2. GHANA

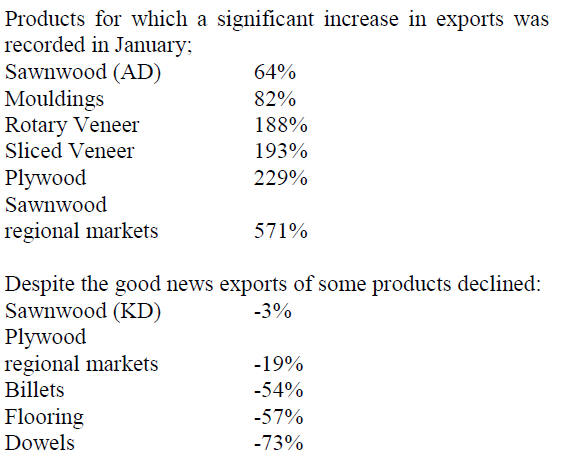

Ghana¡¯s timber exports register growth

Ghana earned euro 9.17 million from the export of 21,028

cubic metres of wood products in January. By way of

comparison exports for January 2013 were up by 47% in

terms of value and almost 18% higher in terms of volume

on levels in the same month in 2012.

January 2013 exports of primary products (Poles and

Billets) amounted to euro 160,904 and 665 cubic metres.

January exports were lower than in the same month in

2012 (down 51% in volume and 71% in value). Analysts

say the main reason for the decline was the scarcity of

logs.

Secondary wood products, mainly sawnwood, boules,

veneer and plywood comprised the bulk of the country‟s

January wood product exports. Exports of secondary

products generated euro 8.28million from a sale of 19,037

cubic metres.

Exports of tertiary wood products such as mouldings,

flooring, dowels and profile boards earned euro 727,355

from a volume of 1,326 cubic metres in January.

African countries were the major destination for Ghana‟s

wood product exports, accounting for some 43% of export

revenues.

The ECOWAS market accounted for approximately 44%

of the total value of exports to African countries and

exports were mainly of plywood and sawnwood to

Nigeria, Niger, Senegal,. Burkina Faso, Togo, Benin and

Mali.

Inflation proving difficult to tame

Ghana's annual producer price inflation rose to 10.7

percent year-on-year in March from 9.1 percent in

February according to the National Statistics Office.

Producer price inflation is an advance indicator of

consumer price inflation (CPI), which the government

aims to hold within single digits. The CPI rose to a fresh

three year high of 10.4 percent in March from 10.0 percent

the previous month.

3. MALAYSIA

Malaysia¡¯s main trading partner - China

The Malaysia External Trade Corporation recently

reported that China continues to be Malaysia‟s largest

trade partner.

In 2012, trade between Malaysia and China amounted to

RM180.6 billion (approximately US$58.6 billion), an

increase of 13 per cent compared with the previous year.

Of this total, Malaysia‟s exports to China were worth RM

88.75 billion (approximately US$28.8 billion) and imports

from China RM 91.86 billion (approximately US$29.8

billion).

The main reason cited for the trade imbalance was the

declining price of commodities such as palm oil and

rubber, both of which were exported to China.

VPA to be concluded by year end

Malaysia‟s Ministry of Plantation Industries and

Commodities has indicated it hopes to conclude

negotiations and sign the Voluntary Partnership

Agreement (VPA) with the European Union (EU) by yearend.

The national news agency BERNAMA quoted the

ministry's advisor, Dr Freezailah Che Yeom as saying

"One of Malaysia's initiatives to ensure an uninterrupted

flow of wood exports to the EU until the VPA is

concluded includes the Malaysian Timber Legality

Assurance System."

In a recent workshop on timber legality assurance,

representatives of the European Forest Institute (EFI) said

Malaysia has made good progress in drawing up its

legality assurance system as a first step in the VPA

process.

The workshop was organised by the EU FLEGT Facility

and the ASEAN Secretariat and attracted some 70

participants from seven ASEAN countries, the EU and

Ghana.

The workshop provided an opportunity for participants to

exchange experiences as well as explore increased

collaboration on timber legality among agencies and

stakeholder groups in Southeast Asia.

In addressing the workshop the EU Ambassador and Head

of Delegation to Malaysia, Luc Vandebon, said "Countries

that have Forest Law Enforcement, Governance and Trade

(FLEGT) VPAs with the EU will be able to export their

timber on a fast "greenlane" because EU timber operators

are looking for an assurance that the timber they place on

the market is legally harvested."

The EU, a key market for value-added timber and timber

products such as furniture, is Asia's second largest export

market for sawn wood and plywood.

Malaysia's timber and timber product exports to the EU

last year were worth RM20.197 billion (approximately

US$6.6 billion).

Ambassador Vandebon said strengthening forest

governance should be a priority in implementing effective

policies to conserve and sustainably manage resources so

as to reduce unintended deforestation.

Sarawak plywood exporters encouraged by growth in

Japanese demand

The Star newspaper reported Shin Yang Group executive

director, Wong Kai Song as saying Japan's higher housing

starts this year had spurred demand for imported

woodbased panel products. Shin Yang is the largest

producer of panel products in Sarawak with six plywood

mills.

Japan is increasing imports of plywood from Sarawak as

reconstruction activity has gained momentum in coastal

towns devastated by the earthquake and tsunami two years

ago.

¡°Japanese housing companies are now very busy with

reconstruction work although they are facing a shortage of

carpenters. This year's new housing starts in Japan were

around 900,000 units, which is about 10% higher than

820,000 units last year,¡± Wong said.

Statistics from the Sarawak Timber Association show

Japan imported 1.44 million cubic metres of plywood from

Sarawak in 2012, compared to 1.31 million cubic metres

in 2011.

About 55% of the state's total export of 2.64 million cubic

metres last year went to Japan. Sarawak's total exports of

plywood in 2012 were 16.5% higher than the 2.27 mil.

cubic metres in 2011.

Wong said the average price of Sarawak plywood in the

Japanese market rose by about 15% to US$550 (RM1,670)

per cubic metre in the first quarter of this year thanks to

the stronger demand. ¡°There is another 5% to 10% upside

potential in the price,¡± he added, in anticipation of further

growth in Japanese demand.

Anti-dumping duty little impact on Sarawak plywood

exports to S. Korea

In 2012 South Korea increased its imports of plywood

from Sarawak by 38% to 331,600 cubic metres up from

239,900 cu m in 2011. This was despite the imposition of

an anti-dumping duty on Malaysian plywood which

remains in force.

The anti-dumping duties imposed by South Korea on eight

Sarawak and one Sabah plywood exporters range from 5%

to 38% and will remain in force until February 2014.

4. INDONESIA

Opportunities for international trade in

Indonesian

plantation logs

Media reports suggest that the Ministry of Forestry is

considering lifting the log export ban to provide an

incentive for the further development of industrial

plantations.

The log export ban has been in effect since 2001 but the

Association of Indonesian Forest Concessionaires (APHI)

has said the ban has resulted in a marked decline in log

prices.

Current market prices for plantation logs are in the region

of US$30-40 per cubic metre, significantly lower than the

regional average because plantation owners can only sell

in logs on the domestic market where fierce competition

has driven down prices.

Under the present conditions there is little incentive to

invest in forest plantations.

The Ministry of Forestry plans to create the conditions for

a viable international trade in Indonesian plantation

timbers so that its target for annual plantation

establishment of 500,000 hectares of industrial forests can

be achieved.

In 2011 only 374,000 ha of new plantations were

established, around 75% of the government target and in

2012 only about 400,000 ha were established.

SVLK to assure legality of export logs

One of the main reasons for the implementation of the log

export ban was to help eliminate illegal logging. However,

conditions in Indonesia are now very different as the

country has a rigorous timber legality verification system

(SVLK) which is providing Indonesian exporters with

greater access to markets where proof of legality is

demanded.

In related news, the government is planning to extend the

moratorium on forest clearance, introduced following an

agreement between Indonesia and Norway on assistance to

reduce greenhouse gas emissions and deforestation in

Indonesia.

Green Peace in Indonesia, while welcoming the extension

of the moratorium on forest conversion, expressed concern

that a lifting of the log export ban could result in an

increase in illegal logging.

To open or not, the mining concession debate in Aceh

Province

Unconfirmed reports suggest that the Ministry of Forestry

has approved plans by the Aceh administration to open

around 1 million hectares of forests for mining

prospecting; 400,000 hectares for logging; and 250,000

hectares for conversion to oil palm plantations.

News of this resulted in immediate calls from NGOs and

others for the decision to be withdrawn.

Media reports say Gracia Paramitha, the United Nations

Environment Program, Tunza Global Youth Advisor, said

¡°1.2 million hectares of protected forests in Aceh had been

converted into industrial plantations¡±, adding that this

figure was already too high.

This week, East Asia Minerals said in a press release

(http://archive.is/taeU6) „the Ministry of Forestry is close

to accepting a proposal to open 1.2 million hectares of

forest in Aceh province for mining, logging, and palm oil

production¡±.

The CEO of East Asia Minerals was quoted in the press

release as saying "We are very pleased with the recent

news from the Indonesian Government.

These new developments are good progress and positive

news for mineral extraction in the area. This will help us

realize the full value of our Miwah gold project in Aceh

with a forecast resource of 3.1 million ounces of gold."

Policies needed to unlock economic benefits of urban

agglomerations

Indonesia‟s economy grew throughout 2012, but the

World Bank‟s March 2013 edition of the Indonesia

Economic Quarterly (IEQ) notes that domestic economic

and policy pressures are mounting.

GDP growth for 2012 was 6.2 percent, down slightly from

6.5 percent in 2011. The World Bank forecasts a 6.2

percent growth in 2013 but warns that improving the rate

of growth will be challenging.

Stefan Koeberle, the World Bank Country Director for

Indonesia said ¡°With the right policies in place, Indonesia

could move growth higher, harnessing the forces of

urbanization and rising incomes, while providing quality

jobs for a growing labour force.¡±

The biggest risk to short-term growth will be a drop in

domestic investment which recently slowed, in the capitalintensive

resource sectors.

The Bank says the investment climate would benefit from

improved certainty in the regulatory environment.

Investment is also crucially needed in infrastructure which

continues to constrain growth, causing bottlenecks and

high logistics costs. Infrastructure investment remains at

around 3 to 4 percent of GDP, compared with pre-Asian

crisis levels of around 7 percent.

The infrastructure challenge for many of Indonesia‟s cities

is particularly acute - more than half of Indonesia‟s

population live in urban areas, and the pace of

urbanization remains high.

Improving the level, quality and efficiency of

infrastructure investment can help to unlock the economic

benefits of urban agglomerations and support the quality

of service delivery, particularly in mid-size cities that lag

behind smaller urban centres and the ¡°mega-cities¡±.

For the World Bank press release see:

http://www.worldbank.org/en/news/pressrelease/

2013/03/19/indonesia-steady-growth-butpressures-

mounting

5. MYANMAR

Business activity in Myanmar has slowed to

almost zero as

everyone celebrates the New Year this month.

ADB upbeat on prospects for Myanmar

An easing of sanctions in Myanmar, along with rising

exports and business enthusiasm, will fuel annual growth

of more than 6% for the next two years provided the

government stays the course with its reform programme,

says a new Asian Development Bank (ADB) study.

See the related press release at

www.adb.org/news/myanmar/myanmar-grow-stronglyreforms-

roll-out-investmentrolls?

ref=countries/myanmar/news

¡°The outlook for the Myanmar economy is the brightest it

has been for decades with investment, exports, tourism,

and business optimism all on the rise. However this

positive outlook could be at risk if the forward momentum

of policy reforms falters or if recent tensions escalate

further¡±, said ADB Chief Economist, Changyong Rhee.

The ADB „Development Outlook 2013‟ forecasts an

annual GDP growth in Myanmar of 6.5% in the year to 31

March 2014, rising to 6.7% in 2014.

In 2012, the economy expanded an estimated 6.3%, well

above the annual average of 5% recorded over the

previous five years.

Proposed tax reforms and greater financial autonomy for

state enterprises, coupled with increased export receipts,

should give the government more fiscal leeway to step up

spending on social services and infrastructure, while also

lowering the fiscal deficit, says the ADB report.

This will also help reduce an over-reliance on natural

resources revenues, which currently make up nearly a

quarter of all public revenue.

Although the policy reform agenda may take years to yield

results, the report underscores measures to deliver benefits

within two to three years, such as increasing the

participation of private banks in the economy, and easing

restrictions on interest rates and lending.

Simplifying business registration and visa procedures for

tourists, upgrading inefficient power systems, and

increasing access to finance and other services in the

agriculture sector, would also be beneficial in the short

term.

Singaporean company capture major construction

contract

The Myanmar Mizzima News of 11 April reported that a

Singaporean firm has won a US$74 mil. construction

project. The company, Bouygues Construction, will be

contracted to build the second phase of Yangon‟s Star City

in a joint venture with Serge Pun‟s SPA Project

Management ltd., Myanmar.

Some 500 jobs will be created and workers will be trained

in modern construction techniques. The residential estate

will feature 4980 apartments and community facilities

along the Bago River in outer Yangon. Analysts anticipate

a rise in domestic consumption of wood products when

construction begins.

In related news the Singaporean government has

reportedly upgraded its business presence in Myanmar in

an effort to secure business opportunities. The government

agency International Enterprise Singapore has opened an

office in Myanmar and is sponsoring trade visits.

US dollar replaces euro in teak auctions

Beginning this month the Myanma Timber Enterprise has

changed to using the US dollar for teak pricing, the euro

will no longer be used.

Bidding at the latest auction was reported as quite

competitive. Buyers from India and Pakistan actively

participated in the bidding and prices increases were

observed for all teak log qualities.

The following prices were recorded during the teak

auctions on 26th and 29th April 2013.

6.

INDIA

Prospects for an interest rate cut improve

The Wholesale Price Index, a widely watched measure of

inflation, dropped to 5.96% in March, the lowest in the

past forty months. The March level compares to an overall

rate of inflation of 9 % during last year.

The decline in inflation, coupled with an easing of prices

for crude oil and gold, is reducing India‟s current account

deficit since both these commodities feature prominently

in India‟s finances.

If the current economic conditions are maintained then the

prospects for a reduction in interest rates improve and this

would greatly assist the wood product manufacturers

directly and through improving the affordability of

housing and thus stimulating demand.

Export incentives announced

In the latest annual foreign trade policy decision the

scheme for duty free imports of capital goods has been

extended and made available to all industrial sectors.

Moreover, exporters are now entitled to an additional two

percent export duty credit on the incremental value of

shipments. This additional credit will be over and above

the scheme for duty credits ranging from two percent to

five percent all ready being provided.

These benefits were introduced during 2012-13 as exports

fell almost 2%. Supporting a growth in exports is

important, not only to help reduce the current account

deficit but also to ensure growth in employment.

The Indian government has also introduced measures for

simplification of the procedures for value added tax

refunds and a reduction in transactional costs has also been

introduced.

Growth in exports at risk from EUTR

Indian exporters are of the view that the EU timber

regulation (EUTR) will adversely affect trade as the

formalities that must be met will increase costs and could

cause shipments to be delayed.

Recently, meetings were held between representatives

from the European Forest Institute, EU FLEGT Facility,

government officials, export promotion council officials

and the media to discuss the requirements of the EUTR

and its possible impact on Indian exporters.

According to provisional data, India‟s exports of wood

products increased 72% year on year to US$270 million

during the period April 2012 to January 2013 and the EU

was a major market.

Indian handicraft producers fear losing EU market

According to the Indian Handicrafts Export Promotion

Council, approximately 1.1 million artisans are employed

in the manufacture of wooden handicrafts and the sector is

a major contributor to economic growth.

As many of these manufacturers also export products they

fear losing market opportunities in the EU as a result of

the EUTR.

The major importers of Indian wooden handicrafts are

Australia, Canada, France, Germany, Italy, Japan,

Netherlands, UAE, Switzerland, Saudi Arabia, USA and

UK.

Demand for Indian handicrafts has been increasing in both

international and domestic markets. Exports of wooden

handicrafts were worth US$325 million in 2011-12 and

US$507 million for 2012-13.

The export council has organized seminars and training

programmes on compliances and certification for wooden

handicrafts exporters at some of the major craft clusters

and continues to disseminate information.

However, for the small artisans, tracking wood flows and

timber legality issues are far beyond their capabilities.

The EUTR applies to all products made from imported as

well as locally sourced timber so will impact thousands of

small and medium sized enterprises producing

reproduction antique furniture, doors, windows, panels and

wooden household utility items.

An expert committee has been constituted by the

Handicraft Council to assess the supply chain against the

various timber legality requirements of EUTR, Lacey Act

and others. The aim is to achieve international credibility

for Indian exporters.

A major effort is underway in India to see that the supply

of legal timber is sustained so that wood product export

growth is not adversely affected and that employment

opportunities are maintained.

Improved harvesting conditions eases log shortage

In the recently concluded auction sales at government

forest depots in the Jabalpur, Hoshangabad and Betul

divisions of Central India, approximately 10,000 cubic

metres of mainly Teak, Haldu and Laurel were sold.

As there is a serious shortage of domestic logs, these

auctions supplied acutely needed resources for industry.

The weather conditions for harvesting are currently good

and additional log stocks are expected at the depots. The

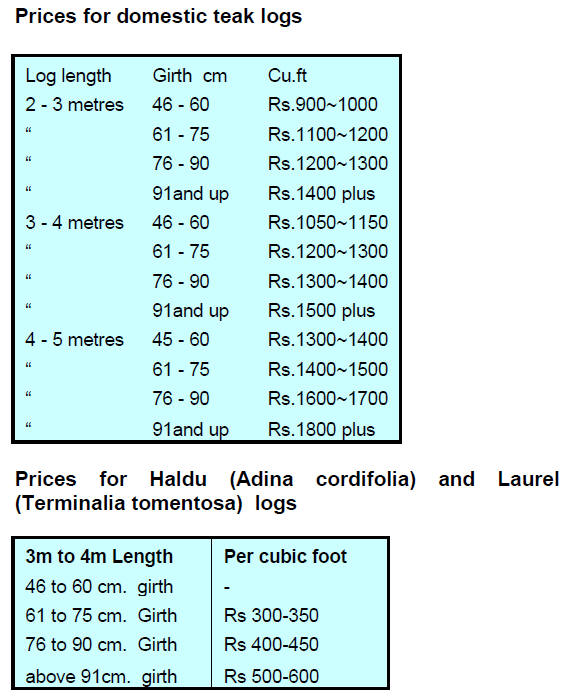

following prices were recorded at the recent auction.

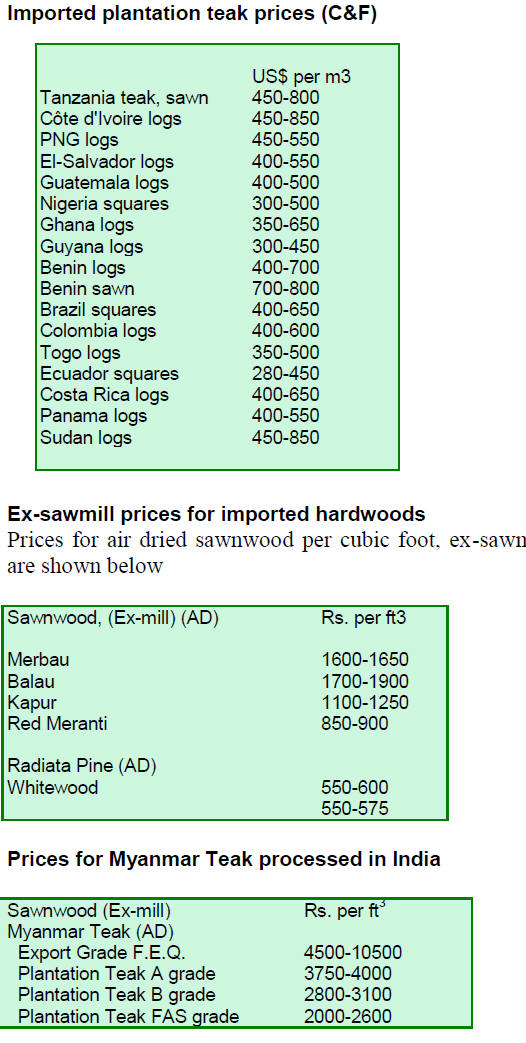

Imported teak logs and sawnwood

Supplies and shipments of teak logs and sawnwood were

steady and prices have been generally stable with just a

few exceptions. There is active trade in imported timber as

domestic resources are limited.

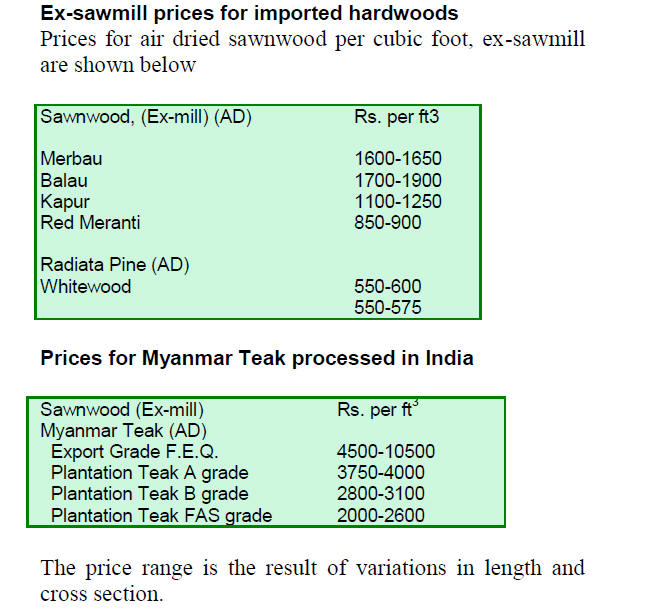

Imported KD 12% sawn wood

Domestic demand for imported kiln dry sawnwood is

growing and imports from the US have been increasing.

Ex-sawmill prices for air dried sawnwood remain largely

unchanged except for slight increases in prices for US

hardwoods, a reflection of exchange rate movements and

an overall increase in US hardwood log prices.

Plymill productivity rises as log availability

improves

Plywood manufacturers report improved demand and

some improvement in log supplies which is lifting mill

productivity. Plywood prices remain unchanged after the

recent increases and are as shown below.

¡¡

7.

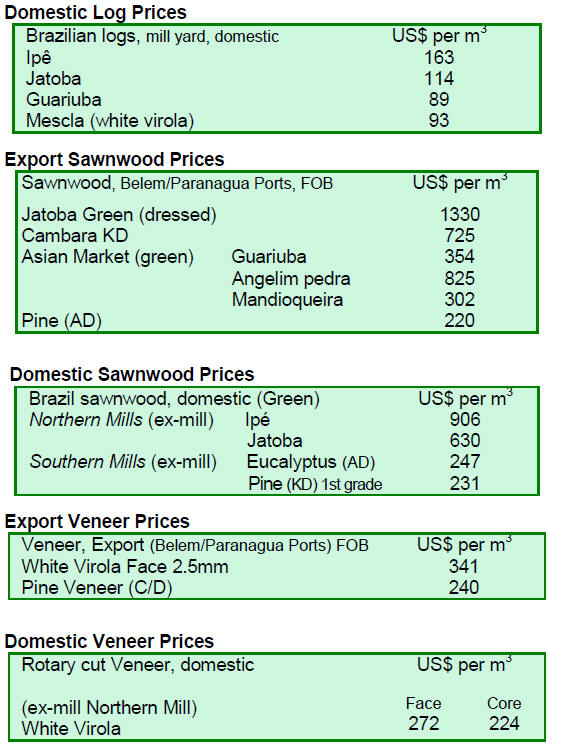

BRAZIL

Furniture sector showing signs of

weakness

Furniture production in Brazil increased in March but the

rate of growth was lower than that observed for the same

month in the past two years.

Analysis of production data suggests that average

utilisation of installed capacity in the furniture

manufacturing sector during March was lower than that in

either March 2011 or 2012.

Of the various constraints facing the furniture sector the

rising costs of raw materials and a heavy tax burden are

often cited. Prices of raw materials for the industry rose

significantly in the first quarter of 2013 according to the

National Confederation of Industry.

The weaker than expected performance of the furniture

sector over the past few months, coupled with rising

production costs, affected the financial standing of

companies. Adding to the woes of the sector is the

difficulty faced in securing competitive credit services.

Results of FIMMA Brazil 2013 Exceed Expectations

The 2013 International Machinery, Raw Material and

Accessories fair - FIMMA Brazil - was declared a success.

Some 653 exhibitors and 45,443 visitors from 41 countries

attended the fair. For more see

http://www.fimma.com.br/en/

This was the eleventh fair and the largest for the furniture

sector in Latin America and fifth largest worldwide.

Estimates put the level of business transacted at US$ 439

million, about 9% higher than during FIMMA 2011.

The fair provided companies with access to development

opportunities, facilitated access to new technological

developments and showcased cutting-edge initiatives from

around the world.

For companies interested in expanding their international

markets, the FIMMA ¡°Buyer Project¡±, a buyer meet seller

initiative, provided the opportunity for companies to forge

business partnerships. It is estimated that the ¡°Buyer

Project¡± generated US$7.15 million in business from the

numerous business meetings that were held involving 20

foreign buyers from eight countries and 72 exhibitors.

Tropical plywood exports rise in otherwise quiet

market

In March 2013, wood products exports (except pulp and

paper) fell 9.8% compared to values in March 2012, from

US$221.2 million to US$199.5 million.

Pine sawnwood exports also fell, reversing a recent

upward trend. March exports of pine sawnwood declined

14.2% in value compared to March 2012, from US$14.1

million to US$12.1 million. In terms of volume, exports

fell 14.3%, from 63,800 cu.m to 54,700 cu.m over the

same period.

Exports of tropical sawnwood fell sharply by 20.4% in

volume, from 40,100 cu.m in March 2012 to 31,900 cu.m

in March 2013. In terms of value the decline was even

more significant falling almost 30% from US$22.3 million

in March 2012 to US$15.7 million in March this year.

Pine plywood exports also fell dropping 4.9% in value

from US$ 34.5 million to US$ 32.8 million. The volume

of exports fell marginally (minus 3.6%) from 89,700 cu.m

to 86,500 cu.m. (March 2012 ¨C March 2013).

In a surprising reversal of the downward trend for other

woood product exports, in March this year tropical

plywood exports increased 21.6%, from 3,700 cu.m in

March 2012 to 4,500 cu.m in March 2013.

However, average prices dropped as the total value of

exports in March 2013 were almost the same as in March

2012, US$ 2.7 million.

Brazil‟s exports of wooden furniture dropped from

US$38.2 million in March 2012 to US$35.9 million in

March 2013, a 6.0% decline.

Challenging the Chinese market for luxury furniture

According to research of the global luxury furniture

market undertaken by the Federation of Industries of Santa

Catarina State, opportunities could be generated for the

export of Brazilian furniture to China.

It was determined in the Federation study that demand in

the Chinese market for high class western-style furniture

could be an opportunity for Brazil. It was determined that

consumers in this segment of the market pay high prices

for quality western designs.

The Federation study suggests that if Brazilian furniture

manufacturers want to capture a share of the up-market

furniture market in China then attention must be placed on

developing brand image.

The Chinese market for top-end furniture is concentrated

in Shanghai and Beijing and is currently dominated by

Italian and German brands, according to the study.

Remarkable data on per capita consumption of furniture in

China is also reported in the study. Apparently, annual per

capita consumption of furniture in China is higher than the

world average.

The Federation report says while the world average is

US$50.00 per person per year, in China the average over

recent years was US$ 75.00 per person per year.

The latest data available for Brazilian exports to China are

for 2011 when five Brazilian companies exported just

US$62,000, almost nothing compared to the US$91

million from Italy and the US$89 million from Germany.

Furniture exporters face difficult trading conditions in

international markets

First quarter 2013 data shows that the Brazilian furniture

sector began the year on an encouraging note. Demand in

the domestic market was good however; the good news

was tempered by difficult trading conditions in the

international markets.

In January 2013, according to the National Confederation

of Industry (CNI), the furniture sector in Brazil ranked

fifth among 16 industrial sectors in terms of growth.

Growth in the furniture sector was reported as 11.7% in

January, a figure that is higher than the average for all

sectors examined.

Brazilian furniture exports have been disappointing.

During the period from March 2012 to February 2013, the

furniture industry exported approximately US$ 457

million, 11% lower than that of recorded over the same

period one year earlier.

The Rio Grande do Sul furniture cluster accounted for a

26.6% share of Brazil's international furniture sales,

(US$11,858,942). However, overall national data indicate

stagnation in furniture exports in recent years.

On the other hand Brazilian furniture imports have

continued to grow. From January to December 2012,

imports totaled US$ 27 million, approximately 79% higher

than imports in 2011 (US$17 million).

In January and February 2013, furniture imports continued

the upward trend and the average monthly growth was

1.9% over the past 12 months.

Central Bank rate cut, first since July 2011

According to the Brazilian Institute of Geography and

Statistics (IBGE), Brazil‟s consumer price index (IPCA)

touched 0.47% in March, which is below the 0.60% rate

recorded in February.

In March the inflation rate was 0.21% and the

accumulated rate of inflation over the past 12 months was

6.59%, a level exceeding the upper limit target set by the

Brazilian Central Bank (BCB).

In the foreign exchange markets the average exchange rate

to the US dollar in March was BRL 1.98/US$ compared to

BRL1.79/US$ in March 2012 indicating a slight

depreciation of the Brazilian currency against the dollar.

The Monetary Policy Committee of the BCB raised the

prime interest rate (Selic) by 0.25 percentage point at its

meeting in April. This was the first increase in rates since

July 2011. Interest rates now stand at the equivalent of

7.5% per year.

¡¡

8. PERU

Sector financing opportunities for

downstream

manufacturers

In order to promote and strengthen financial management

capabilities in enterprises a seminar, "Application of

financial mechanisms for industrial wood production¡±,

was recently conducted as part of an ITTO project.

The aim of the project is to improve the productivity of the

Peruvian timber industry to develop higher value-added

products.

This seminar was aimed at entrepreneurs and business

professionals from primary and secondary wood

processing enterprises and was attended by more than 65

forestry enterprises.

During the workshop representatives from the National

Forestry Camera, the Agricultural Bank and from the

private sector company, Orvisa S.A. presented suggestions

and ideas on management techniques and sourcing

investment capital.

As this first workshop was such a success it will be held

again for companies in Pucallpa and Aguayt¨ªa during the

first half of May.

Agrobanco opened offices in the Amazon

In order to provide forestry and agri-business companies

with access to finance Agrobanco, a state financial entity,

has opened two new offices, one in the town of Puerto

Inca and the other in Quillabamba, both in the Peruvian

Amazon.

In the case of forestry, Agrobanco will provide financing

to companies with forest concessions as well as companies

that are undertaking reforestation of degraded forests.

9.

GUYANA

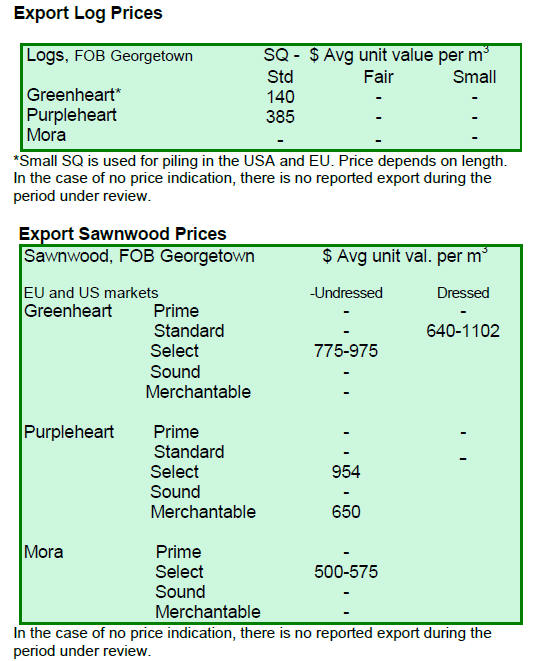

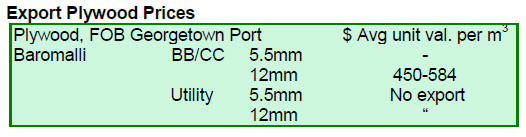

Quiet log market but prices steady

The market for Guyana export logs remains very quiet and

only greenheart Standard Quality logs were shipped

(US$140 per cubic metre FOB).

Purpleheart Standard Quality logs were also shipped at an

average of US$385 per cubic metre FOB and

pricesremained firm in comparison to levels previously

reported. There were no exports of Mora logs during the

period reported.

Sawnwood prices trend weaker in slow market

FOB prices for Guyana sawnwood remain largely

unchanged. Undressed greenheart sawnwood FOB prices

rose from US$594 to US$775 per cubic metre.

Select Quality Undressed purpleheart top-end FOB prices

were slightly lower than over the past weeks, dropping

from US$1,080 to US$954 per cubic metre. In contrast,

Undressed purpleheart (Merchantable Quality) prices

remains stable at US$650 per cubic metre FOB.

Mora sawnwood was exported but FOB prices for

Undressed Mora (Select Quality) declined marginally

from US$672 to US$575 per cubic metre.

Weaker FOB prices were recorded for Dressed greenheart

sawnwood where top end prices fell slightly from

US$1,150 to US$1,102 per cubic metre during this period.

However, Dressed purpleheart top end FOB prices

remained firm at US$1,102 per cubic metre.

Ipe (Washiba) exports continue and FOB prices as high as

US$ 2,550 per cubic metre were recorded.

Export prices for non-traditional species have been

encouraging:

Darina (Angelim pedra) US$ 700 per cubic metre FOB

Kabukalli (Goupia glabra) US$ 742 per cubic metre FOB

Wamara (Swartzia leiocalycina) US$ 575 per cubic metre

FOB.

Some of the major destinations for Guyana‟s hardwoods

include the Caribbean, Europe, Middle East and North

America.

Guyana‟s roundwood (piles and posts) attracted good

prices on the export market with pile prices rising to as

much as US$400 per cubic metre FOB in the Caribbean

and North American markets. FOB prices for posts were

also favourable at an average of US$329 per cubic in the

Caribbean market.

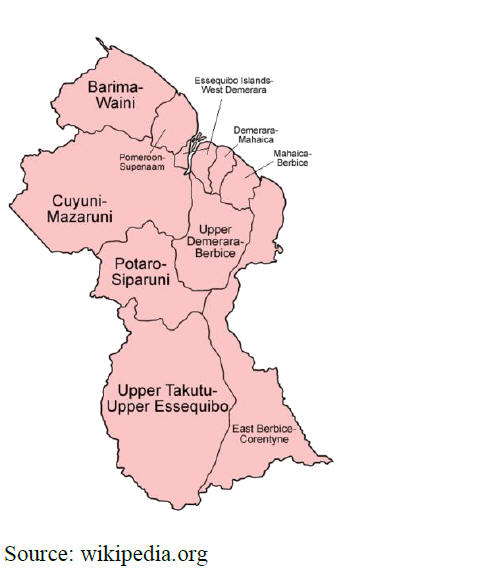

Foreign investment boost to employment

Bai Shan Lin Forest Development Inc. president Chu

Wenzhe has unveiled plans for the establishment of a

wood processing plant in Linden in Region 10, the Upper

Demerara-Berbice region.

Region 10 borders Essequibo Islands-West Demerara,

Demerara-Mahaica and Mahaica-Berbice to the north, the

region of East Berbice-Corentyne to the east, and the

regions of Potaaro-Siparuni and Cuyuni-Mazaruni to the

west.

¡¡

Bai Shan Lin recent advertised vacancies for its

wood

processing and export operations.

The company has plans for production of value added

wood products and has ambitious plans for worker and

community services including a school and a hospital.

The Chinese company has been operating in the forestry

sector of Guyana for several years and has strategic

alliances with other companies in the wood processing and

value added wood sector.

Steps on the FLEGT roadmap

The Guyana Forestry Commission (GFC) recently hosted

a stakeholder workshop on three major elements in the

EU/GFC FLEGT Roadmap - draft Legality Definition, the

Communication Strategy and Scoping of Impacts.

The workshop was attended by over one hundred

participants from twenty eight communities and

discussions focused on the Legality Definition as it relates

to Amerindian Communities.

The Terms of Reference for the Communication Strategy

and the Scoping of Impacts were also discussed.

Communication Strategy and Scoping of Impacts

study

Work on drafting the communication strategy and scoping

of impacts study have been held and FAO has offered to

assist with the drafting of the communication strategy and

scoping of impacts.

A second technical meeting was held between the EU and

Guyana in mid March to discuss the legality definition.

Having benefited from comments on ways in which the

definition can be improved, the Guyana FLEGT

Secretariat will further produce a revised document for

presentation to stakeholder groups. The GFC is seeking

support so that it can engage a wider stakeholder group

and is discussing this with FAO.

The range of wood products to be included in the VPA has

been identified but the agreement allows for the possibility

of additions being built in after the VPA is ratified.

A final decision on the initial product list will taken in July

of 2013 during the second phase of the VPA negotiations

to be held in Brussels. An Aide Memoire for the first

negotiation session between EU and Guyana has been

finalised and is available on the Guyana Forestry

Commission website.

http://www.forestry.gov.gy/Downloads/FLEGT_EU_Guyana_Ai

de_Memoire_Nego1_Dec_5th_2012_Revised_April_10_13.pdf

¡¡