|

Report

from

Europe

Wood flooring consumption down 4% in 2012

In 2012, wooden floor consumption in Europe (excluding

the UK) is estimated at 91 million m², a 4% decline

compared to the previous year.

Last‟s years decline is a reversal of the trend in 2011 when

there was a brief revival in European parquet consumption

following a sharp fall in consumption following the

financial crises between 2008 and 2010.

The 2012 consumption estimate is derived from FEP

(European Federation of the Parquet Industry) based on a

preliminary survey of country representatives at their

recent meeting held at the DOMOTEX fair in Hannover.

A more comprehensive assessment of consumption will be

published at FEP‟s annual General Assembly in June

2013.

In publishing their preliminary assessment, FEP stress that

market conditions vary considerably between European

countries and that this variation has increased. The

German-speaking countries of central northern Europe are

performing well with consumption rising slightly in 2012.

Scandinavian and Nordic countries are reporting stable

consumption or slight declines but no indication of a

significant downward trend.

However, market conditions in southern Europe, including

in the traditionally large consuming countries of Italy and

Spain, are very challenging with consumption falling more

than 15% in 2012. There were also quite significant falls

in consumption in France, Belgium and the Netherlands.

As regards the product mix, FEP report that strong

demand for one-strip planks has helped compensate the

decline in other product categories.

Apart from the shaky economy, major challenges for the

sector result from high energy costs, continuously stiff

competition, expensive transport & logistics, extremely

high unemployment rates in some important EU regions

and the volatile and uncertain EUR/USD exchange rate.

On the other hand, FEP are optimistic that the ¡°overall EU

parquet industry remains strong and resilient, fuelling the

belief that it will successfully rebound as soon as the

overall economic indicators take a positive turn¡±.

On releasing the results, FEP identified two factors which

suggest better times might lie ahead: first, the ¡°never

ceasing innovative product creativity and evolutionary

design of European parquet manufacturers¡±; and second

¡°the multiple economic forecasts for 2013 which converge

on a more optimistic business development in the half of

the year, which should also boost overall consumer

confidence.¡±

Optimism at Domotex that better times lie ahead

While Europe‟s central role in the international flooring

industry has diminished in recent years, Domotex held

during January every year in Hanover, Germany, still

claims to be the world‟s leading trade show for the

international flooring coverings sector.

The Domotex organisers issued the usual positive press

release reporting another successful show in 2013.

However early estimates of visitor numbers of around

40,000 were down significantly compared to 2012 when

close to 46,000 attended the show.

This may be partly explained by many of Germany‟s

largest flooring manufacturers choosing not to exhibit at

Domotex this year and to focus instead on the BAU

biannual German building show held a few days later in

Munich.

Nevertheless, the Domotex show remains a truly

international event. It attracted 1,350 exhibitors from 60

nations, including producers and suppliers of carpets,

textile floor coverings, resilient floor coverings, parquet

flooring and laminated coverings as well as installation,

cleaning and application technologies.

More than 60% of visitors were from outside Germany

with over 80 nations represented. Half were from

European countries other than Germany, while 21% came

from Asia and 11% from the Americas.

Attendance from Asian countries and North America

increased compared to last year. The show's attendees

once again consisted primarily of wholesale and

specialized retail buyers, at 30% and 20% respectively.

Wooden flooring producers exhibiting at the show

appeared quite optimistic about prospects for 2013. There

was a widespread view that the crises may be nearly over

and many producers were expecting sales to improve in

2013. Companies were generally reporting robust sales in

Germany, and stable demand in Scandinavia and the UK.

On the other hand, Italian and Spanish manufacturers were

reporting very poor domestic demand. As a result they

were focusing more on exports to other European

countries, the Middle East and the USA.

As in previous years, the Domotex show again emphasised

the extent to which oak dominates in the European

flooring sector. Oak products were found on virtually

every single stand, both solid wood and engineered.

Many laminate producers were also reproducing

artificially the ¡°oak look¡±. Very few other wood species

were on display ¨C a bit of ash, walnut and elm, some

maple for specialist sports floors, only a tiny quantity of

tropical woods, and no cherry at all. There was also a bit

of bamboo.

To bring diversity to the displays, the emphasis again was

on the wide range of staining, varnishing, brushing, and

other surface treatments that can be applied to oak. Oak

flooring came in every shade from limed-white to black

stain and finishes ranged from clean modern through to

antique and rustic.

Widespread preference by manufacturers for European

oak a mystery

The vast majority of European producers use European

oak rather than American white oak. Although some

manufacturers claim otherwise, the widespread use of

European oak instead of American white oak cannot be

due to any real preference by European consumers.

Since most oak flooring products are stained or subject to

other treatments, consumers are very unlikely to be able to

tell the difference between oak species.

The choice of European oak by European manufacturers is

driven primarily by supply issues. Manufacturers are able

to source lumber and strips most competitively from

European sawmills, especially in the lower grades.

Local sourcing also helps reduce risks associated with

volatile exchange rates, long transport routes and the

potential for delayed deliveries.

Chinese wood flooring manufacturers at the show were

also focusing heavily on oak product ranges. They were

equally keen to stress that these products are composed

entirely of European oak (as opposed to Russian or

American) in the belief that this aligned to European

tastes.

However in practice, it is well known that manufacturers

in China often mix oak species in their products and it was

difficult to assess the actual origin of the wood on display.

Stronger demand for wide flooring

Domotex demonstrated that European consumers prefer

wider boards. Most stands were displaying wide solid

boards or one-strip multi-layered products.

There were very few narrow solid boards or two-strip or

three-strip engineered products. Some high-end producers

were offering very wide boards in excess of 8 inches. Even

laminate products were printed with wide board surface

patterns.

Wood flooring manufacturers at Domotex suggested

demand for oak will remain strong for the foreseeable

future. Some believed the strong fashion for walnut may

have peaked, although walnut floors are still selling well.

There still seems little prospect of any significant increase

in demand for beech or cherry in the European flooring

sector. Prospects for maple are a little better, with some

manufacturers expecting rising demand for maple in high

performance sports floors and in floors for high-traffic

public areas.

Tropical wood species are generally out of fashion in the

European flooring sector. These species also tend to be

considered high risk under the EU Timber Regulation

unless backed by FSC or other third party forms of legality

verification.

As a result, more limited availability is likely to

increasingly restrict tropical wood floors to a high value

niche in the future.

Integrating wood flooring into interior sign

A key theme of Domotex 2013 was to try to better

integrate floor coverings into the broader field of interior

design.

This was encouraged by the show organisers through

introduction of the ¡°Flooring Deluxe¡± exhibition to

Domotex this year. The exhibition involved 15 specially

arranged booths (so-called ¡°Concept Rooms¡±) with

installations created by young designers in collaboration

with floor covering manufacturers.

The wood flooring section of ¡°Flooring Deluxe¡± was

represented by Poland‟s Baltic Wood S.A. working in

collaboration with the German designer Mark Braun. The

resulting installation displayed embossed wood parquet in

a domino-like formation on both wall and floor.

According to Braun, the aim was to consciously break

with wood parquet‟s conventional application to

emphasise its natural colour and surface feel. Another aim

was to reintroduce the idea of wood as wall panelling.

After three days of voting by an expert panel and visitors,

Braun‟s wood display was recognized as the best project

in the floor coverings category.

The result emphasises the enduring attraction of real wood

floors and panelling. It also suggests strong consumer

interest in innovative designs which combine wood‟s

natural texture with modern materials and bold colours.

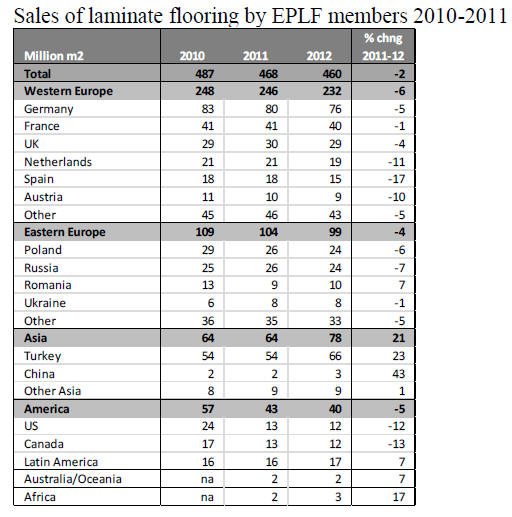

European laminate flooring sales declined in 2012

Another indication of challenging market condition in the

European flooring sector in 2012 is provided by data

released by the Association of European Producers of

Laminate Flooring (EPLF).

The association represents the leading producers of

laminate flooring in Europe. The 22 member companies

account for around 55% of the global market for laminated

floors and around 80% of the European market.

In recent years, laminate flooring has taken a rising share

of the European floor covering market, mainly at the

expense of textiles.

According to market research by Intercontuft, laminates

share of this market increased from 12.7% in 2004 to

14.3% in 2010 (wood‟s share increased from 5.1% to

5.6% during the same period).

European and international production capacity of

laminate flooring increased rapidly in the years before the

recession.

However, during the recession, excess capacity and ongoing

moves by manufacturers to replace d¨¦cor papers

with direct printing meant that prices for laminate flooring

remained low.

High street prices for laminate flooring may be as low as

€5-10 per sq.m with little variation between looks and

specifications.

The problems associated with low pricing and tight

margins in the sector are now being made worse by

declining consumption.

The latest EPLF data shows that European sales of

laminated flooring by EPLF members fell sharply during

2012 (see table). Last year the volume of laminate flooring

sales fell 6% in Western Europe and 4% in Eastern

Europe. The decline in sales was apparent across nearly all

the leading European markets.

European manufacturers also suffered from declining sales

in North America. However manufacturers have had some

success to offset these losses by increasing sales to other

markets outside Europe, including Turkey, Latin America,

China and Africa.

Laminate flooring industry seeks to do more than

duplicate wood

Reviewing information supplied by the EPLF, demand for

laminate floors in Europe is still heavily oriented around

the "all-rounder oak", as it is in the real wood sector.

There is a strong preference for the wide "country-house"

plank, with or without a V-joint. However EPLF also note

that there are signs of three-strip planks re-gaining

popularity in the laminates sector, although less for

isolated installations and more often as part of an

integrated interior design scheme.

The trend is towards floors with a consistent pattern

direction to create a more elegant appearance. For tile

designs, large, rectangular formats are preferred, which

create a spacious effect in larger areas.

In recent years, the laminates industry has invested heavily

in perfecting digital printing technologies to allow near

perfect replication of the look of real wood and other

natural materials.

However, according to EPLF, the industry now has

ambitions to move beyond mere duplication. It is

challenging real wood and other floor types by seeking to

deliver finishes which, while authentic and "natural", are

also unique and striking.

For example the heavy knottiness of pine may be

combined with the medium-brown shades of oak, perhaps

with subtle white effects added. Elm, a pale wood with

dark beige tones in nature, may be given a dark shade with

reddish brown effects.

EPLF note that the range of possibilities to modify

laminated decors is expanding all the time, now including

colouring, bleaching, etching, whitewashing, oiling, and

waxing.

These techniques can be used not only to duplicate nature,

but to produce "never-before-seen" extreme surface

finishing styles. This is combined with sophisticated

haptics and texturing so that, according to the EPLF, "the

floors appear more interesting and life-like than the wood

from which they were modelled".

EPLF note that these same principles are also being

applied to stone designs. The industry is now focusing

attention on improving and promoting stone decors -

including slate, marble and granite - which to date have

been far less popular than wooden decors.

It's an ambitious agenda, to try to do better than nature

through use of modern technology and materials. The

response of consumers is still uncertain. For now, the

majority still seem to prefer the look and feel of natural

oak.

Technical developments

In addition to delivering new designs, the laminates

industry is seeking to build market share through

improved technical performance.

According to Dr. Theo Smet, Chairman of the Technical

Committee of the EPLF: "The response of the EPLF

members to the generally tough economic conditions is a

clear commitment to technical quality, the development of

innovative products, further transparency in terms of

technical features and work on complete laminate flooring

systems.

This means combining laminate flooring with what lies

beneath them, for example taking account of underfloor

heating and cooling, soundproofing, cleaning, care and

environmental aspects."

Participation in the European laminates market is a

complex and demanding process requiring compliance to a

wide range of technical standards. The EPLF assists

members through active participation in on-going

standardisation work in Europe.

For example it is participating in Technical Committee

CEN TC 134 (Laminate, Textile, Resilient) which is now

revising the European Norm (EN) 14041. This standard

introduces environmental aspects into CE marking of

flooring materials, especially relating to indoor air quality,

VOC emissions and potentially hazardous substances.

EPLF also recently contributed to finalisation of EN

16094 (test procedures for determining resistance to micro

scratches) and drafting of EN 16354 (covering

requirements for underlay materials). Further

standardisation projects include the revision of the

standards for laminate floor coverings EN 13329

(thermoset resins), EN 14978 (electron beam-hardened

acrylic surfaces), and EN 15468 (direct printing).

Environmental groups react to EUTR

The EU Timber Regulation (EUTR), which regulates

illegal timber trade, entered into force on March 3. Import

of illegal timber is prohibited under EUTR. Failure to

comply can land importers with up to two years

imprisonment or a 50,000 Euro fine, in addition to

confiscation of timber.

Companies importing timber into the EU are required to

carry out „due diligence‟ to ensure that the timber was

logged according to the producer country's laws, including

for example, knowing the details of each logging licence

under which timber is cut and taking measures to verify

that all relevant laws are followed.

An immediate effect of EUTR has been to encourage

campaigns by European environmental groups targeting

specific species and supply sources perceived to be high

risk of illegal logging. So far, the main focus has been on

tropical products and countries.

Following a report that illegal Liberian timber was found

in a French port, Global Witness campaigner Alexandra

Pardal told the BBC: "Almost all timber from tropical

rainforests carries a high risk of illegality and should be

checked out thoroughly - if there's any suspicion at all,

don't touch it¡±.

A recent Greenpeace report singled out the Democratic

Republic of Congo as ¡°clearly extremely high risk".

China is also frequently mentioned by environmentalists

as a participant in the illegal trade. In March, the WWF‟s

Beatrix Richards told the BBC ¡°much of the illegally

traded timber comes from central Africa and South-East

Asia, with a significant proportion being processed in

China and Hong Hong before being shipped to EU

nations, particularly the UK¡±.

Timber exporting countries in both Africa and South East

Asia are negotiating bilateral Voluntary Partnership

Agreements (VPAs) on timber trade and forest governance

with the EU. A key objective of the VPAs is to implement

rigorous procedures for "Legality Licensing" of all wood

exported from partner countries into the EU.

Wood covered by these licences will be exempt from

control under the EUTR. However the conclusion of some

VPAs has been delayed and no tropical country is yet in a

position to issue a VPA license. In the meantime, wood

imported from VPA countries must trade under the EUTR.

* The market information above has been generously provided

by the Chinese Forest Products Index Mechanism (FPI)

¡¡

|