Japan Wood Products

Prices

Dollar Exchange Rates of

12th July 2013

Japan Yen 101.15

Reports From Japan

Consumer confidence falls on concerns for income

growth and price rises

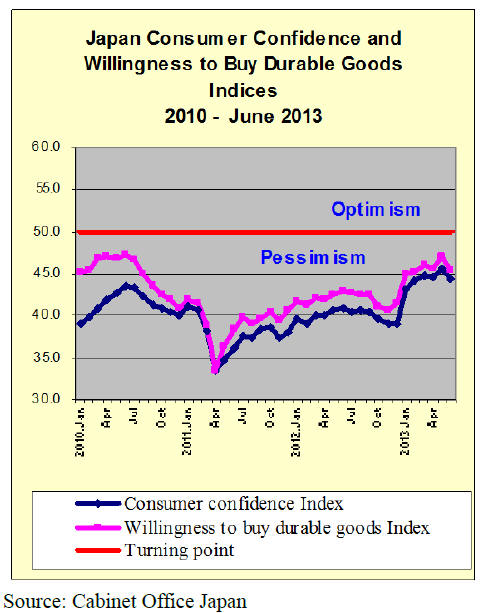

Japanese consumer confidence declined in June marking

the first fall in six months.

The main reason cited for the fall was consumer

expectations for rising prices and stagnant income growth.

For the Cabinet Office data see:

http://www.esri.cao.go.jp/en/stat/shouhi/shouhi-e.html

The latest survey shows that ‘household sentiment’ fell to

44.3 in June, down 1.4 points from the level in May. See:

http://www.esri.cao.go.jp/en/stat/juchu/1305juchue.

html#g01

Household sentiment covers consumer expectations for

overall ‘livelihood’ as well as income growth

expectations, employment and a willingness to buy

durable goods. All four of these elements declined June in

the survey. A consumer confidence number below 50

indicates pessimistic expectations.

Japanese companies finally begin expansion

investment

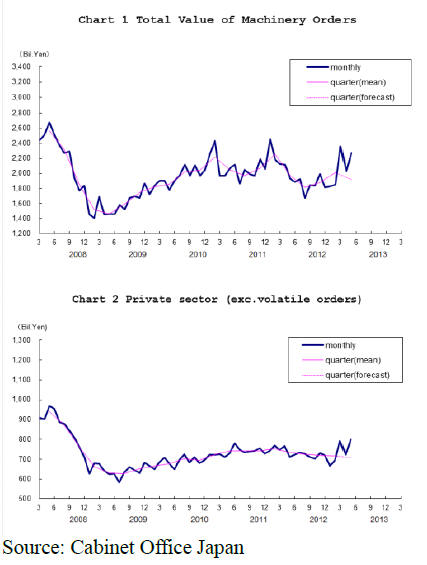

In Japan, private sector machinery orders are used as an

indicator of private sector investment trends. In the

statistics from the Cabinet Office the data exclude orders

placed by very large companies such as electric power

companies it also excludes orders for ships.

The Cabinet Office report for May says the total value of

machinery orders increased by 12% in May from the

previous month.

These latest figures, along with the results of the Bank of

Japan's Tankan survey, suggest companies in Japan are

planning to expand investment.

Stimulating private sector investment is at the heart of the

government's plan to reverse the weakening economy and

get the Japanese economy back onto a growth path.

Improved profits should lift household income and

business investment

In its Monthly Economic Report the Cabinet Office is now

painting a more optimistic picture for the Japanese

economy. See:

http://www5.cao.go.jp/keizai3/getsurei-e/2013jun.html

In summary the report says:

the Japanese economy is picking up steadily

exports show movements of picking up

industrial production is picking up

corporate profits are improving, mainly among

manufacturers

business investment is starting to level off

firms’ judgment on current business conditions

shows movements of improvement

the employment situation is improving, although

some severe aspects remain

private consumption is picking up

However the report cautions that “recent price

developments indicate that the Japanese economy is in a

mild deflationary phase, while signs of change have

recently been seen in some areas”.

In the short term a recovery may take hold if improved

corporate profits lead to higher incomes and business

investment. Much now depends on growth in exports but,

as the report points out, weakness in overseas economies

is a downside risk for the Japanese economy.

The good news is that private consumption and company

investment is picking up. If consumers see incomes

improving, says the report, a measure of sustainability in

growth may be achieved.

Positive growth in the housing sector is also adding to the

overall impression that a turn-around in the economy is

possible. Construction of owner occupied homes and

houses built for rent has picked up and sales of

condominiums in the Tokyo metropolitan area have been

increasing. The report notes that exports are increasing.

Exports to Asian countries remain subdued but exports to

the U.S. are showing improvement but exports are not

growing.

Bank of Japan stance creates more exchange rate

volatility

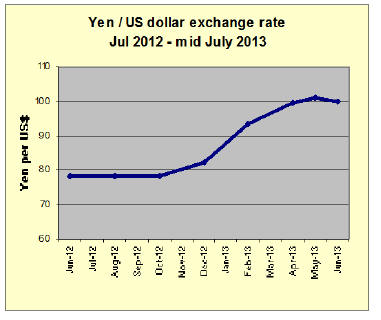

The US dollar was trading at yen 98 in early July. The

dollar was sold after comments from the Federal Reserve

suggested the US stimulus programme would have to be

continued for some time yet.

However the yen strengthened against the US dollar in the

past weeks largely because the Bank of Japan did not offer

any further indication that it would expand its monetary

easing initiative.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to extract and reproduce news on the Japanese

market.

The JLR requires that ITTO reproduces newsworthy text

exactly as it appears in their publication.

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

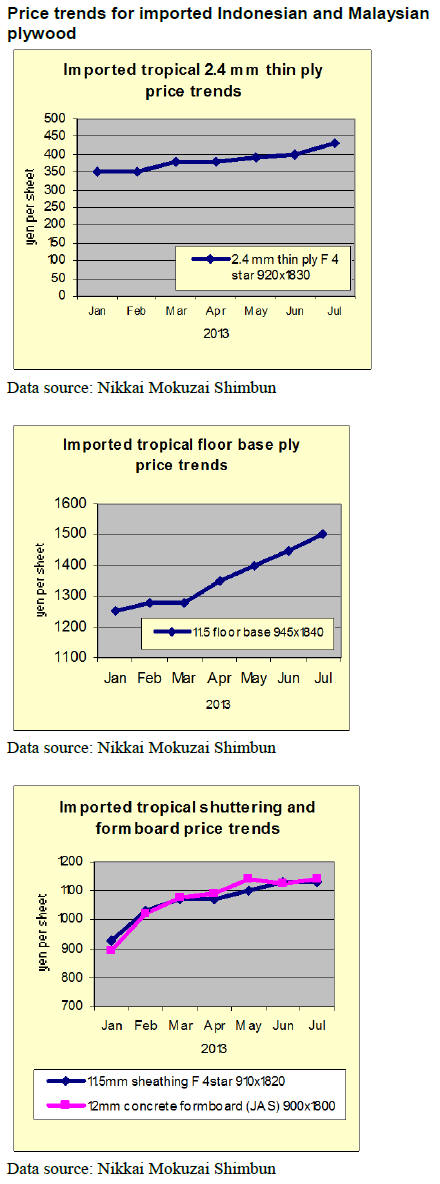

Plywood market

The market of both imported and domestic produced

plywood continues firm trend with the prices edging up.

Shipment of domestic plywood has been brisk for

precutting plants and house builders. Both production and

shipment in May exceeded 210 M cbms.

The shipment has been over 200 M cbms for eight straight

months then the monthly production has also been over

190 M cbms for nine straight months.The inventory

increased by 5,000 cbms in May but remains at low level

of 127 M cbms.

Plywood manufacturers hold aggressive stance and keep

increasing sales prices little by little in every month.

Currently in Tokyo market, 12 mm 3x6 (special type/F4

star) prices are 950 yen per sheet delivered, 20 yen higher

than June, 24 mm 3x6 prices are 1,900 yen, 30 yen up,

long sheet 9 mm 3x10 prices are 1,370 yen , unchanged

from June.

Imported plywood market is firm with higher FOB prices

offered by the suppliers. Log supply shortage and higher

log cost continue in Malaysia so that there is no sign that

FOB prices would slack.

With this background, the market in Japan continues firm

despite higher port inventories and higher arrivals in April

and May over 340 M cbms.

Shipments in the second quarter were slower but the cost

of future arrivals is higher so importers and wholesalers

are holding firm stand.

Benefit for low income house buyers

The Tax Commission of controlling parties made up a

plan to give cash benefit for low income house buyers,

which are not able to take advantage fully of housing

mortgage loan tax reduction after the consumption tax

increase in April 2014.

For ones whose annual income is less than 5.1 million yen,

maximum of 300,000 yen cash is given when consumption

tax rate is 8% then when the rate is raised to 10%,

maximum of 500,000 yen is given, whose annual income

is less than 7.75 million yen.

Also in case house buyer with age of 50 or older pays cash

to buy a house with annual income of less than 6.5 million

yen, the same benefit is applied.

The government extended the housing loan tax reduction

measure, which was supposed to end in March 2014, for

four more years to March 2017. This is to relieve housing

market, which is likely to drop when the consumption tax

is raised.

This is the system to deduct 1% of housing loan balance

from the income with the maximum deduction of 200,000

yen but the amount is changed to 400,000 yen after the

consumption tax is raised in April 2014.

However, this system is beneficial to higher income

people, whose annual income is more than 6 million yen

so to make the measure fair for low income house buyers,

cash benefit is newly proposed.

Wood Use Point System

The administration office of the Wood Use Point System

publicized list of 545 products by 30 companies of wood

products (furniture, office furniture), 600 products by 61

manufacturers of wood stove, 1,348 products by 22

manufacturers of interior and exterior materials and 705

official windows for point issuance and for application of

trade of the points. Also it announced that additional

builders for the system are invited since July 8.

Wood products are bed, desk, table, chair, bookshelf,

partition, bench, counter, storage cabinet and cupboard

manufactured by Izumo Wood Works, Itoki, Uchida

Youkou, Okamura, Kokuyo Furniture, Xience, Toa

Ringyo, Dream Bed, Yoshiken、Teikoku Kizai, Hida

Sangyou, Wise Wise Inc. and others.

Manufacturers of registered building materials for interior

and exterior are Daiken, Eidai, Nichiha, Shimane

Plywood, Sato Kougyo, Marutama Sangyo, Pal Wood,

Noda, Kariya Annex, AP Floor (Akita Plywood), Chubu

Flooring, Sato Kogyo, Sorachi Veneer, Sumitomo Ringyo

Crest, Seihoku Plywood, Japan Kenzai, Kohoku Veneer,

Fujishima Wood Manufacturing and others.

In 22 companies, 21 are interior materials manufacturers

(5 interior wall, 19 floor and some are both). Windows for

application vary by prefectures but they are mainly

selected from group of architects, construction companies,

wood products distributors and forest unions.

JAS rules on CLT

The Ministry of Land, Infrastructure and Transport has

made up draft of JAS rules on CLT (cross laminated

timber) and is inviting public opinions through July 12.

JAS draft specifies formation of lamina, lamina quality,

adhesive, formaldehyde emission, species and test method.

After public opinions are collected in July, official rule of

JAS on CLT is expected to be issued by the year end.

Lamina has to be 12 mm or thicker and less than 50 mm in

thickness and basically even in thickness. Width is less

than 300 mm. Type of adhesive is specified depending on

environment and direction of gluing.

Once JAS rule is officially enacted, the Ministry of Land,

Infrastructure and Transport sets standard strength so that

CLT can be used as structural materials.

Revision of JAS rule on LVL

The National LVL Association formed JAS revision

committee since four years ago and the Association thinks

that LVL use is limited if it is used as structural post and

beam and it is necessary to develop market of LVL as

panel so it hopes that the revision this time would

contribute developing new market area for LVL.

In revised rule, there will be two type of structural LVL.

One is standard structural LVL of type A then type B

allows use of orthogonal layer into LVL freely to some

extent. For more information see Japan Lumber Reports

No 613 of July 12th.

|