By Madison's Lumber Reporter

A significant uncertainty for North American

business owners was resolved today as Canada,

the U.S., and Mexico signed the new trilateral

trade agreement, the CUSMA. Full details will be

revealed soon, and the new deal will take effect

Jan. 1, 2020.

Also this week the Western Wood Products

Association released its latest monthly Lumber

Track of Canadian and U.S. softwood lumber

production and sawmill capacity utilization

data, for September 2019. There is not much

improvement in the figures, since all the

sawmill closures and curtailments over this

summer. However, the currently-stabilizing North

American construction framing dimension softwood

lumber prices suggest that supply-and-demand are

in good balance, as forest operators approach

their usual year-end seasonal closures.

Continuing flat, as last month, U.S. softwood

lumber production volume for January – September

2019 was 26,616 mmfbm. Also like last month,

softwood lumber production in Canada continued

big drops since the beginning of this year, once

more falling -11%, to 18,608 mmfbm, compared to

the first nine months of 2018 when it was 20,889

mmfbm.

U.S. sawmill production as per cent of practical

capacity for the first nine months of 2019

dropped quite a bit compared to the same time in

2018; at 83%, from 86% in 2018, said the latest

Western Wood Products Association’s monthly

Lumber Track. For January-September 2019,

Canadian sawmill production as per cent of

practical capacity kept falling off a cliff, to

land at 80% from 89% the previous year.

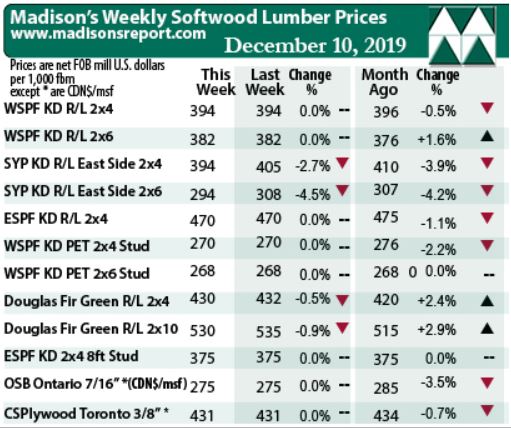

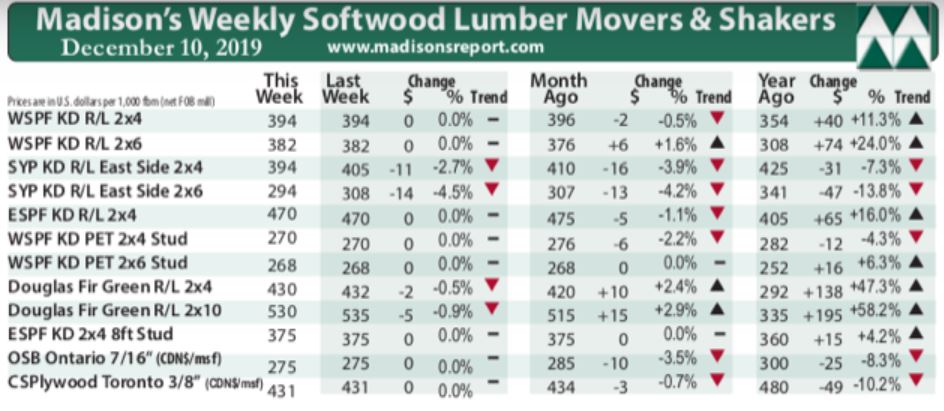

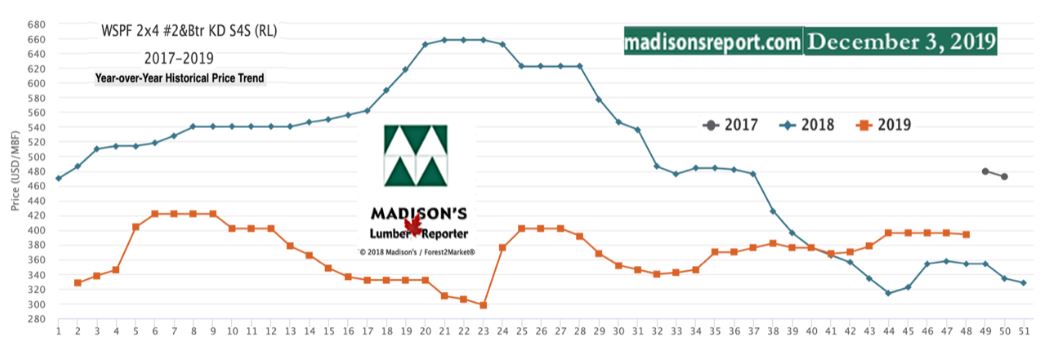

The price of benchmark lumber commodity Western Spruce-Pine-Fir KD 2×4

#2&Btr last week was unchanged from the week

before, still at US$394 mfbm (net FOB sawmill;

cash price, or “print”).

Compared to historical trend, last week’s WSPF 2×4 #2&Btr price rose

further over last week’s gains, up by another +$25, or +7%, relative to

the 1-year rolling average price of US$369 mfbm, and is down -$44, or

-10%, relative to the 2-year rolling average price of US$438 mfbm.

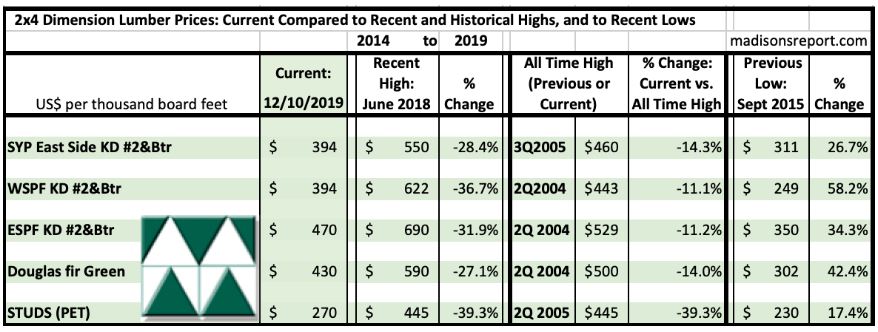

The below table is a comparison of recent highs, in June 2018, and

current December 2019 benchmark dimension softwood lumber 2×4 prices

compared to historical highs of 2004/05 and compared to recent lows of

Sept 2015: 2015:

Related News:

-

U.S. &

Canada softwood and panel markets - week 48, 2019 (December

3,

2019)

-

U.S. &

Canada softwood and panel markets - week 47, 2019 (November

26,

2019)

-

U.S. &

Canada softwood and panel markets - week 46, 2019 (November

19,

2019)

-

U.S. &

Canada softwood and panel markets - week 45, 2019 (November

12,

2019)

-

U.S. &

Canada softwood and panel markets - week 44, 2019 (November

5,

2019)

-

U.S. &

Canada softwood and panel markets - week 43, 2019 ( October

29,

2019)

-

U.S. &

Canada softwood and panel markets - week 42, 2019 ( October

22,

2019)

-

U.S. &

Canada softwood and panel markets - week 41, 2019 ( October

15,

2019)

-

U.S. &

Canada softwood and panel markets - week 40, 2019 ( October

8,

2019)

-

U.S. &

Canada softwood and panel markets - week 39, 2019 ( October

1,

2019)

-

U.S. &

Canada softwood and panel markets - week 38, 2019 ( September 24,

2019)

-

U.S. softwood and panel markets - week 37, 2019 ( September 17,

2019)

-

U.S. softwood and panel markets - week 36, 2019 ( September 10,

2019)

-

U.S. softwood and panel markets - week 35, 2019 ( September 3,

2019)

-

U.S. softwood and panel markets - week 34, 2019 ( August 23,

2019)

-

U.S. softwood and panel markets - week 33, 2019 ( August 16,

2019)

-

U.S. softwood and panel markets - week 32, 2019 ( August 09,

2019)

-

U.S. softwood and panel markets - week 31, 2019 ( August 02,

2019)

-

U.S. softwood and panel markets - week 30, 2019 ( July

26, 2019)

-

U.S. softwood and panel markets - week 29, 2019 ( July 19,

2019)

-

U.S. softwood and panel markets - week 28, 2019 ( July 12,

2019)

-

U.S. softwood and panel markets - week 27, 2019 ( July 03,

2019)

-

U.S. softwood and panel markets - week 26, 2019 ( June 28,

2019)

-

U.S. softwood and panel markets - week 25, 2019 ( June 21,

2019)

-

U.S. softwood and panel markets - week 24, 2019 ( June 14,

2019)

-

U.S. softwood and panel markets - week 23, 2019 ( June 07,

2019)

-

U.S. softwood and panel markets - week 22, 2019 ( May 31,

2019)

-

U.S. softwood and panel markets - week 21, 2019 ( May 24,

2019)

-

U.S. softwood and panel markets - week 20, 2019 ( May 17,

2019)

-

U.S. softwood and panel markets - week 19, 2019 ( May 10,

2019)

-

U.S. softwood and panel markets - week 18, 2019 ( May 03,

2019)

-

U.S. softwood and panel markets - week 17, 2019 ( April 26,

2019)

-

U.S. softwood and panel markets - week 16, 2019 ( April 19,

2019)

-

U.S. softwood and panel markets - week 15, 2019 ( April 12,

2019)

-

U.S. softwood and panel markets - week 14, 2019 ( April 05,

2019)

-

U.S. softwood and panel markets - week 13, 2019 ( March

29, 2019)

-

U.S. softwood and panel markets - week 12, 2019 ( March

22, 2019)

-

U.S. softwood and panel markets - week 11, 2019 ( March

15, 2019)

-

U.S. softwood and panel markets - week 10, 2019 ( March

08, 2019)

-

U.S. softwood and panel markets - week 9, 2019 ( March

01, 2019)

-

U.S. softwood and panel markets - week 8, 2019 ( February.

22, 2019)

-

U.S. softwood and panel markets - week 7, 2019 ( February.

15, 2019)

-

U.S. softwood and panel markets - week 6, 2019 ( February.

08, 2019)

-

U.S. softwood and panel markets - week 5, 2019 ( February.

01, 2019)

-

U.S. softwood and panel markets - week 4, 2019 (January. 25,

2019)

-

U.S. softwood and panel markets - week 3, 2019 (January. 18,

2019)

-

U.S. softwood and panel markets - week 2, 2019 (January. 11,

2019)

-

U.S. softwood and panel markets - week 1, 2019 (January. 04,

2019)

|