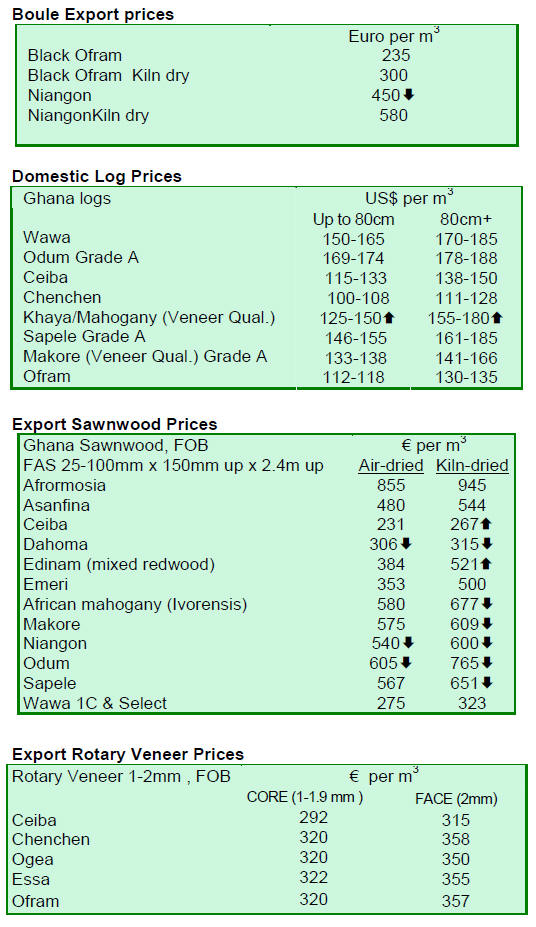

2. GHANA

Ghana to import timber from Cameroon

As a short to medium term measure, Ghana will begin importing timber from

Cameroon. The process of finalising a bilateral agreement with authorities

in Cameroon is currently underway.

The decision to seek external sources of raw materials stems from the

rapidly growing consumption of wood products in Ghana and the reduced

availability of raw materials from domestic forests.

Manufacturers in Ghana are being encouraged to take advantage of the imports

and produce added value products.

Fire destroys Samartex finished products warehouse

Part of the finished products warehouse of Samartex Timber and Plywood at

Samreboi in the Western Region was destroyed by fire and large quantities of

wood products were lost in the blaze.

The National Fire Service in the district responded promptly to the

emergency and managed to prevent the fire spreading to other warehouses.

Samartex Timber and Plywood Company, is one of the largest timber companies

in the country.

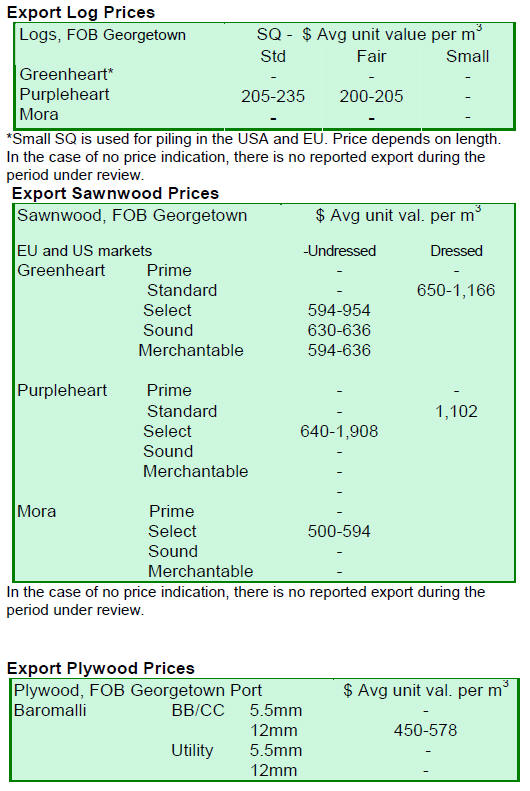

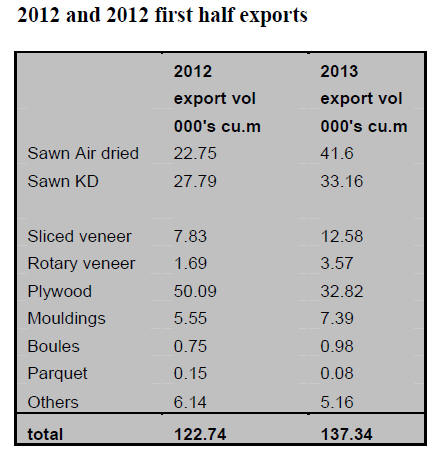

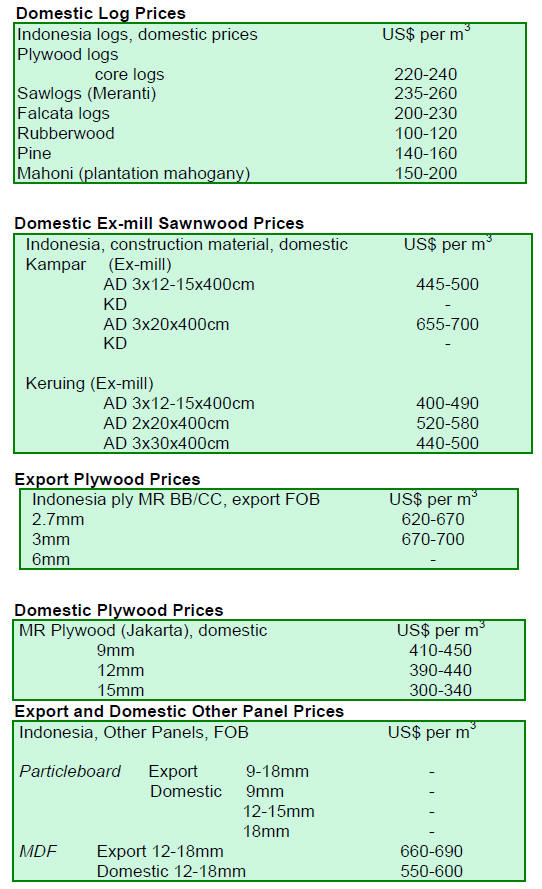

Encouraging first six month export performance

According to available data from the Timber Industry Development Division (TIDD)

of the Forestry Commission, wood product exports from Ghana in the first six

months of 2013 was 137,363 cubic metres earning euro 61.4 million.

The half year figures for 2013 show that export volumes increased by 11.9%

while the value of exports increased 36.8% when compared to the same period

in 2012.

With the exception of Plywood and Parquet Flooring,

all other products registered increases in the volume and value of exports

in the first half of 2013.

The distribution of product groups during the period

reported was as follows;

The EU was the major destination for Ghana¡¯s wood

products, accounting for 41% of the total export volume, with Africa,

Asia/Far East, America, Oceania and Middle East accounting for 33.07%,

17.54%, 5.98%, 1.86% respectively.

The ECOWAS sub region accounted for 71.5% of the total value of exports of

wood products to African countries during the first half of this year.

¡¡

3. MALAYSIA

August 8 marked the end of the Muslim

holy month of Ramadan and was celebrated with a four day long weekend. This,

along with what is traditionally a slow month for the timber trade, further

dampened business activity.

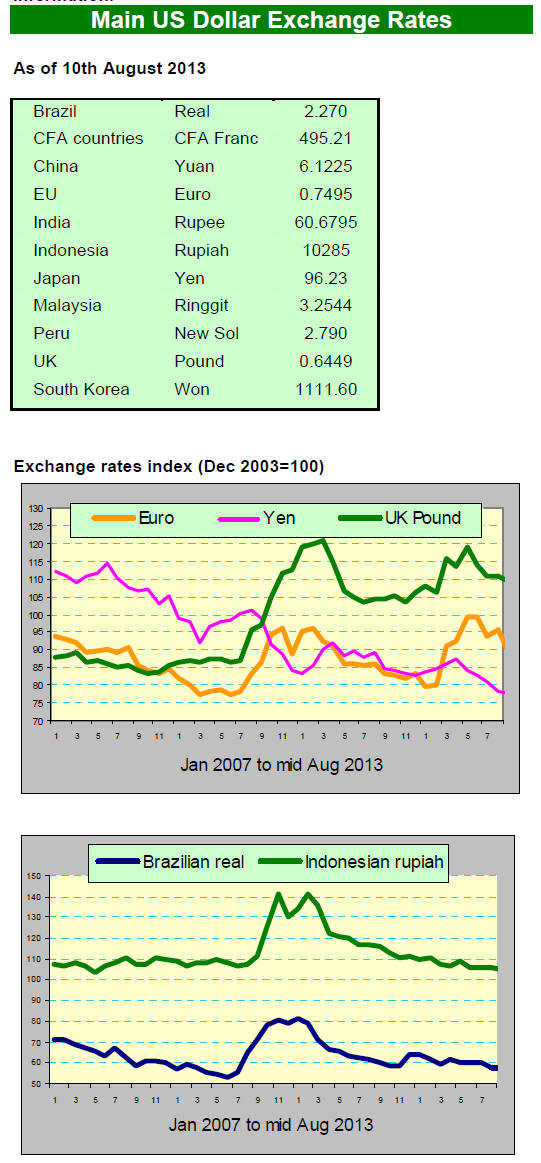

Weak currency brings joy to exporters

The weakening of the Malaysian ringgit against the US dollar is an advantage

for exporters in the timber and plantation sectors as almost all

international trade in these commodities are denominated in US dollars.

The ringgit has weakened by as much as 8 ¨C 9% over the last two months,

dropping from a high of RM 2.96 to the dollar to as low as RM 3.29. Foreign

exchange analysts expect the US$/ringgit exchange to hover around RM 3.10 to

US$ 1.00 in the coming months.

It has been estimated that for every RM0.10 weakening of the ringgit to the

US dollar the annual earnings, in terms of ringgit, of timber companies in

Sarawak will improve as by as much as 10%.

Sarawak log production down

Sarawak log production in the January to May period dropped by more than

700,000 cu.m compared production in the same period last year.

For the first five months, timber companies in the State produced 3.24

million cu.m of logs according to the Sarawak Forestry Corporation.

This level of log harvest works out as an average monthly production of

648,000 cu.m. This is a smaller volume than the average monthly production

of 787,500 cu.m/month in 2012. Total log produced in 2012 was 9.45 million

cu.m and in 2011 it was 9.61 million cu.m.

The production statistics show a decline in harvests in swamp forests. Hill

species harvests amounted to 3.15 million cu.m while the harvest of swamp

species was just 530,441 cu.m in the first five months of 2013.

For hill logs, Sibu region is the leading producer with logging conducted

along the main rivers such as Rejang, Balleh and Balui in central Sarawak.

Harvests of hill species in Sibu in the first five months of the year

totaled 1.32 million cu.m or 40% of the total production in the State.

Harvesting in the Bintulu region yielded 1.13 million cu.m while harvesting

in the Miri region produced 689,800 cu.m.

From January to May 1.22 million cu.m of meranti logs were produced and the

other main species were: kapur 124,970 cu.m, keruing 98,520 cu.m and

selangan batu 87,917 cu.m.

Strengthening of demand in Japan expected to lift export prices for

Sarawak plywood

The Borneo Post recently carried a story based on a report from RHB Research

Institute. According to the Post, this report says plywood prices are likely

to rise in the short term because Japanese importers will be buying more.

The post story quotes Hoe Lee Leng of RHB as saying:

¡°In Japan, the aggressive policy easing to reflate the economy has led to

higher government spending, aggressive monetary easing and structural

reforms.

This should help to promote asset prices that would stimulate consumption

and business investment to sustain a recovery over the longer term. These

policies have thus led to stronger growth in Japanese housing starts over

the last few months¡±.

Projected housing starts are good indicators of future timber demand and in

the first five months of this year housing starts in Japan grew 7.2% year on

year, to 367,400 units. If this growth is sustained total starts for 2013

year could be 946,400 units.

Hoe Lee Leng further said ¡°According to the management of timber companies

we cover, while (plywood) order volume has improved from Japan, prices have

not risen significantly yet¡±.

However, given the general lag of four to six months to pass on higher log

costs to plywood customers, most companies expect plywood prices to start

moving up from September ¨C October¡±.

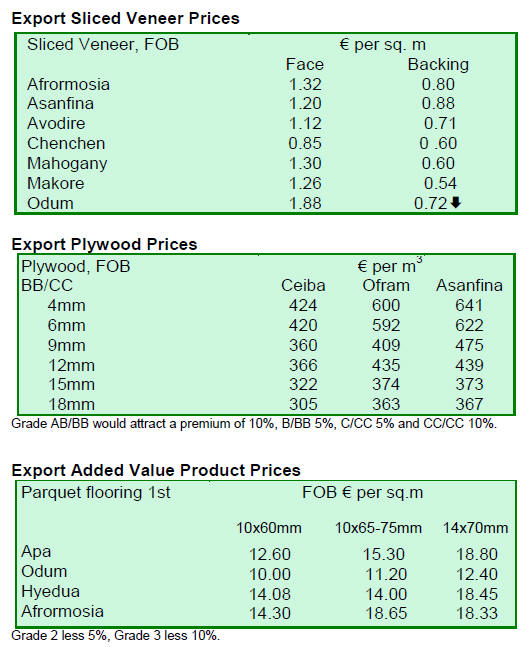

Diverse markets for Sabah plywood

The Department of Statistics in Sabah has released trade statistics for the

first five months of the year.

In this period, Sabah exported sawntimber worth RM150.3 mil. (approx.

US$45.71 mil.); plywood RM439.5 mil. (approx. US$133.64 mil.); veneer RM22.8

mil. (approx. US$6.93 mil.); laminated boards RM35.5 mil. (approx. US$ 10.79

mil. and mouldings RM24.5 mil. (approx. US$7.45 million).

The main destinations for external sales of plywood (i.e. exports plus sales

to Peninsula Malaysia) for the period January to May 2013 are shown below.

Exports to nine countries plus sales to P. Malaysia account for 94 percent

of all sales in the first five months of the year.

Exports of small volumes were also made to UAE,

Singapore, Hong Kong, India, Saudi Arabia, China, Vietnam, UK, Canada and

Australia.

¡¡

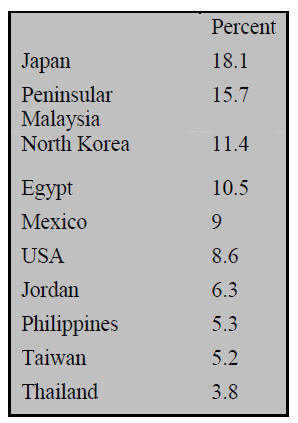

4. INDONESIA

Indonesia/EU VPA to be signed in

September

The Indonesian government has agreed with the EU proposal that the VPA will

be signed on September 30. In a statement the Forestry Ministry¡¯ Director of

Forest Products Management and Marketing said the government expects the EU

to demonstrate its commitment to promoting trade in legal timber by sticking

to the timeframe agreed.

The EU had proposed several dates for the agreement signing as the schedule

of the Lithuanian environment minister, who holds the EU presidency, and EU

Environment Commissioner had to be coordinated.

Government agencies urged to get serious on timber certification

As wood product importers in the EU now require verified legal products the

pressure is on Indonesian manufacturers to secure SVLK certification.

However, SVLK certification by small firms in Bali

is moving only slowly and analysts complain there is poor communication

between agencies in the central and provincial government.

The chairman of the Association of Indonesian Community Forestry

Entrepreneurs has criticised the Ministry of Forestry and the Bali Forestry

Agency for not doing enough to assist small companies.

The Association has called on the authorities to coordinate and promote a

¡®reward¡¯ system whereby those securing SVLK certification could have an

advantage in for example, allocation of the soft loans provided by the

Ministry of Forestry for community forests.

Forest management index launched

The Indonesian government, in cooperation with UNDP and UNREDD, has launched

an English version of it comprehensive forest management index.

This index provides an analysis of forest management conditions and their

implication for the REDD+ programme.Indonesia is one of the countries that

has committed itself to reducing green house gas emissions by over 20% by

2020.

Most fire alerts on land leased to plantation companies

The Tropical Forest Foundation website is reporting analysis of available

concession maps from official national and provincial government offices,

superimposed on daily fire alerts from NASA. This work was undertaken by the

World Resources Institute (WRI), Eyes on the Forest, and the World

Agroforestry Centre.

The analysis shows that the bulk of fire alerts occurred on land leased out

to plantation companies for the development of large industrial oil palm and

acacia plantations.

For the full story see:

http://www.tff-indonesia.org/index.php/en/forest-news/4096-research-nearly-a-quarter-of-june-fires-in-indonesia-occurred-in-industrial-plantations

The authors of the report say ¡°There are two caveats to these analyses:

NASA¡¯s fire alerts do not indicate the shape and size of the area burned, so

it is difficult to accurately determine the use of the land from these data.

More importantly, however, is that if the available

maps of industrial concession boundaries for oil palm and pulpwood (acacia)

plantations are different from the boundary maps held by companies, the

analyses can be wrong ¡ª and many companies are arguing precisely this.

When the ministers of Indonesia, Malaysia,

Singapore, Thailand and Brunei met on 17 July to find solutions to the

recent haze problem, they stressed the need for Indonesia to provide

detailed maps of land use and fire-affected areas.¡±

Using before-and-after-fire images from NASA¡¯s

recently launched LANDSAT 8 satellite the data show that about 140,000 ha

were burned during the June fire event in one LANDSAT scene

(Path/Row:127/059) covering an area of 3.5 million ha (i.e. circa 7.5

percent of Sumatra¡¯s landmass).

The tentative conclusions in the analysis are that:

Industrial oil palm and acacia plantations accounted for 21% of the

burned area

Many industrial plantations exist on LANDSAT imagery where there are no

concessions on

government maps and vice versa.

Only 4% of the burned area was covered in natural forest before the

fires.

¡¡

5. MYANMAR

Prices for non-teak hardwoods far below

expectations

Analysts report that, at present, demand in international markets is very

poor especially for non-teak hardwoods.

Exports of pyinkado have been severely hit and prices offered at the latest

Myanma Timber Enterprise (MTE) sealed tenders were unexpectedly low.

In the July¡¯s sealed tender sale of export quality pyinkado logs prices

offered were from US$368 to US$421 per hoppus ton against the MTE¡¯s target

price of US$678.

One possible explanation is that buyers were not keen on these logs as they

were left over from the previous harvesting season. However, pyinkado is a

highly durable wood and does not deteriorate so this cannot account for the

steep decline in offered prices.

Teak log sales were at normal levels and prices, the only concern of the MTE

is that the Indian rupee has depreciated over recent months and this is

beginning to affect demand.

Analysts are quick to point out that despite currency constraints, teak logs

from the areas known to produce good quality sell much easier than logs from

other areas.

Overall the teak market has eased slightly over the past four weeks.

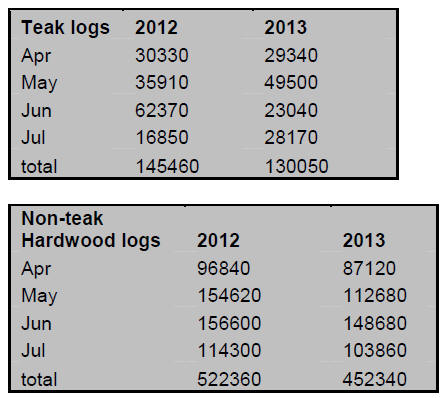

Exports of teak and non-teak hardwood logs

The figures below illustrate shipment of teak and other hardwood logs during

the first four months of the fiscal years 2012-13 and 2013-14.

These comparative figures expressed in cubic metres mirror international

market demand for timber from Myanmar.

Analysts point to the overall decline in shipments

in the first four months of fiscal 2013 compared to the same period a year

earlier.

With a log export ban likely to be introduced in

April next year it was anticipated that shipments would increase as buyers

sought to increase stock levels but this has not yet been seen.

Seizure of illegal logs reported in daily press

The Daily Eleven newspaper has reported that 57 trucks carrying illegally

felled timber were seized within a period of three days along the Bamaw-

Momauk ¨C Loigye road in the eastern part of Kachin State.

This is the first time government action to tackle

transport of illegal logs has been reported by a local newspapers.

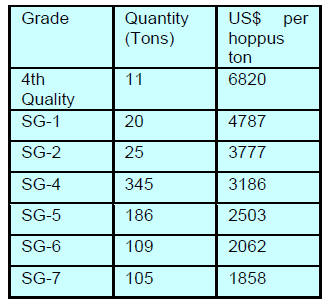

Teak tender prices

The following prices were recorded for teak log sales during competitive

bidding on 26th and 29th July during the MTE tender. The next sale will be

held in late August.

¡¡

6.

INDIA

Revised ¡®Affordable Housing in

Partnership¡¯ scheme

When addressing REALTY 2013, the Confederation of Indian Industry (CII)

conference on real estate on August 2, Dr Girija Vyas, Union Minister of

Housing and Urban Poverty Alleviation said the aim of the soon to be revised

¡®Affordable Housing in Partnership¡¯ (AHP) scheme is to provide half a

million houses to economically weaker and lower income groups.

A summary of the minister¡¯s statement can be seen in a CII press release at:

http://www.cii.in/PressreleasesDetail.aspx?enc=hVStv2IOaSXkpbtAMD72jY+An+KHQnMZqv+eF7+xuZw=

Through this scheme, the government intends to encourage partnerships

between various agencies such as the central and state government housing

boards, development authorities, local urban bodies and industry for

creation of affordable housing.

The scheme will provide several supply side as well as demand side

incentives such as concessions on development charges, service tax and

direct tax exemptions, encouragement to foreign investment in affordable

housing and reduced stamp duties.

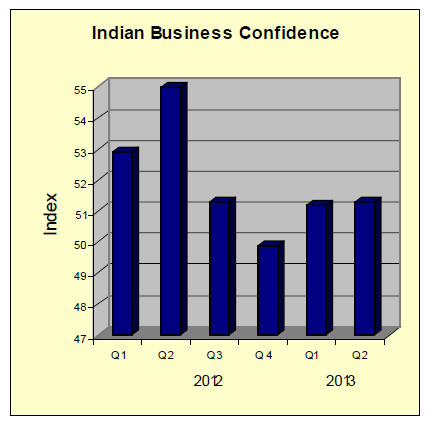

Business confidence slips in June

Indian companies became more pessimistic about the economy in the second

quarter as the business confidence index dropped slightly from levels in the

first quarter.

The New Delhi based Associated Chambers of Commerce and Industry reported

that more than 50% of respondents to their recent survey now feel the

economic situation has worsened.

The main factors negatively affecting industry were stated as weak domestic

and international demand, the weakening rupee, the high cost of credit,

rising prices for raw materials and wage increase pressures.

¡°The current situation calls for urgent policy

initiatives both by the Reserve Bank of India and the central government to

rescue Indian industry from further deterioration as it may significantly

impact employment and consumer demand,¡± said a spokesperson from the

Associated Chambers of Commerce and Industry.

Indian companies eye overseas plantation resources

Ensuring adequate and uninterrupted supplies of raw materials at reasonable

cost has become the key focus for all wood based industries in India.

As the number of enterprises increases and as others increase capacity the

problem of raw material supply increases. Companies are realising that the

best solution is to have their own plantations.

Several Indian companies have sought to invest in

Malaysia, Myanmar and Vietnam and have plantations and manufacturing

capacity in those countries.

Taking up the challenge is India¡¯s JK Paper Mills which, reports suggest, is

discussing large scale plantation development with the Government of

Myanmar.

The company is also considering establishing a paper mill with a 70,000

tonne annual capacity. The total investment is said to be worth around US$

30 million.

At its home base in India, JK Paper Mills has extended its activities and in

August its new plant at Raygada in Odisha will start production (pulp mill

capacity of 215,000 t/yr and paper capacity about 150,000 t/yr).

This will lift the paper production capacity from the present 290,000 to

450,000 tonnes a year. The company¡¯s total wood requirement last year was

474,000 tonnes with 35-40 per cent coming from its own plantations.

Because of the additional production capacity the company will have to

source a further 200,000 tonnes of raw material. It is noteworthy that over

the past year the cost of domestic pulp wood increased 35%.

Price trends for domestic plantation teak logs in Kerala, South India

Approximately 50,000 cubic metres of teak logs are sold annually through

auctions in the State of Kerala. The state has a wide network of timber

depots where auctions are regularly held.

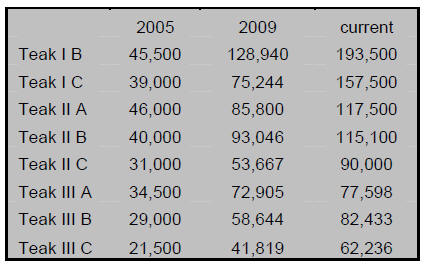

TeakNet and its Coordinator Dr. M.Sivaramhave reported the latest teak price

trends. When compared with prices in 2005 and 2009 the current upswing in

prices is rather severe as illustrated in the table below.

Prices for plantation grown teak logs from Kerala are shown below. Prices

are per cubic metre Ex-depot.

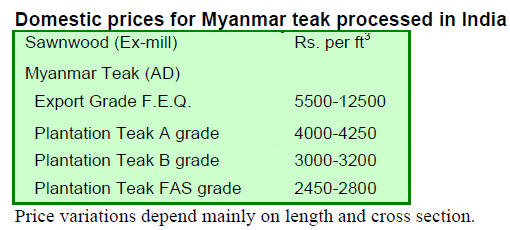

Prices for imported plantation teak

Fluctuations in Indian rupee continue but the level of plantation teak

imports continues unchanged a reflection of the firm demand in the country.

Plantation teak prices are shown in the following table.

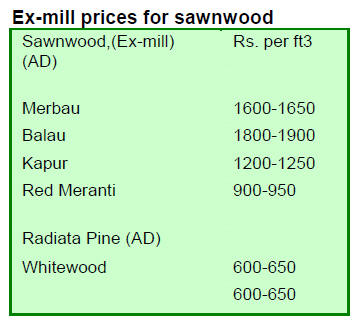

Domestic ex-sawmill prices for air dried sawnwood

cut from imported logs. Price per cubic foot is shown below.

Slowing demand continues to hold down price

structures.

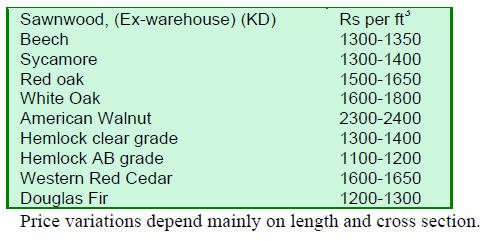

Prices for imported sawnwood

Ex-warehouse prices for imported kiln dry (12% mc.) sawnwood per cu.ft are

shown below.

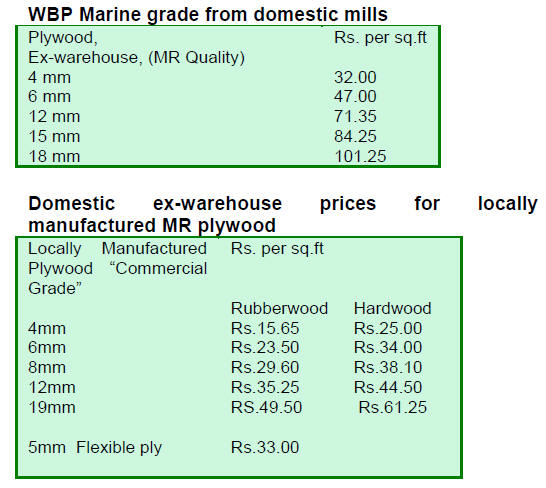

Plywood prices

Domestic demand for plywood continues to grow.

7.

BRAZIL

Better communication key to

influencing consumption of sustainable tropical timber

A dialogue on sustainable tropical wood organized by the Friends of the

Amazon Network (RAA), in partnership with WWF-Brazil and Traffic has been

held in São Paulo.

The purpose of the meeting was to strengthen communication in the sector

with the aim of creating a governance model that can influence consumption

of sustainable tropical timber in the domestic market

.

The participants concluded that restructuring of the sector is required to

address issues such as monitoring of sustainable harvesting, surveillance,

transport and taxation.

The meeting was attended by representatives of forest producers, certified

forest community cooperatives, certified companies, labour unions, civil

construction companies and NGOs.

The main issues that need addressing according to the participants are the

lack of information and transparency in the timber market and the need to

establish public policies that promote the sector.

Working groups were established to prepare proposals for cooperation and

public policy development in the sector. Before November this year

additional meetings will be held to discuss and strengthen the proposals

suggested by the participants.

Furniture makers in Cuiab¨¢ seek support to boost local manufacturing

Entrepreneurs and government representatives from the state of Mato Grosso

in the Amazon region gathered to discuss the establishment of a furniture

cluster in Cuiab¨¢, in the V¨¢rzea Grande area. A working group was set up to

speed up the process of establishment of a timber processing centre.

Successful restructuring of the furniture sector in the V¨¢rzea Grande area

will generate more employment opportunities, strengthen the wood

manufacturing sector and improve the competitiveness of the sector.

The idea for establishment of a furniture cluster in the region came from

local entrepreneurs who are seeking ways to garner support from the

government to boost the local manufacturing industries.

The State Secretary for Industry, Trade, Energy and Mining is reportedly

enthusiastic about this idea and it is anticipated that support for the

creation of the furniture cluster can be included in the governmental

programme ¡®Development Plan of Local Productive Arrangement¡¯.

Timber sector performance not keeping pace with other industries

The consensus is that, due to the lack of governmental incentives for the

timber industry, the sector is failing to achieve the levels of growth by

other industries which is resulting in a declining contribution to exports.

This is demonstrated in the municipality of Guarapuava where timber is one

of the most important sectors of the economy.

According to the Ministry of Development, Industry and Foreign Trade, even

though overall wood product exports from Guarapuava have increased since

2009 (from US$14 million to US$ 39 million last year), the share of wood

product exports in total exports has fallen sharply from 86% in 2011 to just

28% in 2013.

This problem was discussed by the Wood Sector Council of Federation of

Industries of Paran¨¢ State (FIEP) recently and proposals were made on

industrial policy and market development that would support the industry.

During a meeting of the Wood Sector Council of the National Confederation of

Industry a comparative analysis of the timber sector contribution to the

economy between 1996 and 2013 was presented.

It was revealed that in 1996 the wood sector was

responsible for 3.4% of total jobs generated but by 2013 this had dropped to

2.6%.

In terms of trade, exports of wood products fell by more than half and this

decline was attributed mainly to a reduction in construction activity in

Europe and in the United States as well as disadvantageous exchange rates.

Furniture imports in São Paulo up almost 60 percent

Brazilian furniture exports were US$66 million in May 2013, representing a

4.5% increase over the same month in 2012. On the other hand, the country's

furniture imports were US$62.1 million, representing a 6.5% decrease during

the same month in 2012.

Furniture exports in May from the state of Rio Grande do Sul, the major

furniture producing state, registered a high of US$19.6 mil. (+21%) whereas

state furniture imports totaled US$4.1 million, a 69% increase year on year.

Of particular significance was the import of furniture making equipment that

registered growth of over 20% between January and June 2013 compared to the

same period in 2012.

São Paulo state continues to be the main consumer of imported furniture and

imports grew almost 60% in value during May 2013 compared to a year ago. The

states of Paran¨¢, Santa Catarina and Rio Grande do Sul together accounted

for around 25% of Brazil¡¯s furniture imports.

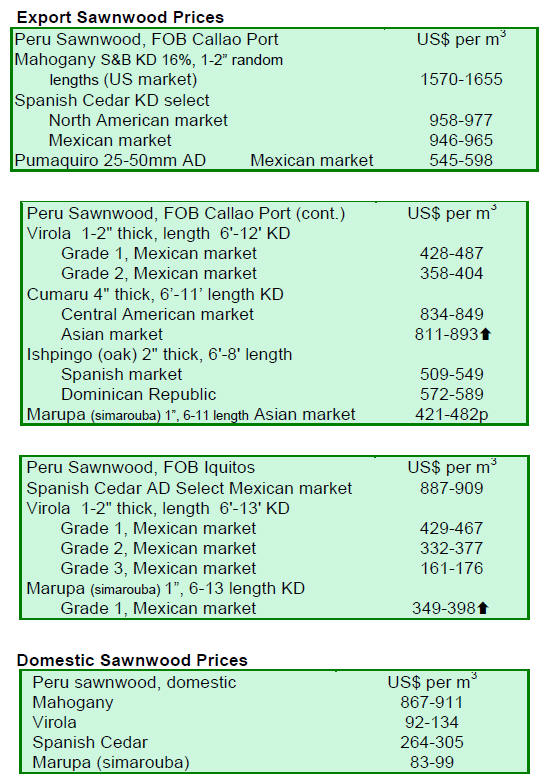

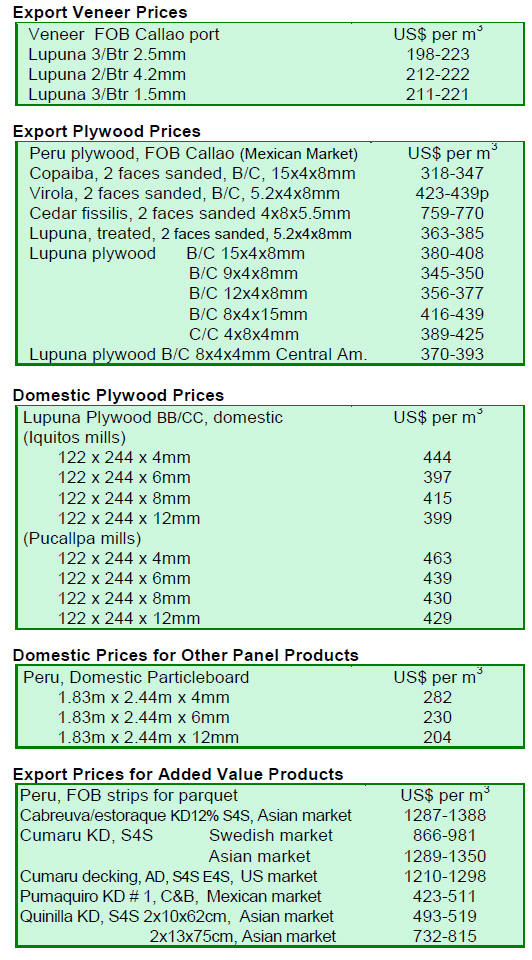

8. PERU

Potential for US$ 5 billion forest

product exports

Peru's forest product exports have the potential to grow to as much as US$5

bil. in 10 years because of the positive impact of the new National Forestry

Policy and Wildlife (PNFFS) according to the Ministry of Agriculture and

Irrigation.

The ministry spokesperson stressed that at present wood product exports

contribute just 1% to GDP but this can change as the sector will benefit

from the sound legal framework provided by the new forest policy.

Draft regulations for forest policy ready for discussion

Forestry Law would take effect in March 2014 and consultation would be

September. The Forest Act and Wildlife will apply from the second quarter of

2014 said the Ministry of Agriculture and Irrigation (MINAGRI).

The Minister of Agriculture and Irrigation, Milton von Hesse, explained that

the first draft of the regulations in the Act have been drafted and will now

be discussed with stakeholders.

The minister reiterated that the new National Forestry Policy and Wildlife

Act is just one step towards a comprehensive plan to promote the sustainable

use of the country¡¯s natural resources.

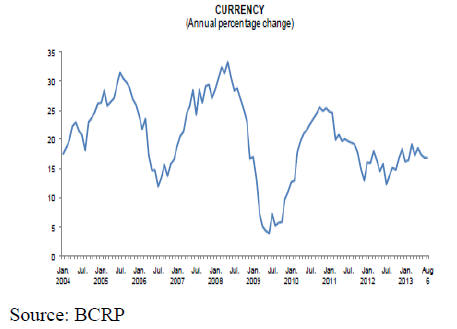

Central Reserve Bank of Peru intervenes to support Nuevo Sol

The sol/dollar exchange rate has been very volatile over the past weeks. On

August 6 the average selling price of the dollar was Nuevo Sol 2.796 per

dollar.

A press release from the Central Reserve Bank of

Peru (BCRP) says that the bank intervened in the foreign exchange market

selling US$190 mil. in an effort to support the sol.

See:

http://www.bcrp.gob.pe/home.html

The movement of the sol against the US dollar is shown below.

Strong US economic growth in the second quarter

strengthened the dollar and local banks were big buyers as they sought to

improve their positions.

After appreciating to historically high levels in 2012, the Nuevo Sol has

weakened more than 9.5 percent so far this year.

9.

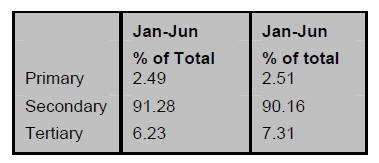

GUYANA

Growth through innovation forum

A National Economic Forum, scheduled from August 14 to August 15 and hosted

by the National Competitiveness Strategy Unit (NSCU) will discuss issues

relevant to the theme ¡°Promoting economic growth and development through

innovation, diversification and partnership¡±.

The Forum will feature presentations by President Donald Ramotar, Finance

Minister Dr Ashni Singh, Private Sector Commission Chairman Ronald Webster

and other representatives of the government.

The National Competitiveness Strategy (NCS) was launched in 2006and

comprises government representatives, private sector stakeholders and labour

unions.

The NCC also promotes the strategies, locally and internationally; finds

solutions to address various challenges; and seeks to identify synergies

among donors to improve the effectiveness of lenders¡¯ initiatives.

EU support for Guyana REDD plus activities

Guyana is one of four countries to benefit from a euro 2.7 million regional

REDD+ project supported by the European Regional Development Fund (FEDER),

the French Global Environment Facility (FFEM) and the government of French

Guiana.

According to a press release from the Office of Climate Change work will be

supported for an estimation of land cover changes and forest carbon stocks;

identifying deforestation and degradation drivers; and modelling land use

changes and socio-economic development.

At the first meeting of the project, held on August 8 in Paramaribo, Shyam

Nokta adviser to the president and head of the Office of Climate Change said

this project was initiated when Bharrat Jagdeo was President.

He said further that Guyana is willing to share experiences and lessons

learnt while at the same time seeking support as the country continues to

build a REDD+ model.