|

Report

from

Europe

UK leads a slow recovery in the EU

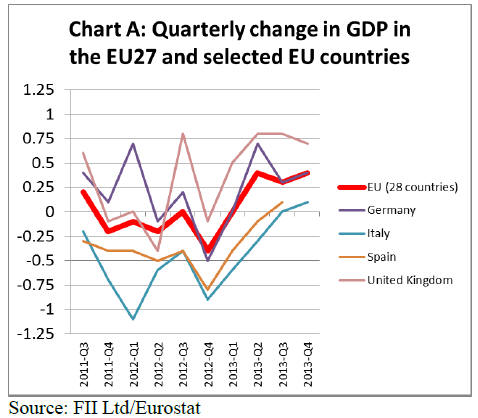

According to a preliminary estimate by Eurostat, GDP

rose by 0.1% in the EU28 and fell by 0.4% in the euro area

during 2013. Quarterly data shows that the European

economy has been recovering slowly since the second

quarter of 2013 (Chart A).

Of the large EU countries, the UK was the best performing

economy in 2013. The UK's services and manufacturing

sectors were the drivers of 0.7% growth in the fourth

quarter, taking the annual growth rate to 1.9%, the

strongest since 2007.

In the euro-zone, 0.4% and 0.3% GDP growth respectively

in Germany and France in 2013 helped offset further

declines in Italy and Spain. However, all these economies

were recovering slowly in the second half of 2013.

Fragile recovery in the euro-zone

The euro zone's fragile economy improved modestly in the

final quarter of 2013. GDP increased 1.1% at an

annualized rate during the period. Recent growth is being

buoyed by gains in exports and investment which is

helping offset sluggish consumer spending.

However growth is still well below the pace needed to

make a dent in near record-high unemployment or to

alleviate debt burdens in Southern Europe.

Nevertheless, with a value of $12.7 trillion, the euro-zone

economy remains the second-biggest in the world behind

the U.S. Official and private-sector estimates peg growth

of around 1% across the region during 2014. This suggests

that while the euro-zone won't be a drag on the global

economy this year, it is unlikely to provide much of a lift

to its trading partners either.

With the exception of Germany - which is renowned for

its export prowess- the outlook for euro-zone growth is

insufficient to propel much new investment and hiring.

That leaves much of the currency bloc vulnerable to

shocks from the global economy, financial markets or

renewed political uncertainty.

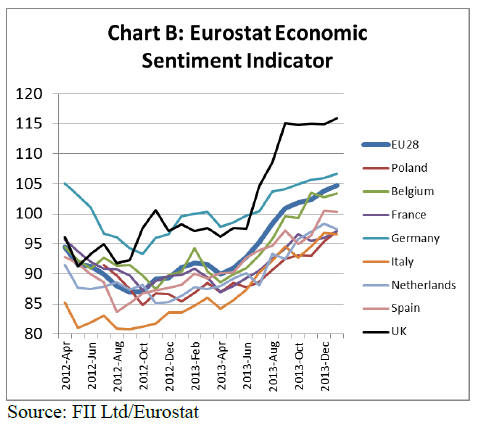

More positively, economic sentiment was improving

across the EU during the second half of 2013 (Chart B).

For the EU28 as a whole, the Eurostat Economic

Sentiment Indicator has exceeded 100 since August 2013.

This implies above average sentiment across all five

economic sectors (industry, services, retail trade,

construction and consumers). Economic sentiment is

particularly good in the UK and Germany.

Broad-based recovery in the UK

Prospects look much improved in the UK as economic

recovery is now apparent across a wide range of industrial

sectors. Britain's dominant services sector expanded by

0.8% between October and December 2013, while the

construction sector increased by 0.2%.

British manufacturing increased by 0.9%, with industrial

production overall up by 0.7%, while agricultural output

increased by 0.5%.

Of particular note for the wood industry, house building in

the UK staged a dramatic recovery in 2013. British

builders enjoyed their best year since the financial crisis

struck.

The UK Office for National Statistics reports that new

housing construction jumped 10.4% to £22.1 billion in

2013. That is the highest level since 2007. The surge

pushed output across the construction sector up 1.3% to

£112.6 billion in 2013, 3.9% higher than the low in 2009

but still 12.2% below the 2007 peak of £128.2 billion.

Very slow recovery in construction in other EU

countries

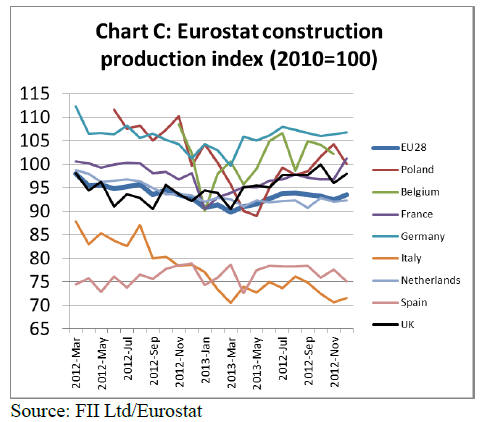

Construction activity throughout the whole of EU is

currently running at around 95% of the level in 2010

(Chart C). Activity in Germany maintained a relatively

high level throughout 2013.

Activity was also showing signs of recovery in Belgium,

Poland and France during the second half of 2013.

However construction activity remained at a very low

level in Italy and Spain throughout the year.

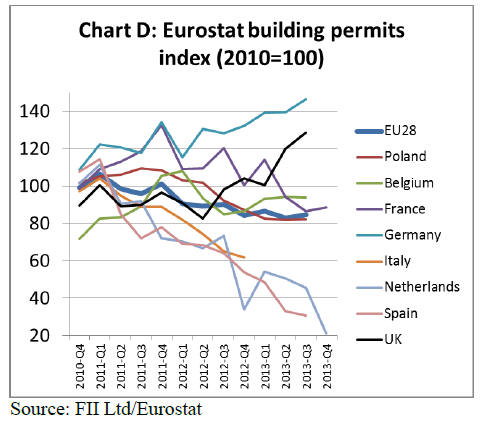

The Eurostat Building Permits Index, an indicator of

future activity, suggests only very slow recovery in

construction activity in the EU during 2014 (Chart D).

Building permits were rising strongly in the UK and

Germany in the second half of 2013.

However the number of building permits issued in Spain

and the Netherlands declined sharply during this period.

Overall building permits issued in the 3rd quarter of 2013

were only around 80% of the level prevailing in 2010.

EU wood flooring consumption down 5% in 2013

After a year in which overall European wood flooring

consumption fell by 5.9%, first estimates suggest the

market contracted another 5% in 2013. This is based on

comments received from member country representatives

at the FEP (European Federation of the Parquet Industry)

meeting held at the DOMOTEX fair in Hannover in

January 2014.

As in previous years, the results show some variation

between European countries and from quarter to quarter.

However, the overall picture is not as diverse as it once

was. Indeed, countries which were performing rather well

and driving the markets upwards also lost momentum in

2013.

Markets in the south of the EU (e.g. Spain, Italy, and

France) still face serious difficulties and probably

experienced double digit decline in 2013. The situation is

better in northern Europe, but developments are still

slightly negative or, in the best case, stable (e.g. in

Sweden).

Central Europe remains the best performing region,

particularly Switzerland with expected growth of 6% in

2013. Consumption in Austria and Germany is estimated

to have remained stable between 2012 and 2013.

According to FEP, these figures ¡°have to be seen in the

light of the major challenges faced by the sector in 2013

and still faced today, notably the continuously stiff

competition, extremely high unemployment rates in some

important EU regions and ever uncertain exchange rates,

especially the EUR/USD rate¡±.

However FEP also note that the latest economic forecasts

provide some grounds for optimism. FEP stress the

conclusions of recent FEP consumer perception studies

¡°which confirm that parquet is a great natural product,

very much valued and desired by consumers, who see real

wood parquet as an indispensable element of interior

decoration of the future.¡±

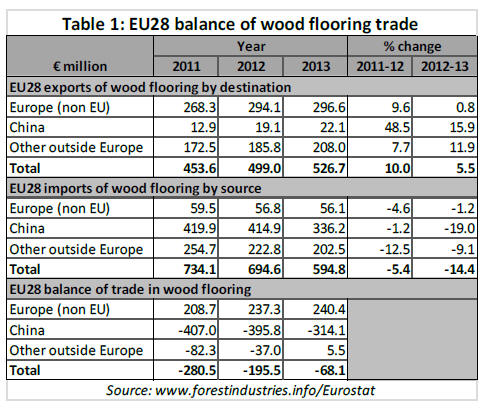

Big fall in EU wood flooring trade deficit

While European wood flooring consumption remains

slow, there are signs that EU wood flooring manufacturers

have adjusted to the new market situation by significantly

boosting competitiveness in international markets.

This is suggested by the recent rise EU exports of wood

flooring to other regions and by a sharp decline in EU

imports of wood flooring. The value of the EU‟s trade

deficit in wood flooring has fallen from euro 281 million

to only euro68 million in only three years (Table 1).

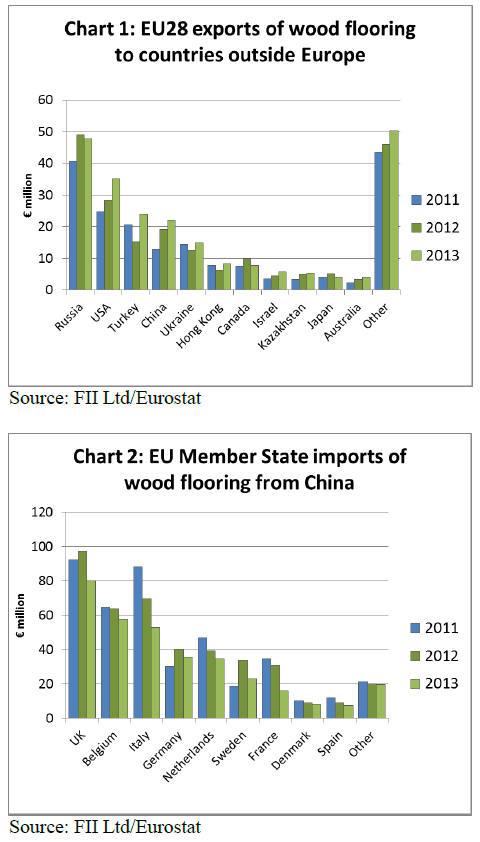

Between 2012 and 2013, the value EU28 wood flooring

exports increased by 5.5% to €527m. This followed a 10%

increase in export value between 2011 and 2012. Most of

the export gains in 2013 were to markets outside the

European continent, notably USA, Turkey and China

(Chart 1).

This is in contrast to 2012 when most of the rise in exports

was destined for other European countries (mainly

Switzerland and Norway).

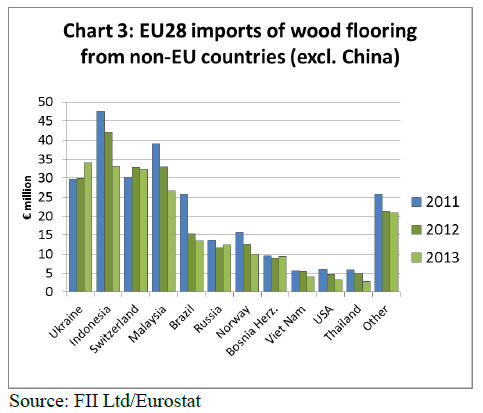

Last year, EU imports of wood flooring from outside the

region fell by over 14% to €595 million. Imports from

China, by far the largest external supplier to the EU, fell

19% to €336.2 million.

All the main EU markets imported less Chinese wood

flooring during 2013, including UK, Belgium, Italy,

Germany, Netherlands, Sweden and France (Chart 2).

While much of the decline in imports is due to China, EU

imports also declined from most tropical producing

countries during 2013 (Chart 3). EU import value of wood

flooring fell sharply from Indonesia (-22% to euro 33m),

Malaysia (-19% to euro 26.7m), Brazil (-12% to

euro13.6m), Viet Nam (-27% toeuro€4m) and Thailand (-

41% to euro2.9m).

Domotex highlights dominant position of oak in

European flooring

Domotex is Europe‟s leading flooring sector trade show

held each year in Hannover, Germany during January.

Every year for the last decade, the wood content of the

show has become increasingly dominated by engineered

wood flooring faced with oak.

In relation to wood species, the only observable trend has

been the increasingly wide and creative range of oak

finishes. This year was no different with some companies

promoting up to 150 finishes of oak. Other species, both

tropical and temperate, have been pushed to the side-lines.

From the perspective of overall wood flooring demand, the

Domotex show provided reasons for optimism about the

future. After an attendance drop in 2013, the show

rebounded 11% to 45,000 visitors and attracted 1,350

exhibitors from 57 countries.

It was also encouraging that two large halls this year were

dedicated to wood and laminate flooring. Some of the

bigger brands who also produce laminate and non-wood

flooring were showing a wider range of real wood

products. Most of the biggest European flooring brands

were exhibiting this year.

This contrasts with 2013 when some opted instead for the

German building show Bau held at the same time. There

were quite a few Chinese producers promoting their

products to European buyers, but perhaps not as many as

in the past. This year there appeared to be more producers

from Central Europe including Hungary, Czech Republic,

Poland, Croatia and Serbia.

The show highlighted that the rustic antique look remains

strong in in the wood flooring sector. This trend is one the

producers clearly want to perpetuate as they are able to

source cheaper lower grades and small dimension oak

lumber, especially from Central and Eastern Europe.

Manufacturers were generally confident of continuity of

supply and stable prices for this lower grade material. This

contrasts with supply of joinery grades of European oak

and most grades of U.S. oak which are currently

experiencing supply shortages and firming prices.

One indication that the European wood flooring market is

recovering is provided in a comment by a US hardwood

supplier attending Domotex quoted in the US-based

journal Hardwood Floors. He notes that ¡°In comparison to

2013, [European] buyers seem much more focused on

availability than price. Most buyers are aware of the tight

supply of U.S. hardwoods and are responding more

aggressively than this time last year.¡±

Much of the oak on display appeared to be of European

origin, although most large European flooring

manufacturers are also buying significant volumes of

American white oak. Other species being promoted,

although much less prominent than oak, were walnut

(almost all American) and ash (European and American).

Some brands were marketing a few tropical species but

there was no maple or cherry.

Mixed messages for tropical wood at Domotex

The Domotex show sent out mixed messages for tropical

hardwoods. In addition to evidence of declining usage,

there was the usual negative commentary by suppliers of

competing products on the environmental profile of

tropical hardwood. MOSO was promoting bamboo

flooring on grounds that it offered ¡°an ecological and

long-lasting alternative to patio floorboards made of ever

scarcer tropical woods¡±.

MOSO claimed that‟s patented bamboo treatment process

¡°gives the outdoor floorboards a level of hardness, shape

stability and resistance that exceeds that of even the best

tropical hardwoods¡±. MOSO also claimed "carbonneutrality"

for their product based on "an official Life

Cycle Assessment following the ISO 14040 and 14044

standard".

More positively for tropical wood, a press release issued

by the Domotex organisers highlights - as a ¡°Hot Topic in

2014¡± - the availability of VLEGAL certified teak flooring

from Indonesia.

The press release notes that ¡°under the 2013 EU Timber

Regulation, operators placing timber on the EU market

must demonstrate that they have not imported illegally

harvested wood. Indonesia with its VLEGAL certification

and documentation system offers a foundation for legal

wood harvesting that is recognized by the EU¡±.

The press release draws on information supplied to

Domotex by the Import Promotion Desk (IPD), a project

for trade promotion financed by the German Ministry for

Economic Cooperation (BMZ) together with its

cooperation partner SIPPO (Swiss Import Promotion

Programme). The project helped finance participation by

several Indonesian flooring manufacturers at the Domotex

show.

* The market information above has been generously provided by the

Chinese Forest Products Index Mechanism (FPI)

|