By Madison's Lumber Reporter

An unfortunate truth of life, economics, and

physics is that not all things can go up at the

same time. Once up, they don’t always stay

there. This is a week of mixed news: U.S. home

building activity continues to improve, but in

Canada forest operators are facing work-stoppage

with one of the two railways.

In regards to this CN Rail strike: usually these

last just a few days. However, at this time the

House of Commons does not sit again until Dec. 2

so there is no possibility of back-to-work

legislation until then. In any case, it is a

fact that forest products are among the last to

resume service once the railway starts operating

again.

As for the good news, U.S. home building for

October jumped +3.8% the Commerce Department

said Tuesday, reaching a seasonally adjusted

annual rate of 1.31 million units. Starts for

single-family houses were up +2%, largely due to

construction in the West and South. Construction

of apartment buildings rose +6.8% in October

from the prior month.

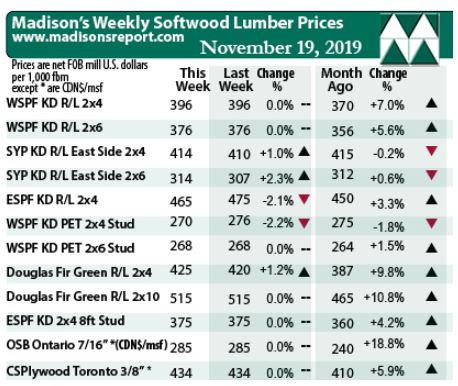

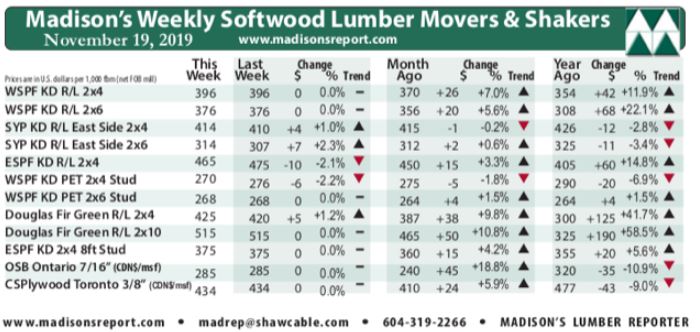

Once again flat over the previous week, the

price of benchmark lumber commodity Western

Spruce-Pine-Fir KD 2×4 #2&Btr remained last week

at US$396 mfbm (net FOB sawmill; cash price, or

“print”). Last week’s price is +$26, or +7%,

more than it was one month ago. Compared to one

year ago, when prices were sliding down

terribly, this price is up +$42 or +12%.

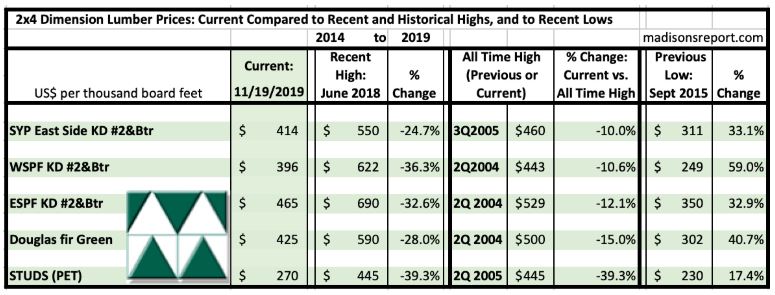

Compared to historical trend, last week’s WSPF 2×4 #2&Btr price is again

up but by a smaller amount, up +$30, or +8%, relative to the 1-year

rolling average price of US$366 mfbm, and is down -$46, or -10%,

relative to the 2-year rolling average price of US$442 mfbm.

With sawmill order files pushing into early December on an increasing

number of items, Western SPF producers in the United states were content

to hold prices at the previous week’s levels. Buyers stepped back from

placing new orders as they sorted out arriving volumes. Field

inventories remained pretty low. Western SPF sales in Canada were

already cooling off prior to last week. The arrival of extremely cold

weather in much of Canada and the US didn’t help.

The below table is a comparison of recent highs, in June 2018, and

current November 2019 benchmark dimension softwood lumber 2×4 prices

compared to historical highs of 2004/05 and compared to recent lows of

Sept 2015: 2015:

Related News:

-

U.S. &

Canada softwood and panel markets - week 45, 2019 (November

12,

2019)

-

U.S. &

Canada softwood and panel markets - week 44, 2019 (November

5,

2019)

-

U.S. &

Canada softwood and panel markets - week 43, 2019 ( October

29,

2019)

-

U.S. &

Canada softwood and panel markets - week 42, 2019 ( October

22,

2019)

-

U.S. &

Canada softwood and panel markets - week 41, 2019 ( October

15,

2019)

-

U.S. &

Canada softwood and panel markets - week 40, 2019 ( October

8,

2019)

-

U.S. &

Canada softwood and panel markets - week 39, 2019 ( October

1,

2019)

-

U.S. &

Canada softwood and panel markets - week 38, 2019 ( September 24,

2019)

-

U.S. softwood and panel markets - week 37, 2019 ( September 17,

2019)

-

U.S. softwood and panel markets - week 36, 2019 ( September 10,

2019)

-

U.S. softwood and panel markets - week 35, 2019 ( September 3,

2019)

-

U.S. softwood and panel markets - week 34, 2019 ( August 23,

2019)

-

U.S. softwood and panel markets - week 33, 2019 ( August 16,

2019)

-

U.S. softwood and panel markets - week 32, 2019 ( August 09,

2019)

-

U.S. softwood and panel markets - week 31, 2019 ( August 02,

2019)

-

U.S. softwood and panel markets - week 30, 2019 ( July

26, 2019)

-

U.S. softwood and panel markets - week 29, 2019 ( July 19,

2019)

-

U.S. softwood and panel markets - week 28, 2019 ( July 12,

2019)

-

U.S. softwood and panel markets - week 27, 2019 ( July 03,

2019)

-

U.S. softwood and panel markets - week 26, 2019 ( June 28,

2019)

-

U.S. softwood and panel markets - week 25, 2019 ( June 21,

2019)

-

U.S. softwood and panel markets - week 24, 2019 ( June 14,

2019)

-

U.S. softwood and panel markets - week 23, 2019 ( June 07,

2019)

-

U.S. softwood and panel markets - week 22, 2019 ( May 31,

2019)

-

U.S. softwood and panel markets - week 21, 2019 ( May 24,

2019)

-

U.S. softwood and panel markets - week 20, 2019 ( May 17,

2019)

-

U.S. softwood and panel markets - week 19, 2019 ( May 10,

2019)

-

U.S. softwood and panel markets - week 18, 2019 ( May 03,

2019)

-

U.S. softwood and panel markets - week 17, 2019 ( April 26,

2019)

-

U.S. softwood and panel markets - week 16, 2019 ( April 19,

2019)

-

U.S. softwood and panel markets - week 15, 2019 ( April 12,

2019)

-

U.S. softwood and panel markets - week 14, 2019 ( April 05,

2019)

-

U.S. softwood and panel markets - week 13, 2019 ( March

29, 2019)

-

U.S. softwood and panel markets - week 12, 2019 ( March

22, 2019)

-

U.S. softwood and panel markets - week 11, 2019 ( March

15, 2019)

-

U.S. softwood and panel markets - week 10, 2019 ( March

08, 2019)

-

U.S. softwood and panel markets - week 9, 2019 ( March

01, 2019)

-

U.S. softwood and panel markets - week 8, 2019 ( February.

22, 2019)

-

U.S. softwood and panel markets - week 7, 2019 ( February.

15, 2019)

-

U.S. softwood and panel markets - week 6, 2019 ( February.

08, 2019)

-

U.S. softwood and panel markets - week 5, 2019 ( February.

01, 2019)

-

U.S. softwood and panel markets - week 4, 2019 (January. 25,

2019)

-

U.S. softwood and panel markets - week 3, 2019 (January. 18,

2019)

-

U.S. softwood and panel markets - week 2, 2019 (January. 11,

2019)

-

U.S. softwood and panel markets - week 1, 2019 (January. 04,

2019)

|