Technical progress includes the development of a methodology to assess

private certification schemes and procedures for issuing legality

certificates, as well as the organisation of an independent audit.

With the EU Timber Regulation already in force but FLEGT licensing not

yet in place, Cameroon¡¯s timber producers and exporters must demonstrate

their compliance with the country¡¯s legal framework.

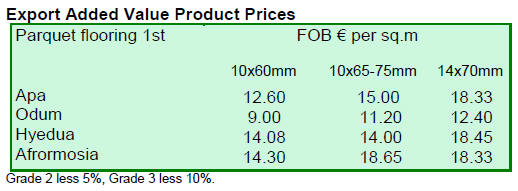

2. GHANA

Sawnwood exports generate bulk of first

quarter earnings

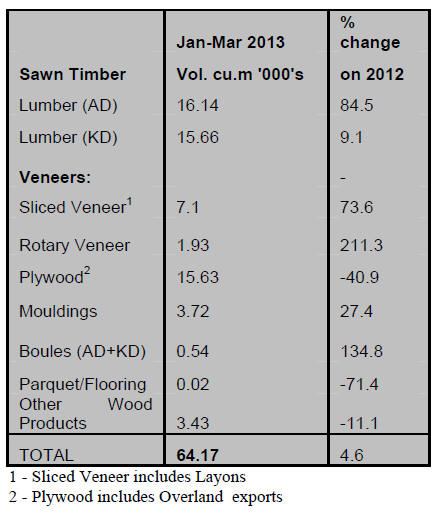

Ghana exported a total of 64,166 cu.m of wood products during the first

quarter of 2013 to earn Euro 29.48 million.

Compared to exports in the same period in 2012 there was a 4.6% increase in

export volumes and a 35% increase in export earnings in the first quarter

2013.

Exports of rotary veneer, boules, lumber (air and kiln dry), sliced veneer

and mouldings were the main driver of the increase in export earnings.

Exports of Air-Dry lumber (including overland exports) and Kiln-Dry lumber

together accounted for 47% of the total wood export volume for the first

quarter of the 2013.

Plywood exports were the second best performer accounting for 24% of the

total export volume. These three products together accounted for 68% (Euro

20.18 mil.) of the total value of exports for the quarter.

¡¡

EU remains main export market despite economic

downturn

Of the total Euro 29.48 million in export earnings from wood products in the

first quarter Europe emerged as the major destination accounting for 41% of

the trade. Imports by countries in Asia accounted for 25%, and this was

closely followed by imports by African countries at 23%.

Export of wood products from Ghana to ECOWAS countries for the period

Jan-Mar 2013 amounted to 17,558 cu.m compared to 26,204 cu.m recorded for

the same period in 2012.

Removal of fuel subsidy will lead to higher prices

From the 1 June the fuel subsidy was withdrawn and this, say analysts, will

result in price increases which will eventually have to be passed on to

consumers.

Ghana¡¯s budget deficit remains high and the Vice President, Kwesi Amissah-Arthur,

has said Ghana needs to renegotiate some resource contracts to increase tax

revenues and to give the country more fiscal room to maneuver.

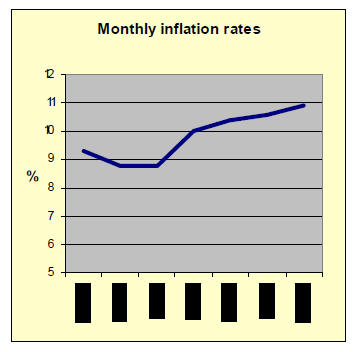

May inflation highest in three years

Ghana's annual consumer price inflation rose to 10.9 percent in May, the

highest in three years.

An increase in the annual rate of inflation from

10.6 percent in April was due to seasonal rises in the cost of education and

clothes and a scarcity of major food staples ahead of the next agricultural

harvest.

3. MALAYSIA

Malaysian Timber Council brochure sets

out scope of MYTLAS

The European Union (EU) Forest Law Enforcement, Governance and Trade

Voluntary Partnership Agreement (FLEGT VPA) is a mechanism to combat illegal

logging and facilitate trade in legal timber. The Malaysian government has

signalled its full support for this EU initiative and is in the final stages

of negotiation to conclude a FLEGT VPA.

Pending conclusion of negotiations for a FLEGT VPA with the EU, Malaysia

commenced implementation of a timber legality assurance scheme (TLAS)

designated as MYTLAS (Malaysia TLAS) on the 1February.

This is Malaysia¡¯s own initiative to assure the legality of its timber and

timber products exported to the EU. MYTLAS has also in place comprehensive

control procedures to ensure the exclusion of unverified timber.

A brochure for MYTLAS has been produced with

information on the scope of MYTLAS, its control procedures, institutional

arrangements and its implementation in Peninsular Malaysia.

The Malaysia Timber Council has said it is confident that MYTLAS meets the

requirements for due diligence on the part of EU importers under the EU

Timber Regulation.

For more information see:

www.mtc.com.my/issues/

Industry urged to consider species other than Acacia for plantations

Over the past weeks the timber industry in Malaysia was focused on the

Sarawak Grand Timber Expo and Conference 2013, held in Kuching in early

June. There were 112 exhibitors showcasing various products and the

conference attracted wide participation.

The Chief Minister of Sarawak, Abdul Taib Mahmud presented a keynote address

which touched on the policies and development objectives of the State.

Taib said forest plantations are fast approaching 20% of the permanent

forest area in the state and in the future these plantations should be able

to yield as much as presently harvested from around 80% of the natural

forests.

The species currently planted are fast growing but

he urged the industry to conduct more research on species other than Acacia

mangium.

By December 2012, Sarawak had 306,486 ha of tree plantations. Acacia is the

main species (comprising 72% of total), Batai 12%, Eucalyptus 7%, Kelampayan

6% and others 2% make up the balance.

However, to meet the state target of one million hectare of tree plantations

by year 2020 the industry has to plant 90,000 ha. a year.

Sarawak slow to supply international furniture market

Despite the steady export performance of the timber industry in the state

and generation of around RM7 bil. (appox. US$2.2 bil.) in export earnings a

year, Sarawak¡¯s Chief Minister has called on industry to take advantage of

the international demand for furniture.

He said ¡°Sarawak is not a big furniture producer and finds it hard to

compete in the world market against established players based in Peninsular

Malaysia¡±.

Peninsular Malaysia furniture exports close to value of all timber

exports from Sabah and Sarawak

In 2012, the total value of wood products exported from Malaysia was RM20.4

bil. (appox. US$6.4 bil.). The breakdown of exports from Peninsular

Malaysia, Sabah and Sarawak was; Peninsular Malaysia RM11.2 bil. (approx.

US$3.5 bil. with about half of that from furniture alone, Sabah RM1.8 bil.

(approx. US$564 mil.), and Sarawak RM 7.4 bil. (appox. US$2.32 bil.).

Asian destinations dominate Sarawak timber export trade

The major 2012 export markets for wood products from Sarawak were:

Wood products are the fourth largest source of

export earnings in Sarawak after liquefied natural gas, petroleum and palm

oil.

January to April export statistics for Sabah

The Department of Statistics in Sabah has released timber export statistics

for January to April 2013. In that period, Sabah exported 82,471 cu.m of

sawntimber worth RM123, 615,472 (appox. US$38.8 mil.).

In term of volume, 26.4% went to Thailand, 13% to each of Taiwan P.o.C and

China and 10.5% to South Africa.

Sabah exported 221,811 cu.m of plywood worth RM338,765,223 (appox. US$106.2

mil.).

In terms of volume 19% was shipped to Japan, 16% to Peninsular Malaysia,

12.5% to Egypt and almost 12% to the Democratic People¡¯s Republic of Korea.

Companies in Sabah also exported 11,735 cu.m of veneer worth RM17.1 mil. (appox.

US$5.4 mil.), 5,906 cu.m of mouldings, worth RM19.74 mil. (appox. US$6.2

mil.) and 17,407 cu.m of laminated boards, worth RM27.54 mil. (appox. US$8.7

mil).

¡¡

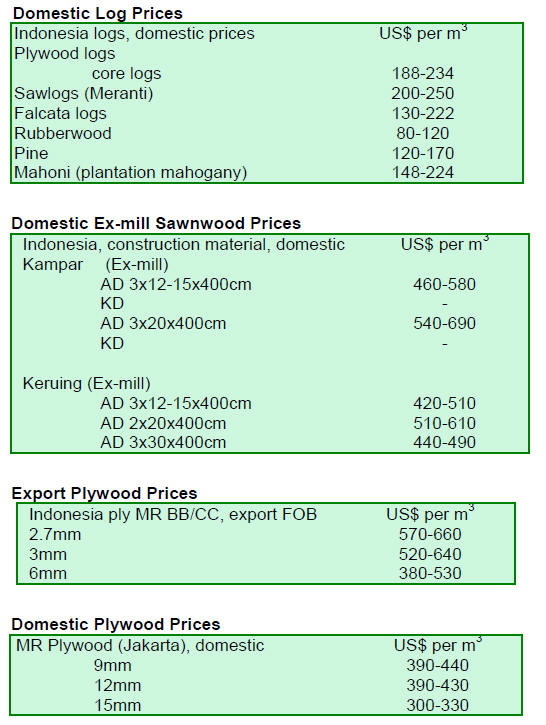

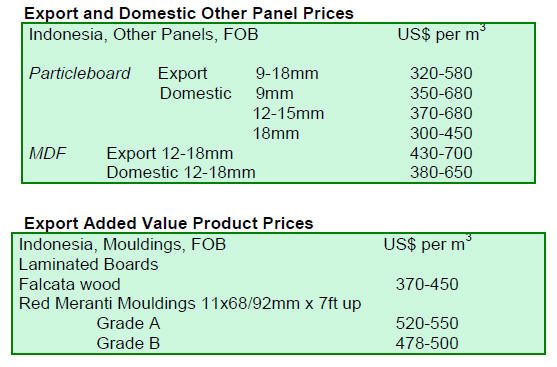

4. INDONESIA

Too many requirements in SVLK for

small manufacturers

Indonesia introduced a mandatory timber legality assurance scheme (SVLK) at

the beginning of this year and while many larger companies have secured the

required certification most small enterprises have not.

At a recent conference in Jepra a Programme Director of the

Multi-stakeholder Forestry Programme (MFP), Diah Raharjo, said that the

number of small enterprises that have the capacity to meet the requirements

of the SVLK is small.

The main problems for small industries is that first the process is

expensive and second the process is complicated and beyond the management

capacity of most small enterprises.

However, the major exporters are doing well and up to 3 June the value of

SVLK certified timber and wood product exports amounted to US$ 2,45 bil., up

from the US$ 2.06 billion as of 10 May.

The Indonesian License Information Unit of the Ministry of Forestry has

processed 31,724 export documents related to the US$ 2.45 bil.exports.

No decision yet on plantation log exports

The Secretary General of the Ministry of Forestry (MoF) has said that the

government has not decided on the issue of plantation log exports.

The Executive Director of APHI (Asosiasi Pengusaha Hutan Indonesia), the

association of Indonesian timber concession holders, Purwadi Soeprihanto is

urging the ministry to act decisively as the price of plantation logs the

domestic market is very low and opening a export trade in plantation logs

will bring multiple benefits to the forestry and wood processing sectors.

The potential for exports of Indonesian plantation timbers to Asian

countries such as China, Japan and South Korea is huge said Purwadi

Soeprihanto.

The MoF is moving cautiously on this issue and needs time to assess the risk

that a change in regulations could lead to illegal logging.

Government decision to revoke concessions only in legally recognised

customary forests raises concern

The government has said it would revoke the allocations to companies for

operations in customary forests. This comes after the Constitutional Court

annulled government ownership of customary forests.

The secretary general of the MoF said the government would withdraw all

plantation and mining concession allocations that have been granted in

customary forests that have been legally recognized by local

administrations.

This stance by the MoF has caused some concern as, currently, there is no

official data on the number of existing indigenous communities and the size

and territory of their customary land and forests.

However, a civil society group The Participatory Mapping Working Network (JKPP)

has documented 3.9 million hectares of indigenous land most of which is

forest.

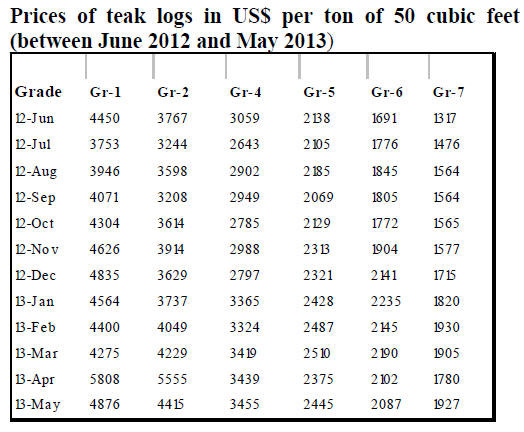

5. MYANMAR

Teak prices climb in advance of log

export ban

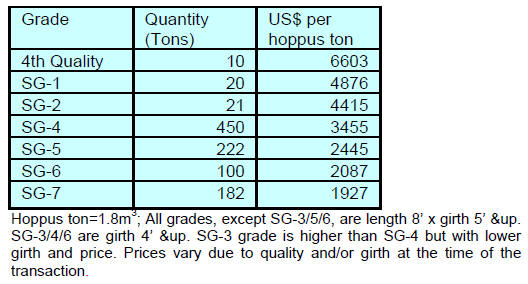

The following table illustrates the trend in teak log prices after the log

export ban was proposed in October 2012.

Overseas buyers holding high levels of teak

stocks

Analysts report that demand for teak logs is currently slow with India, the

main buyer, apparently unable to absorb any further shipments at present.

The market for pyinkado and gurjan is even quieter than that for teak.

With the log export ban due to come into force in April 2014, buyers in

India and Thailand are reportedly already heavily overstocked. Teak

shipments are moving slowly despite pressure from MTE on buyers to speed up

shipments of logs that have been purchased.

Some analysts suggest that, at the rate the logs are currently being

shipped, the log-stock in Yangon will not be moved before the log export ban

commences.

Under these circumstances there could be unshipped logs when the log export

ban comes into force but the MTE has not made public how it will deal with

unshipped logs.

Reforms in Myanmar can lead to vibrant market

economy

The World Economic Forum for East Asia was recently concluded in Nay Pyi

Taw, the capital of Myanmar. The forum was attended by executives and policy

makers from industry, government, academia and civil society from the around

the world.

The New Light of Myanmar newspaper reported on the opening speech by

President Thein Sein, in which he emphasised that the country is moving from

military rule towards democracy; to end armed conflicts and to reform the

economy to one based on free markets.

The Mizzima newspaper reported that in summing up the conclusions from the

World Economic Forum the meeting co-chairs agreed that Myanmar and the

Philippines are demonstrating the importance of driving reforms in response

to peoples¡¯ aspirations.

End May teak auction prices

The following prices were reported from competitive bidding for teak logs on

23rd and 27th May, the most recent Myanma Timber Enterprise tender.

¡¡

¡¡

6.

INDIA

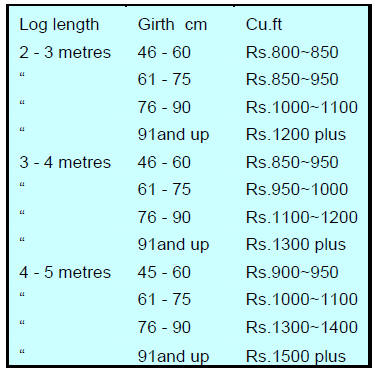

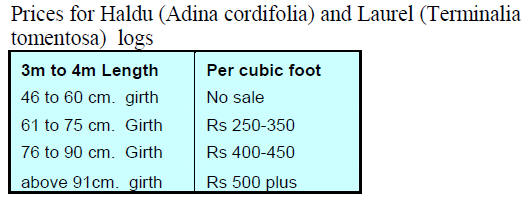

Domestic teak log prices ease during

recent auction

In recently concluded auction sales at the government forest depots in

Jabalpur, Narmada Nagar and Raipur divisions of Central India, approximately

8,000 cubic metres of mainly teak and small quantities of haldu and laurel

were sold. Average prices for domestic teak logs per cubic foot, ex-depot,

are shown below.

As the quality of the logs at these auctions was

below average and because buyers from Gujarat and Maharashtra were not

present, prices were lower than in the previous sale.

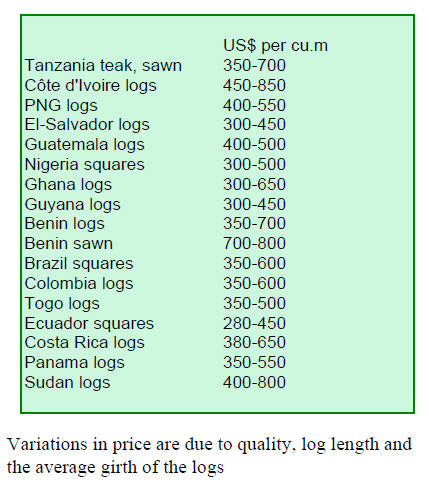

Plantation teak imports up five percent

Supplies and shipments of imported plantation teak have been maintained and

the volume of imports increased by 5% over the past month. Some minor price

changes have been reported.

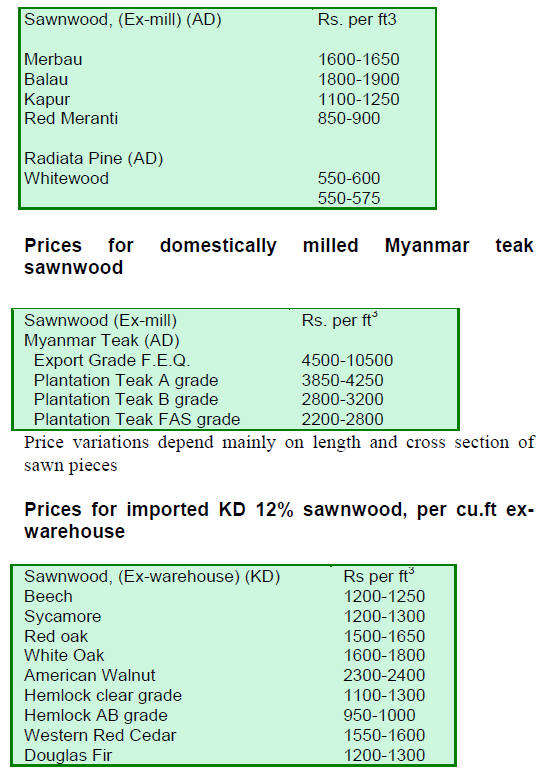

Current prices for plantation teak C & F Indian ports, per cubic metre are

shown below.

Imports of teak and other hardwoods

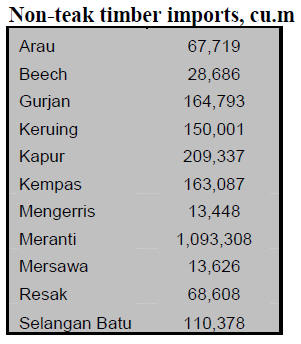

The volumes of teak and other sawn hardwood imports from April 2012 to March

2013 are shown below.

Domestic prices for sawnwood

The domestic prices for air dried sawnwood remained unchanged over the past

two weeks.

¡¡

Study assesses effects of EU Timber Regulation

on industry in India

The EU FLEGT Facility has published a report that explores the potential

effects of the EU Timber Regulation and the growing demand for forest

certification on India¡¯s timber industry.

The study examines European companies¡¯ procurement policies and practices;

explores the implications of the EU Timber Regulation for the

competitiveness of India¡¯s timber products industry; and assesses the

measures that selected Indian companies and multinational corporations

operating in India are likely to take in response to changes in market

requirements.

The report suggests possible strategies for adoption by the Indian

government to mitigate the negative impacts of the changes.

The full report ¡°Effects of the EU Timber Regulation and the demand for

certified legal timber on business and industry in India¡± by T R Manoharan

can be downloaded at:

http://www.euflegt.efi.int/files/attachments/euflegt/india_eu_tr_study.pdf

The EFI summary of the report says:

¡°As of early 2013, India was not considering entering into a Voluntary

Partnership Agreement (VPA) under the EU Forest Law Enforcement, Governance

and Trade (FLEGT) Action Plan, largely because India has prohibited the

export of timber in the form of unprocessed logs.

The export of timber products from India, however, is not only permitted but

is actively encourage d by the government and is growing.

The EU, India¡¯s largest overall international trade partner, is a major

market for India¡¯s semi-processed and value-added timber products, including

wooden handicrafts, pulp and paper, plywood and veneer, and wooden

furniture.

India¡¯s timber products industry is therefore

likely to be affected by the introduction of the EU Timber Regulation (EUTR),

which came into force on 3 March 2013.

For India, products listed under the EUTR have an annual export value of

around US$1.3 billion, and in 2012, six EU Member States accounted for more

than 12% of this total value.

Furthermore, India¡¯s exports of value-added timber and timber products to

the EU and other markets are increasing, with these products manufactured

from both domestically sourced and imported timber.¡±

JICA support for livelihood development project

The forest department of Jharkhand has prepared a Project on the Advancement

of Livelihood and Forestry for Ecological Security (Palash) which has been

submitted to the Japan International Cooperation Agency (JICA).

A national level deliberation took place in Ahmedabad in early May and

officials of the central government¡¯s Ministry of Environments and Forestry,

as well as officials from 13 states, including Jharkhand participated.

The focus of the project is development of the livelihood of people living

within or on the fringe of forest areas.

It has been proposed that the project be funded through a soft loan over a

period of 40 years. JICA has funded such projects in India since 1991. The

first phase of JICA funded work in India was from 1991-2001, the second from

2002-2012 and the third, beginning from 2013 will stress livelihood and

sustainability of forestry projects.

¡¡

7.

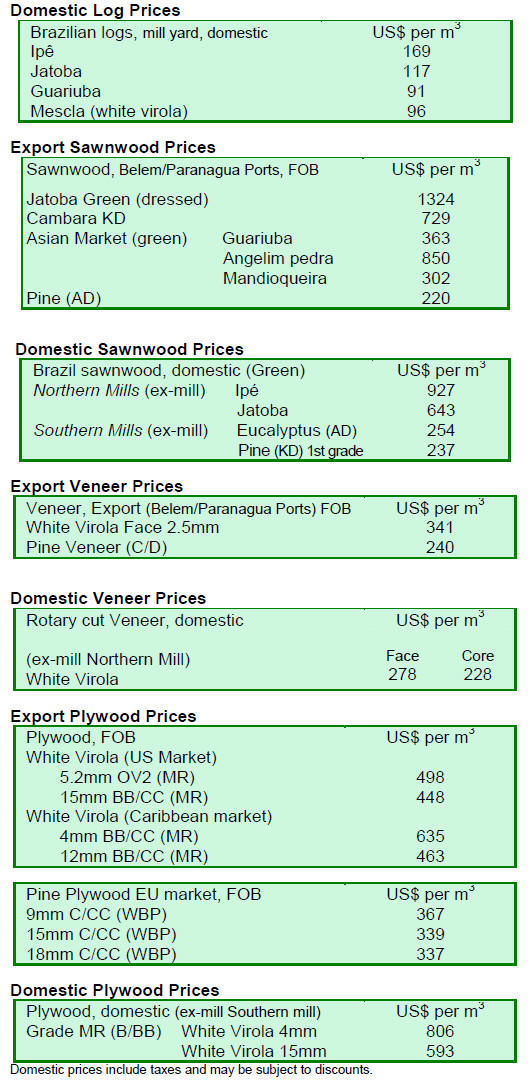

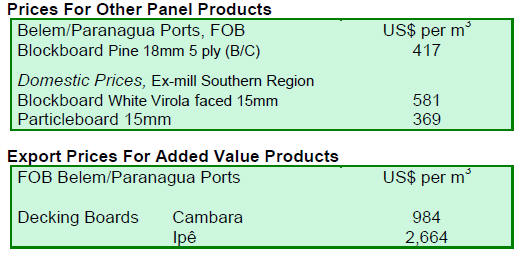

BRAZIL

Changes in licensing system aids

joinery sector in Acre

In 2011, the government of Acre introduced measures to create more

opportunities for the joinery sector in the state with the aim of improving

the contribution of the sector to the local economy.

This initiative, through the ¡®Program for Strengthening the Timber Sector¡¯,

focused on licensing all joinery makers in the state.

There are around 350 joiners in Acre but before the new support programme

only 10% were licensed. The major hurdle to licensing was the difficulty in

securing the required ¡®environmental¡¯ license a process which was hampered

by bureaucracy and was also costly.

In the past, joiners had to travel to one of governmental offices of the

Institute of Environment of Acre (IMAC) in Cruzeiro do Sul or Rio Branco,

the state capital, to get the license.

In order to address this issue the state government took the initiative and

went directly to the joiners and assisted them in securing the required

environmental license. Today, out of 350 joiners in Acre, 90% are licensed.

The legalisation of the joiners has brought some benefits. Now the state

government can purchase its joinery requirements from local industry rather

than having to buy from licensed producers in other states.

After the licensing of joiners the state government began a programme to

advise manufacturers to only purchase raw material coming from managed

forests. This programme was conducted in cooperation with the Timber Workers

Union.

Bidding opens for forest concession in Para

At the end of May the Brazilian Forest Service (SFB) launched bidding for

forest concession in the Crepori National Forest (FLONA) in Par¨¢ state.

The concession area is divided in four management units of 29,000 ha.,

59,800ha, 134,000 ha and 219,000ha, in order to satisfy the needs of

different sized companies.

Companies interested in bidding had to submit documentation proving its

capacity as well as technical and pricing proposals. The minimum price for

bidding is R$16,38 per cubic metre which was established on the basis of

market values and to ensure an internal rate of return compatible with other

investment options.

The structure of the technical proposal had to focus on those environmental,

social and economic indicators that would contribute to expansion of the

benefits to be generated through management of the concession.

Companies that win concession contracts will receive the right to manage the

areas for logging and extraction of non-timber forest products for up to 40

years. The concessionaires will enjoy a number of mechanisms that reduce

transaction costs and encourage improvement of the social and environmental

performance of the undertaking.

Among these new mechanisms is the expansion of the ¡°bonus¡± mechanism through

which discounts are given based on the achievement of quality indicators

established in the agreement.

Phytosanitary regulations reviewed to facilitate log exports to China

The strong demand for raw materials in China is seen as an opportunity for

Brazilian exporters especially those marketing sawnwood as well as producers

of pine and eucalyptus logs.

The tropical main species of interest to China at the moment are jatob¨¢ (Hymenaea

courbaril), cedro (Cedrela sp.), cabreuva (Myrocarpus frondosus), angelim (Hymenolobium

sp), itaub¨¢ (Mezilaurus itauba), tauari (Couratari), ip¨º (Tabebuia spp),

cumaru (Dipteryx odorata) and sucupira (Bowdichia n¨ªtida).

¡¡

Pine from Brazil is well accepted in the Chinese

market but eucalypt is of less interest, partly because China imports large

quantities from South Africa.

The Ministry of Agriculture, Livestock and Food Supply (MAPA) and the

Integrated Agricultural Development Company (CIDASC) are looking for ways to

facilitate the export of pine logs with bark to China where strict

phytosanitary rules are in force.

Representatives of International Agricultural Inspection System of MAPA and

the Plant Health Protection Service and CIDASC Regional Administration of

Itaja¨ª municipality met recently to discuss adjustments to the regulations

for issuance of phytosanitary certificates to allow for the export of pine

logs with bark.

¡¡

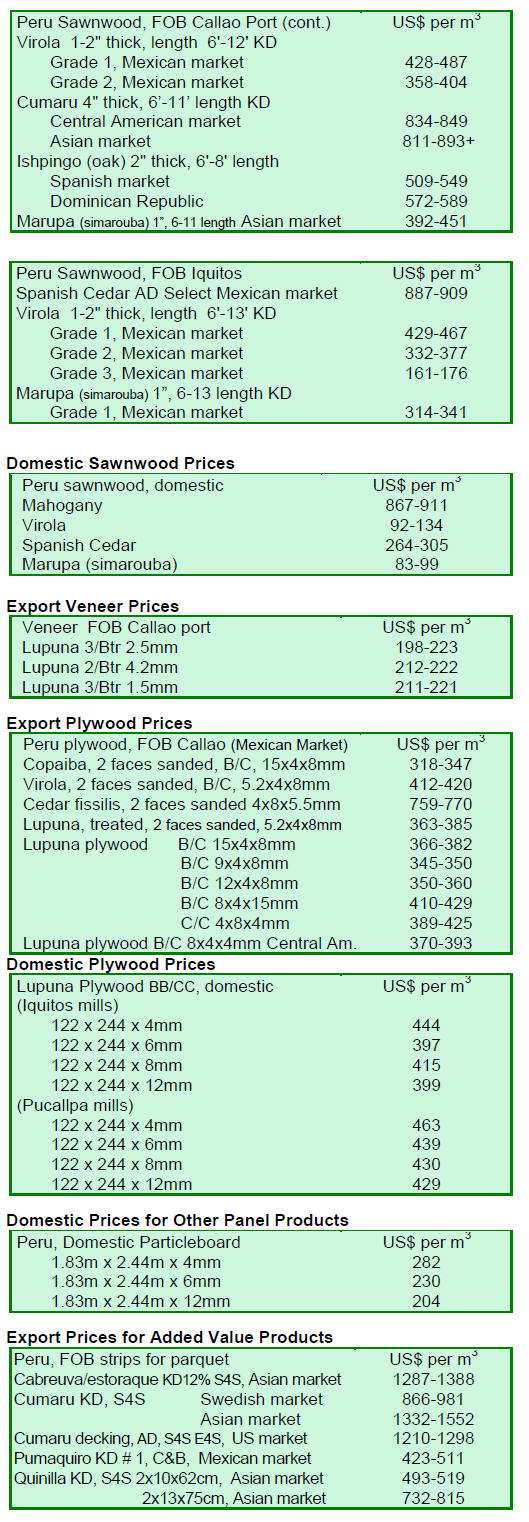

8. PERU

Expo Amazonica 2013 scheduled for

August

Expo Amazonica 2013 will be held from 10th to 31st August this year in the

city of Iquitos and is expected to generate business worth around US$15

million for businesses in the Amazon region of the country. The purpose of

the event is to promote private investment and business development in the

Amazon region and wood products feature prominently in the expo.

It has been reported that, as of May, fourteen international delegations

will attend including from Brazil, Bolivia, Colombia, Spain, Mexico,

Venezuela, China and the United States. The expo is expected to attract

around 400 exhibitors and 30,000 visitors.

Amazonian people present their own vision on REDD +

Edwin V¨¢squez Campos, from Coordinadora de las Organizaciones Ind¨ªgenas de

la Cuenca Amaz¨®nica (COICA) an organisation that coordinates action by nine

national Amazonian indigenous organizations has presented the views of

Amazonian indigenous people on mechanisms related to Reducing Emissions from

Deforestation and Degradation (REDD +).

At a side event at the headquarters of the United Nations in New York he

said that ¡°REDD + Indigenous Amazonian (RIA)¡± has the same goal of reducing

emissions but with a different strategy that placed priority on a long-term

¡®life plan¡¯ for Amazonian peoples.

The vision of COICA, said V¨¢squez Campos, is the holistic management of

forests to integrate mitigation and adaptation, climate change and

biodiversity.

He described the proposed Indigenous REDD + as having three main components:

strengthening ecosystem functions through a management or holistic

management of indigenous territories, reducing the overall footprint and

eliminating the drivers of deforestation in the Amazon.

9.

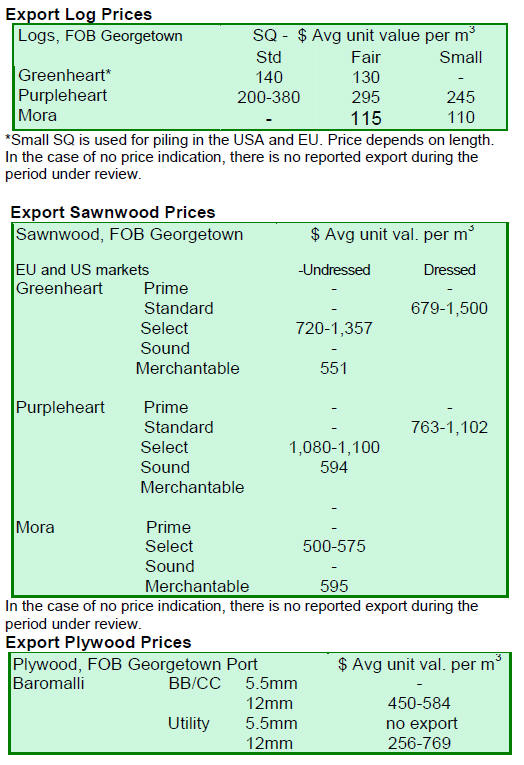

GUYANA

Log exports resume and prices climb

During the later part of May log exports resumed. Greenheart log export

prices were fair for both standard and fair sawmill quality logs.

Prices for all categories of purpleheart logs were exceptional last month

with Standard Sawmill Quality top end prices rising to as much as US$380 per

cubic metre FOB.

This was closely followed by prices for purpleheart Fair Sawmill Quality

logs which attracted a price of US$295 per cubic metre FOB. Small Sawmill

Quality purpleheart logs earned a price of US$245 per cubic metre FOB.

Mora log exports also made a noteworthy contribution to export earning with

good prices posted for the Fair and Small Sawmill Qualities. Asian markets

were the major destination for these top class durable timbers from Guyana.

Japanese buyers seek dressed greenheart

During the period reviewed sawnwood exports were encouraging earning

favourable market prices for both rough sawn and dressed categories.

Undressed greenheart sawnwood earned a significantly high top end FOB price

of US$1,357 per cubic metre towards the end of May while merchantable

Sawmill Quality logs only managed to sustain a price of US$551 per cubic

FOB. The main market for sawn greenheart was Europe and the Caribbean and

this timber is popular in both markets.

In sharp contrast, Undressed purpleheart sawnwood FOB prices fell slightly

from US$1,251 to US$1,100 per cubic metre. Sound Quality purpleheart

sawnwood was priced at US$594 per cubic metre FOB.

Undressed mora sawnwood exports also performed well with both Select and

Merchantable Quality timbers fetching US$575 and US$595 per cubic metre FOB

respectively.

Prices for Dressed greenheart sawnwood recorded a significant increase in

top end price from US$1,187 to US$ 1,500 per cubic metre FOB for the

Japanese market. Dressed purpleheart FOB prices improved from US$806 to

US$1,102 per cubic metre.

Caribbean plywood market picks up after a lull

The plywood market was active and prices for Utility grade plywood improved.

On the other hand, export prices for BB/CC quality remained unchanged.

Utility grade plywood has not been traded for some time but recently has

attracted interest from buyers. Prices for Utility grade boards are in the

region of US$769 per cubic FOB in the Caribbean and South American markets.

Exports include products from high value species

Splitwood (shingles) continues to attract favourable prices on the export

market in the region of US$955 per cubic metre FOB with the Caribbean the

primary market.

Roundwood (greenheart piles) also attracted favourable prices on the export

market earning US$569 per cubic metre, with North America and Europe the

main destination.

Also, exports of wallaba posts made a noteworthy contribution to earnings

attracting prices as high as US$600 per cubic metre FOB in the Caribbean

markets.

A variety of added value products were traded including doors, indoor and

outdoor furniture, mouldings, spindles and window frames. Some of Guyana¡¯s

primary species such as crabwood (andiroba) locust (jatoba) and purpleheart

are utilised in producing some of these high value products.

¡¡