2. GHANA

Ghana on track to trade FLEGT licensed

timber

A meeting of managers of all projects and activities being

implemented in support of the Forest Law Enforcement

Governance and Trade Voluntary Partnership Agreement

(FLEGT-VPA) between Ghana and the European Union

was held recently.

The meeting was jointly convened by the EU Delegation

to Ghana and the Forestry Commission of Ghana in an

effort to ensure the effective collaboration and

coordination between the organisations managing these

projects.

Ghana became the first country to agree a VPA with the

EU which will result in systems to verify the legality of

timber for exports and to strengthen forest governance.

The EU is Ghana largest market for wood products.

By agreeing the VPA Ghana has committed to dealing

with the challenges of illegal logging and its associated

economic, social and environmental costs. The changes

that have been effected in Ghana paved the way for the

country to access investment from the World Bank, the

International Finance Corporation (IFC) and the African

Development Bank.

Over the past five years, the Forestry Commission

has

been working to put in place the systems and reforms

necessary to implement the VPA. After considerable

progress with the development of the system to license

legal timber Ghana is on track to soon be shipping FLEGT

licensed wood products.

Signing EPA will ensure competiveness of exporters

Ghana‟s Minister of Trade and Industry has said that

signing the ECOWAS-EU Economic Partnership

Agreement is essential as not signing would seriously

undermine export opportunities for the main commodities

such as cocoa, gold, oil and timber as well as for nontraditional

products.

The EU is Ghana‟s largest export market, accounting for

more than half of all exports and failure to seize the

opportunity for improved market access would result in

the country‟s exporters losing competitiveness in the EU

market.

3. MALAYSIA

Promoting recognition of legal timber in

the domestic

market

Malaysia is presently negotiating with the EU on a VPA

but while these negotiations continue the private sector is

implementing a project to identify certified and credible

timber suppliers in Malaysia.

The ¡°Certified Timber and Credible Suppliers¡± (CTCS)

project was initiated by Ahmad Shah and is currently

being executed by PEKA (Association of Malaysian

Bumiputra Timber and Furniture Entrepreneurs).

The CTCS has the full support of the Ministry of

Plantation Industries and Commodities, the Malaysian

Timber Industries Board and the Malaysian Timber

Council.

According to Ahmad, ¡°In Malaysia there is inadequate

recognition and use of certified timber and timber products

in the domestic market. The trade network between small

and medium sized timber companies and domestic housing

developers is poor such that the SMEs find it difficult to

trade directly¡±.

The CTCS was designed to promote sales of green and

environmentally friendly wood based products to domestic

consumers and to regain and increase market share in

applications such as flooring, window and door frames.

Currently, the CTCS Programme covers four main

product

categories: (1) windows, doors and flooring, including

decking, (2) glulam, (3) furniture, and (4) interior

products.

The strength of this initiative lies in its Quality Assurance

Verification which verifies the source of timber and

assesses quality standards and compliance with the green

building code.

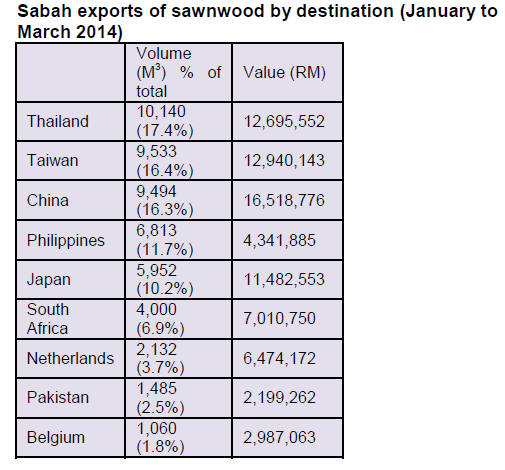

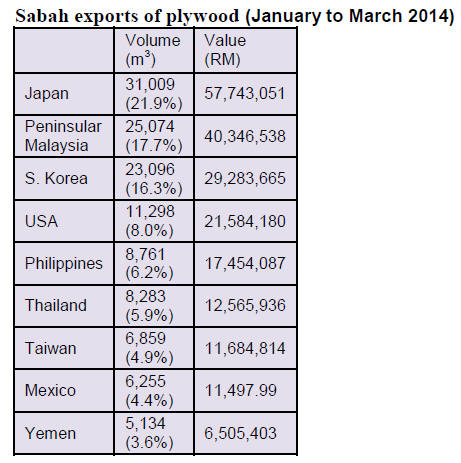

First quarter exports from Sabah

The latest data released by the Sabah Department of

Statistics show that Sabah exported 58,282 cubic metres of

sawntimber in the first quarter of 2014 worth

RM90,180,563 (approximately US$26.66 million).

Also in the first quarter, Sabah exported 141,422 cubic

metres of plywood worth RM235,027,628 (approx. US$72

million).

Japan takes lion¡¯s share of Sarawak plywood

exports

Last year log production in Sarawak fell to 8.2 mil. cubic

metres compared to 9.5 mil. cubic metres in 2012, and

10.2 mil. in 2011. Of the total log production in 2013

around 8 mil. cubic metres was harvested from the hill

forests and the remaining came from swamp forests.

In 2013 log exports from Sarawak totalled 2.8 mil. cubic

metres with India being the biggest buyer taking a 62%

share.

Sarawak Timber Association data showed that in 2013,

Sarawak exported 2.58 mil. cubic metres of plywood

valued at RM 4.0 bil. (approximately US$ 1.23 bil.). Out

of this total Japan took 1.43 mil. cubic metres (55%).

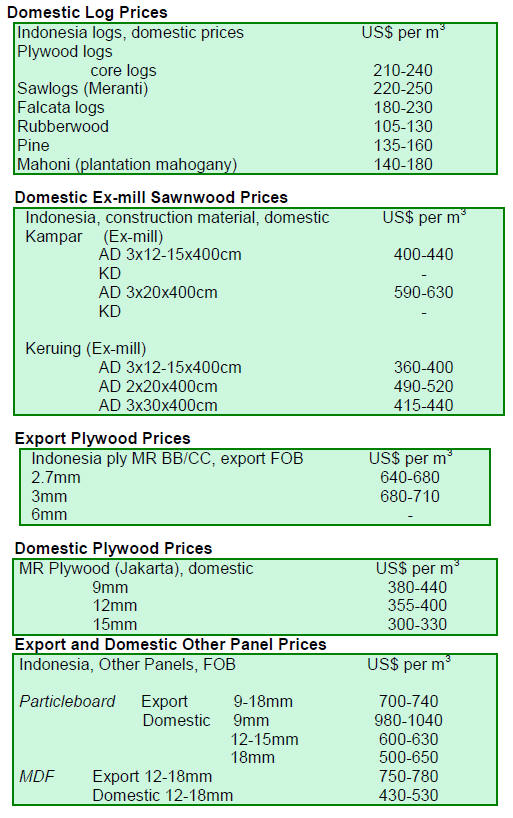

4. INDONESIA

Satellite mapping provides new

deforestation data

In November 2013 a group of researchers who partnered

with Google and NASA noted that there appeared to be an

alarming increase in the rate of deforestation in Indonesia.

Through satellite mapping technologies the researchers

found that the rate of deforestation in Indonesia had

doubled between 2000 and 2012.

The deforestation rate in Indonesia was estimated to have

increased from about 10,000 square kilometres per year in

2000-03, to nearly 20,000 square kilometres per year

between by 2011-2012.

The impact of deforestation in Indonesia has given rise to

more frequent floods and contributes to rising

temperatures in the archipelago say researchers.

The Ministry of Forestry (MoF) has released details of

grants provided under the First Tropical Forest

Conservation Act ( TFCA ).

The available funds will be disbursed by the Biodiversity

Foundation ( KEHATI ) that facilitate the conservation,

protection, restoration and sustainable use of tropical

forests in Indonesia. KEHATI supports the Berau Forest

Carbon Program ( BFCP ) and the Heart of Borneo

initiative in Kapuas Hulu, West Kalimantan and in the

West Kutai district, the Mahakam Ulu and the Berau

districts in East Kalimantan .

Nine institutions will receive grants namely : Operation

Wallacea Trust (Bogor), PEKA Indonesia Foundation

(Bogor), BIOMA Foundation (Samarinda), Center of

Sosial Forestry Mulawarman University (Samarinda),

Organis Indonesia Alliance (Bogor), FORINA (Bogor),

PRCF Indonesia Foundation (Pontianak), Gemawan

Institution (Pontianak) and Penabulu Foundation

(Jakarta).

For more see

http://www.dephut.go.id/uploads/files/62a4b8b8caffc878f

9dc21bfe3c2dafa.pdf

Protect environment but not at expense of local

communities

President Susilo Bambang Yudhoyono has said Indonesia

should strive for a balance between protecting the

environment and the use of forests by local communities.

In an address at the Forests Asia Summit in Jakarta the

President said ¡°It is about striking a balance between the

need to conserve the environment and guaranteeing the

rights of local communities over their customary forests,¡±

The President called on all countries in the region to

implement strategies to promote sustainability of all

natural resources.

Biomass and Bioenergy, an opportunity for Indonesian

forestry

The Indonesian government has adopted an energy plan

which foresees a change in energy sources. By 2025 the

government hopes to secure 15 % of the energy needs by

investing in renewable energy sources such as geothermal

sources, biofuels and biomass.

The Ministry of Energy and Mineral Resources has

developed a Biofuel Development Roadmap to this end.

The forestry sector, which manages 60% of the land area

of Indonesia, has great potential as a supplier of bioenergy

to meet national energy needs.

According to Ir. Sofwan Bustomi, wood energy resources

are still a low priority for the government but emphasised

the wood pellet industry would deliver many local social

and economic benefits and could provide a source of

export earning as the global wood pellet market is

projected to grow quickly.

Economy on a stronger footing in first quarter

The Bank of Indonesia (BoI)has reported a year on year

growth in the first quarter of 2014 of 5.2% slightly below

that in the fourth quarter of 2013 (5.7%). The first quarter

2014 GDP growth is below the Bank‟s expectation.

In a press release the BoI said the slower than expected

growth was largely due to external factors as the growth in

exports slowed particularly for minerals and coal.

Imports also slowed in the first quarter of 2014 in line with

an easing of domestic demand and by lower consumption

in the public sector.

Economic growth in the first quarter of 2014 was

supported by satisfactory performance of household

consumption and investment.

For more see: http://www.bi.go.id/en/ruang-media/siaranpers/

Pages/SP_1628_DKom.aspx

In related news inflation in April 2014 continued a

downward trend and the Consumer Price Index (CPI) in

April recorded deflation of -0.02% month on month.

The mild deflation in April mainly was supported by

falling prices for fresh food the result of an abundant

supply as harvests were good in the first quarter.

¡¡

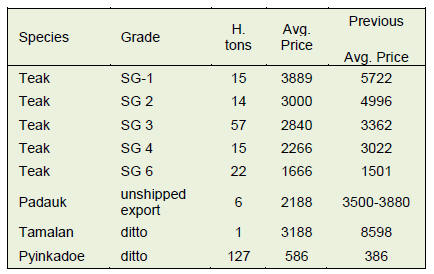

5. MYANMAR

Tender prices collapse on heels of log

export ban

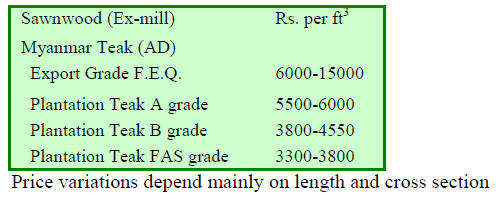

Average prices secured by the MTE during the latest open

tender (28 April) are shown below along with the average

prices obtained in the previous sale for comparison.

As logs can no longer be exported but have to be milled

locally the decline in average prices is in line with

forecasts made by local analysts.

Given the sizeable volume of unshipped logs in the

country observers do not foresee a rise in open tender sale

prices in the coming months. Average prices US$ per

hoppus ton are shown below.

Tamalan (Dalbergia oliveri) is the favourite of

Chinese

buyers and attracted very high prices prior to the log

export ban as will be seen from the above table.

Risk that timber smuggling will rise

During March and April this year almost 600 tons of

illegally harvested timber was seized by authorities in

Mandalay. The illegal timber was either in illicit log

depots or loaded on trucks ready for transport.

Tamalan accounted for more than 500 tons of the total

seized, a huge increase on the mere 50 tons seized in the

same period a year before. About 400 tons of tamalan was

seized during the‟ water festival‟ between 13th and 16th

April.

The Forest Department reported seizure of 502 tons of

tamalan ; 57 tons of padauk; 6 tons of teak 6 tons; 6 tons

of pyinkadoe; 2 tons of red sandalwood and 13 tons of

other species.

Between 29 April and 4 March over 1,000 tons of teak and

non-teak hardwoods were seized by authorities across the

country. The largest quantity was seized in Sagaing

Division in the north says the Ministry of Environmental

Conservation and Forestry (MOECAF).

FREDA Chairman Ohn, commented that, because of the

log export ban, overland smuggling appears to be

increasing.

According to Weekly Eleven Journal the cost of illegally

trucking Tamalan from Mandalay to Muse on the

Myanmar China border could be as high as Myanmar

Kyats 100,000 (roughly US$10,000) per trip.

From Namhsan and Kholan in the Southern Shan States to

China. skirting the Kengtung area, truck owner will

reportedly receive K90,000 per trip. Each truck can carry

as much as 15 to 20 tons.

Analysts say that, because the authorities have stepped up

operations against smugglers, the illicit trade has become

more risky. However, the risks pale when such enormous

profits are possible. Unless the government finds an

answer to these activities, analysts say the situation may

worsen.

Forest degradation from illegal activities is now viewed as

a major cause of the increased risk of natural disasters and

the domestic media are trying to raise public awareness of

these issues.

Record export shipments of teak and other hardwoods

The local newspaper, Daily Eleven, quoting Ministry of

Commerce trade statistics, reported a record of shipment

of teak and non-teak hardwood logs worth nearly one

billion US dollars in the last fiscal year.

It reported that some US$916,400 million was exported by

sea and an additional US$31,420 million overland.

According to the data available, teak log exports amounted

to US$638.400 million while the quantity of other

hardwood logs shipped was over 590,000 tons valued at

US$222 million.

6.

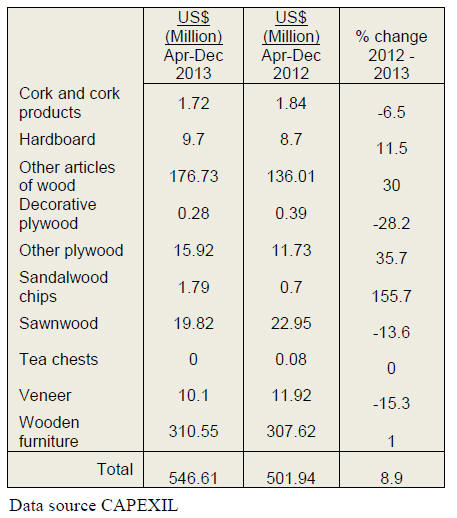

INDIA

India¡¯s wood product exports jump 8

percent

Between April and December 2013 India‟s wood product

export exports were over US$540 mil. Up 8.9% year on

year. Exports of plywood and veneer fell and wooden

furniture exports were maintained at the same level as a

year earlier.

In terms rupee, exports improved from Rs.27,365.08

million a year ago to Rs.32,953.82 million between April

and December 2013, a growth of 20.42 %. Export figures

in US dollars terms are shown below.

India¡¯s largest casuarina propagation centre

APPM Ltd, a group company of the US based

International Paper in India, has established India‟s largest

casuarina clonal propagation centre in Mulugapudi village

in Vishakhapatnam district of Andhra Pradesh.

This is the fifth centre opened in the country and

is

equipped with technology to develop superior clones to

improve the productivity of pulpwood plantations.

Yields are expected to increase to25- 28 tonnes of

pulpwood per hectare over a 4 year plantation cycle as

against the 12- 14 tonnes per hectare at present in

conventional seedling plantations.

By establishing plant distribution centers around the

country the company has made it easier for farmers to

obtain planting high quality stock as well as technical

support. It is imperative that wood production is expanded

to support the domestic industry.

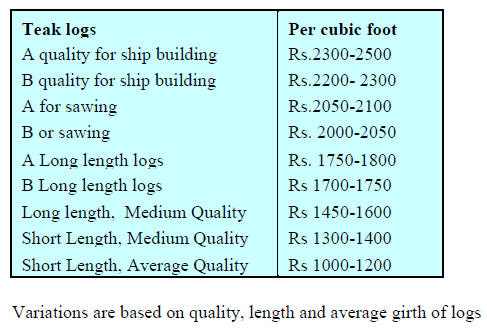

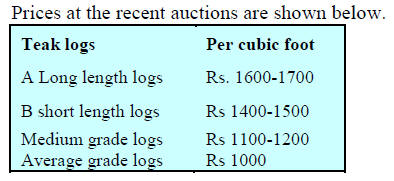

Domestic teak log prices

At various depots approximately 12,500 cubic metres of

newly harvested and logs left unsold at earlier auctions

were put up for sale.

The average prices recorded at the most recent auction are

as follows:

Good quality non-teak hardwood logs (Haldu (Adina

cordifolia), Laurel (Terminalia tomentosa), kalam

(Mitragyna parviflora) and Pterocarpus marsupium) of 3 to

4 metres length with girths of 91cms and up attracted

prices in the range of Rs.700-900 per cubic foot.

Medium quality logs of the same size were sold at

between Rs500-600 per cubic foot. Lower quality logs

were sold at around Rs.250 per cubic foot.

Analysts report that a good quantity of freshly harvested

teak and hardwood logs are arriving at depots in Dang,

Vyara, Raj Pipla and Valsad.

Teak sales in Central India forest depots

Over 8,000 cubic metres of teak logs were sold at the

Timarni, Khirakia, Ashapur, Narmada nagar depots in

Central India.

As the volumes of teak available in the depots of

Maharashtra are declining the auctions in Madhya Pradesh

are good news for millers in and around Nagpur.

Millers switch to domestic teak as imported logs

getting smaller

The flow of imported plantation teak logs has been

maintained but domestic millers are complaining that the

quality of logs is deteriorating.

The plantation teak logs presently coming from West

Africa, especially from Nigeria, Ghana and Ivory Coast

are now smaller and of poor quality than previously. Also,

Sudan, Tanzania and Ghana used to ship good quality logs

and the recovery rate for these logs was comparable to

recovery rates for Myanmar logs.

Analysts suspect that, in the counties mentioned, all old

growth logs have been harvested as now most of the logs

arriving in India from W. Africa are small in the 30-36

inch girth range.

These developments have prompted some mills to begin

buying higher priced domestic teak as recovery rates are

better than for imported plantation teak.

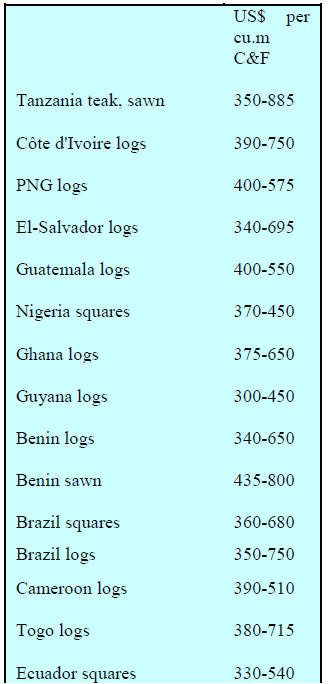

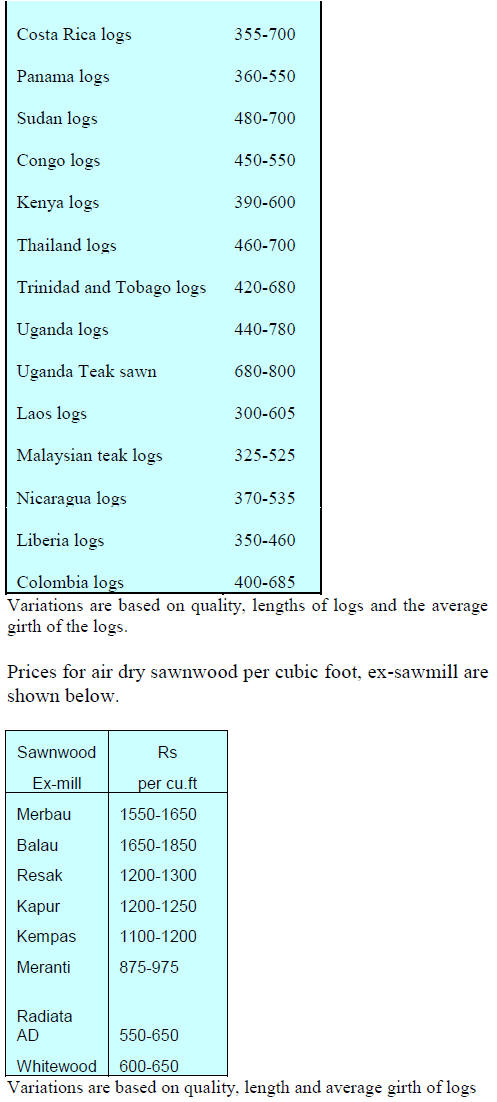

Current C & F prices for imported plantation teak, Indian

ports, per cubic metre are shown below.

Balau, kapur and red meranti are gaining in

popularity and

demand for these timbers is expected to increase further.

Myanmar teak processed in India

Just prior to the introduction of the log export ban in

Myanmar Indian buyers increased the number of

shipments of logs from Myanmar and almost double the

number of shipments were made.

However, it was not possible to clear all stocks in

Myanmar so Indian buyers are now trying to negotiate

with the authorities for permission to export the logs left

behind.

In the domestic market teak prices have risen as

the

availability of high quality teak is likely to be an issue

once stocks of Myanmar teak are sold.

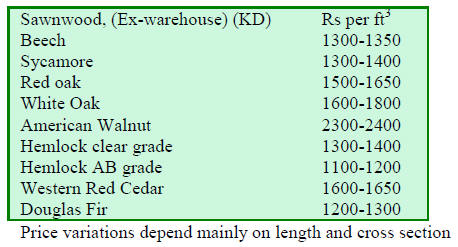

Imported sawnwood prices

Ex-warehouse prices for imported kiln dry (12% mc.)

sawnwood per cu.ft are shown below.

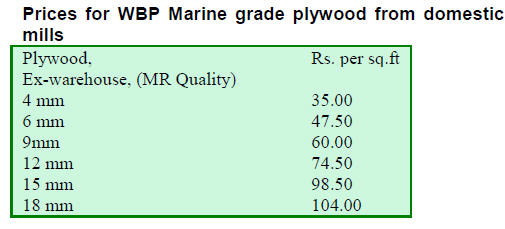

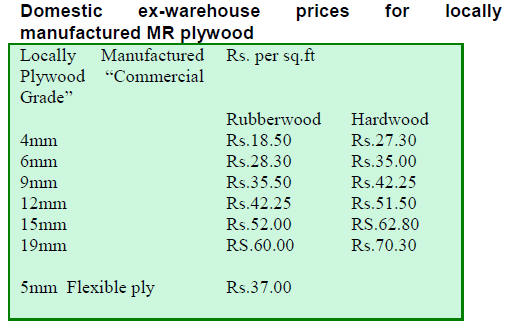

Plywood makers looking for an alternative to

gurjan

Plywood manufacturers rely heavily on sales to the

building and construction sectors but the real estate sector

continues to be weak despite builders offering a wide

range of discounts and other incentives to prospective

buyers.

Demand in the main urban centres is particularly

depressed and it is only sales in the smaller towns that

keep the market alive.

Gurjan, the main species used for face veneers in India is

no longer available in log form from Myanmar, the main

supplier until the log export ban was introduced.

Indian plywood mills are now searching for reliable

sources of alternative red coloured durable species. The

shortage of gurjan has pushed up plywood prices but

analysts say some mills are taking advantage of the

shortage of gurjan and raising rises more than justified.

¡¡

7.

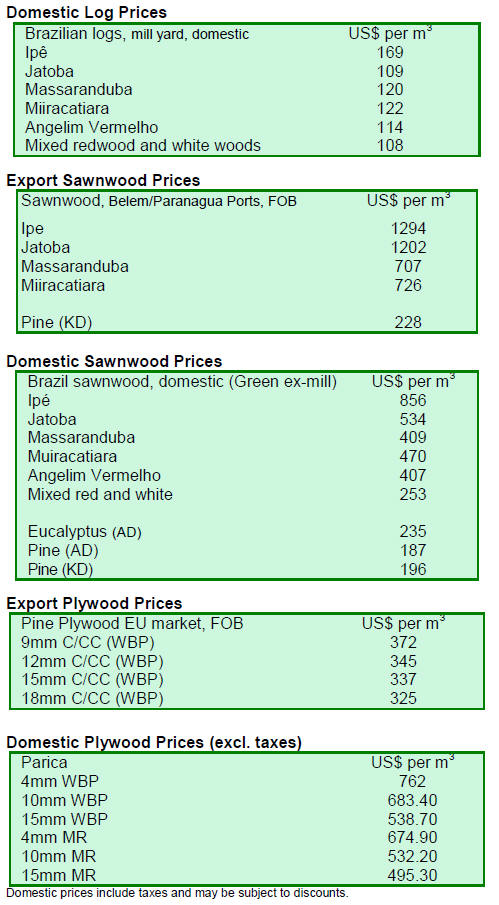

BRAZIL

New association asking for policies

to stimulate

investment

The newly-established Brazilian Tree IndustryAsociation

(IBA) represents almost the entire forestry sector in the

country, replacing the Brazilian Association of Wood

Panel Industry (ABIPA), the Brazilian Association of

High Strength Laminated Flooring Industry (ABIPLAR),

the Brazilian Association of Forest Plantation Producers

(ABRAF) and the Brazilian Pulp and Paper Association

(BRACELPA).

Companies in the new association have annual gross

revenues of R$ 60 billion, equivalent to 6% of GDP; they

employ around 5 million people which is close to 5% of

the economically active population (PEA).

In addition the association members export some US$8

billion annually, equivalent to about 3% of total Brazilian

exports.

IBA„s objectives for 2014 are to reduce the tax burden in

the forestry sector to stimulate investment, increase carbon

credit trading, broaden the debate on national

infrastructure and to further the debate on the purchase of

land by companies with foreign capital and the use of

genetically modified trees.

The forestry association would like to see a doubling in

the size of the forest sector by 2020, to see an increase in

plantations from 7 to 14 million hectares; to see pulp

production increase from 14 to 22 million tons per year

and paper production to rise to 13 million tons per year.

In the wood based panel sector IBA aims to raise panel

production from around 10 to 14 million tons per year.

To achieve to goals set forestry sector investments of R$

53 billion will be required from the present to 2020 with

the bulk being investment by companies that produce and

export pulp.

Public-private collaboration to strengthening forestry

in Mato Grosso

The Center for Timber Industries Producers and Exporters

of Mato Grosso (CIPEM) and the State government of

Mato Grosso, through the State Secretary for Industry,

Commerce, Mines and Energy (SICME), signed an

agreement providing for R$600,000 to be spent on the

State Sustainable Forestry Development Plan (PDFS).

SICME designated R$500,000 for the development of the

State Forest Plan and is committed to disseminate and

promote the development plan so as to attract investment.

The PDFS was launched in early 2014 and is the result of

a joint effortof the private sector (CIPEM) and the State

government for the development of forest-based activities

taking into consideration environmental, social and

economic aspects.

According to CIPEM, the launch of PDFS was very

important for the sector which has seen a decline in

production over the past years and currently operates at

only around 30% of its production potential. The average

annual production of the forest industry in Mato Grosso in

recent years required just 3.6 million cubic metres of raw

materials.

According to SICME, companies wood based industry

will benefit from a reduced tax burden on trade within the

state as well as interstate trade which,it is hoped, will

encourage expansion in the sector.

Infrared scan to distinguish mahogany from ¡®look-alikes¡¯

The Forest Products Laboratory of the Brazilian Forest

Service (LPF/SFB) is evaluating the use of infrared light

to distinguish mahogany from other similar species.

The financial support for this research is coming from the

International Tropical Timber Organization (ITTO).

Mahogany is an endangered timber species and included

in CITES appendix II limiting its trade. Sawn mahogany is

simillar in appearance to cedar (Cedrela odorata), andiroba

(Carapa guianensis) and curupix¨¢ (Micropholis Venulosa)

and there is a danger that mahogany could be mislabelled

as one of the „look-a-likes‟ and traded illegally.

Using a bench spectrometer (equipment that emits infrared

light), the researchers were able to take a visual

„thumbprint‟ of mahogany, cedar, andiroba and curupix¨¢

based on the unique chemical composition of each species

and have verified that it is possible to distinguish the

species using this technology.

The LPF will assess whether this methodology, using

portable devices in a commmercial environment, can be

used to identify mahogany wood with the same reliability

as in the laboratory.

New regulation makes trading more difficult

Mato Grosso is home to major wood product exporters but

in the first quarter of 2014 exports declined.

Between January to March 2014, 20,048 tons of wood

products were exported, down 28% compared to the same

period of last year. Trading revenue also fell but by only

6% to US$20.9 million.

Analysts point out that a new regulation (Normative

Instruction (IN) No. 21) published in December 2013 by

Brazilian Institute for Environment and Renewable

Natural Resources (IBAMA), made trading of wood

products more complex and this contributed to the decline

in exports.

The regulation IN 21 establishes standardised mechanisms

for forest products transport into the Document of Forest

Origin (DOF). The DOF is a compulsory license required

for transport and storage of forest products of native

species.

Observers point out that some processed forest products

are not included in IN 21 and are therefore blocked at the

port and this has undermined exports to MERCOSUR and

other markets.

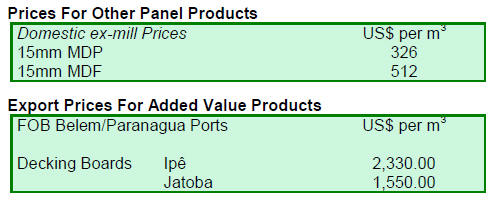

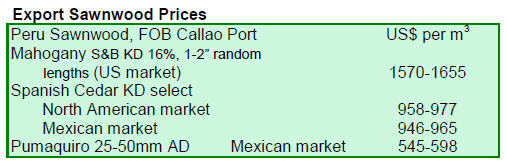

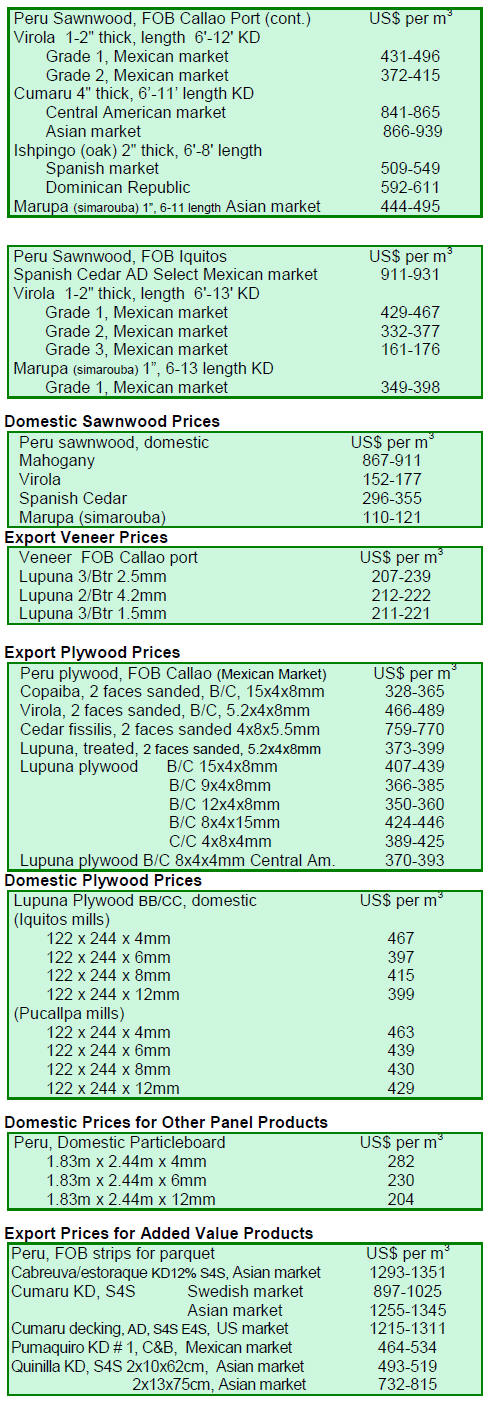

8. PERU

Germany supporting forest management

The German Development Bank (KFW) has contributed

US$0.85mil. to the Forest and Wildlife department

(DGFFS) of the Ministry of Agriculture and Irrigation to

implement a sustainable forest management programme to

improve the competitiveness of the sector.

This first contribution and will be used for pre-investment

studies of this programme and an assessment of is

compatibility with the National Public Investment System

(SNIP).

The second phase of the programme involve another

contribution of US$49.4 million from KFW, of which

US$42.3 million will be a loan, and US$ 7.1 million will

be contributed by the Peruvian government.

Activities will be conducted in the regions of Loreto,

Ucayali, San Martin, Amazonas, Madre de Dios, Cusco,

Puno, Junin, Ayacucho, Pasco, Huanuco and Cajamarca,

for a period of five years.

Regional efforts to tackle illegal logging

The Ministry of Economy and Finance (MEF) has

authorised the transfer of US$0.62 mil. to nine regional

governments to maintain and operate control systems for

the fight against illegal logging and transport of illegal

timber.

The funds for these activities will come from the budgets

of the Ministry of Agriculture and Irrigation (MINAGRI)

and will be transferred to the regional governments of

Amazonas, Ayacucho, Hu¨¢nuco, La Libertad, Loreto,

Madre de Dios, San Martin, Tumbes and Ucayali.

9.

GUYANA

Moderately brisk logs exports and

encouraging prices

During the period reviewed greenheart logs were exported

and there were price adjustments in all categories.

Standard sawmill quality log FOB prices were US$210 per

cubic metre, Fair sawmill quality greenheart logs were

traded at between US$130 and US$210 per cubic metre

FOB while Small sawmill quality logs were sold for

US$120 per cubic metre.

Purpleheart logs attracted favourable prices. The top end

price for Standard sawmill quality purpleheart logs was

US$215 FOB, Fair sawmill quality logs traded at US$200

per cubic metre while Small sawmill quality logs were

priced at US$170 per cubic metre FOB.

There were no exports of Mora logs in the period

reviewed.

Sawnwood demand remains firm

Overall, sawnwood prices were favourable and made a

valuable contribution towards the total export earnings.

Undressed greenheart (Prime) saw a decline in price from

US$1,057 to US$954 per cubic metre FOB. But for Select

category there was an improvement in price from US$

1,060 to US$ 1,102 per cubic metre.

Sound category Undressed sawn greenheart recorded an

increase in price from US$763 to US$933 per cubic metre

FOB. Undressed Greenheart, which is an ideal timber for

heavy duty construction, was in high demand in

Caribbean, European, Middle Eastern, North American

and Oceania markets.

Undressed purpleheart sawnwood export prices improved

moving up from US$1,100 to US$1,200 per cubic metre

FOB. This product was exported to markets in Asia,

Caribbean, Oceania and North America.

Export prices for Undressed mora were maintained at

US$500 per cubic metre FOB for markets in Asia, the

Caribbean and Europe.

Dressed greenheart FOB prices moved up from US$996 to

US$1,158 per cubic metre FOB and the Caribbean remains

the main market for this product. Similarly Dressed

purpleheart recorded an attractive price on the market

which saw the price moving from US$1,060 to US$1,158

per cubic metre.

Caribbean markets providing good opportunities

Guyana‟s Plywood continues to be in high demand in

Central and South American markets earning prices as

much as US$ 584 per cubic metre FOB.

Splitwood (shingles) prices remain firm and FOB prices

increased from US$1,000 to US$1,332 per cubic metre in

Caribbean and North America markets.

Domestic mills advised to change business model

to

capture market share

The Forest Products Development and Marketing Council

(FPDMC) has determined that, when it comes to the

domestic market, the timber industry in the country needs

to adjust their business model from the current traditional

way of supplying wood products one that is more

customer- friendly with respect to price, quality and

accessibility.

Currently, local millers face strong competition from

imported wood products especially pine sawnwood which

is available in standard sizes.

With this in mind the FPDMC is promoting the concept of

supplying dimensional sawnwood for specific enduses.

This, says the FPDMC, would deliver savings to the

consumer as well as increase sales from supplier.

Producers of sawnwood could significantly expand their

market base by stocking dimensional timber in local

outlets.

The production of dimensional sawnwood in standard

sizes may also open up further opportunities in foreign

markets says the FPDMC.