Japan Wood Products

Prices

Dollar Exchange Rates of

10th September 2013

Japan Yen 99.58

Reports From Japan

Bank of Japan supports consumption tax increase

In a recent statement the governor of the Bank of Japan

(BoJ) added his voice to those calling on the government

to go ahead with the increase in consumption tax

scheduled for next April. The basis for this

recommendation from the BoJ is their assessment that the

economy is strong enough and that consumers have

already accepted the concept of and need for the increase.

The BoJ policy board has determined that the Japanese

economy is recovering and the board declared it will

continue to aim for the 2 percent inflation over two years.

The BoJ statement can be found at:

http://www.boj.or.jp/en/announcements/release_2013/k13

0905a.pdf

Japan's economy is recovering helped by stabilisation of

overseas economies says the BoJ, mainly because exports

have been picking up and business fixed investment has

strengthened on the back of improved corporate profits.

Public investment in Japan continues to increase and the

sustained investment in housing is providing support to

growth.

Private consumption is a pillar of the current economic

strengthening as there has been some improvement in

employment opportunities, especially for the younger

generation, and incomes are improving.

Manufacturers have interpreted these developments as

reflecting improvements in domestic and international

demand so are raising industrial production.

Economic outlook favourable as deflation ends

The BoJ statement says: „on the price front, the year-onyear

rate of change in the consumer price index (CPI, all

items less fresh food) is in the range of 0.5-1.0 percent so

inflation expectations appear to be rising‟.

With regard to the outlook, Japan's economy is expected to

continue a moderate recovery and the year-on-year rate of

increase in the CPI is likely to rise gradually.

The BoJ confirmed it would continue with its quantitative

and qualitative monetary easing as long as it was

necessary to achieve its 2 percent inflation target.

Mismatch, Consumer confidence down while BoJ

reports economy strengthening

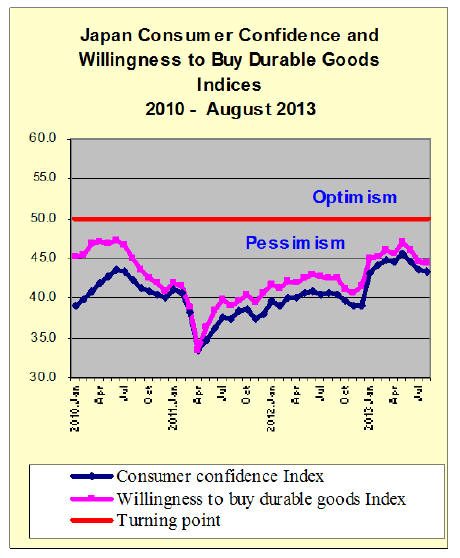

The Japanese Cabinet Office released August Consumer

Confidence data on 9 September. The Consumer

Confidence index fell to 43.0 marking three consecutive

months‟ of decline. A reading below 50 indicates

consumer pessimism. The index for Willingness to buy

durable goods also fell in August.

For the complete Cabinet Office survey data see:

http://www.esri.cao.go.jp/en/stat/shouhi/shouhi-e.html

Analysts suggest that Japanese consumers, while seeing

improvement in the financial markets, are yet to be

convinced there is growth in the real economy as reflected

in job creation and rising wages. The Cabinet Office has

acknowledged that the improvement seen in consumer

sentiment has stalled.

Japan struggles to make up time in TPP talks

Representatives of the Japanese government and private

sector have been actively participating in the negotiations

for the Trans-Pacific Partnership (TPP) initiative and have

been working hard to make up for their late participation

in the talks.

The countries negotiating the TPP (Australia, Brunei,

Canada, Chile, Japan, Malaysia, Mexico, New Zealand,

Peru, Singapore, the United States and Vietnam) have

agreed to declare their uncontroversial tariff eliminations

by mid September to keep within the four-stage timetable

for concluding the framework agreement by October.

Japan will hold bilateral talks on the elimination of tariffs

with six TPP countries through mid-September in an

attempt to make up for its late start in the negotiation

process, say government sources.

The first of several bilateral talks will begin on 18

September with Australia, Canada, Chile, Peru, the United

States and Vietnam. This will be followed by talks with

Brunei, Malaysia, Mexico, New Zealand and Singapore.

Yen weakens on revision of US GDP and improved

global economies

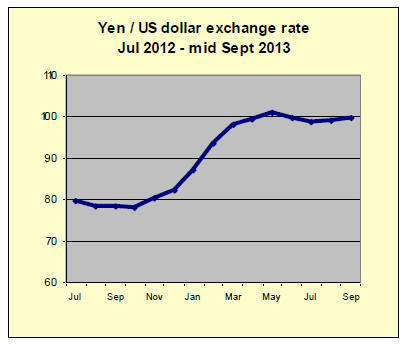

The yen weakened marginally against the dollar in late

August after the US announced revised GDP figures for

the second quarter indicating growth was almost double

the initial figure for the quarter.

The continued slide in the yen dollar exchange was also

fuelled by signs of economic improvement in the major

developed markets such that demand diminished for

refuge assets such as the yen.

Consumers see end to house price deflation

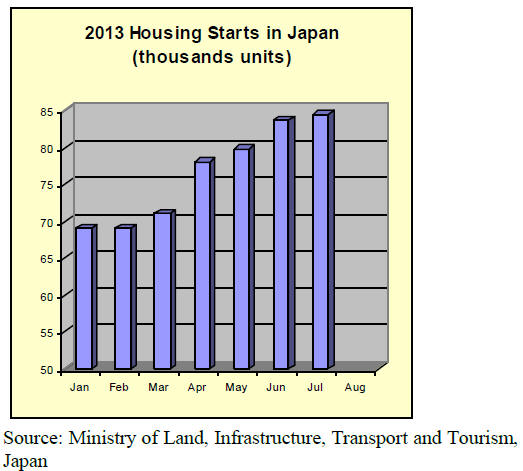

July housing starts in Japan increased 12.0 percent year on

year but were only marginally higher than in June. House

building companies have reported an almost 14 percent

rise in orders for new homes compared to levels in July

last year.

See data at www.mlit.go.jp/toukeijouhou/chojou/state.

htm

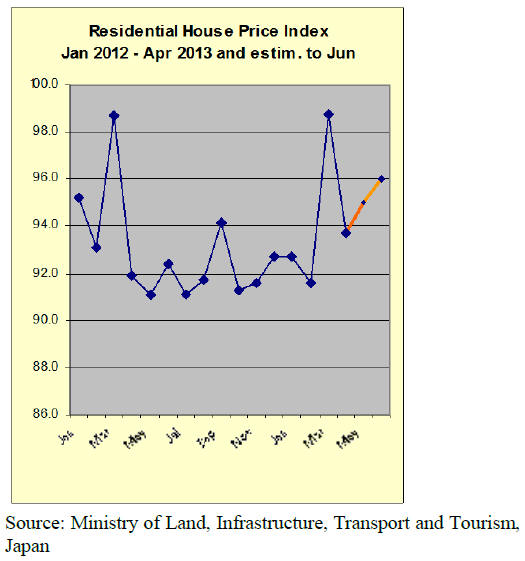

Analysts say that behind the steady growth in housing

starts is the ease at which low fixed rate interest mortgages

can be obtained and concern on the part of buyers that

house prices will not be falling any further after a decade

of almost uninterrupted declines.

Trade news from the Japan Lumber Reports (JLR)

Publication of the Japan Lumber Reports (JLR) for mid

September is delayed because of a public holiday. Updates

from the JLR will be provided in the next market report

from ITTO

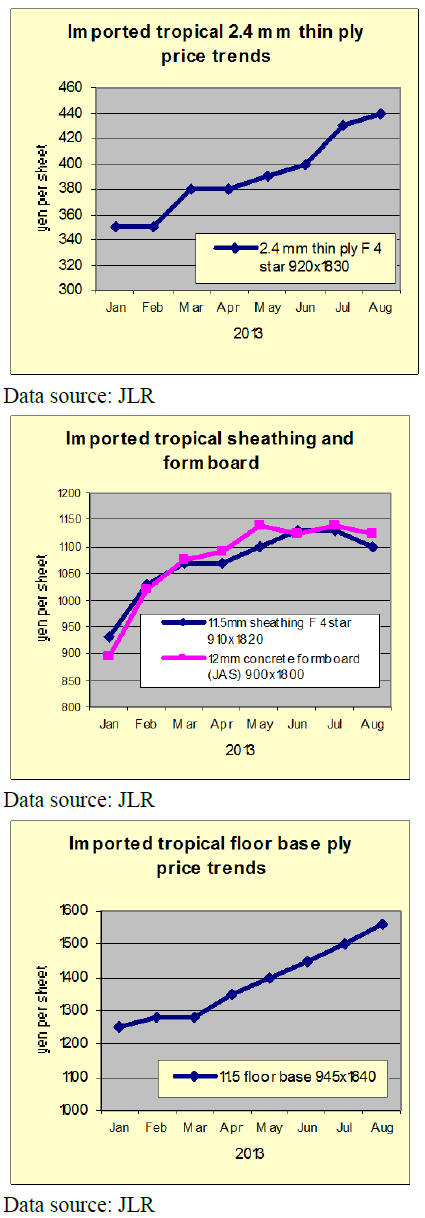

Steady climb in plywood prices arrested

The steady increase in plywood prices over the past

months eased in August as stock holdings by

manufacturers and traders had risen. However, prices

began climbing again in September.

The rise in stocks was partly because of the lull in building

activity during the holiday month of August and because

the pace of building work, particularly in the disaster hit

areas, had slowed because of a shortage of skill builders

and problems with supplies of non-wood building

products.

Japan’s furniture imports

July 2013 furniture imports

The source and value of Japan‟s office, kitchen and

bedroom furniture imports for July 2013 are shown below.

Also illustrated is the trend in imports of office furniture

(HS 9403.30), kitchen furniture (HS 9403.40) and

bedroom furniture (HS 9403.50) between 2009 and June

2013.

Office furniture imports (HS 9403.30)

In July 2013 Japan‟s imports of office furniture surged

over 50% from levels in June the top four suppliers in July

were China (31%), Poland (18%), Portugal (12%) and

Malaysia (9%). July imports totalled yen 213 million close

to the second highest monthly import for 2013 with around

52% being provided by exporters in Asia and 46% from

exporters in the EU.

China‟s July office furniture exports to Japan were

marginally up on levels in June while Japan‟s imports of

office furniture from Malaysia and Indonesia almost

doubled. Imports from Poland, Portugal, Italy and the

USA showed double digit growth.

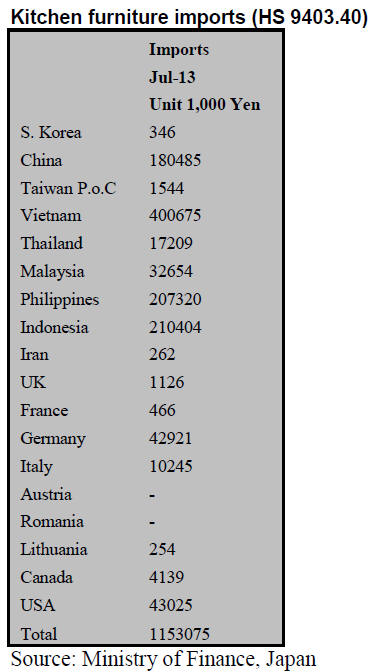

Kitchen furniture imports (HS 9403.40)

Asian suppliers provided over 90% of all kitchen furniture

imports by Japan in July according to figures from Japan‟s

Ministry of Finance. July imports at yen 1,153 million,

were around 15% higher than in June and the highest level

for 2013.

The top three suppliers in July were Vietnam, Philippines

and Indonesia, together accounting for over 70% of all

kitchen furniture imports. If imports from China are added

to the amount from the top three suppliers then some 86%

of all kitchen furniture imports are accounted for.

Imports from countries outside of Asia remain small and

imports from Germany, usually one of the larger EU

suppliers, fell by 40% while imports from Italy and the US

were up.

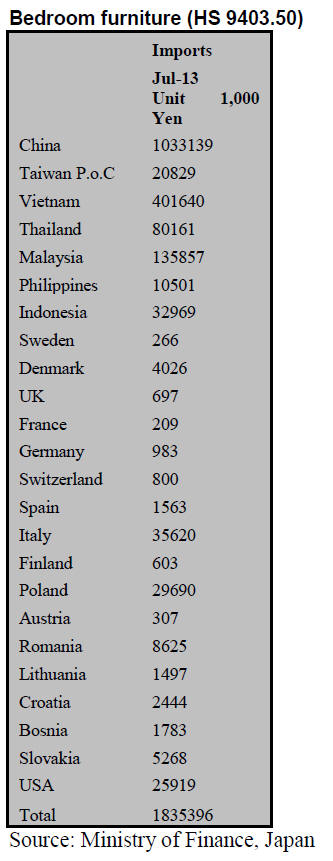

Bedroom furniture (HS 9403.50)

Japan‟s imports of bedroom furniture were close to yen 2

bil. every month up until June when they fell around 16%

to yen 1,582 million but in July imports improved by 16%

to yen 1.8 bil.

Malaysia‟s exports of bedroom furniture to Japan surged

45% in July closely followed by the 20% jump in imports

from Thailand. But, the number one supplier of bedroom

furniture remains China followed by Vietnam, Malaysia

and Thailand.

China‟s exports of bedroom furniture to Japan account for

56% of Japan‟s total imports of bedroom furniture. Asian

suppliers provided 93% of Japan‟s July imports of

bedroom furniture.

Source of information on import tariffs in Japan

The Japan Customs website has information on duties and

taxes.

See:http://www.customs.go.jp/english/summary/tariff.htm

Specific tariff rates are regularly amended and the latest

available on the Japan Customs website can be found at:

http://www.customs.go.jp/english/tariff/2013_4/data/i2013

04e_44.htm

and

http://www.customs.go.jp/english/tariff/2013_4/data/i2013

04e_94.htm

Goods imported into Japan are subject to Customs duty

and consumption tax. In addition to consumption tax,

certain other internal taxes (liquor tax, tobacco tax, etc.)

are also applicable to dutiable imported goods.

Tariff (Duty Rates) System for Commercial Goods

The harmonized classification schedule annexed in the

Customs Tariff Law sets out both the classification and the

corresponding Customs duty rate (called the General Rate)

of particular products.

The actually applied rate, however, is not necessarily this

General Rate. The Temporary Tariff Measures Law sets

out the Temporary Rate for certain products, which in

these cases prevails over the General Rate.

In addition, when the Customs duty rate in the WTO

Concession Schedule (so-called WTO Rate) or the rate set

forth by the Economic Partnership Agreement (so-called

EPA Rate) is lower than the General Rate (or the

Temporary Rate, if applicable), the WTO rate or EPA rate

is applied.

In short, the applied rate is the lower of the WTO rate, the

Singapore rate, and the General (or the Temporary) rate.

For designated developing countries, the Customs Tariff

Law and the Temporary Tariff Measures Law also provide

Preferential Rate (GSP) which is applicable to certain

products and naturally lower than any of the above rates.

Most of the Customs duties are assessed at ad valorem

rates, which are applied to the dutiable value of the

imported goods. Some items including certain alcoholic

beverages and cereals, however, are dutiable at a specific

rate, and others are dutiable at a compound rate such as a

combination of both ad valorem and specific rates.

For more see:

http://www.customs.go.jp/english/summary/tariff.htm

|