US Dollar Exchange Rates of

10th

Mar

2024

China Yuan 7.19

Report from China

2024 catalogue of national key industrial

products

includes wood

The State Administration for Market Regulation recently

issued the’ Catalogue of National Key Industrial Product

Quality and Safety Supervision’ (2024 edition). Wood

products, such as wooden furniture and wood-based panels

are included in the catalogue.

Wood-based panels in the Catalogue include blockboard,

MDF, particleboard, plywood, impregnated adhesive film

papered veneer, laminated wood flooring and solid wood

composite flooring. Food related products such as

disposable bamboo-wood chopsticks and wooden cutting

board are also included.

See:

https://www.forestry.gov.cn/lyj/1/lcdt/20240131/544533.html

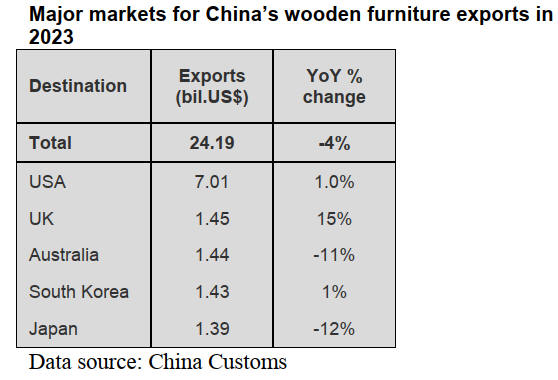

Decline in wooden furniture exports

According to China Customs, wooden furniture exports in

2023 fell 4% to US$24.19 billion year on year. The US

was the largest market for China’s wooden furniture

exports and nearly 30% of China’s wooden furniture

exports were to the US, up 1% over 2022.

China’s wooden furniture is exported to more than 200

countries and these markets are very diverse. The top 5

countries for furniture exports of more than US$1billion

together accounted for only 53% of the national total

wooden furniture exports in 2023.

China’s wooden furniture exports to UK in 2023 rose 15%

to US$1.45 billion year on year. In contrast, China’s

wooden furniture exports to Australia and Japan dropped

11% and 12% to US$1.44 billion and US$1.39 billion

respectively in 2023.

China's wooden furniture exporters have encountered

difficulties and challenges in recent years, resulting in a

decline in wooden furniture exports in 2023. The main

reasons were as follows:

China's wooden furniture exports are often subjected to

barriers in the import countries especially those related to

in anti-dumping, technical standards and environmental

certification and environmental protection requirements

are getting higher and higher.

Many countries have begun to implement strict

environmental protection laws and regulations and have

put forward higher requirements for raw materials,

production processes and environmental protection

treatment of imported wooden furniture. This drives up

production costs and impacts competitiveness.

China’s wooden furniture enterprises are facing

competition from shippers whose costs are lower.

With the fluctuations in the global economy the supply

and demand has changed greatly and the furniture prices in

some emerging markets such as India and Vietnam are

relatively low which poses a competitive pressure on

China’s wooden furniture exporters.

In addition, the production technology and management

level of domestic wooden furniture production enterprises

in China is not high resulting in low productivity and

unstable product quality and these factors affect

international competitiveness. China’s wooden furniture

enterprises plan to respond by improving production

technology and management, optimising the supply chain

and strengthen brand building to enhance the

competitiveness.

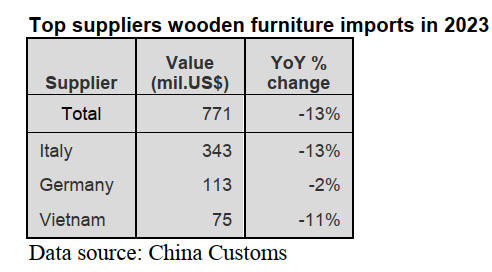

Decline in wooden furniture imports

According to China Customs, wooden furniture imports

fell 13% to US$770.57 million in 2023. Italy, Germany

and Vietnam were the top 3 suppliers of wooden furniture

to China. Nearly 70% of wooden furniture from these

three countries fell by13%, 2% and 11%, to US$343

million, US$113 million and US$74.6 million respectively

in 2023. The demand for wooden furniture in the domestic

market is said to be weak and opportunities for growth are

limited.

Rapid development of China /Russia supply chain

A cooperation agreement has been agreed between the

Timber Industry Association in Suifenhe City,

Heilongjiang Province and the Federation of Timber

Industries and Exporters in Primorsky Krai, Russia.

According to the agreement the two sides will I”n line

with the basic principles of giving full play to the

advantages of all parties, realizing complementary

resources, matching mutual needs, voluntary win-win and

common development, determine the establishment of

partnership mainly in the wood industry raw material

supply chain, establish a management meeting and

communication mechanism from time to time, the

association leads the exchange of visits between the two

companies, build an industry exchange platform, and

regularly carry out activities”.

In particular, the Russian Association discussed the

possibility of the Association trading timber in the St.

Petersburg International Commodity Raw Materials

Exchange in Vladivostok and expressed its willingness to

set up a branch in Suifenhe City to jointly promote

commodities in China.

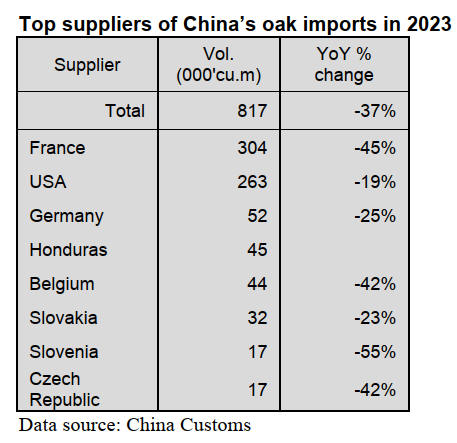

Imports of oak logs from Honduras

The forest products trade between Honduras and China is

growing and China’s log imports from Honduras in 2023

surged. While China’s oak imports have dropped

significantly from traditional shippers oak log arrivals

from Honduras have started for the first time. China

imported 450,000 cubic metres of oak logs from

Honduras, valued US$25 million in 2023.

According to China Customs, China’s oak imports in 2023

totalled 817,000 cubic metres, down 37% year on year.

The top 3 suppliers, France, USA and Germany saw oak

exports to Chian fall by 45%, 19% and 25% respectively

in 2023 resulting in the overall decrease in oak imports.

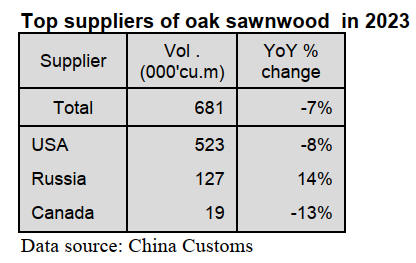

Rise in oak sawnwood imports from Russia

According to China Customs, oak sawnwood imports from

Russia in 2023 rose 14% to 127,000 cubic metres valued

at US$61 million, up 14% year on year.

In contrast, the top suppliers of oak sawnwood, the US and

Canada saw 2023 exports to China fall by 8% and 13% to

523,000 cubic metres and 190,000 cubic metres

respectively resulting in the overall decrease in oak

sawnwood imports in 2023. China’s oak sawnwood

imports felld 7% to 681,000 cubic metres in 2023.

China’s oak sawnwood imports from France and Germany

in 2023also dropped 87% and 25% year on year.

Through the eyes of industry

The latest GTI report lists the challenges identified by the private

sector in China.

See:

https://www.itto-ggsc.org/static/upload/file/20240223/1708653799120615.pdf

|