Japan Wood Products

Prices

Dollar Exchange Rates of

27th August 2013

Japan Yen 98.35

Reports From Japan

Decision on raising sales tax vital for government credibility

The Japanese government has convened a working group of economists, business

leaders and representatives of consumer bodies to prepare recommendations on

plans to raise the consumption tax to 8 percent in April 2014 from the

current 5 percent.

It has been proposed that a further increase taking the tax to 10 percent

will be introduced in 2015.

The prime minister has said he would make a decision in the autumn when

revised GDP figures for the first half of the year become available and

would take into account the views of the working group just established.

The latest economic data is providing support for the consumption tax rise

but analysts worry that this move would add to household costs at a time

when income growth is stagnant.

Consumer confidence declined in July for the second consecutive month

signalling that most consumers expect prices to increase. Recent data shows

that consumer prices (excluding fresh food) are indeed rising.

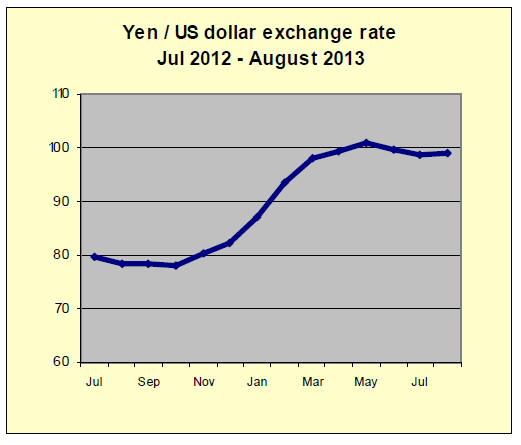

Revision of US GDP figures weakens yen

The yen weakened marginally against the dollar in late August after the

US announced revised GDP figures for the second quarter indicating growth

was almost double the initial figure for the quarter.

Cabinet Office sees improvement in Japanese economy

In its August assessment of the Japanese economy the Cabinet Office

concludes that the Japanese economy shows signs of recovery such as:

exports and industrial production are increasing at a moderate pace.

corporate profits are improving, mainly among manufacturers and business

investment is leveling off and shows some movements of

increasing.

Private firms are judging that current business conditions are improving.

the employment situation is improving.

private consumption continues to grow.

recent price surveys indicate that the deflation is ending.

Stronger recovery is expected if increased corporate profits lead to higher

household income and greater corporate investment.

According to the June Short-Term Economic Survey of Enterprises in Japan (Tankan)

by the Bank of Japan, planned business investment in fiscal 2013 is expected

to increase for the third consecutive year for manufacturers, but investment

by non-manufacturers is expected to decline for the first time in two years.

Overall the assessment is that investment is expected to increase for the

second consecutive year.

According to the Business Outlook Survey by the Ministry of Finance and the

Cabinet Office, planned business investment in fiscal year 2013 is expected

to increase both for large manufacturers and large non-manufacturers.

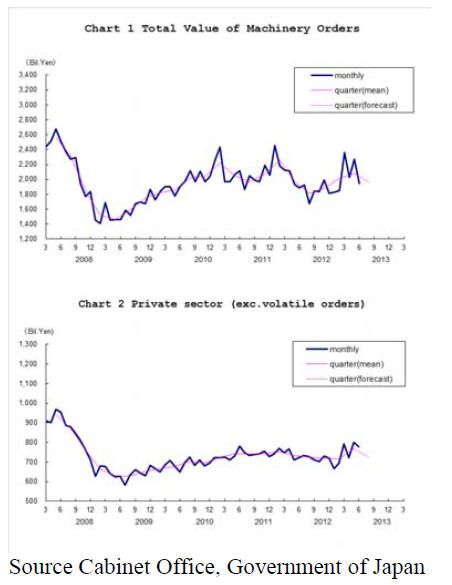

The figures for Orders Received for Machinery, a leading indicator, have

been improving recently.

See

http://www.esri.cao.go.jp/en/stat/juchu/1306juchu-e.html

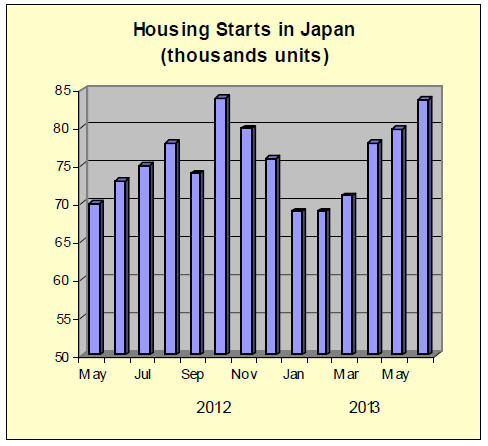

Housing market supports growth prospects

Housing construction is increasing especially privately owned homes and

houses for rent, overall, construction activity is picking up.

The Cabinet Office says the short-term prospects for house building is

firm with an upward trend supported by work on reconstruction and by an

improvement of the employment and income situations.

However, the construction sector is already reporting a shortage of skilled

workers and the Cabinet Office identifies this as a risk to sustained growth

in the housing sector.

Employment situation improving

The rate of unemployment fell 0.2 percent in June from the previous

month to 3.9%. In June the unemployment rate of those aged 15 to 24 was

6.4%, (down 0.7%)

however, the labor force and the number of employed persons increased.

The ratio of job offers to applicants has been rising because of an increase

in the number of new jobs being created and the data show that overtime

hours worked in the manufacturing industry are rising. These trends need to

translate into rising incomes if the fledgling growth in the economy is to

be supported.

To boost economy, get more women working

Japan's working-age population is projected to fall to about 60 million in

2030 from a peak of almost 80 million in 2000 but it has been estimated that

Japan could add millions to the workforce if the proportion of working women

was lifted to the same level as the average in the OECD countries.

The impact of the added work force would be a boost to the economy, to

household incomes and consumer spending.

The current government in Japan is the first to lay out concrete proposals

for expanding the female workforce as a means to address the declining

workforce without having to expand immigration as this has very little

support across the country.

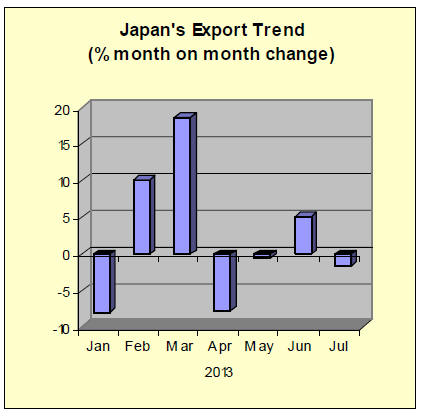

Exports to major trading partners improve

Japan’s Ministry of Finance released export data on the 19 August

showing July exports fell around 1.6 per cent from June, to yen 5.78

trillion, see:

http://www.mof.go.jp/english/

However, exports rose more that 7% when compared to the performance in July

last year. Exports to the EU improved for the first time in almost two years

growing over 8% as did exports to the US (+15% year on year) and China (+

almost 10% year on year) .

While the weaker yen has given a boost to exports it has led to a nearly

20% jump in the import bill. This increase was largely because of the impact

of oil prices but also, encouragingly, Japanese companies have been

importing manufacturing equipment.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade journal published every

two weeks in English, is generously allowing the ITTO Tropical Timber Market

Report to extract and reproduce news on the Japanese market.

South Sea (tropical) logs

Log supply season has arrived in the South East Asian countries but actual

log supply in Sarawak, Malaysia continues tight. The reason is depleting

resources.

Log production in the first six months in Sarawak this year was about 20%

less than the same period of last year but the log demand for export and

domestic plywood mills remain firm so that a balance of supply and demand is

way off.

More than 60% of export logs from Sarawak go to India, which reduced the

purchase for a month or so then it restarted buying since late July. To fill

up large size log ships, Indian buyers need to pay high log prices when the

suppliers’ log inventory is low, which influence export log prices for other

markets.

Export log prices at hand on Sarawak meranti regular are holding at $280-290

per cbm FOB. Meranti small are softening at $250. Sabah’s mixed serayah

regular prices are also holding flat at about $270.

Log prices in Japan are firming with high FOB and weak yen. Sarawak meranti

regular prices are 10,100-10,200 yen per koku CIF. Sabah kapur are 13,700

yen.

Facing continuous high log prices, only solution to cover the higher cost is

to keep increasing higher sales prices of plywood.

Plywood

Domestic softwood plywood market continues firm with brisk demand. Shipments

for house builders and precutting plants are active.

June production was 223,200 cbms, the highest in six years and three months

then the shipment was 220,400 cbms. This is nine consecutive months with

monthly shipment over 200 M cbms. The inventory remains low with 129,900

cbms. Thus, undertone is solid.

Only negative factor is delay of construction works because of shortage of

workers, which puts brake on delivery of processed materials.

Plywood mills had to give up price increase on 12 mm 3x6 panel for July

and August after gradual price hike in every month.

In Tokyo metropolitan market, prices of 12 mm 3x6 (special type/F 4star) are

up by 10 yen from July at 940-950 yen per sheet delivered.

Long 9 mm 3x10 prices are flat at 1,370 yen. Thick 24 mm 3x6 prices are

1,910-1,920 yen, 40 yen up from July. Market prices of imported plywood are

weakly holding with high port inventories.

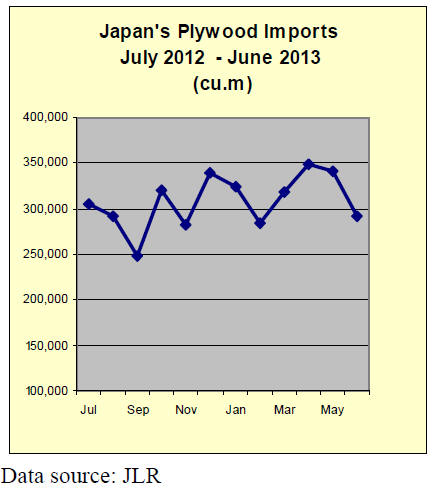

Shipment from warehouses is increasing since last May but heavy arrivals in

April and May over 340 M cbms still remain as negative factor. With this

issue, purchase for futures declined so that the arrivals seem to drop since

August.

Port inventories should decline to balance supply and demand

Market prices of JAS concrete forming 3x6 panels are 1,120-1,130 yen per

sheet delivered, 10-20 yen down from July. JAS 3x6 concrete forming for

coating is 1,220-1,230 yen, 10-20 yen down. 12 mm structural panel prices

are 1,120-1,130 yen, 10-20 yen down and weakening.

|