US Dollar Exchange Rates of 26th May 2013

China Yuan 6.1314

Report from China

Currency volatility - Chinese exporters focus

on short-term business

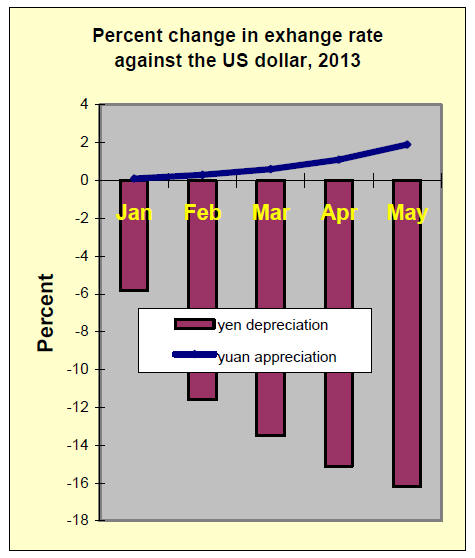

The depreciation in the yen has greatly affected China's exports to

Japan. By mid May the accumulated appreciation of the yuan against the

dollar was around 2% but the yuan had strengthened by more than 5%

against the yen.

The strong yuan appreciation has hit Chinese exporter¡¯s profit margins

hard and this extra burden comes on top of the rising costs of raw

materials and labour.

The continued appreciation of the yuan is seriously affecting Chinese

exporters and causing them to focus on short-term business arrangements

instead of longer-term business developments. The challenges in the

export market from very volatile exchange rates are now a threat to the

survival of many small and medium sized businesses according to the

Ministry of Commerce.

A survey of Chinese exporters conducted by the Ministry of Commerce

indicated that more than three quarters of those surveyed experienced

significant declines in profits during the first four months of the

year.

See: http://english.mofcom.gov.cn/article/newsreleases

Increased April domestic sales boost profits

The profits of large Chinese industrial companies improved in April due

mainly to increased sales and this is in sharp contrast to the reported

decline in the manufacturing index that appeared to signal a slowing of

the economy.

The National Bureau of Statistics, in a recent press release, said

company profits in the first four months of the year increased 11

percent. Analysts commented that improved profit levels could stimulate

industrial expansion and that this would help sustain growth in the

economy.

In related news the government has made it clear that the industrial

sector should not sacrifice the environment to ensure short-term growth.

Output Value of China¡¯s Forestry Industry in 2012

According to the State Forestry Administration Annual Forestry

Statistical Yearbook for 2012, the total output value of China¡¯s

forestry industry was RMB3.95 trillion in 2012 (calculated at present

price).

This represents an increase of 29% compared to levels in 2011. The

growth rate in output from China¡¯s forest industry has averaged 23%

since 2001.

The output value from the primary sector was RMB1.37 trillion,

accounting for 35% of the total, up by 24% year on year.

The output value of the secondary processing sector was RMB2.09

trillion, some 53% of total output and up by 25% on 2011 levels. Output

from the tertiary sector was RMB0.48 trillion, accounting for 12% of the

total up by 68% compared with output in 2011.

In recent years, the structure of the three main timber sectors has

changed and at present the proportion of the three main industrial

sectors, primary, secondary and tertiary is 35¡Ã53¡Ã12, this marks a

significant change from the situation at the end of 2005 (the 10th Five

Year Plan) when the distribution was 52¡Ã41¡Ã7. The proportion of

secondary and tertiary industries has steadily increased.

Within the primary sector the output value of economic forest products

such as dry and fresh fruit, tea, herbal medicine and food items was

RMB775 billion or 56% of the total in the primary sector making it the

largest segment.

Amongst the secondary sector outputs the value of timber and bamboo

processing and output from manufacturing including sawnwood and

wood-based panel was RMB823 billion, which at 39% of the total output

from the secondary sector was the largest proportion.

Also, within the secondary sector, the output value of wood and bamboo

pulp paper making was RMB475 billion and the output value of wooden and

bamboo furniture manufacturing industry was RMB279 billion.

In the tertiary industry, the output value of forestry tourism and

leisure services industry was RMB352 billion (73%of the total).

The expansion of new industries in the sector has been rapid with forest

tourism and leisure services industry growing by 89%, output of the oil

tea industry growing by 58% and wild animal breeding expanding by 39%.

Output of logs and sawnwood

In 2012, the total output of roundwood was 81.74 million cubic metres,

being basically the same as in 2011. Industrial log output from national

forest was 74.94 million cubic metres. Fuel wood production in 2012 was

6.80 million cubic metres.

The main log producing areas in 2012 were Guangxi Zhuang Autonomous

Region, Guangdong, Fujian, Shandong, Yunnan, Anhui and Hunan provinces.

The output of sawnwood in 2012 was 55.68 million cubic metres, up by 25%

over that in 2011 while the output of woodchips was 29.07 million cubic

metres, up 30%year on year.

Output of woodbased panel

In 2012, furniture industries, the construction sector and the builders

wood work sector were affected by the forced slowdown of the domestic

real estate industry and by weaker export demand.

As a result of these two factors production of woodbased panels slowed

in 2012. Total output of woodbased panels was 223.36 million cubic

metres, up by 7% in comparison with that of 2011.

The output of plywood in 2012 was 109.81 million cubic metres, (plus 11%

year on year) and accounted for 49% of the total output of woodbased

panels. The output of fibreboard was 58 million cubic metres (of which

50 mil. was MDF), up by 4% on 2011 and accounted for 26% of the total.

Particleboard production was 23.50 million cubic metres, down 8% on 2011

levels. Output of other wood based panels was 32.50 million cubic metres

up by 9% year on year.

Blockboard made up 58% of other woodbased panel output. Other outputs

included veneer, 34.92 million cubic metres and decorative boards 192

million square metres.

At the provincial level, the output of wood-based panel exceed 10

million cubic metres in Shandong, Jiangsu, Guangxi, Henan, Anhui and

Hebei provinces and autonomous regions.

The total output of wood based panels in these six provinces was 163.93

million cubic metres, making up 73% of China¡¯s total output of wood

based panels.

Output of wooden and bamboo flooring

The output of wood and bamboo flooring in 2012 was 604 million square

metres, down by 4% on 2011 and the first drop in many years.

Of the total, the output of wooden flooring was 125 million square

metres, (21% of the total); the output of composite wood flooring was

371 million square metres, (61% of the total); the output of other

wooden flooring and bamboo flooring was 59 million square metres and 49

million square metres respectively.

The largest wood and bamboo flooring producers are Jiangsu and Zhejiang

provinces whose outputs were 144 million square metres and 119 million

square metres respectively.

The national output of rosin products was 1.41 million tonnes in 2012

about the same as in 2011; turpentine output was 187,400 tonnes, up 3%

compared to 2011 while camphor output was 11,400 tonnes.

In 2012, the output of bamboo poles was 1.644 billion pieces an increase

of 7% from levels in 2011. Of the total, the output of Moso bamboo (a

temperate species of giant timber bamboo native to China) was 1.115

billion pieces. The output value of the bamboo industry as a whole

reached RMB122.4 billion in 2012.

Domestic prices of forest products

The average price of logs in 2012 was 757 Yuan/cubic metre, the same

level as in 2011 and the average price for bamboo was 8 Yuan/piece, a

slight increase on 2011.

The average price of sawnwood was 1213 Yuan/ cubic metre, (plus 6% year

on year) and the average price for wood chips was 716 Yuan/cubic metre,

down 17% on 2011 prices.

The average price for wooden flooring was 158 Yuan/square metre, up by

20% in comparison with 2011 and the average price for plywood was 1868

Yuan/cubic metre, down by 9% on 2011.

The average price for MDF was 1505 Yuan/cubic metre, a drop of 11% year

on year but the average price for particleboard was 1103 Yuan/cubic

metre, up by 3% on 2011.

China¡¯s Foreign trade in Forest Products

Because of the sharp drop in demand in the EU, US and Japanese markets

China¡¯s traditional wood product exports such as wood furniture, plywood

and paper fell dramatically in 2012.

The volume of China¡¯s softwood imports also fell sharply in 2012.

While demand weakened in traditional markets demand in emerging markets

steadily increased in 2012 and imports by these markets and increased

imports by the US on the back of improving economic conditions softened

to downward trends in international trade.

A summary analysis from the statistic data of China Customs indicates

that the total import and export value of China¡¯s forest products in

2012 was US$118.83 billion, down just 1% year on year.

Of the total trade exports wereUS$57.57 billion, (plus 5.0% year on

year) while imports were US$61.26 billion a drop of 6% from 2011 levels.

Import of main wood products

In 2012, the volume of log imports was 37.89 million cubic metres valued

at US$7.25 billion, a decline of 10% in volume and 12% in value from

2011. The volume of sawnwood imports in 2012 was 20.67 million cubic

metres worth US$5.52 billion, down 4% in volume and 3.5% in value

compared with levels in 2011.

The volume of paper and paper board imports were 3.254 million tonnes

(down 6% year on year) valued at US$4.6 billion (down 9% year on year).

The volume of paper pulp imports was 16.46 million tons valued at

US$11.04 billion, reflecting a 14% decline in volume and 7% decline in

value compared to 2011.

Imports of wooden furniture amounted to 6.368 million pieces valued at

US$600 million in 2012 up by 15% in terms of number of pieces and up 9%

in value compared to 2011.

Export of main forest product

2012 exports of wooden furniture amounted to 290 million pieces (down

almost 1% year on year) valued at US$18.33 billion (up by 7% year on

year).

China¡¯s exports of paper and paper board totaled 6.065 million tonnes

(plus 1%) valued at US$10.98 billion (plus 6%).

The volume of plywood exports was 10.03 million cubic metres valued at

US$4.8 billion, increasing by 5% and 10% respectively on 2011 figures.

|