By Madison's Lumber Reporter

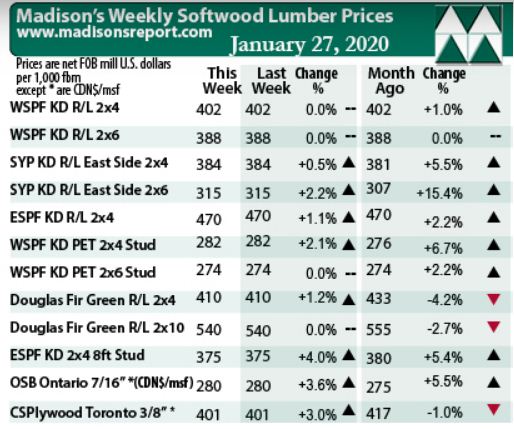

While benchmark construction framing softwood

lumber commodity Western Spruce-Pine-Fir 2×4

held firm last week, prices of a lot of other

dimension lumber items did pop up somewhat. The

lumber supply-demand balance across North

America is currently quite good, if not a little

in favour of producers. Harsh weather in several

regions, especially in Canada, over the past

couple of weeks created some problems in

transportation; more with getting lumber out to

customers than with bringing logs into sawmill

yards. Despite this, most players are looking

forward to a busy spring as customer inquiry –

if not actual purchasing – continues unabated

daily. The latest U.S. housing data, for home

sales and prices in November, shows a shrinking

supply with house prices rising sharply in many

U.S. cities.

By far the largest consumer of Canadian and U.S. solid wood products is

the U.S. housing market. As everyone knows, when that crashed miserably

in 2008 the North American sawmilling industry suffered horribly.

Indeed, some could say has still not fully recovered. Historically, 80

to 85 per cent of all Canadian wood was sold into the U.S.; following

the U.S. housing crash that figure is now closer to 65 per cent. As

well, the mix of wood products being ordered by U.S. customers has

changed; as the home construction market shifts to a higher ratio of

multi-family housing. Where single-family starts used to be king, now

apartments and condos make up a higher percentage of total home

building. This is a much more volatile data set than is single-family

starts, with volume fluctuations of 15 per cent between months being

quite common.

It is important to note that different softwood lumber commodities are

used in multi-family construction, compared to the benchmark items used

for single-family. For example; building codes require more 2×6 sizes

than 2×4, in studs as well as dimension, and also 10’ lengths are

required (to accommodate the higher ceilings). Madison’s has been

tracking this shift closely since it became apparent in the US

house-for-sale and house-price data last year. Check back often: lumber

prices come out every week for that week, housing data comes out monthly

for 2 or 3 months ago. Thus lumber prices could be an excellent forward

indicator of US housing market conditions.

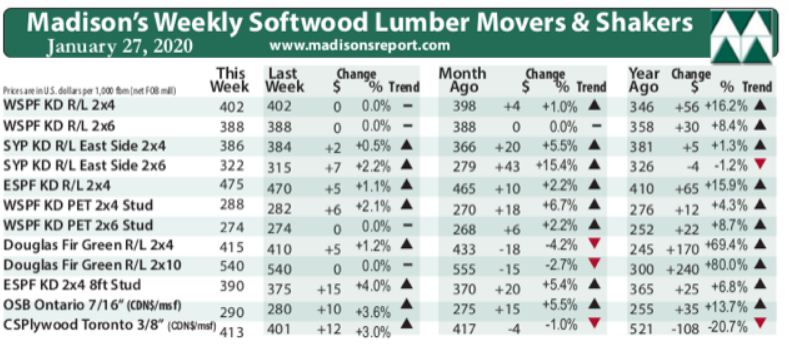

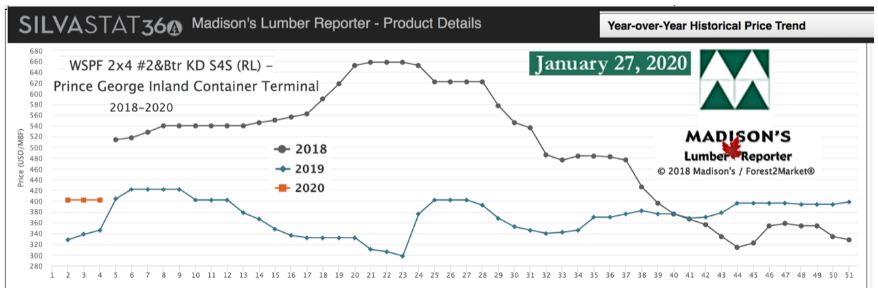

In week ending January 23, 2020, benchmark North American construction

framing lumber item Western Spruce-Pine-Fir KD 2×4 #2&Btr (RL) prices

remained at US$402 mfbm, again unchanged from the previous week. This

week’s price is +$4, or +1%, more than it was one month ago. Compared to

one year ago, this price is up by a smaller degree than recent weeks, by

+$56, or +16%.

Compared to historical trend, last week’s WSPF 2×4 #2&Btr price rise

moderated somewhat, still up +$27, or +7%, relative to the 1-year

rolling average price of US$375 mfbm, but are down -$32, or -7.4%,

relative to the 2-year rolling average price of US$434 mfbm. This week’s

price is up +$27, or +7% relative to the 5-year rolling average price of

US$375 mfbm.

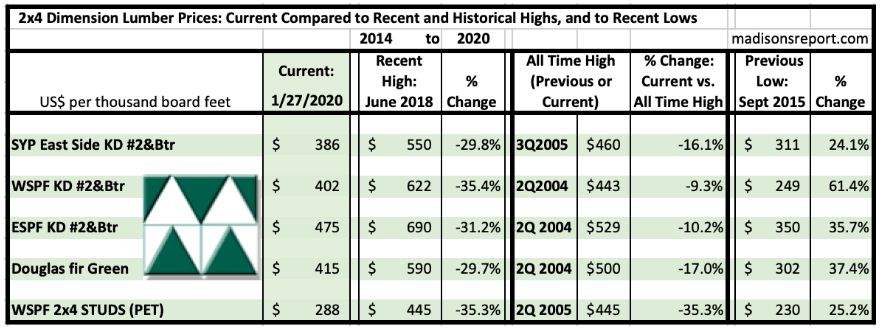

The below table is a comparison of recent highs, in June 2018, and

current January 2020 benchmark dimension softwood lumber 2×4 prices

compared to historical highs of 2004/05 and compared to recent lows of

Sept 2015:

Related News:

-

U.S. &

Canada softwood and panel markets - week 2, 2020 (January

20,

2020)

-

U.S. &

Canada softwood and panel markets - week 1, 2020 (January

13,

2020)

-

U.S. &

Canada softwood and panel markets - week 50, 2019 (December

17,

2019)

-

U.S. &

Canada softwood and panel markets - week 49, 2019 (December

10,

2019)

-

U.S. &

Canada softwood and panel markets - week 48, 2019 (December

3,

2019)

-

U.S. &

Canada softwood and panel markets - week 47, 2019 (November

26,

2019)

-

U.S. &

Canada softwood and panel markets - week 46, 2019 (November

19,

2019)

-

U.S. &

Canada softwood and panel markets - week 45, 2019 (November

12,

2019)

-

U.S. &

Canada softwood and panel markets - week 44, 2019 (November

5,

2019)

-

U.S. &

Canada softwood and panel markets - week 43, 2019 ( October

29,

2019)

-

U.S. &

Canada softwood and panel markets - week 42, 2019 ( October

22,

2019)

-

U.S. &

Canada softwood and panel markets - week 41, 2019 ( October

15,

2019)

-

U.S. &

Canada softwood and panel markets - week 40, 2019 ( October

8,

2019)

-

U.S. &

Canada softwood and panel markets - week 39, 2019 ( October

1,

2019)

-

U.S. &

Canada softwood and panel markets - week 38, 2019 ( September 24,

2019)

-

U.S. softwood and panel markets - week 37, 2019 ( September 17,

2019)

-

U.S. softwood and panel markets - week 36, 2019 ( September 10,

2019)

-

U.S. softwood and panel markets - week 35, 2019 ( September 3,

2019)

-

U.S. softwood and panel markets - week 34, 2019 ( August 23,

2019)

-

U.S. softwood and panel markets - week 33, 2019 ( August 16,

2019)

-

U.S. softwood and panel markets - week 32, 2019 ( August 09,

2019)

-

U.S. softwood and panel markets - week 31, 2019 ( August 02,

2019)

-

U.S. softwood and panel markets - week 30, 2019 ( July

26, 2019)

-

U.S. softwood and panel markets - week 29, 2019 ( July 19,

2019)

-

U.S. softwood and panel markets - week 28, 2019 ( July 12,

2019)

-

U.S. softwood and panel markets - week 27, 2019 ( July 03,

2019)

-

U.S. softwood and panel markets - week 26, 2019 ( June 28,

2019)

-

U.S. softwood and panel markets - week 25, 2019 ( June 21,

2019)

-

U.S. softwood and panel markets - week 24, 2019 ( June 14,

2019)

-

U.S. softwood and panel markets - week 23, 2019 ( June 07,

2019)

-

U.S. softwood and panel markets - week 22, 2019 ( May 31,

2019)

-

U.S. softwood and panel markets - week 21, 2019 ( May 24,

2019)

-

U.S. softwood and panel markets - week 20, 2019 ( May 17,

2019)

-

U.S. softwood and panel markets - week 19, 2019 ( May 10,

2019)

-

U.S. softwood and panel markets - week 18, 2019 ( May 03,

2019)

-

U.S. softwood and panel markets - week 17, 2019 ( April 26,

2019)

-

U.S. softwood and panel markets - week 16, 2019 ( April 19,

2019)

-

U.S. softwood and panel markets - week 15, 2019 ( April 12,

2019)

-

U.S. softwood and panel markets - week 14, 2019 ( April 05,

2019)

-

U.S. softwood and panel markets - week 13, 2019 ( March

29, 2019)

-

U.S. softwood and panel markets - week 12, 2019 ( March

22, 2019)

-

U.S. softwood and panel markets - week 11, 2019 ( March

15, 2019)

-

U.S. softwood and panel markets - week 10, 2019 ( March

08, 2019)

-

U.S. softwood and panel markets - week 9, 2019 ( March

01, 2019)

-

U.S. softwood and panel markets - week 8, 2019 ( February.

22, 2019)

-

U.S. softwood and panel markets - week 7, 2019 ( February.

15, 2019)

-

U.S. softwood and panel markets - week 6, 2019 ( February.

08, 2019)

-

U.S. softwood and panel markets - week 5, 2019 ( February.

01, 2019)

-

U.S. softwood and panel markets - week 4, 2019 (January. 25,

2019)

-

U.S. softwood and panel markets - week 3, 2019 (January. 18,

2019)

-

U.S. softwood and panel markets - week 2, 2019 (January. 11,

2019)

-

U.S. softwood and panel markets - week 1, 2019 (January. 04,

2019)

|