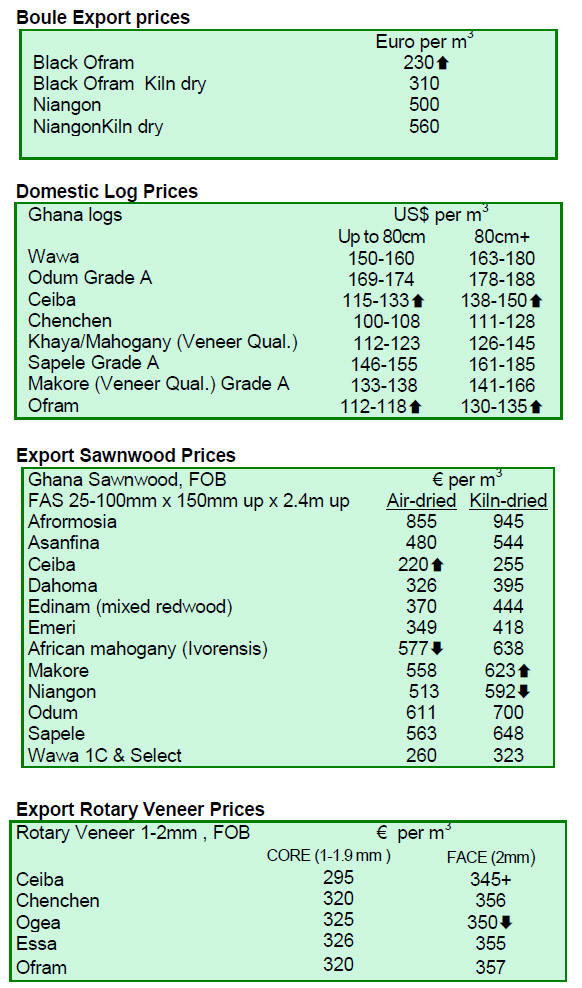

2. GHANA

Improving wood supply to domestic market

key to

eliminating illegal logging

The Minister for Lands and Natural Resources, Alhaji

Fuseini, said the Forestry Commission would continue to

implement activities under the National Forestry

Plantation Programme so as to improve the supply of

timber to the domestic market and at the same time satisfy

the public wood procurement policy.

The Minister made this known at a press conference in

Accra where he also announced Ghana¡¯s gold production

in 2012 was the highest in the history of the country

amounting to over 4 mil. ounces worth almost US$6

billion.

As demand for sawnwood in the domestic market grows

there is an urgent need for the government increase

plantation output which will help reduce the incidence of

illegal logging.

The minister said the Forestry Commission has established

a Rapid Response Unit to clamp down on illegal activities

within the forest reserves and protected areas.

Low prices affects export earnings from

nontraditional

products

Revenue from Ghana¡¯s non-traditional exports (NTEs)

which does not include timber, cocoa beans and minerals

fell around 4% in 2012 to US$2.3 billion.

According to the Ghana News Agency, available figures

show that exports of processed and semi-processed goods

contributed about 90% to total earnings, with agricultural

and handicraft products making up the balance.

Europe remains the main destination for non-tradional

exports and accounted for about 50% of the total in 2012.

The 15 member ECOWAS countries accounted for 31% of

export sales.

According to the acting Chief Executive of the Ghana

Export Promotion Authority (GEPA), Mr. Gideon Kwame

Boye Quarcoo, the decline in the 2012 revenue could be

attributed to a general weakening of prices.

3. MALAYSIA

Smoke haze eases in Peninsular Malaysia

The smoke haze problem in Peninsular Malaysia has eased

considerably because of a change in the weather. Heavy

rain in Indonesia has contributed to the efforts of the

authorities to bring the fires under control.

The Indonesian President Susilo Bambang Yudhoyono has

offered an apology to the people of Singapore and

Malaysia for the thick smoke haze from raging fires in

Sumatra. In his message the Indonesian President said ¡°we

accept the smoke pollution is our responsibility and we

will tackle the problem¡±.

In related news it seems that the Indonesian police are

investigating a Malaysian firm having plantations in

Sumatra as this company is thought to be responsible for

one of the major forest fires.

Number of forest rangers to be doubled

Increased public awareness of environmental issues,

possibly sharpened as a result of the current smoke haze,

has prompted the Malaysian Minister of Natural Resources

and Environment, G Palanivel, to announce that the

permanent forest cover in Peninsular Malaysia will be

extended to five million hectares from the present 4.7

million hectares.

BERNAMA, the national news agency, has reported the

minister as saying, ¡°the health of the forest is an important

issue for the country, not only as a source of income, but

also for the protection and conservation of flora and fauna.

Efforts must be made to ensure sustainable

forest

management and to prevent poaching and illegal killing of

endangered animals¡±.

The Malaysian government has agreed to double the

number of forest rangers to help manage, monitor and

protect forest resources. Presently, Malaysia has about

2000 forest rangers stationed in permanent forest reserves

spread across the country.

Drive on to get more companies to register with MTIB

Industry analysts report that officials from the Malaysian

Timber Industry Board (MTIB) have mounted a campaign

to get more wood product manufacturers, especially

furniture producers, to register with MTIB. It is thought

that this is in preparation for further negotiations with the

EU on a VPA.

Persistent power failures affecting production in

Sabah

It is perhaps fortunate that the timber industry in Sabah is

experiencing quiet trading conditions as mills are suffering

from power failures.

The Sabah Timber Industries Association (STIA) recently

called for urgent action by the federal and state

governments to solve the continuing problem over power

failures in the Seguntor Industrial Area where many

timber companies have production facilities.

STIA told the Daily Express newspaper their records show

there were 662 hours of downtime in 2011, and 106 hours

without power in 2012. The STIA says power outages this

year are already over 500 hours.

India remains number one Sarawak log buyer

The Sarawak Forestry Department reported that in the

period January to April 2013, the State produced a total of

2,596,901 cu.m of logs. Swamp species contributed only

67,483 cu.m, while the remaining harvest was of hill

species.

Of the total log production, 1,000,304 cu.m were exported.

Log exports for the first four months of 2013 were worth

around RM 572 mil.

For the year to-date India is the leading buyer of logs

having bought 606,583 cu.m (worth RM 370 mil.) and

Taiwan P.o.C was second, purchasing 149,974 cu.m (RM

85 mil.). China was the third largest buyer at 93,920 cu.m

(RM 44mil.).

Imports by these countries are followed by Vietnam

66,596 cu.m (RM 29 mil.) and Japan 44,852 cu.m (RM 29

mil.). From being the main buyer of Sarawak logs Japan is

now only the fifth ranked importer.

Imports of Sarawak sawnwood by Philippines and

Thailand top 76,000 cu.m

In the January to April 2013 period, Sarawak exported a

total of 271,573 cu.m of sawntimber worth RM 237 mil.

Importers in the Philippines bought the most at 76,686

cu.m (worth RM 29,670,539) and Thailand was the second

largest buyer at 76,226 cu.m (RM 74,898,825).

Yemen was the third biggest buyer of sawntimber at

34,041 cu.m (RM 41 mil.), followed by Taiwan P.o.C at

21,866 cu.m (RM 17 mil.). Buyers in Singapore purchased

10,201 cu.m (RM 11 mil.).

Product and market diversity brings rewards

In the year to April 2013 Sarawak exported a total of

976,600 cu.m of plywood (worth RM 1,418 mil.).

Japan was the main buyer at 545,718 cu.m (worth RM 799

mil.) and South Korea was number two at 106, 330 cu.m

(RM 136 mil.).

Third biggest buyer was Taiwan P.o.C at 98,544 cu.m

(RM 135 mil.), followed by Yemen 49,461 cu.m (RM 62

mil.) and Egypt at 39,745 cu.m (RM 58 mil.).

The value and volume of veneer exports from Sarawak in

the year to April 2013 totalled 63,596 cu.m (worth RM 73

mil.).

In addition, 2,040 cu.m of mouldings were exported

earning RM 5 mil. along with 40,761 cu.m of

particleboard (RM 19 mil.); 63,814 cu.m of MDF (RM 90

mil.); 5,061 cu.m of laminated board/flooring (RM 12

mil.) and, 105,800 tonnes of woodchips/particles (RM 20

mil.).

¡¡

4. INDONESIA

Error in EU statistics, Indonesia

furniture exports to

EU fall sharply

In the June issue of this market report statistics on

Indonesian furniture imports by the EU were presented.

Specifically our report said:

¡°Indonesia¡¯s Ministry of Trade has data (from the EU)

showing wood product exports, mostly furniture, more

than doubled to US$416 million in the first quarter of this

year, compared to US$194 million in the same period last

year¡±.

As yet unconfirmed reports say that the data provided to

Indonesian authorities by the EU was incorrect due to a

statistical error in Belgian import data.

The value of the Belgian imports of Indonesia furniture in

January 2013, as provided by the Belgian Statistical

Office, was not euro 200 million.

It is more likely that imports were in the region of euro 4-5

million. The Belgian Statistical Office said it will publish

revised data in September 2013.

It is now forecast that first quarter 2013 EU imports of

furniture from Indonesia will be around euro 100 million

instead of the euro 296 million reported by the EU. If this

is the case then EU imports of Indonesian furniture

actually fell around 15%.

Illegal logging bill approved after 11 years

The Indonesian parliament has now approved a bill on

prevention and eradication of deforestation but this has

attracted criticism from environmentalists who say the

Ministry of Forestry has been given too much authority

under the new law.

The draft legislation was first submitted in 2002 as an

illegal logging bill but debate on the bill was delayed such

that it was first discussed by the House only in 2010.

The deputy chairman of House Commission IV overseeing

agriculture and forestry, Firman Subagyo, said the initial

draft only dealt with illegal logging but that since its

introduction to the House there was a clear need to expand

the legislation to include deforestation.

Firman said this legislation would go a long way to

providing the means for the Ministry of Forestry to

effectively protect the country¡¯s natural forest.

Environmental groups had strongly opposed the text of the

draft because of concerns it could result in indigenous

communities being denied access to the forests on which

they depend. Appropriate changes were made to the draft

before it was debated and approved.

The Minister of Forestry, Zulkifli Hasan, has reaffirmed

that the powers vested in his ministry to address illegal

logging and deforestation would not be used against

indigenous communities.

Indonesia-Australia Kalimantan Forest Conservation

Partnership to be reassessed

The Australian government has indicated it will not extend

the Indonesia-Australia Kalimantan Forest Conservation

Partnership in its present form and will halt a project in

Indonesia to restore and protect forests and peatland in

Kalimantan.

The Australian prime minister has met with his Indonesian

counterpart to discuss which elements of the original

project could be supported in the future.

¡¡

5. MYANMAR

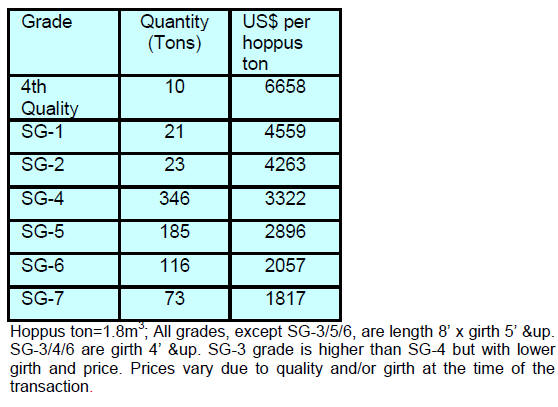

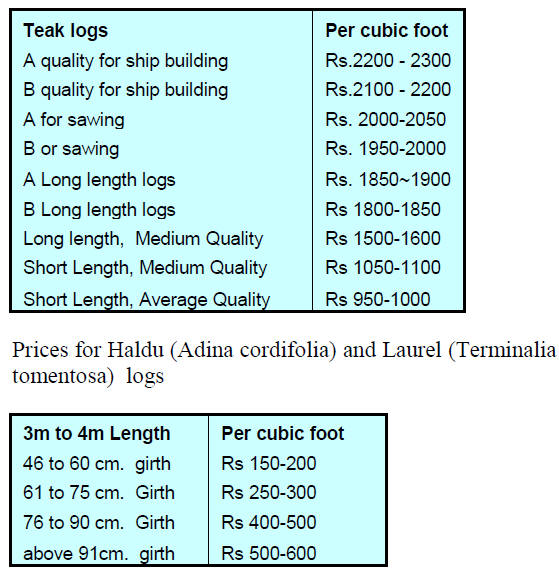

Teak log sales

The following prices were recorded for teak log sales

during competitive bidding on 21st and 24th June 2013

during the Myanma Timber Enterprise tender. The next

tender sale is in late July.

Teak harvests

to be drastically reduced

Teak harvests

to be drastically reduced

The State-run newspapers the Mirror Daily and the New

Light of Myanmar has reported that Myanma Timber

Enterprise (MTE) is drastically cutting its annual

harvesting.

MTE is still the sole agency responsible for harvesting,

extraction and distribution of logs in Myanmar.

This reduction in harvest is said to be with a view to

stopping the decline in forest cover in the country.

Maintaining the forest cover is seen as key to

preventing

natural disasters, especially floods, as more efficient water

resource management will be possible.

The newspapers also reported that MTE harvested about

268,900 Hoppus tons (HT) of teak and 1,391,600 HT of

other hardwoods during the financial year 2012-13. The

target for 2013-14 will be about 180,000 HT teak and

about 800,000 HT of other hardwoods.

Analysts suggest the sharp reduction in harvests is to take

account of the current processing capacity in the country

which is insufficient to handle the volume of logs that

would become available if past annual harvest levels were

maintained after the log export ban is introduced in April

2014.

The Daily Eleven newspaper of 10 July reported that in

answer to questions in the Amyotha Hluttaw (Upper

House of Parliament), Win Tun, Minister of

Environmental Conservation and Forestry (MOECAF),

said 600,000 HT of hardwood logs will be sold by open

tender to private saw-millers in the country to satisfy

domestic sawnwood requirements.

He also mentioned that, compared to harvest levels last

year, teak harvests would be reduced by 40% and harvests

of non-teak hardwoods will drop 45%.This is a very

significant reduction in log harvests.

Under these circumstances analysts with long working

experience with MTE are making informed guesses on the

availability of logs for export sales during the current

fiscal year. Of the teak logs to be harvested this year more

than 20,000 HT will be requited by mills and plant run by

the MTE leaving only about 160,000 HT for export in log

form.

Of the 800,000 HT of non-teak hardwood logs to be

harvested this year about 600,000 HT is expected to be

processed by domestic mills, about 100,000 HT will be for

the MTE plywood factories and other plants and MTE will

have to supply about 100,000 HT to joint venture

companies producing plywood and other wood based

products.

If these assumptions are correct, say analysts, the planned

harvest reduction will leave few logs available for export.

Until now Myanmar relied on the export of logs and sales

of value added products for income generation but with

the proposed harvest reductions the country may not be

able to achieve its export earnings target.

Greenply Industries of India invests in Myanmar

Daily Eleven News reported that the Myanmar Investment

Commission has approved an investment by an Indian

based company, Greenply Industries Ltd. (India), for

production of wood based products.

A new production facility will be built at the Dagon Port

Industrial Zone.

In related news the paper quoted an official from

MOECAF as saying Asian, US, and EU investors are also

planning to invest in the wood processing sector in the

country.

¡¡

6.

INDIA

Smuggling of red sanders continues

Illegal felling and smuggling of high value timber is in the

news again in India. The Enforcement Directorate of India

has intercepted 13 containers containing 200 tons of red

sanders and has arrested the trader and seized his assets.

The Indian media are saying that just this one trader

exported more than Rs.1000 million before the arrest.

This much sought after wood ultimately ends up in several

of the main Asian markets where it is used for the

manufacture of musical instruments amongst other high

value items. While this single arrest is a step in the right

direction analysts in India can only guess at how much

more of this precious wood is being smuggled by how

many other traders.

Sales of teak and other hardwoods at western Indian

forest depots

Auctions were held at Ahwa, Borkhet, and Waghai depots

of the Dangs Forest Division. Auctions were also held at

various depots of the Rajpipla and Vyara Forest Division.

Approximately 7,000 cubic metres of teak and about 4,000

cubic metres of non-teak hardwoods were sold.

Because the monsoon has set in buyers know that future

auctions may be postponed so there was active bidding for

the available logs which pushed prices slightly higher than

in previous auctions.

Average prices recorded at the most recent auction are as

follows:

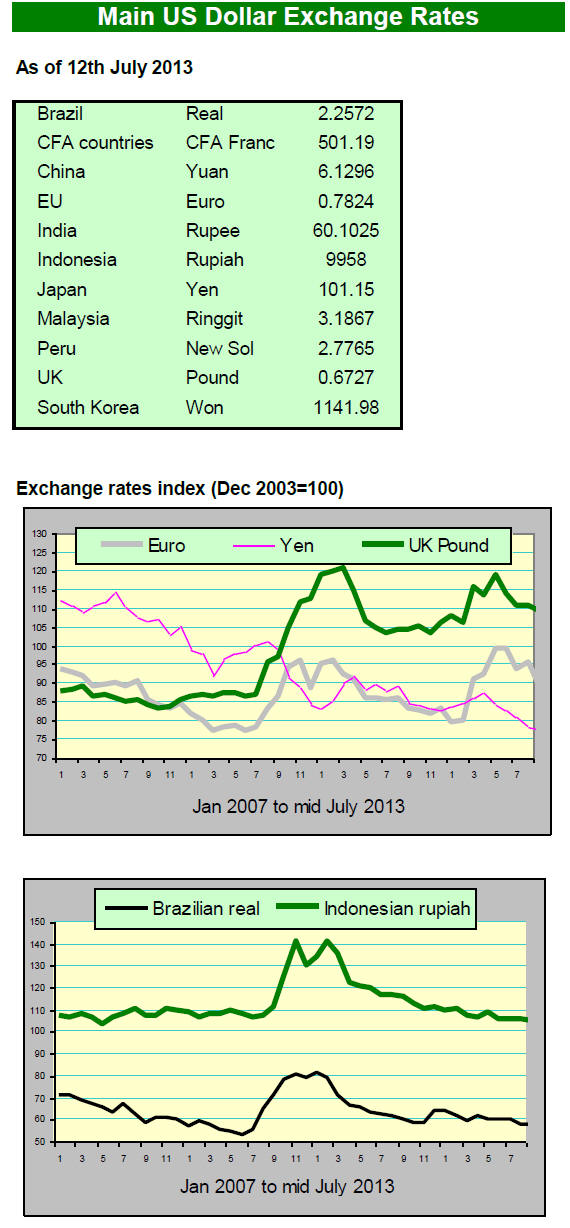

Plantation teak imports

Plantation teak imports have slowed due mainly to the

sharp depreciation of the rupee against US Dollar, the

main currency used in this trade. Indian importers try to

effect payments quickly so as to secure the best exchange

rate as the rupee continued to weaken.

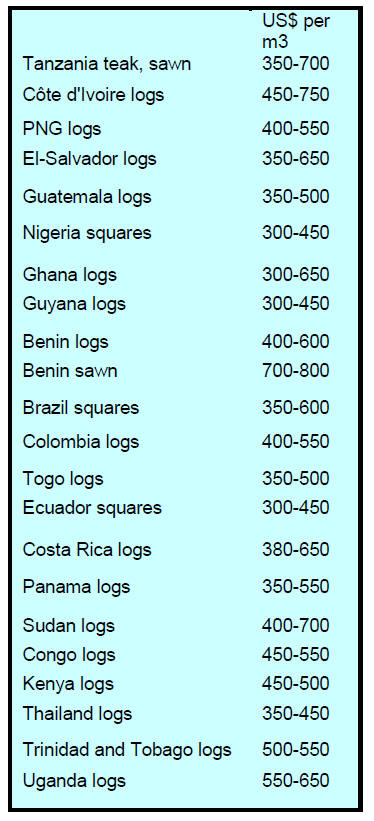

Current prices, C & F Indian ports per cubic metre are

shown below.

Variations are based on quality, lengths of logs

and the average

girth of the logs.

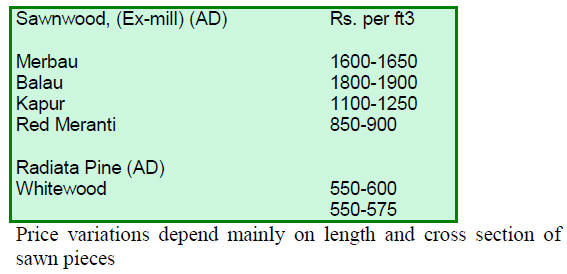

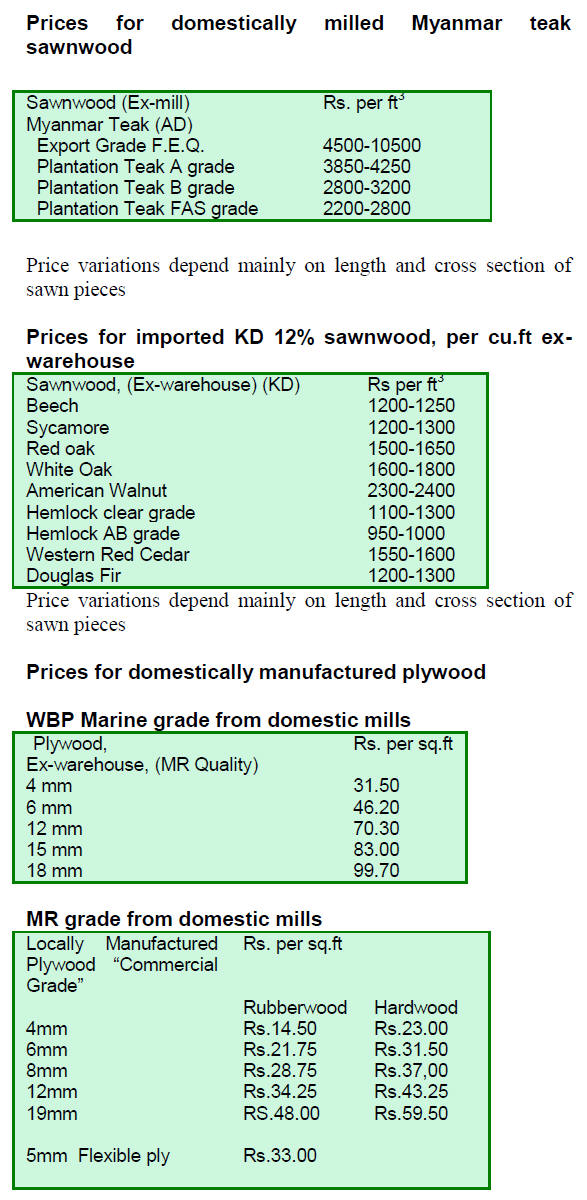

Domestic prices for sawnwood

The domestic prices for air dried sawnwood remained

unchanged over the past two weeks.

Monsoon planting season underway

The monsoon has arrived in India and this is the time for

planting. The Forestry Departments of many states are

cooperating and distributing saplings of fruit bearing trees

which also yield good quality of timber such as jack fruit

(Artocarpus spp,) jambhul (Eugenia spp,) kokum

(Garcinia spp.), wild badam (Terminalia catappa) and

tamarind (Tamarindus indicus).

Nurseries in Mangalore are distributing sandalwood and

red sanders saplings in addition to teak and mahogany.

According to a press release from the Maharashtra

Forestry Department during last year¡¯s planting season the

state government supported the planting 77 million

saplings over an area of 75,000 hectares and for this

season they have prepared 145 million saplings.

Products from many trees in India have medical uses

and

quite a few are of religious significance also. Such trees

include ashok (Ashoka sarica), bael or bilva (Aegle

marmalosa), sacred fig, Peepal (Ficus religiosa), banyan,

(Ficus bengalenses) and nagkesar (Mesua ferrea). Such

trees are also planted during the monsoon period.

Himalayan state of Uttarakhand launches disaster

early warning initiative

Last month the Indian Himalayan state of Uttarakhand

suffered devastating flash floods and land slides after three

days of extremely heavy rain. The flood and landslides

resulted in unprecedented devastation and loss of life and

property.

The state authorities believe the extent of the disaster was

made worse because of heavy deforestation, uncontrolled

mining activity and building along river banks. More than

10,000 are feared dead and the government is still

assessing the extent of casualties.

To limit damage from such disasters in the future the state

government has launched a programme which will provide

regular assessments of the status of glaciers, forests, rivers,

soil etc. to be used as a basis for disaster prevention

initiatives.

7.

BRAZIL

Tax hike hits wood product

manufacturers

The tax on industrialised products (IPI) was raised as of 1

July and this has affected furniture, wood panel and veneer

manufacturers. The new IPI rates for these three products

will go from 2.5% to 3% and will be effective until a

review in September.

The Ministry of Finance pointed out that they have no

room for exemptions and asked the timber sector

representatives not to pass along the tax increase to

consumers to avoid adding to inflationary pressures.

According to the Institute for Retail Development of

(IDV), there is a dilemma between the government's

commitment to fiscal adjustment and the desire to

maintain the competitiveness of the items listed in the

programme. Representatives of Walmart Brazil say that

this change in tax rate will have a major impact on sales

Partnership benefits small furniture companies

A furniture cluster in Belo Horizonte, Minas Gerais state

will benefit from the recently launched Technology

Services Network (Rede de Serviços Tecnol¨®gicos - RST).

The RST will benefit almost 200 micro and small

companies in the city of Belo Horizonte and the

municipalities of Par¨¢ de Minas and Carmo do Cajuru in

the Midwest region of the state. The RST has a budget of

R$ 2.6 million for activities until 2016.

The RST is a project within the Supporting Service for

Micro and Small Businesses (SEBRAE) implemented in

partnership with the Inter-American Development Bank

(IDB) and the Center for Technology and Quality of

Furniture Industry (Cosmob), with support from the

United Nations Development Program (UNDP) and the

Multilateral Investment Fund (MIF).

The objectives of the RST include improving the quality

of furniture parts manufactured by small companies,

improving manufacturing processes and introducing the

application of advanced design methods. Incentives will

be provided for the development of prototypes and

investigation of new technologies appropriate to the

sector.

In 2008, in the states of Amazonas and Par¨¢, a similar

programme was implemented called the SEBRAE-IDBCosmob

partnership. The idea was to create

competitiveness and disseminate technical solutions

suitable for small companies.

After the successful experience in the Amazon, the state of

Minas Gerais will now implement a similar project after

which the project activities will be extended to the

furniture sector of Arapongas, in the state of Paran¨¢. In

total, the RST project, with a budget of R$ 16 million, will

involve 1,214 companies.

Amazon fund approval for forest monitoring project

The Brazilian Development Bank (BNDES) has offered

RS 23 million from the Amazon Fund to the Organization

of the Amazon Cooperation Treaty (OTCA), an

intergovernmental organization formed by Bolivia, Brazil,

Colombia, Ecuador, Guyana, Peru, Suriname and

Venezuela, whose territories comprise about 99% of the

Amazon biome.

With this latest disbursement the Amazon Fund will have

invested in 37 projects valued at R$462, 8 million the aim

of all projects is to address deforestation and sustainable

development.

The Amazon Fund initiative began in 2011 and has the

support of the Brazilian Ministry of Foreign Affairs and

the Ministry of the Environment which includes the

National Coordinating Institution for deforestation control.

The Brazilian National Institute for Space Research

(INPE) will participate in the project providing training

and technology for the forest cover monitoring. This

technology was developed with support from the German

agency for international technical cooperation and the

International Tropical Timber Organization.

Currently there are no accurate data on the forest cover

and deforestation in the OTCA countries, except Brazil.

This project ¡°Forest Cover Monitoring in the Amazon¡±

will deliver support to other OTCA countries in respect of

satellite image analysis, access to forest cover monitoring

technologies, national forest monitoring planning as well

as harmonisation of institutional capacity for land use

change monitoring and surveys.

The programme will also support regional cooperation to

combat illegal deforestation and the sharing of experiences

related to public policy instruments for the reduction of

deforestation rates.

Rio Grande so Sul regains leadership in furniture

exports

The state of Rio Grande do Sul (RS) has once more taken

the lead in terms of international sales of furniture with

US$ 76 million exported between January and May 2013,

a 4.9% increase compared to the same period in 2012.

The second ranked exporter was Santa Catarina state with

just over US$ 75 million in exports, a 2.9% drop from the

same period in 2012. Exports of furniture from Paran¨¢ and

São Paulo trail the leaders.

The main countries that imported furniture from Brazil up

to May this year were Argentina (US$52 million), the

United States (US$ 38 million), the United Kingdom

(US$30 million) and Peru (US$16 million).

Furniture from Rio Grande do Sul was exported mainly to

the UK (US$10 mil.), followed by Uruguay (US$9.8 mil.),

Peru (US$8.6 mi.) and Chile (US$8.3 mil.).

According to the Association of Furniture Industries of the

State of Rio Grande do Sul (MOVERGS), there are still

serious obstacles hampering growth of furniture exports

from Rio Grande do Sul. The association has said the state

needs a robust trade policy to increase competitiveness of

the furniture sector.

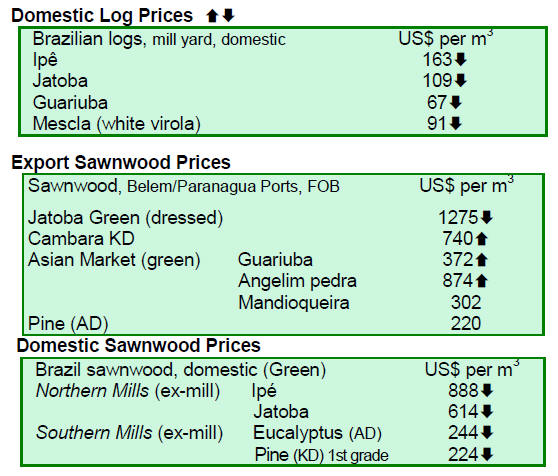

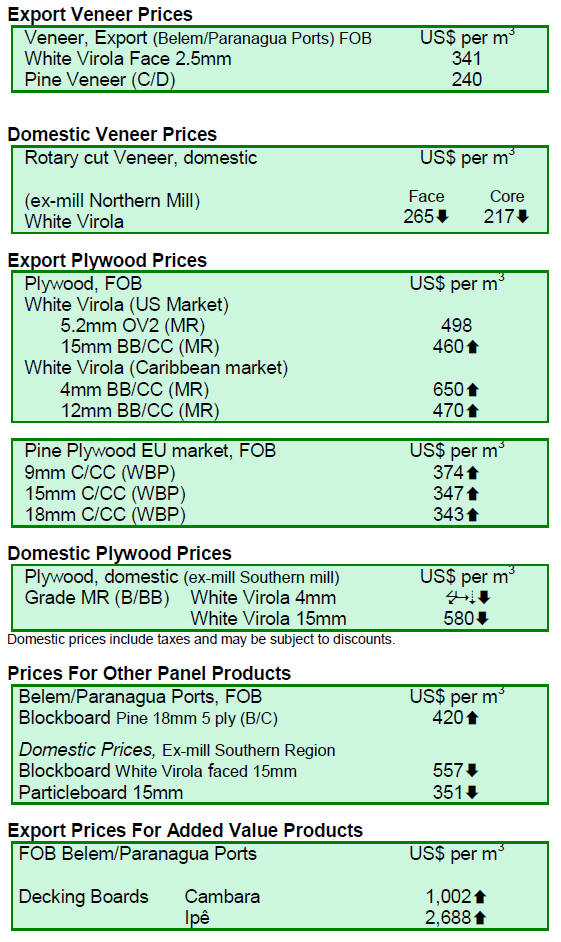

Price movements

Prices of wood products in the domestic market increased

by around 0.3% compared to prices in the previous

fortnight.

The values in US dollars, as shown in the table below,

below fell on average by 4.6% because of the depreciation

of the Brazilian currency against the US dollar.

¡¡

8. PERU

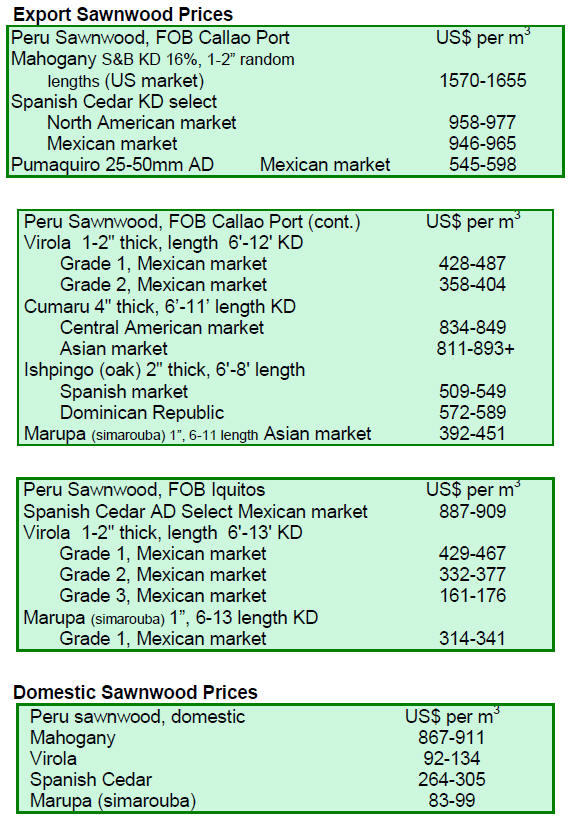

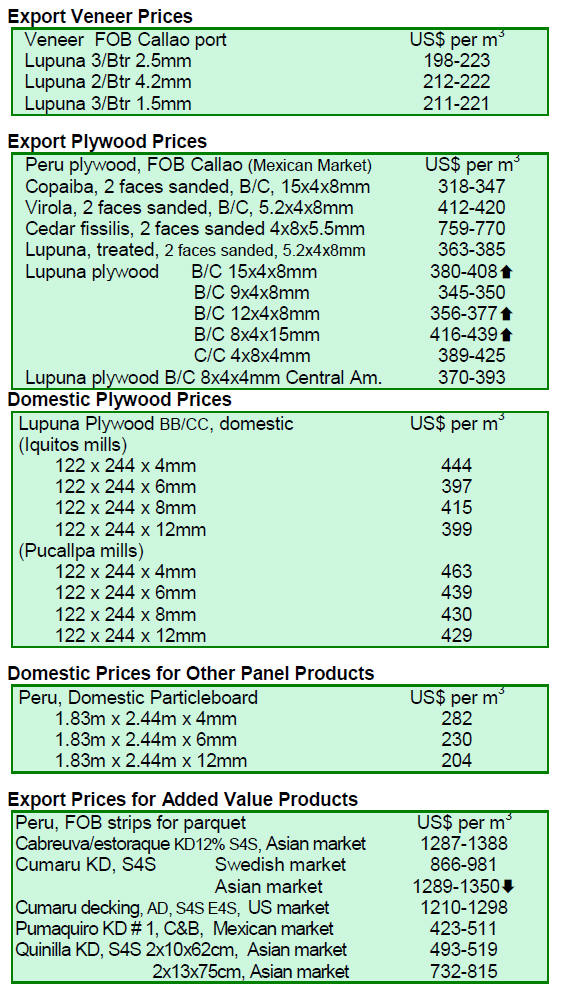

Exports fall 15 percent

According to the Export Association of Peru (ADEX),

exports in the period January ¨C April 2013, were US$47.2

million FOB compared to US$55.5 million FOB in the

same period last year representing a decline of almost

15%.

To-date, the three main export markets were China,

Mexico and United States and these three markets

accounted for just over 70% of all wood product exports.

Imports by the Dominican Republic increased

significantly over the previous year.

The main product of interest in the Chinese market was

hardwood flooring while for the US the two most traded

items were kiln-dried sawnwood and plywood.

China actively buying sawnwood and processed

products

Exports of sawnwood in the period January ¨C December

2012 represented the 38% of all wood product exports and

for 2013, up to April, sawnwood exports totalled US$18.1

million FOB but in the same period in 2012 the value of

sawn exports was US$22.9 million FOB.

Sawnwood from Peru was shipped mainly to buyers in

China which accounted for about 30% of all sales up to

April 2013.

Exports of semi-manufactured products up to April this

year accounted for 37% of all wood product exports. The

cumulative value of exports of semi-manufactured

products up to April this year was US$17.3 million FOB

representing a decline of over 10% on the value of exports

in the same period in 2012.

Once again the main market for semi-manufactured wood

products was China (58%) however, demand in Mexico

and Sweden improved significantly compared to the same

period in 2102.

US the main market for veneer and plywood exports

Exports of veneer and plywood up to April 2013 were

US$5.6 million FOB compared to the US$7.2 million in

the same period in 2012 representing a 23% drop. The US

is the main market for veneer and plywood exports and

this market accounted for 62 % of all exports of these

products.

Exports of furniture and furniture parts had been growing

over the past few years but, for the year to-date, the value

of exports is down. Up to April 2013 exports of furniture

and furniture parts totalled US$ 2.3 million FOB a drop of

around 7% on the same period in 2012.

9.

GUYANA

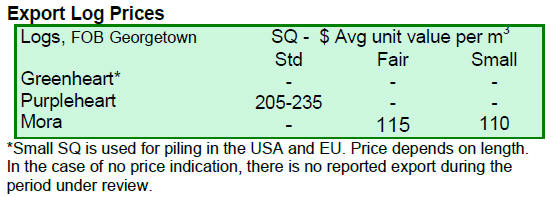

Wamara log exports to China

In the period under review there were no log exports of

major commercial species except wamara (Swartzia

leiocalycina) which was exported to buyers in China at

acceptable prices in the region of US$120 per cubic metre.

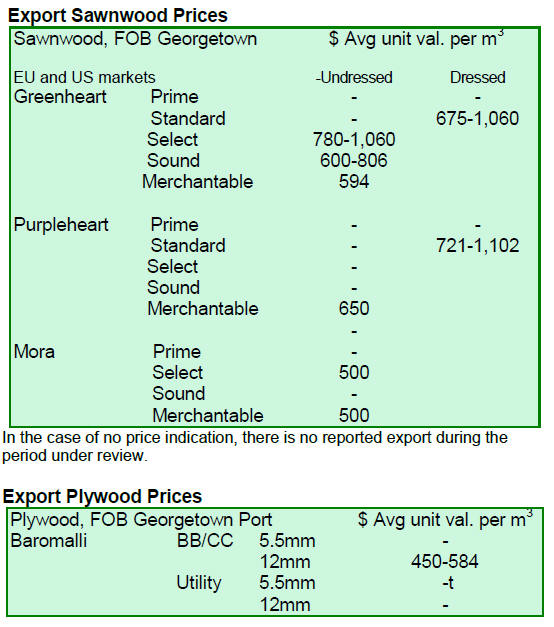

On the other hand sawnwood exports held up and prices

were considered favourable during the period reviewed.

Good prices secured for sawn greenheart and

purpleheart

Sawn Undressed greenheart (select) top end FOB prices

increased from US$1,060 to US$1,230 per cubic metre

and greenheart (merchantable) export prices were also

favourable at US$636 per cubic metre FOB.

The main markets for this prime timber were Caribbean

nations, Europe and North America.

Undressed purpleheart (select) FOB prices moved up and

the best price secured was US$1,100 per cubic metre FOB.

The main markets for undressed purpleheart include North

America and the Oceania countries.

Undressed mora (select and sound) is in demand in

the

markets of Australia, the Caribbean, Europe and North

America. Export FOB prices were good at US$500 per

cubic metre. Dressed mora sawnwood export prices

remain unchanged.

Firm demand in Caribbean markets but washiba is the

favourite in N. America

Dressed greenheart low end price saw an increase from

US$675 to US$721 per cubic metre FOB while top end

FOB prices remained unchanged at US$1,060 per cubic

metre.

Dressed purpleheart prices remained unchanged during the

period reviewed. In recent weeks demand from buyers in

the Caribbean has grown for the prime commercial timber

species from Guyana.

Guyana¡¯s ipe is attracting favourable prices in the export

market and recently prices moved as high as US$ 2,550

per cubic meter FOB.

Splitwood export prices can in firm and averaged

US$1,023 per cubic metre FOB in the Caribbean and

North American markets.

Guyana Expo 2013 focuses business partnerships for

delivery of low cost homes

The construction and real estate sectors contributed an

average of around 11 percent to GDP over the past four

years and the value of output from the two sectors in 2012

ranked the fourth largest after agriculture, wholesale and

retail services and mining.

The recent Building Expo 2013 focused on the

development of partnerships between local companies and

those form outside the aim being diversification of the

production base.

The minister of the Central Housing and Planning

Authority, Irfaan Ali, said that there has been tremendous

growth in the housing sector over the past four years as

part of the government¡¯s effort to create a winning

environment ¡°we must build tomorrow¡¯s infrastructure

today therefore major projects that the government is

engaged in now will definitely boost Guyana¡¯s economy,¡±

said the minister.

Private Sector Commission Chairman Mr. Ronald Webster

emphasised the significance of the construction sector to

Guyana¡¯s economic well being. He said that globally the

construction and real estate sectors are the cornerstone of

economic growth.