2. GHANA

First three quarter export data released

According to data from the Timber Industry Development

Division (TIDD) of the Ghana Forestry Commission

(GFC), the country earned Euro 91.35 mil. from the export

of 206,603 cu.m of wood products in the first three

quarters of 2013 as against Euro 68.93 mil. from the

export of 179,819 cu.m in 2012.

Exports in the first three quarters of 2013 increased 32.5%

in value and 4.9% in volume compared to the same period

last year.

The European Union is the country‟s major market for

wood products and, for in the period reviewed, accounted

for Euro 39.45 mil. or almost 49% of all exports.

The United States imports of kiln dried sawnwood

amounted to 17% of the total volume of sawnwood

exports and were worth euro 5.48 mil. The main species

exported as sawnwood were wawa, mahogany, cedrela,

koto and sapele.

Markets in neighbouring African countries accounted for

30.4% of the value of Ghana‟s wood product exports in

the first three quarters of 2013 as against 34.2% in the

same period last year. The ECOWAS market (mainly

Nigeria, Niger, Senegal, Burkina Faso, Togo, Benin and

Mali) were the main destinations (70%).

Exports of primary products (poles and billets), secondary

wood products (mainly sawnwood, boules, veneers and

plywood) and tertiary wood products (comprising

mouldings, flooring, dowels and profile boards) accounted

for Euro 2.02 mil. (2.21%), Euro 83.05mil. (90.92%) and

Euro 6.272 mil. (6.87%) respectively of the total export

revenue. Secondary wood products comprised the bulk of

the country‟s exports in the first three quarters of 2013.

Ghana*s 2014 Budget Statement Overview

The Minister of Finance, Mr Seth Terkper, presented

Ghana‟s Budget and economic policy for 2014 to

parliament in Accra. The theme was ※Rising to the

Challenge: Re-aligning the budget to meet key national

priorities§.

Among the key initiatives proposed were the

establishment of a Ghana Infrastructural Fund (GIF), a

10% salary cut for members of the Executive, debt

management strategies (including a third eurobond issue

and the setting up of a contingency fund).

GDP growth in 2013 is forecast to be 7.4% somewhat

lower than the projected 8% growth. The fiscal deficit is

projected at GH¢8 .9 bil., equivalent to 10.2 percent of

GDP.

The macroeconomic targets for 2014 were summarised in

the recent report to the executive as; non-oil real GDP

growth of 7.4 percent; overall real GDP (including oil)

growth of 8.0 percent; an end year inflation target of 9.5

percent within the band of ㊣2 percent; an overall budget

deficit equivalent to 8.5 percent of GDP and gross

international reserves of not less than 3 months of imports

of goods and services.

Timber industry is importing logs

Mr Peter Zormelo of the TIDD has expressed concern over

the likely impact of reduced raw material availability for

the timber industry, saying the area of forests in Ghana has

fallen from about 8.5 mil. ha to the current 1.8 million ha.

He went on to say that the timber industries in the country

may be forced to import logs to remain viable in supplying

even domestic demand for wood products.

Mr Zormelo expressed these views at the recently

concluded National Forest Forum organised by Civic

Response, a non-governmental organisation. Mr Zormelo

reported that some companies are already importing small

quantities of logs and that the TIDD is working with the

Customs Division to regularise such imports to enable the

industry import larger volumes.

﹛

3. MALAYSIA

Glulam, another step forward

The MTC has signed a memorandum of understanding

with the Public Works Department (PWD) and an

architect, Ahmad Asmadi Architecture, to promote the use

of glulam in government funded projects in Malaysia.

Glulam, or glue laminated timber, is considered a versatile

timber construction material which is stronger than steel,

can be made fire resistant, is easy to machine and

assemble and most importantly, ecologically sustainable.

Structural glued-laminated timber is manufactured by

bonding assemblies of high-strength, kiln-dried lumber,

with waterproof adhesives.

The laminating process in glulam allows timber to be used

for much longer spans, heavier loads and more complex

shapes in construction, giving engineers and architects the

freedom to design a variety of shapes, from straight beams

to graceful, curved arches 每 without compromising on

structural or strength requirements.

Under the MoU, the PWD would provide engineering

design, including detailing and specifications to enhance

the capability to design glulam structures and monitor the

project. MTC plans to engage a suitably qualified

structural engineer to check, evaluate and verify the

engineering details prepared for the design of a glulam

surau (Muslim prayer house).

Certification not the saviour of the forest says head of

Sabah Forestry

In the recent international conference „Heart of Borneo‟s

Natural Capital: Unleashing their potential for sustainable

growth in Sabah‟, Sam Mannan, Director of Sabah

Forestry, made some interesting and strong points in his

speech.

Sabah is planning to increase its totally protected areas

from some 20% of the total land area to 30%, or from 1.35

million hectares today to about 2.10 million hectares over

the next 10 years.

Sabah will increasingly depend on planted forests

including commercial tree plantations as well as agoforestry

crops for timber supply and forest revenue.

Mannan made a strong point when he said: ※the world

could not care less about certified timber§ and ※this is our

experience, it is price that matters§.

He said certified timber is no longer a saviour. In today‟s‟

market it is pure economics and financial decisions that

drive people to buy or not buy certified timber.

Industry anticipates stronger business with India

The general manager of Sarawak Timber Industry

Development Corp (STIDC), Sarudu Hoklai, was reported

by the Star newspaper as saying Sarawak timber industry

will earn RM 7.8 billion from exports this year

(approximately US$ 2.4) as compared to RM 7.454 billion

last year. In 2011, total exports were RM 7.075 billion.

Meanwhile, WTK Holdings Bhd, a major timber group

based in Sibu, Sarawak expects Indian importers to

gradually increase their orders for Sarawak‟s tropical logs

now that the rupee is more stable compared to three

months ago. Some 73% of the group‟s logs exports went

to India in the third quarter of 2013.

※On a year-on-year basis, average round logs prices

increased by 5.1% while sales volume decreased by

25.8%,§ said WTK to The Star, adding that besides India,

the group exported round logs to Taiwan, China, Vietnam

and Singapore.

Some 80% of WTK‟s plywood exports went to Japan,

19% to Taiwan and the remaining 1% to China. As for the

group‟s plywood division, WTK said average selling price

rose by 8.9% but sales volume fell by 27.7% due to its

decision to reduce production of some non-premium

plywood products in anticipation of stock disposal by

other companies.

Plantation C&I open for public discussion

The Malaysian Timber Certification Council (MTCC) is

currently facilitating the second public discussion on the

review of the Malaysian Criteria and Indicators for Forest

Management Certification (Forest Plantations), referred to

in short as the M C&I (Forest Plantations). The Review

will be held throughout the month of December.

The M C&I (Forest Plantations) is the standard for

assessing the management practices for plantation forests

under the Malaysian Timber Certification Scheme

(MTCS) which has been implemented by MTCC since

2009.

MTCC has received no application to certify plantation

forests under this standard nevertheless the ongoing

review is in line with international practices that

certification standards be reviewed at least once every five

years to ensure continuous improvements.

The main body to undertake the review the MC&I (Forest

Plantations) and develop a revised standard will be the

Standards Review Committee (SRC).

This Committee will serve as the multi-stakeholder

※Forum§ and its members will comprise representatives

nominated by stakeholder groups representing the interests

of social, environmental and economic groups. Relevant

government agencies, from the three regions of Malaysia,

Sabah, Sarawak and Peninsular Malaysia will also

participate.

It is anticipated that the entire full review of the M C&I

(Forest Plantations) will be over by end of 2014.

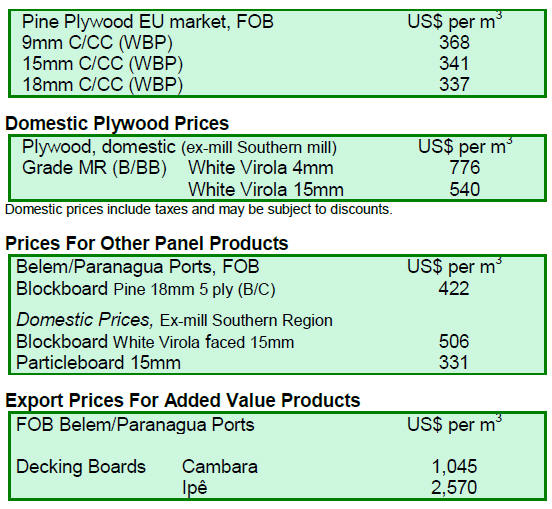

Plywood price indications

Plywood traders in Sarawak have reported export prices as

follows:

Floor base B (11.5mm) US$ 680 每 685 FOB;

Fromboard (3 x 6 feet UCP)

Japan (3 x 6 feet UCP) US$ 530 每 550 FOB;

Middle East (9-18mm) US$ 460 FOB;

South Korea (8.5 每 17.5mm) US$ 480 每 500 C&F;

Taiwan (8.5 每 17.5mm) US$ 450 FOB;

China/Hong Kong US$ 460 每 480 FOB.

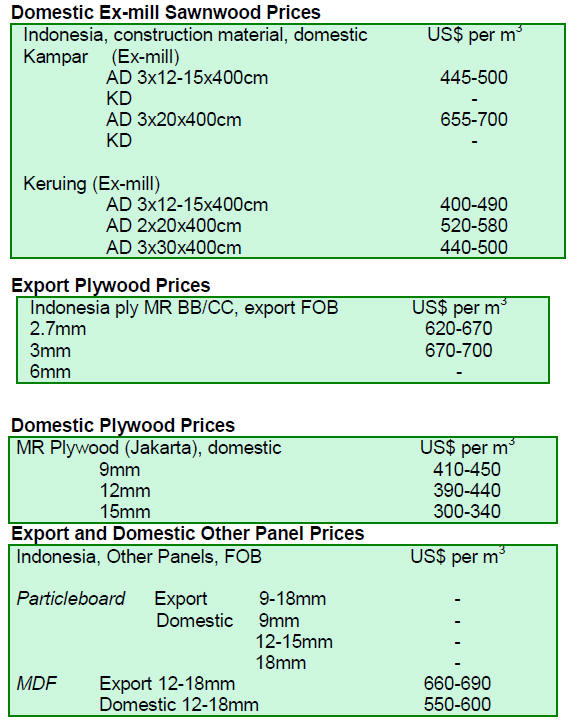

4. INDONESIA

Log exports from community forests

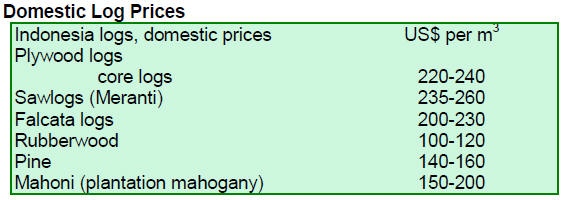

The Ministry of Forestry (MoF) has said exports of logs

from community forests will be permitted but that, for the

time being, exports of logs from industrial plantations

remain restricted. All exports of community forest

plantation logs must comply with Indonesia‟s timber

legality assurance system (SVLK).

The Secretary General of the MoF, Daryanto, said exports

of logs from community forests is unlikely to attract

international criticism as the move will benefit community

forest owners.

Daryanto also said the decision to allow plantation log

exports will encourage the expansion of community

owned plantations. At present most of the community

forests are in Java but hopefully the change in the law

allowing log exports will encourage the establishment of

plantations in other regions of the country.

The move to allow plantation log exports is expected to

result in a rise in plantation log prices.

Wood product exports may top US$5 billion

The Indonesia Ministry of Forestry (MoF) Director of

Processing and Marketing of Forest Products, Dwi

Sudharto, said that wood product exports in the first 10

months of this year are about 10% higher than in the same

period last year. The value of wood product exports from

January to October 2012 was US$4.2 bil. while in the first

ten months of 2013 the total was US$4.7 bil.

Some 64,682 V-legal certificates have been issued as of

November covering exports from 69 exit points in the

country.

The top five export destinations were China US$1.40 bil.,

Japan US$874.8 mil., South Korea US$378.2 mil., the

United States US$340.7 mil., and Australia US$194.0

mil.. Exports to Asian countries totalled more than 75% of

the total value of exports. Sawnwood exports to the

European Union at 346,000 tons ranked second after those

to Asian markets.

The main wood products exported were woodbased

panels, pulp, paper, wood crafts, and furniture. The

Executive Director of the Association of Indonesian Forest

Concessionaires. Purwadi Soeprihanto, said prospects for

Indonesian wood product exports are good now that the

timber legality assurance system in Indonesia has been

recognised by the European Union.

﹛

5. MYANMAR

Weak demand for non-teak hardwoods

Analysts report that the pace of teak log shipments

continues to increase driven by the impending log export

ban set to come into force in 2014.

Teak log prices have risen compared to levels observed in

October but, overall market sentiment is mixed. Demand

for non-teak hardwood logs remains weak. There has been

some interest in small purchases of Gurjan but, unlike the

demand for teak, it will need a miracle to drive up interest

in the non-teak hardwoods.

Investments from the EU

Myanmar President Thein Sein has urged European

companies to make responsible investments in Myanmar.

This was the theme of a meeting with representatives from

the EU in Naypyitaw in mid November. The President

said investment by EU companies would boost Myanmar‟s

economy and provide good returns for investors.

GSP and easing of financial restrictions a boost

private sector

According to the Irrawaddy Newspaper, the World Bank

has forecast that Myanmar‟s economy is set to grow 6.8 %

next year, placing it among Southeast Asia‟s fastest

growing economies. However, the Bank warns of the

impact of rising inflation on the poor.

The Bank review suggests economic expansion will be

driven by energy and commodities exports, foreign

investments, construction.

Foreign direct investment in Myanmar has so far risen to

US$2.7 bil. in fiscal 2012-13 up from US$1.9 bil. in 2011-

12. On the other hand the Asian development Bank (ADB)

is forecasting stronger growth supported by investor

optimism following policy reforms.

The reinstatement of Myanmar in the European Union‟s

Generalized System of Preferences for duty free and quota

free market access and the gradual easing of restrictions on

financial institutions are boosts to the private sector.

MTE announces log supply to domestic industry

The indications are that the Myanma Timber Enterprise

(MTE) will make available some 600,000 tons of

hardwood logs to the domestic industry in fiscal 2013-14.

In December this year the MTE plans to sell 430 tons of

teak logs to domestic millers.

This announcement was made by MOECAF Union

Minister Win Tun at the Amyotha Hluttaw (House of

Nationalities).

The MOECAF Minister, Win Tun, emphasized that the

decision to provide these raw materials to the domestic

mills was to stimulate job creation in the timber sector.

The Minister said that 186,650 tons of teak logs will be

extracted during this fiscal year which is 80,000 tons less

than last year. Similarly 787,600 tons of hardwood logs

will be extracted this year compared to the previous year‟s

1,355,227 tons.

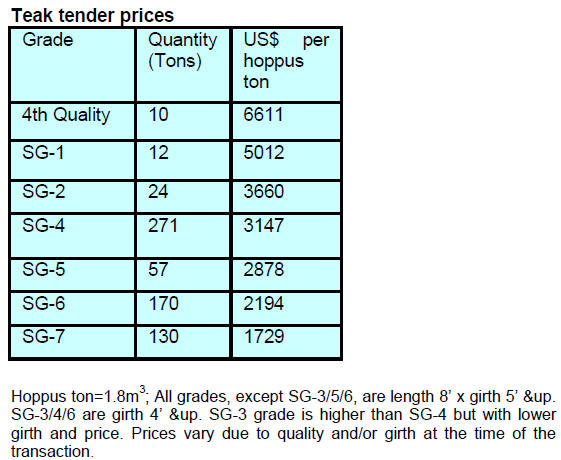

November teak log tender results

The following shows the grade, quantity and prices for

teak logs during the 22 and 25 November tender

conducted by the MTE.

MTMA seeks clarification on commodity tax after

log

export ban

Under current system of sales the price of logs purchased

by domestic millers from the MTE are inclusive of the

commodity tax.

The Myanmar Timber Merchants‟ Association (MTMA) is

seeking clarification on how the commodity tax will be

levied after the 1 April 2014 entery into force of the log

export ban.

MTMA is also seeking exemption from the commodity tax

on logs purchased from MTE and those imported from

neighbouring countries saying this will improve the

competitiveness of the domestic industry and help

stimulate investment in the sector.

﹛

6.

INDIA

Manufacturers see positive signs in US

and EU

markets

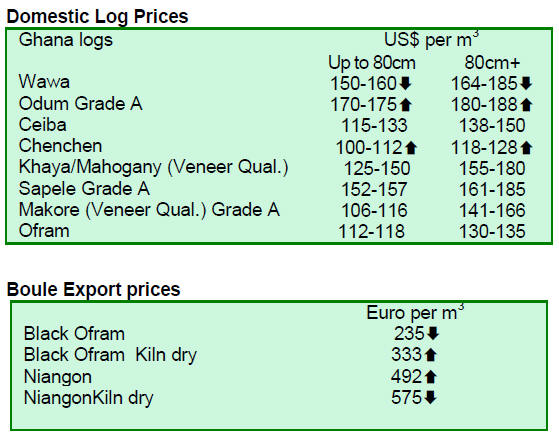

The Indian rupee exchange rate has been steady over the

past weeks, moving in a narrow range of 62-63 to the US

dollar. Exporters have benefited from the weaker rupee

and export values have grown at the fastest pace for two

years.

Export shipments rose by 13.5% to US$27.3 billion in

October while imports of gold and silver dropped

precipitously by 80% which has helped narrow the trade

deficit to around US$10.5 billion, nearly half the level

seen a year ago.

Factory output is said to be improving and figures for

October show a 2% gain in output over the figures for

September. Manufacturers see positive signs of improved

demand in the US and Europe markets.

Plywood industries struggle with competition from

reconstituted panels

The woodbased panel sector is still suffering from

shortages of raw materials which is pushing up prices for

logs, chemicals and fuel. Labour shortages are now

increasingly of concern.

To add to the woes of the plywood industry, re-constituted

boards such as MDF, HDF, WPC (wood plastic

combination) boards and particleboards are increasingly

replacing plywood.

Rising costs and competition with substitutes are eating up

profitability in the plywood sector. Competition in the

woodbased panel sector is shifting in favour of the

composite boards as prices are very competitive and the

quality of the panels now available is so much better than

in the past because of improved manufacturing

technologies.

The reconstituted panel manufacturers have moved

downstream and are now laminating panels within their

own plants thus cutting out intermediary companies which

previously handled the lamination. These boards from the

panel mills now go directly to manufacturers of furniture,

doors etc.

These changes are bringing very competitively priced

products to the consumer. Recently the Ministry of Public

Works and the Military Engineering Services have

permitted the use of reconstituted boards in public sector

works thus reducing the share of plywood in this market

segment.

Laminated boards have also affected consumption of solid

wood for doors. In India today flush doors are becoming

more popular in up-market homes.

Currently there are around 85 plants producing veneered

flush doors, laminated flush doors and moulded flush

doors with PVC membranes. Because Indian carpenters

find wages better in the Gulf States Indian producers of

solid doors are having to increase wages to keep

carpenters but this means there products become more

expensive and they find themselves priced out of the

market.

India has introduced an employment scheme under which

a worker when employed must be guaranteed at least 100

days employment. This has reduced labour mobility and

caused a scarcity of workers. The scheme applies to unskilled

and skilled workers.

This welfare measure introduced by the state is a problem

for plywood mills which are more labour intensive than

the sophisticated reconstituted board factories.

Because of labour shortages many plywood mills have had

to limit production to one shift.

Imports now dominated by hardwoods other than teak

With the conclusion of the Hindu New Year holidays the

timber markets have come back to life and stocks have

started to move once more. Currently, demand is stronger

in the smaller towns and moffusil areas rather than in the

metropolitan areas.

Analysis of species imports shows that non-teak tropical

hardwood imports continue to gain over teak and analysts

point to several reasons for this. The first reason is that

good quality plantation teak from Africa is getting scarcer;

secondly, Myanmar teak is getting more and more

expensive.

African teak can be landed in India at between Rs.1200 每

1500 per cubic foot and Myanmar teak is priced between

Rs.2000 每 2700 per cubic foot. In contrast Malaysian

species are available in the range of Rs.700~900 per cubic

foot.

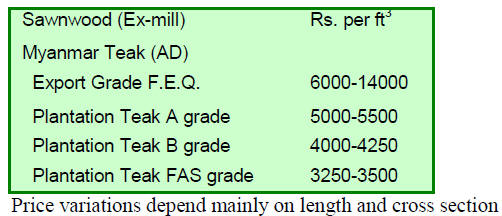

Current C & F prices for imported plantation teak,

Indian

ports per cubic metre are shown below.

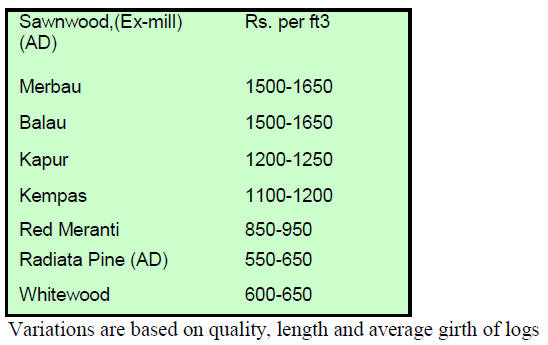

Domestic ex-sawmill prices for air dried

sawnwood cut

from imported logs

Demand is steadily improving as these are most

economically available good timbers for construction as

also industrial uses.

Prices for air dry sawnwood per cubic Foot,

ex-sawmill

are shown below.

Domestic prices for Myanmar teak processed in

India

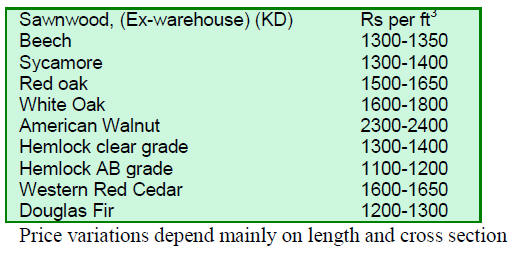

Prices for imported sawnwood

The recent slowing in the Indian economy and the weak

housing market is still capping prices for imported

sawnwood. Ex-warehouse prices for imported kiln dry

(12% mc.) sawnwood per cu.ft are shown below.

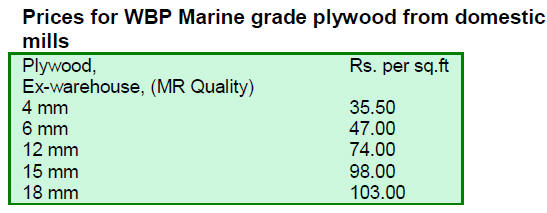

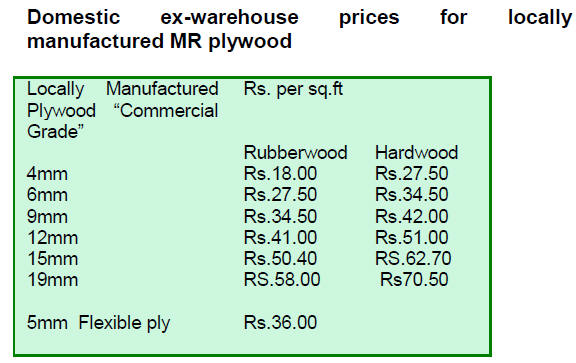

Plywood Market trends

Due to poor market conditions prevailing in the housing

and furniture sectors, prices have remained steady. Many

small scale plywood mills in South India are facing

licensing problems and will not be operating until this

situation is resolved.

7.

BRAZIL

Base rate increase

Brazil‟s Consumer Price Index (IPCA) rose from 0.35% in

September 2013 to 0.57% in October 2013 bringing the

accumulated IPCA for the year to October to 4.38%. This

is the same level as recorded for all of 2012.

Over the twelve months from November 2012 the index

stood at 5.84%, marginally below the 5.86% registered in

the previous twelve months.

At its end November meeting the Central Bank Monetary

Policy Committee (Copom) increased the base interest rate

to 10% a half percent an increase of 0.5% on the rate set at

the last meeting.

Even companies operating with approved management

plans face huge hurdles

Brazilian tropical sawnwood production is concentrated in

the states in the Amazon Region. Domestic producers,

generally source logs from areas with sustainable

management plans, from other concessions and from

public forests such as National Forests (FLONAS 每

Florestas Nacionais) and/or State Forests (FLOTAS -

Florestas Estaduais). Some companies purchases logs on

the open market.

The recently released 2013 Sectoral Study from the

Brazilian Association for Mechanically Processed Timber

Industry (ABIMCI) suggests that, the intense control of

logging operations by environmental agencies and the

overwhelming burden of bureaucratic red tape has become

a significant hurdle even to companies operating with

approved management plans.

The combined impact of these problems and other factors

such as seasonal weather changes, taxation issues and poor

infrastructure has been a sharp reduction in the supply of

logs from natural forests. This reduced supply has caused

prices to rise to a level where tropical log raw materials

are becoming uncompetitive.

It has been observed, says the ABIMCI report, that the

supply of logs from legal sources has dropped

considerably.

By way of example, the report says in the state of Par芍,

one of the leading states having tropical forests in Brazil,

only about 324,000 cu.m of tropical sawnwood was

harvested in 2011 and in 2012 the volume harvested fell to

305,000 cu.m in 2012 (-6%).

By way of contrast, mills in the state produced around

390,000 cu.m of sawnwood representative of a log input of

around 5-600,000 cu.m.

In 2012, production of tropical sawnwood in Brazil

totalled around 6.0 million cu.m, a 57% decline from

levels in 2000. In the period 2000 - 2012, between 88%

and 94% of domestic tropical sawnwood production in

Brazil was consumed by the domestic market.

African mahogany - a new plantation investment

option

It has been found that the soil and climatic conditions in

the state of Mato Grosso, one of the main tropical timber

producing states in the Amazon region, are suitable for

growing African mahogany. The plantation area in Mato

Grosso is expanding as private companies invest to secure

raw materials.

In October a technical guideline on the commercial

establishment of African mahogany was launched. This

technical guideline was drafted with support from the

State Government, through the Secretariat for Rural

Development and Family Agriculture (Sedraf) and the

Mato Grosso agency for Research, Rural Assistance and

Extension (Empaer). Support was also provided by the

Center for Timber Producers and Exporters Industries of

Mato Grosso (Cipem).

The Bank of Brazil is encouraging this development as it

wishes to finance plantation projects which it considers a

new option for investment by both the timber sector and

farmers.

According to Empaer, the establishment of African

mahogany plantations could become a significant

investment for farmers and the timber industry as a high

value timber will be produced. Through the introduction of

African mahogany the state of Mato Grosso aims to bring

unproductive deforested and degraded land back into

productive use.

October trade trends

In October 2013, the value of wood products exports

(except pulp and paper) increased 15% over levels in

October 2012, rising from US$198.1 million to US$ 228.4

million.

Pine sawnwood exports increased 21% in value in October

2013 compared to October 2012, from US$13.1 million to

US$15.8 million. In terms of volume, exports rose 12.6%,

from 60,500 cu.m to 68,100 cu.m over the same period.

In October this year tropical sawnwood exports fell 15%

in volume, from 32,200 cu.m (October 2012) to 27,400

cu.m.

The value of these exports fell by only 1.9% from

US$16.1 million to US$ 15.8 million over the same

period.

In contrast, pine plywood exports grew 37% in value in

October 2013 compared to October 2012, from US$27.5

million to US$37.7 million. The volume of exports

increased 46.4% from 74,500 cu.m to 109,100 cu.m.

during the same period.

While pine plywood exports have been performing well,

tropical plywood exports fell 25.4% in October from 5,900

cu.m in October 2012 to 4,400 cu.m in October 2013. In

value terms exports of tropical plywood fell 23%, from

US$3.5 million in October 2012 to US$2.7 million in

October 2013.

Exports of wooden furniture increased from US$ 41.9

million in October 2012 to US$ 44.3 million in October

2013, a 5.7% increase.

Falling production undermines regional growth

The sectoral study published by ABIMCI illustrates the

declining trend in Brazilian exports of tropical sawnwood

in the period 2000-2012.

In terms of volume between 2000 and 2012 there was a

66% decline, (av. 8.5% per year) in tropical sawnwood

exports. In the same period the value of exports dropped

37%.

Annual tropical sawnwood exports grew up until 2004,

and then gradually began to decline, a trend which

continues today. In the 2007 - 2008 period, there was a

sharp decline in tropical sawnwood exports as trade was

affected by the global economic crisis.

Analysis of export data for 2011 and 2012 reveals that the

downward trend continued and had a strong negative

impact on development in the production areas.

The slowdown in tropical sawnwood production had a

strong impact, not only on the sector itself, but also on

industrial production, job security, tax incomes socioeconomic

development. The report also suggests that the

decline in tropical sawnwood production and export has

affected the value placed on forest assets.

In 2008, the largest exporters of tropical sawnwood were

located in the state of Par芍 (with 49%) and in the State of

Mato Grosso (22%). In 2012, despite the reduction in the

value of exports in relation to 2008, the state of Par芍

remains the largest exporter of tropical sawnwood

accounting for 43% of the national total export. The state

of Rondônia accounted for 10% of 2012 tropical

sawnwood exports.

Furniture and wood sector discuss exports to Italy

Possibilities of timber and furniture export to Italy, were

discussed between the timber and furniture industry

associations in Acre State (Sindusmad and Sindm車veis)

and the Federation of Industries in the State (FIEAC). The

focus of the discussions were on what innovations and

process improvements would be required to produce

products suitable for the Italian market.

Representatives from the National Service for Industrial

Learning (SENAI) and the Brazilian Amazonia

Association (Associazone Amazzonia Brasile), which

currently provides the link between Acre state and Italian

companies, participated in the meeting.

The Brazilian Amazonia Association reported that Italian

furniture companies have shown an interest in importing

quality certified products from Acre. According to

Sindusmad, one of the biggest obstacles reported by

entrepreneurs is the high tax burden on the timber

industry. Another barrier is that in Acre state most

companies are small-sized and would find it difficult to

satisfy large export orders.

One of the first steps recommended to allow exporters

from Acre to be better known would be participation in the

1014 Milan Furniture Fair and the World furniture

Exhibition in 2015.

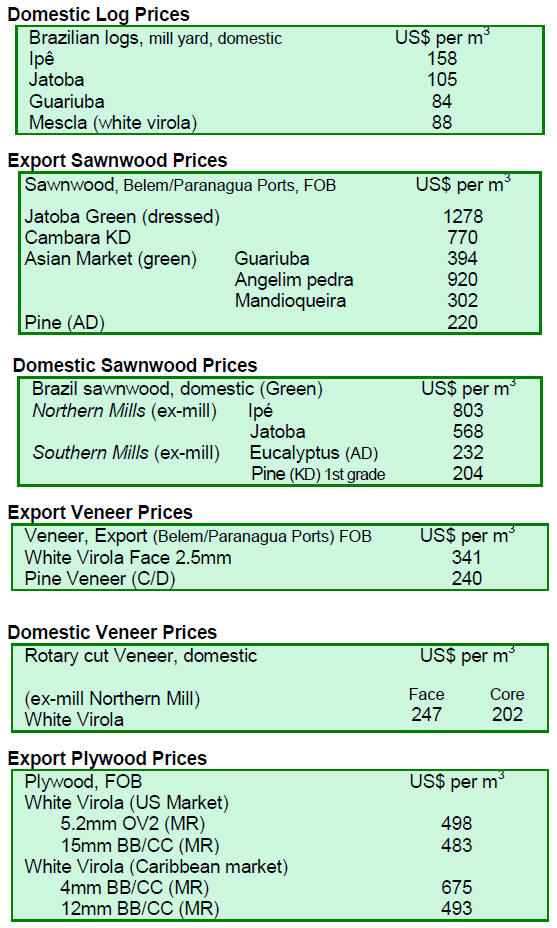

Price trends

The average price of timber products in BRL did not show

variation from the previous fortnight.

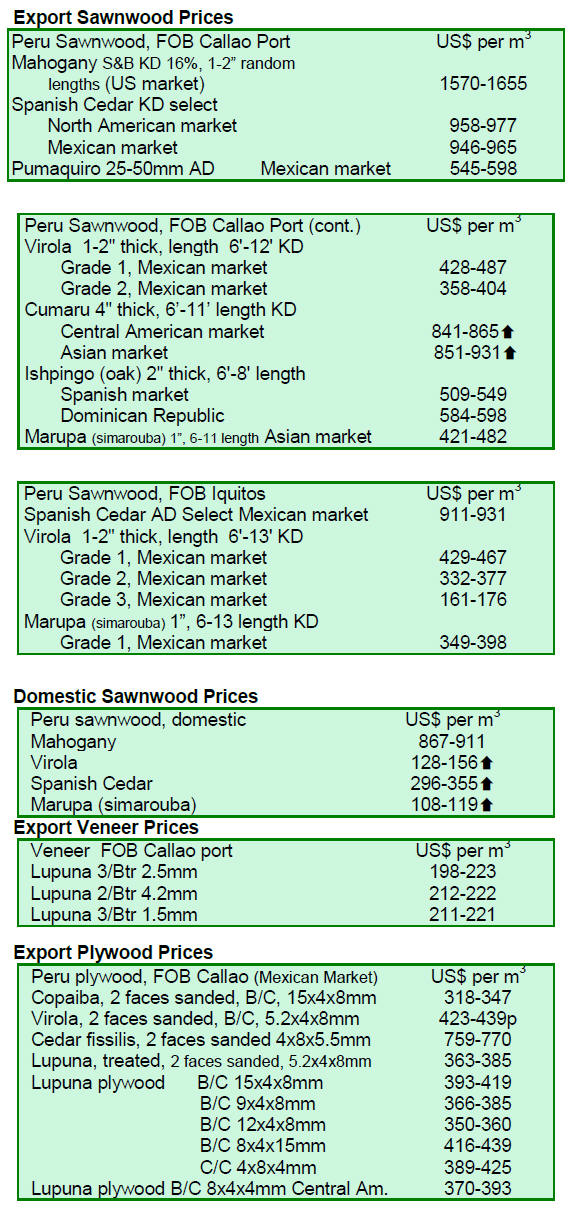

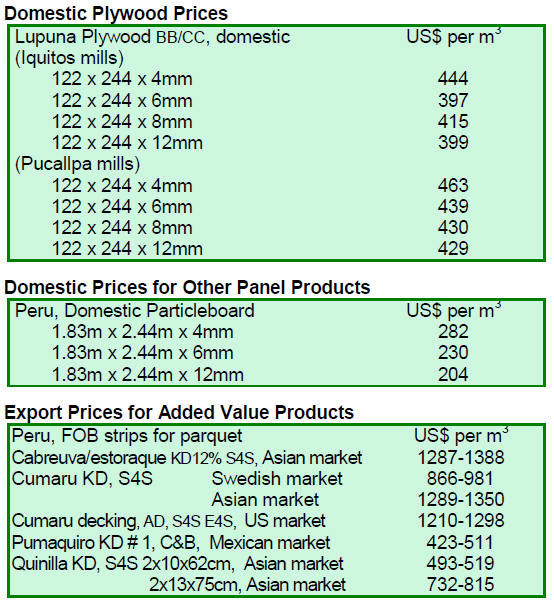

8. PERU

Deforestation in Cusco

According to a study conducted by the regional

government, deforestation in Cusco continues at an

alarming rate. The study suggests that over 70,000 ha. of

forest are being lost every year.

Edwin Mansilla, the Deputy Director in the Natural

Resources Department, attributed the losses to illegal

logging, illegal mining and the increased incidence of

forest fires.

The highest rate of deforestation was observed in

Quispicanchi, bordering Madre de Dios. Quispicanchi

Province is one of thirteen provinces in the Cusco Region

in the southern highlands of Peru.

Ninoska Rozas, a manager in the Natural Resources

Department, said that forest loss was putting many native

forest species at risk of extinction. Cusco still possesses

significant biodiversity and some 40% of the region is

considered as Amazonian. To date some 177 key

biodiversity areas have been identified mostly in the

province of La Convencion.

US$300 million to mitigate climate change

The environment ministry (Minam) reported that US$300

million of international cooperation projects would be

implemented in the country to mitigate the effects of

climate change. Deputy Minister, Strategic Development

of Natural Resources, Gabriel Quijandr赤a, has indicated

that projects would be undertaken that go beyond the

issues of adaptation and mitigation of climate change.

He said "The mitigation issues are important to reduce the

damage caused by climate change but that it is also

important to improve forest management in the country so

that Peru ceases to be a contributor to the climate change

through deforestation§.

9.

GUYANA

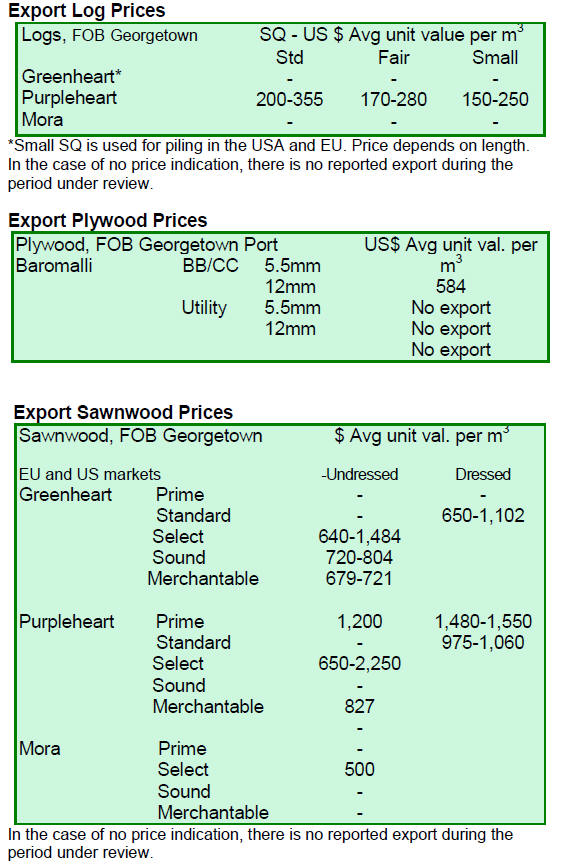

Purpleheart prices beat expectations

Active price movements for purpleheart logs were seen

during the period reviewed. Purpleheart logs and

sawnwood attracted significantly improved prices in

contracts concluded over recent weeks.

Purpleheart Standard sawmill quality logs earned top end

prices of US$355 per cubic metre FOB significantly up

on the price of US$235 seen last month.

Improved prices were also achieved for Fair sawmill

quality purpleheart logs where the best price was US$280

per cubic metre FOB.

For Small sawmill quality purpleheart logs FOB prices

were in the region of US$250 per cubic metre. The

principal export market for recent shipments of

purpleheart logs was India.

Demand for sawnwood firms lifting prices

Sawnwood FOB prices improved in the period under

review. Undressed sawn greenheart attracted good prices

for Select category and top end FOB prices moved from

US$954 to US$1,484 per cubic metre.

Sound category Undressed sawn greenheart price moved

from US$741 to US$804 per cubic metre FOB and the

improved momentum in prices spilled over to

Merchantable quality Undressed sawn greenheart where

FOB prices moved up from US$594 to US$721 per cubic

metre.

The leading markets for Undressed Greenheart timber

species include the Caribbean, Europe, Middle East and

North America.

Undressed Purpleheart sawnwood prices benefited from

the overall firm demand and FOB prices for Prime

category timbers increased from US$1,080 to US$1,200.

This price increase was mirrored by prices for Select

category purpleheart sawnwood where FOB prices firmed

from US$1,993 to US$2,250 per cubic metre. For

Merchantable quality the price increase went from

US$640 to US$827 per cubic metre FOB.

One endues for mora is railway sleepers and sales of sawn

mora for sleeper category earned favourable prices of as

much as US$749 per cubic metre in the Caribbean market.

Additionally Dressed Greenheart maintained firm prices

on the export market (US$ 1,102 per cubic metre) during

this period in comparison to the previous period. The main

market was the Caribbean.

Dressed purpleheart attracted high prices on the export

market, there was price activity in the prime category

earning as much as US$ 1,550 per cubic metre attracting

the market of New Zealand.

However, in the standard category top end prices fell

during this period from US$ 1,230 to US$ 1,060 per cubic

metre.

There was no export of Plywood during the period

reviewed.

Splitwood managed to secure noteworthy prices as much

as US$ 1,300 per cubic metre on the export market

attracting the destination of the Caribbean, Middle East

and North America. Roundwood (Piles and Posts)

exported during this period made it way on to the

Caribbean and North American market.

Greenheart Piles earned fair pricing as much as US$ 563

per cubic metre, while Wallaba Post made an input of US$

663 per cubic metre.

Value added products also made a valuable contribution

towards the total export earnings during this period. Many

of Guyana‟s commercialised species were used to craft

and produce these items into beautiful value added

products.

Update on Guyana*s EU FLEGT VPA process

Stakeholder involvement in the EU FLEGT VPA Process

is a critical component and as such efforts are continually

being made to reach all stakeholders. In this regard, work

on the communication and consultation strategy and the

scoping of impacts has begun and should be completed by

year end.

In addition, the stakeholders awareness sessions arel

ongoing with focus on creating awareness and providing

updates on the FLEGT VPA process to stakeholders

across the country.

Additionally, the scoping of impacts study has

commenced with the aim of identifying the potential

impacts of the VPA be and how these will vary for

different stakeholder groups.

Work is still ongoing on Guyana‟s legality assurance

system with emphasis on the legality definition. Feedback

on this draft document is currently being sought from

stakeholders and is available on Guyana Forestry

Commission‟s website.

﹛