|

Report

from

North America

Suppressed government spending holding back economic growth

Real GDP increased at an annual rate of 2.5% in the first quarter of

2013, according to the first estimate by the US Department of Commerce.

Higher personal consumption, private investment, exports and a stronger

construction market contributed to the higher GDP growth rate. Lower

government spending had a negative effect on GDP growth.

GDP growth could reach 4% in 2013 if public spending would recover,

according to the International Monetary Fund.

The unemployment is slowly edging down. It declined from 7.7% in

February to 7.5% in March, according to the US Bureau of Labor

Statistics. Home builders report that they are not able to hire enough

qualified workers.

Many workers have left home construction when the housing market

collapsed and they work in other industries now. Higher wages in other

industries are also attracting workers away from construction.

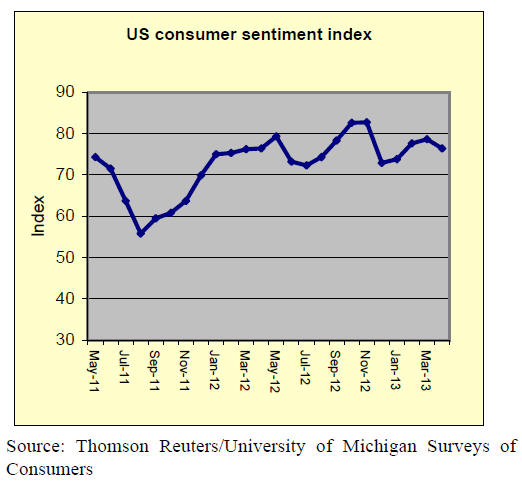

Consumers worry that economic recovery may waver

Consumer confidence in the US economy declined from March to April,

according to the Thomson Reuters/University of Michigan consumer

sentiment index.

Consumer spending increased because of rising home prices and stock

prices, but consumers worry that the economy will not continue to

expand.

Upper income households in particular have increased spending. The

majority of consumers do not expect the employment situation to improve

this year.

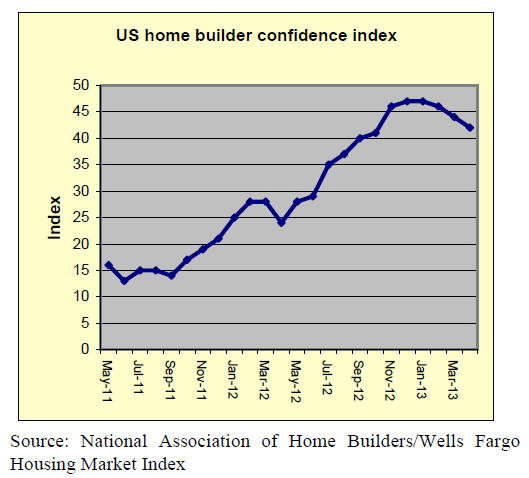

Lack of qualified workers affects builders¡¯ confidence

Builder confidence in newly built single-family homes declined again in

April, according to the National Association of Home Builders.

Home builder confidence has been falling since January, despite

improving demand for new houses.

Finding qualified workers remains a problem in the areas where demand for

new homes is strongest (Arizona, California, Texas, Colorado and

Florida). Many Hispanic immigrants have left the US, especially to

Mexico where the economy is doing very well.

The National Association of Home Builders reported in March that half of

the builders questioned had to delay construction work because of a lack

of labour.

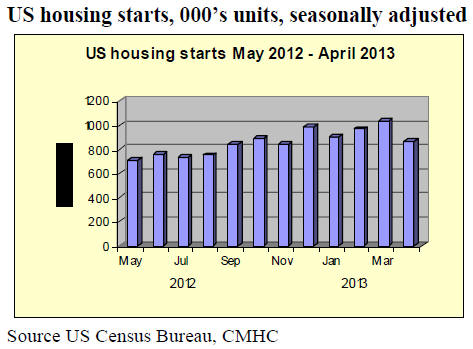

Housing starts exceeded one million in March but fall back in April

US housing starts passed the one-million mark in March for the first

time since 2008. The increase was mainly due to high demand for rental

apartments.

The number of total starts rose to 1.036 million homes in March

(seasonally adjusted annual rate), up by 7% from February.

Multi-family starts increased by 31%, while single-family starts fell by

5%. The share of single-family homes in total starts declined to just

60%.

However, the growth in starts was not sustained in April as starts fell

back to 870,000 units. Analysts did not read too much into this decline

as applications for building permits rose 14.3 percent in April to a

rate of 1.02 million, the highest since June 2008.

The number of building permits issued was 902,000 in March (seasonally

adjusted annual rate), down 4% from February. The number of permits

issued is usually an indicator of future building activity.

Sales of existing homes fell again in March, mainly because of an

insufficient supply of homes on the market. The supply of homes for sale

was at 4.7 months in March (i.e. they would sell out in 4.7 months at

the current sales pace). A 6-month supply is considered a balanced

market between sellers and buyers.

Higher home prices would encourage more home owners to sell, but price

increases remain modest. Home prices increased by 1.9% from February.

The strongest recovery in home prices was in the West (Nevada,

California, Arizona, Idaho and Oregon).

Little change in Canadian housing market

Canada¡¯s housing starts remained stable in March. The Canada Housing and

Mortgage Corporation forecasts lower housing starts in 2013 compared to

the previous year.

The exception is British Columbia where home construction will rise

moderately. A slower housing market is expected to slightly reduce

economic growth in Canada this year.

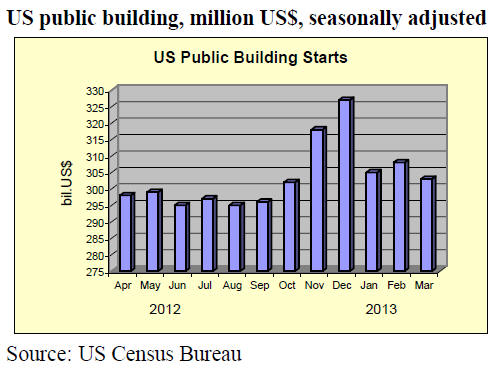

US non-residential construction market still slow

Spending on non-residential building construction in the US declined by

1.9% in March compared to the previous month (at a seasonally adjusted

rate). Private construction decreased by 1.5% in March, while public

construction fell by 3% due to reduced government spending.

Architecture firms with a commercial/industrial specialization reported

better business conditions in March, according to the Architecture

Billings Index. However, business in the non-residential sector

continues to lag residential construction.

Significantly lower plywood imports from China in March

Plywood imports from China have dropped significantly since the US

Department of Commerce announced in February the preliminary

countervailing duties on Chinese plywood. Imports of other wood products

were largely stable in March, except for a decline in furniture imports.

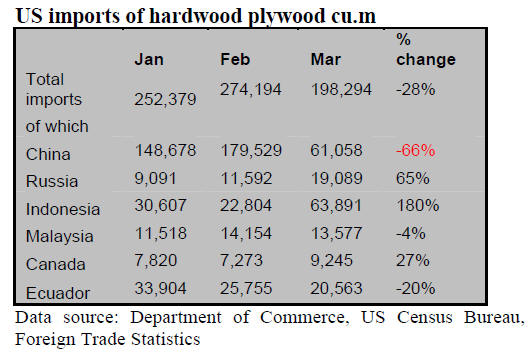

Hardwood plywood imports fell in March due to significantly lower

imports from China. Total hardwood plywood imports were 198,294 cu.m in

March, down 28% from February. Imports remain higher than in 2012 (+28%

year-to-date).

Imports from China fell from 179,529 cu.m in February to 61,058 cu.m in

March (-66%). Imports from Indonesia surpassed imports from China in

March. Indonesian shipments increased to 63,891 cu.m (+104%

year-to-date).

Imports from Malaysia were 13,577 cu.m in March (+67% year-to-date).

Shipments from Ecuador were 20,563 cu.m (+470% year-to-date). Ecuador

has been the third-largest supplier of hardwood plywood so far in 2013,

after China and Indonesia.

Hardwood moulding imports decline

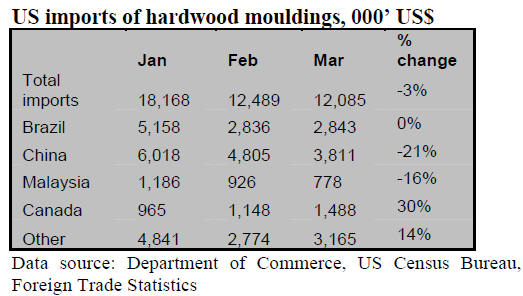

Hardwood moulding imports declined further in March to $12.1 million

(-15% year-to-date). Imports from Brazil remained stable from February

at $2.8 million, (-19% year-to-date).

Hardwood moulding imports from China were worth $3.8 million (-23%

year-to-date). Imports from all other major suppliers also declined in

March.

Imports of hardwood flooring from China nose dive

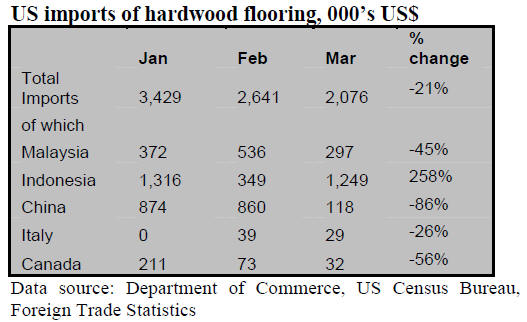

Hardwood flooring imports declined further to $2.1 million in March.

Indonesia¡¯s shipments more than doubled to $1.2 million in March (+326%

year-to-date).

Malaysian hardwood flooring exports were worth $0.3 million in March

(-40% year-to-date). Imports from China decreased to $0.1 million in

March (+59% year-to-date), but it remains the second-largest supplier to

the US market in 2013 after Indonesia.

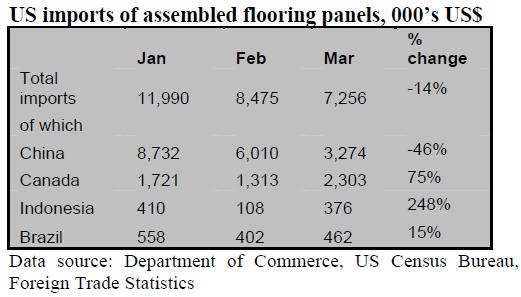

US imports of assembled flooring panels declined to $7.3 million in March,

and they are only 3% above year-to-date imports in 2012. Imports from

China fell to $3.3 million (-5% year-to-date).

Canada¡¯s shipments grew to $2.3 million (+15% year-to-date).

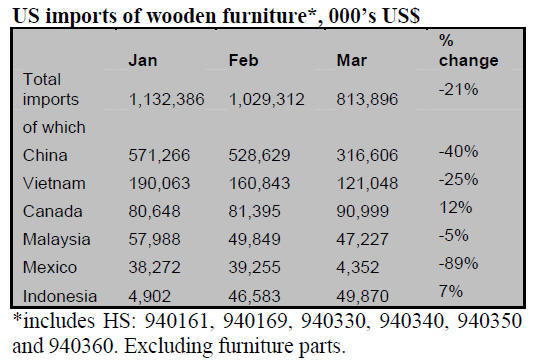

Wooden furniture imports growing despite March declines

US imports of wooden furniture fell below $1 billion for the first time

in the last 12 months. March imports were worth $813.9 billion, down 21%

from the previous month. Year-to-date imports are still 6% higher than

in 2012.

China¡¯s furniture shipments to the US fell to $316.6 million (+8%

year-to-date). Imports from Vietnam declined to $121.0 million in March

(+11% year-to-date).

Many US SMEs exit kitchen and bathroom cabinet manufacturing sector

Sales of cabinets for kitchens and bathrooms were severely affected

by the economic recession in the US. The low demand from new

construction and remodeling of existing homes continues to have an

effect on the industry today.

In the last five years industry concentration has increased because many

smaller companies had to close their business, according to a recently

released report by IBISWorld (Cabinet and Vanity Manufacturing in the

US).

However, the majority of US cabinet manufacturers remain small

companies. The four largest US manufacturers account for less than 25%

of sales.

Cabinet sales started to recover in 2011. Freedonia predicts cabinet

demand to grow by an average 8.2% per year to $15.3 billion in 2016

(Cabinets: US Industry Study with Forecasts for 2016 & 2021).

New housing is expected to be the strongest driver of demand, but the

renovation of kitchens and bathrooms remains an important market.

The trend to larger kitchens and larger cabinets will support demand,

according to Freedonia. The bathroom cabinet market is forecast to grow

6.5% per year to reach US$1.8 billion in 2016. More homes have multiple

bathrooms, which has a positive effect on cabinet sales.

Cabinet demand in non-residential applications is expected to grow 6.5%

per year to $2.8 billion in 2016. Growth in the construction of offices,

retail stores and hotels will support demand for cabinets.

Preliminary anti-dumping duties for plywood imports from China

The US Department of Commerce announced on April 30 the preliminary

anti-dumping duties on decorative plywood imports from China.

These duties were to come into effect on July 17 but, because two of the

affected companies requested the postponement of the deadline the entry

into force was delayed to allow for further investigation.

Those investigations have been concluded and the duties will come into

effect in July. The new duties will be added to the existing preliminary

countervailing duties, which range from 0.22% to 27.16%.

Two companies will not pay any anti-dumping duties (Linyi San Fortune

Wood Co. and Jiangyang Group).

Over 100 companies were assigned a preliminary anti-dumping duty of

22.14%. All other producers will pay the China-wide duty of 63.96%.

Plywood from China has an estimated 30% market share in the US. All

hardwood and decorative plywood is subject to the investigation and

duties, including plywood with face and back veneer made from softwoods

or bamboo.

Structural plywood and shaped plywood are excluded from the

investigation.

¡¡

|