By Madison's Lumber Reporter

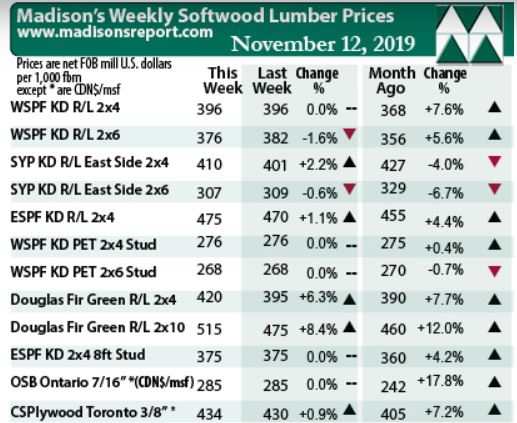

A couple of weeks ago it was panel (OSB and

plywood) prices that saw spectacular rebounds;

this week, Douglas fir green 2×4 prices

recovered back to one-month-ago levels. A strong

undercurrent of sales activity allowed U.S.

sawmills to keep most of their prices flat from

last week as many buyers couldn’t avoid coming

back to the table repeatedly to keep their

inventories from bleeding dry.

Customers were looking to other solid wood

commodities besides benchmark Western

Spruce-Pine-Fir KD 2×4 #2&Btr for their home

building needs, thus the price of specialty

construction framing dimension softwood lumber

item Douglas fir green 2×4 #2&Btr surged this

week +$25, or more than +6%, to U.S. $420 from

U.S. $395 mfbm last week (net FOB sawmill; cash

price, or “print”). Madison’s Lumber Reporter

suggests that buyers are weighing the ratio of

recent price increases for “the usual house

construction suspects,” and decided to cast

their queries wider. A sudden spurt of demand

for this one item would be enough for

manufacturers to be able to raise their price

quotes by a healthy degree.

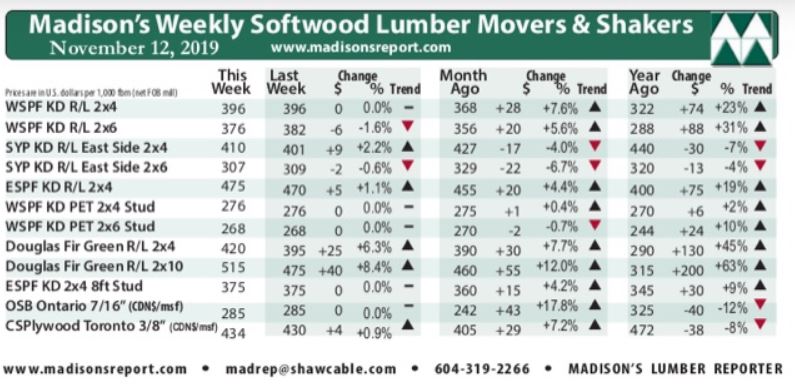

Remaining flat after recent climbs, the price of

benchmark lumber commodity Western

Spruce-Pine-Fir KD 2×4 #2&Btr stayed flat last

week at U.S. $396 mfbm (net FOB sawmill; cash

price, or “print”). Last week’s price is +$28,

or +8%, more than it was one month ago. Compared

to one year ago, when prices were at the

beginning of a terrible slide, this price is up

+74% or +23%.

Compared to historical trend, last week’s WSPF 2×4 #2&Btr price is up

again, but by a lesser degree, by +$31, or +8%, relative to the one-year

rolling average price of U.S. $365 mfbm, and is down -$47, or -11%,

relative to the two-year rolling average price of U.S. $443 mfbm.

Still on the west coast, primary and secondary suppliers of kiln-dried

Douglas-fir commodities were almost unfailingly positive about their

corner of the market this week. According to players, buyers were

underbought and light on inventory, prices were firm and rising, and

Pacific NorthWest sawmills had healthy two- to three-week order files.

In Canada, kiln-dried Douglas-fir producers built judicious log decks

since fibre prices there were quite high. Fewer U.S. raw logs were being

exported off the west coast lately, so log supply was a non-issue.

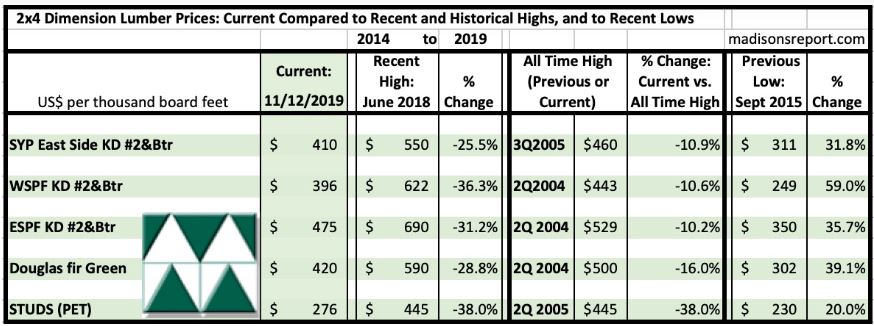

The below table is a comparison of recent highs, in June 2018, and

current Nov. 2019 benchmark dimension softwood lumber 2×4 prices

compared to historical highs of 2004/05 and compared to recent lows of

Sept. 2015: 2015:

Related News:

-

U.S. &

Canada softwood and panel markets - week 44, 2019 (November

5,

2019)

-

U.S. &

Canada softwood and panel markets - week 43, 2019 ( October

29,

2019)

-

U.S. &

Canada softwood and panel markets - week 42, 2019 ( October

22,

2019)

-

U.S. &

Canada softwood and panel markets - week 41, 2019 ( October

15,

2019)

-

U.S. &

Canada softwood and panel markets - week 40, 2019 ( October

8,

2019)

-

U.S. &

Canada softwood and panel markets - week 39, 2019 ( October

1,

2019)

-

U.S. &

Canada softwood and panel markets - week 38, 2019 ( September 24,

2019)

-

U.S. softwood and panel markets - week 37, 2019 ( September 17,

2019)

-

U.S. softwood and panel markets - week 36, 2019 ( September 10,

2019)

-

U.S. softwood and panel markets - week 35, 2019 ( September 3,

2019)

-

U.S. softwood and panel markets - week 34, 2019 ( August 23,

2019)

-

U.S. softwood and panel markets - week 33, 2019 ( August 16,

2019)

-

U.S. softwood and panel markets - week 32, 2019 ( August 09,

2019)

-

U.S. softwood and panel markets - week 31, 2019 ( August 02,

2019)

-

U.S. softwood and panel markets - week 30, 2019 ( July

26, 2019)

-

U.S. softwood and panel markets - week 29, 2019 ( July 19,

2019)

-

U.S. softwood and panel markets - week 28, 2019 ( July 12,

2019)

-

U.S. softwood and panel markets - week 27, 2019 ( July 03,

2019)

-

U.S. softwood and panel markets - week 26, 2019 ( June 28,

2019)

-

U.S. softwood and panel markets - week 25, 2019 ( June 21,

2019)

-

U.S. softwood and panel markets - week 24, 2019 ( June 14,

2019)

-

U.S. softwood and panel markets - week 23, 2019 ( June 07,

2019)

-

U.S. softwood and panel markets - week 22, 2019 ( May 31,

2019)

-

U.S. softwood and panel markets - week 21, 2019 ( May 24,

2019)

-

U.S. softwood and panel markets - week 20, 2019 ( May 17,

2019)

-

U.S. softwood and panel markets - week 19, 2019 ( May 10,

2019)

-

U.S. softwood and panel markets - week 18, 2019 ( May 03,

2019)

-

U.S. softwood and panel markets - week 17, 2019 ( April 26,

2019)

-

U.S. softwood and panel markets - week 16, 2019 ( April 19,

2019)

-

U.S. softwood and panel markets - week 15, 2019 ( April 12,

2019)

-

U.S. softwood and panel markets - week 14, 2019 ( April 05,

2019)

-

U.S. softwood and panel markets - week 13, 2019 ( March

29, 2019)

-

U.S. softwood and panel markets - week 12, 2019 ( March

22, 2019)

-

U.S. softwood and panel markets - week 11, 2019 ( March

15, 2019)

-

U.S. softwood and panel markets - week 10, 2019 ( March

08, 2019)

-

U.S. softwood and panel markets - week 9, 2019 ( March

01, 2019)

-

U.S. softwood and panel markets - week 8, 2019 ( February.

22, 2019)

-

U.S. softwood and panel markets - week 7, 2019 ( February.

15, 2019)

-

U.S. softwood and panel markets - week 6, 2019 ( February.

08, 2019)

-

U.S. softwood and panel markets - week 5, 2019 ( February.

01, 2019)

-

U.S. softwood and panel markets - week 4, 2019 (January. 25,

2019)

-

U.S. softwood and panel markets - week 3, 2019 (January. 18,

2019)

-

U.S. softwood and panel markets - week 2, 2019 (January. 11,

2019)

-

U.S. softwood and panel markets - week 1, 2019 (January. 04,

2019)

|