By Madison's Lumber Reporter

Dec. 10 is the deadline for retirement of two of

the three remaining Appellate Judges at the

World Trade Organization, where there are

currently disputes revolving around North

American softwood lumber. This WTO appellate

panel, which usually has seven people, now only

has the legal minimum of three, until Dec. 10.

Following years of pent-up U.S. frustration over

the behaviour of the WTO’s ultimate

dispute-resolution body, the administration of

President Donald Trump began blocking the

appointment of new panellists. As a result, the

group’s appellate body will stop functioning

next month, plunging into uncertainty and

casting a cloud over future ones.

The uncertainty stemming from the panel’s

dissolution would touch every country with

business before the WTO, including Canada.

Experts recently gathered at an event in

Washington, D.C. where they discussed the

consequences of the WTO becoming paralyzed.

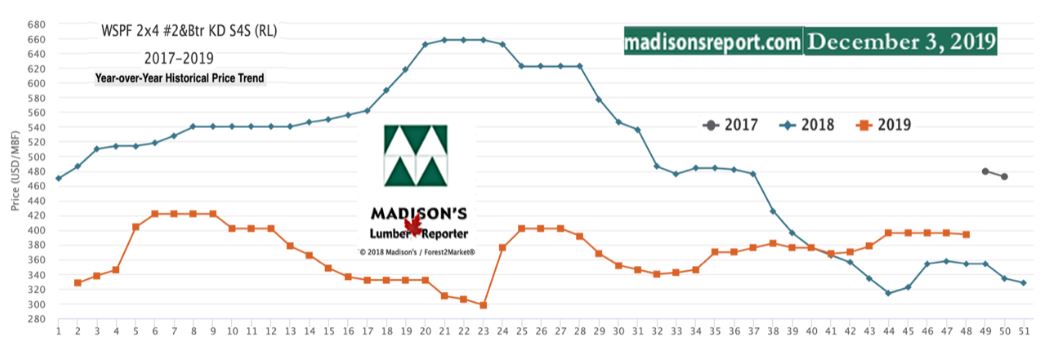

Construction framing dimension softwood lumber

prices in Canada and the U.S., meanwhile,

stabilized last week to levels moderate when

compared to one-year and two-years ago price

levels. The latest U.S. housing starts and home

sales data, out last week, showed continued

strong building activity with this important

customer for North American softwood lumber.

The price of benchmark lumber commodity Western

Spruce-Pine-Fir KD 2×4 #2&Btr last week dropped

-$2 to close Friday at US$394 mfbm (net FOB

sawmill; cash price, or “print”). Recovering

from drops in autumn, last week’s price is also

-$2 less than it was one month ago. Continuing

to gain ground after severe lows, compared to

one year ago this price is up +$40 or +11%.

Compared to historical trend, last week’s WSPF 2×4 #2&Btr price

continued recent reversals to bounce last week by another +$26, or +7%,

relative to the 1-year rolling average price of US$368 mfbm, and is down

-$45, or -10%, relative to the 2-year rolling average price of US$439

mfbm. This week’s price is up +$20, or up +5% relative to the 5-year

rolling average price of US$374 mfbm.

Eastern Canadian sawmills started out last week fielding strong demand,

as the combined effects of American Thanksgiving and the CN Rail strike

forced the hands of most buyers. By midweek, demand settled down as the

strike was tentatively settled and U.S. players were absent from the

office. With the slowdown in sales activity, producers began to build

inventory at their facilities, secure in the knowledge that buyers’

depleted stocks would have them coming back sooner rather than later.

U.S. Northeast construction was the very definition of making hay while

the sun shone there last week, where hay was analogous to building

projects. Eastern stocking wholesalers reported hearty sales activity

while conducive weather was in effect, bracing themselves for the

inevitable slowdown when winter weather arrives – apparently imminent.

Vendors were just happy they could say that November has been amazing

for the tri-state building market.

The below table is a comparison of recent highs, in June 2018, and

current November 2019 benchmark dimension softwood lumber 2×4 prices

compared to historical highs of 2004/05 and compared to recent lows of

Sept 2015: 2015:

Related News:

-

U.S. &

Canada softwood and panel markets - week 47, 2019 (November

26,

2019)

-

U.S. &

Canada softwood and panel markets - week 46, 2019 (November

19,

2019)

-

U.S. &

Canada softwood and panel markets - week 45, 2019 (November

12,

2019)

-

U.S. &

Canada softwood and panel markets - week 44, 2019 (November

5,

2019)

-

U.S. &

Canada softwood and panel markets - week 43, 2019 ( October

29,

2019)

-

U.S. &

Canada softwood and panel markets - week 42, 2019 ( October

22,

2019)

-

U.S. &

Canada softwood and panel markets - week 41, 2019 ( October

15,

2019)

-

U.S. &

Canada softwood and panel markets - week 40, 2019 ( October

8,

2019)

-

U.S. &

Canada softwood and panel markets - week 39, 2019 ( October

1,

2019)

-

U.S. &

Canada softwood and panel markets - week 38, 2019 ( September 24,

2019)

-

U.S. softwood and panel markets - week 37, 2019 ( September 17,

2019)

-

U.S. softwood and panel markets - week 36, 2019 ( September 10,

2019)

-

U.S. softwood and panel markets - week 35, 2019 ( September 3,

2019)

-

U.S. softwood and panel markets - week 34, 2019 ( August 23,

2019)

-

U.S. softwood and panel markets - week 33, 2019 ( August 16,

2019)

-

U.S. softwood and panel markets - week 32, 2019 ( August 09,

2019)

-

U.S. softwood and panel markets - week 31, 2019 ( August 02,

2019)

-

U.S. softwood and panel markets - week 30, 2019 ( July

26, 2019)

-

U.S. softwood and panel markets - week 29, 2019 ( July 19,

2019)

-

U.S. softwood and panel markets - week 28, 2019 ( July 12,

2019)

-

U.S. softwood and panel markets - week 27, 2019 ( July 03,

2019)

-

U.S. softwood and panel markets - week 26, 2019 ( June 28,

2019)

-

U.S. softwood and panel markets - week 25, 2019 ( June 21,

2019)

-

U.S. softwood and panel markets - week 24, 2019 ( June 14,

2019)

-

U.S. softwood and panel markets - week 23, 2019 ( June 07,

2019)

-

U.S. softwood and panel markets - week 22, 2019 ( May 31,

2019)

-

U.S. softwood and panel markets - week 21, 2019 ( May 24,

2019)

-

U.S. softwood and panel markets - week 20, 2019 ( May 17,

2019)

-

U.S. softwood and panel markets - week 19, 2019 ( May 10,

2019)

-

U.S. softwood and panel markets - week 18, 2019 ( May 03,

2019)

-

U.S. softwood and panel markets - week 17, 2019 ( April 26,

2019)

-

U.S. softwood and panel markets - week 16, 2019 ( April 19,

2019)

-

U.S. softwood and panel markets - week 15, 2019 ( April 12,

2019)

-

U.S. softwood and panel markets - week 14, 2019 ( April 05,

2019)

-

U.S. softwood and panel markets - week 13, 2019 ( March

29, 2019)

-

U.S. softwood and panel markets - week 12, 2019 ( March

22, 2019)

-

U.S. softwood and panel markets - week 11, 2019 ( March

15, 2019)

-

U.S. softwood and panel markets - week 10, 2019 ( March

08, 2019)

-

U.S. softwood and panel markets - week 9, 2019 ( March

01, 2019)

-

U.S. softwood and panel markets - week 8, 2019 ( February.

22, 2019)

-

U.S. softwood and panel markets - week 7, 2019 ( February.

15, 2019)

-

U.S. softwood and panel markets - week 6, 2019 ( February.

08, 2019)

-

U.S. softwood and panel markets - week 5, 2019 ( February.

01, 2019)

-

U.S. softwood and panel markets - week 4, 2019 (January. 25,

2019)

-

U.S. softwood and panel markets - week 3, 2019 (January. 18,

2019)

-

U.S. softwood and panel markets - week 2, 2019 (January. 11,

2019)

-

U.S. softwood and panel markets - week 1, 2019 (January. 04,

2019)

|