Japan Wood Products

Prices

Dollar Exchange Rates of

10th March 2014

Japan Yen 103.28

Reports From Japan

National debt continues to expand

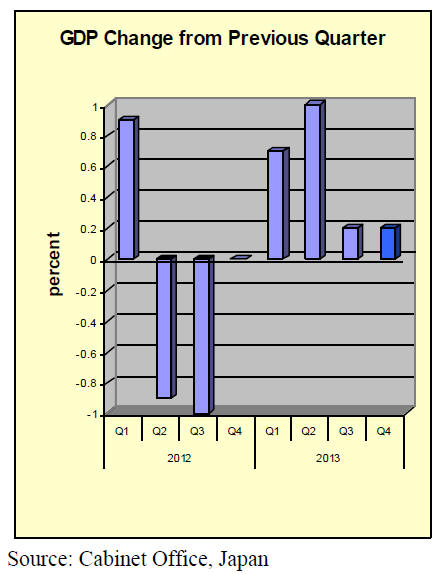

Japan's economy grew by 0.7% in 2013, down from an

initial estimate of 1%, being dragged down by lower than

forecast capital expenditure and a dip in consumer

spending.

Some economists doubt that either business investment or

consumer spending will recover quickly after the April tax

increase. The recent improvement in growth, say analysts,

is mostly the result of households rushing to buy cars,

electronics and other expensive items before the tax

increase.

Despite the growing debt the Bank of Japan (BoJ) is still

maintaining the economy will continue in a recovery mode

by the third quarter of this year and that 2014 will also see

positive growth.

Even with the downward revision in GDP the 2013

economic performance was still the best in three years.

BoJ – No need to adjust stimulus measures

The BoJ has reiterated it will continue with its monetary

stimulus programme as, in its view, both the economy and

consumer sentiment are on track.

At its latest meeting the BoJ decided there was no need to

amend the monetary policy, saying the recent fall in

exports is temporary, the result of a slowdown in demand

from China and other emerging markets. The firm stance

by the BoJ pushed up the yen against the US dollar.

The bank appears confident that, because businesses are

pouring into new plant growth, will be generated. Recent

data showed industrial production rose 4% in January, the

second month increase in April.

In a statement the BoJ said: “With regard to the outlook,

Japan's economy is expected to continue a moderate

recovery as a trend, while it will be affected by the frontloaded

increase and subsequent decline in demand prior to

and after the consumption tax hike.

Exports are expected to increase moderately mainly

against the background of the recovery in overseas

economies.

As for domestic demand, public investment is expected to

trend upward for the time being and then become more or

less flat at a high level. Business fixed investment is

projected to follow a moderate increasing. Private

consumption and housing trend as corporate profits

continue to improve. Investment, albeit with some

fluctuations, are expected to remain resilient as a trend.”

For the full statement see:

https://www.boj.or.jp/en/mopo/gp_2014/gp1403a.pdf

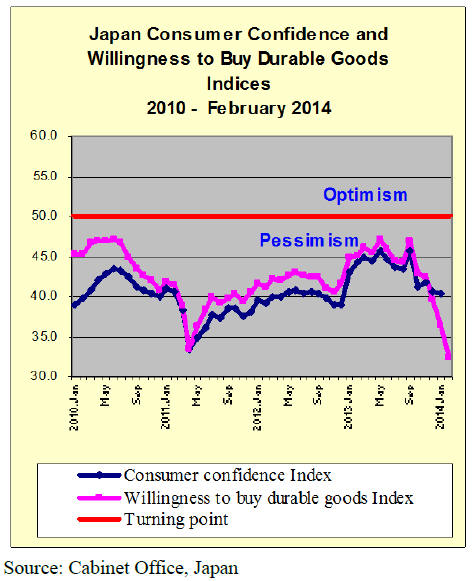

Consumer confidence lowest for years in Japan

Japan‟s Cabinet Office has released the results of the

February 2014 Consumer Confidence Survey showing the

consumer confidence index fell to 38.3, the third month of

decline and the lowest it has been since September 2011.

The latest survey was carried out on 15 February and

covered some 5,635 households (a 67% response rate) was

released on 12 March.

This survey shows more Japanese have become

pessimistic on the four main issues surveyed; overall

economic well-being, income growth, employment and

whether it is a good time to buy durable goods.

See: http://www.esri.cao.go.jp/en/stat/shouhi/shouhie.

html

The overall negative result of the survey prompted the

government to downgrade its assessment, saying,

"consumer confidence is weaker." Last month it said

confidence was "marking time."

Most analysts say consumer confidence is falling as

consumers worry the upcoming tax increase will be hard

to bear, especially as basic pay levels have been stagnant

for years and inflation seems set to rise.

During the latest round of wage negotiations the major

companies have been pushed by the government to raise

basic wages.

The proposed wage increases of between yen 2-3,000 per

month have been well received by workers and may result

in an improvement in the consumer confidence index for

March.

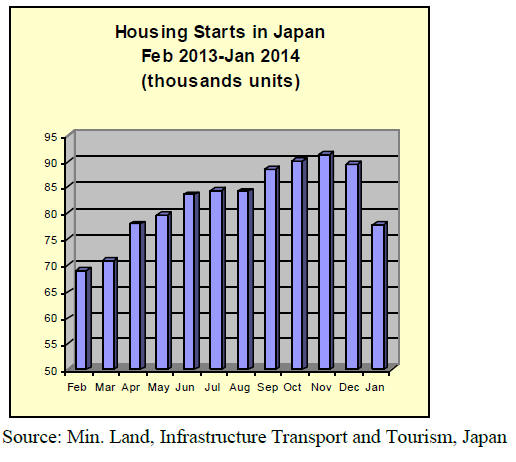

January housing starts fail to meet expectations

Despite a year on year 12% growth in January housing

starts, January 2014 starts, at 77,800, were down 13%

from levels a month earlier and below analysts

expectations.

The complete data set of housing starts can be found at the

Ministry of Land, Infrastructure, Transport and Tourism

website.

Despite the lower than expected January starts

construction companies report that orders increased by

around 15% year-on-year in January, the best result since

November 2013.

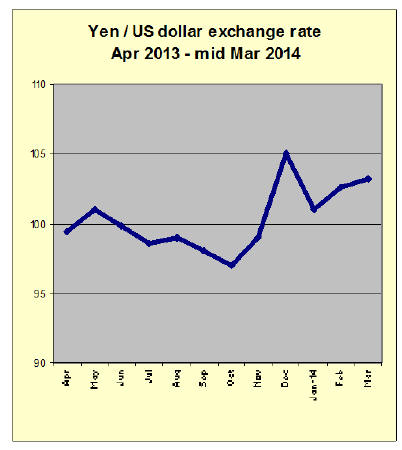

Yen strengthens as money moves out of China

In early March the yen strengthened against the US dollar

despite the drastic downward revision of fourth quarter

growth in GDP and a bigger than wider than expected

current account deficit for January.

The main cause of this strengthening, say analyst, was the

weaker than expected output data from China.

Large Japanese corporations posted high levels of profits

last year and 2013 was the best year for many of the large

corporations since 2007. However, almost all of the gains

were due to the depreciation of the yen against major

currencies which boosted Japan‟s export earning.

However, data suggests few companies actually shipped

more goods in 2013 but gained because more yen was

earned.

The ultra-loose monetary policy of the government

continues to hold down the exchange rate of the yen which

has fallen 24% against the US dollar since the current

government came into power.

Analysts estimate that, for Japanese manufacturers and

exporters, up to 80% of the rise in profits last year can be

explained by the yen:US dollar exchange rate change.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to extract and reproduce news on the Japanese

market.

The JLR requires that ITTO reproduces newsworthy text

exactly as it appears in their publication.

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

Robust demand for New Zealand logs by China

Chinese purchase of New Zealand radiate pine logs had

kept growing until 2011 when the Chinese government

took tight money policy. The volume of import plunged all

of a sudden but since second half of 2012, the import

recovered again by increasing demand and total log import

in 2013 was 11,050 M cbms, 13.4% more than 2012 and it

is the highest import volume.

The log inventories in China before the Chinese New Year

in late January were 2,300-2,400,000 cbms then they

increased to 3,600,000 cbms now.

With active consumption of logs in China, aggressive

purchase will start again shortly.

Log production in New Zealand is steady but it is getting

close to the maximum level considering transportation and

handling capacity of loading ports and the export log

prices have kept climbing continually.

Continuous increase of log export prices for China affects

the prices for Japan. Log prices for Japan are higher than

China but for the suppliers, profitability is lower as Japan

demands longer logs and cleaner surface while Chinese

specifications are much easier to manufacture.

Radiate pine sawmills in Japan have been trying to

increase lumber sales prices by higher log cost but endless

price increase is likely to ruin price structure of crating

lumber market.

Meantime, Chilean radiate pine lumber prices are firming.

The prices for February shipment are up by US$10-15 per

cbm C&F and March shipment prices seem to go higher

again driven by active demand in other markets.

Russian logs and lumber import in 2013

Total log import from Russia in 2013 was 214,000 cbms,

15% less than 2012 and the drop of log import continues

year after year. Meantime, lumber import was 751,000

cbms, 22.1% more than 2012.

There was more demand for logs in the first half of 2013

but the supply was not there and missed the chance to

grow. Lumber import had been steady with about 60,000

cbms a month all through the year.

North American hardwood lumber Market

Market of temperate hardwood lumber from North

America is firming. Wholesalers‟ prices of red oak lumber

(FAS grade of 4/4 inch thick) have climbed to 125,000-

130,000 yen per cbm delivered retailers.

Recovery of housing market in North America and

aggressive purchase by China push the prices up and it is

hard to have desirable volume now. Red oak lumber had

been relatively low in prices but now they are getting close

to white oak lumber prices or higher.

Chinese interior lumber manufacturers used to purchase

directly but now large Chinese lumber distributors buy in

large volume. One company buys 300 containers a month,

which about 10,000 cbms. Others buy 100 containers a

month. China buys from top to the bottom in grade.

The prices of red oak lumber are particularly up. It is

widely used for flooring, baseboard and wall trim in the

States.

Oji group’ Indonesian project

Oji group has been developing forest products project in

Kalimantan, Indonesia. Objective of the project is to

utilize plantation trees like Eucalyptus and Acacia.

It started veneer manufacturing plant in March 2013,

which consumes 60,000 cbms of eucalyptus. Produced

veneer of 36,000 square meters a year is supplied to

plywood mill Korindo group runs.

Then in April 2013, wood chip plant started, which

consumes one million cubic meters of logs a year. Wood

chip of 500,000 BD ton is supplied to Oji Paper in Japan

for paper manufacturing.

In February this year, sawmill started running. The mill

consumes about 25,000 cbms of logs a year. Lumber is

used for crating, pallet, decking, flooring and furniture.

In future, the mill will be expanded to consume 200 M

cbms of logs a year. In July this year, wood pellet plant

will start up, which uses residue of mills and unused wood

in the forest.

The production will be 100,000 ton a year and the pellet

will be marketed in Japan and Korea. With all the

manufacturing facilities, total log consumption will be

1,085,000 cbms a year.

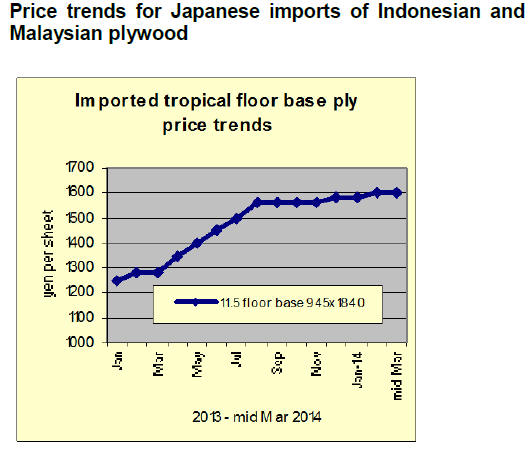

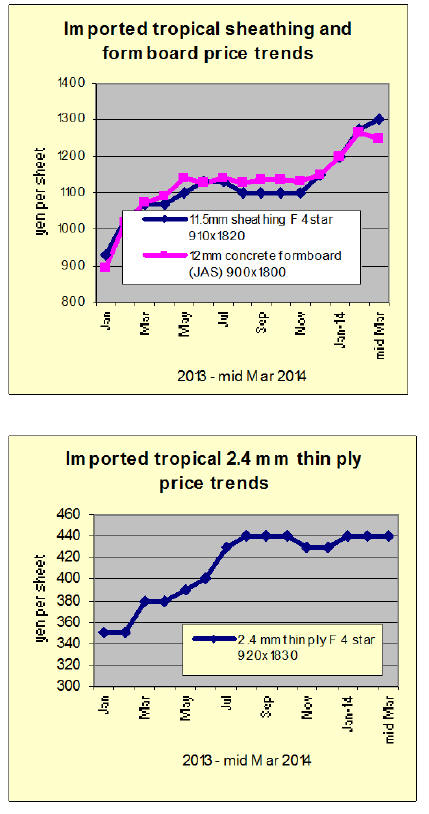

Plywood

Domestic softwood plywood market continues strong.

Although orders for pre-cutting plants for local contractors

and builders started fluctuating, orders from large house

builders continue firm and orders for plywood

manufacturers remain brisk so the supply continues tight.

Since mid January, more trucking became available so that

manufacturers‟ shipments increased and the inventories

declined. Large house builders are busy for February and

March so that plywood demand should continue brisk

through March.

January production was 217,900 cbms, 16% more than the

same month a year ago and 38% less than December due

to holidays and cold weather but the shipments 240,600

cbms, 93% more and 62% more. Thus, the inventories

declined by 20 M cbms down to 98,900 cbms.

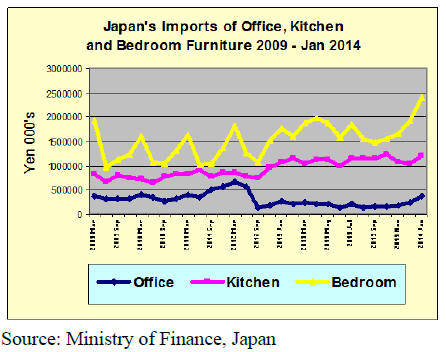

Trends in office, kitchen and bedroom furniture

imports

Japan‟s office kitchen and bedroom furniture imports from

2009 to the end of January 2014 are shown below. Imports

of bedroom furniture exhibited a cyclical trend between

2009 and 2012. However, from 2012 bedroom furniture

imports began to increase and have continued upwards

since. January 2014 imports marked a new high for

monthly imports of bedroom furniture.

January imports of office and kitchen furniture expanded

sharply a reflection of the firm housing market and the

desire on the part of businesses and the public to purchase

furniture before the consumption tax is raised in April.

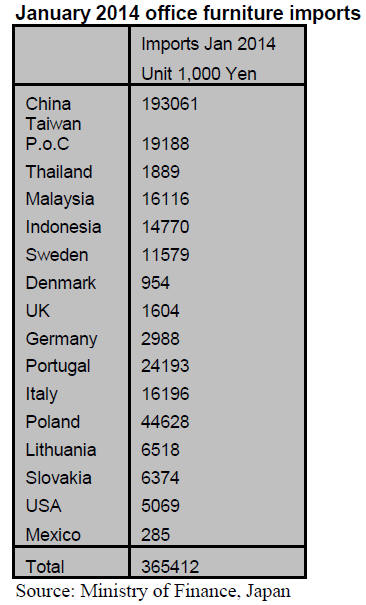

Office furniture imports (HS 9403.30)

January 2014 office furniture imports into Japan were

around 40% higher than for the same month in 2013 and

sharply up on December 2013 imports. The top suppliers

of office furniture to Japan during January were China

(53%) Poland (12%) and Portugal (7%) accounting for

some 72% of all office furniture imports.

If imports from Malaysia and Indonesia are added to the

imports from China then Asian suppliers accounted for

close to 60% of Japan‟s January 2014 office furniture

imports with the balance coming from EU suppliers.

Kitchen furniture imports (HS 9403.40)

Imports of kitchen furniture in January 2014 were one of

the highest since 2009. January 2014 kitchen furniture

imports were 13% higher than in January 2013 and 17%

higher than in December 2013. Vietnam (37%), China

(26%) and Philippines (16%) accounted for the bulk of the

kitchen furniture imports in January 2014.

If imports from Thailand and Indonesia are included in the

sub total above then Asian suppliers accounted for over

90% of Japan‟s kitchen furniture imports.

Of the non-Asian suppliers Germany and the US were in

the top 20 suppliers but could together only secure a

modest 5% market share.

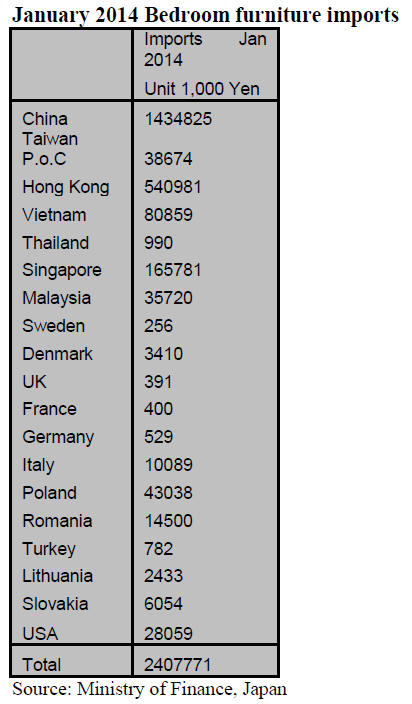

Bedroom furniture imports (HS 9403.50)

Japan‟s imports of bedroom furniture steadily increased

throughout 2013 and there was a surge in imports in

January 2014 lifting the monthly value of imports to a new

record high.

Compared to imports in January a year early, 2014

January imports were up 36.5% and compared to imports

in the previous month of December, imports rose 24%.

While China maintained its number one ranking in terms

of the value of imports, newcomer suppliers, namely Hong

Kong and Singapore, provided a large proportion of

January 2014 bedroom furniture imports.

Together, China Hong Kong and Singapore accounted for

89.5% of Japan‟s January 2014 imports of bedroom

furniture.The top non Asia suppliers were Poland, the US

and Romania.

|