2. GHANA

Implementation of VPA in Ghana

The Government of Ghana and the EU concluded negotiations on a Voluntary

Partnership Agreement (VPA) in September, 2008 and both parties signed the

world¡¯s first FLEGT VPA on November, 20th 2009.

Through implementing the VPA Ghana wood product manufacturers will be able

to satisfy demands in the market for proof that traded wood products are

legal.

Through the VPA Ghana also seeks to achieve the following:

governance reforms within the forestry sector

sustainable forest management

realisation of the full economic value of forests

viable forest sector which contributes to poverty alleviation

Piloting Legality Assurance System (LAS) completed

A key element of the VPA is the implementation of a Legality Assurance

System (LAS).

Between 2010 and 2011 the Government of Ghana piloted its LAS and the

associated Wood Tracking System (WTS). The results of this pilot have been

used to prepare for the national ¡®roll-out¡¯ of the WTS.

The Government of Ghana has contracted a Consortium ¨C Ata Marie Group to

further design and develop the WTS and assist in its national roll-out.

Interim arrangements in advance of compliance with VPA

Ghana is however, unable to meet the EUTR (EU Timber Regulation) effective

date of 3rd March, 2013.

As FLEGT Licensed wood products will not be available for some time the

Ghana Forestry Commission is working with stakeholders to put in place

interim arrangements to assure overseas buyers of the legality of the raw

materials used by manufacturers.

Programme launched to highlight VPA progress

The Ghanaian authorities have embarked on a programme to raise awareness and

inform stakeholders on progress in implementation of the VPA in Ghana.

This programme will be undertaken during February and March this year in

both Ghana and the EU.

The Ghanaian authorities also seek to exchange views with the Competent

Authorities in the EU in respect of the progress in implementation of the

VPA in Ghana.

Ghana has, through the VPA process, targeted the development of its domestic

market and has developed a public procurement policy to promote the use and

trade in legal timber in the domestic market.

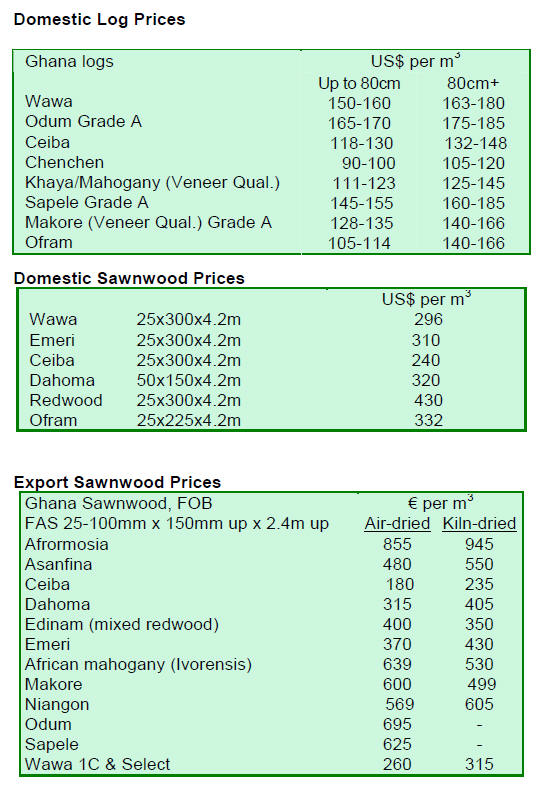

Revenues from timber exports fell in September 2012

The latest available data shows that the total value of wood products

exported in September 2012 amounted to euro 7.54 million, an approximate 13%

decline from the euro 8.64 million earned in August 2012.

There was a corresponding 10% drop in the volume of exports from 21,235 cu.m

in August to 19,112 cu.m in September 2012.

The volume of air dried sawnwood exports between August and September 2012

increased by 3.5%, while export volumes for other products fell in the same

period.

Exports of plywood, dowels, mouldings, air dried boules and poles also fell

in September compared to levels in August.

The shares of the primary, secondary and tertiary product exports in

September were 3.7%, 93.3% and 3.0% respectively.

John Bitar & Co. Ltd was the leading exporter of plywood and kiln dried

sawnwood to markets in Nigeria, Burkina Faso and Benin. These markets

accounted for about 13% of total export earnings from wood products.

In terms of export markets by region, African markets accounted for 47.5%,

Asia/Far East 26.8%, Europe 16.1%, Middle East 5.0% and N. America 4.6%.

For timber export to the ECOWAS market, Nigeria¡¯s imports accounted for 55%

in terms of volume and 60% in terms of value.

New Minister for Lands and Natural Resources

The Ghanaian President His Excellency, John Dramani Maham, has nominated

Alhaji Inusah Fuseini as the new Minster for the Ministry of Lands and

Natural Resources. The nomination of the Mr. Fuseini was among the first

ministerial appointees presented to Parliament¡¯s Appointment Committee for

vetting and approval.

¡¡

¡¡

3. MALAYSIA

Production set to halt for Chinese New

Year holidays

As the Chinese New Year holidays approach the timber industries in Malaysia

are beginning to wind down production and prepare for a shut down from the

first week in February. Sawmills, especially in Peninsular Malaysia, will

shut for an extended break in early February.

Rubberwood furniture maker invests in plantations

The Malaysian Star newspaper reported (22/1/13) Celment Hii, director of the

country¡¯s largest rubberwood furniture manufacturer SYF Resources Bhd, as

saying the company does not expect to be seriously affected by the current

global economic slowdown and the narrowing of profit margins.

Hii said the company has diversified upstream through investment in rubber

plantations in order to secure its rubberwood raw material supply.

On a year-on-year basis, SYF¡¯s revenue for the last quarter of 2012 grew

from RM42.98mil in 2011 to RM58.07mil last year.

WTK to maintain cap on production until demand improves

The Star newspaper also reported on WTK Holdings Bhd, a major log supplier

based in Sibu, Sarawak. WTK produced 441,471 cu.m of logs in 2012 compared

to 530,864 cu.m in 2011. WTK produces plywood and other wood products. The

company says it will continue to cap production of logs until the demand

improves thus continuing the same reduced production policy adopted in early

2012.

The company cited the uncertainty in major markets and resulting reduced

consumption as the main reason for the decision to reduce output.

Sabah Forest department considers domestic legality assurance

Despite anticipation of the quiet period in industry over the New Year

holidays, the industry in Sabah has been busy working on legality issues.

The companies exporting to Europe are focussed on the impending coming into

force of the EUTR. Analysts report that the Sabah Forestry Department is

studying how the State should approach development of a Sabah timber

legality assurance scheme.

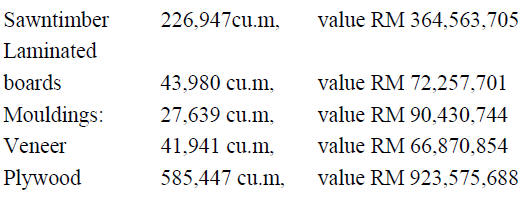

Data on timber exports from Sabah were released recently. Export levels for

the period January to November 2012 are shown below, (prices are FOB basis):

Sarawak industries prepare for Australian due

diligence

The industry in Sarawak is already experiencing quiet trading as overseas

buyers are well aware that production will soon come to a standstill and

company offices will close for the New Year holidays.

The Australian market is important for companies in Sarawak and the industry

is watching developments in the Australian Illegal Logging Prohibition Act

2012.

Some companies in Sarawak are already preparing to meet the due diligence

regulations so as not to disrupt timber exports to Australia.

Malaysian Furniture Fair strengthened by partnership with Muar Furniture

Association

In a press release the Malaysian International Furniture Fair (MIFF)

announced a strategic alliance with the Muar Furniture Association (MFA),

one of the most prominent furniture industry groups in Malaysia.

Beginning in 2013, MFA will participate exclusively in MIFF, Southeast

Asia¡¯s annual furniture trade show managed by UBM Asia, setting the stage

for the biggest ever MIFF since its inception in 1995.

This is the first ever commitment of its kind by the MFA. Manufacturers in

Muar account for 45% of Malaysian furniture exports from a base of about 500

manufacturers, including eight public-listed companies.

The participation of furniture manufacturers from Muar will further

strengthen MIFF as the single biggest platform for Malaysian furniture known

primarily for hardwood products.

MIFF 2013 will be held from March 5th to 9th 2013 at the Putra World Trade

Centre and Matrade Exhibition and Convention Centre in Kuala Lumpur.

Moves to cool real estate market

Over the past two years growth in the real estate sector in Malaysia has

been an important market for the timber industries in the country. However,

the growth witnessed over the past years is expected to slow in 2013 as the

government is determined to cool the sector.

The Malaysian government has introduced a 70 percent Loan-to-Value maximum

on loans to those buying a third property and is now basing the loan

assessment on net income rather than gross income

.

The government is also raising the property capital gains tax.

Analysts say that, while these changes will have an

impact on new investment in the Malaysia¡¯s property market, long-term

investors and people buying homes to occupy rather than for rent will

provide a measure of continued growth in the housing market.

Correction

In the previous ITTO report (17:1 15th Jan 2013) the statistics on exports

of plywood from Sarawak were incorrect. The correct data is: for the period

January to November 2012, Sarawak exported 2,402,120 cu.m of plywood, valued

at RM 3,634,972,141.

¡¡

4. INDONESIA

Jakarta businesses hit by deadly floods

Indonesia¡¯s capital, Jakarta, was brought to a standstill by flooding which

peaked on 17 January. Some 10 million people living and working in the city

were affected and 20 people are reported to have died in flood related

accidents.

The local media reports that more than 40,000 people were displaced and more

than 100,000 homes and businesses were under water.

Most of the timber industries located in Jakarta, Banten and West Java had

to postpone shipments during the 5 days of floods in Jakarta. Most exporters

managed to re-arrange export schedule but some are facing delayed shipment

penalties from buyers.

So far, there is no detailed information on the financial loses suffered by

timber industries located in Jakarta, Tangerang, bekasi, and Banten.

However, estimates put potential losses at around 1 trillion rupiah.

Analysts point out that some industries located in the flood hit pockets

such as the Pulogadung industrial area and Tangerang Banten probably

suffered financial losses because wood working machinery and raw materials

were submerged.

Jakarta is surrounded by mountains and 13 rivers flow through the city to

the Java Sea. The government has identified poor drainage in the catchment

areas of Bogor-Puncak-Cianjur as contributing to the flooding of the

Ciliwung river.

EU a major destination for processed wood products

The Indonesian Ministry of Forestry has reported that the volume of wood

products export during the past 12 months totalled 1.01million cu.m for

shipments to 94 countries, including EU member states.

The EU is a significant importer of Indonesian timber products.

While the volume of primary product exports to the EU was a modest 169.000

cu.m, or just 11% of the total export volume, exports of processed wood

products to the EU were worth US$ 210 million or 22% of the total export

value of all processed wood product exports.

Forestry and timber sectors could attract FDI

At the same time as the floods hit Jakarta the Government announced record

high levels of foreign investment (FDI) during 2012. Total investments of Rp

313.2 trillion (US$32.5 billion), exceeding the target of Rp 283.5 trillion,

were recorded.

Most of the investment was in the mining sector (17 percent of total FDI);

followed by the transportation and telecommunication sectors (11 percent)

and the pharmaceutical sector (11 percent).

Analysts point out that with the successful introduction of the domestic

timber legality assurance scheme, there is a good chance that investment in

the forestry and timber sectors will expand.

Indonesian SVLK satisfies EUTR

The Indonesian government has inaugurated a V-Legal/ FLEGT timber license

system to boost timber sales globally and especially to meet the

requirements of the EUTR.

The Indonesian government has said that when the EUTR enters into force in

March this year, Indonesian wood products shipped by exporters with the

domestic SVLK certificate will be deemed as satisfying the due diligence

requirements of the EUTR It is said that around 1,500 companies nationwide

have obtained SVLK certification.

Indonesia is the first Asian country to conclude negotiations of a Voluntary

partnership Agreement (VPA) and the Indonesia/EU VPA is expected to be

ratified in September this year.

EU importer expresses satisfaction with test shipment

The EU is a major destination for wood products from Indonesia and some EU

member states recently participated in a test shipment of verified legal

wood products from Indonesia.

The Netherlands Koninglijke Dekker Hout Group, which imports from Indonesia,

participated in the test shipment and expressed satisfaction on the results

of the test.

Indonesia looks forward to the early ratification of its VPA as this will

bring tangible benefits to Indonesian exporters and European importers

catering to demands of consumers in the EU.

Small companies offered help with SVLK certification

All wood product manufacturers in Indonesia are required to comply with the

domestic timber legality assurance system. This requires that they secure

third party verification.

The cost of securing the third party verification is a serious issue for

small scale industries and the handicraft makers. Until now these small

companies could not obtain financial or technical assistance to meet the new

requirements.

The Indonesian government has allocated an initial Rp 3 billion (US$312,000)

from the state budget to help subsidise small-scale producers in obtaining

SVLK certification.

¡¡

5. MYANMAR

What is causing weak demand for teak in EU?

Analysts say that, despite the easing of economic sanctions, the demand for

teak in the EU, US and Japanese markets is low. Whilst the current economic

downturn in the EU and US may be partly responsible for the poor demand for

teak in these markets, other factors may be involved.

The number of companies in Thailand and Taiwan P.o.C manufacturing teak

products for export to Europe and the US has fallen dramatically over the

past few years.

Some traders suggest that teak seems to have lost the appeal it enjoyed in

the 1980¡¯s and 90¡¯s and that efforts are required to stimulate the markets.

The shrinking market for teak in Europe also seems to be linked to the

decline in the quality of teak being made available.

High quality teak, the grades preferred by Japan, US and EU are not now

readily available, reflecting the decline in the teak forests, say analysts.

The teak forests in central Myanmar have been harvested over and over again

and now yield only small quantities of high quality logs.

China and India major markets for teak

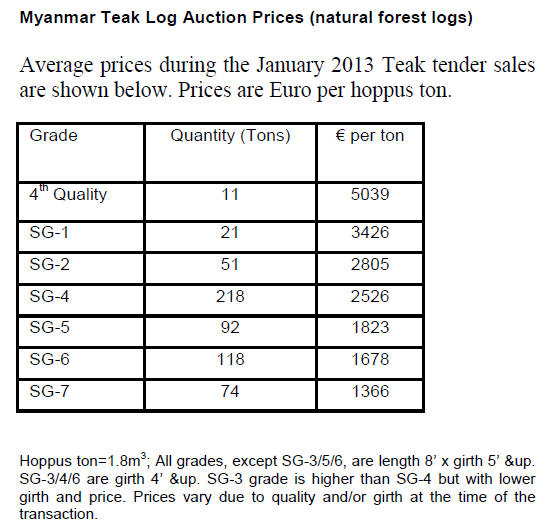

In recent years the log grades available have been mainly SG-4 and lower.

European buyers tended to purchase mainly higher grade 4th Quality logs but

the scarcity of higher grades has meant European buyers had to accept lower

grades such as SG-4.

Lower grades such as SG-7 and SG-8 are available in large quantities and

these grades are acceptable in the Indian market, especially now as the

Indian rupee has fallen against major currencies.

It is estimated that 80% of Myanmar¡¯s teak log exports go to India. It is

not possible to gauge the exact volume exported to China as only a small

quantity is shipped out by sea to China and is thus carefully documented.

Most teak for the Chinese timber industry is transported overland and

documentation of this trade is a major problem.

Undecided on investment in processing capacity

While many longstanding and experienced exporters and traders are

considering investing in wood processing industries in Myanmar in face of

the proposed log export ban, it is reported that some still believe that the

decision on the ban is reversible.

Plan needed to address forest degradation

The main issue confronting the forest authorities in Myanmar today, say

analysts, is not a total or a partial log ban but how to ensure harvests are

within the annual allowable cut to check forest degradation and

deforestation.

In order to develop appropriate polices it is vital that the state of the

forest is understood. There are conflicting reports on the forest cover

which must be addressed.

According to the Myanmar forestry authority the forest cover is around 47%

but according to the NGO community the forest cover is only around half of

that.

Verification of the actual forest cover is will take time and will involve a

considerable investment. Until such data is available there is a risk that

harvest levels will be set too high.

¡¡

¡¡

6.

INDIA

Timber imports through Kandla port

grow as industries in vicinity expand

Kandla Port registered double digit cargo growth during 2011-12. Strong

demand and increasing numbers of timber processing plants in the vicinity of

the port has resulted in higher imports of logs through the port.

In 2010-2011 log imports through Kandla port were 3.728 million cubic metres,

but in 2011-2012 the figure rose to 4.131 million cubic metres a rise of

10.8 %.

Currently there are 952 licensed wood working factories in and around Kandla

and analysts expected more plants to be established in the Kandla and Mundra

as the area is serviced by two very modern ports.

Over a 12 month period Kandla and Mundra ports handled some 992,000 cu.m of

Meranti logs mainly from Malaysia, 301,000 cu.m of Gurjan / Keruing logs

from Myanmar and Malaysia, some 1.4 mil. cu.m of Pine logs from New Zealand

and Europe and 455,000 cu.m of Teak logs.

The major supplies of teak, both natural forest and plantation teak were

Ecuador, Myanmar, Ghana, Costa Rica, Ivory Coast, Panama, Benin, Sudan,

Brazil, Tanzania, Togo, El-Salvador and Nigeria.

It is estimated that nearly 70% of all timber imported by India moved

through the ports of Kandla and Mundra. Analysts anticipate imports will

exceed 5mil. cu.m in the current fiscal year. New modern port facilities are

under consideration to service companies on the east coast of India.

Industry seeks reduction of State VAT on raw materials

The timber industries in the east have voiced concern over the high (15%)

value added tax (VAT) charged by the state government. The industry argues

that, as logs are the raw material input for industries the VAT should be

reduced to 4% to bring it in line with rates charged by many other states.

Reviving wood based industries in N.E. India

Central and State Governments have development plans for N.E. region of

India through a combination of private and public investment. Reviving the

development of the plywood industry in the region is under consideration.

Demand in India for plywood continues to rise and the ever widening gap

between supply and demand can only be met by imports.

The N.E. region of India was up until around 1966 a major centre for wood

based industries. At that time almost 80% of India¡¯s requirements for

plywood were being met from mills in that region.

To-day, mills in the N.E. provide to less than 10% of the plywood demand in

the country.

The N.E. has a climate suitable for plantations of the fast growing species

which are ideal for plywood manufacture. There is ample land available in

and around villages, adjacent to forest areas and close to tea-plantations

and deforested hills as well as along river banks.

Infrastructure in the region is adequate and there is a pool of experienced

technicians and skilled workers. Reviving the wood based industries in the

region would help reduce regional un-employment.

The agro-forestry developments in the northern Indian states of U.P.,

Punjab, Haryana and Uttaranchal are good examples of what can be achieved. A

revival of the plywood industry in N.E. India would deliver many benefits.

Cross border trade with Myanmar set to grow

Relations between India and Myanmar are improving which could lead to

expanded cross border trade. In the Border Trade Agreement of 1995

mechanisms for road transport of goods between India and Myanmar were

established bringing economic benefits to both countries.

Observers point out that the roads used for this cross border trade need to

be upgraded to make transportation of goods in both directions more

efficient. When this is done the timber industry will benefit and so will

other sectors for which the cross border trade is important.

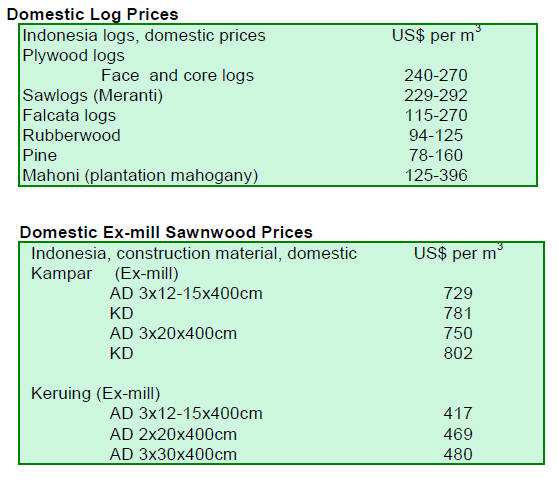

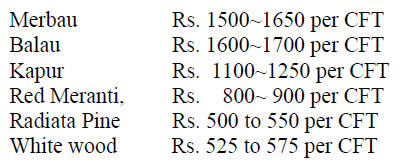

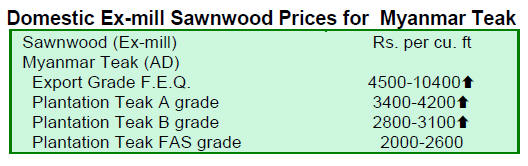

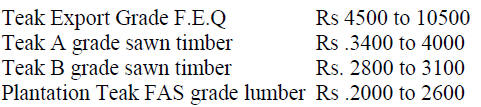

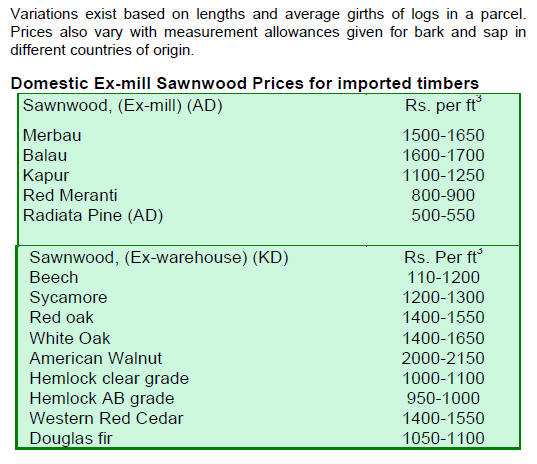

The local prices for air dried Sawn timber per cubic foot, ex-saw mill

remain unchanged and are shown below:

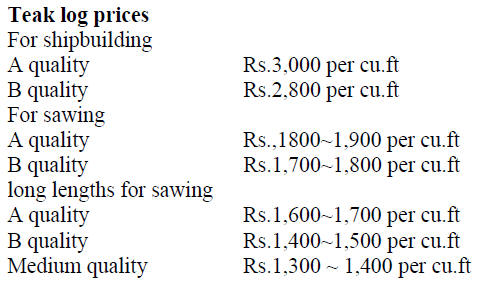

Average prices realised at sales held in Government

Teak depots in Central India are shown below. The prices are per cubic foot

ex depot.

Myanmar Teak processed in India

The demand in India for Myanmar teak remains steady. Analysts in India say

that as the EU and US have improved relations with Myanmar the teak trade

between Myanmar and the west may expand which will mean Indian importers

will face increased competition.

Some Indian companies are already planning to shift processing capacity from

India to Myanmar in response to the proposed 2014 log export ban in Myanmar.

Prices for Myanmar teak are shown below:

Price variations are mainly due to differences in

lengths and diameter.

Despite the depreciation of the Indian rupee, teak sawnwood prices remain at

pre-depreciation levels as Indian buyers are reluctant to pay higher prices.

Some Indian manufacturers are replacing teak with durable non-teak hardwoods

such as Merbau

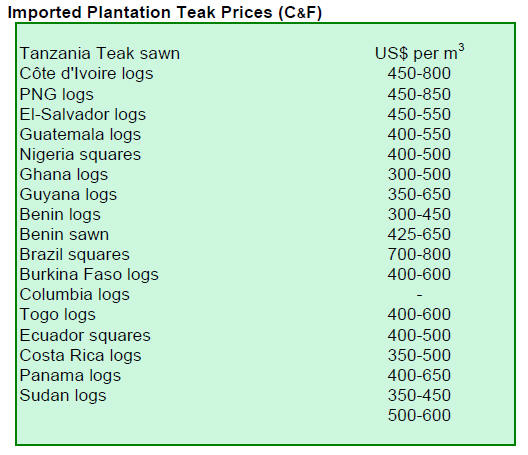

High quality plantation teak arriving from Sudan

Presently, out of all the sources of West African plantation teak, logs

coming from Benin are reportedly of the highest quality. The quality of

plantation teak from Sudan and shipped through Mombassa in Kenya is highly

regarded by Indian buyers and this is reflected in the log prices.

Current prices, C & F Indian ports, for Teak are shown below:

Indian plywood manufacturers seek protection

from low cost imports

The domestic plywood industry continues to face severe competition from

cheaper imports, mainly from China.

This is a matter of considerable concern in India as the small mills, which

number over 1000 and which support employment, are suffering the most.

A request from industry for an anti-dumping levy to be imposed on some

imports is being considered and support of Central Government is being

sought by the various plywood manufacturer¡¯s associations.

.

7.

BRAZIL

Inflation spikes in December but

yearly target achieved

According to the Brazilian Institute of Geography and Statistics (IBGE), the

inflation rate was higher than expected in December 2012.

The December Consumer Price Index (IPCA), at 0.79%, was the highest since

March 2011. The December 2012 figure was the highest rate for a month of

December since 2004.

Despite the spike in December inflation the Government reached its inflation

control target for 2012, stipulated at 4.5% with a variation of two

percentage points. In 2011, the inflation rate was 6.5%.

Further weakening of the Real against the US dollar

In 2012, the average real/US dollar exchange rate was BRL 1.95/USD. In 2011

the average was BRL 1.67/USD.

The average exchange rate in December 2012 came in at BRL 2.08/USD

indicating a slight easing of the Brazilian currency against the US dollar.

Reduction in interest rate possible in second quarter

The Monetary Policy Committee (Copom) of the Central Bank (BC), in its last

final meeting of 2012 and in the first meeting of 2013, decided to maintain

the prime interest rate (Selic) at 7.25% per year.

Many financial analysts are of the opinio that the Selic rate should be

maintained at its current level, at least during the first quarter of this

year and that a reduction to 7% could be considered for the second quarter

if the economy does not show signs of recovery.

Promoting investment in plantations not bonds

Investing in land and forest plantations is being promoted as an alternative

investment in Brazil. Investment companies claim that yields on investment

in Brazilian plantations in 2012 would have yielded better returns than on

gold or US saving bonds.

Several companies are offering plantation land as an alternative investment.

Investors can purchase plantation packages for as little as euro 6.200 to

500,000. The return on such an investment is only seen when the plantations

mature and are harvested.

Brazilian entrepreneurs are optimistic that demand for wood products in the

domestic and international markets will continue to grow.

The hosting of the Olympic Games and World Cup will involve considerable

investment in construction leading to increased demand for wood products say

analysts. Also, the Brazilian government is promoting building of more

housing for low income families which will increase demand for wood

products.

Demand for hardwood planting stock expected to rise

In 2012 the demand for seedlings of high value hardwood species for

plantations exceeded expectations. Projections for 2013 anticipate a

tripling of demand according to Tropical Flora Reflorestadora, a specialist

company providing planting stock.

Investment in the so-called ‘green economy?is now being actively promoted and

workshops have been organised by Tropical Flora to provide information on

the potential of this type of investment.

Currently, the hardwood species that have been planted include Guanandi (Calophyllum

brasiliense), African mahogany (Khaya ivorensis), Jequitib?Rosa (Cariniana

legalis), Teak (Tectona grandis ) and Cana fístula (Peltophorum dubium).

Forestry experts say that farmers could plant such high value hardwoods

alongside coffee, pupunha palm tree and other crops to generate higher

income.

Round up of December 2012 timber exports

In December 2012,the value of wood products exports (except pulp and paper)

fell 5.9% compared to values in December 2011, from US$ 218.6 million to US$

205.7 million.

Pine sawnwood exports declined 30.4% in value in December 2012 compared to

December 2011, from US$ 14.8 million to US$ 10.3 million. In terms of

volume, exports dropped from 66,100 cu.m to 46,000 cu.m over the period.

Exports of tropical sawnwood fell 26% in volume, from 44,700 cu.m in 2011 to

33,100 cu.m in December 2012 compared to December 2011, (from US$ 24.7

million to US$ 16.4 million).

Pine plywood exports rose 21% in value in December 2012 compared to December

2011, from US$ 26 million to US$ 31.5 million. The volume increased was just

over 19% in December, from 71,600 cu.m to 85,500 cu.m.

Exports of tropical plywood fell from 5,200 cu.m in December 2011 to 5,100

cu.m in December 2012, an approximate 2% decline.

A much higher rate of decline was observed in the value of tropical plywood

exports in December where a 22% fall was registered, (US$ 3.6 million to US$

2.8 million).

Brazilian exports of wooden furniture dropped from US$ 44.3 million in

December 2011 to US$ 41.1 million in December 2012, a 7% decline.

"Orchestra Brazil"diversifies furniture export markets

A project called “Orchestra Brazil?is promoting diversification of export

markets. This project is a partnership between Sindmóveis (Association of

Furniture Industries of Bento Gonçalves) and Apex-Brazil (Brazilian Trade and

Investment Promotion Agency).

The aim of “Orchestra Brazil?is to improve the competitiveness of Brazilian

furniture exporters . This is being achieved through combining the expertise

from manufacturers, suppliers, technologists and designers to the furniture

sector. The target markets for this initiative are Peru, Paraguay, Uruguay

and Argentina.

From 2005 ?2011 the annual import growth of companies associated with the “Orchestra

Brazil?initiative in the four target markets was over 15% in Peru; 26% in

Paraguay; 13% in Uruguay and 15% in Argentina. Research has concluded that

this project was highly regarded in Peru, Paraguay and Uruguay.

Despite the declining imports by Argentina of furniture from Brazil, the

result of barriers affecting bilateral trade say analysts, the country was

the second largest importer of furniture from companies associated with the

"Orchestra Brazil" initiative.

Brazilian sawmilling sector anticipates positive growth

The Brazilian sawnwood industry is forecasting positive growth in 2013 in

anticipation of increased demand resulting from construction of facilities

for the World Cup (2014) and the Olympic Games (2016). A further boost to

demand will come from the government’s housing programme "My House My Life (Minha

Casa Minha Vida)".

In other encouraging news the Brazilian Association of Mechanically

Processed Timber Industries (ABIMCI) has indicated that the federal

government intends to reduce payroll taxes for the sawnwood sector in 2013.

The Ministry of Development, Industry and Foreign Trade (MDIC) is said to be

considering eliminating the tax on Industrialized Products (IPI) for plywood

and also the 8% tax charged when the Brazilian forest products are exported

to the US market.

¡¡

8. PERU

Civil society calls for greater

dynamism in forestry reform

A group of civil society organizations has petitioned the head of the

Ministry of Agriculture (Minag), Milton Von Hesse, for a more dynamic reform

of the forest and wildlife sectors to, as they say, "give it competitiveness

and inclusion ".

The petition mentions the status and progress in improving the policy and

institutional framework of forestry management in the country and

specifically recommends:

the development of a new participatory policy for forestry and wildlife;

the design and implementation of improved institutional arrangement and

a revised Forest Act and Wildlife Act

The petition directed at the Ministry of Agriculture says "We urge your

office to strengthen the team of the Forestry and Wildlife (DGFFS),

providing dedicated staff necessary for the process, the necessary budget

for implementation of activities and the political and institutional support

of all Ministries¡¨.

Regarding the proposed draft National Forestry Policy and Wildlife (PNFFS),

submitted in December 2012, the organizations asked to expand to 120 days

the period for receiving input from the public¡¨.

The group further asked for greater transparency in progress with

development of regulations being developed by the National Forestry and

Wildlife Agency (SERFOR).

The petition to the Ministry was signed by organizations such as the

Peruvian Society for Environmental Law (SPDA), Law Environment and Natural

Resources (DAR), Peruvian Society for Ecological Development (SPDE),

Proetica, Association for the Conservation of the Amazon Basin (ACCA),

Center Indigenous Cultures of Peru (Chirapaq), the Centre for Environmental

Sustainability Universidad Peruana Cayetano Heredia (CSA-UPCH), amongst

others.

Forestry Training Centre in Peru

The Tropical Forest Foundation has launched a fundraising campaign to secure

funds to accelerate the development of a training and education centre in

Peru.

This centre would focus on how to balance sustainable forest management,

demand for wood products, the ecological integrity of the forests and the

economic welfare of local communities.

This training centre would, if funds are forthcoming be built in the Amazon

region of Madre de Dios an area which has about 350,000 hectares of

certified forest.

¡¡

¡¡

9.

GUYANA

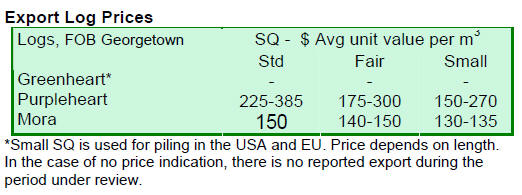

Slow start to year for log exporters

A slowing of log exports in the early part of the month was observed, the

cause of which say analysts, was the extended holidays in the main western

markets. However, some Mora log contracts were shipped and prices were

reported as fair for all categories.

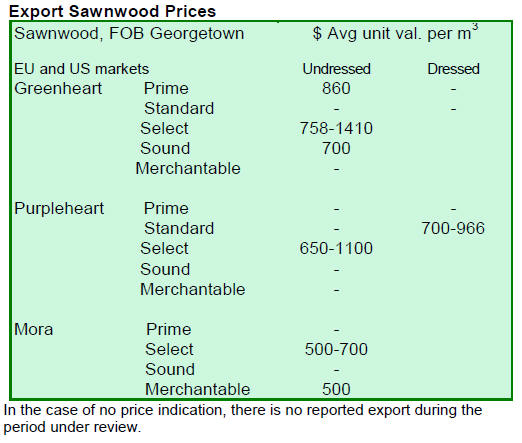

Shipments of Undressed Greenheart sawnwood were concluded during the month

but prices weakened for select grade.

On the other hand prices increases for Sound quality were recorded and

prices rose from US$ 700 to US$ 721 per cubic metre. Prices for Merchantable

quality were reported as only fair.

More species exported to the EU

There were no exports of Undressed Purpleheart sawnwood early in the month.

Undressed Mora sawnwood prices held steady, unchanged from December 2012.

Europe is the main market for Undressed Mora sawnwood. Some of Guyana¡¯s

lesser used species such as Burada, Darina, Fukadi and Kautaballi made their

way to the European market and prices were reportedly satisfactory.

Dressed Purpleheart sawnwood prices were maintained at around US$ 1,080 per

cubic metre. Guyana¡¯s Washiba (Ipe) sawnwood price remains very attractive

to exporters who now earn a maximum price of US$ 2,300 per cubic metre,

mainly form buyers for the North America market.

Suriname, a growing market for plywood

Prices for Guyana plywood BB/CC category held steady at around US$ 584 per

cubic metre. Suriname is now a significant importer of plywood from Guyana.

The market for Splitwood (shingles) was reported as good during January and

prices were at US$ 909 per cubic metre in the markets of the Caribbean.

Guyana revises export tax schedules

After a thorough consultative process the Government of Guyana published

amendments to its policy on the export of logs and squares. The policy

document sets out a schedule of increases in export taxes for specific

species and products.

The new export duty rates has one schedule for logs and another for squares

with dimensions of 20.3 cm x 20.3 cm and above.

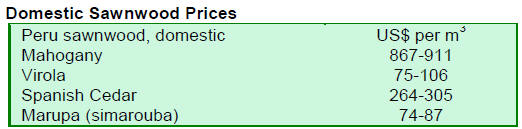

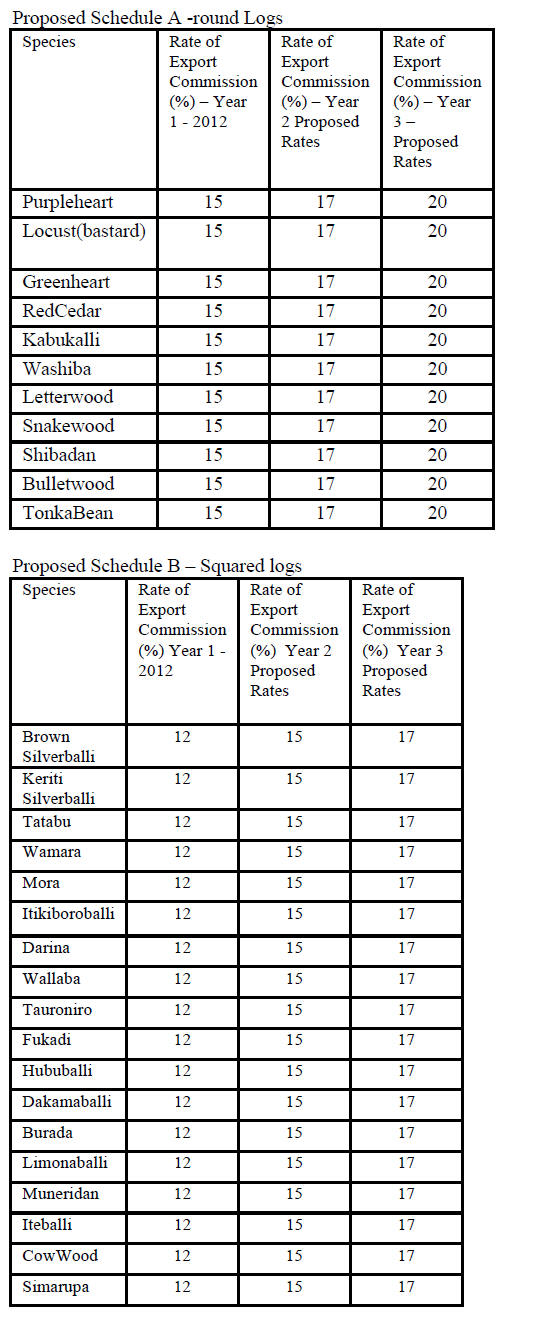

The rate of export duty in Schedule A (logs) will be 15% in the first year,

17% in year two and 20% in the final year of the amended policy schedule.

The export duty rates applied to squares (Schedule B) will be 12% in the

first year, 15% in year two and 17% in the final year. At the end of the

three year period a decision will be made for future rates.

Exports of logs and squares of species not identified in either Schedule A

or B will attract a 2% across the board flat rate of export duty.

The government policy notes that special consideration will be given to

local companies or entities exporting squares (products with dimensions of

20.3 cm x 20.3 cm and above) which are to be used in the sizes exported for

engineering end uses and applications.

The latest policy document extends the total restriction on the export of

Crabwood (Andiroba) and Locust (Jatoba) logs.

This policy document is considered a significant way to further improve the

performance of the sector through encouraging adding more value to forest

products so as to contribute further to the development of Guyana forest

sector.

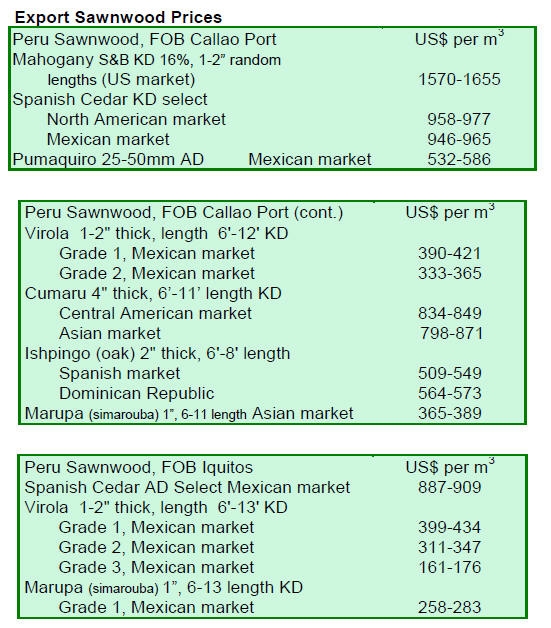

See below for schedules for round logs and squares.

¡¡