|

Report

from

Europe

EU plywood imports reflect construction downturn and EUTR

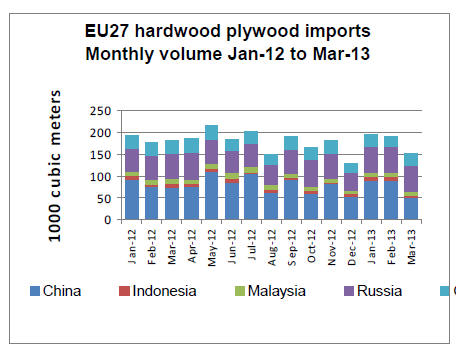

Monthly data for EU27 hardwood plywood imports suggests that

European trade in this commodity is coming under pressure from the

combined effects of the recent slowdown in European construction and the

enforcement of the EU Timber Regulation (EUTR) from 3 March onwards (

see chart ).

The latest data 每 to the end of March 2013 每 is the first to record

trade levels immediately before and after the EUTR deadline.

The data shows a fall in imports in December 2012 每 a much sharper dip

than is usual in the run up to the holiday season 每 followed by a surge

in imports in January and February 2013. Then, between the second and

third months of the year, imports fell by over 20% to only 150,000 m3 in

March 2013. This is significantly lower than normal for the time of

year.

Overall the data supports the narrative that European consumption of

plywood is weakening with declining construction activity, particularly

since the middle of 2012.

However EUTR encouraged a surge in imports in the weeks before

enforcement, so that stocks built up in excess of market demand. This

surge tailed off following introduction of EUTR.

The data shows that there was a particularly large increase in imports

from China in January and February 2013, but that imports from this

country fell by 40% in March.

The main question now is whether the March downturn is indicative of a

long term trend or merely short-term indigestion after the rush of

imports in the opening weeks of 2013.

There*s some uncertainty over just how long it will take to work through

the excess stock of Chinese plywood built up in Europe in advance of

EUTR enforcement. In the latest TTJ article on the UK plywood market,

one importer claims that ※a lot of that stock has gone 每 I don*t think

there is as much as people think there is§. Another added: ※there have

been stocks, but holes are appearing. Supplies of thin panel in

particular are not plentiful§.

Larger Chinese manufacturers adapting quickly to EUTR

It*s still early days, but so far the signs are that the downturn in

imports from China may be short lived. The larger Chinese manufacturers

are already demonstrating strong capacity to adapt to the new market

requirements.

The most immediate change may be just a switch in the face veneers used

by these manufacturers, away from species perceived in Europe to be

※high risk§ (such as bintangor or Russian birch), in favour of species

perceived to be ※low risk§ such as dyed poplar or certified meranti or

sapele.

Some of the smaller manufacturers in China may well struggle now to

compete in the EU market as buyers focus more on those manufacturers

that have chain of custody and are geared up to provide the required

evidence of legality. These changes are already increasing prices of

Chinese plywood products to European buyers.

EUTR is tending to reinforce other commercial trends that were already

limiting opportunities for smaller manufacturers and encouraging higher

prices for Chinese plywood.

These include higher quality standards with imposition of the EU*s

Construction Products Regulation (CPR) from 1 July 2013 and rising

labour and material costs in China itself.

In coming months, China may become slightly less dominant in the EU

plywood market. However it*s likely to maintain its position as the

largest single supplier.

Chinese plywood prices may now be rising for EU buyers, but they remain

highly competitive. For example, European CIF prices for 18 mm C=BB/CC

Mixed Light Hardwood plywood from China were around $380/m3 in the last

quarter of 2012.

Prices for comparable Chinese plywood with an FSC certified sapele face

and eucalyptus core now stand at around $420-440/m3. Even these prices

are still $100/m3 less than those for 18 mm BB/CC meranti from Malaysia

and $150/m3 below prices for Indonesian lauan plywood.

Exporters in other countries wishing to regain market share for tropical

hardwood plywood in the EU market need to do more than provide new forms

of legality verification at a competitive price. They need to focus at

least as much on the considerable quality and technical performance

benefits of their products.

New opportunities might arise following introduction of the CPR which

implies much wider and more effective mandatory enforcement of CE

Marking standards, including conformance of structural plywood to the

EN13986 standard.

Malaysia sees short-term benefits from EUTR

European importers report that Malaysia has seen some short-term

benefit from implementation of EUTR, with demand for PEFC certified

BB/CC grades of meranti-faced plywood rising a little in recent months.

Some EU buyers appear at least temporarily to have switched away from

Chinese hardwood plywood products due to lack of confidence in

assurances offered on legal status of hardwoods imported into China.

In recent weeks, European importers have been able to source PEFC

certified Malaysian hardwood plywood without difficulty, although the

switch to Malaysia has meant they are paying significantly higher prices

than they used to in China.

Slowdown in imports of Indonesian plywood

Comparatively high prices are currently deterring European buying of

Indonesian plywood, despite these products being well known for their

quality and now arriving in the EU with V-Legal documents.

It*s notable that EU imports from Indonesia declined from 9800 m3 in

February 2013 to 4400 m3 in March 2013. This trend may be driven mainly

by weak European consumption, but could also be related to Indonesia*s

rolling out of the V-legal system for all exports to the EU during the

first quarter of 2013.

According to the German timber trade journal EUWID, most Indonesian

plywood imported into the EU was formerly classified under tariff code

44123190 which is subject to a 3.5% import tariff.

However more accurate information on species content supplied with the

V-legal documents has led to some product being reclassified as 44123110

subject to a higher tariff of 6.5%.

The latter tariff applies to plywood faced with various higher value

tropical hardwoods including several Asian species such as dark red

meranti, light red meranti, and white lauan.

Very slow European market for okoume plywood

Early optimism that EUTR might feed through into improved demand for

okoume plywood manufactured in Europe or in Africa has so far been

disappointed. Manufacturers of okoume plywood have been trying to force

through price increases in Europe in an effort to widen very tight

margins.

However European demand for okoume plywood remains very weak. There was

a brief increase in European buying in the opening months of the year,

but this has fallen away again following manufacturers* price rises

introduced from April onwards.

Okoume plywood consumption in the main markets of France and the

Netherlands has been very slow this year. While there are reports of

delivery delays for okoume plywood manufactured in Gabon, low

consumption has meant that supply has not been a significant issue for

the European trade.

European plywood manufacturers under intense pressure

EUWID report that Europe*s domestic plywood industry has been

struggling seriously in the face of mounting costs and the intense

competition from overseas suppliers. Key problems have been high

roundwood prices and wage costs relative to other parts of the world.

With the added pressure of weakening consumption in the European

construction sector, profit margins are now being reduced to

unsustainable levels. Some suppliers have been forced to file for

insolvency, while others have had to postpone or cancel plans for

investment in new plant and machinery.

According to EUWID, the problem has been especially difficult in the

European poplar plywood sector which added a significant amount of new

production capacity just before the economic downturn.

For example, one Spanish plywood producer completed two investment

projects in Spain and France in mid-2009 which boosted the group*s

poplar plywood manufacturing capacity from 60,000 m3 to 210,000 m3.

However this came on-stream just as consumption was falling and led to a

significant decline in prices and much lower margins across the whole

industry.

Europe*s okoume plywood market has also suffered badly from the

long-drawn out failure of the French producer Plysorol.

Various investors had shown an interest in the company, according to

EUWID primarily in order to take control of Plysorol*s concessions in

Gabon. After these efforts failed, the company eventually went into

liquidation in September 2012.

Since then the company*s remaining stocks have been sold off at a series

of auctions, the latest in May, undermining demand for other suppliers*

products.

Softwood plywood

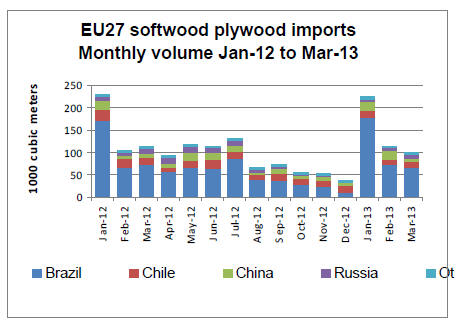

EU imports of softwood plywood during the opening months of 2013

followed a slightly different pattern to the previous year (see Chart).

EUTR may have been partly responsible.

This year the usual January surge in imports on opening of the EU*s annual

quota was at the same level as in 2011.

Total imports in February 2013 were also at a similar level to February

2012, but with a larger volume from China offsetting a decline from

Chile. In March, after enforcement of EUTR, imports fell away quite

significantly, notably from China and Brazil.

By the end of March 2012, total softwood plywood imports into the EU for

the year had reached 441,000 m3. Around two thirds of the 650,000 m3

duty-free quota was already accounted for.

Of total imports during the first quarter of 2013, 72% was from Brazil, 9%

from Chile, 11% from China and 5% from Russia.

European consumption of softwood plywood is currently slow. Brazilian

exporters of elliotis pine plywood have been raising prices in response

to tight log supply and good plywood demand in the United States and

Caribbean.

However sales prices in Europe have been declining as importers are

struggling to sell on landed stocks. The usual seasonal increase in

demand in April and May has been much slower than in previous years.

* The market information above has been generously provided by the

Chinese Forest Products Index Mechanism (FPI)

|