|

Report

from

North America

More sawn hardwood from Brazil and Africa in July

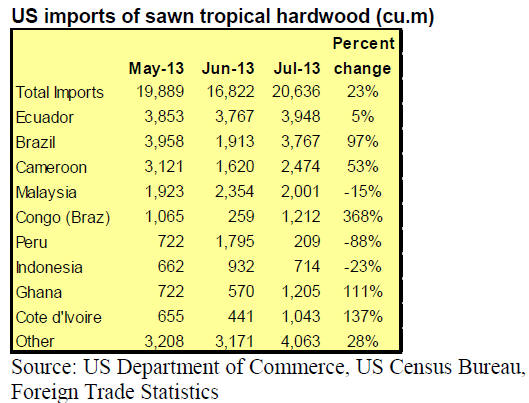

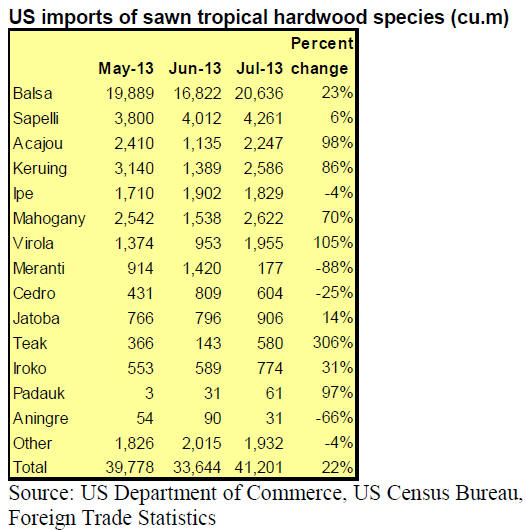

Total sawn hardwood imports grew to 56,340 cu.m. in

July. The growth in tropical sawnwood imports was

stronger than for temperate species.

Tropical sawnwood imports were 20,636 cu.m., up 23%

from June. The additional volumes came primarily from

Brazil and Africa (Congo, Cameroon and Ghana).

Ipe imports from Brazil doubled from the previous month

to 2,539 cu.m. in July. Total Brazilian shipments to the US

were 3,767 (+16% year-to-date).

Imports from Cameroon were 2,474 cu.m. in July (-7%

year-to-date), with much of the increase in sapeli imports

(1,181 cu.m.). Congo/Brazzaville shipments recovered

from the low volumes in June to 1,212 cu.m. (-24% yearto-

date).

Hardwood imports from Ghana more than doubled from

June to 1,205 cu.m. (-4% year-to-date). The growth was in

exports of acajou d‟Afrique, reaching 954 cu.m. in July.

US imports of sawn tropical hardwoods

Balsa imports from Ecuador increased slightly to 3,984

cu.m., but year-to-date imports remain 19% below 2012

volumes. Tropical hardwood imports from Peru fell again

in July to just 209 cu.m. (+39% year-to-date).

Malaysian shipments declined to 2,001 cu.m. in July (+5%

year-to-date). Imports from Indonesia were 714 cu.m. (-

23% year-to-date).

Antidumping and countervailing duties on Chinese

plywood

The US Department of Commerce announced its final

determination of antidumping duties and countervailing

duties on plywood from China on September 17. The

investigations looked at dumping of hardwood and other

decorative plywood at less than fair value and whether

China‟s government provided subsidies to plywood

producers.

More than 100 plywood companies were assigned an

antidumping rate between 55.76% and 62.55%. All other

companies received a rate of 121.65%.

In the countervailing duty investigation, three companies

will not need to pay duties. Fifteen companies were

assigned a countervailing rate of 27.16% for their failure

to respond to the Department of Commerce; all other

producers and exporters were assigned a rate of 13.58%.

The US International Trade Commission held a hearing

regarding injury of American plywood producers on

September 19. A decision on injury determination is

expected for late October. If the commission finds no

injury, the antidumping and countervailing duties will be

cancelled.

American Alliance for Hardwood Plywood condemns

high duties on Chinese plywood

The American Alliance for Hardwood Plywood,

representing US distributors, importers and manufacturers,

predicts job losses in the cabinet industry as a result of the

antidumping and countervailing duties on plywood from

China.

In the short-term, the high duties create higher cost and

supply uncertainty for US buyers and users of Chinese

plywood.

The Alliance also criticized that the Department of

Commerce used Bulgaria for market comparison with

China in its determination and not an Asian country.

AHEC presents American Hardwood Environmental

Profiles

The American Hardwood Export Council (AHEC) has

developed í░American Hardwood Environmental Profilesí▒

(AHEP) to promote the legality and environmental

sustainability of US hardwoods in export markets.

AHEP is based on Life Cycle Assessment data and legality

data. The data contained in AHEP allows manufacturers

who use hardwood sawnwood from the US to prepare

formal Environmental Product Declarations (EPD) for

their finished products. In the legality reporting portion,

AHEP follows the EU Timber Regulation.

AHEPs will be available for 19 hardwood species, which

represent 95% of total US hardwood production.

Individual US hardwood companies will be able to adjust

data for each specific consignment and customer location

quickly and at low cost with a software tool.

The following information is included in the AHEP: US

supplier, product description, quantity of wood,

commercial and scientific species name, place of harvest,

and documents demonstrating negligible risk of illegal

harvest, access to information on the sustainability of the

species, and quantitative data on the environmental

impacts.

The data follows the EN 15804 standard for environmental

assessment of construction materials in the EU (such as

Global Warming Potential, Acidification potential, and

Eutrophication potential).AHEC had previously

commissioned work to develop EPDs for hardwood

sawnwood. But as an intermediary product sawnwood

mostly does not require full EPDs.

The environmental impact data contained in AHEP allows

manufacturers of flooring, furniture etc. to prepare EPDs

for their finished products.

|