By Madison's Lumber Reporter

Drama unfolded large in downtown Vancouver last

week, where the Union of British Columbia

Municipalities annual meeting was being held.

Mayors and political leaders from across the

province were greeted by a convoy of 230

unloaded logging trucks arriving Friday morning

to large crowds of surprised, and cheering,

onlookers. The issue of reduced timber supply is

hitting rural areas especially hard, so log

truck operators decided to make a statement

directly in the faces of decision-makers. At the

same time, the BC Ministry of Forests, Lands,

Natural Resource Operations and Rural

Development released the “State of British

Columbia Forests 2018,” which provides full data

update for the harvest, manufacture, and export

of B.C. wood fibre resource: Economic State of

B.C.’s Forest Sector 2018

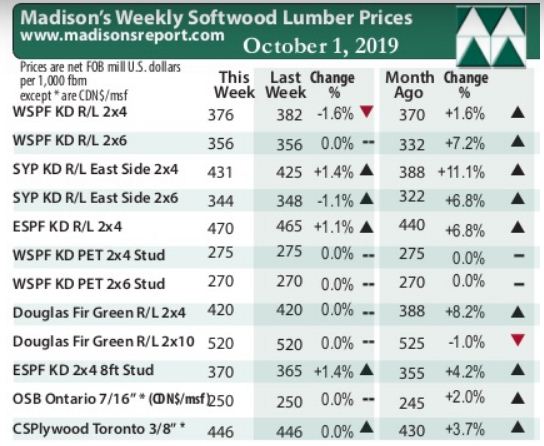

Lumber prices moderated down slightly on some

construction framing items, but stayed flat on

most solid wood commodities. Producers of lumber

price benchmark item Western Spruce-Pine-Fir KD

2×4 #2&Btr, lowered their asking prices by six

dollars to U.S. $376 mfbm. Canadian WSPF

producers adamantly refused to take any more

counter-offers on any item. Oct. 14 order files

prevailed on nearly everything, with at least

one sawmill mentioning a notable lack of 2×8

supply, saying they hadn’t had any all week. Wet

weather continued to prevent a few sawmills in

British Columbia and Alberta from getting enough

logs, so much so that another facility was down

for at least a week. Keep reading to find out

more:

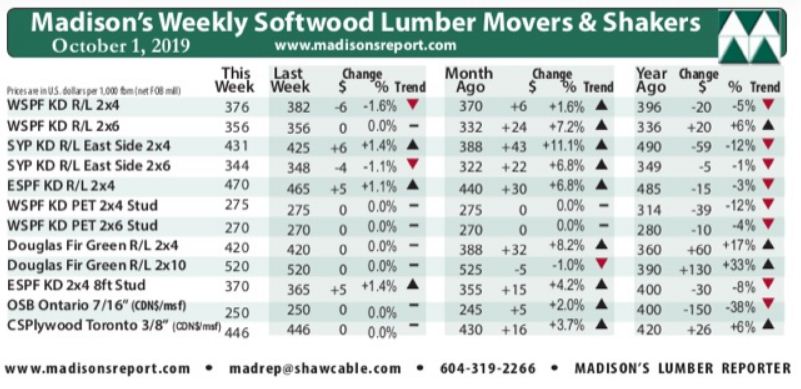

After increasing by six dollars the previous

week, this week’s benchmark lumber commodity

Western Spruce-Pine-Fir KD 2×4 #2&Btr price was

U.S. $376 mfbm, down -$6, or -1.5%. This might

be an indication that the latest sawmill

curtailments have taken enough production

offline to bring the supply-demand balance to an

even keel. This price is up six dollars from one

month ago, when it was U.S. $382 mfbm. Further

narrowing the gap from 2018, compared to one

year ago this price is down -$20, or -5%.

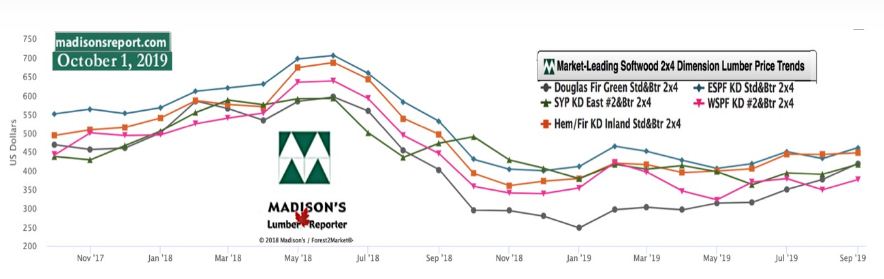

Compared to historical trend, this week’s WSPF KD 2×4 #2&Btr price is up

+$14, or +4%, relative to the one-year rolling average price of U.S.

$362 mfbm. This price is down -$70, or -16%, relative to the two-year

rolling average price of $446.

Prices of studs were flat, but those items sold with consistency all

week. Production bookings at stud mills were up to three weeks out on

kiln-dried Douglas fir.

In Quebec, overall sales of Eastern Spruce-Pine-Fir lumber slowed down

last week. Most customers had taken care of their short term needs over

the preceding four-to-seven business days, but perpetually low field

inventories indicated that they’d be back at the ordering table before

long. Two-week order files prevailed, as sawmills reported annoying but

not unnavigable kinks with transportation.

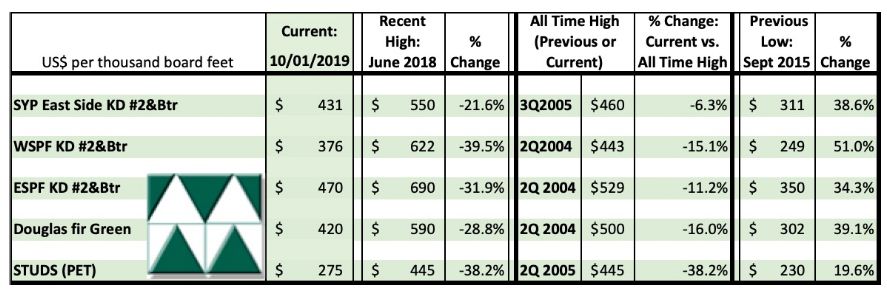

The below table is a comparison of recent highs, in June 2018, and

current October 2019 benchmark dimension softwood lumber 2×4 prices

compared to historical highs of 2004/05 and compared to recent lows of

Sept. 2015:

Related News:

-

U.S. &

Canada softwood and panel markets - week 38, 2019 ( September 24,

2019)

-

U.S. softwood and panel markets - week 37, 2019 ( September 17,

2019)

-

U.S. softwood and panel markets - week 36, 2019 ( September 10,

2019)

-

U.S. softwood and panel markets - week 35, 2019 ( September 3,

2019)

-

U.S. softwood and panel markets - week 34, 2019 ( August 23,

2019)

-

U.S. softwood and panel markets - week 33, 2019 ( August 16,

2019)

-

U.S. softwood and panel markets - week 32, 2019 ( August 09,

2019)

-

U.S. softwood and panel markets - week 31, 2019 ( August 02,

2019)

-

U.S. softwood and panel markets - week 30, 2019 ( July

26, 2019)

-

U.S. softwood and panel markets - week 29, 2019 ( July 19,

2019)

-

U.S. softwood and panel markets - week 28, 2019 ( July 12,

2019)

-

U.S. softwood and panel markets - week 27, 2019 ( July 03,

2019)

-

U.S. softwood and panel markets - week 26, 2019 ( June 28,

2019)

-

U.S. softwood and panel markets - week 25, 2019 ( June 21,

2019)

-

U.S. softwood and panel markets - week 24, 2019 ( June 14,

2019)

-

U.S. softwood and panel markets - week 23, 2019 ( June 07,

2019)

-

U.S. softwood and panel markets - week 22, 2019 ( May 31,

2019)

-

U.S. softwood and panel markets - week 21, 2019 ( May 24,

2019)

-

U.S. softwood and panel markets - week 20, 2019 ( May 17,

2019)

-

U.S. softwood and panel markets - week 19, 2019 ( May 10,

2019)

-

U.S. softwood and panel markets - week 18, 2019 ( May 03,

2019)

-

U.S. softwood and panel markets - week 17, 2019 ( April 26,

2019)

-

U.S. softwood and panel markets - week 16, 2019 ( April 19,

2019)

-

U.S. softwood and panel markets - week 15, 2019 ( April 12,

2019)

-

U.S. softwood and panel markets - week 14, 2019 ( April 05,

2019)

-

U.S. softwood and panel markets - week 13, 2019 ( March

29, 2019)

-

U.S. softwood and panel markets - week 12, 2019 ( March

22, 2019)

-

U.S. softwood and panel markets - week 11, 2019 ( March

15, 2019)

-

U.S. softwood and panel markets - week 10, 2019 ( March

08, 2019)

-

U.S. softwood and panel markets - week 9, 2019 ( March

01, 2019)

-

U.S. softwood and panel markets - week 8, 2019 ( February.

22, 2019)

-

U.S. softwood and panel markets - week 7, 2019 ( February.

15, 2019)

-

U.S. softwood and panel markets - week 6, 2019 ( February.

08, 2019)

-

U.S. softwood and panel markets - week 5, 2019 ( February.

01, 2019)

-

U.S. softwood and panel markets - week 4, 2019 (January. 25,

2019)

-

U.S. softwood and panel markets - week 3, 2019 (January. 18,

2019)

-

U.S. softwood and panel markets - week 2, 2019 (January. 11,

2019)

-

U.S. softwood and panel markets - week 1, 2019 (January. 04,

2019)

|