|

Report from

Europe

EU27 tropical wood imports below historically low pre-

COVID level

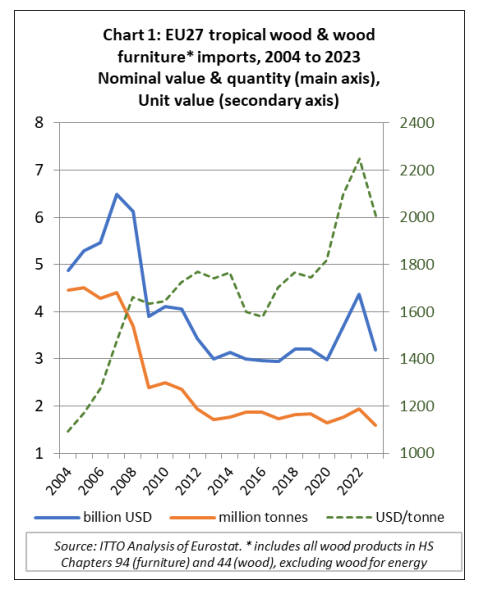

In 2023, the EU27 imported 1.59 million tonnes of tropical

wood and wood furniture products with a total value of

US$3.18 billion, respectively 18% and 27% less than the

previous year. This marked a return to the historically low

pre-pandemic level. EU27 import value of tropical wood

and wood furniture products last year was only slightly

above the annual average of US$3.06 billion during the

pre-COVID 2013 to 2019 period.

When account is taken of inflation, import value last year

was about 10% below the pre-COVID level. Import

quantity in 2023 was around 12% below the annual

average of 1.8 million tonnes during the 2013 to 2019

period.

The sharp rise in unit prices for tropical wood and wood

furniture imported into the EU that occurred during the

pandemic was also partially reversed last year.

The average price per tonne of all EU27 tropical wood and

wood furniture imports fell from a record high of

US$2250 in 2022 to US$2000 in 2023 (Chart 1 above).

In reviewing EU27 tropical imports during 2023, it is

notable that the decline in trade was almost universal,

impacting on all product groups and all supply countries

almost without exception. A downturn in which all

products and suppliers are losers is a rare event indeed and

is another indication of the sheer scale of the shift in trade

last year.

Precipitous fall in EU27 trade in the fourth quarter of

2023

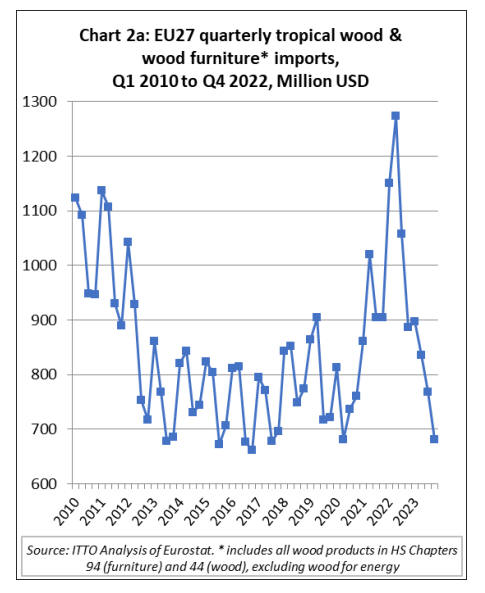

The EU27 imported tropical wood and wood furniture

with total value of US$681 million in the fourth quarter of

2023, 11% less than the previous quarter and 23% down

on the same quarter the previous year.

Quarterly import value fell precipitously from a historical

high of US$1274 in the second quarter of 2022 at the peak

of the post-COVID boom (Chart 2a).

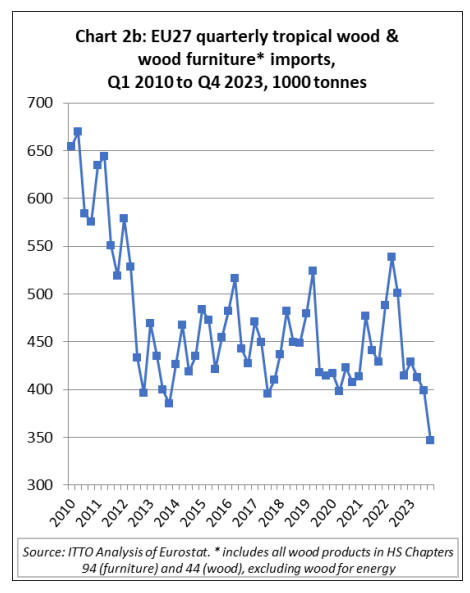

In quantity terms, total EU27 imports of tropical wood and

wood furniture of 347,000 tonnes in the fourth quarter last

year were 13% down compared to the previous quarter and

16% less than during the same quarter the previous year.

In fact, this was by far the lowest quarterly import quantity

recorded this century by the EU and quite possibly ever

recorded by the EU since it was first formed (as the EEC)

in 1957 (Chart 2b).

EU economic expansion comes to an abrupt end in

2023

The challenges facing the European economy are

highlighted in EU’s Winter 2024 Economic Forecast

published on 15 February. This indicates that GDP

expanded by only 0.5% in both the EU and the euro area

during 2023. Growth of only 0.9% is now projected in the

EU and 0.8% in the euro area in 2024.

According to the EU Forecast: “Last year’s modest growth

largely owes itself to the momentum of the post-pandemic

economic rebound in the previous two years.

Already towards the end of 2022, the economic expansion

came to an abrupt end and activity has since been broadly

stagnating, against the background of falling household

purchasing power, collapsing external demand, forceful

monetary tightening and the partial withdrawal of fiscal

support in 2023.

The EU economy thus entered 2024 on a weaker footing

than previously expected. After narrowly avoiding a

technical recession in the second half of last year,

prospects for the first quarter of 2024 remain subdued”.

The EU Forecast identifies some positive developments in

the EU economy, particularly in relation to inflation, since

the previous 2023 Autumn Forecast. It notes that “As

energy supply keeps outstripping demand, spot and future

prices for oil and especially gas are now significantly

lower than assumed in the Autumn Forecast.

Retail energy prices are therefore set to fall further,

helping EU recover some of the competitiveness lost

during the energy crisis. Despite mild upward pressure

from higher shipping costs in the wake of Red Sea trade

disruptions, underlying inflation continues on a steady

downward path”.

Overall, the EU Forecast suggests that “the conditions for

a gradual acceleration of economic activity this year

appear to be still in place. As inflation decelerates, real

wage growth and resilient employment should support a

rebound in consumption.

Despite falling profit margins, investment is set to benefit

from a gradual easing of credit conditions and further

deployment of the Recovery and Resilience Facility

(RRF). The pace of growth is set to stabilise broadly in

line with potential, as of the second half of this year”.

On the other hand, the EU Forecast notes that “protracted

geopolitical tensions and the broadening of the Middle

East conflict to the Red Sea tilt the balance of risks

towards more adverse outcomes”. Furthermore, “a more

persistent transmission of the still tight monetary

conditions could further delay the rebound in economic

activity”.

EU27 tropical wooden furniture imports down by a

third in 2023

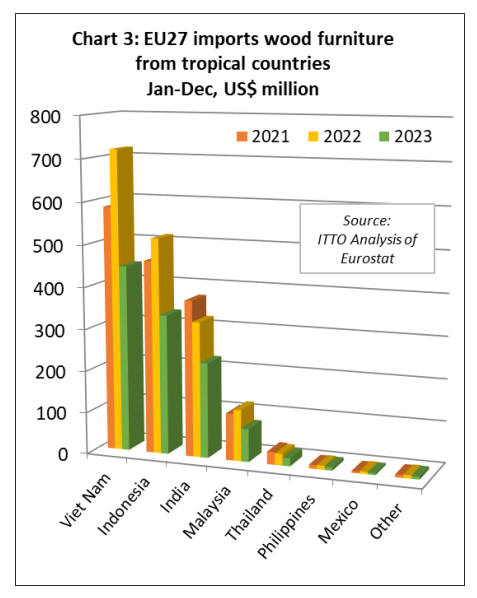

The EU27 imported 265,600 tonnes of wood furniture

from tropical countries with a total value of US$1124

million in 2023, down 24% and 35% respectively

compared to the previous year.

EU27 import value of wood furniture decreased from all

leading tropical supply countries in 2023, including

Vietnam (-38% to US$445 million), Indonesia (-35% to

US$334 million), India (-30% to US$227 million),

Malaysia (-36% to US$79 million), and Thailand (-32% to

US$19 million). EU27 wood furniture imports from all

other tropical countries were negligible during the year

(Chart 3).

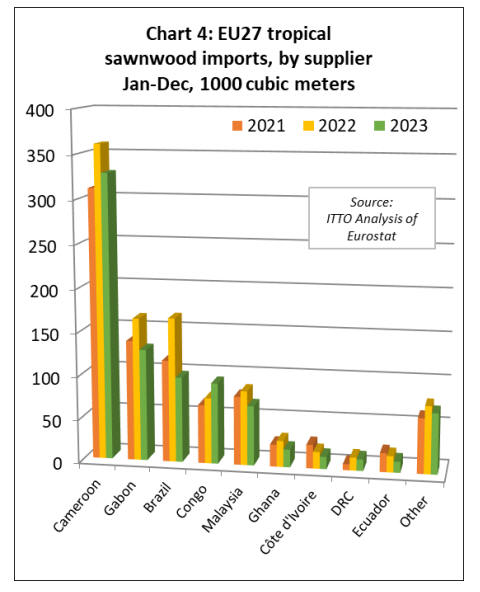

EU27 imports of tropical sawnwood declined 16% in

2023

The EU27 imported 848,000 cubic metres of tropical

sawnwood in 2023, 16% less than the previous year.

Import value of this commodity was US$782 million in

2023, 14% less than in 2022.

Imports declined from nearly all leading supply countries

including Cameroon (-9% to 328,600 cubic metres),

Gabon (-22% to 128,800 cubic metres), Brazil (-41% to

98,300 cubic metres), Malaysia (-20% to 68,700 cubic

metres), Ghana (-32% to 20,500 cubic metres), Côte

d’Ivoire (-27% to 14,100 cubic metres), DRC (-12% to

13,200 cubic metres), and Ecuador (-27% to 10,000 cubic

metres).

The only significant increases in tropical sawnwood

imports were from the Republic of Congo (+23% to

93,300 cubic metres) and CAR (+85% to 12,600 cubic

metres). The increase in sawnwood imports from the

Republic of Congo last year coincides with introduction of

a ban on log exports from the country on 1st January 2023

(Chart 4).

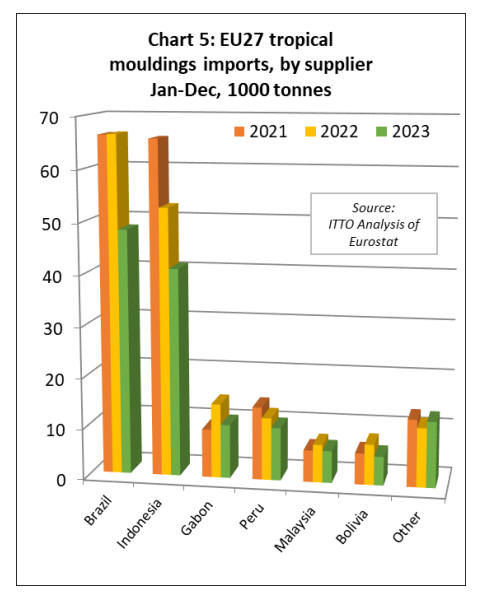

The EU27 imported 134,900 tonnes of tropical

mouldings/decking in 2023, 22% less than in the previous

year. Import value of tropical mouldings/decking was

down 35% to US$258 million in 2023.

Imports fell sharply from all the leading supply countries

including Brazil (-27% to 48,200 tonnes), Indonesia (-22%

to 40,900 tonnes), Gabon (-28% to 10,500 tonnes), Peru (-

15% to 10,400 tonnes), Malaysia (-16% to 6,300 tonnes),

and Bolivia (-29% to 5,600 tonnes) (Chart 5).

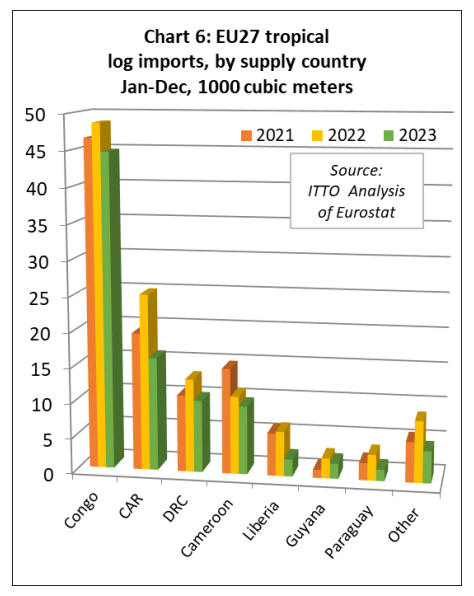

The EU27 imported 91,500 cubic metres of tropical logs

with a total value of US$58.3 million in 2023, respectively

23% and 10% less than in 2022.

The decline was universal across all supply countries

including the Republic of Congo (-8% to 44,700 cubic

metres), Central African Republic (-36% to 16,100 cubic

metres), Democratic Republic of Congo (-23% to 10,200

cubic metres), Cameroon (-12% to 9,700 cubic metres),

Liberia (-61% to 2,400 cubic metres), Guyana (-25% to

2,100 cubic metres) and Paraguay (-56% to 1,600 cubic

metres) (Chart 6).

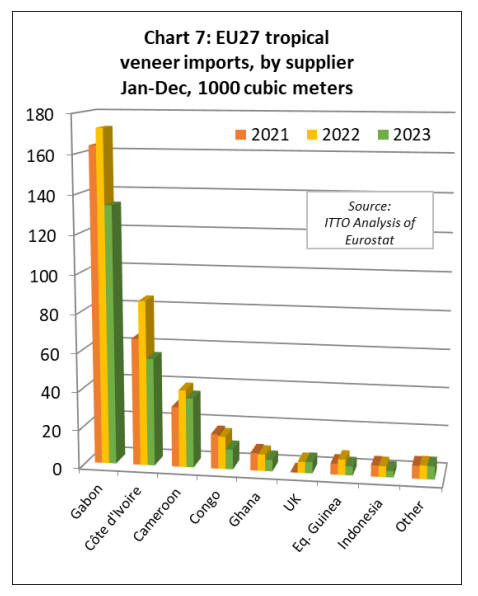

Reversal in EU27 imports of tropical hardwood veneer

in 2023

The EU27 imported 262,800 cubic metres of tropical

veneer with a total value of US$180 million in 2023, down

25% and 23% respectively compared to the previous year.

Imports of tropical veneer from Gabon, by far the largest

supplier to the EU27, decreased 22% to 133,800 cubic

metres in 2023. Imports of this commodity also declined

from Côte d'Ivoire (-35% to 55,900 cubic metres),

Cameroon (-10% to 36,100 cubic metres), Republic of

Congo (-39% to 10,300 cubic metres), Ghana (-30% to

6,000 cubic metres), and Equatorial Guinea (-41% to

4,700 cubic metres).

The only increase in tropical veneer imports into the EU27

last year was in indirect trade with the UK which was up

3% to 5,900 cubic metres (Chart 7).

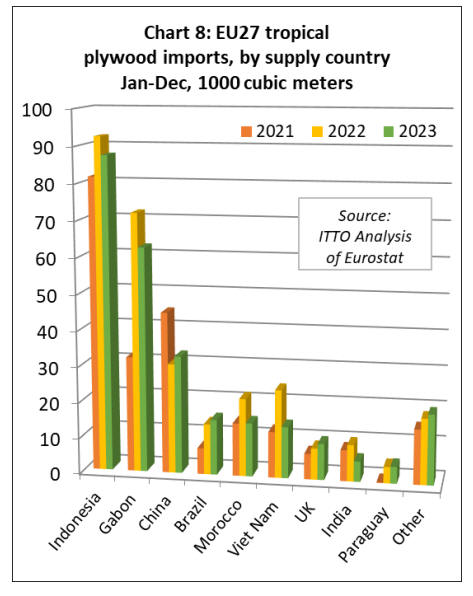

The EU27 imported 267,600 cubic metres of tropical

plywood with a total value of US$197 million in 2023,

respectively 10% and 24% less than the previous year.

Imports increased from China (+7% to 32,800 cubic

metres), Brazil (+9% to 15,400 cubic metres), and

Paraguay (+3% to 4,700 cubic metres), while indirect

imports via the UK were also up 15% to 10,100 cubic

metres.

However, imports from other tropical supply countries

declined including Indonesia (-5% to 87,500 cubic

metres), Gabon (-13% to 62,600 cubic metres), Morocco (-

31% to 14,900 cubic metres), Vietnam (-42% to 14,300

cubic metres), and India (-44% to 5,700 cubic metres)

(Chart 8).

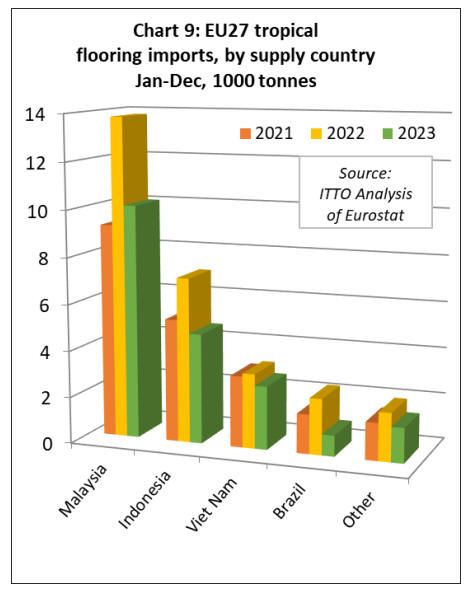

EU27 imports of tropical flooring decline 30% in 2023

The EU27 imported 19,900 tonnes of tropical wood

flooring with a total value of US$57 million in 2023, down

30% and 35% respectively compared to the previous year.

The consistent rise in EU27 wood flooring imports from

Malaysia, that began in 2020, stalled in 2023. Imports of

10,100 tonnes from Malaysia last year were 27% less than

in 2022. Imports also fell from Indonesia (-33% to 4,700

tonnes), Vietnam (-15% to 2,700 tonnes), and Brazil (-

63% to 900 tonnes) (Chart 9).

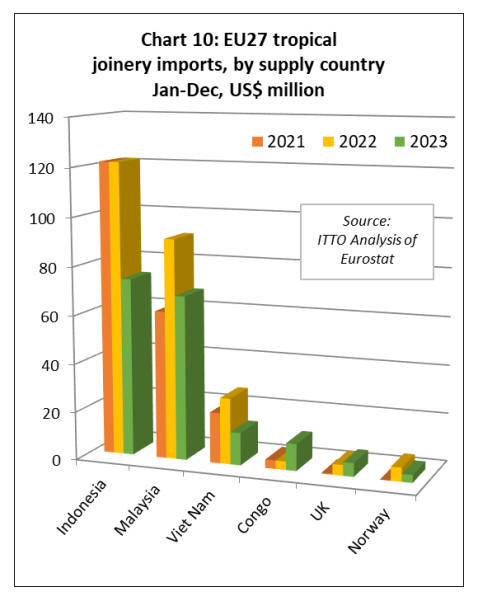

The value of EU27 imports of other joinery products from

tropical countries - which mainly comprise laminated

window scantlings, kitchen tops and wood doors –

declined 31% to US$198 million in 2023.

Import quantity fell 25% to 80,500 tonnes during the year.

Imports were down 39% to US$74 million from Indonesia,

down 25% to US$68 million from Malaysia, down 51% to

US$13 million from Vietnam, and down 74% to US$3

million from China.

In a potentially significant longer-term development, given

efforts in the country to shift up the value chain as log

exports are banned, EU imports of laminated joinery

products from the Republic of Congo were valued at

US$11 million in 2023, nearly three times the value of

2022 (Chart 10).

|