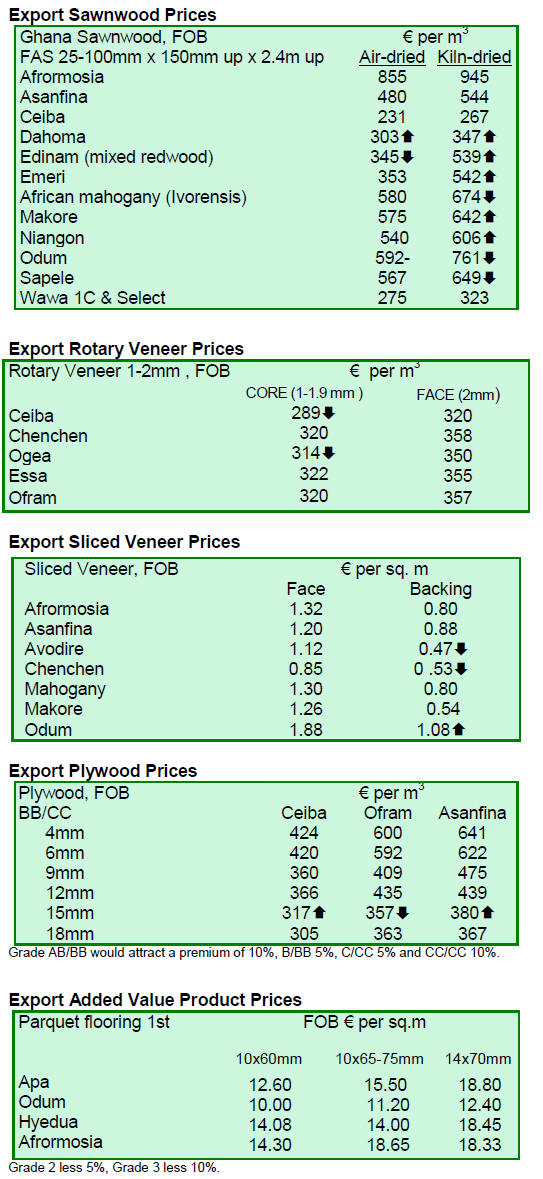

2. GHANA

Huge increase in water and electricity

prices

Manufacturing and trading costs will increase as utility

prices are set to increase by a huge margin. Charges for

water are set to rise 52% and charges for electricity will

jump a massive 79%.

These increased were announced by the Public Utility and

Regulatory Commission (PURC), in Accra, which has

been engaging stakeholders in discussions on tariff

changes over the past few months.

Nana Yaa Gyantuah, the Director of Public Affairs at the

PURC confirmed that tariffs "are definitely going up".

A previous tariff increment was put on hold because of a

nationwide power load shedding exercise that plagued the

country.

The increase in utility tariff is attributed to the high

dependence on crude oil to generate power compared to

gas. Unfortunately Ghana has not been able to access gas

resources from the stalled West African Gas Pipeline

project.

The last time utility rates were increased was in 2010 but

still many in Ghana have condemned the rate increase

saying it will be hard for the average Ghanaian family to

absorb such an increase.

Helping the younger generation appreciate role of

forests

A Senior Lecturer at the Kwame Nkrumah University of

Science and Technology (KNUST), Dr Ernest Asare

Abeney, has called on stakeholders in the forestry sector to

partner civil society organisations to promote sustainable

forest management practices in the country.

According to Dr. Abeney the destruction of Ghana‟s

forests could be attributed to the lack of adequate

education on forestry laws and policies because, he says,

most Ghanaians were not aware of the impact of forestry

on national wellbeing.

Speaking at a press briefing in Accra, Dr Abeney, said

¡°since the forestry sector contributes substantially to the

development of the country‟s economy there is the need

for Ghanaians to be informed and educated to desist from

negative practices that affect forests.¡±

He also underscored the need for the Ghana Education

Service to include forest protection in educational

programmes to inform the younger generation on forest

protection issues.

¡¡

3. MALAYSIA

Government and industry identify

challenges in the

timber sector

The plantation and commodity sector is a major income

earner for Malaysia, having brought in RM 127.5 billion in

2012, or around 18% of all total exports.

The National Timber Industry Policy which was launched

in 2009 envisioned yearly earnings of RM 53 billion

(about US$16.2 billion) by year 2020 from the timber subsector

alone.

Recently representatives of the Ministry of Plantation

Industries and Commodities, which is responsible for the

timber industry in Malaysia, met with industry

associations and representatives to discuss issues they

faced.

The issues that are common to the various sub-sectors of

the timber industry are the importance of foreign workers

in the processing plants, the impact of the new minimum

wage policy on competitiveness, the shortage of raw

materials and increasing operational costs.

Online MYTLAS license applications

The timber industries in Malaysia have been working hard

to meet the requirements of the recently introduced

Malaysian Timber Legality assurance Scheme

(MYTLAS). The Malaysian Timber Industry Board

(MTIB) is supporting the efforts of industry and has a

website to facilitate online applications for the MYTLAS

license.

The MTIB website is designed to accommodate

application for all categories of timber products. When the

MYTLAS conditions have been satisfied a license is

generated at the same time as the compulsory MTIB

export license.

Although furniture exporters do not need an export license

they can obtain the MYTLAS license on the MTIB

website. The issuance of a MYTLAS license is subject to

physical inspection of the furniture consignment by MTIB.

A copy of the MYTLAS brochure is available at this

MTIB site:

http://www.mtib.gov.my/index.php?option=com_content

&view=article&id=2142%3Abrochure-mytlas-yourassurance-

of-legal-timber-frommalaysia&

catid=1%3Ahighlights&lang=en

Port facilities in Sabah to be upgraded

The government agency operating ports in Sabah, Sabah

Ports Sdn Bhd, has announced plans to spend RM229

million (about US$70 million) over the next two years to

improve port infrastructure and equipment.

Sabah Ports plans to expand berthing facilities at

Sandakan Port and the Sapangar Bay oil Terminal. After

completion of the jetty extensions these two ports will

have additional berthing facilities thus eliminating the risk

of congestion.

Sabah Ports has also increased the fleet of container

handling equipment at Sepangar Bay Container Port,

Sandakan Port and Tawau Port. By the end of this year,

Lahud Datu Port will also have additional transfer and

yard equipment.

Moreover, Sabah Ports will acquire a new mobile harbour

crane for Sandakan Port in addition to the existing crane to

further improve the loading and discharging of containers.

Meanwhile, ongoing studies by Sabah Ports will look at

further improving port services in Sabah.

Sarawak minister calls for review of tax

deductions

The Sarawak, Industrial Development Minister, Awang

Tengah Ali Hasan, has appealed to the Federal

government to introduce a double tax deduction on freight

charges as the high freight charges for both inbound and

outbound goods have always been seen as a burden to

businesses in Sarawak.

The local newspaper, Borneo Post, reported the latest call

was aimed at three categories of trade saying the double

deductions should cover sales of products by all industries

to Peninsular Malaysia and Sabah; purchases of raw

materials from Peninsular Malaysia for manufacturing of

products specifically for export and the transportation

costs within the state of Sarawak.

The minister said double tax deductions would help local

business compete on a level playing field with their

counterparts in Peninsular Malaysia and ultimately make

Sarawak products more competitive in world markets.

Malaysian industry to visit Vietnam wood Expo

The Malaysian Timber Council (MTC) is organising a

Technology Study Mission to Vietnam on 23 ¨C 27

September 2013.

The Mission aims to provide Malaysian wood product

manufacturers with exposure to the latest developments in

woodworking and wood processing technologies. The

Mission will also provide opportunities for trade and joint

ventures with Vietnamese companies.

The itinerary will include visits to the 10th Vietnam

International Woodworking Industry Fair (Vietnamwood),

which will be held at the Saigon Exhibition and

Convention Center. In addition to the fair the Malaysia

delegates will tour woodworking factories in the vicinity

of Ho Chi Minh City to observe the application of

advanced technology.

Learning from New Zealand¡¯s experience in plantation

management

The Sarawak Timber Association (STA) is organising a

trip to New Zealand for its members involved in tree

plantations. STA general manager Dr. Peter Kho said

New Zealand was chosen because it has the most

extensive experience in industrial forest plantation

establishment.

The New Zealand Forest Owners Association says

members manage around two thirds of the country‟s 1.79

million ha. planted forests.

Dr. Kho told the Star newspaper, ¡°We will be meeting

industry players and will participate in field trips to the

forest plantations to see how they manage the plantations¡±.

STA has collaborated with New Zealand experts for over

15 years, especially in training of tree fellers and forest

managers.

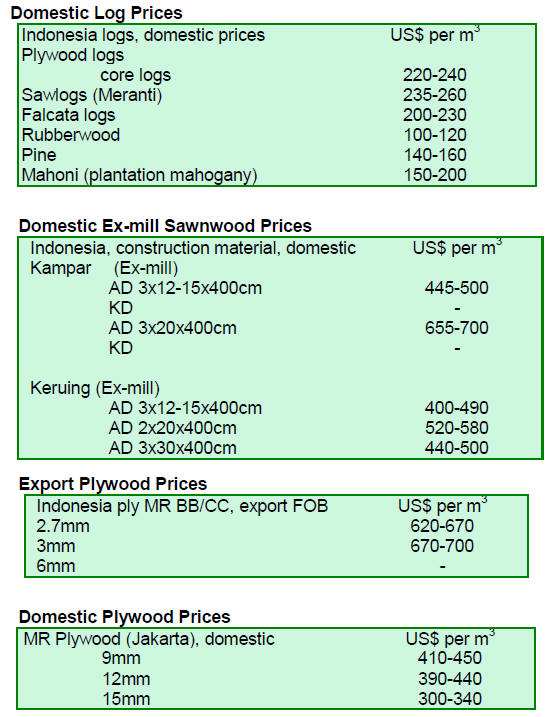

4. INDONESIA

Long struggle culminates with VPA signing

Indonesia has moved a step closer to becoming one of the

first suppliers of timber licensed as legal under the EU

Forest Law Enforcement Governance and Trade Action

Plan (FLEGT).

In a press release the European Timber Trade Federation

(ETTF) said the Indonesian signing of a VPA is a big step

toward FLEGT-licensed timber delivery. The press release

goes on to say: ¡°When available, this will satisfy the

requirements of the EU Timber Regulation (EUTR)

without additional due diligence risk assessment.

On Monday 30th September Indonesia‟s Forestry Minister

Zulkifli Hasan and EU Environment Commissioner Janez

Potočnik sign the country‟s FLEGT Voluntary Partnership

Agreement (VPA).

This marked the culmination of six years‟ work, from the

start of its VPA negotiations, to establish a watertight

forestry and timber legality assurance framework that

meets the parameters of the EU anti-illegal timber FLEGT

initiative.

Central to the process has been the establishment of

Indonesia‟s definition of illegal timber. It has also had to

set up a legality assurance system (LAS), and associated

licensing, auditing and monitoring mechanisms and

organisations, with the input of as wide a range of

stakeholders as possible.

Next Indonesia and the EU have to ratify the VPA, which

covers a specific list of named timber and wood products,

into their respective laws. Both must be then be finally

assured that the LAS is up to the task, before the listed

goods can enter the EU as FLEGT-licensed and,

subsequently, automatically legal under the EUTR.

No definitive deadlines have been set, but the hope is that

Indonesia will start issuing FLEGT licenses in 2014.

ETTF members also looked forward to the next stage ¨C the

delivery of Indonesian FLEGT-licensed timber. ¡°That is

of utmost importance to importers, given that it will

provide them with a supply of timber considered legal

under the EUTR without further due diligence,¡± said Mr

de Boer, Secretary General of the ETTF.¡±

Private sector ready for forest restoration in Riau

A major pulp and paper company in Indonesia is about to

begin work to restore a degraded peat forest in Sumatra.

Restorasi Ekosistem Riau (RER), a non-profit organization

started by Asia Pacific Resources International Limited

will conduct work to rehabilitate 20,000 hectares of land

in the southeastern part of Riau‟s Kampar Peninsula.

RER secured an ecosystem restoration license from the

Ministry of Forestry early this year.

For more on this story see:

http://www.thejakartaglobe.com/news/april-prepares-newforest-

restoration-project-in-riau/

Green-house gas emission technology transfer

improved

The Tropical Forest Foundation has reported that

Indonesia and Japan have agreed to ways to speed up the

processing of deals through which Japanese companies

can assist Indonesia reduce greenhouse emissions through

improved technology and conservation schemes.

A joint crediting mechanism (JCM) has been agreed where

by the two countries will cut out intermediaries in

greenhouse-friendly technology transfer, investment,

financing and capacity building.

Under the Kyoto Clean Development Mechanism

protocol‟s the United Nations must approve any such

investment but it has been found the UN process is too

slow requiring a lengthy screening process.

Under the new agreement, the Japanese government will

conduct feasibility studies to secure carbon emission

reductions in Indonesia through renewable energy,

forestry, energy conservation, agriculture, transportation,

carbon storage and waste treatment.

¡¡

5. MYANMAR

Teak sales quiet as Indian buyers remain

on the

sidelines

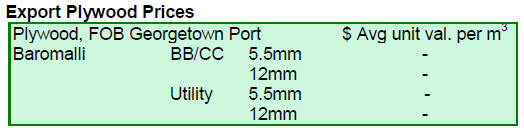

The overall impression in the market is that demand

remains as sluggish as last month with no clear direction.

The Indian market is still reeling from the effects of the

sharp depreciation of the rupee and this has un-nerved

Indian buyers who are taking a wait and see stance even

though the rupee has appreciated to 62 to a dollar in the

past week.

The uncertainty in the trade over the impending log export

ban coupled with the volatile rupee exchange rate is

having a big impact on sentiment in the trade and will

determine the level of shipments in the coming months.

Corporate governance principles MTE discussed

Timber Trade Journal of September 21 -27 mentioned an

email Q&A with Union Minister for Environmental

Conservation and Forestry (MOECAF) U Win Tun on the

subject of the Myanma Timber Enterprise (MTE)

corporatisation.

Minister Win Tun explained that, at this point in time, it

was envisaged that MTE will remain a 100% state-owned

corporation and that there are no immediate plans to

transform it into a public company.

Regarding „Corporate Governance‟, the minister

mentioned that the principles and guidelines as practised

in OECD and non-OECD countries were being examined

and that Myanmar needs more experience to adjust to

internationally recognised corporate governance standards.

The minister indicated that instead of directly adopting

principles and guidelines for corporate governance in

OECD countries the situation in Myanmar would be

assessed and appropriate principles would be adopted and

people would be trained accordingly.

He further spoke on the need for „ethical behaviour‟

amongst management but mentioned it would take time to

convert this concept into a „culture‟ in the MTE.

The indications are that MTE will be state-owned and the

management and the Board of Directors would be

personnel representing state interests, professionals and

those that have in mind the welfare of the country.

Even though a restructuring was in the offing, the minister

said, the present officers of the MTE would form the new

management but, as in a private company, they would be

required to execute the function of MTE in a competent

manner to create an atmosphere of efficient

commercialisation.

Foreign investment in Myanmar

Myanmar introduced a revised foreign investment law in

2012 and the Mizzima News, quoting local media,

reported that Myanmar attracted over US$731 million in

foreign investment during a single month bringing

investment to the end of August to US$43 billion since

1988.

For the year up to August, China has invested US$14.2

billion, Hong Kong SAR US$6.5 billion, South Korea

US$3 billion, Singapore US$2.4 billion dollars, Malaysia

US$1.6 billion and Japan US$274 million.

US$150 million to address chronic power shortages

In related news, the World Bank is lending Myanmar

almost US$150 million to help alleviate the country's

chronic power shortages.

In a press release the bank said ¡°the World Bank Group

and Myanmar reinforced their commitment to grow the

economy, create jobs and reduce poverty through

accelerated reforms and a focus on energy infrastructure

development¡±.

See: http://www.worldbank.org/en/news/pressrelease/

2013/02/05/World-Bank-Group-to-Support-

Myanmar-8217-s-Plan-to-Improve-People-8217-s-Accessto-

Electricity

A recent delegation to Myanmar agreed to support a

request for urgent upgrading of the electric power capacity

and improvement of the telecommunications and banking

sectors. The bank said a 106 megawatt plant will provide 5

percent of peak power demand for the entire country and

50 percent of peak demand in Mon state.

The press release says the Bank is providing Myanmar

with US$165 million in zero-interest loans for its priority

needs. This is in addition to a US$80 million grant for

community driven development that will enable villagers

to improve schools, clinics, roads and water supply.

The International Finance Corporation, member of the

World Bank Group focused on private sector development

in emerging markets, has invested US$2 million in

ACLEDA Bank Plc to help set up a new microfinance

institution in Myanmar to provide loans to more than

200,000 people ¨C mostly micro and small businesses run

by women ¨C by 2020.

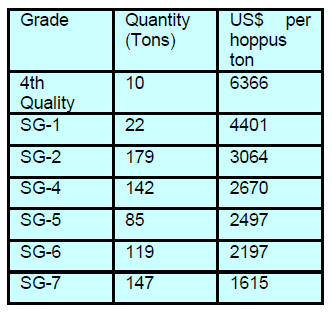

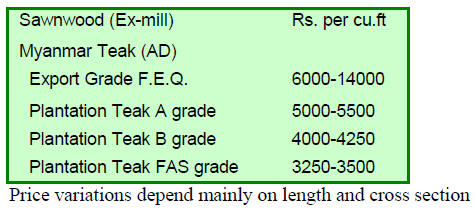

Teak tender prices

The following prices were recorded for teak log sales

during competitive bidding on 27th and 30th September

during the MTE tender.

¡¡

6.

INDIA

Indian economy and Rupee back from the

brink

In a remarkable short time the signs are that the recent

uncertainty in the Indian economy have dissipated. The

encouraging signs in overseas demand and in domestic

consumption have brought cheer to an otherwise cheerless

industry.

The abrupt depreciation of the rupee has been halted and

the currency has clawed back from a historic low of 68.85

to the US dollar on August 28 to 62.30 to a dollar on

September 23. Analysts expect the rupee to strengthen

further to around Rs.60 to the dollar.

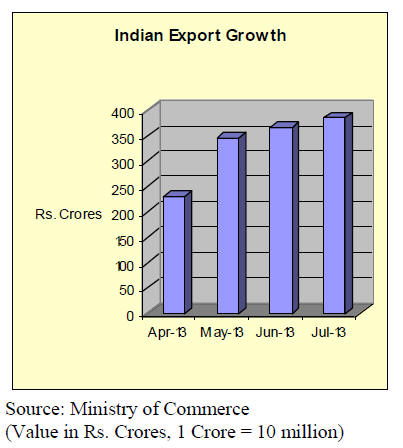

Double digit growth of exports and reduced imports has

narrowed the trade deficit. Exports surged 13% in August

2013 compared to levels in August last year and exports of

wood products registered an even higher year on year

growth of 18% from April to July.

The current account trade deficit narrowed to

US$10.9

billion in August from $14.2 billion a year ago. There are

plans to raise import duties on a range of non-essential

items which will bring the deficit down further.

In other news, industrial output in July improved

marginally by 2.6%, up from the 1.8% growth in June.

Few cities benefit from flow of overseas funds

property market

Despite the steadying of the economy the real estate sector

is still feeling the impact of the recent domestic crisis.

Indians living and working overseas have taken advantage

of the depreciated rupee to bring foreign exchange home

and buy property. The flow of remittances has been high

in recent weeks.

Analysts report that this new money has flowed to the real

estate sector in just for of 26 major cities and has had the

effect of pushing up prices. However, in the other 22

major urban areas home prices have declined and

expectations are that it will take at least another six

months for prices to correct.

According to the property research firm Liases Foras

around 670 million square feet of housing stock is lying

unsold. Demand has been hit by high inflation, increased

costs of basic raw materials such as cement, steel, sand etc

and also because of job cuts in several sectors which has

undermined consumer confidence.

New building projects are not likely to begin any time

soon especially as the festive season is just around the

corner. Developers are now resorting to offering discounts

and innovative payment structures to stimulate sales to

reduce the unsold inventory.

Plantation teak imports

With the economic situation improving the pace of

imports will eventually resume but traders remain cautious

fearing further shocks. Analysts report there are sufficient

teak in transit and at the ports to meet the immediate needs

of industry.

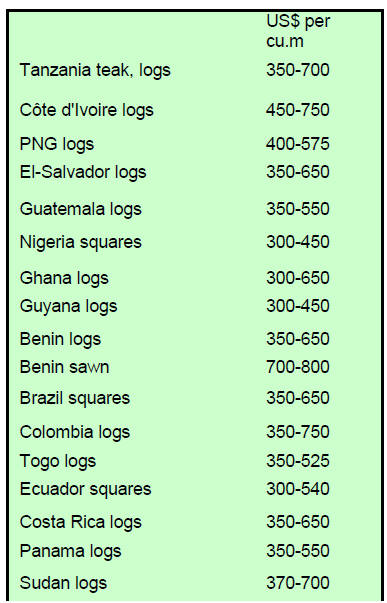

Current C & F prices for imported plantation teak, Indian

ports per cubic metre are shown below.

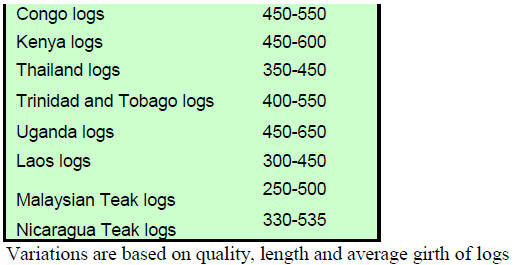

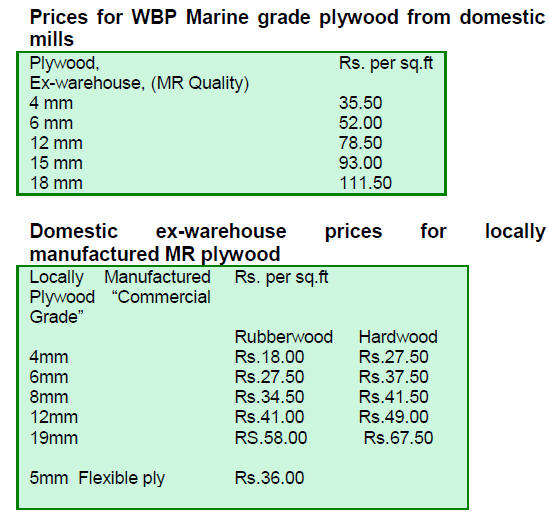

Domestic ex-sawmill prices for air dried

sawnwood cut

from imported logs

Prices per cubic foot are shown below.

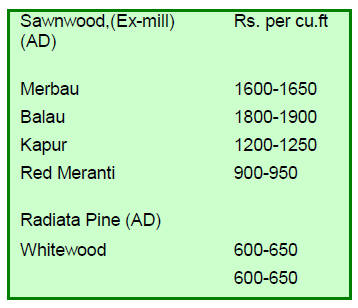

Domestic prices for Myanmar teak processed in India

The effects of higher log landed costs are now reflected in

prices being quoted for Myanmar logs sawn by Indian

mills. Current prices are shown below.

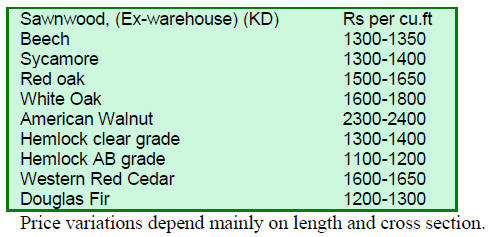

Prices for imported sawnwood

Ex-warehouse prices for imported kiln dry (12% mc.)

sawnwood per cu.ft are shown below.

7.

BRAZIL

Interest rates raised to address

inflation

Brazil.s Consumer Price Index (IPCA) at 0.41% was up

0.24% in August after increasing 0.03% in July.

With the August result, the IPCA has increased 3.43% for

the year to August. In the same period last year, the

cumulative inflation for the year was 3.18%.

The average exchange rate in August 2013 was BRL 2.34

to the dollar while in the same month of the previous year

was BRL 2.03 signaling a sharp depreciation of the

Brazilian real against the US dollar.

Largely because inflation needs to be tamed a decision

was taken to raise the interest rate (Selic) by 0.5% at the

Central Bank meeting held at the end of August. This

brings the interest rate to 9% per year. This was the fourth

consecutive interest rate increase so far this year. Since

April the rate has climbed from 7.25%, the lowest

historical level, to 9%.

Concession bidding opens in Altamira National Forest

The Brazilian Forest Service (SFB) has recently concluded

the bidding process for concession harvesting rights.

The latest areas offered include forest areas in the

Altamira National Forest (FLONA). Bids remain open for

around 740,000 hectares areas in the FLONAS of Amana,

Crepori, and Saraca Taquera in the state of Para.

So far there are more than 1 million hectares of FLONAs

in the Amazon are under forest concession management.

In addition to the production of timber whose origin can

be traced forest concessions create jobs, investment and

increase incomes for local administrations.

The Altamira FLONA has 360,000 hectares, divided into 4

forest management units that range from 39,000 and

113,000 hectares. In the bidding process companies are

required to submit two different proposals, one technical

and the price offer per cubic metre. Stumpage prices range

from BRL 21 and 42 per cubic metre.

Furniture sector expects increased sales towards year

end

Despite the slump in furniture sales in the second quarter

of 2013 the Brazilian furniture industry anticipates that

sales will begin to expand towards year end so that, overall

2013 sales could be up by 4%.

The furniture industry in Brazil faces many challenges

such as high transaction costs, high inflation, high labour

taxes and high logistics costs. An additional problem faced

by the industry is skilled labour. Even when sales dip

seasonally companies are reluctant to lay off their

employees because they are highly skilled and it is

difficult to find skilled and qualified manpower.

The furniture sector believes that there will be a seasonal

increase in orders starting this month because the retail

sector starts ordering furniture in anticipation of the end of

year increase in demand. Normally a one or two percent

rise in sales can be expected but the recent easing of credit

restrictions could lift sales.

August export data has no surprises

In August wood products exports (except pulp and paper)

fell 4.6% compared to values in August last year, that is

from US$ 213.2 million to US$ 203.4 million.

Pine sawnwood exports increased 8.9% in value in August

2013 compared to August 2012, from US$13.5 million to

US$14.7 million. In terms of volume, exports rose 5.5%,

from 61,300 cu.m to 64,700 cu.m.

In contrast tropical sawnwood exports fell 6.3% in

volume, from 28,500 cu.m in August 2012 to 26,700 cu.m

in August 2013 representing a decline of 2.0% in value

from US$14.7 million to US$ 14.4 million.

Pine plywood exports expanded 8.6% in value in August

2013 compared to August 2012, from US$30.4 million to

US$33.0 million. In terms of volume, exports increased

11.4% from 82,200 cu.m to 91,600 cu.m.

Tropical plywood exports were disappointing falling 7.0%

in volume, from 5,700 cu.m in August 2012 to 5,300 cu.m

in August 2013. In value, tropical plywood exports

fell16%, from US$3.7 million in August 2012 to US$3.1

million in August 2013.

At the same time wooden furniture exports dropped from

US$47.7 million in August 2012 to US$41.4 million in

August 2013, a 13.2% decline.

Rio Grande do Sul State maintains leadership in

furniture exports

In the first seven months of the year furniture exports grew

substantially, fueling optimism for the remainder of this

year and for next years‟ sales.

The state of Rio Grande do Sul still ranks first among the

states that export furniture with over US$111 million

traded for the year to July. This represents about a 28%

share of Brazilian furniture exports up to the end of July.

The major markets for Brazilian furniture are the United

Kingdom, (US$16.2), representing a 28.4% increase

compared to the previous year. Other major markets

included Uruguay (US$14.4 million), Peru (US$12.3

million), Chile (US$11.3 million) and the United States

(US$7.8 million).

In an increasingly competitive market, Brazilian furniture

manufacturers have demonstrated their entrepreneurial

talent to overcome domestic constraints such as high

labour taxes and high logistical costs. The weakening of

the real has contributed to the success of exporters.

Calls for increased automation to improve productivity

Sawnwood products prices are currently high in the

international market since the international economic

crisis in 2008.

The favorable moment in the international scenario has

motivated the timber sector, which is searching for

solutions to increase productivity.

As international demand for sawnwood is beginning to

grow the timber industry in Brazil has begun to look at

ways to improve productivity so as to be more

competitive.

In mid September the Federation of Industries of Parana

State in partnership with the Brazilian Association for

Mechanically Processed Timber brought millers together

to discuss measures to increase productivity.

The main conclusion from the meeting was that further

mechanisation is essential if productivity is to be raised. It

was agreed that the timber industries are too labour

intensive at a time when it is very difficult to find skilled

manpower.

Recently the level of mechanisation has increased but

automation is still something new which, the meeting

decided, must be addressed. Participants at the meeting

appreciated the quality of information exchanged during

the discussions considering this fundamental to address

production constraints.

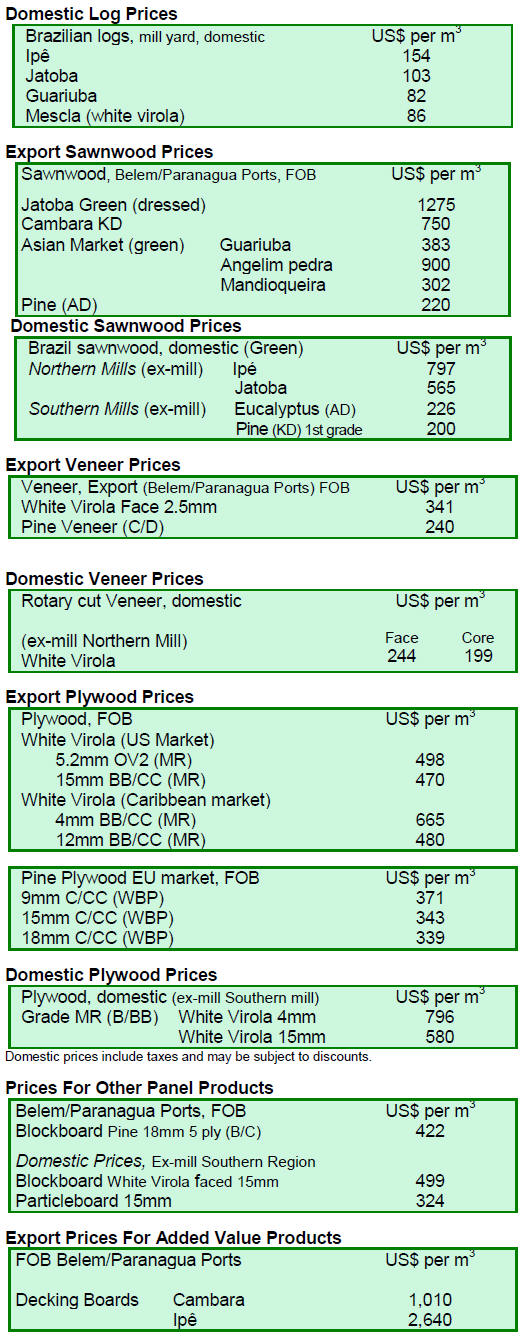

Price movements

The average price of timber products in BRL did not show

variation from the previous fortnight.

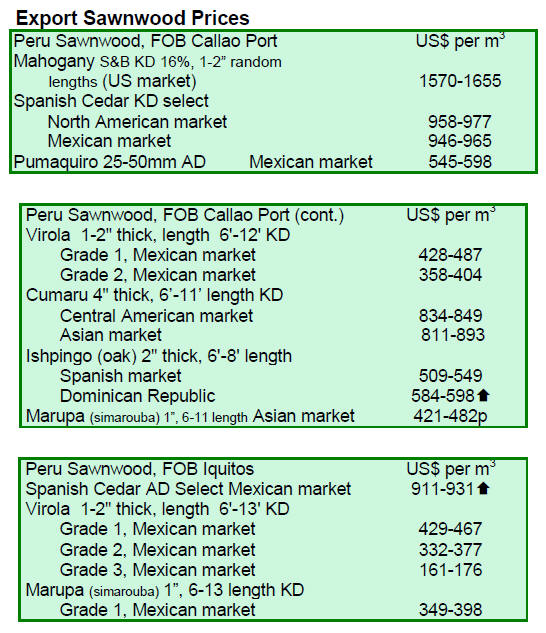

8. PERU

APEC Ministers discuss role of

forests in improving

quality of life

The second APEC Ministerial Forestry Forum was

recently held in Peru. The main theme of this meeting was

how forests can contribute more to an improved quality of

life.

The 21 APEC countries possess 53% of the world's

tropical forests and are responsible for 80% of

international forest products. The APEC meeting was held

just after the government passed into law forestry and

wildlife regulations to regulate the use of forest resources.

China ready to support reforestation in Peru

Media reports are saying China has expressed a

willingness to contribute resources and cooperate with

Peru in projects related to reforestation and sustainable

management of forests.

Zhang Yongli of China‟s State Forest Administration said

that this is possible because there is a memorandum of

understanding between the two countries which includes

bilateral cooperation in regard to the sustainable

management of forests, wildlife protection and

biodiversity conservation.

Only 12% of potential commercial forests currently

utilised

Erik Fischer, chairman of Wood and Timber Industry

ADEX, said that the country has 17 million hectares of

forest suitable for commercial forestry but of this less than

2 million hectares are in production.

He said further that of the 600 plus concessions that have

been offered or granted only 80 are operating effectively.

9.

GUYANA

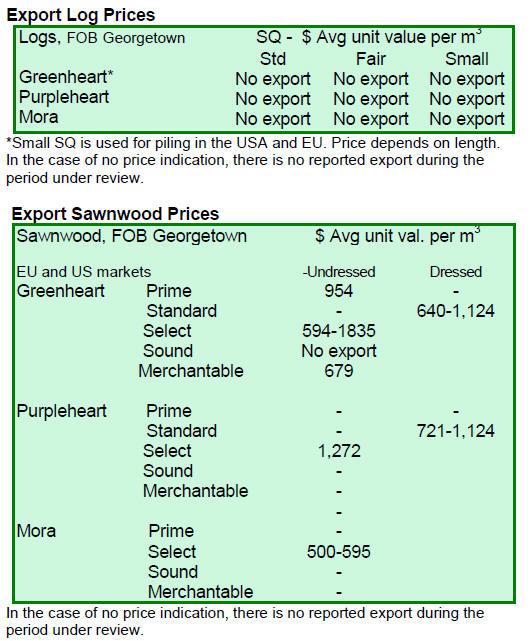

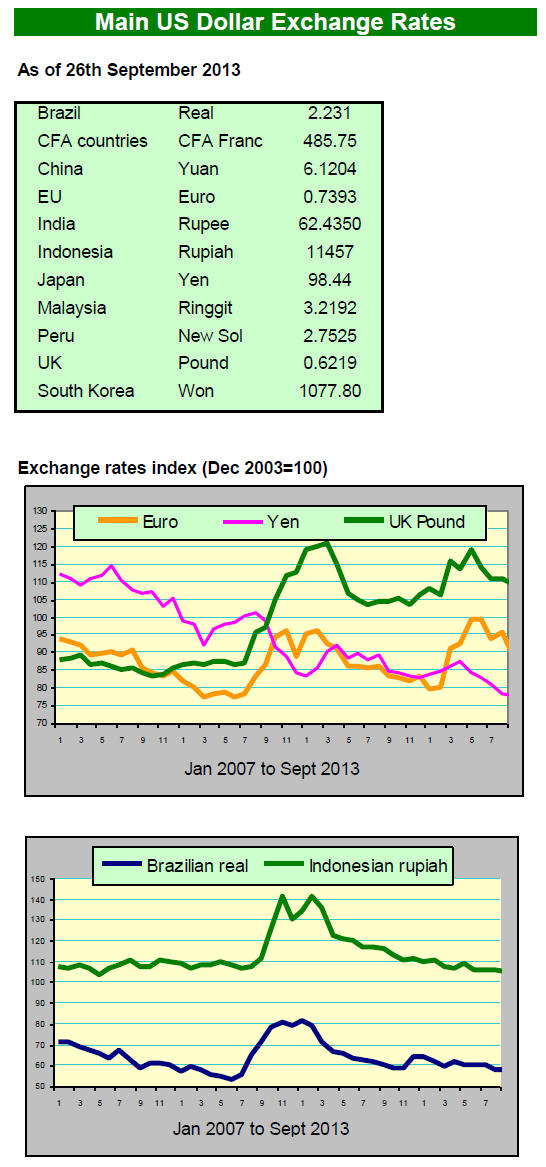

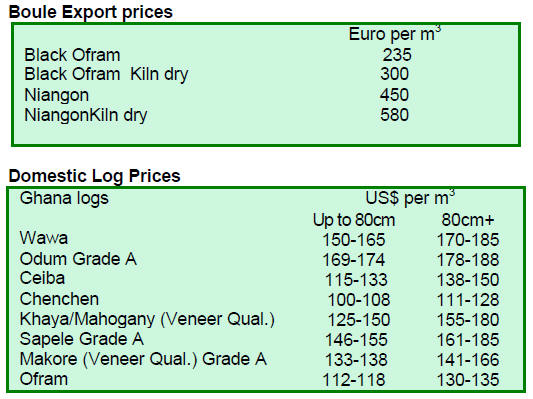

Sawnwood alone providing export earnings

There were no exports of the main commercial species in

the period under review. However the wamara (Swartzia

leiocalycina) logs made an impact on the export market

attracting favourable prices as much as US$160 per cubic

metre in Asian markets.

Sawnwood exports continued and both Undressed (rough

sawn) Dressed categories were traded. Undressed sawn

greenheart attracted an average price of US$954 per cubic

metre FOB for prime category.

On the other hand the select category Undressed sawn

greenheart secured a top end price of US$1,835 per cubic

metre FOB, while merchantable quality prices held firm at

US$679 per cubic metre FOB during the period reviewed.

The major markets for sawn greenheart were the

Caribbean, Europe and North America.

Undressed purpleheart (select) maintained firm FOB

prices of US$1,272 per cubic metre The main markets for

this species and quality were the Caribbean and Oceania

(New Zealand).

Undressed mora (select) also secured fair market prices of

US$595 per cubic metre FOB.

Exports of Dressed sawnwood were encouraging and

earnings made a positive contribution to total export

earnings.

Dressed greenheart top end FOB prices fell compared to

the previous period from US$ 1,450 to US$ 1,124 per

cubic metre. Similarly Dressed purpleheart also had a drop

in export prices from US$ 1,290 to US$ 1,124 per cubic

metre during this period. The major market remains firm

with the Caribbean being the leading market for this

product category.

During this period under review there was no export of

plywood. Exports of greenheart piles made a significant

contribution to export earnings and FOB prices were as

high as US$734 per cubic metre for select quality and

US$600 for sound category.

Update on VPA implementation

With the 2nd Negotiation session between Guyana and the

European Union having been completed on July, 18 in

Brussels, Belgium, expectations are still high with an

eventual completion in September 2015.

Five members of the NTWG were able to participate in a

meeting at Chatham House and presented their views on

issues such as the indigenous peoples perspectives on

FLEGT and how the private sector expects to benefit from

the VPA.

Funding for the various activities to move the VPA

forward are still being sought. FAO continues to support

the process and has made much of the initial works

completed possible.

The EU has published a Call for Proposals on FLEGT and

related activities. This is aimed at reaching mainly Civil

Society and Private sector groups. The Department for

International Development DFID has expressed an interest

in providing funding for various aspects of the VPA

process. In spite of these funding challenges, Guyana is

still moving ahead with the FLEGT process.

Tracking basis to Guyana¡¯s national legality assurance

system

A national Legality Assurance System (LAS) is one of the

prerequisites of a FLEGT Voluntary Partnership

Agreement. Central to the LAS are measures to monitor

and control the supply chain. To achieve this the Guyana

Forestry Commission has developed a Wood Tracking

System (WTS) details of which can be found at:

http://www.forestry.gov.gy/Downloads/Guyana_Wood_Tr

acking_System.pdf

The Guyana Forestry Commission document says ¡°WTS

links closely to the Guyana Legality Definition (GLD) and

is designed to meet specific requirements of that standard.

Accordingly, the explicit indicators of the GLD are

referenced in footnotes in this document.

The traceability of wood products from export to forest

will be maintained under the WTS. The monitoring of

wood flows requires the identification of critical control

points at different locations within the supply chain as well

as the monitoring of stages and processes that affect the

state of the asset as it moves through the chain.

The first control point will be the source of timber and the

allocation of logging rights followed by data gathering

through pre-harvest inventory. Essentially, the latter will

involve mapping standing trees and gathering specific

metrics data such as species, size and quality as well as

determining tree location.

Official GFC tags with unique numbers are affixed to both

the stump and the log. The process follows throughout the

forest and processing operations, monitoring timber as it

transforms and flows through the supply chain and

reconciling data gathered at each of the individual control

points.

The GFC gathers information at all the supply chain

control points, processes the data gathered and

automatically reconciles it with data gathered at previous

control points, identifying any errors or anomalies that are

found in the data.¡±