Japan

Wood Products Prices

Dollar Exchange Rates of 10th

Mar

2024

Japan Yen 148.46

Reports From Japan

Trend in wage negotiations

key in decisions on

interest rates

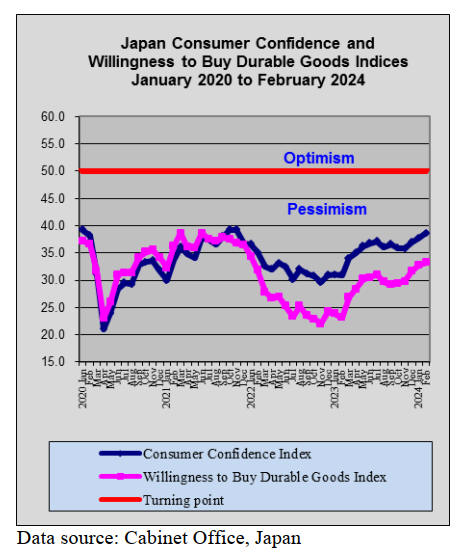

Every spring unions and management in Japan hold talks

(known as shunto) to agree wages ahead of the April fiscal

year. Economists are closely monitoring this years’

negotiations because the outcome will influence the Bank

of Japan (BoJ) monetary policy. The BoJ governor has

said that “a clear trend of wage increases is key to meeting

its inflation target which will give the Bank the confidence

to adjust its policy on interest rates.

The largest labour confederation has announced record

pay increases, signaling a break from the deflationary

spiral that held down growth in the so-called "lost decades.

Driving the wage increases is the growing labour shortage

in many sectors along with rising prices of everyday items

made worse by a weak yen.

However, only about 16% of workers in Japan are union

members and, with small companies accounting for

around 70% of employment, the ability of these companies

to raise wages depends heavily on whether they can pass

on costs to customers, many of which are the big

enterprises who will fight to keep production costs down.

See:

https://www.cnbc.com/2024/03/14/japan-2024-shunto-spring-wage-negotiations.html

Third quarter surge in capital spending

Ministry of Finance data shows capital spending by

Japanese companies surged in the October-December

quarter from a year earlier which was interpreted to

suggest the state of the Japanese economy was not as weak

as often portrayed.

Investment by financial sectors in building factories and

adding equipment in the same quarter was a record.

Japanese companies increased investment for the 11th

straight quarter suggesting an underlying strength in

demand.

Manufacturers increased investment by just over 20% to

boost output capacity marking the 11th straight quarter of

expansion. Investment by non-manufacturers rose 14%,

marking the sixth straight quarterly increase.

However, a study by the Cabinet Office shows Japanese

companies, mainly the small and medium companies, are

using some of the oldest equipment among Group of

Seven economies and indicated this needs to be addressed

if productivity is to improve. Japan was ranked 30th in

labour productivity among the 38 Organization for

Economic Cooperation Development members in a 2022

survey.

See:https://www.japantimes.co.jp/business/2024/01/08/japan-labor-productivity-ranking/

and

https://asia.nikkei.com/Business/Business-trends/Japanese-companies-stuck-with-second-oldest-equipment-in-G7

Another home builder eyes the US market

Japanese homebuilder Daiwa House Industry Group is

looking to launch a business in the US to make

prefabricated panels for residential homes. The company

believes building a factory in the country can lead to lower

construction costs over the medium to long term. This

approach to market diversification is different from that of

the Sekisui House approach which is to acquire US

companies as a way to penetrate the US market.

See:

https://asia.nikkei.com/Business/Construction/U.S.-housing-market-becomes-battleground-for-rival-Japan-homebuilders

Shift in Bank of Japan rate policy expected this

month

When the Bank of Japan (BoJ) will begin exiting its policy

of negative interest rates which was introduced to lift the

country out of deflation is now hotly debated with most

analysts expecting a change this year. For the first time in

a month the yen strengthened to 147 against the US dollar

in early March as a wave of yen buying was sparked by

comments from a BoJ official.

See:

https://www.reuters.com/markets/asia/boj-leaning-toward-exiting-negative-rates-march-sources-2024-03-08/

Forestry and timber industries in need of foreign

workers

It appears a decision will be made soon by the government

to sharply increase the number of foreign nationals it

accepts under its Skilled Worker Visa scheme. This

change in policy is in response to the acute labour shortage

in the country. The domestic media reports that the

government is considering adding the road transportation,

railways, forestry and timber industries to those within

scope for the skilled worker visa system.

See:

https://asia.nikkei.com/Spotlight/Japan-immigration/Japan-to-double-cap-on-skilled-foreign-workers-from-fiscal-2024

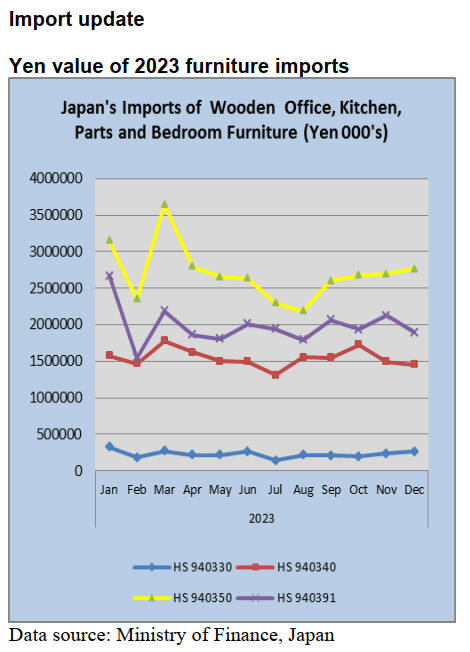

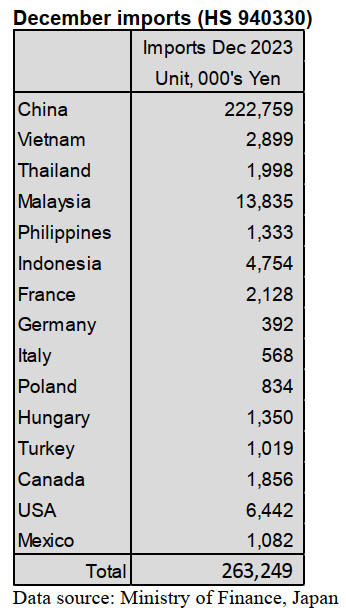

December wooden office furniture imports (HS

940330)

In December last year shipments of wooden office

furniture from China accounted for over 80% of all

imports of HS940330 marking a sharp jump in the value

of shipments compared to a month earlier.

Malaysia was the second largest shipper of wooden

office

furniture in December and accounted for around 5% of

arrivals in Japan. The other significant shipper in

December was the US at around 3% of the total value of

arrivals but this was down slightly compared to

November.

Year on year, the value of December 2023 imports of

wooden office furniture was down 15%, however,

compared to November 2023 there was a 10% increase in

the value of imports.

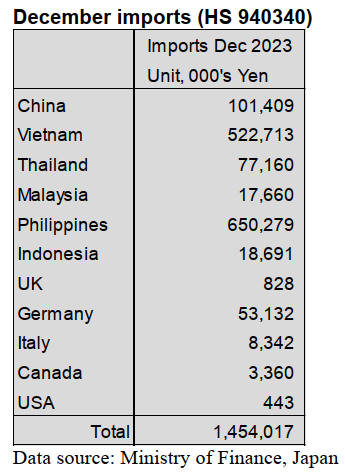

December kitchen furniture imports (HS 940340)

Shippers of wooden kitchen furniture in just two countries

accounted for over 80% of the value of Japan’s imports of

wooden kitchen furniture; the Philippines (45%) and

Vietnam (36%). Shippers in China contributed a further

7% and there was a slight rise in shipments from Germany

to account for a further 4% of total arrivals.

The value of imports of HS940340 in December 2023 was

unchanged when compared to a year earlier and also

largely unchanged when compared to a month earlier.

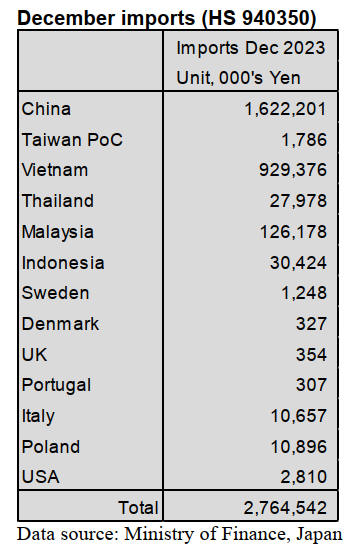

December wooden bedroom furniture imports (HS

940350)

Beginning September 2023 there was a recovery in the

value of wooden bedroom furniture imports to Japan. The

upward trend continued through October and November

but the up-swing slowed in December when month on

month the value of imports was almost unchanged.

However, Compared to a year earlier, December 2023

imports were up around 3%.

Shippers in Vietnam do well in Japan with shipments of

HS940340 and HS940350. In December shippers in

Vietnam accounted for around 35% of the value of imports

to Japan of HS940350 but, as in previous months, the top

shipper was China with close to 60% of the total value of

December arrivals. Other major shipments were from

Malaysia at 3-4%, Thailand, Indonesia as well as small

amounts from Italy and Poland.

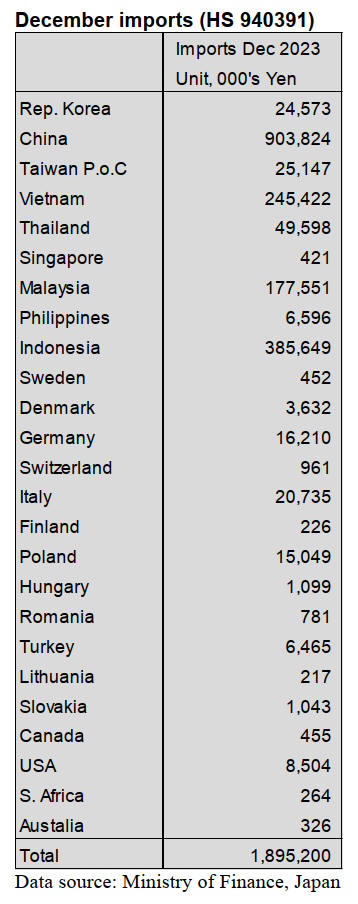

December wooden furniture parts imports (HS

940391)

Japan’s imports of of wooden furniture parts are very

diverse, much more so than with imports of assembled

furniture. In December shippers in China topped the list of

shippers in terms of the value of exports of wooden

furniture parts to Japan, accounting for just over 45% of

the total December import value. China was followed by

Indonesia, shipping 20% of December imports, Vietnam

(13%) and Malaysia (9%).

All four top shippers witnessed a decline in the value of

December shipments and for the month there was an

overall 11% decline in the value of imports. There was

also a 13% decline in year on year imports in December.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

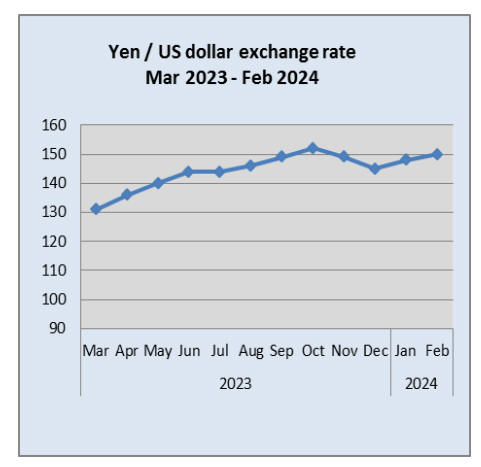

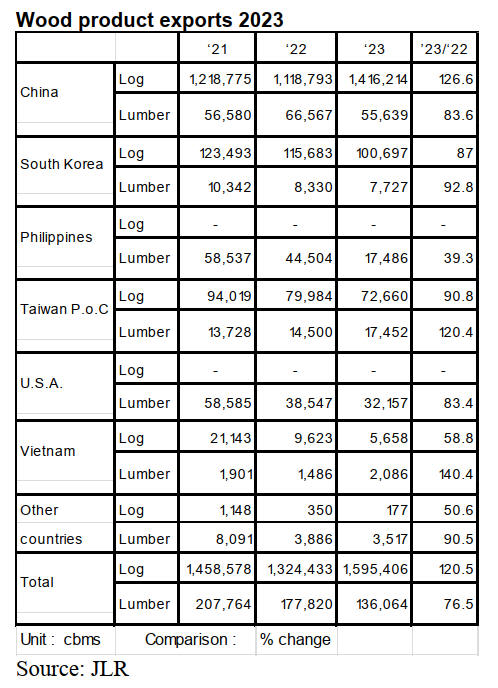

Wood export in 2023

Lumber export in 2023 is 135,064 cbms, 23.5 % less than

2022. This is straight two years decreasing. On the other

hand, log export in 2023 is 1,595,406 cbms, 20.5 % more

than last year. This is for the first time in two years to rise

and this is the first time to exceed 1,500,000 cbms ever.

There is a huge influence of sluggish demand for lumber

in the world. The weak yen does not make a good result

for exporting lumber. Many logs are exported to China.

Total wood exports were 50.4 billion yen, 4.2 % down

from the previous year. This is for the first time in four

years to decline but this is straight two years exceeding 50

billion yen.

Log export to China is 1,416,214 cbms, 26.6 % up

from

2022. This result exceeds the result in 2021, which was

1,218,775 cbms and was the highest record at that time.

The yen was 130 yen against the dollar at the

beginning of

2023 and the yen continued depreciating through the year.

The yen depreciated to 150 yen against the dollar in

November, 2023. The freight for a bulk ship to China was

$45,000 – 50,000. The cost of collecting cedar logs had

been 10,000 – 10,500 yen, delivered per cbm through the

year. The selling price of cedar log at the beginning of

2023 was $115, C&F per cbm and the selling price

declined to $110, C&F per cbm in the middle of the year.

However, other cost also declined and Japanese exporters’

motivation to export logs did not decline. Exporting logs

to South Korea, Taiwan and Vietnam decline in 2023.

Lumber export to the U.S.A. in 2023 is 32,157 cbms, 16.6

% down from 2022.

This is straight two years falling. This is 45.1 % down

from 2021, when the lumber export was 58,537 cbms. A

lot of backboards and scraps of precutting lumber are

exported to China. The unit price of exporting cedar

lumber is 20,000 yen, FOB per cbm.

Domestic logs and lumber

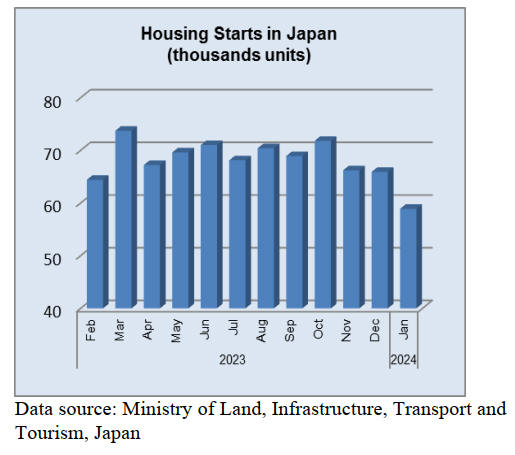

Demand for domestic lumber has been very sluggish

through the nation. Therefore, the price of structural

lumber plunged in February, 2024.

3 m x 105 mm KD cedar post in Kanto region is around

57,000 yen, delivered per cbm and this is around 3,000

yen lower than the previous month. In the northern part of

Kanto region, it is 60,000 yen.

The movement of 4 m x 105 mm KD cypress sill is

still

slow and the price is 77,000 – 80,000 yen. This is 5,000

yen lower than last month.

The price of KD whitewood stud is around 70,000 –

75,000 yen, delivered per cbm and the price will rise in the

future. 3 m x 30 x 105 mm KD cedar stud is around

60,000 yen, delivered.

The price of domestic log has been no changed because

the lumber market is dull and there are not enough logs

due to snowfall or rainfall. Cedar log for posts is 16,000

yen, delivered per cbm in the northern part of Kanto

region. It is 15,500 yen, delivered per cbm in Kyushu

region.

The price of cypress log for post in Tokai region is 22,000

yen, delivered per cbm and it is 17,000 yen, delivered per

cbm in the northern part of Kanto region. Cedar log is

1,000 – 2,000 yen lower than the previous year and

cypress log is 1,000 – 3,000 yen lower than the previous

year.

The price of cedar log plunged in the northern part of

Kanto region last spring so log companies are very

cautious for the plummet this year.

Plywood

Movement of domestic softwood plywood has been

sluggish since the end of January, 2024. Domestic

plywood manufacturers keep reducing production but

demand and supply for softwood plywood are lower than.

production in February. Some reasons are a decrease in the

new starts, a decrease in orders to precutting plants and a

decrease in demand and supply in distribution business.

12 mm 3 x 6 structural softwood plywood is around 1,350

yen, delivered per sheet, in the Greater Tokyo

Metropolitan area. This is around 100 yen lower than

January and February. However, the price of 12 3 x 6

structural softwood plywood in Kyushu region and

Hokkaido Prefecture is higher than other areas.

Since the log price and the distribution cost have been

increasing, a sense of urgency in the plywood business has

increased because the price has been falling.

Also, movement of South Sea plywood has been sluggish.

There is not tight supply so far even though the arrival

volume of South Sea plywood has been decreasing since

last year.

The price of South Sea plywood is unchanged from the

previous month. 2.5 mm plywood is 780 yen, delivered

per sheet. 4 mm plywood is 1,000 yen, delivered per sheet.

5.5 mm plywood is 1,200 yen, delivered per sheet. 12 mm

3 x 6 painted plywood for concrete form is 1,990 – 2,000

yen, delivered per sheet. Structural plywood is 1,800 yen,

delivered per sheet.

Shippers in Malaysia and Indonesia still expect to raise the

price but Japanese buyers hesitate to purchase a lot of

South Sea plywood so the price of South Sea plywood is

unchanged.

2.4 mm 3 x 6 is around $950, C&F per cbm. 3.7 mm is

US$880, C&F per cbm. 5.2 mm is US$850, C&F per cbm.

12

3 x 6 painted plywood for concrete form is $670 – 680,

C&F per cbm. Form plywood is around US$580, C&F per

cbm. Structural plywood is US$560– 570, C&F per cbm.

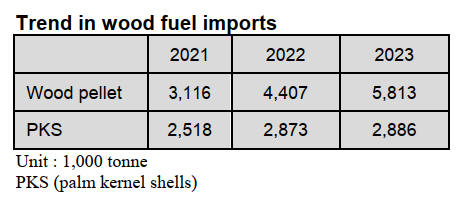

Imported wood fuel in 2023

Import of wood pellet and PKS both increased in 2023.

Total volume of wood pellet and PKS is 8,600,000 tonnes.

Wood pellet import in 2023 is 5,810,000 tonnes, 31.9 %

more than 2022. Vietnamese wood pellet is 2,610,000

tonnes, 9.1 % up from the previous year.

Canadian wood pellet is 1,580,000 tonnes, 16.5 % more

than last year. American wood pellet is 1,260,000 tonnes,

316.8 % up. However, Australian wood pellet is 49,000

tonnes, 16.7 % less than 2022.

The reason for the increase is that many huge wooden

biomass power plants have been established last year. PKS

import in 2023 is 2,880,000 tonnes, 0.4 % up from 2022.

Indonesian PKS is 2,240,000 tonnes a 1.5 % increase from

last year. Malaysian PKS is 631,000 tonnes, 4.5 % down

from the previous year.

|