|

1.

CENTRAL/ WEST AFRICA

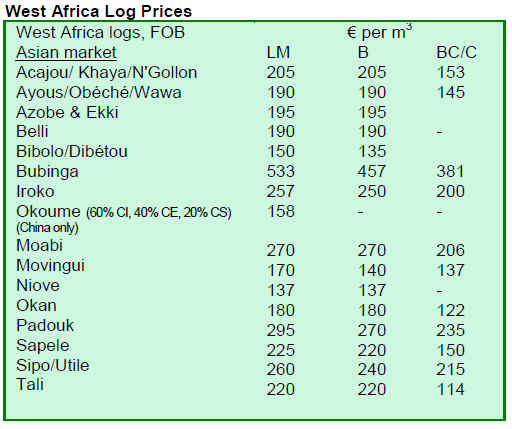

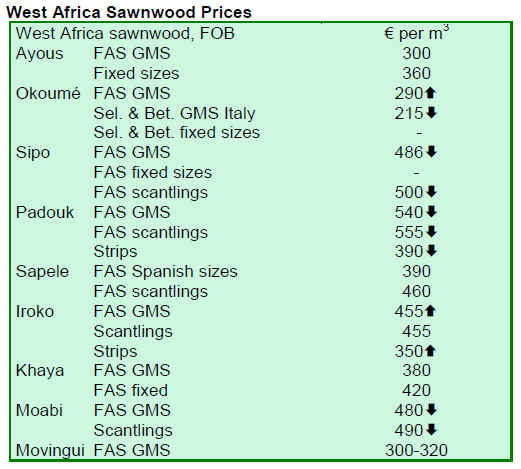

Sawn timber business slow in West Africa

Demand from Asian buyers has been good enough to keep

the remaining active log exporters reasonably busy and

prices stable over the past weeks. Congo Brazzaville

resumed limited volume log exports about two months ago

and after a slow start a few exporters have now actively reentered

the market.

Buying for Europe has not strengthened although there

have been some sales in relatively small volume for

Portugal. French importers are well stocked but have

recently made a few contracts for species where their

inventory is low. The low demand for Continental Europe

will not improve during the traditional summer vacation

period that is now in full swing and traders are not

convinced that business will show much if any

improvement until the fourth quarter. The construction

industry has been hit very hard in the recession and the

number of jobs lost in this sector is larger than any except

banking and finance. Log exporters expect to rely on

Asian buyers for stability through the third quarter of the

year and shipments to China being the largest in volume.

Sawn lumber business is very slow, with Europe still very

much out of the market. Although reports indicate stocks

are running low in the UK, extremely limited demand for

tropical hardwoods keep buyers unwilling to speculate on

new purchases. Enquiries for FSC or other certified

lumber has shown some improvement but producers say

price competition is such that they do not recover the extra

costs for certified products.

Producers in Africa show no signs of gearing up for higher

volume output in logs or sawn lumber and some are

rumored to be considering a reduction in output.

2. GHANA

Teak planting project to benefit Ashanti region

Dr. Owusu Afriyie Akoto, Member of Parliament for

Kwadaso, has initiated a teak-planting project for schools

in his constituency in the Ashanti region in Ghana. The

project was intended to provide some 40 schools in the

area with 15,000 teak seedlings for planting on school

compounds. The aim was to raise awareness of school

children to the value of trees. Under the project, each

school child is to be given a number of teak seedlings for

planting, watering, weed control and pruning as part of

school daily curriculum and from all indications interest in

the project is growing.

At the launch, Dr. Akoto said the vision behind the project

included environmental, economic and social aspects and

was designed to train students to appreciate the role of

trees in environmental restoration and raise resources to

finance schools* future expansion of educational facilities.

To ensure the success of the project, the MP will present

an award to schools that excel in the initiative. Mrs Edith

Abroquah, the Ashanti Regional Minister of the Forestry

Services Division (FSD), who represented the Minister of

Lands and Natural Resources, commended the MP for his

initiative, said she hoped the initiative would prove a

success and offered FSD*s support to ensure its success.

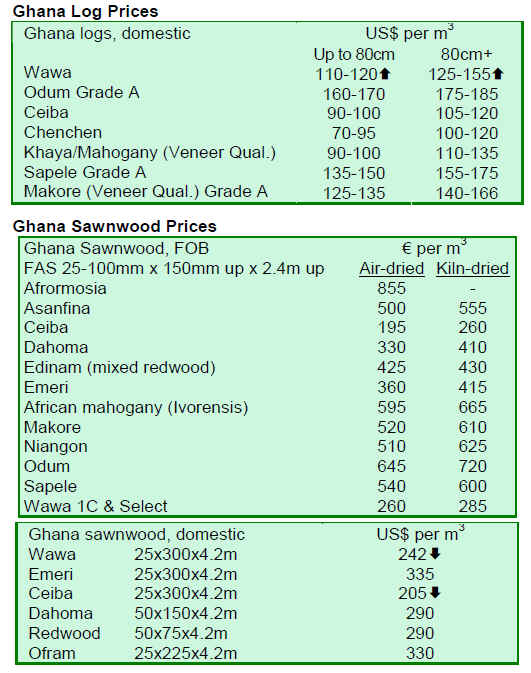

First quarter contract volume drops

Ghana*s timber trade saw a further decrease in the volume

of wood products processed and approved by the Timber

Industry Development Division (TIDD) during the quarter

under review. A total contract volume of 107,184 m³ and

1,801 pieces of furniture parts representing decreases of

29.60% and 81.06%, respectively, were processed and

approved as compared to the figures achieved during the

last quarter of 2008. Demand for wood products has

reduced considerably in the major importing countries of

Germany, Italy, Spain, the UK and the US since the onset

of the global financial crisis.

With the exception of teak poles/billets/logs, which mainly

go to the Indian market, all the major exportable products

experienced further decreases in volume during the quarter

under review. Compared with figures from fourth quarter

2008, teak poles/billets/logs increased by 111.75% to

reach a volume of 29,078 m³, while lumber, plywood,

sliced veneer, rotary veneer and finger jointed products

decreased in volume, ranging from 9% to 22%. The TIDD

contract office in Kumasi, Accra and Sunyani processed

and approved 36.91%, 5.99% and 6.93%, respectively, of

the total volume of wood products during the quarter

under review, with the headquarters in Takoradi

contributing the remaining 50.17%.

3.

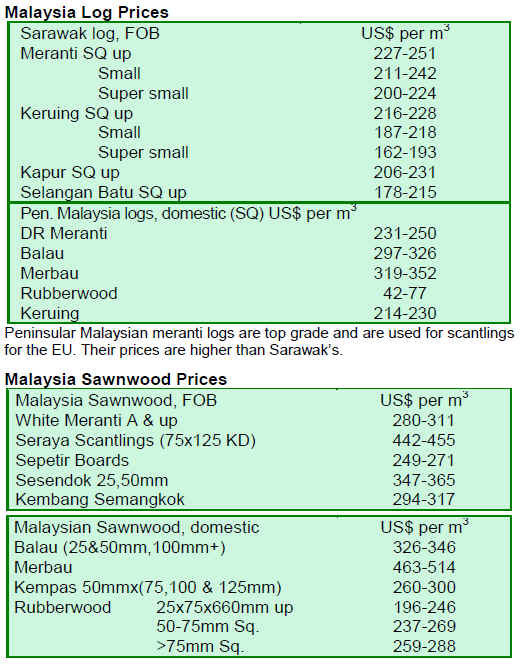

MALAYSIA

Minister encourages stopping log and sawnwood exports

Chief Minister Datuk Seri Musa Aman has encouraged the

East Malaysian state of Sabah to stop exports of logs and

sawnwood in the near future in order to generate more

employment and investment in the downstream processing

sector. According to The Star, Musa further noted that

sustainable forest management would be practiced in

natural forests and that tree plantations would be

established in degraded and heavily logged areas.

In line with this transition, the Minister helped launch a

Sino-Malaysian RM230 million joint-venture to create

12,000 hectares of rubber plantation in Sabah, reported the

Daily Express. The project is located in the Bornion

Timber concession area (Forest Management Unit 11) in

Ulu Sungai Milian. The Bornion Guangken Rubber Forest

Plantation project is a joint venture between Bornion

Timber and Guangdong Guangken Rubber Group Co. Ltd.

of Guangdong Agribusiness Group Corporation of China

and is expected to be completed in six to eight years* time.

When completed, it will be one of the largest rubber

plantations in Malaysia. To date, Bornion Timber has

planted 3,500 hectares out of the 25,000 hectares allocated

for rubber planting. It has also planted 800 hectares of

acacia under the Industrial Tree Planting (ITP)

programme.

Similar initiatives have been seen in the state of Sarawak

with 5,000 hectares of rubber trees expected to be planted

by government agencies under the Ninth Malaysia Plan.

The Star reports that 1.9 million hectares of available land

in East Malaysia has been identified as suitable for rubber

trees cultivation, out of a total of 41.2 million hectares of

commercial agriculture land. The Sabah regional office

director of the Malaysia Rubber Board, Dariman Darham,

estimated that about 1.5 million hectares of land was

available for rubber tree cultivation in Sarawak while

400,000 hectares was available in Sabah.

Malaysia keeps close watch on China*s skyrocketing shipping rates

Malaysian timber products manufacturers are keeping a

close watch on their competitors in China as the second

largest container carrier in China - China Shipping

Container Lines Co. - increased its rates for Asia-Europe

routes by almost 100% from 1 July 2009 onwards. Rates

for Asia to Europe routes would rise to as much as

USD650 per 20 foot container, said China Shipping

Container Lines Co*s managing director Huang Xiaowen

to the Business Times.

Shipping rates usually increase from July 1 every year as it

is the busiest season for sea-cargo box carriers. The new

rates may make Malaysian timber products more

competitive if other shipping lines in China take similar

actions and Malaysian shippers hike their current rates

only marginally.

4.

INDONESIA

Forestry Minister requires independent certification of

timber exports

Indonesian Forestry Minister Mr. MS Kaban announced

that all timber products leaving the country must be

independently certified by an independent body consisting

of representatives from both the timber business sector and

NGOs. The Jakarta Globe reported that the new directive

is designed to stop the flow of illegally traded products.

NGO representatives expressed support for the measures,

noting they would help boost the image of the

government*s monitoring and oversight capabilities by

involving new stakeholders in the certification process.

SME sector could grow despite overall economic gloom

The Deputy Chairman of the Indonesian Chamber of

Commerce and Industry, Mr. Sandiaga Uno, commented

that the Small and Medium Enterprise (SME) sector is

poised for higher growth. He said SMEs in Indonesia

contribute up to 50% of national economic growth,

reported Tempo Interactive. Most of Indonesian timber

products producers are SMEs, in particular furniture

manufacturers, which are often community-based or

operated by family owned businesses. According to Mr.

Uno, SMEs in Indonesia could contribute to growth of up

to 25% if given adequate government support such as

further capital and training on finance, management and

marketing techniques.

Business pauses as elections conclude

Most trading activities in Indonesian have come to almost

a standstill as the country held its national general

elections on 8 July 2009. Businesses are looking forward

to more positive changes in both state and federal laws and

regulations that will encourage more foreign direct

investments, as well as technology transfer to hire

currently unemployed skilled workers and university

graduates.

5.

MYANMAR

Teak exports drop from Myanmar

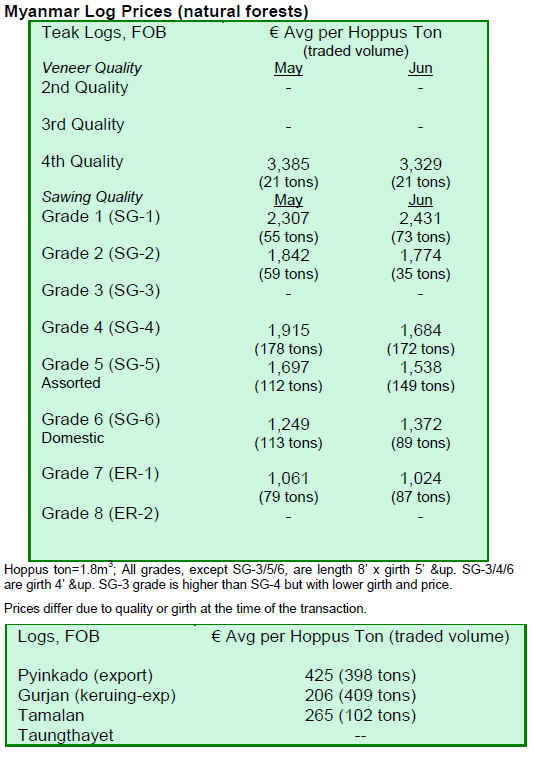

Local experts indicate Myanmar*s market situation is quite

erratic at present, especially for teak exports. First quarter

comparisons for FY2008 and 2009 show slides in export

figures: teak log shipments fell about 60%; hardwood log

shipments dropped about 6%; and sawn teak (primarily

processed) shipments slid nearly 57%.

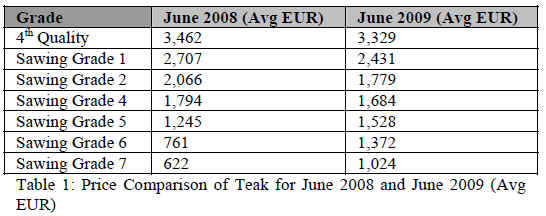

A year-on-year comparison of tender prices showed mixed

results. Average prices of fourth quality and sawing grades

1, 2 and 3 of teak fell up to 16% in June 2009 when

compared to 2008 prices. Average prices for the lower

sawing grades (5, 6 and 7) rose to a maximum of 80% in

June 2009.

Prices drops of the higher grades occurred due to a slide in

demand, particularly due to declines in European

purchasing of these grades during the period specified.

Prices for the lower grades that go to Asian markets rose

because of short supply and other factors such as

purchasing on an FOB basis and better quality of log

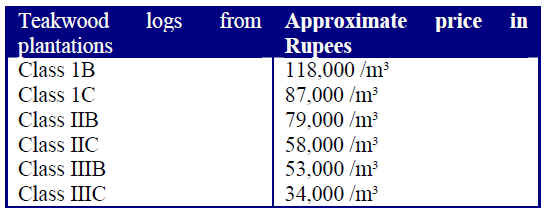

producing areas. The table below shows a year-on-year

price comparison for teak:

6. INDIA

Export figures for timber products show gains by value

Indian economy grew by 6.7% during the first half of 2009

as against an average growth of 8.8% in the previous five

years. The slowdown in 2009 was primarily due to the

global financial meltdown and consequent economic

recession in developed economies. The growth outlook for

FY 2010 is maintained by the government at 7% and since

the present government has full majority in the parliament

it is hoped that many of the measures outlined by the

government will be implemented. The foreign trade

figures for May 2009 were in line with the expectations.

Despite depressed export and import figures in other

countries, wood and wood products have remained unaffected.

While there has been a general shrinkage in

exports, the decline in imports is greater, thereby reducing

the trade deficit for the first two months of 2009 to

USD10.2 billion compared to USD19.88 billion in the first

two months of 2008, mainly because of lower rates for

crude in the current market.

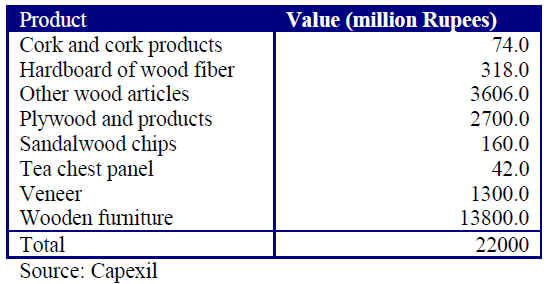

The figures for exports of wood products for the financial

year 2008-2009 were set at a target value of 22,635

million Rupees, with the actual exports estimated to be

worth 22,000 million Rupees during this period. Exports

during 2007-2008 were 1.9620 million Rupees. Exported

products were as follows (in million Rupees):

Exports of wood products would have been much better if

USA and EU demand did not plummet as an effect of the

global financial crisis. Buying from these countries has

been low, particularly for musical instrument components

made of Indian Rosewood (Dalbergia latifolia). Before

the ban on exports of Rosewood logs and sawn timber

exports, India used to export approximately 35,000 m³ to

Japan, Italy, Germany and other countries that used to

import them to manufacture veneers for fancy plywood

and musical instruments such as guitars. After the ban,

exports of parts such as sides and backs plus finger boards

for guitars jumped but presently, exports have been much

lower due to the global financial crisis.

Similarly, exports of all logs and sawn timber of Indian

origin are banned under the green cover programme. Only

sawn timber made of imported logs are permitted for

exports under this well monitored scheme. The main

conditions set by the programme indicate that against 100

m³ of timber imported, not more than 60 m³ will be

allowed for re-export and that the extent of value-added

activities of these products in the country must be at least

30%. Under this scheme, mainly teak sawn timber is

exported.

Door and window frames have continued to be a popular

product to Middle Eastern countries and flooring decking.

Prices for Middle East quality for door and window frames

were around USD2,200 /m³. Planks have been popular to

Australia, Europe and North America. Plank (6* to 6**)

prices to Europe have been up around USD5,000. Kerala

teak had been widely used by boat builders in the Persian

Gulf but having been banned, shipbuilding activity is now

done on India*s western coast ports and the ships export

mostly to the Gulf countries.

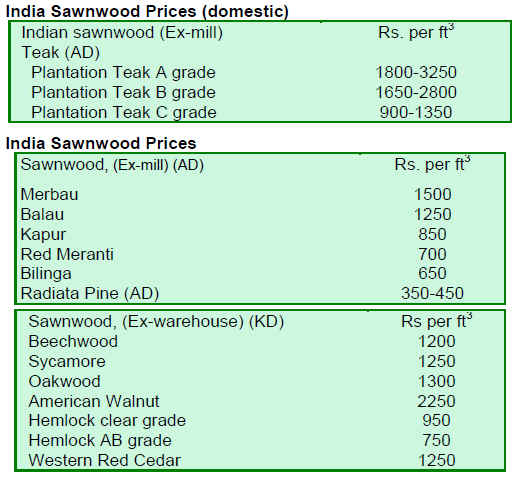

Auctions of teak and other hardwoods have also shown a

firm price trend. Currently, prices realized in ex-forest

depots of the Kerala government auctions are the

following:

Changes in Teaknet spur new initiatives

An informal meeting was held at Kerala Forest Research

Institute (KFRI), in Peechi, Kerala to discuss future

activities and areas where Teaknet could advise teak

planters, traders and consumers. The meeting was chaired

by Dr.K.V.Sankaran, Director of KFRI and consisted of a

variety of participants and other experts and researchers on

teak.

Mr. R.T. Somaiya, President of Timber Importers

Association of India and member of Teaknet Steering

Committee, provided the audience an overview of the

international teak trade. He emphasized the need to

standardize specifications, measurement systems and a

formula for arriving at the volume of bark and sap as they

differ in supplying countries. He said there is a need to

help teak planters improve the quality of growing stock,

pest control and the integration of plantations with natural

flora and fauna. Teaknet can also guide planters on the

most suitable habitats, and desirability of setting up

plantations where silvicultural practices such as weeding,

pruning, occasional ploughing and pest management can

be carried out economically, with the hope that these

activities will bring excellent returns at the time of harvest

and provide a quality as close to forest grown teak as

possible.

A seminar has been planned from 23-25 November 2009

at Peechi to discuss matters of interest to traders and

planters and Teaknet will be making an announcement of

this event officially shortly.

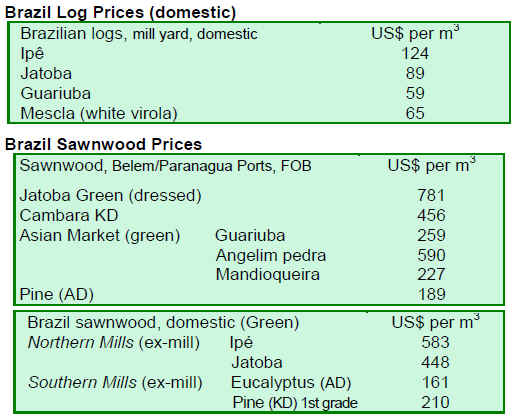

7. BRAZIL

Illegal timber seized in Marcelândia region

In an operation to combat illegal logging in the

municipality of Marcelândia, located in Mato Grosso state

in the Amazon region, the Brazilian Institute of

Environment and Renewable Natural Resources (IBAMA)

inspectors seized illegal timber and found that illegal

logging in the Amazon forest is continuing at a very fast

pace. In three months, timber equivalent to six thousand

trees has been seized in the region, reported Globo/S車

Not赤cias. Illegally logged timber is supplied to regional

sawmills, some of which operate illegally without permits

from environmental agencies.

In another municipality, also in Mato Grosso state (Ju赤na),

the Federal Police arrested 16 people during the &Arco do

Fogo* Operation, also designed to combat illegal logging.

Two check points were established in the municipality to

control timber trucks; a total of 14 trucks were seized with

approximately 2,500 m³ of timber, with an estimated value

of BRL200 thousand.

According to the inspectors of the region, illegal timber

transport is part of organized crime, as state and interstate

organizations are benefiting from the illegal logging

operations in Mato Grosso and throughout the Amazon

region.

NASA images reveal a drop in Amazon burning in 2008

New NASA research showed a sharp decline in the

quantity of smoke over the Amazon region during the

2008 burning season, coinciding with a drop of the

deforestation rate reported at the end of June 2009. The

burning in the region is primarily used to establish pasture

for cattle ranching, which is the main activity responsible

for land-use change in the Amazon.

According to Amigos da Terra, deforestation in the

Brazilian Amazon is increasingly caused by industrial

development rather than subsistence activities, considering

that the region is one of the world's major sources of meat

and soybeans. However, due to the global financial crisis,

the bank credit lines have not been easily opened and

commodity prices dropped, which discouraged forest land

conversion to pasture and other uses, leaving an area of

approximately 25,000 square kilometers degraded, but not

deforested. Forest burning dropped drastically in the 2008

burning season, leaving deforestation for the 2008-2009

year at its lowest level, below 10,000 square kilometers,

according to the Ministry of Environment (MMA).

The Brazilian government expects the trend to continue,

despite a recent drop in commodity prices. The Brazilian

government also agreed to reduce annual forest loss by

70% by 2018 under its national action plan on climate

change. Brazil expects industrialized countries to

contribute to its fund to protect the Amazon, which is

expected to avoid emissions of 4.8 billion tons of carbon

dioxide in the atmosphere.

Rio Grande do Sul*s furniture exports drop

The furniture industry of the state of Rio Grande do Sul (a

major furniture exporting state in Brazil) faced a 32.9%

drop in its exports between January and May 2009

compared to the same period of 2008. Some companies of

the state increased their exports to new or underdeveloped

markets such as Cuba, Uruguay and Angola (a 105.1%,

82.8%, and 13.2% increase, respectively). Comparing May

to April 2009, there was a 6.3% increase in furniture

exports of the state, amounting to USD15.2 million,

although furniture exports dropped 39% in May 2009

when compared to May 2008. The main reasons for the

decline were the high dollar exchange rate and barriers

imposed on imports by Argentina, one of the main buyers

of Rio Grande do Sul*s products.

According to Gazeta RS, the export figures for Brazil were

similar to those of Rio Grande do Sul state over the

January to May 2009 period, with a 32.1% drop in the

exports from the furniture sector, totaling USD260.8

million. The country that most increased its imports of

Brazilian furniture was Cuba. Although it represents only

3% of total Brazilian exports, it increased its imports by

85.5%. The US continues to be the main buyer of

Brazilian furniture, representing 15% of Brazil*s total

market share of exports were worth USD38.2 million, a

49.1% decrease.

8.

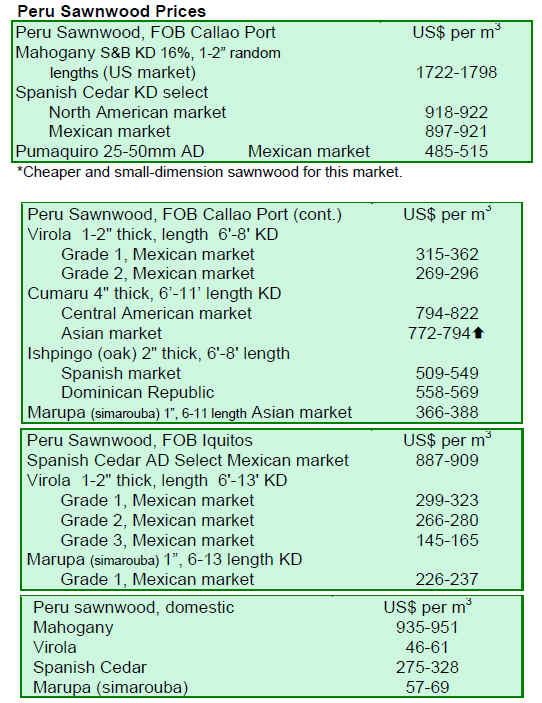

PERU

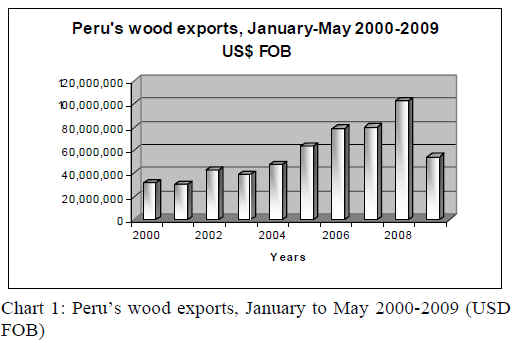

Peru*s timber exports plummet 47%

According to recent statistics given by the Export

Association of Peru (ADEX), Peru*s timber exports from

January 每 March 2009 were USD54.61 million while for

the same quarter 2008 they were USD102.97 million, a

year-on-year decline of 47% (Chart 1). During the same

period, the three main timber export markets were China,

Mexico and the US, which overall represented 78.54% of

the wood sector exports.

During the January 每 May 2009 period, New Zealand

imports of Peru*s timber products grew 262% against the

same quarter a year earlier. The primary imports consisted

of railway ties. This growth is similar to that of Panama,

which imported 104% more of Peru*s timber products

during the same period, primarily as a result of sawnwood

imports. China*s imports jumped 52.245%, with the Hong

Kong market showing a massive 476% gain in imports of

Peru*s timber products, particularly decking. On the other

hand, Mexican imports slumped 72.44% over the period,

as demand stopped for Peru*s mouldings.

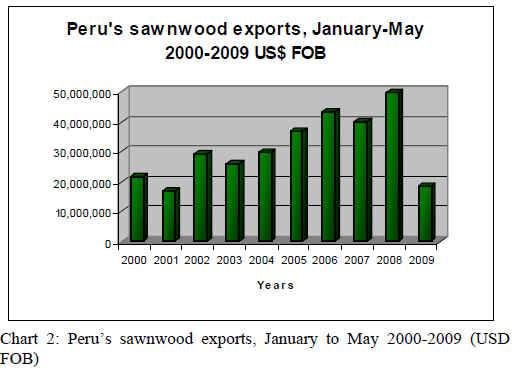

Sawnwood, the second largest product exported during the

period, consisted of about 34% of timber exports. Exports

of sawnwood for the January 每 May 2009 period were

USD18.65 million by value while for the same quarter in

2008 the sawnwood exports were just over USD49

million, a year-on-year drop of 62.54%. The main market

of exports destination for this product was Mexico. A

year-by-year comparison for Peru*s sawnwood exports is

shown below:

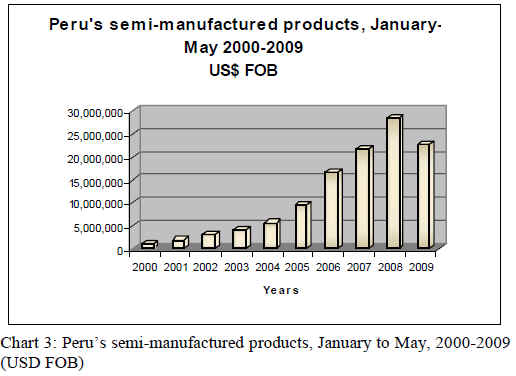

Semi-manufactured exports over the January 每 May 2009

period represented the largest product exported, consisting

of 41.5% of total timber exports (Chart 3). Exports were

worth USD22.66 million during the period, falling 20.91%

from the same period during 2008. The main destination

market in these products was China.

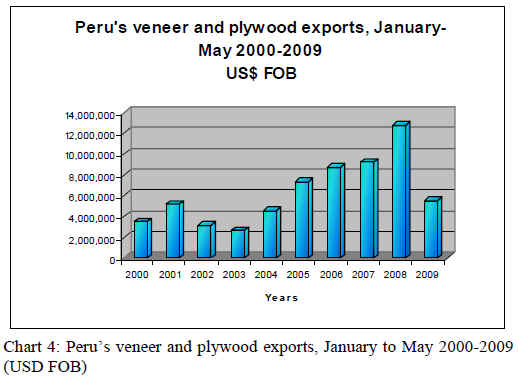

Exports of veneer and plywood for the January 每 May

2009 were USD5.52 million, dropping from USD 12.77

million for the same period in 2008. The Mexican market

was the main destination for Peru*s veneer and plywood

products. The chart below shows a yearly comparison of

Peru*s veneer and plywood exports by value.

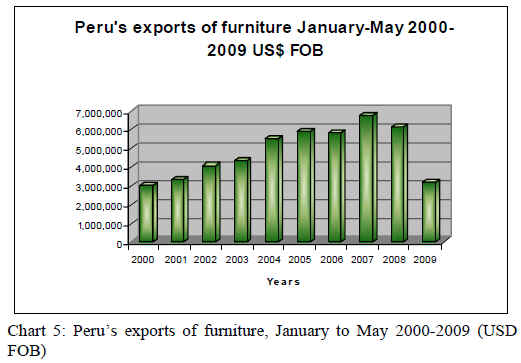

Exports of furniture and parts during the January 每 May

2009 period were USD3.21 million by value, nearly half

of what they were in the same quarter of 2008. The main

destination market for these exports was the US, which

received just over half of these products although its

import levels significantly declined during the same period

as a result of the global economic slowdown.

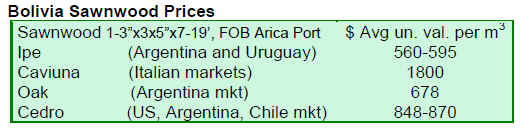

9. BOLIVIA

10. MEXICO

Mexico*s southeast region is host to most plantation

species

The main plantation areas in Mexico are located in the

southeast of the country, particularly Veracruz, Tabasco,

Michoacan, Campeche, Oaxaca and Guerrero. The species

planted in these areas include eucalyptus, melina, teak,

cedar and rubber wood. The two most important plantation

projects cover a total area of about 22,600 hectares. The

raw material from these plantations is sawnwood, pulp,

and rubberwood.

The main species planted in all areas of Mexico for

commercial purposes are: eucalyptus (15.85%), cedar

(12.02%), melina (7.71%), pine (7.37%), mahogany

(6.31%), teak (6.22%) and others. The table below shows

the places where these species are located in Mexico.

11.

Guyana

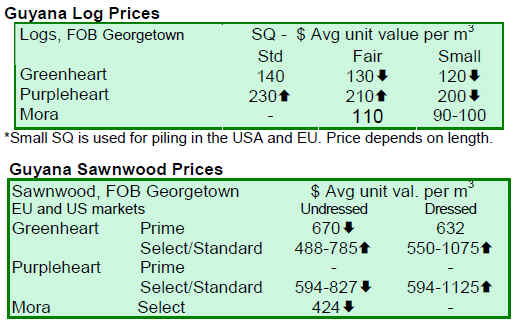

Prices for greenheart remain stable

Log prices for greenheart have remained relatively stable

over the last fortnight while prices for purpleheart

continue to increase on average by 20% for both standard

and fair sawmill quality. There has been a slight increase

in the export of mora logs with prices ranging from

USD90 to USD110. Prices for undressed sawnwood have

been fairly stable, while prices for dressed sawnwood have

comparatively increased during the same period. Plywood

prices continue to climb from the last fortnight in the

BB/CC category.

The export of other value-added timber products, such as

furniture, building components, doors, mouldings,

continue to contribute to export value earnings, with prices

showing marginal increases in some cases, but overall

stability throughout the period.

Guyana*s economy expected to rebound

The Central Bank of Guyana has recently released its first

quarter economic and financial review of the country for

2009. The Report outlined that the Guyanese economy is

expected to rebound during the year, albeit at a slower rate

than in 2008. It was noted that the economy continued to

grow modestly, although the agriculture and

manufacturing sectors contracted. The forestry sector saw

an increase in output in 2009, which was a cause of early

harvesting and a higher level of compliance with the

requirements of forest management planning, annual

planning and submission of forest inventory information.

The economy grew in real terms by 3.1% and in nominal

terms by 11.4%. In 2009, the Guyanese economy is

projected to grow by 4.7%. This growth is expected to be

driven by the agriculture, engineering and construction as

well as the services sectors.

The Guyana dollar remained relatively stable, appreciating

against the US dollar by 0.37% to 204.5 at end March,

2009. The weighted mid-rate of the commercial banks,

however, depreciated by 0.27% to 203.82. The overall

spread widened marginally to G$3.41 from G$3.38 at end

March 2009. The inflation rate dropped sharply to 0.4%

compared with an increase of 4.8% over the corresponding

period last year. This outcome was due to lower

international fuel and commodity prices as well as falling

domestic prices for food items.

Recovery rates identified as key priority by workshop

A two-day regional workshop on chainsaw milling in

Guiana Shield/Caribbean was hosted by the Forestry

Training Centre Inc (FTCI) and Iwokrama Center for

Rainforest Conservation and Development (ICRCD) in

Guyana.

The workshop, entitled &Working with chainsaw millers

and communities to improve the utilization of timber

resources*, is part of a collaborative project of Tropenbos

International of the Netherlands and local partners FTCI

and Iwokrama. The chainsaw milling project has evident

links to Guyana*s Low Carbon Development Strategy

(LCDS), which aims to facilitate high-potential low

carbon sectors, the production of fruits and vegetables,

aquaculture, and sustainable forestry and wood processing.

Minister of Agriculture with responsibility for Forestry,

Robert Persaud, delivered the opening address outlining

Guyana*s approach to chainsaw milling in which the

social and economic benefits do not come at the cost to

environmental standards. Minister Persaud noted that the

chainsaw milling sector does not operate without

challenges in the country*s forest industry. Recovery was

overall lower than expected and there still was an

identified need for capacity building in the use and

maintenance of chainsaws. While some efforts have been

made in the past and continue to be implemented, more

still needs to be done to increase recovery, create better

practices and decrease the level of waste generated.

Having recognized the benefits that chainsaw lumbering

provides, including employment, support to rural

communities and income, the Minister explained that a

pragmatic and concerted approach has been taken to allow

the existence of chainsaw milling through a

comprehensive system of regulatory standards and

requirements, while at the same time supporting the sector

to grow, improve and develop. The Minister emphasized

that Guyana*s approach to chainsaw lumbering in Guyana

has been one that is dynamic, constantly looking to

improve on the regulations and practices while at the same

time balancing the requirements of the stakeholders which

depend on this activity for their livelihood.

Guyana*s R-Plan on climate change readiness

approved by World Bank

Guyana has advanced its efforts in preparatory activities

for climate change readiness through the World Bank*s

Forest Carbon Partnership Facility. Guyana*s R-Plan was

formally approved by the Bank*s Participants Committee

on 16-19 June 2009 as second in the world that has

advanced to this stage, with Panama*s plan being the first.

This Plan will assist Guyana in developing a monitoring,

reporting and verification system that will allow an

effective indicator system to be developed as a necessary

part of a forest carbon financing scheme.

The R-Plan is one component of the recently launched

Low Carbon Development Strategy (LCDS) which seeks

to transform Guyana*s economy and at the same time,

combat climate change. The proposed low carbon

development initiatives will not be at the cost to

livelihoods or sustainable development of communities, as

highlighted in the Strategy document. The Strategy also

notes it will not in any way threaten the sovereignty of

Guyana to chart the path of its own development at the

community or national level. In the context of the LCDS,

logging activities, and other utilization activities will be

able to continue but will have to be done in a sustainable

way that is compatible with the provisions of the LCDS.

Over the course of the next two months, Guyana will

continue to seek the inputs and comments of stakeholders

to finalize the LCDS in September.

|