Japan Wood Products

Prices

Dollar Exchange Rates of

20th November

2013

Japan Yen

100.02

Reports From Japan

Assessment of the current state of the Japanese

economy

The Japanese Cabinet Office has released its latest

assessment of the current state of the Japanese economy

saying the recovery is proceeding at a moderate pace

despite some weakness in exports. The full press release

can be found at: www5.cao.go.jp/keizai3/getsureie/

2013nov.html

In summary the latest report says:

Industrial production is increasing at a moderate

pace

Corporate profits continue to improve mainly

among large firms

Business investment is picking up, mainly among

non-manufacturing industries

The judgment of firms on current business

conditions is further improving

The employment situation is improving

Private consumption is on an upward trend

Recent price developments suggest that deflation

is ending

In the short term, says the report, the recovery is expected

to consolidate as household income and business

investment continue to improve. A last-minute rise in

consumption is expected as consumers buy items in

advance of the consumption tax increase however, weak

overseas demand is still a risk.

Consumption and investment

Real GDP in the July - September quarter of 2013

increased by 0.5% on a quarterly basis (equivalent to an

annual rate of 1.9%), this was the fourth consecutive

quarter of growth.

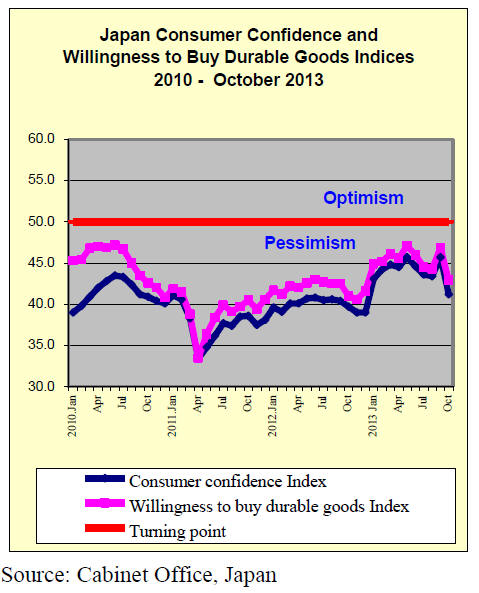

Private consumption is said to be picking up and although

consumer confidence has weakened recently, real

household incomes are said to have held firm. Recent

demand-side statistics, including the Family Income and

Expenditure Survey, point to an improvement in

sentiment.

Quarterly financial statements from large corporations

show that investment increased in the April-June quarter

by 2.9% from the previous quarter, the third consecutive

quarter of increase. However, investment by

manufacturers fell by 0.6% from the previous quarter but

for non-manufacturers investment grew by 4.7% from the

previous quarter.

According to the Business Outlook Survey by the Ministry

of Finance and the Cabinet Office, planned business

investment in fiscal year 2013 is expected to increase both

for large manufacturers and large non-manufacturers. The

figures for Orders Received for Machinery, a leading

indicator, have improved.

Consumer confidence undermined

Japan‟s economy is showing steady signs of growth and

the efforts to fight deflation seem to be having an impact

as the government data shows consumer prices (excluding

food and energy)rose in October however, household

spending remains subdued.

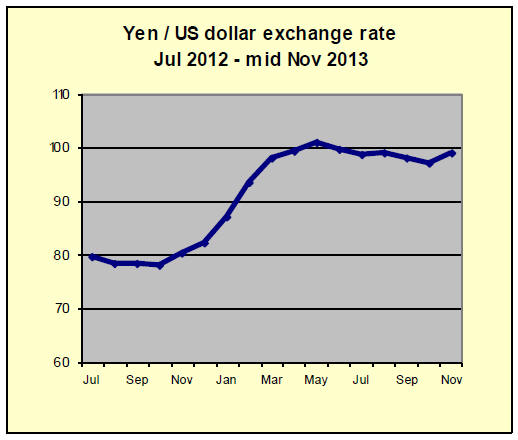

The government and BoJ have a 2% inflation target to be

achieved over the next two years. Analysts say most of the

current consumer price increases are the result of the

weaker yen which has driven up the cost of imported

items, notably fuel for power generation and petrol. The

higher cost of these items has spilled over into higher

household costs.

In Japan household spending accounts for over 60% of the

country‟s economic activity but spending has fallen for

two months in a row. The rising cost of living and stagnant

incomes is undermining consumer confidence.

Monetary policy begins to turn around deflationary

trend

Economic indicators released by Japan suggest that the

monetary policy and stimulus strategy of the government

and Bank of Japan (BoJ) are beginning to impact

deflation. for the world's No. 3 economy.

Japan has not had experienced inflation since October

2008 because there has been virtually no economic

growth. The Bank of Japan has set its self a target of two

per cent inflation. By mid 2014.

The government reported that, excluding food, the

consumer price index rose almost 1% from a year earlier

but much of this could be the result of the steep jump in

electricity prices introduced after the nuclear power plants

were shut down after the Fukushima nuclear disaster.

Household spending in Japan remains weak mainly

because consumers do not have confidence that they will

benefit from current economic policies and because

employment situation is tough. In the face of rising

inflation and stagnant incomes short term prospects are not

bright.

Yen drops to below 100 to the US dollar

The sharp decline in the yen exchange rate to below yen

100 to the US dollar resulted in a boost to the value of the

Japanese stock market which is dominated by export

companies.

Japan's exporters will be the biggest beneficiaries of the

yen's weakness, as consumers overseas with dollars will

find Japanese imports cheaper.

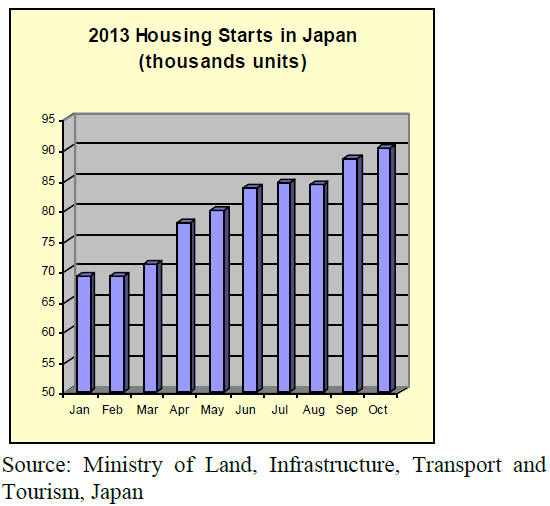

Good short term prospects in housing sector

Housing construction has been increasing in recent months

the result of a last-minute rise in demand before a

consumption tax increase. Construction of privately owned

houses, houses for rent and houses for sale have all

increased. Also, the total number of sales of

condominiums in the Tokyo metropolitan area has been

increasing.

The short-term prospects for housing construction is good,

supported by the improvement of the employment and

income situations and a last-minute rise in demand before

a consumption tax increase.

However, the availability of skilled construction workers

may become a constraint on further growth in housing

starts.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to extract and reproduce news on the Japanese

market.

The JLR requires that ITTO reproduces newsworthy text

exactly as it appears in their publication.

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

Soaring prices of domestic logs

Domestic log prices have been inflating rapidly by busy

orders sawmills and plywood mills as a result of booming

housing starts before consumption tax increase.

Log supply is way behind swelling demand so that log

prices are soaring everywhere in Japan. With higher log

prices, lumber market prices are also firming.

In Kyushu and Shikoku, prices of sill cutting cypress logs

exceed 28,000 yen per cbm. In Tochigi, post cutting cedar

log prices shot up to 15,800 yen, 1,500 yen up from

September prices and sill cutting cypress log prices

jumped up to 30,700 per cbm yen, 4,100 yen up from

September.

Compared to the bottom prices in last June, they are 5,300

yen or 50.5% higher and 10,300 yen or 50.5% up.

Compared to the recent low prices in May through July

last year, they are 81.6% up and 98.1% up.

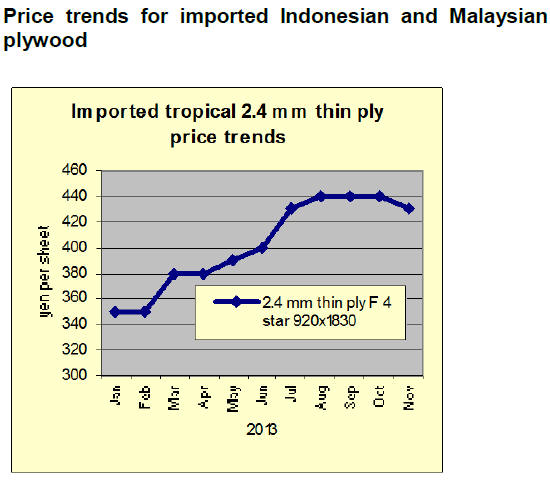

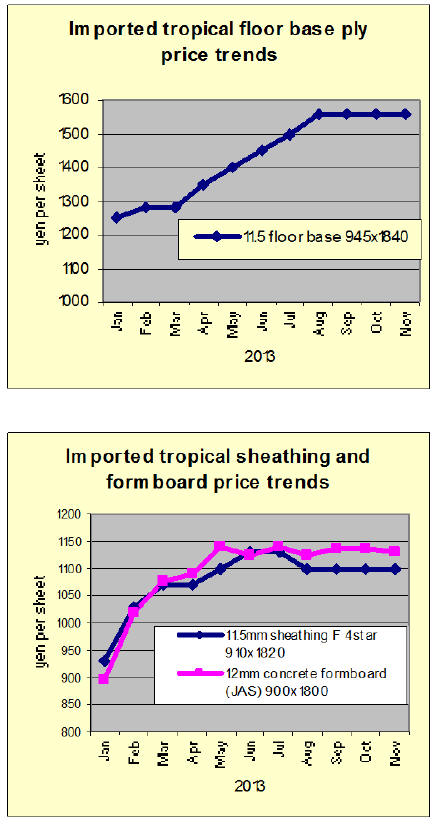

South Sea (tropical) plywood market bottoming out

Market of South Sea hardwood plywood is bottoming both

in supplying regions and in Japan.

In Tokyo market, where the demand should be better than

other areas after Tokyo is selected as the Olympic game in

2020 but weakness remains in November.

Dumping sales by the importers and wholesalers started in

mid August to dispose of excessive inventories and peaked

in late September in time for book closing then the

aftereffect lingered into October.

Market undertone remained unsteady even in November

when the importers sold under the cost of future cargoes to

DIY stores and wholesalers. Finally low priced offers

disappeared in mid November.

Shipping volume from the port yards was the bottom in

August then they have kept increasing and October

shipment was the same as the peak month of this year.

Arrivals of concrete forming panel have been declining

since June.

By heavy arrivals and weakening yen, many reduced

future purchases so finally supply and demand are

balancing.

General forecast is the supply of 3x6 concrete forming for

coating would get tight by late November and of green

3x6 concrete forming by late December.

Producing regions are partially in rainy season and India is

aggressively purchasing. After major suppliers built up

order files then the export prices bottomed out, other

suppliers get aggressive and their attitude is rigid now.

Japanese buyers are puzzling to see if they should buy

futures after lengthy market slump but considering

dropping inventories in Japan and rush-in demand before

the tax raise, it is necessary to buy futures now.

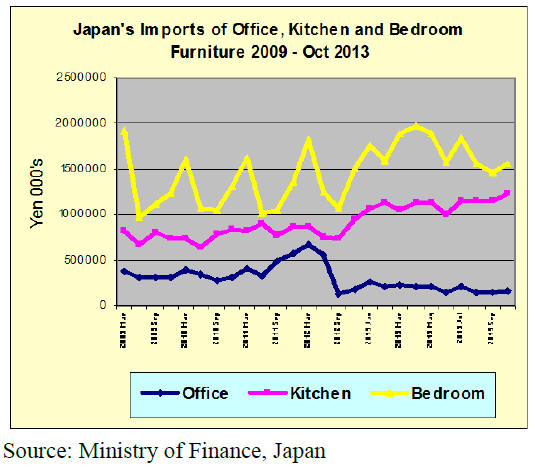

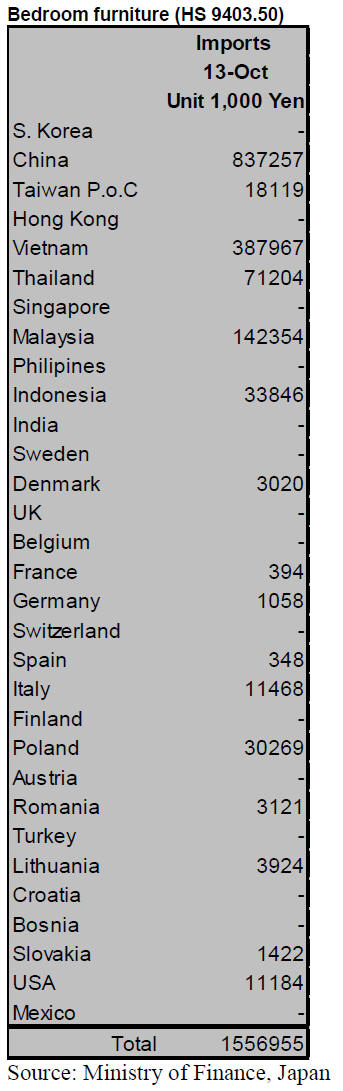

October 2013 furniture imports

The source and value of Japan‟s office, kitchen and

bedroom furniture imports for October 2013 are shown

below. Also illustrated is the trend in imports of office

furniture (HS 9403.30), kitchen furniture (HS 9403.40)

and bedroom furniture (HS 9403.50) between 2009 and

October 2013.

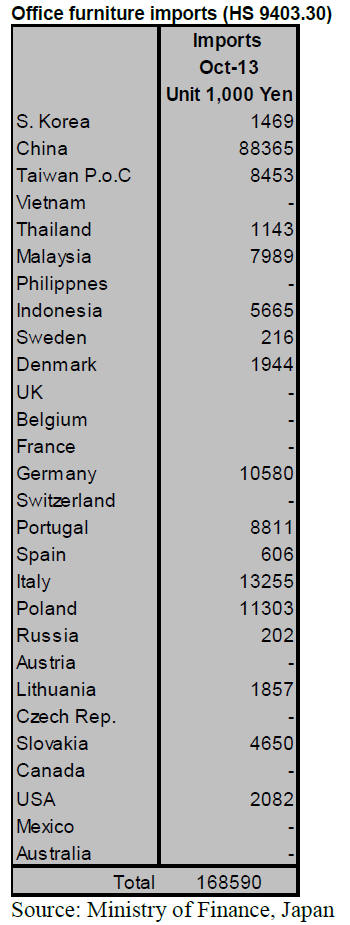

Office furniture imports (HS 9403.30)

In October 2013 Japan‟s imports of office furniture

increased by around 13% from levels in September The

top supplier was China which provided 52% of all office

furniture in October. Other main suppliers were Italy

(7.7%) and Germany (6.5%).

Office furniture exporters in Asia provided some 66% of

Japan‟s imports of this category of furniture in October

and China‟s share of imports in October rose to 22%.

October imports from Germany were also up on levels in

September rising 5 fold.

However, the value of imports from Germany was very

modest compared to the value of imports from China.

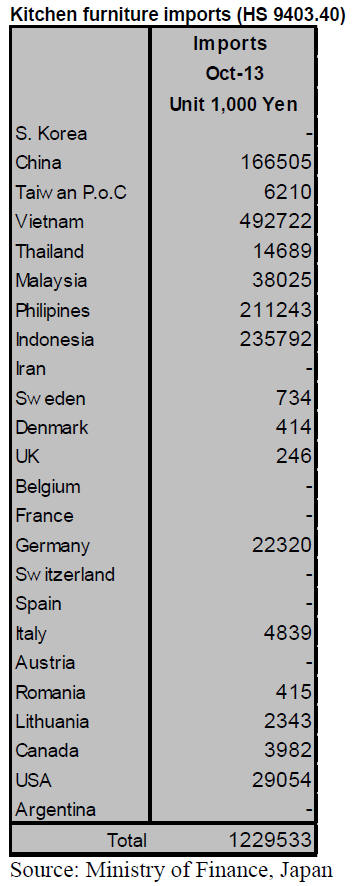

Kitchen furniture imports (HS 9403.40)

Asian suppliers continue to supply the bulk of the kitchen

furniture imports by Japan. According to figures from

Japan‟s Ministry of Finance. October kitchen furniture

imports, at yen 1,229 mil. were up slightly on levels in

September (yen 1,152). Overall, suppliers in Asia

provided 89% of Japan‟s kitchen furniture in October.

The top supplier in October was Vietnam, by a huge

margin. Vietnam has maintained its position as number

one supplier for the year to-data. In a reversal of ranking

Indonesia bcame the second ranked supplier pushing the

Philippines into number three position.

It is worth noting that Japan‟s imports of kitchen furniture

in October were more than the combined imports from

Indonesia and Philippines.

Of the non-Asian suppliers the US was the largest

contributor to imports of kitchen furniture in October but

could only secure a 2.4% share of imports of this category

of furniture. The EU supplier around 2.5% of Japan‟s

kitchen furniture imports in October with Germany being

the main source.

Bedroom furniture (HS 9403.50)

Japan‟s October imports of bedroom furniture rose to yen

1,557 mil. in October, up on the yen 1,465 mil. in

September but not too much should be read into this

change as monthly imports of bedroom furniture swing

from peaks to dips as illustrated in the graph above.

China‟s October exports of bedroom furniture to Japan

accounted for 54% of Japan‟s total imports of bedroom

furniture in the month. Asian suppliers, once more,

provided the bulk of the bedroom furniture imports

accounting for 88% of all bedroom furniture.

Bedroom furniture imports are almost 30% higher than

imports of kitchen furniture and som nine times more than

office furniture imports

|