices continue to rise

At the most recent auction held in Marayoor 35.4 tonnes

of sandalwood were sold earning Rs.234 million for the

Kerala Forest Department.

The Department maintains about 3,500 ha. of natural

sandalwood forest in the Western Ghats section of Idukki

district of Kerala. The sandalwood grown here has a

worldwide reputation for quality.

The highest price realised was Rs.10,500 per kg. for class

5 sandalwood while the average price for this class was

Rs.9950 per kg, higher than the average at February

auctions. Protection of sandalwood trees receives the

highest priority and only fallen trees and branches and

dead trees are auctioned.

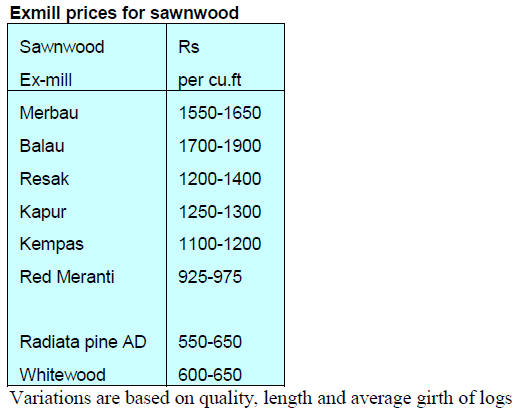

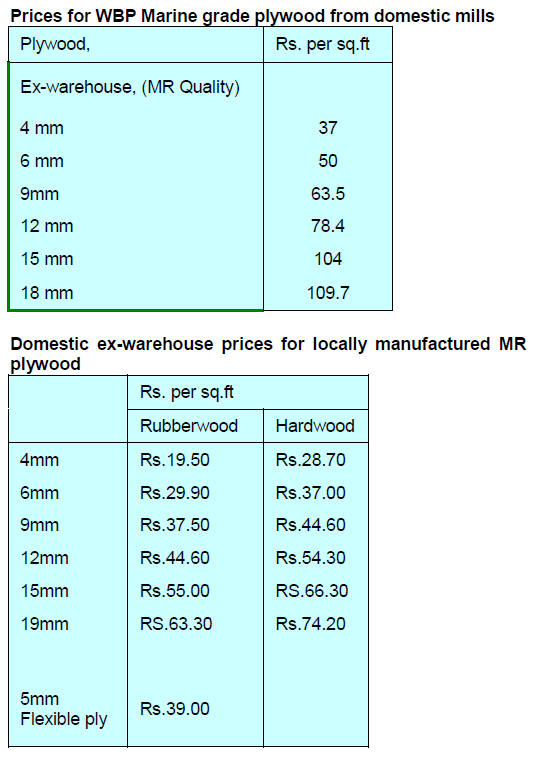

Improved business sentiment drives up demand for

reconstituted boards

In keeping with its election manifesto the new

Government has begun implementing stalled

infrastructure, power generation, road building, port and

mining projects.

The wood panel sector has suffered weak demand during

the past few years but is now coming to life as domestic

demand expands and prices rise helped by the rising prices

of chips and fibre as well as imported boards. Currently

domestically manufactured boards are competing well

with imported thick plywood prices of which have been

rising.

India‟s annual wood panel market is estimated at Rs.200

billion comprising 75% plywood and 25% particleboard

and MDF.

Local manufacturers have been improving the surface

quality of boards and are producing higher density panels

to permit accurate routing.

Indian manufacturers are also supplying laminated panels

in a variety of designs and colors to compete with

imported surfaced plywood.

Domestic pre-laminated particleboard is now produced by

the particleboard mills which eliminates the need for onsite

lamination which would almost double the cost of

each panel. Additionally, the lower raw material cost for

reconstituted boards compared to that for plywood is also

helping the revival of the particleboard and MDF

industries in India.

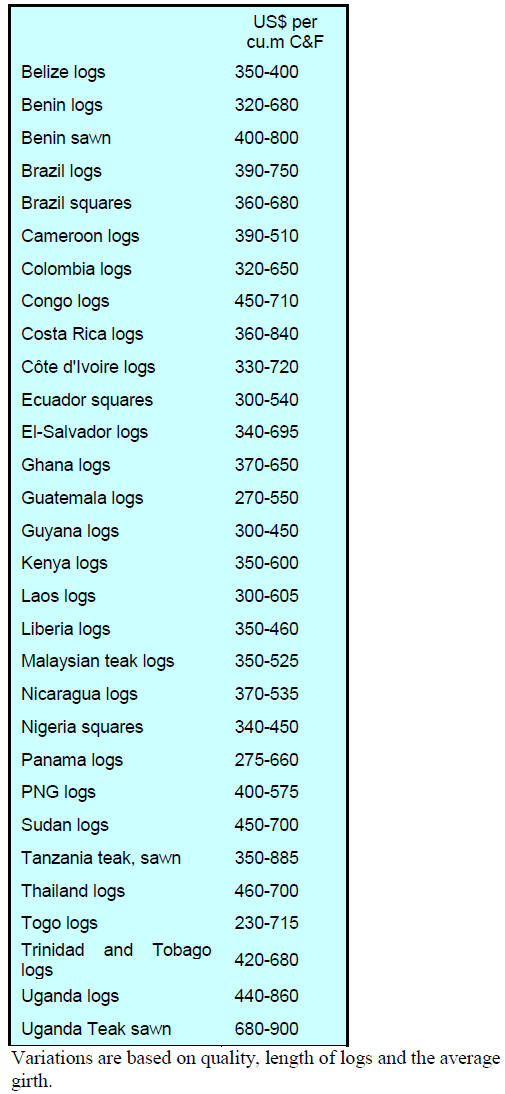

Imported plantation teak

Prices for small teak log thinnings from Costa Rica,

Ghana, Panama and Togo have fallen reflecting the lower

quality and small size of logs but, as exporters in Congo,

Ivory Coast and Panama have shipped better grades, prices

for their plantation teak logs have risen. A new supplier,

Belize, has started to export plantation teak log thinnings.

The current prices for plantation teak logs per cubic metre

C & F Indian ports are shown below:

Myanmar veneer logs in short supply

The declining stocks in India of Myanmar teak is

beginning to bite and prices are rising especially for

veneer quality logs required by manufacturers of fancy

plywood. Prices for Myanmar teak sawnwood milled in

India are also rising.

Diversified sources of veneer

The shortage of Myanmar gurjan face veneers has been

alleviated to some extent by imports from China and

Vietnam.

Malaysia and South Africa have also started supplying

veneers to Indian factories.

As domestic and imported particleboard is starting to

replace thicker plywood panels shippers of plywood in

China have started to lower their prices.

7.

BRAZIL

Restructuring of forest sector boosts

output in Mato

Grosso

Forestry and wood product manufacturing is the forth

largest economic sector in Mato Grosso and sector

activities are spread across more than 40 municipalities

generating 100,000 direct jobs.

In 2013 the sector paid to government R$85 million in

ICMS (Tax on Circulation of Goods and Services) and

R$19 million in State Fund for Transport and Housing

(FETHAB) tax.

In order to reconcile economic development and

environmental conservation the forestry sector in the State

of Mato Grosso has been improving forest management.

According to CIPEM (Center for Wood Industry

Producers and Exporters of Mato Grosso), the

restructuring of the forest sector in the state was a major

factor in boosting output of wood products. Further

improvement in forest management practises are expected

to lead to high output.

2015 forest concession plan

The 2015 Forest Concession Plan (PAOF 2015) ) for

public forests in the states of Amazonas, Par¨¢ and

Rondônia has been published by the Ministry of the

Environment (MMA). The plan identifies 3.4 million

hectares available for allocation.

The PAOF 2015 plan is based on the National

Register of

Public Forests (CNFP) for which some 313 million ha of

forests had been registered as of November 2013. Of this

total, approximately 224 million ha. are Federal Public

Forests, 89 million ha. Are State Public Forests and the

balance are Municipal Public Forests.

The inclusion of Public Forest in the PAOF 2015 does not

necessarily mean all areas will be available as harvesting

concession during the period of the current plan.

The PAOF 2015 identifies areas that may become

available as forest concessions allowing entrepreneurs

access to public forests for sustainable management.

Around 92% of Public Forests in Brazil are in the Amazon

region.

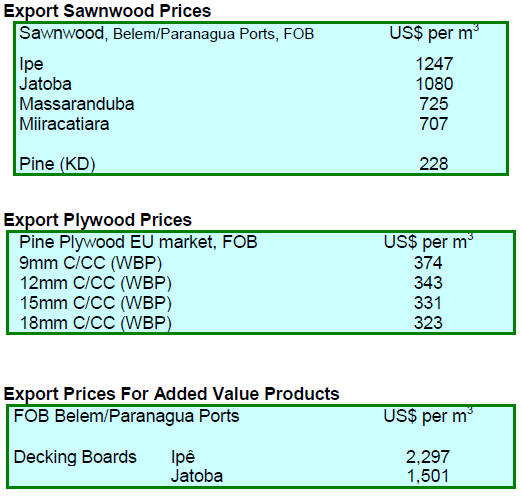

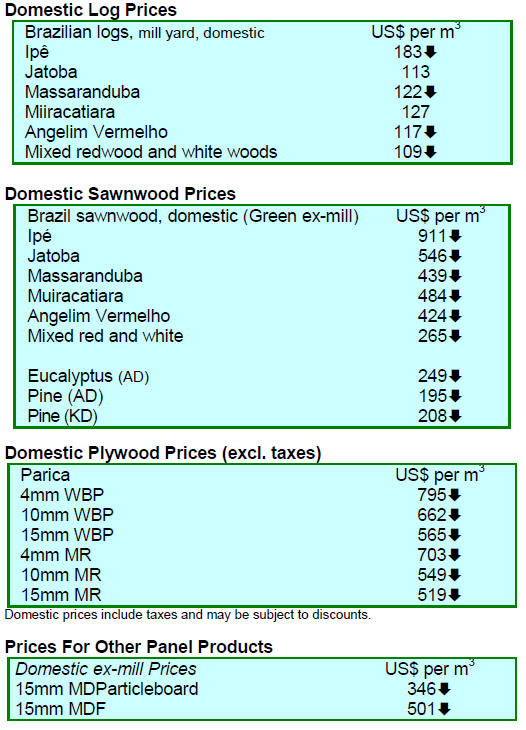

Hardwood price movements

Prices fro Brazilian roundwood from natural forests in the

period reviewed ranged from US$109/cu.m to

US$183/cu.m at mill yard. The price of Brazilian

sawnwood from natural forests varied from US$265 per

cu.m to US$911 per cu.m ex-factory depending on the

species. In each case the upper price refers to ip¨º

(Tabebuia sp.).

The average price of parica WBP glue plywood ranged

from US$565 percu.m to US$795 per cu.m ex-factory

depending on thickness.

Prices for parica MR glue plywood ranged from US$519

per cu.m to US$703 per cu.m ex-factory depending on

thickness. Average prices for reconstituted wood panels

were, in the period reviewed, US$346 per cu.m ex-factory

for raw MDP (15 mm) and US$501 per cu.m ex-factory

for raw MDF (15 mm).

Pine product exports lead the field

In July 2014, wood product exports (except pulp and

paper) increased 12.2% in terms of value compared to July

2013, from US$204.0 million to US$228.9 million.

Pine sawnwood exports increased 43.4% in value in July

2014 compared to July 2013, from US$14.5 million to

US$20.8 million. In terms of volume, exports rose 37.6%,

from 64,400 cu.m to 88,600 cu.m inthe same period.

Tropical sawnwood exports increased 9.2% to 27,300

cu.m in July 2014 compared to the 25,000 cu.m exported

in July 2013. In terms of value July 2014 exports increased

2.8% year on year.

Pine plywood exports also improved in July rising 45.3%

in value compared to levels in July 2013 (US$ 24.5

million to US$ 35.6 million). The volume of pine plywood

exports also increased from 66,400 cu.m in July last year

to to 96,000 cu.m. On the other hand tropical plywood

exports fell 2.6% in volume, from 3,900 cu.m in July 2013

to 3,800 cu.m in July 2014.

Wooden furniture exports increased slightly from the

US$41.0 million in July 2013 to US$41.8 million in July

this year.

Par¨¢ timber exporters face a raw material crisis

Exports of processed and manufactured timber products in

the state of Par¨¢, one of the main timber products exporter

states of Brazil, grew 21% in the first half of 2014

compared to the same period in 2013. Currently, added

value product exports from Par¨¢ comprise mainly

sawnwood (44%) and flooring (38%).

According to the Association of Timber Industries

Exporters of Par¨¢ State (AIMEX), the good performance

of exporters in the state of Par¨¢ in the first half of 2014

was due to an abundant supply of raw materials and firm

order books reflecting the favourable exchange rate in the

first half of the year.

AIMEX is warning that the good export performance in

the first half of this year is threatened by the change in the

BRL/US$ exchange rate and a looming crisis in the supply

of raw material brought on by delays in the approval of

forest management plans.

Regional markets dominate veneer exports

Brazil‟s tropical hardwood veneer exports in July 2014 fell

48% in value and 3% in volume compared to levels in July

last year. In July 2013 the main markets for veneer were

Argentina, Italy, Chile and Belgium, representing 30%,

25%, 12% and 7% respectively.

In July 2014, Argentina remained the main importer of

Brazilian tropical veneer, (21%), followed by Chile (20%),

the United States (15%), and China (12%).

Manufacturers in Paran¨¢ state were the main tropical

veneer exporters in July 2014, (45%) followed by Par¨¢

(42%) and Rondônia (12%).

8. PERU

IFC issues first green bond in Sols

The International Finance Corporation (IFC) focusses on

support for the private sector in developing countries. In

August the IFC issued a „green‟ bond denominated in

Peruvian sols which generated around US$15 million for

investments that favor the environment in emerging

markets.

IFC Vice President, Jingdong Hua, said the latest „green‟

bond offers an opportunity for investors in emerging

markets. The bond will support investment projects in

renewable energy and energy efficient technologies.

For more see:

http://ifcext.ifc.org/IFCExt/pressroom/IFCPressRoom.nsf/

0/5C75C78F84D22AB685257D320069686B?OpenDocu

ment

US$3 billion from exports by 2021

The production and marketing of forest products could

generate more than US$3 billion per year from 2021

representing a 10 fold increase in output, said the Minister

of Agriculture and Irrigation.

For this to be achieved the Minister reiterated the

importance of land use planning and support for an

efficient and competitive industry.

He said the ministry is working on a financing scheme for

forestry and confirmed that industry development will be

carefully monitored and the utilisation of forest resources

will be carefully planned.

In support of the government‟s objectives the Minister

announced that MINAGRI plans to allocate some 5

million hectares of forest concessions over the next ten

years which will generate more than 100,000 jobs and

should have a positive impact on GDP growth.

Protected areas control Amazon deforestation

Manuel Glave, principal investigator of the Group of

Analysis for Development (GRADE) ,

http://www.grade.org.pe/en/novedades/ reported that the

designation of Protected Natural Areas (PNA) has been

successful to some extent in controlling deforestation in

the Peruvian Amazon.

It was reported that in the San Martin region and in some

provinces of Loreto and Madre de Dios, land use plans

are being developed that will lead to an inclusive plan for

sustainable development.

9.

GUYANA

Incentives for added value production

The Forest Products Development and Marketing Council

(FPDMC) will conduct a seminar to discuss key issues in

the forest sector.

There is a growing need for stakeholders to be made aware

of the full range of government incentives that are

available to the forest sector. Such incentives include tax

relief and investment incentives. Another issue to be

discussed is compliance with national worker protection

laws.

The seminar will provide an opportunity for discussion on

the investment incentives that are available and the

application process.

Another key area in the forestry sector is the need to for all

companies to comply with the National Insurance scheme

in order to access benefits offered by government.

The FPDMC is hoping the seminar will encourage the

timber industry and help make the sector more productive

and efficient and through this contribute more to the

country‟s development.

Representatives from the Guyana Manufacturing and

Services Association as well as the Forest Producers

Association are expected to deliver key addresses at this

seminar.