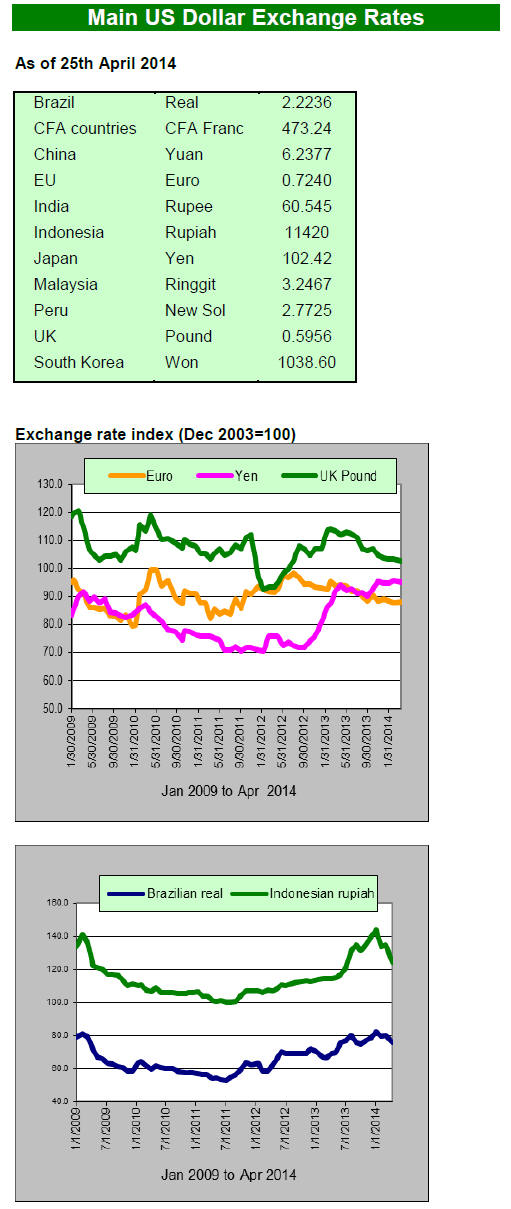

2. GHANA

Bold initiative to strengthen Ghana

Forestry

Commission

To improve oversight of the sector the Forestry

Commission (FC) an eleven member committee has been

tasked with recommending ways in which the FC can

better ensure the it its functions in a credible, transparent

and independent manner.

Inaugurating the committee, known as the Timber

Validation Committee (TVC) the Minister for Lands and

Natural Resources, Alhaji Inusah Fuseini, lamented the

inadequate and weak laws that have been the root cause of

illegal forestry operations in the country.

The Minister tasked the TVC with recommending

additional measures to improve the verification and

validation of licenses and for addressing complaints in

ways that eliminate the risk of any outside interference or

influence.

The committee is also responsible to come up with ways

to inform consumers of their rights, obligations and

understanding of the functioning of the Legality Assurance

System (LAS).

Alhaji Fuseini called on stakeholders and the public to

contribute to good governance in the forestry sector.

Tax hike on domestic sales by companies in the Free

Trade Zone

Sales into Ghana‟s domestic market by companies

enjoying the benefits of the Free Zone Enterprises (FZE)

will now attract a 25% sales tax, up from the previous 8%.

Timber companies within the Free Zones will likely raise

the prices of products for the local market when the higher

tax rate is introduced. It is estimated that around 30% of

the output of timber companies in the free zones are sold

into the domestic market.

According to a statement from the tax policy unit of the

Ministry of Finance this change is aimed at ensuring

equity in the payment of taxes between FZEs and the local

industry.

Power shortages soon to be a thing of the past

Mr. Kofi Ellis, Director, Planning and Business

Development at the Volta River Authority (VRA), has said

gas supplies from Nigeria have picked up from a low of 50

to around 100 mi. cubic feet per day, inching closer to the

120 mil.contracted. Mr. Ellis said he expects the power

supply in Ghana to normalise by the end of April when all

power plant maintenance has been completed.

Inflation above government target

Ghana's annual inflation rate reached a four-year high of

14.5 percent in March up from 14.0 percent in February

largely because of increases in house prices and water and

electricity rates. The latest rise has lifted the rate past

target 9.5 percent (+/- 2 percent) set by the government for

2014.

3. MALAYSIA

Exports picked up from start of 2014

The Malaysian Timber Industry Board (MTIB) released

data on exports from January 2013 to January this year.

Exports of sawnwood, fibreboard and particleboard picked

up in the early part of the year while exports of plywood

and mouldings remained flat throughout the year.

At the beginning of the third quarter sawnwood,

fibreboard and particleboard exports fell away and January

2014 exports of these three products were well below

levels a year earlier.

January 2014 wood product exports from Peninsular

Malaysia totalled 145,971 cu.m out of which Port Klang,

the closest port to Kuala Lumpur, handled the most at

87,851 cu.m (60% of all exports). Kuantan Port handled

9,352 cu.m; Pasier Gudang 15,770 cu.m; Tanjung Pelepas

10,180 cu.m and Penang 22,818 cu.m.

Malaysian imports of bamboo products six to eight

times higher than exports

The MTIB is promoting the potential of bamboo in an

effort to boost the bamboo industry in the country.

Malaysia‟s exports of bamboo products over past 10 years

were valued at only RM 250,000 (approximately US$

75,000) while imports of bamboo products, mainly from

China, Indonesia and Thailand, were six to eight times

higher than exports.

According to the International Network for Bamboo and

Rattan (INBAR), the international bamboo trade is worth

around US$18 billion a year and rising.

Malaysia has a 10 year action plan to develop the bamboo

industry and intends to focus efforts on:

Establishment of bamboo plantations and

preservation of existing natural resource

management.

Human capital development.

Development of downstream activities.

Research and development.

Marketing and promotion.

Fears that Korea may reintroduce anti-dumping duties

on Malaysian plywood

Sarawak plywood exporters are worried that South Korean

authorities may extend anti-dumping duties on imports of

Malaysian plywood.

The current round of duties ended in February this year

but now the Korean Trade Commission is conducting a

review to determine if they should be

reintroduced.

The duties on Malaysian plywood imports into South

Korea which were imposed in March 2011 ranged from

5% to 38% depending on the supplier and applied to

panels of 6mm and above.

The duties took a heavy toll on Sarawak‟s plywood

exports to South Korea. In 2013, Sarawak exported 266,00

cu.m of plywood compared to the 331,600 cu.m in 2012.

In 2010, before the duties were imposed, Sarawak

exported around 530,000cu. m of plywood to South Korea.

Forest Watch initiative for quick response to illegal

activities

Transparency International Malaysia has launched a Forest

Watch Initiative in Sarawak which allows for individuals

or representatives of forest communities to report

suspected illegal forest operations.

Forest Watch has established a website providing satellite

imagery and a GIS capacity so areas where there is a

suspicion of wrongdoing can be pinpointed.

Reports that are lodged with the system are examined by a

task force comprising of officials from the Sarawak

Forestry department, the Malaysian Anti-Corruption

Commission, Institute of Foresters Malaysia, and

Transparency International Malaysia and action is taken

when necessary.

¡¡

4. INDONESIA

Costs and shortage of assessors hindering

SVLK

implementation

At a recent gathering to discuss the implementation of

Indonesia‟s timber legality assurance system (SVLK),

Bibi Fatmawati of Yogya Indo Global exports said

securing SVLK certification costs at least US$2,000 and

that this bars many smaller enterprises from applying for

certification.

Costs are one issue said WWF Indonesia‟s director of

policy and transformation, Budi Wardhana, but the lack of

a standard cost structure for the certification is another

hurdle. He said the charges for SVLK assessment vary

widely with no clear rationale for the various price

structures.

According to Budi, the low number of SVLK assessors is

also a stumbling block for the government as it pushes

ahead with SVLK.

Several analysts have said that Indonesian officials need to

focus on developing consistent standards for the SVLK

and FLEGT-VPA, on capacity building for local officials

and businesses and on developing a complete chain of

accountability.

Arguments for and against lifting log export ban

A group of wood product manufacturers is strongly

opposed to the government‟s plan to resume log exports

fearing this will result in a shortage of raw materials for

local companies.

The chairman of the Indonesian Furniture and Handicraft

Association (AMKRI ¨C Assosiasi Mebel & Kerejinan

Indonesia) Soenoto said logs contributed about 40 percent

of the total production cost so a shortage leading to higher

log costs would push up production costs significantly.

He stressed that at the end of 2011 the export of raw rattan

was banned to support local companies and that this

resulted in a sharp increase in exports of rattan products.

Data from Sucofindo, an independent surveyor in

Indonesia, shows that between January and March this

year rattan product exports grew by around 30 percent

year-on-year to US$48 million.

Indonesia's log export ban followed the massive outflows

of logs between 1998 and 2001 when the export tax was

sharply reduced and the ban has helped domestic industry.

While the proposal to lift the log export ban has met

opposition from several ministries concerned on the

impact on domestic manufacturers discussions on the issue

continue.

Industry minister Mohammad Suleman Hidayat, has

revealed that timber companies in Papua are in favour of

lifting the ban which, they say, is part of the reason why

unemployment in the province is high.

Exhibition of top rate furniture from SVLK certified

companies

Indonesia‟s Timber Legality Verification System (SVLK)

is likely to boost exports of wood products to the

European Union.

To promote the wider adoption of the SVLK an exhibition

of furniture from SVLK certified companies was hosted

by WWF Indonesia, the Indonesian Furniture

Entrepreneurs Association (Asmindo), the Indonesia

Furniture Designers Association (HDMI) and the EU.

As part of the exhibition, nine small and medium

enterprises (SMEs) from Java displayed SVLK-certified

products at the recent WWF SWICTH-ASIA booth at the

International Furniture and Craft Fair Indonesia (IFFINA)

in Jakarta.

WWF Indonesia and Asmindo have been helping furniture

SMEs understand and secure SVLK certification through

training and intensive interaction with furniture SMEs.

Dita Ramadhani, the trade and networking coordinator for

WWF Indonesia, said WWF and Asmindo had selected the

best businesses from their SME Switch-Asia Program

participants for a special exhibition of furniture designs

made from SVLK certified wood.

¡¡

5. MYANMAR

Aftermath of the log export ban

The export trade for Myanmar timbers became very quiet

after the 31 March coming into force of the log export ban.

A substantial volume of logs purchased for export was not

shipped before the deadline and remains in Yangon depots

but the Myanma Timber Enterprise (MTE) has yet to

determine the exact unshipped volume.

Observers say that companies with huge volumes of

unshipped logs are considering a petition to the authorities.

The MTE is saying it began advising exporters to clear

logs quickly once it became clear in October 2012 that the

ban would be implemented.

Analysts point out that factors such as the weak Indian

rupee, high stocks and congested log-yards in India and

tight financing hindered prompt shipments to India, the

main market for Myanmar logs. It was only in October

2013 that export shipment started to rise, peaking in

March 2014. Export shipments of logs for the 2013-14

financial year were around 661,000 cubic metres of teak

logs and 2,013,000 cubic metres of other hardwoods.

Analysts say around 50% of the years‟ teak logs and

46%

of the total hardwood logs were shipped out in just the last

quarter of the financial year (January to March).

As the regulations stand at present, unshipped logs will

have to be processed locally after which products meeting

the required level of processing could be exported.

Analysts anticipate lower log prices in upcoming auctions

because of the large volumes that will be for sale.

However, once the stock of unshipped logs are utilised

prices will better reflect mill requirements for the domestic

and international market. Looking ahead, the plan by

MTE‟s to reduce annual log harvests will likely firm up

log prices.

Illegal overland transport of timber

Overland transport of illegal harvested Tamalan

(Dalbergia oliveri) increased during 2014 according to

Myanmar Customs officials. In early April six trucks

attempting to carry Tamalan logs to a neighbouring

country were stopped.

Reports suggest that Tamalan is in great demand in China

and can fetch prices up to Myanmar kyats 70,00,000

(roughly US$7000) per ton.

According to Forestry Department officials and the

Auditor General‟s office about 35,000 tons of illegal

timber was seized during in the last 9 months of the fiscal

year.

The high incidence of illegal logging of Tamalan and

Padauk is raising concerns in Myanmar of the danger that

these species may become endangered.

Investment from China nosedives

The local media has reported that China‟s investment in

Myanmar fell sharply in 2013 to only US$20 million or

just 5% of the investment reported in 2012 and only 1% of

the investment in the peak year of 2010.

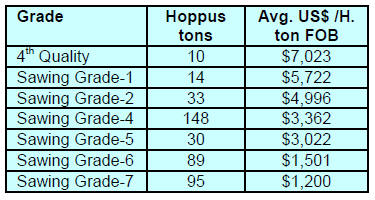

Past log tender prices

The following regular items were sold by competitive

bidding at the most recent sale (10 and 21 March 2014) at

the Myanma Timber Enterprise (MTE) tender hall. Details

of the end April auctions are not yet available.

Teak sales

The following grades were sold by competitive bidding on

10 and 21 March 2014 at the Myanma Timber Enterprise

(MTE) tender hall.

6.

INDIA

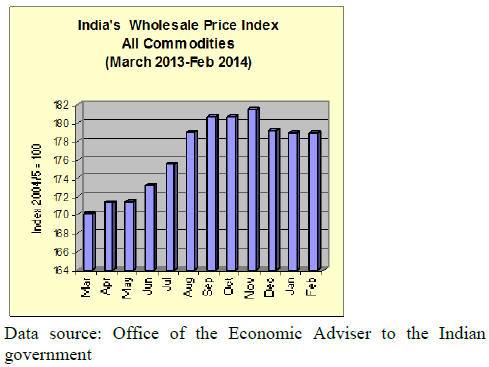

Wholesale Price Index rises stoking fears

of further

inflation

The Office of the Economic Adviser (OEA) to the Indian

government provides trends in the Wholesale Price Index

(WPI). The official Wholesale Price Index for „All

Commodities‟ (Base: 2004-05 = 100) for March 2014 was

up just under 1 point to 179.8.

On inflation a press release from the OEA says ¡° The

annual rate of inflation, based on monthly WPI, stood at

5.70% (provisional) for the month of March 2014 (over

March 2013) as compared to 4.68% (provisional) for the

previous month and 5.65% during the corresponding

month of the previous year.

For more see: http://www.eaindustry.nic.in/cmonthly.pdf

The March increase in the WPI was driven largely by

rising food prices. The latest numbers have analysts

concerned that the Reserve Bank of India (RBI) will delay

lowering interest rates which, say industrialists, is holding

back economic growth.

Data show that March fuel prices were up over 10% year

on year and that prices for manufactured products also

rose.

The RBI has increased interest rates every month since last

September saying it is more concerned about inflation than

short-term growth prospects.

El nino effect to impact Indian economy

Skymet, a private Indian company that provides weather

forecast and analyses of weather related events on the

Indian economy, has said there is very high probability

that India will see below normal monsoon rains this year

because of the currently developing El Nino in the Pacific

Ocean.

The RBI has also warned that. if the El Nino does result in

poor monsoon rains, agricultural yields will be lower than

normal which could mean higher food prices.

This would trigger higher inflation requiring the

Bank to

increase in interest rates even higher.

For more see: http://www.skymet.net/reports.php and

(http://rbi.org.in/Scripts/BS_ViewBulletin.aspx?Id=14842)

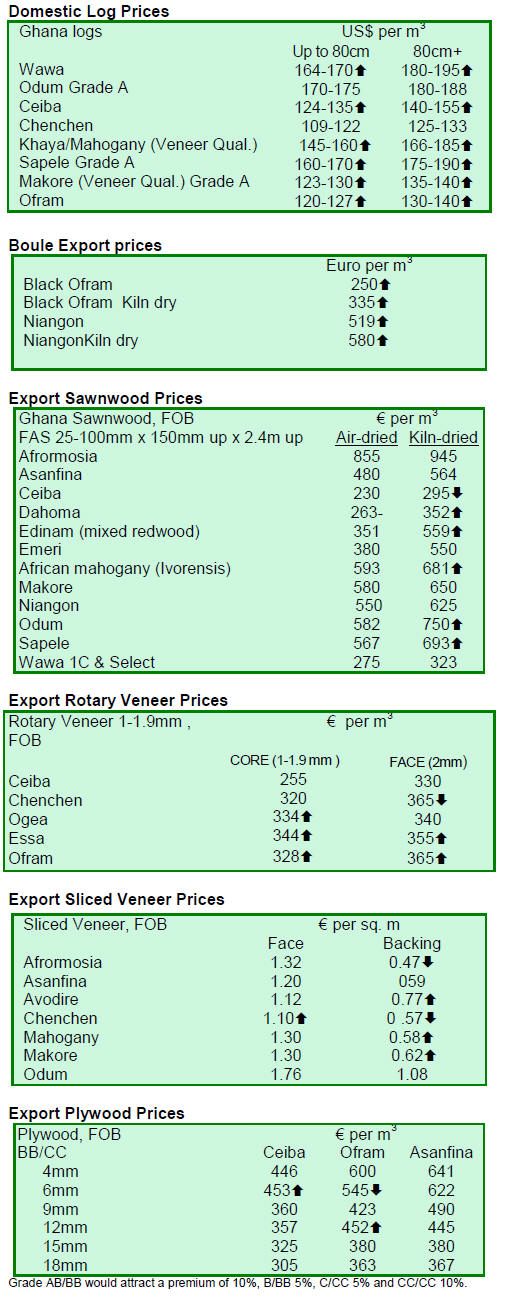

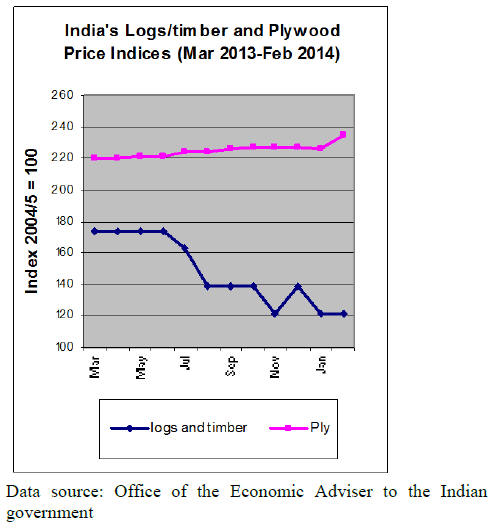

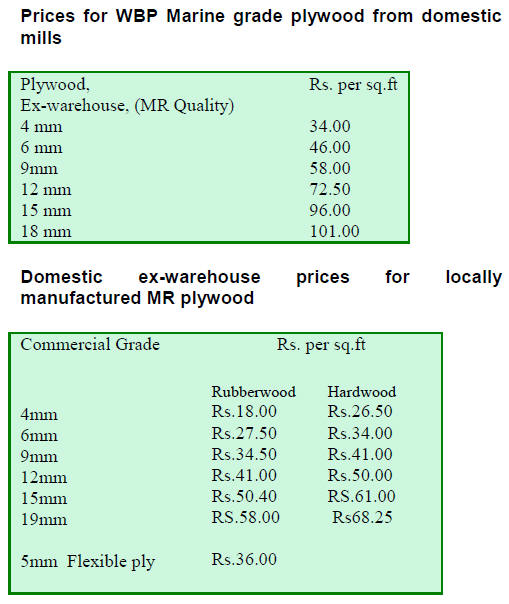

Timber and plywood wholesale price indices

In addition to data on the Wholesale Price Index for all

commodities, the OEA reports wholesale price indices for

a variety of wood products.

The Wholesale Price Indices for Logs/timber and Plywood

are shown below. The March 2014 logs/timber index was

virtually unchanged from February but the plywood index

has moved up sharply.

Record prices paid for 500 year old rosewood

Many top rated international guitar manufacturers bid for

the over 500-year-old rosewood on auction at the Indian

Forest Department timber depot at Chaliyam. The

Chaliyam timber depot has been the major supplier of

rosewood for the international market as the wood is

traded only in this state depot.

The depot recently secured logs from one of the oldest

rosewood trees in the Chethalayam range after it was

uprooted in a storm.

The demand for Indian rosewood increased after Brazil

banned the export of Brazilian rosewood. The brilliant

hues of the timber and the density make it one of the best

woods for musical instruments.

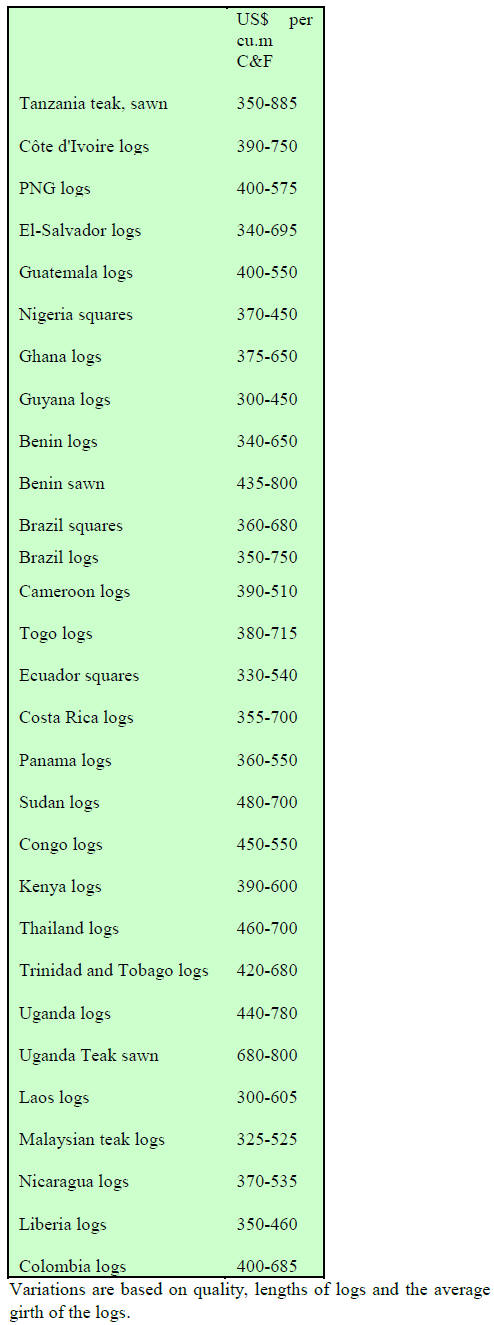

Imported teak prices

Current C & F prices for imported plantation teak, Indian

ports per cubic metre are shown below.

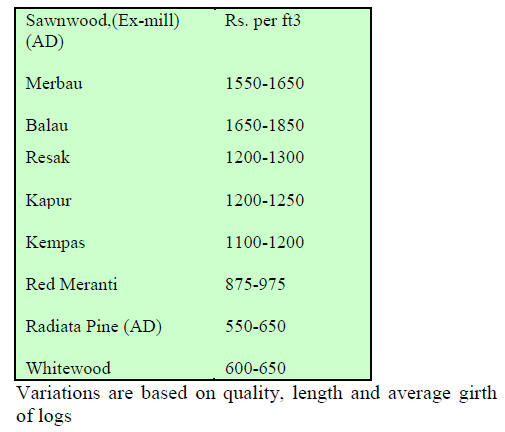

Prices for air dry sawnwood per cubic foot,

ex-sawmill are

shown below.

Myanmar teak processed in India

Export demand continues to be good. Indian buyers of

Myanmar teak imported as much as possible before the log

export ban in Myanmar and therefore have high stocks.

Analysts report that domestic demand for teak products is

weak and that prices for sawn teak remain un-changed.

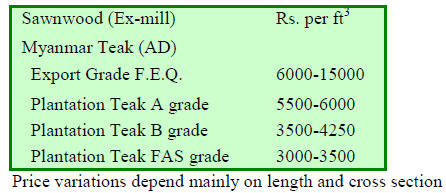

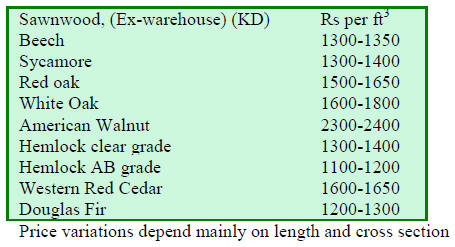

Imported sawnwood prices

Ex-warehouse prices for imported kiln dry (12% mc.)

sawnwood per cu.ft are shown below.

¡¡

7.

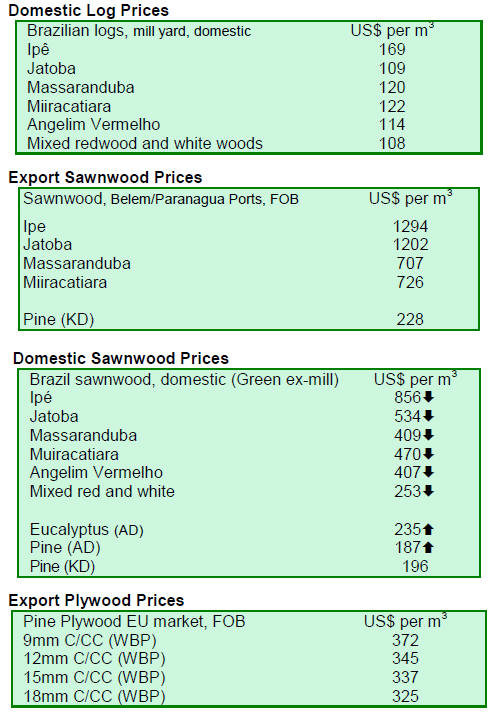

BRAZIL

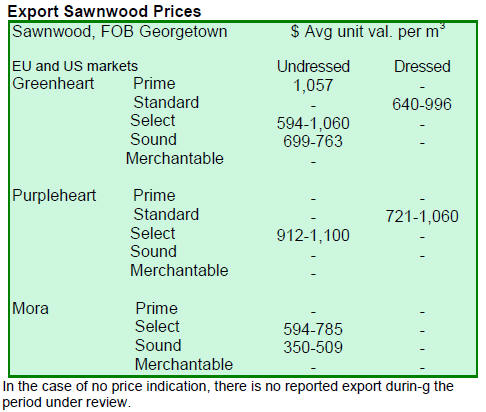

Brazilian real slumps on Central

Bank policy decision

While average prices for wood products in the domestic

market in Brazilian real have not changed over the past

month values in US dollars reflect fluctuation in exchange

rates.

The average exchange rate in March was BRL 2.33 to the

dollar while in March 2013 the rate was BRL 1.98 to the

dollar.

On the 25th April Brazil‟s real fell sharply to 2.244 to the

US dollar, the steepest decline since December last year.

This dramatic fall was triggered by a decision by the

Central Bank not to continue currency swaps which had

supported the recent 5% strengthening of the real.

Diverging forecasts of growth prospects

Brazil‟s Central Bank's most recent index of economic

activity shows that the economy grew 1.63% in February

compared to February 2013. On this basis year-on-year

growth would be 2.41 percent, up from the 2.3% reported

based on January data.

See:

https://www.bcb.gov.br/textonoticia.asp?codigo=3815&ID

PAI=NEWS

The IMF has said that it expects the Brazilian economy to

continue its slow pace of growth in 2014 despite a boost it

may get from hosting the World Cup. The IMF has

forecast growth for the year at 1.8% compared to earlier

estimates of 2.3%.

The IMF also lowered Brazil's 2015 growth forecast

to

2.7% having forecast 2.8% at the beginning of the year.

Interest rates jump to 11 percent

Inflation, as measured by the consumer price index, ended

up almost 1% at the end of March. Over the past 12

months cumulative rate of inflation was 6.15%. In

response to the steep rise in inflation the Monetary Policy

Committee of the Central Bank decided to increase the

Selic rate to 11% per year.

See:

https://www.bcb.gov.br/textonoticia.asp?codigo=3812&IDPAI=

NEWS and

http://www.bcb.gov.br/htms/relinf/direita.asp?idioma=P&ano=2

014&acaoAno=ABRIR&mes=03&acaoMes=ABRIR

New Brazilian forestry sector association

The Brazilian Tree Industry (IBA or Ind¨²stria Brasileira

de Árvores) is the newest association in the Brazilian

forestry sector and is the result of a merger of three major

associations; ABRAF (Brazilian Association of Forest

Plantation Producers), BRACELPA (Brazilian Pulp and

Paper Association) and ABIPA (Brazilian Association of

Wood Panel Industry).

The term IBA, or more correctly Ib¨¢, comes from the Tupi

Guarani language Yb¨¢, which means tree or fruit.

The new association will be formally launched in June

2014, during the environment week and will begin with a

membership of 70 forestry sector companies.

The board of the association has been holding meetings in

São Paulo to discuss guidelines and other strategic issues

with the aim of building a new less conservative image

than the previous associations.

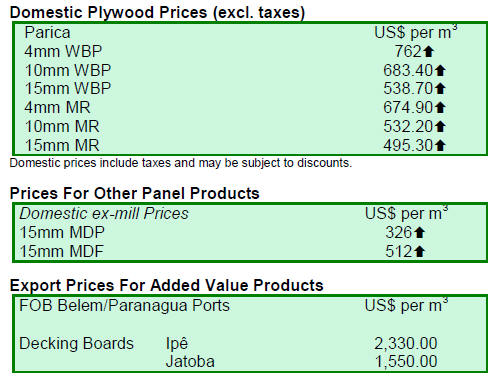

Amazon native species for plantations

A native Amazon tree species, called cuiabano pine,

guapuruvu or paric¨¢ (Shizolobium amazonicum), is gaining

acceptance as a plantation timber in the state of Mato

Grosso. This tree is said to have some advantages

compared to eucalyptus which is commonly planted in

Brazil.

Paric¨¢ grows for around seven years without producing

side branches resulting in a knot free bole. In addition it is

claimed that this timber yields as much as four times more

per hectare than eucalyptus and produces high quality pulp

and good light colour veneers.

Reports indicate that the timber is highly susceptable to

insect and fungal attack and needs to be preservative

treated if used in the soild form.

The timber industry has recognised the potential of this

species because it is light, easy to work and has good

technical charateristics making it suitable for a wide range

of enduses.

Tropical wood product exports continue to slide

In March 2014, wood product exports (except pulp and

paper) increased 9.7% in terms of value compared to

March 2013, from US$199.3 million to US$218.6 million.

Pine sawnwood exports increased 44.6% in value in

March 2014 compared to March 2013, from US$12.1

million to US$17.5 million. In terms of volume, exports

rose 38%, from 54,700 cu.m to 75,500 cu.m over the same

period.

In contrast, tropical sawnwood exports fell 29% in

volume, from 31,900 cu.m in March 2013 to 22,600 cu.m

in March 2014. In terms of value, exports dropped 15.3%

from US$15.7 million to US$13.3 million, over the same

period.

In March pine plywood exports increased almost 13% in

value year on year, from US$32.8 million to US$37

million. Export volumes increased 14%, from 86,500 cu.m

to 98,800 cu.m, during the same period. However, tropical

plywood exports continue to fall and in March this year

exports declined 11% from 4,500 cu.m last year to 4,000

cu.m this year.

Better results were posted for wooden furniture exports

which increased from US$35.7 million in March 2013 to

US$40.7 million in March this year, a 14% increase.

Projection of exports to traditional and new markets

Brazil‟s sawnwood exports to the United States increased

from 70,000 cu.m in 2012 to 86,000 cu.m in 2013

reflecting a recovery of demand. Moreover, exports of

pine plywood to the US also increased, from 40,000 cu.m

in 2012 to 120,000 cu.m in 2013. For 2014 exports of

plywood to the US are expected to be as high as 140,000

cu.m.

According to ABIMCI (the Brazilian Association of

Mechanically Processed Timber Industry) Germany is

now importing more from Brazil as the construction and

housing markets are growing. January pine plywood

exports to Germany totalled 11,106 cu.m and this

increased to 15,092 cu.m in February.

ABIMCI notes that demand seems to be improving in

Belgium, Italy and the United Kingdom.

The European market is seen as offering better prospects

in 2014 as some European plywood producers have either

closed or have, as in the case of Finland, reduced output

due to raw material supply issues. These changes are

opening new opportunities for Brazilain exporters in both

traditional western markets and new markets in Eastern

Europe.

Another region with opportunities for the Brazilian timber

industry is South America. Forecasts from the IMF and

others suggest the economies in countries such as Peru,

Ecuador and Chile will grow in 2014 which will result in

increased consumption of wood products.

SFB creates timber ID tool

The Amazon Cooperation Treaty Organization (ACTO) is

developing an interactive tool with information on the

commercial species in eight ACTO member countries

based on a similar tool developed by the Brazilian Forest

Service (SFB).

The tool that is being developed will be more

comprehensive than the Brazilian ID tool as it will include

genetic information and images of flowers, fruits, bark and

standing trees. The SFB will undertake work on the

description of species. SINCHI (Instituto Amaz¨®nico de

Investigaciones Cient¨ªficas) will perform DNA analysis

and botanical identification of collected samples.

The objective of the development of this interactive tool is

to provide information for environmental agencies, police

officers and experts or researchers for the easy

identification of a timber .

In Brazil, the tool is used by IBAMA (Brazilian Institute

for Environment and Renewable Natural Resources) and

by the Federal Police to identify whether timbers being

transported or processed are species that can be legally

harvested.

¡¡

8. PERU

Analysing contributions to the Forestry

and Wildlife

regulations

As part of the approval process for the new Forestry and

Wildlife Act, an intergovernmental group held a workshop

to establish criteria for assessing the over 2,000 written

contributions made by concerned groups and individuals.

The workshop was attended by representatives of regional

governments, civil society, NGOs and international

technical cooperation agencies.

The new Forestry and Wildlife Law contains 459 articles

and was submitted for review and public comment in

September last year and there was a huge response from

stakeholders.

To facilitate assessment of the comments and suggestions

the submissions were categorised into those related to

wildlife, forest management and indigenous and rural

communities.

The intergovernmental group was led by the General

Directorate of Forestry and Wildlife, Ministry of

Agriculture and Irrigation and involved the Ministries of

Environment, Foreign Trade and Tourism, Culture,

Production, Economy and Finance, the Presidency of the

Council of Ministers.

Also included was the agency for the Supervision of

Forest Resources and Wildlife (OSINFOR), the

Interregional Amazon Council Amazon (representing

regional governments and appointed by the National

Assembly of Regional Governments) and the Centre for

National Planning. Asessment of the many submissions

will take a considerable time.

Agrobanco exceeded placements during the first

quarter of 2014

Agrobanco has reported that its loans nationwide reached

US$350 million during the first quarter of this year,

exceeding initial projections. The president of the

organization, Hugo Wiener, noted that this is very good

news for the agriculture and forestry sectors.

Wiener said that during 2013 approximately 50,000

agricultural and timber sector enterprises benefitted from

Agrobanco credit and long-term finance.

The highest percentage of loans in 2013 were to finance

production of agricultural crops, forestry, timber

processing and agribusiness.

9.

GUYANA

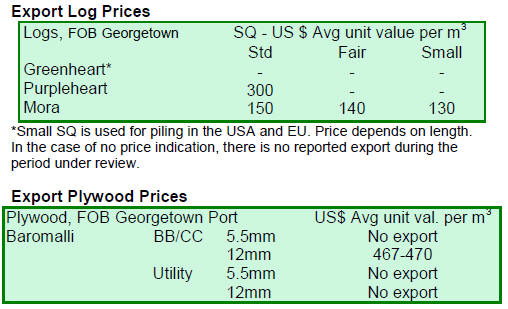

Top three timbers dominate export trade

During the period reviewed there were no shipments of

greenheart logs but purpleheart logs were exported and at

moderately attractive prices. Standard Sawmills quality

purpleheart logs were priced at US$300 per cubic metre

FOB.

Mora logs were sold for a fair price to international buyers

with mora Standard Sawmill quality logs fetching US$150

per cubic metre FOB. Fair Sawmill quality mora attracted

an FOB price of US$140 while Small Sawmill quality

mora logs were traded at US$130 per cubic metre FOB.

Wamara (Swartzia leiocalycina) logs continue to be in

demand and the latest shipments went at prices ranging

from US$120 to US$170 per cubic metre FOB. Guyana‟s

logs continue to attract buyers mainly in the Asian

markets.

Greenheart sawnwood demand firms

Sawnwood exports were encouraging and made a useful

contribution to total export earnings during the period

reviewed. Undressed greenheart (Prime) continues to

maintain a price of US$1,057 per cubic metre FOB.

The FOB price for Undressed greenheart (Select)

remained stable at US$1,060 per cubic metre. The top-end

FOB price for Undressed greenheart (Sound) moved from

US$594 to US$763 per cubic metre. This quality of

greenheart is in demand in Europe, the Middle East and

North America.

During the period reviewed Undressed purpleheart FOB

prices moved from US$1,080 to US$1,100 per cubic metre

for shipments to markets in the Caribbean and New

Zealand.

Undressed mora (Select) sawnwood recorded a significant

price increase, climbing as high as US$785 per cubic

metre FOB while for Sound quality prices were around

US$509 per cubic metre.

In contrast to the price gains mentioned above during the

period reviewed Dressed greenheart sawnwood FOB

prices fell US$1,102 to US$996 per cubic metre, the

Caribbean remains the main market for this product.

Similarly Dressed purpleheart FOB prices eased from

US$1,102 to US$ 1,060 per cubic metre.

Recently plywood prices have also eased from US$578 to

US$470 per cubic metre FOB with the demand coming

mainly from buyers for the Central American markets.

Greenheart piles (Select category) secured a noteworthy

price on the export market and earned as much as US$ 531

per cubic metre FOB in the North American market.

Wallaba poles FOB prices remained unchanged at US$833

per cubic metre in the Caribbean market. However,

Splitwood (shingles) prices were maintained at US$1,045

per cubic metre, up from the previous shipment prices.

Harnessing local building contractors to promote LUS

use

As part of an effort to raise public awareness of the wide

range of timbers available the FPDMC has published a

guide that groups the lesser used species into categories

based on their properties compared to the more commonly

used timbers.

As an example the guide mentions that black kakaralli can

be a substitute for greenheart in many applications ,

morabukea for ora, futui for silverballi whilst darina can

be substituted for locust. The species guide is proving very

popular with local builders and furniture makers.

Homeowners in Guyana have expressed satisfaction with

the performance of tonka bean and darina, both LUS, for

flooring as well as with the performance of korokororo,

another LUS, for ceiling panels and itikiboroballi and

kurokai for wall panels.

In Guyana consumers often seek assistance and guidance

on suitable timbers from building contractors and as such

these specialists are in a position to perform an important

role in promoting the use of a wider range of timbers.

Carpenters and building contractors are now being

encouraged to familiarise themselves on the LUS timbers

that are available.