|

1.

CENTRAL/ WEST AFRICA

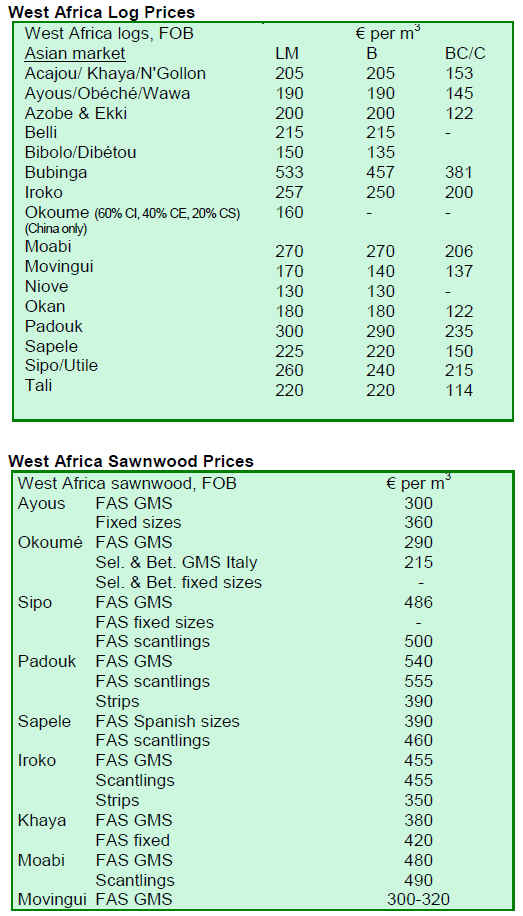

Prices hold steady in West Africa

There is no change in the market since the end of July.

Sustained business with China, Vietnam and India

continues to hold export prices and volumes steady, a

trend similar to the past two months. Trade with European

buyers is still very slow and neither exporters nor

importers appear to be expecting a sustained improvement

in business with Europe in the short to medium term. The

modest price gains for some species in July have held and

there are reports that demand for okoume logs has been

particularly high.

The ongoing demand for the very selective number of

favorite species is not likely at this stage to tempt

producers into any prompt reactivation of logging. The

emphasis on so few species does tend to mask the lack of

interest in other species available in most forest

concession areas, forcing loggers to log very selectively,

resulting in a rise in the cost of extraction. Although most

world stock markets have made some gains in the past two

weeks, economists continue to warn that the underlying

market prospects remain very fragile and recovery to

normal trade conditions is many months if not years away.

This is certainly the view of many in the West African

timber industry as the boom years in building construction

in consumer countries such as Spain, Portugal, the US and

UK are over and unemployment is climbing. Some timber

trade representatives have recently commented that the

tropical hardwood trade may not decline further from the

present low level, but it is not likely to return to the

volumes traded in the past three or four years.

For the present, West African log and lumber exporters

have survived through a very difficult 12 months, thanks

to continued demand from the Asian market. It is

anticipated that if these markets hold, the companies

benefiting from this trade will continue to do so through

the third and fourth quarters. The expectation remains that

2010 will bring some revival in European business.

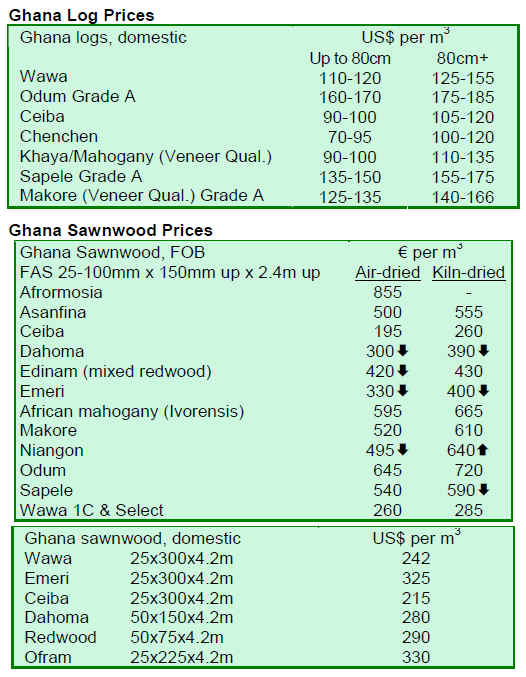

2. GHANA

Ayum sets pace for best timber practices

Ayum Forest Products Ltd, a forest resource concession

holder in the Asunafo North Municipality of the Brong

Ahafo Region, has committed about USD500 million

towards a reforestation project in the degraded Amama

Forest Reserve at Atronie, near Sunyani. Since the

programme began in 2003, the company has planted over

five million indigenous tree species. According to The

Daily Graphic, the new initiatives are designed to show

the company¡¯s best timber practices. The tree species

planted in the degraded areas, covering about 42.28 square

kilometers, include cedrela, ofram, ceiba, mahogany,

edina, wawa, utile, emirem chenchen, koto, kokrodua,

mansonia, asanfina, makore, akasaa and otie.

Currently, the company sources about 80% of all wood

material input from its own concession areas and its

current forest management practices are in line with the

laws and regulations of the Forestry Commission (FC) as

well as its logging manual. In addition, the company is

highly committed to forest restoration in degraded areas

and reclamation of log siding in productive forest areas

using indigenous species. As one of the largest timber

companies and a leader in timber products from Ghana,

Ayum has the opportunity to positively influence the

Ghanaian landscape through its commitment to

responsible forestry practices to become a leader in the

sub-regional forest products industry.

Recently, the company joined the Global Forest and Trade

Network ¨C West Africa, thereby committing its forest

concessions to be responsibly managed, including through

the use of credible certification systems. In addition to the

forest concessions under the company¡¯s management,

Ayum also agreed to implement responsible procurement

policies for the timber entering sawnwood, veneer and

plywood mills. The company¡¯s forest reserves are crucial

to the conservation and protection of biodiversity in the

Guinean Moist Forest Eco-region, which is considered the

most biodiverse region in West Africa. At a press briefing,

Ayum¡¯s Director of Operations Mr. Akufo Owoo hinted

the company adopted a waste management system to

ensure proper management and disposal of waste at all

levels of the company¡¯s operations. Ayum is also a

beneficiary of an ITTO pilot scheme on timber tracking.

3.

MALAYSIA

Trade event expected to draw about 50,000 visitors

Organizers of the Malaysia International Commodity

Conference & Showcase (MICCOS), to be held from 13-

16 August 2009, expect the event to draw up to 50,000

visitors. The Malaysian Timber Council will be organizing

a major business-matching session during the event, which

will include at least 49 delegates from 35 companies from

16 countries including China, Germany, Greece, Hungary,

India, Pakistan, Poland, United Arab Emirates and

Uzbekistan. According to The Star Online, about 100

business representatives from 61 Malaysian timber-based

companies will also be participating in the businessmatching

session at MICCOS. The president of the

National Smallholders Association (NASH), Datuk

Aliasak Ambia said the event would provide small

businesses a good opportunity to be updated on the latest

market information on cash crops such as palm oil and

rubber.

Malaysian furniture manufacturers will also be

participating in the Furniture China trade exhibition to be

held at the Shanghai International Exhibition Centre

(SIEC) and the Redstar Macalline Global Furnishing

Trade Center (RMGFTC) from 9-12 September 2009.

Furniture Today reported the trade show will feature 1,800

exhibitors occupying 2.3 million square feet at the SIEC

and another 500 exhibitors occupying about 1.8 million

square feet at the RMGFTC.

New Zealand seen as model for Malaysia¡¯s plantation development

The Malaysian Deputy Ministry of Plantation Industries

and Commodities Hamzah Zainuddin said that Malaysia

should emulate the management practices of forest

plantations in New Zealand in order to stimulate research

and development in the timber sector. According to

Bernama, the Deputy Minister was leading a delegation

from Malaysia to New Zealand to discuss cooperation

between the two countries in the timber sector.

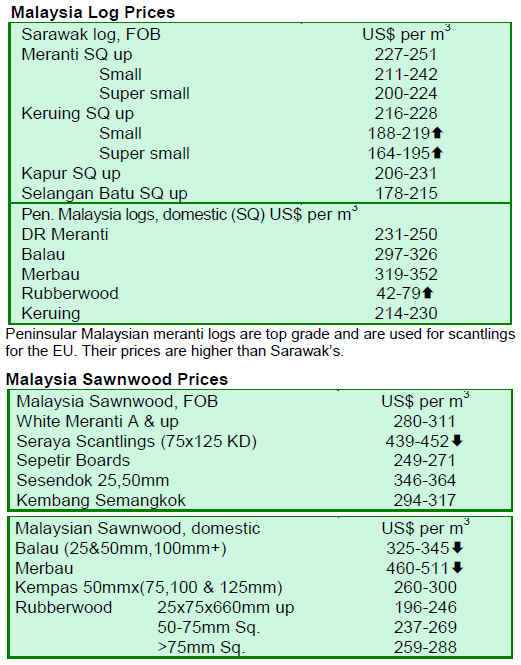

Drought and haze hit Sarawak

Bernama reported that timber logging activities in

Sarawak were being reduced as a combination of drought

and haze has covered the state of Sarawak. The drought

brought about by the El Niño effect has been depriving

timber logging camps of drinking water and sanitation.

The drought has also created extremely dry conditions in

the forests, making it very susceptible and vulnerable to

fires. Deputy Chief Minister Mr. George Chan, who is also

the chairman of the state Disaster Management and Relief

Committee, has activated disaster operations across the

state. The situation may create a temporary shortage of

logs that will arrest any decline in prices for timber

products in Sarawak. However, prices are unlikely to

strengthen as there are adequate supplies of raw logs and

other timber products in Sarawak.

4.

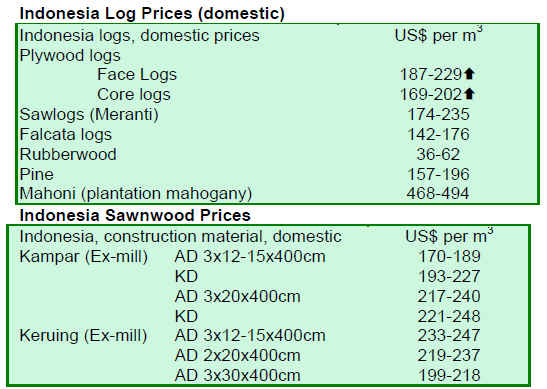

INDONESIA

Sengon used as alternative to raw materials from production forests

Timber products manufacturers in Java are increasingly

turning to sengon wood as an alternative raw material,

reported The Jakarta Post. As a result, its price has

quadrupled to Rp 800,000 (USD79) per m³ over the last

four years. Sengon wood is preferred by many

manufacturers as the tree is highly adaptable to most soil

conditions and has a 5 to 10 year gestation period. The

physical properties of the wood also meet the requirements

of manufacturers for a wide range of timber products.

With some companies utilizing up to 80% of sengon wood

as raw material, competition for the wood has become

keen. Prices of the wood of a higher quality are anticipated

to hit Rp. 1 million per m³. As such, some companies

have resorted to buying other lesser-used species such as

coconut and oil palms as a source of raw material.

However, sengon wood remains a favorite among timber

products manufacturers in Java which are reported to have

processed and used up to 4 million m³ of the wood over

the last three years.

New certification system to take effect in September

The Jakarta Post reported that by 1 September 2009, a

new certification system would be in place for the

country¡¯s log and wood products produced by local

companies. The Institute of Independent Evaluators and

Verifiers (LPVI) will be responsible for issuing certificates

for these products as well as standardization documents to

licensed holders of forest management units, production

forests and community forests. The system will apply to

Indonesian products sold domestically and internationally.

Until now, the Board for the Revitalizing the Forest

Industry (BRIK) has been in charge of issuing certification

documents for exported products and will continue to do

so until LPVI is ready to take over BRIK¡¯s

responsibilities. Unlike BRIK, LPVI will comprise more

non-governmental, independent and professional experts.

Ministries wrangle over rattan quotas

Uncertainty continues to prevail over quotas imposed on

rattan exports involving the Indonesian Trade Ministry and

the Industry Ministry, reported The Jakarta Post. The

quotas imposed under a new regulation, which constitutes

the fourth revision of a 2005 regulation, have remained

unchanged despite mounting calls to reduce or completely

ban rattan exports in order to address the acute shortage of

the raw material. However, Industry Minister Mr. Fahmi

Idris indicated that the quotas could be amended as the

new regulation was still undergoing further revision.

The Industry Ministry reveals that the country produces

600,000 tons of raw rattan annually, which represents 75%

to 80% of the world¡¯s total production. Sumatra,

Kalimantan, Sulawesi and Papua are the main rattanproducing

regions in Indonesia. The Indonesian Furniture

Entrepreneurs Association (Asmindo) said the local annual

demand for the commodity amounts to 300,000 tons.

The Industry Ministry and Asmindo, which represents

rattan producers and craftsmen, have called on the Trade

Ministry to curtail raw rattan exports further, while the

Indonesian Rattan Furniture and Craft Association

(AMKRI) is demanding that the Trade Ministry should

cease issuing export permits for the commodity. AMKRI

Chairman Hatta Sinatra commented that the country might

not be able to meet local demand, estimated at up to

USD300 million, if the government did not curtail exports

of rattan.

5.

MYANMAR

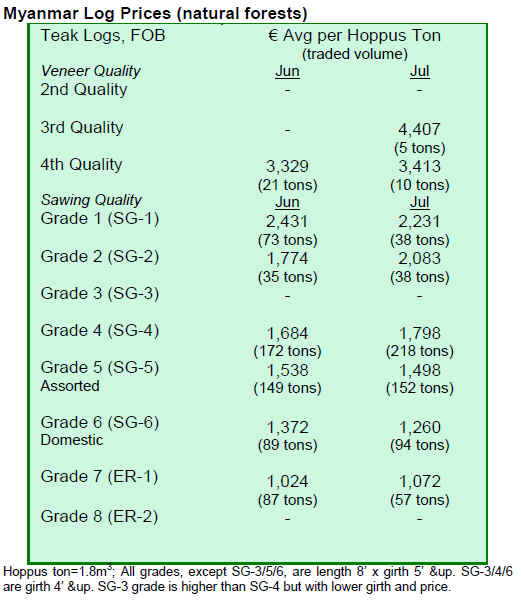

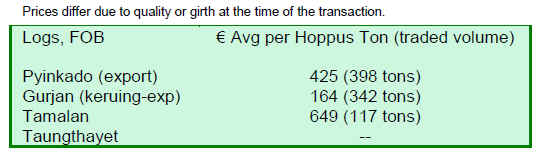

Active purchasing points to market recovery

Export products from Myanmar such as freshly cut teak,

pyinkadoe and gurjan have been selling in reasonable

quantities. Buyers say grading and pricing are the key

elements to bringing the market back to normal. Insofar as

pricing is concerned, Myanmar Timber Enterprise (MTE)

is reluctant to adjust prices downward, while grading has

been reviewed to accommodate the needs of the day.

Given the current trading patterns in Myanmar, it seems to

be an optimistic time for some and buyers hope positive

trends will continue in the months ahead.

Timber transport by road to Yangon is most feasible

The Bi-Weekly Eleven journal and Myanmar Post noted

the discussion of a paper presented recently at a meeting

of the Myanmar Timber Entrepreneurs¡¯ Association. The

paper discussed the pros and cons of relying on various

methods of transport in the country including by river, rail

and road. The paper stressed the need to observe ASEAN

standards for axle load, weight and dimension limits to

reduce wear and tear on existing roads and highways. The

paper also indicated that transport of logs to Yangon was

most feasible by trucks.

6. INDIA

Indian housing sector gets a boost from government

stimulus measures

The beginning of August showed positive results for

India¡¯s realty sector. The Ministry of Finance announced

incentives to the building industry, extended tax breaks for

realtors by three years and offered individual buyers of

homes subsidies on the interest on loans up to Rp.1 million

per year provided the purchase price of the home is not

more than Rp.2 million. The government earmarked about

Rp.10 billion for these provisions, which are expected to

offer benefits to low and middle-income families.

The Ministry also proposed an amendment to the Income

Tax Act, whereby profits from housing projects approved

by a local authority between 1 April 2007 and 31 March

2008 would be tax free if completed by 31 March 2012.

The government has urged the builders to pass on the

benefit to the consumers. There is an immense shortage of

dwelling units in the country, as it is expected that about

47.4 million new dwelling units in rural areas and 26.5

million in urban areas will be needed by 2012.

The measures announced by the government have been

well-received by the construction industry and are

expected to give a boost to wood working industries as

well. Plywood alone accounts for 78% of the wood panel

market in India, with the rest being composed of

engineered panels such as MDF and particleboard. For the

housing interiors industry, the Indian market is still

dominated by plywood and blockboard. However, the

trend is gradually changing with a growing market share

for plywood and blockboard and an increasing share of

particleboard and MDF.

With the housing sector getting a boost, interior wood

products comprised of decorative panels, wooden

floorings and ready made furniture also gets a lift. India is

a net importer of furniture. Small quantities of furniture

are being exported representing not more than 0.25% of

the global furniture industry. At present, the furniture

sector is predominantly in the hands of unorganized small

units. Fortunately, large corporate houses have started

taking interest in production of modern furniture and

prominent names like Godrej and Wipro have entered the

furniture manufacturing business.

The government has also extended tax breaks to industrial

parks. Companies working from industrial parks can now

plan for the long-term with tax breaks extended for two

years, until 31 March 2011. Profits from development,

operation and maintenance of industrial parks will

continue to be tax-free. The Federation of Indian

Chambers of Commerce and Industry have welcomed

these measures that should give new momentum to the

economic recovery currently under way.

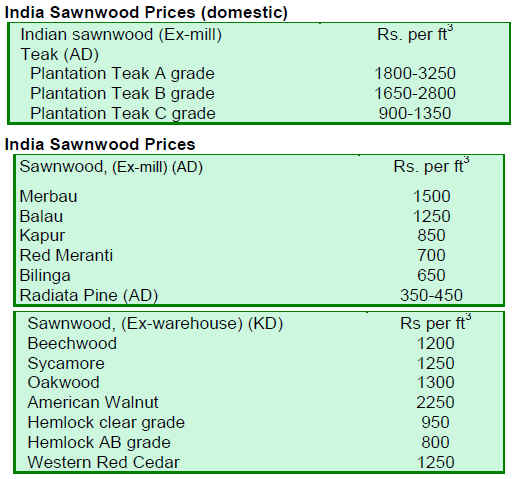

Corporate results for 2008-2009 have shown positive

growth for most companies, including plywood and

woodworking producers. The overwhelming consumer

needs from urban and rural areas have sustained demand

for tropical hardwoods like balau, merbau, and keruing

from Malaysia and Myanmar and also teak from

Myanmar, Tanzania, Nigeria, Ghana and Central

American and South American countries. However, the

Sabah state government in Malaysia has restricted log and

sawn exports to India. This will make prices of logs

suitable for the plywood industry more competitive. India

substantially depends on imported hardwoods like gurjan

and keruing for plywood faces. Other than face veneers for

core material, Indian factories are able to get local

hardwoods from agroforestry and plantations in the

country.

India¡¯s forest cover stands at 23.6% of the total

geographical area. Sustained efforts by the government

and the local community are improving the forest cover. It

is estimated that by the end of 2010 total forest cover

could reach 25% and 30% by the end of 2012. The Indian

government also has set a long-term target of increasing

the country¡¯s forest cover to 33%. Private and forest

department tree planting is expanding.

In post-independence India, a new festival ¡®Van

Mahotsav¡¯, has been introduced. The season for Van

Mahotsav, which literally means ¡®Festival of Forests¡¯, is a

week in July. During this period, every state in the country

plants large number of trees. The forest department also

helps local communities and village-level panchayats to

plant millions of saplings, which are mostly distributed

free of cost. For planting in urban areas, the saplings are

distributed at nominal charge of about Rp. 1 per sapling.

Many social organizations bear these costs and urge the

people to take away the saplings free and plant as many

trees as they can in and around their dwellings.

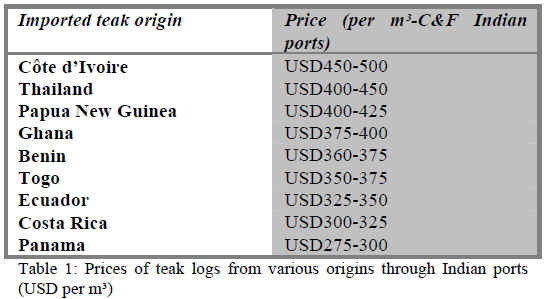

Teak prices on an upward trend

Prices for local teak have been showing an upward trend.

Despite the monsoon season, most timber offered for sale

is sold. Imports are also steady, augmenting supplies to a

great extent. Besides helping housing and industrial

infrastructure, the imports help forest conservation efforts

in the country. The current prices for imported teak of

various origins are as follows:

Different measurement systems are used by exporters from

different countries and if the importer is not well versed he

loses profits. The reactivated Teaknet is planning to take

up the matter of uniform specifications, measurement

systems and allowances for sapwood and bark and some

guidelines on uniform price vis-¨¤-vis classifications.

In India, the local practice is to measure the logs under the

sap, regardless of the species. Even in African countries,

timber such as padauk is measured under sap. For the

protection of buyers and consumers, the ideal system

would be to measure the logs under the sap so the question

of allowance for sapwood and barkwood would not arise.

Teaknet is expected to take up this matter in due course,

possibly at its next international seminar planned for the

month of November 2009.

7. BRAZIL

Brazil offers national forests for auction

By the end of 2010, over 2.7 million hectares of national

forests in Brazil will be offered for auction, according to

the estimate of the Brazilian Forest Service (SFB in

Portuguese), the agency responsible for the auction

process. Thus, the timber supply from legal and

sustainable sources is estimated to reach a total of 840,000

m³.

The Annual Plan for Forest Concession (PAOF) 2010,

which defines the concession areas for sustainable

harvesting was signed in Brasilia by the Minister of

Environment, reported MMA/ASCOM. The measure will

contribute to revenue generation of nearly BRL430 million

to both the government and the industry - in addition to

12,000 direct and indirect jobs. Until now, some 90,000

hectares in the country had been auctioned within a single

Conservation Unit, the Jamari Flona (National Forest) in

the Northern state of Rondônia.

According to SFB, the concessions will expand the

sustainable forest area for harvesting and provide an

opportunity to the timber sector to purchase legal products.

To the Ministry of the Environment (MMA), the creation

of sustainable economic activities is an important

alternative to combating deforestation, since the

supervision of forest management and penalties for

inappropriate harvesting are not sufficient to control the

destruction of the forests.

This year, nearly 1 million hectares will be offered for

bidding in three auctions. One has already opened, the

Sarac¨¢-Taquera Flona, which covers 140,000 hectares.

Later this year, auctions of the Amana and Crepori

National Forests, in the state of Par¨¢, will be announced.

Among the possible buyers of the concessions are

companies that consume wood raw materials, forest

service providers, machinery companies, equipment and

forest suppliers and communities living around the

concession areas.

Minas Gerais¡¯ stands to gain from federal programme

Even with the slowdown of furniture sales in the first half

of 2009, the Minas Gerais¡¯ furniture sector foresees a

promising year, reported O Tempo. Compared to 2008, a

7% growth in revenue amounting to BRL190 million is

expected in 2009. Additionally, with the completion of the

first house under the federal programme ¡®My House, My

Life¡¯ in 2010, the prospect for increased sales in such

homes is 30%, according to the Ub¨¢ Inter-Municipality

Union of Furniture Industry (INTERSIND).

The Union represents 400 furniture companies in the

regional cluster. It expects domestic sales to expand next

year and have a positive impact on revenues from

investments in the real estate market. In the first half of

2009, furniture exports fell 50% compared to the same

period of 2008. With the slump in exports, especially due

to the global economic crisis, the industry is increasingly

targeting the domestic market. The ¡®My House, My Life¡¯

programme is expected to boost sales, as those who buy

new homes also need new furniture.

According to the Minas Gerais Furniture Merchants and

Representatives Association, furniture sales in the first two

months of 2009 were low as result of consumers¡¯ limited

interest in purchasing home furniture. To avoid the worst,

companies worked to maintain minimum sales. As the

crisis appears to be coming to an end, companies need to

continue their work, considering that the domestic market

is expanding and offering an opportunity to grow.

Exports of Brazilian solidwood products tumble amid

global financial crisis

Brazilian exports of solidwood products have been

declining since 2007, and the situation has become even

more serious for the sector since the beginning of the

financial crisis. According to Ag¨ºncia Brasil / O Liberal,

the crisis has affected exports from traditional solidwood

producing regions in Brazil. According to the Paran¨¢

Wood Industry Union, in the first six months of 2009,

solidwood exports from the country fell 43% by volume

compared to 2008. In Paran¨¢, the fall in sales in the last 20

months was 54%, which included lumber, pine and

tropical plywood, door and solidwood product sales from

other segments. The state employs about 600,000 workers

in the timber industry comprising 1,200 companies

affiliated to the Union. As companies have made

adjustments following the financial crisis, nearly 6% of the

workers have been laid off in the first half of the year.

In the Northern state of Par¨¢, exports of solidwood

products in the first half of 2009 plummeted 52.9% by

value compared to the same period of 2008, according to

the Par¨¢ Timber Exporters Association (AIMEX).

Although exports by volume rose 1.7% from May to June

2009, the devaluation of the Brazilian real against the US

dollar hurt producers, with revenues dropping 2.3% over

the period, resulting in a loss of nearly USD 660,000.

The main factors contributing to the poor performance of

the industry are high tax burdens; low demand from

external markets; fierce competition with other tropical

countries such as Malaysia and Indonesia; high interest

rates for small and medium producers; and the fluctuation

of exchange rates. The recovery of timber exports,

according to AIMEX, is expected to occur from October

2009. The expectation is that the crisis will start to

slowdown and the civil construction industry abroad will

strengthen, consequently improving prospects for exports

of Brazilian solidwood products.

High costs deter forest product certification

Although it has become a condition for some companies to

access external markets, certification of wood and nonwood

products is still resisted by some small and medium

sized companies, reported Folha de São Paulo. As

observed by the Forest Stewardship Council in Brazil,

companies¡¯ reasons for not certifying include the high cost

of certification and the process of compliance with

environmental and labor standards.

At times, the costs for adjusting forest management areas

and chain of custody are higher than the cost of

certification itself. Nevertheless, the Brazilian companies

that do invest in certification confirm having benefited

from greater opportunities to exports.

In addition, the INMETRO (The National Institute of

Metrology, Normalization and Industrial Quality) also

certifies forest companies that operate in a sustainable

way. The CERFLOR (Brazilian Program of Forest

Certification) was established in 2002 by INMETRO

under which more than 1 million hectares of natural and

planted forests nationwide have been certified.

8.

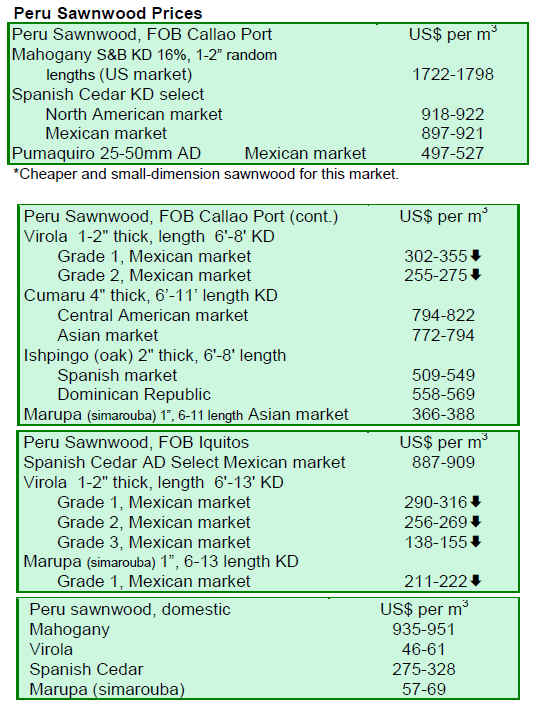

PERU

FTA can boost Peruvian exports to the EU

EU representatives anticipate growth in Peru¡¯s agricultural

exports to the EU, if the EU and Peru were to sign a Free

Trade Agreement (FTA). Rupert Schlegelmilch, chief

negotiator for the EU, commented that Peruvian products,

particularly certified wood and other popular agricultural

products, have a high potential to enter the European

market under preferential tax rates, since they are in high

demand in the region. Schlegelmilch hopes to finalize the

FTA by the next meeting of the two groups in Brussels

during September 2009 and for the FTA to be signed by

the end of this year.

9. BOLIVIA

10. MEXICO

Mexico aims to restore degraded land

Over the past seven years, Mexico has worked to conserve

and restore soil quality covering about 600 thousand

hectares in the country. During the period 2001-2007, the

National Forest Agency, with the support of owners of

forest land, restored 596 thousand hectares of land and soil

in the country, involving an investment exceeding 540

million pesos. The states suffering from a greater degree

of deterioration of soil and forest resources are considered

priority areas. They include Oaxaca, Chiapas, Quintana

Roo, Jalisco, the state of Mexico, Chihuahua and Durango.

CONAFOR, through ProTree, has promoted various

activities to prevent soil degradation through: reforestation

and soil enrichment; construction and land restoration;

maintenance; and soil conservation. Mexico is working

through some 29 federal entities to promote sustainable

management of agricultural and forest lands. To

strengthen efforts toward the sustainable management of

soils, many institutions also took part in drafting the

National Strategy for Sustainable Land Management,

aimed at developing public policies that support

sustainable management of land. The Strategy will be

issued in the coming months and will be presented as a

tool to tackle the problem of land degradation.

11.

Guyana

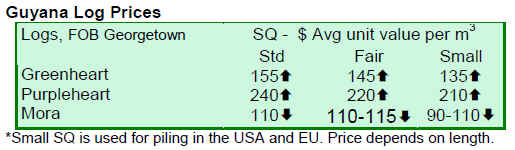

Prices for popular log species mark further gains

Log prices for greenheart have further improved, with

mora prices remaining relatively stable for the period 16-

31 July 2009 as compared to the previous period of 1¨C15

July 2009. Prices for purpleheart undressed sawnwood

(812/649) have been positive, while greenheart dressed

sawnwood (1165/806) and purpleheart (1126/806) have

showed significant price increases over the same period.

Prices for plywood in the BB/CC and utility category for

the period 16¨C31 July 2009 were also favorable. Prices for

splitwood (2344/975) and roundwood have showed gains

during the same period. Value-added products, such as

doors, mouldings and outdoor furniture have also recorded

higher average prices for the end of July compared to the

first half of July, with outdoor furniture gaining export

value earnings significantly.

Local producer receives top award for innovative activities

In recognition of its innovative contributions to local

business, Bulkan Timber Works was awarded the country

Prize during the 2009 Pioneers of Prosperity Caribbean

Awards Competition, according to the Stabroek News. The

will now compete with entrepreneurs from The Bahamas,

Barbados, Belize, Haiti, Jamaica and Trinidad & Tobago

for the regional prize this September in Jamaica.

Receiving the prize on behalf of the company was

Managing Director, Howard Bulkan, who has been

involved in the business for approximately 38 years.

Bulkan Timber Works Inc. was formed in 1997,

manufacturing and exporting value-added wood products

specifically for overseas markets. Currently the business

has over fifty employees. As the country winner, Bulkan

Timber Works will receive a grant from the Inter-

American Development Bank¡¯s (IADB) Multilateral

Investment Fund of USD40,000 to be invested in training

and technical infrastructure for the company.

The Pioneers of Prosperity Programme is sponsored by the

IADB¡¯s multilateral investment fund, the John Templeton

Foundation, and the Social Equity Venture Fund (S.E.

VEN Fund). The programme seeks to inspire a new

generation of entrepreneurs in emerging economies by

identifying, rewarding and promoting outstanding

businesses to serve as role models for the community.

According to the Programme¡¯s website, the winners are

chosen on their ability to: create unique value for

customers through innovative products and/or services;

generate a sustainable profit for owners/shareholders

commensurate with the risks taken by investing in them;

invest in their employees through training; create safe

working conditions; increase salaries; and protect the

future by strengthening local and global environments and

communities.

|