| Home: Global Wood |

|

Industry News & Markets |

|

Canada raw materials prices

rise in March: StatsCan |

|

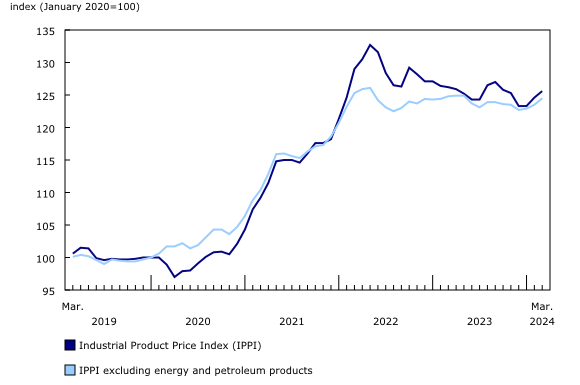

According to the latest report from Statistics Canada, Prices of products manufactured in Canada, as measured by the Industrial Product Price Index (IPPI), increased 0.8% month over month in March and fell 0.5% on a yearly basis. Prices of raw materials purchased by manufacturers operating in Canada, as measured by the Raw Materials Price Index (RMPI), rose 4.7% from February to March and were up 0.8% year over year in March.  Prices for industrial products increase in March Industrial Product Price Index The IPPI increased 0.8% month over month in March, following a 1.1% rise the previous month. Prices for primary non-ferrous metal products rose 4.9% in March after declining for three consecutive months. This was the largest monthly increase for this commodity group since December 2022 (+7.3%). Prices were up for unwrought silver and silver alloys (+8.4%) and for unwrought gold and gold alloys (+7.1%). Precious metals rallied amid expectations that the United States Federal Reserve will make several interest rate cuts in 2024. Prices also increased for unwrought nickel and nickel alloys (+7.1%) and unwrought copper and copper alloys (+4.9%) in March. Permitting delays have recently constrained supply growth in Indonesia, the world's top nickel producer, supporting prices in the oversupplied market. As for copper, key Chinese smelters agreed to cut production in March, while the promising interest rate outlook also exerted upward pressure as interest rates influence industrial demand for copper. After four consecutive months of declines, prices for meat, fish and dairy products increased 3.1% in March. The increase was driven by higher prices for both fresh and frozen beef and veal (+7.8%) and fresh and frozen chicken (+16.1%). Seasonal demand started to pick up for beef while the cost of cattle remained high, mainly due to continued tight supply. According to Agriculture and Agri-Food Canada, cattle slaughter counts in March declined year over year in both Canada and the United States. Additionally, Canadian beef storage figures for the first quarter of 2024 were 15.2% lower compared with the first quarter of 2023. Chicken prices were recovering after posting five consecutive months of declines. Stronger seasonal demand played a key role in the price increases for chicken. Lumber and other wood products experienced price growth for the third straight month in March 2024 (+3.6%), driven by higher prices for softwood lumber (+7.8%). This was the fifth consecutive monthly increase for softwood lumber and the strongest month-over-month growth since July 2023 (+11.3%). Fuelled in part by improving sentiment in the homebuilding sector as expectations rise for future interest rate cuts, demand for lumber has been strong recently, helping to push up prices. The prices of energy and petroleum products increased 1.1% in March. Price movements for refined petroleum products were mixed. Finished motor gasoline prices increased 8.1% while diesel fuel prices fell 3.2%. For gasoline, maintenance and shutdowns at North American refineries reduced supply in March, contributing to higher prices. Additionally, the transition to more expensive summer gasoline blends and higher seasonal demand both supported the price increase. Warm weather in March reduced demand for heating fuel, which played a part in lowering diesel prices despite crude prices increasing (+7.2%). According to Natural Resources Canada, Canadian diesel refinery margins decreased by 16.9% month over month in March, dropping from 49.7 cents per litre to 41.3 cents per litre. The prices of chemicals and chemical products rose 0.7% in March. Petrochemicals (+5.3%) contributed the most, increasing mainly due to the higher price of crude oil (+7.2%), the primary raw material input in petrochemical production. Raw Materials Price Index In March, the RMPI rose 4.7% on a monthly basis, the largest monthly increase since March 2022 (+11.8%). Prices for crude energy products (+8.1%) have been rising for three months in a row, leading the increase in the RMPI. Conventional crude oil prices were up 7.2% and synthetic crude oil rose 13.3%. The higher prices for crude oil were partly influenced by several OPEC+ countries extending voluntary output cuts of 2.2 million barrels per day until the end of June to stabilize the oil market. Recent attacks on major Russian refineries by Ukraine, as well as the conflict in the Middle East, also drove up crude oil prices in March. Metal ores, concentrates and scrap rose 4.3% in March, the largest month-over-month increase since December 2022 (+6.9%). Higher prices for the group in March 2024 were driven mainly by gold, silver, and platinum group metal ores and concentrates (+8.1%). Nickel ores and concentrates (+7.0%) also rose relative to February. On the contrary, iron ores and concentrates (-11.5%) fell for the third consecutive month in March, mostly influenced in the month by slowing demand and strong supplies that led to rising inventories in the Chinese market, putting downward pressure on prices. Source: statcan.gc.ca |