Japan Wood Products

Prices

Dollar Exchange Rates of

11th April 2014

Japan Yen 101.63

Reports From Japan

Companies remain concerned over prospects for

continued growth

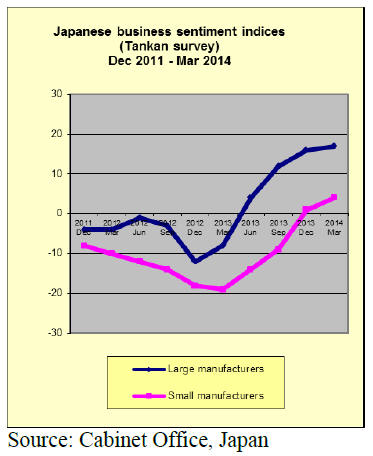

The latest survey of sentiment amongst Japanese

companies is showing that all firms are increasingly

pessimistic about prospects the rest of the year.

This highlights private sector concerns on the impact of

the consumption tax rise on consumer spending in the

coming quarter which is expected to drop sharply after the

booming sales prior to 1 April when consumers had rushed

to buy everything from cars to groceries ahead of the tax

rise.

Business sentiment in Japan in the first quarter of this year

was almost stagnant. Today‟s corporate sentiment is

weaker than when Japan last raised the tax in 1997.

The sentiment index for big manufacturers rose in the first

quarter by just one point from three months ago to plus 17,

the fifth quarter of improvement but below expectations.

The future outlook, as assessed by big manufacturers, fell

9 points.

For the Cabinet Office survey see:

www.boj.or.jp/en/statistics/tk/index.htm/

While analysts say this time Japan's economy should have

a better chance of adjusting to the current tax rise than

when it was last raised retailers are forecasting a sharp

drop in sales in the second quarter.

No immediate response by BOJ to weak economic

news

The Bank of Japan (BoJ) surprised the financial markets

by keeping its policy unchanged. Most analysts had

expected the Bank to announce additional stimulus

measures but the Bank has not reacted immediately, the

latest weak economic data may prompt them to act soon.

For the full press release see:

https://www.boj.or.jp/en/announcements/release_2014/k14

0408a.pdf

The latest statement from the BoJ says Japan's economy

continues to slowly recover despite a negative impact from

the consumption tax increase. The Bank notes that

advanced economies are showing signs of recovery which

is good news for Japanese exporters.

Japan‟s exports have recently levelled but there has been

an improvement in business investment as corporate

profits have improved. Private consumption and housing

investment were resilient and there have been

improvements in employment opportunities and incomes.

The Bank insists business sentiment continues to improve

but that the recent weakening of sentiment presents a

challenge for the short term. Inflation expectations (but not

the reality) appear to be rising says the Bank and the

outlook is that the Japanese economy will gradually

strengthen once the impact of the tax increase on

consumer spending fades.

The Bank says it will continue with quantitative and

qualitative monetary easing as long as necessary to

achieve its 2% inflation target.

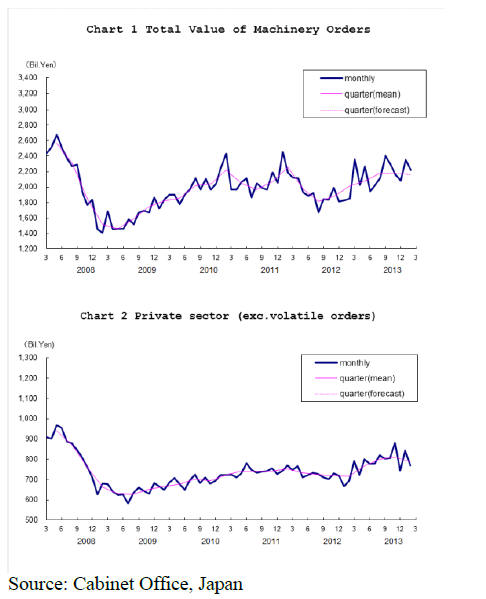

February machinery orders down 6% year on year

Business sentiment as gauged by the level of machinery

orders has weakened. Machinery orders are published

regularly and have been found to be good indicators of

sentiment as they reflect capital spending for future

production.

In February the value of orders for machinery received by

Japanese manufacturers fell by almost 6% from a month

earlier suggesting manufacturers are pessimistic on the

midterm economic prospects.

Orders placed by the private-sector declined 8.8%

excluding orders for ships and orders from power

companies. The drop in orders in February comes after the

healthy January increase of 13% which was the best

performance since early 2013.

In a recent assessment the Japanese Cabinet Office has

changed its assessment of machinery order trends saying

the orders have stalled and that the outlook is challenging.

For more see:

http://www.esri.cao.go.jp/en/stat/juchu/1402juchu-e.html

The sharp reaction of consumers and businesses to the

consumption tax increase on 1 April is not surprising but

most analysts do not see a turn-around in growth until the

third quarter.

Too early to assess impact of tax hike

From 1 April the consumption (sales) tax was raised by

3% to 8%. The government has indicated that if the

economy remained on a growth track it will increase the

tax to 10% in October 2015.

The fast pace of consumption tax rises are necessary to

finance soaring social welfare related to Japan's rapidly

ageing population.

Recent assessments of the population age distribution

show that by 2025 people over 65 could account for

around 35% of the population. As the birth rate in Japan

continues to fall there are serious concerns about Japan‟s

future economic growth.

The need to raise the consumption tax has been discussed

in Japan for several years and previous attempts by various

administrations to raise the tax have been disastrous and

the current rise will be a challenge to the government‟s

efforts to lift the country out of its deflationary spiral.

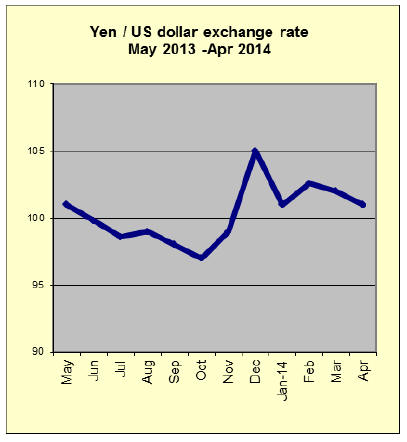

Yen strengthens against US dollar

The US dollar fell more than 1 percent against the yen in

early April on the back of the 8 April policy statement

from the Bank of Japan (BoJ) which ruled out the

immediate need for additional stimulus.

In a news conference held after the latest Policy Board

meeting the BoJ Governor said, while the economy is sure

to slump in the second quarter because consumer spending

will decline sharply, a return to solid growth can be

expected from the third quarter of this year.

The BoJ decision not to inject more liquidity into the

market was read as supporting the yen but any significant

strengthening of the yen is expected to bring a swift

response.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to extract and reproduce news on the Japanese

market.

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

Bewilderment on Wood Use Point system

For the Wood Use Point system, American Douglas fir

and European whitewood have been selected as qualified

species for the system. American Douglas fir has been

supported by majority of prefectures.

However, in Kyushu, there are mounting voice of

bewilderment and resentment by prefectural councils and

domestic timberland owners. The reason is that the

system‟s one of the conditions is spill-over effect of use of

particular species for local economy and employment.

The Forestry Agency‟s guideline for the system states the

main objective of the system is to stimulate local business.

Four prefectures of Kagoshima, Miyazaki, Kumamoto and

Ohita in Kyushu, where is the main supply region of

domestic logs, are still discussing whether Douglas fir is

appropriate for qualified species and have not made

recommendation like other prefectures.

Douglas fir has been widely used for beam and girder and

many areas enjoy ripple effect of Douglas fir demand such

as employment by sawmills, processing and distribution.

Lumber dealers are anxious to handle Douglas fir lumber

as it is popular items for wooden units but in domestic

timber growing regions, there is very little benefit of

Douglas fir or rather it gives negative impact.

If Douglas fir is approved for beam and girder for the

Wood Use Point system, builders do not have to use

domestic wood. This is reverse move to the measures the

government has been taking.

There are many measures to encourage using domestic

wood so that builders have been trying to use domestic

wood products for post, beam, sill and stud and plywood

made of domestic species. They wonder why imported

species are qualified so fast without considering local

conditions.

Big increase in Japan’s log exports

Export of domestic logs in 2013 was 264,000 cbms,

133.0% more than 2012. This is the highest export since

the Japan Wood Products Export Promotion Council

started gathering statistics. In particular, the export to

China soared to 129,000cbms, 797.2% more.

The Ministry of Agriculture, Forestry and Fisheries made

up export promotion strategy of agricultural and marine

products and target of forest products export value of 25

billion yen by 2020 from 12.3 billion yen in 2012.

In 2013, because of robust demand in China and help of

weak yen, log export to China expanded to 129,000cbms

from 14,000 cbms in 2012.

Log export also increased for Taiwan P.o.C andS. Korea

so total log export more than doubled in 2013. Lumber

export was only 66,000 cbms, 2.9% more but growth is

low.

In 2014, China‟s wood structure standard is revised, which

allows use of Japanese cedar, cypress and larch for

structural materials so further increase of demand for

Japanese logs is expected.

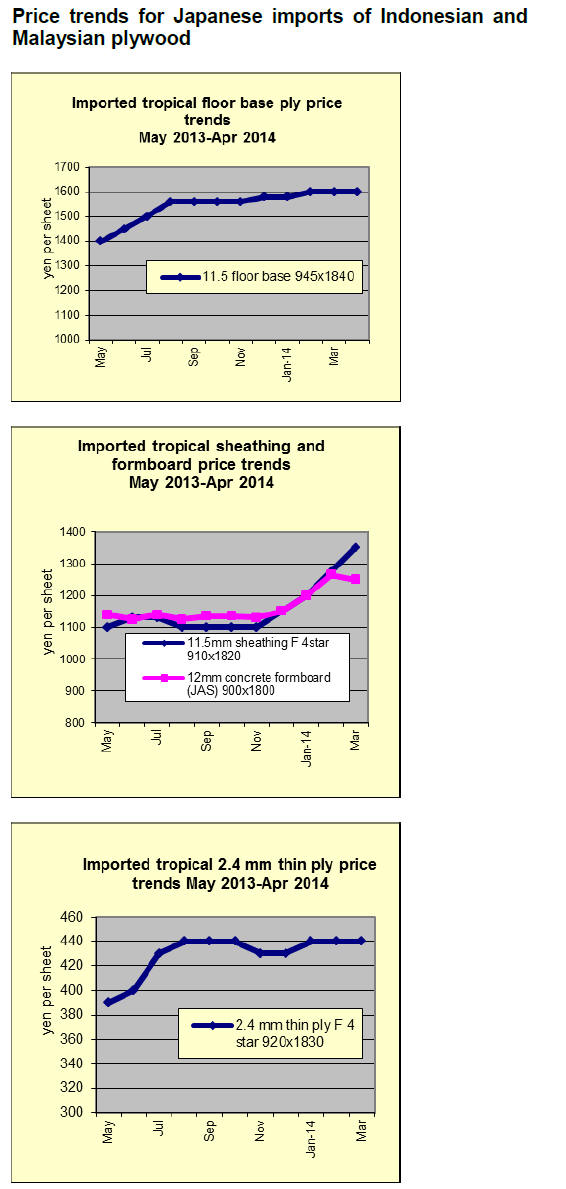

Price hike by secondary processors of South Sea

plywood

Secondary plywood processors to make print plywood and

color plywood are facing higher cost of raw materials so

they are proposing higher prices since April.

Because of price increase of imported South Sea

hardwood plywood mainly due to weaker yen, the

manufacturers increased the sales prices about a year ago

but it was hard to pass higher cost onto sales prices.

Currently the prices of imported thin plywood have been

climbing due to higher log cost, labor cost and energy cost

in producing regions plus weaker yen in Japan. The

manufacturers have to use such high cost materials when

the demand is slowing by consumption tax increase since

April.

There is no other way to absorb higher cost but to price

hike. Meantime, house builders have no room to accept

higher materials cost when new orders are declining. So

the situation is very severe for the manufacturers.

Plywood

Shipment of domestic softwood plywood has been brisk

for large builders and precutting plants. Despite forecast

of slower movement in March, surplus supply went to

large builders.

February production was 215,200 cbms, 9.1% more than

the same month a year ago and 1.2% down from January.

The shipment in February was 220,900 cbms, 7.8% more

and 8.2% more. Therefore, the inventories have kept

declining for five straight months. With low inventories, it

becomes hard to have variety of items other than common

12 and 24 mm panels.

Since late 2013, the movement of imported plywood got

active by bullish FOB prices and weakening yen and the

market prices shot up with some speculative demand then

by late February the fever simmered down in Tokyo

region.

The importers succeeded to make profit by this price

increase then keep carrying low cost inventories as future

arrivals would cost higher so usual dumping sales in

March end book closing period did not take place. Supply

side continues bullish as there is talk about log harvest tax

increase in Indonesia.

Sattsuru Plywood changes log storage

Sattsuru Plywood in Hokkaido has been consuming South

Sea hardwood logs from Malaysia and PNG for plywood

manufacturing. The main species are yellow and red

meranti. It has six or seven shipments a year. One

shipment is about 5,000 cbms.

Logs are unloaded and stored at water log storage of port

of Kushiro but the port decided to close its water log

storage because of safety since logs got out of the storage

and moved up Kushiro river in downtown Kushiro then

deterioration and difficulty of financing for maintenance.

Sattsuru has to relocate log unloading port and storage and

decided to change to port of Tokachi. Sattsuru considered

option of dry land log storage but it requires fumigation,

water sprinkling during summer months and anti-freeze

spray during winter, which is too costly so even though

distance from Tokachi port to plywood mills is much

longer than Kushiro, it decided to use Tokachi port.

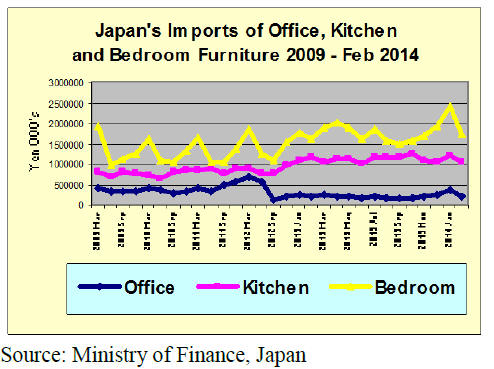

Trends in office, kitchen and bedroom furniture

imports

Japan‟s office kitchen and bedroom furniture imports from

2009 to the end of February 2014 are shown below. March

figures will not be available until the end of April.

Japanese imports of furniture exhibit a cyclical trend

between 2009 and 2012. However, from 2012 bedroom

furniture imports began to increase and have continued

upwards since.

February furniture imports fell sharply as Japanese

importers adjusted stock levels in anticipation of declining

demand as housing starts stall and as the demand for

replacement furniture subsides because of the

consumption tax increase.

|