|

Report

from

North America

Tropical sawn hardwood imports recovered in April

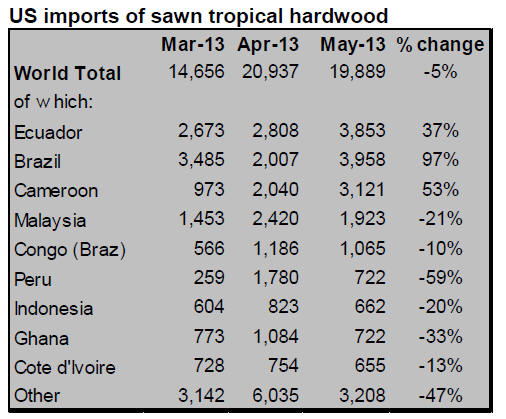

US tropical sawn hardwood imports declined by 5% in May compared to

levels in April. Imports of temperate sawn hardwood increased 22% in the

same time period.

Temperate sawn hardwood imports were 49,444 cu.m. in May, compared to

19,889 cu.m. of tropical sawnwood imports.

Tropical sawn hardwood imports from the US¡¯ three largest suppliers

(Brazil, Ecuador and Cameroon) increased in May, while shipments from

all other major sources were lower than in April.

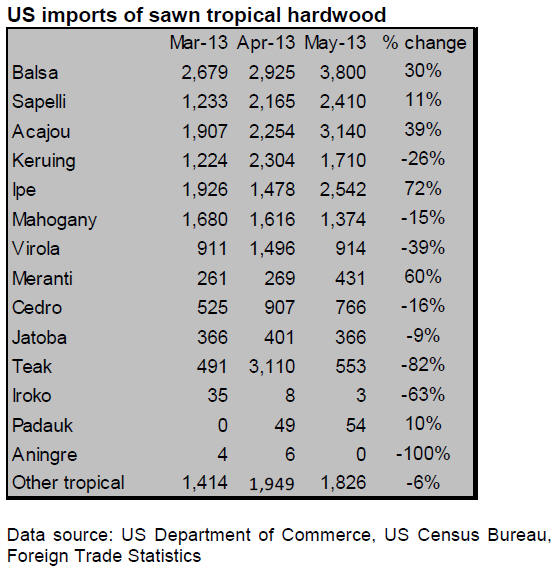

Imports from Brazil almost doubled from April to 3,958 cu.m. (+19%

year-to-date). Ipe imports increased to 2,410 cu.m. No Virola imports

were reported in April, but 610 cu.m. were shipped in May.

Ecuador shipped 3,800 cu.m. of balsa in May, up from 2,808 cu.m. in

April, but US balsa imports remain below 2012 level.

Imports from Cameroon were 3,121 cu.m. in May (+2% year-to-date). Sapeli

shipments increased to 1,567 cu.m., while shipments of acajou d¡¯Afrique

almost tripled to 1,387 cu.m.

Malaysian shipments to the US were 1,923 cu.m. in May, down 21% from the

previous month (+1% year-to-date). The decline was mainly in keruing

shipments (1,593 cu.m.).

Turnaround in Canadian wood product manufacturing

Wood product manufacturing has exceeded growth in most other

manufacturing sectors, according to Statistics Canada.

In the last 12 months (June 2012 to May 2013) sales in the wood products

sector grew by 19.7% from the same period a year earlier.

Over the same period total manufacturing sales (excluding wood products)

declined by 1.1%.

The industry¡¯s recovery is mostly linked to growth in the US housing

market. Canadian sawmills and wood preservation companies increased

sales the most, driven by higher exports to the US.

Statistics Canada reports a 10.5% increase in wood prices over the past

year as a result of higher demand in the sawmill and wood preservation

industries.

The province of British Columbia has the largest wood product

manufacturing industry in Canada, accounting for one third of the

industry¡¯s national sales. While British Columbia was particularly hard

hit by the downturn in the US housing market, its industry is now the

fastest-growing in Canada.

Quebec is Canada¡¯s second largest wood product manufacturing province

with a more diverse industry, which includes processed products such as

millwork, windows and doors. However, the sectors benefiting most from

the US housing market recovery are also sawmills and wood preservation.

Mexico enforcing new phytosanitary regulations

Mexico¡¯s Secretariat of Environment and Natural Resources finalized

phytosanitary regulations for wood imports in March 2013, and the

revised regulations came into effect on July 2, 2013. The goal of the

new regulations is to better protect Mexico¡¯s forests from invasive

insects and other pests.

The US and several other countries (Argentina, Belize, Bolivia, Brazil,

Cameroon, Canada, Chile, China, Colombia, Congo, Costa Rica, Ecuador,

Germany, Spain, Fiji, the Philippines, France, Ghana, Guatemala,

Honduras, India, Indonesia, Italy, Malaysia, Nicaragua, Nigeria, Panama,

Peru, Russia, Taiwan, Uruguay and Venezuela) are allowed to export green

and air dried sawnwood to Mexico without having to prepare a pest risk

analysis.

All sawnwood needs to be bark free and have a phytosanitary certificate

which documents the treatment: heat treated or kiln-dried to 19% or

less, or fumigated with methyl-bromide.

The stricter regulations are expected to affect furniture manufacturers

and other importers in Mexico who rely on hardwood imports from the US

and other countries.

Updates on the regulations are available on the US Phytosanitary Export

Database:

https://pcit.aphis.usda.gov/PExD/faces/ViewPExD.jsp

¡¡

|