|

1.

CENTRAL AND WEST AFRICA

Approval of Operation Plans for some operators

delayed

Observers in Gabon report the forestry sector is facing a

significant setback after suspension of their ‘Plan

d'Amenagement des Operations’ (PAO). This suspension

affected numerous companies whose operations were

stalled due to the expiration of their PAO validity.

In response to this suspension operators sought an

extension to their PAO up until the end of the year and

agreement was reached with some operators. Operators

that did not receive extensions had to cease operations and

this led to worker lay-offs.

Harvesting conditions

In Gabon harvesting conditions remain challenging as the

rains arrived earlier than expected leading to some

disruption of forest operations. During the dry period until

June mills had log low stocks but operations are back in

full swing preparing for the upcoming rainy season to

ensure orders can be met.

In Cameroon the dry season extends to allowing forest

operations to run without delays.

In the Congo the dry season continues in the north and

harvesting activity is picking up due, in part, to renewed

demand in China for okoume. It is reported that demand

for ovangkol is not strong at present but species such as

padouk, bilinga, movingui and sapelli are sought after.

Demand in China stirs but Middle East markets quiet

Buyers for the Chinese market are showing interest in a

variety of species. However, the Middle East market

remains slow. After a quiet period buyers in the

Philippines have returned to buying sawn okoume.

Producers in Gabon report enquiry levels remain stable for

the European market but that there has been a decline in

enquiries for some species in Middle East markets. The

slowing of demand in the Middle East has also been

reported by producers in Cameroon, however, there has

been more activity in the Chinese market.

Correction

In our late February Report it was stated that a large part of a

concession held by Olam has been reclaimed by the government.

This has been refuted by an Olam staffer who emailed saying

“Olam does not hold, and has never had, any timber concessions

in Gabon nor is it a supplier to the Special Economic Zone.

Through the eyes of industry

The latest GTI report lists the challenges identified by the private

sector in the Republic of Congo and Gabon.

See:

https://www.itto-ggsc.org/static/upload/file/20240223/1708653799120615.pdf

2.

GHANA

Industries lament introduction of new taxes

Industrial enterprises are complaining about the impact

numerous taxes are having on their businesses and called

on the government to reassess the tax regime. Pressure is

mounting on the newly appointed Minister of Finance, Dr.

Mohammed Amin-Adam, as industrialists demand the

removal of, what they describe as, ‘nuisance taxes’ from

the country’s tax regime.

The industry anticipates that the mid-year budget review,

expected to be laid before Parliament in the next few

months can create an opportunity to remove some taxes

such as the Electronic Levy (E-Levy) and the Emission tax

among others. The industry also mentioned the numerous

port charges which are also eating deeply into their

finances making it difficult to compete and fully benefit

from the African Continental Free Trade Area (AfCTA).

The Trades Union Congress (TUC) and other

organisations have urged the suspension of the new

Electricity and Emission taxes and some economists have

advised the government to reconsider the introduction of

the 15% VAT. They also said for businesses and

individuals, yet to recover from the economic challenges

in 2022 and 2023, the introduction of these new taxes

would further worsen their plight.

In a letter from the Ministry of Finance to the Ghana

Revenue Authourity (GRA) earlier this year the Ministry

explained that the new measures were part of the

government's medium-term revenue strategy and the

International Monetary Fund (IMF) supported post Covid-

19 programme for economic growth.

See:

https://citinewsroom.com/2023/04/tuc-fears-of-more-layoffs-tough-times-over-3-new-taxes/

Power tariffs for industry lowered

The Public Utilities Regulatory Commission (PURC) has

adopted adjustments to electricity tariffs aimed at

providing relief to companies and consumers declaring a

6.5% reduction in electricity tariffs for residential users

and a nearly 5% reduction in the industry tariff band.

See:

https://www.purc.com.gh/attachment/829688-20240228090210.pdf

MoU to promote industrialisation

The Association of Ghana Industries (AGI) and the Ghana

Commodity Exchange (GCX) have committed to

bolstering the industrial and agriculture sectors through a

strategic MoU. The Agreement is aimed at injecting

liquidity into commodity markets, strengthening price

discovery mechanisms and fostering a more robust trading

environment for designated products. The MoU also aims

to improve existing value chains by linking production to

high value markets.

See:https://gna.org.gh/2024/03/agi-ghana-commodity-exchange-sign-mou-to-support-agriculture-sector/

Protection of country’s forest mentioned in State of the

Nation Address

In his State of the Nation Address the President of Ghana,

H.E Nana Addo Dankwa Akufo-Addo, said government’s

strategic efforts over the years on forest sustainability led

to the recultivation of 690,000 hectares of degraded forest

between 2017 and 2022 under the Ghana Forest Plantation

Strategy.

In his Statement, the President emphasised that Ghana

would do everything possible to continue to work to

ensure the protection of the country’s forest and wildlife

resources.

In related news, the Ghana Forest Plantation Technical

Steering Committee (GFPTSC) has presented a revised

version of the Ghana Forest Plantation Strategy (GFPS) to

the Forestry Commission after an evaluation that was in

accordance with the Monitoring and Evaluation

Framework of the GFPS which prescribes periodic review

of the strategy document to ensure its alignment with

changing conditions and priorities.

See:

https://www.modernghana.com/news/1295633/42-million-trees-planted-over-the-past-three-years.html

and

https://fcghana.org/gfptsc-technical-steering-committee-submits-revised-gfps/.

Renewable energy use in schools

The Attorney-General and Minister of Justice, Godfred

Yeboah Dame, has advocated the promotion of renewable

energy use in schools. He said, this would ensure regular

supply of electricity and also avoid situations where the

power supply to some institutions was cut for non-

payment of electricity bills.

Mr. Dame pointed out that the UN Climate Change Action

Policy had estimated that the share of renewable and solar

energy use in the global power supply system would more

than triple by 2050. He called on educational institutions

to consider an energy mix for every senior high school.

See:

https://www.graphic.com.gh/news/general-news/ghana-news-attorney-general-advocates-renewable-energy-use-in-schools.html

3. MALAYSIA

MIFF 2024

The wood products industry is expected to recover this

year following improved growth projections for the US

economy, the main market for Malaysia’s furniture

exports.

Johari Ghani, the Minister for Plantation and Commodities

said the industry’s performance has declined over the past

two years but the government is committed to supporting

its sustainability and growth. “For 2024, we are quite

confident that furniture exports will rebound to their

former strength,” he said after opening the Malaysia

International Furniture Fair (MIFF) 2024 held in Kuala

Lumpur.

In his address the Minister said the timber and furniture

industry was not insulated from the effects of global

headwinds which resulted in exports of wood products

falling by 13% in 2022 and 18% last year. This was

largely due to a weakening in housing demand in the US,

the biggest buyer of Malaysian furniture, accounting for

over half of furniture exports.

The Malaysian furniture industry is largely export-

oriented, with 44% of exports being shipped to 186

countries over the past five years. Johari said the

government has spent almost RM 1 billion for the Forest

Plantation Development Programme and provided soft

loans to 88 companies for replanting projects.

The Malaysian International Furniture Fair (MIFF), one of

the main furniture trade show in South-East Asia, had a

record number of 714 exhibitors from 15 countries. The

four-day event, from 1 - 4 March, was held in the

Malaysia International Trade and Exhibition Centre. The

Fair is expected to bring in US$1.3 bil. in sales.

See:

https://www.freemalaysiatoday.com/category/nation/2024/03/01/timber-industry-likely-to-recover-with-us-economy-rebound-says-johari/

International Conference in Sarawak

Sarawak Timber Association with partners WWF

Malaysia and the Sarawak Forestry Department organised

a conference entitled “Preserving Tropical Forests through

sustainable management”. The conference was supported

by ITTO.

See:

https://www.itto.int/news/2024/03/06/forestry_offers_pathway_for_sustainable_future_says_executive_director_at_conference/).

The following highlights two presentations:

Sarawak has reduced its timber harvesting operations to

approximately two million cubic metres per year to

balance the need for environmental conservation and

economic considerations, said Hamden Mohammad the

Sarawak Forest Department Director. He added that

requirements on forest management certification apply to

both natural and planted forests.

“We currently have 25 certified natural forests covering

over 2.2 million hectares as well as seven certified forest

plantations covering approximately 97,000 hectares” he

told participants at the opening ceremony of the

Conference.

He added “the Sarawak government strongly believes that

the economically viable, environmentally sound and

socially acceptable responsible forestry practices are

important to show the government’s commitment to

maintain and enhance the best management practices. He

pointed out that Sarawak’s forest policy has undergone

substantial reform with increased importance on

environmental protection and the sustainable management

of forest resources.

On a related subject, Hamden said Sarawak Forest

Departmrnt partnered with the Sarawak Timber

Association (STA) to develop seven handbooks on

Reduced Impact Logging (RIL) aimed at aiding ground

personnel in effectively implementing RIL practices. The

guidelines mark a significant stride towards standardising

timber harvesting practices and enhancing regulation

within Sarawak’s timber industry.

Meanwhile, the Sarawak Timber Association is appealing

to the authorities and policymakers to give full and

continuous support to timber industry players who have

made great sacrifices to ensure that their forest

management units are certified.

STA chairman, Henry Lau, said this can be accomplished

through the provision of transparent, consistent,

sustainable and stable longterm policies, particularly those

concerning government regulations and taxes, licensing as

well as a sustainable long-term tenure.

See:

http://theborneopost.pressreader.com/article/281496461243637

Sabah’s carbon trade deal challenged

The controversial Nature Conservation Agreement (NCA)

involving a two-million-hectare of State forest reserve for

carbon credit trading cannot move forward as it has been

deemed legally flawed.

The legal advisor to Sabah Government, Ahmad Fuad,

said the Agreement does not conform with the Sabah

Biodiversity Enactment 2000 which required all

exploitation of biological resources to be first approved by

the Director of the Biodiversity Institute and the

Biodiversity Council.

The Agreement, signed in 2021 with Singapore-based

Hoch Standard Pvt Limited, fails to take into account the

legal requirements that are needed to be obtained from the

two bodies that oversee all conservation and sustainable

use of natural capital, said Fuad.

Furthermore, he said, an approved "benefit sharing

agreement" with local people must be in place to guarantee

that the native communities benefit. It is claimed the

Agreement fails to provide guarantees to natives and

community rights.

See:

https://www.thestar.com.my/news/nation/2024/02/28/sabah039s-carbon-trade-deal-bogged-down-with-legal-flaws-says-lawyer

Ringgit recovers after steep decline

The Malaysian ringgit has recently drifted down to levels

against the US dollar not seen since the depths of the

Asian financial crisis around 25 years ago.

The ringgit hit a 26-year low of 4.8 to the dollar in late

February which prompted a Ministry of Finance official to

say Bank Negara Malaysia is prepared to defend the

ringgit. By mid-March the ringgit had recovered to 4.68

against the dollar.

4.

INDONESIA

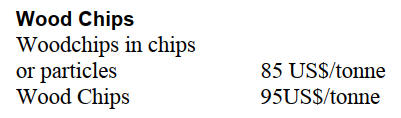

Benchmark export prices (HPE) March 2024

The following is a list of Wood HPE for 1 -31 March

2024.

Processed Wood

Processed wood products which are leveled on all four

sides so that the surface becomes even and smooth with

the provisions of a cross-sectional area of 1000 mm2 to

4000 mm2 (ex 4407.11.00 to ex 4407.99.90)

Processed wood products which are leveled on all four

sides so that the surface becomes even and smooth with

the provisions of a cross-sectional area of 4000 mm2 to

10000 mm2 (ex 4407.11.00 to ex 4407.99.90)

Processed wood products which are leveled on all

four

sides so that the surface becomes even and smooth with

the provisions of a cross-sectional area of 10,000 mm2 to

15,000 mm2 (ex 4407.11.00 to ex 4407.99.90)

See:https://jdih.kemendag.go.id/pdf/Regulasi/2024/198_Kepmendag%20HPE%20dan%20HR%20Produk%20Pertanian%20dan%20Kehutanan%20Maret%202024%20+%20Lampiran-.pdf

Ministry publishes EU market entry update

Didi Sumedi, Director General of National Export

Development introduced an update on "EU Market Entry

Requirements for Wood Sector" at an event attended by

more than 60 Indonesian timber businesses, business

associations and representatives from related

ministries/institutions.

Didi stressed the importance of staying updated on export

market regulations as they constantly change. He

emphasised all stakeholders must work together to

anticipate these changes to boost the export performance

of Indonesian wood products.

The event was a collaboration between the Directorate

General of National Export Development under the

Ministry of Trade and the Swiss Import Promotion

Programme (SIPPO).

The objective was to inform on the regulations governing

wood products in the European Union thereby promoting

the acceptance of Indonesian wood products. Over the past

five years SIPPO has worked with the Directorate General

of National Export Development to enhance the

capabilities of businesses in the Indonesian forest sector

through programmes, workshops and export market

promotion strategies.

See:

https://www.kemendag.go.id/berita/foto/kemendag-gelar-pembaruan-eu-market-entry-requirements-for-wood-sector

In related news, the HIMKI chairperson, Abdul Sobur,

said that the impact of the European Union Deforestation-

Free Regulation (EUDR) could reduce the value of

Indonesian furniture exports to the EU. He said that the

EUDR would pose a challenge to the entry of processed

wood products from Indonesia into the European market

due to strict raw material requirements. Europe, he said,

accounts for a large share of Indonesian furniture exports

at around 28%.

Sobur stated that the EUDR procedure, which involves

due diligence for product traceability, makes it challenging

for Indonesian furniture exporters to continue to ship to

the EU. He added “HIMKI has over 2,000 members but

not all can meet EUDR requirements”. He stressed that

HIMKI is assisting furniture entrepreneurs understand the

EU import regulations and urged the government to help

companies prepare for the impact of EUDR.

See:

https://mediaindonesia.com/ekonomi/656110/eudr-ancam-pukul-ekspor-mebel-dan-furnitur-ri-ke-eropa

Investors invited to revitalise wood processing

Indonesia is welcoming Chinese investors to support the

revitalisation of wood processing in the industry. Acting

Director General of Sustainable Forest Management at the

Ministry of Environment and Forestry, Agus Justianto,

stated that the revitalisation of industrial machinery will

added further value to forest products. This was

announced during an audience with the Indonesian

Furniture and Craft Industry Association (HIMKI) and the

China National Machinery Association (CNFMA) at the

Indonesia International Furniture Expo (IFEX) 2024.

According to data from the Ministry of Environment and

Forestry, sawmill and woodworking industries are

comprised of 3,485 units, including 391 large-scale units

(with a capacity of more than 6,000 cu.m/year) and 3,094

small and medium-scale units (with a capacity of less than

6,000 cu.m/year).

The total installed capacity of sawmill and woodworking

industries was said to be 9.5 million cu.m/year for large-

scale operations and 10.5 million cu.m/year for small and

medium-scale operations.

Agus mentioned that the industry’s capacity utilisation rate

is currently very low mainly due to the lingering effects of

the Covid-19 pandemic and aging machinery. According

to Agus, investor support, including that from China, is

crucial for revitalising wood processing by introducing the

latest technologies in processing. Further efforts are

needed to secure financial support for implementing of

machinery upgrading.

See:

https://agroindonesia.co.id/revitalisasi-mesin-industri-kayu-indonesia-undang-investor-china/

ASMINDO - Indonesia can be a hub for furniture

development

The chairman of the Indonesian Furniture Industry and

Handicraft Association (ASMINDO), Dedy Rochimat,

said Indonesia has the potential to become a global hub for

furniture development and production.

Indonesia boasts abundant natural resources, particularly

in terms of sustainable raw materials, a rich culture,

unique locally inspired furniture designs and is supported

by the world’s fourth-largest population. "This potential

needs to be developed in synergy with all domestic

stakeholders and through mutually beneficial international

collaboration", he said.

He added that Indonesia is the world’s largest producer of

rattan and ranks as one of the top three countries in

bamboo resources.” He emphasised the necessity of

promptly utilising and developing these potentials to

positively contribute to the furniture industry’s role in

generating foreign exchange and improving social welfare.

Rochimat said the demand for eco-friendly furniture is

estimated to have reached 8.6% of the overall market and

that demand for eco-friendly furniture presents a

significant opportunity that must be collectively addressed

by establishing research and production centres for eco-

friendly furniture.

In a bid to promote eco-friendly practices, Asian furniture

manufacturers have initiated efforts to encourage the

utilisation of bamboo as a substitute for plastic. This

initiative aligns with the increasing trend towards

environmentally friendly furniture products. The

utilisation of bamboo was among the key topics discussed

at the 25th Annual General Meeting of the Council of

Asian Furniture Associations (CAFA).

The meeting took place in Tangerang in February and was

attended by 32 delegations from CAFA member countries.

The Association of Indonesian Furniture and Handicraft

Industries (ASMINDO) hosted the meeting.

See:

https://katadata.co.id/berita/industri/65deb9b716ab5/asmindo-dorong-indonesia-jadi-pusat-pengembangan-furnitur-dunia

and

https://forestinsights.id/asian-furniture-manufacturers-launch-initiative-to-utilize-bamboo-as-substitute-for-plastic/

IFEX 2024 - record level of business transactions

Indonesian furniture and handicraft products are

increasingly in demand in the international market. These

products were introduced at the Indonesia International

Furniture Expo (IFEX). During the four day exhibition

direct transactions or on the spot sales were recorded at

US$300 million.

In this year's IFEX there were buyers from 117 countries

with most coming from Europe, Australia, China and the

United States, as well as from countries such as India,

Bahrain, Oman and the United Arab Emirates. The IFEX

Project Manager, Rizki Pahrudi, explained that the number

of international buyers at this years’ show was double that

during the previous show.

See:

https://www.liputan6.com/bisnis/read/5542275/pameran-furniture-ifex-2024-kantongi-transaksi-usd-300-juta

Indonesia should showcase GHG emissions reduction

effort - Minister

Environment and Forestry Minister, Siti Nurbaya,

underscored the need for Indonesia to continue to

demonstrate, at the global level, its significant

performance in reducing greenhouse gas (GHG) emissions

supported by international assistance.

The Minister revealed that Indonesia had received support

from various international communities to achieve climate

targets, including collaboration with Norway for funding

based on performance in lowering GHG emissions from

reducing deforestation and forest degradation.

The Minister remarked that the first funding from Norway

was used to support five activities in the forestry and other

land use sector (FOLU) namely sustainable forest

management, increasing carbon reserves, conservation,

peat and mangrove management and information

disemination. "

In a related development the Minister indicated that the

Ministry was considering schemes to involve business

actors in supporting funding for reducing greenhouse gas

emissions and achieving the country's climate targets.

She said "the carbon business is not just about carbon

trading but also about raising the reputation of a

company." She remarked that companies looking to

improve their reputation can be involved in the efforts to

reduce emissions with the results contributed as an effort

to achieve climate targets.

In a statement during the Workshop on ‘Result Based

Contribution of Indonesia's FOLU Net Sink 2030’ the

Minister reported that Indonesia's efforts to suppress the

amount of greenhouse gas emissions generated have

resulted in a decrease of 875.7 million tonnes of carbon

dioxide equivalent based on data in 2022 .

See:

https://en.antaranews.com/news/306690/indonesia-should-showcase-ghg-emissions-reduction-effort-minister

and

https://en.antaranews.com/news/306747/indonesia-considers-involvement-of-business-actors-in-climate-funding

and

https://en.antaranews.com/news/306723/indonesia-managed-to-reduce-8757-million-tons-of-co2e

Papuan indigenous people's role in forest preservation

The Ministry of Environment and Forestry (KLHK),

through the Papua Ecoregion Development Control Center

(P3E), commended the role of Papuan indigenous people

in preserving forests and the environment. The head of

P3E in the Ministry, Edward Sembiring, said “local

wisdom maintained by indigenous people has long been in

line with the principles of conservation”.

He added that indigenous communities have a crucial role

to play in protecting the environment and ecosystems from

excessive exploitation. He explained that the success of

the work plan to reduce greenhouse gas emissions by the

forestry sector through Indonesia's Forestry and Other

Land Use (FOLU) Net Sink 2030 Programme requires the

support of indigenous communities.

See:

https://en.antaranews.com/news/307905/klhk-lauds-papuan-indigenous-peoples-role-in-forest-preservation

Through the eyes of industry

The latest GTI report lists the challenges identified by the private

sector in Indonesia.

See:

https://www.itto-ggsc.org/static/upload/file/20240223/1708653799120615.pdf

5.

MYANMAR

Controversial timber trade persists despite sanctions

In November last year the European Union law

enforcement agency (Europol) seized a small cargo of

Myanmar timber that had been smuggled into the EU

which, the media says, highlights the persistent trade in

Myanmar timber despite the trade sanctions.

Italian government data analysed by Federlegno Arredo

and shared with an affiliate of the International

Consortium of Investigative Journalists (ICIJ) appears to

show, between January and October 2023, Italian

companies imported more Myanmar wood products than

any other European country.

The ICIJ reports an analysis of US customs data which

seems to show that US companies and individuals have

managed to import small volumes of Myanmar teak. In

response to reports of sanction busting imports the US

Justice Department announced the creation of an

interagency task force to strengthen efforts to combat the

illegal trade in timber.

According to the Myanmar Ministry of Commerce,

Myanmar exported US$235.6 million worth of timber

from October 2021 to mid-2023.

See:

https://www.icij.org/investigations/deforestation-inc/myanmars-controversial-timber-trade-persists-despite-western-sanctions/

and

https://www.icij.org/investigations/deforestation-inc/myanmar-teak-trade-sanctions-military-regime/

and

https://www.icij.org/investigations/deforestation-inc/new-justice-department-led-task-force-pledges-global-crackdown-on-illegal-timber-trade/

Military conscription activated

The Myanmar Government spokesman, Zaw Min Tun, has

said at least 13 million people will be liable to be

conscripted out of the country’s population of 55

million. He said the first intake will be in mid-April after

Myanmar's New Year holiday ‘Thingyan’.

In late February it appears a decision was taken to exclude

women from the military call-up. The media reports the

military aims to recruit 60,000 soldiers in a year. Evading

conscription will be punishable by up to five years in jail

and a fine.

In related news, Malaysia’s Deputy Foreign Minister,

Datuk Mohamad Alamin and Assistant Secretary-General

of the United Nations (UN) Khaled Khiari discussed

collaboration in peacekeeping operations in Myanmar.

Implementing the ASEAN Five-Point Consensus proposal

on Myanmar is facing serious challenge.

In other news, as a result of the military call-up in

Myanmar there is an exodus of young people from

Myanmar to Thailand. The Thai government, in

collaboration with NGOs and international partners, is

working to establish support systems for these refugees.

See: See:

https://www.reuters.com/world/asia-pacific/myanmar-juntas-conscription-plan-lays-bare-toll-fighting-rebels-2024-02-16/

and

https://www.bernama.com/en/world/news.php?id=2278300

6.

INDIA

Mandatory Quality Control

Order on wood panels

postponed

In a news flash Plyreporter says the Quality Control Order

(QCO) for mandatory Bureau of Indian Standards (BIS)

on MDF, particleboard and blockboard has been

postponed for a year. The new date of implementation is

11 February 2025 according to a Ministry of Commerce

notification dated 12 March. The wood based panel QCO

will be effective for small and micro industries from 11

May 2025 and 11 August 2025 respectively.

See:

https://www.plyreporter.com/article/153814/implementation-of-mandatory-qco-on-plywood-shuttering-ply-wooden-doors-postponed

Indiawood 2024 participants see bright prospects in

India

Indiawood 2024, the woodworking machinery show, was

held in February in Bengaluru and the ITTO

correspondent attended and participated in the Global

Summit. He reported there were many foreign exhibitors

as well as domestic companies participating in the show

and “overall the vibe from participants was positive”.

He commented, “one thing that is on everyone’s mind was

that next 10 years is set to be a boom time for the Indian

economy and there will be major investment in

infrastructure and in the manufacturing sector.

However, concerns were raised by local manufacturers

who depend on imported raw materials such as decorative

plywood and laminated boards imports of which are going

to face severe issues in meeting the new Standards”.

Focus on capital spending in recent budgets

The Indian economy performed well during 2023 and the

National Statistical Office has estimated that GDP would

be 7.3% during fiscal 2023–24. This is higher than the

IMF’s December 2023 projected growth of 6.3%.

To drive growth the government has focused on capital

spending in recent budgets and supported State

governments to do the same. However, Biswajit Dharfrom

the Council for Social Development suggests the private

sector’s response to the government’s investment push has

less than anticipated. Dharfrom says private investment

has been declining and foreign investors reduced their

participation in India.

The tepid response from private investors is concerning as

the government will be unable to sustain high levels of

capital spending while also addressing development

deficits through spending on social sectors and welfare

schemes, says Dharfrom.

GDP estimates show one area of weakness — the

relatively slow growth of agriculture and allied sectors.

These sectors grew by less than 2% in the 2022–23 which

is half of their growth in the previous fiscal year.

Uncertain weather conditions, including uneven

distribution of rainfall, adversely affected the performance

of these sectors.

The National Statistics Office predicted that the

manufacturing sector will expand by 6.5% in 2023–24,

considerably higher than the 1.3% growth in the previous

financial year. It is reported that output in the labour-

intensive industries has declined.

See:

https://eastasiaforum.org/2024/03/02/indias-gdp-growth-masks-economic-challenges/

Market-based mechanism under the Green Credit

Programme

The Green Credit Rules 2023 were notified in October last

year with the objective of creating a market-based

mechanism under the Green Credit Programme (GCP).

Directive on land for tree planations raises concerns

In early March the central government released a directive

for tree planations under the the Green Credit Programme

(GCP). The guidelines require Forest Departments to

identify degraded land including open forests and scrub

land, wasteland and catchment areas under their

administrative control and make these available for tree

planations. Critics of this initiative fear that the directive

appears to bring all forests and forest-like areas available

for the GCP and that the clearing for plantations would

lead to a loss of biodiversity.

See:

https://timesofindia.indiatimes.com/home/sunday-times/all-that-matters/indias-green-credit-rules-might-end-up-creating-green-deserts/articleshow/108168308.cms

and

https://www.eco-business.com/news/india-bets-on-green-credits-but-could-they-reward-deforestation/

7.

VIETNAM

Wood and Wood Product (W&WP) trade highlights

According to Vietnam’s Office of Statistics

W&WP exports to the Japanese market in

February 2024 amounted to US$110 million,

down 33% compared to January 2024 and down

23% compared to February 2023. In the first 2

months of 2024 W&WP exports to Japan earned

US$273 million, up almost 1% over the same

period in 2023.

Vietnam’s W&WP exports to Holland in

February 2024 reached US$15 million lifting the

exports in the first 2 months of 2024 to US$32.6

million, up 120% over the same period in 2023.

Vietnam’s exports of bed and dining room

furniture in February 2024 soared to US$210

million, up 62% compared to February 2023. In

the first 2 months of 2024 exports of these two

categories of furniture earned US$474, up 90%

over the same period in 2023.

Vietnam's office furniture exports in February

2024 brought in about US$24 million, up 18%

compared to February 2023. In the first 2 months

of 2024 office furniture exports totalled US$53

million, up 35% over the same period in 2023.

Vietnam's ash imports in February 2024 were

21,700 cu.m worth US$5.8 million, down 42% in

volume and 41% in value compared to January

2024. However, compared to February 2023 there

was a decrease of 29% in volume and 27% in

value. In the first 2 months of 2024, ash imports

reached at 73,900 cu.m, worth US$19.5 million,

up 32% in volume and 34% in value over the

same period in 2023.

Log and sawnwood imports from the EU to

Vietnam in January 2024 stood at 50,360 cu.m, at

a value of US$15.41 million, down 7.5% in

volume and 12% in value compared to December

2023 but up 38% in volume and 44% in value

compared to January 2023.

Pine imports to Vietnam in February 2024

amounted to 35,200 cu.m, worth US$8.1 million,

down 39% in volume and 39% in value compared

to January 2024. However, compared to February

2023, pine wood imports increased by 16% in

volume and 24% in value. In the first 2 months of

2024 pine wood imports were 115,400 cu.m

worth US$26.4 million, up 92% in volume and

103% in value over the same period in 2023.

Vietnam’s NTFP exports in February 2024 were

valued at US$75 million, down 6% compared to

January 2024, but up 32% over the same period

in 2023. In the first 2 months of 2024,NTFP

exports totalled US$154.75 million, up 51% over

the same period in 2023.

Exports recovering but bottlenecks remain

According to data from the Department of Forestry

(Ministry of Agriculture and Rural Development) in the

first 2 months of 2024, the export value of wood and forest

products is estimated to have reached US$2,68 billion, an

increase of 47% over the same period last year.

The value of imports of wood and wood products in the

first 2 months of this year is estimated at US$355 million,

up 31% over the same period in 2023. The wood product

trade surplus in the first 2 months of the year is estimated

at US$2,465 billion.

Despite the positive trend in exports the timber industry is

facing many challenges. Trieu Van Luc, Deputy Director

of the Forestry Department said the impact of the conflict

between Russia - Ukraine and between Israel and Hamas

and shipping problems in the Red Sea is complex and

unpredictable. In addition, global shows signs of slowing

and consumers continue to tighten spending on non-

essential products including furniture and wood products.

Adding to the challenges of the timber industries is the

need to address the requirements in importing countries to

ensure legality and ensure no forest degradation or

deforestation.

A representative of the timber industry shared experiences

on the difficulties and obstacles in importing wood raw

material, processing and exporting wood products. Do

Xuan Lap, Chairman of Vietnam Wood and Forest

Products Association, said that in the US regulations on

the origin of wood raw material are strict.He said he was

aware the US Department of Commerce is amending a

number of regulations on anti-dumping and anti-subsidy

investigations including ways to identify previously

unrecorded subsidies such as export insurance, debt

cancellation and tax advantages.

For the EU market, the EUDR will come into force this

year said Do Xuan Lap and action is needed as Vietnam's

regulations on determining the origin of wood are

currently not specific. Another issue for the Vietnamese

timber exporters is the descision by India to apply new

Standards and there is insufficient time for manufacturers

to comply.

Integration is a must

In 2024 the timber industry aims for US$15.2 billion in

exports of wood and forest products of which wood

product exports are set to be at US$14.2 billion, an

increase of about 6% compared to 2023. Nguyen Tuan

Thanh, Vice Chairman of Binh Dinh Provincial People's

Committee said that to achieve the set goals the wood

industry still has a lot of work to do. Currently, production

costs are still quite high and there are risks in forest

certification as well as traceability. A solution to raw

material supply needs to be found.

On the business side it is necessary to focus on improving

quality, investing in machinery and equipment and

meeting sustainability requirements. Only then will goods

be welcomed by customers in export markets.

Acknowledging the opinions of authorities, associations

and businesses the Deputy Minister of Agriculture and

Rural Development, Nguyen Quoc Tri, further commented

that the wood industry currently faces many difficulties

and to solve these issues he requested that wood industry

associations and businesses agree on the view that to

improve product value supply chains must be fully

integrated.

He added that, currently, wood processing enterprises do

not have to measure carbon emissions but it is likely they

will be required to do so soon. He asked how to reduce

emissions and bring the highest value? To achieve this he

said enterprises need to proactively link with forest

growers and to integrate. At the same time, businesses

need to promptly provide information about regulations

and share skills to avoid risks.

He emphasized “it is desirable that processing enterprises

promote links with forest growers and forest owners to

develop large timber forests. This not only benefits forest

growers but businesses can also proactively source raw

materials that are legal, certified, and originating."

Nguyen Quoc Tri acknowledged that there are very few

direct exports as most go through intermediaries and as

such the full value is not captued. He urged associations

and businesses to get together to discuss this and find a

solution.

See:

https://www.vietnam.vn/en/nganh-go-hop-ban-thao-go-kho-khan-thuc-day-xuat-khau-nam-2024/

HawaExpo 2024

The 2024 Ho Chi Minh Export Furniture Fair (HawaExpo

2024) opened in HCM City in March with the aim of

highlighting the strengths of Vietnam’s wood and

handicrafts industry to international customers.

For the first time the annual Expo has a “Create Hall”

dedicated to design and creativity in the furniture industry.

Vietnamese businesses accounted for 80% of participants

along with prominent Southeast Asian handicraft brands,

furniture design and innovative technology-based

companies, suppliers and service providers.

The Fair included B2B matching, seminars, factory visits

and other activities. Speaking at the opening ceremony,

Deputy Minister of Industry and Trade Phan Thị Thắng,

said the wood industry has always been one of the

country’s pivotal economic sectors.

“Enterprises in the industry have focused on enhancing

product quality and strengthening brand value to gain a

firm foothold in large markets such as China, the US,

Europe and Japan and expand the presence of the

Vietnamese wood and forest products to 160 countries and

territories.”

Exports of wood and timber products declined for the first

time ever in 2023 but there were positive signs in January

this year with exports topping US$1.49 billion, a sharp

increase year-on-year, Thắng said.

During the opening Nguyễn Quốc Trị said, “to achieve the

export target of US $15 billion this year, a year-on year

increase of 6%, the forestry sector needs to continue its

efforts and implement fundamental solutions in technical

innovation, raw material sourcing and utilisation and

product distribution.

Nguyễn Quốc Khanh, chairman of the Handicraft and

Wood Industry Association of HCM City (HAWA) and

also the Viforest Fair Co., Ltd, set up by five wood

processing industry associations (VIFOREST, HAWA,

BIFA, DOWA, and FPA), the Fair organiser said there

were three missions for the fair from the outset.

“Firstly, the fair prioritises trade promotion and showcases

the wood and handicraft products of Vietnam. Secondly, it

contributes to the industry’s transition from OEM

production to developing uniquely designed products

(ODM) to enhance the value of ‘Made in Vietnam’

products.

“And finally, the relentless innovation and creativity drive

by the HawaExpo to pioneer a professional, modern and

efficient trading event, affirming the true strength and

potential of Vietnam’s wood and handicrafts industry.”

Vietnam and US cooperation in combating illegal

timber trade

Training has started as the work to establish a mechanism

to identify and monitor the origin of wood and expand

export markets. Vietnam has proactively implemented a

host of measures to counter illegal timber trafficking over

the past two years under an agreement with the US on

fostering a more collaborative approach to combatting the

illegal timber trade according to Director of the Forest

Protection Department, Bui Chinh Nghia.

Addressing a training workshop in Hanoi for Vietnamese

government officials on countering illegal timber

trafficking, Mr. Nghia said Vietnam has reviewed

financial incentives for the wood processing sector,

enhanced customs supervision and inspection over

imported timber and boosted cooperation with countries

exporting wood materials to have control on the origin of

wood raw materials.

Various workshops have been arranged and co-organised

by attorneys from the Environment and Natural Resources

Division of the US Department of Justice and the Forest

Protection Department of Vietnam. A March technical

workshop was the first in a series of workshops and

discussions with Vietnam’s forestry, industry and non-

governmental stakeholders held under the US-Vietnam

Agreement to foster a more collaborative approach to

combatting the illegal timber trade.

The agreement with the US was signed in October 2021

with the aim of strengthening control over the origin of

wood products and wood supply chains, expanding export

markets, improving forest management mechanisms and

dealing with illegal wood exploitation and trade.

See:

https://vneconomy.vn/vietnam-us-strengthen-cooperation-in-combating-illegal-timber-trade.htm

8. BRAZIL

New bulletin - Brazilian

forests in 2023

The Brazilian Forest Service (SFB) together with SNIF

(National Forest Information System) has published a

bulletin with data on Brazilian forests in 2023. The topics

covered include secondary forests in natural forest areas,

botanical association in the National Forest Inventory and

forest certification in Brazil's forests.

The first topic deals with the methodology for calculating

and defining forest cover gains using the SFB database

and secondary forests monitoring data made available by

INPE (National Institute for Space Research) in the

TerraClass project. The second topic provides a step-by-

step report of the field survey on analysis and

consolidation of species data. The last topic provides

information on the importance of forest certification in

sustainable management practices.

Brazil, it is claimed, has the greatest biodiversity in the

world (more than 116,000 animal species and more than

46,000 plant species).

As such, the identification of species inventoried in the

field is fundamental to obtaining information on forest

biodiversity to contribute to establishing an efficient and

consistent method on the state and trends of forest

biodiversity on a large scale and the respective habitat

conditions.

The data collected in the latest survey allows for the

analysis, development and use of trend models to identify

the distribution of species and endemism allowing

conservation and management activities to be guided, as

well as responding to international conventions and

commitments.

The survey points to a downward trend in the area of

forests being certified worldwide from 2022 onwards but

in Brazil there no clear trend.

See:

https://www.yumpu.com/pt/document/read/68621636/florestal-259web

;https://snif.florestal.gov.br/images/pdf/publicacoes/Boletim_SNIF_2023.pdf

Evaluation of plywood, sawnwood and moulding

markets

In February this year the Brazilian Association of the

Mechanically Processed Timber Industry (ABIMCI) met

with representatives of the plywood, sawnwood and

mouldings committee to assess current demand in both

domestic and foreign markets and to identify the main

competing countries.

The companies representing the plywood sector also

assessed issues related to stocks in destination countries,

the volume of current production, costs and supply. A

broader analysis of logistical and port issues found that in

January 2024 dispatches were disrupted with numerous

changes to orders which hampered the flow of Brazilian

plywood exports. Logistical problems are also affecting

shipments of sawnwood to Asia, the United States and

Mexico which together account for more than half of

sawnwood exports.

Regarding the mouldings market, a broader and more

detailed assessment was made of the behavior and

dynamics of production by Brazil's main competitor

countries such as Chile, China and the countries of

Southeast Asia along with North American which is a

significant market for mouldings.

See:

https://abilink.abimci.com.br/ev/PRVu6/BM6/ef02/w8KE9Kx7yk/BQyw/

ABIMCI discusses expanding exports of wood

products

ABIMCI and FIEP (Federation of Industries of the State of

Paraná) met with the European Union's Ambassador to

Brazil in February 2024. ABIMCI stressed the good

practices already in place in Brazil's timber and forestry

sector emphasising that millers and manufacturers comply

with environmental standards and regulations required in

importing countries.

Also in February ABIMCI took part in a meeting with the

Mexican association CANAINMA (National Chamber of

the Timber Industry) seeking to bring the organisations

closer together to discuss a possible trade mission for

companies from Mexico to Brazil.

The possibility of holding business rounds between the

two countries was the main topic of the meeting as Mexico

continues to be one of the main importers of wood

products from Brazil. The possible development of a

cooperation agreement between the two organisations was

also part of the meeting's agenda and objectives.

See:

https://abilink.abimci.com.br/ev/PRVu6/BM6/ef02/w8KE9Kx7yk/BQyw/

Mato Grosso forest product traceability

The state of Mato Grosso exports forest products to 61

countries in America, Africa, Asia, Europe and Oceania.

The tropical timber shipped is sourced from sustainably

managed forests and the raw material supply chain is

transparent and traceable.

International buyers of wood products from 46 tree

species

identified and authorised in the State by environmental

agencies generated US$120 million in 2023 according to

foreign trade statistics. The main markets were the United

States (US$19.4 million), India (US$17.8 million), France

(US$13.6 million) and China (US$ 8.6 million).

In January 2024 the international trade in wood products

from natural forest species was worth around US$6

million (India US$1.6 million), China (US$478,000), the

United States (US$1.6 million) and France (US$ 934,200).

CIPEM (Center for Timber Producing and Exporting

Industries of Mato Grosso State) emphasised the

importance of the two main importing countries in Asia. It

also cited the importance of expanding the market for

Brazilain wood products by participation in the Global

Forum on Legal and Sustainable Timber (GLSTF) in

Macau, China which was attended by around 700

stakeholders from the forestry sector in 37 countries.

In the context of Brazilian exporting States, Mato Grosso

ranks 4th. It accounts for 2.3% of Brazil's international

timber sales. In 2023 Mato Grosso's timber industry

shipped around 190,600 tonnes of sawnwood and profiled

timber attesting to the quality of tropical timber from

managed areas.

The annual production capacity of the forest sector in the

State of Mato Grosso is around 7 million cu.m of tropical

timber coming from a total area of 4.7 million hectares

with the capacity to reach 6 million ha. of sustainably

managed forest.

Forest-based activities contribute to sustainable

development through conserving native vegetation,

promoting carbon capture and mitigating the effects of

climate change. In addition, this economic segment

generates direct and indirect jobs, ranking 4th in job

creation among the State's manufacturing industries.

See:

https://cipem.org.br/noticias/mato-grosso-exporta-produtos-florestais-com-rastreabilidade-para-61-paises-em-5-continentes

Through the eyes of industry

The latest GTI report lists the challenges identified by the private

sector in Brazil.

See:

https://www.itto-ggsc.org/static/upload/file/20240223/1708653799120615.pdf

9. PERU

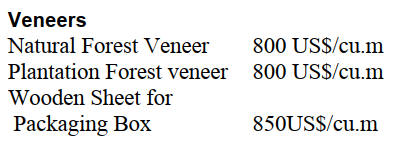

Shipments of veneers

rose in 2023

As reported by the Services Management and Extractive

Industries of the Association of Exporters (ADEX),

exports of veneers and sheets of wood in 2023 were

valued at US$1.6 million, an increase of around 10%

compared to 2022 (US$1.48 million).

Mexico was the main destination accounting for US$1.14

million of the total followed by Ecuador (US$0.28

million) and the Dominican Republic (US$0.21 million)

and there was a year on year increase in the value at plus

76% for Ecuador and 10% for the Dominican Republic. In

addition, small quantities were shipped to Chile but there

were no exports to Australia and the United States as in

previous years.

According to the ADEX Commercial Trade Intelligence

System, 2023 was the third consecutive year of growth in

exports of veneers after the 19% decline in 2020 due to the

effects of the Covid-19 pandemic.

The main items exported were ‘Other veneers or plywood’

(US$1.16 million) including cedar plywood, screwwood

(tornillo, Cedrelinga cateniformis) veneer, ishpingo

plywood, ishpingo veneer and cumala (virola) plywood.

Other shipments (US$0.47 million) included decorative

sheets, ishpingo veneer for the furniture industry, joined

sheets.

Most of the products (US$1 .56 million) were shipped out

from Lima with the balance by land via Junín and Tumbes.

Veneer exports were ranked in eighth place in the ranking

of wood products surpassing only fibreboard and

particleboard.

Earnings from veneer shipments were far below that of

sawn wood (US$42.34 million), semi-manufactured

products (US$34.77 million), construction products

(US$5.55 million), fuelwood and charcoal (US$5.36

million), manufactured goods (US$4.32 million) and

furniture and parts (US$4.11 million).

Women contribute to the country's forestry and wildlife

management

The Forestry and Wildlife Resources Supervision Agency

(OSINFOR) says the forestry sector faces many challenges

but also significant opportunities. “As a woman at the

head of OSINFOR, an entity committed to supervising the

sustainable use of forest and wildlife resources, I consider

it essential to highlight the invaluable contribution of

women in the management and conservation of forest

resources”, said Lucetty Ullilen the Head of OSINFOR.

Ullilen indicated that women's participation not only

enriches the diversity of perspectives in the sector but also

strengthens the collective capacity to efficiently execute

public policies and promote sustainable practices.

“On Women's Day, we celebrate the essential role women

play in building a more sustainable and equitable future

for our communities, forests and people in general

considering current and future generations”, she said.

See:

https://www.gob.pe/institucion/osinfor/noticias/917210-con-fuerza-al-bosque-las-mujeres-contribuyen-en-la-gestion-forestal-y-de-fauna-silvestre-del-pais

APEC 2024 - SERFOR participation

The National Forestry and Wildlife Service (SERFOR)

together with representatives from the Ministry of Foreign

Affairs led Peru's participation at the 25th Meeting of the

APEC Group of Experts on Illegal Logging and

Associated Trade (EGILAT) that took place on February

in Lima as part of the Asia-Pacific Economic Cooperation

Forum (APEC).

Representing Peru, the Executive Director of SERFOR,

Alberto Gonzales Zuñiga, welcomed the experts and

highlighted that the 21 APEC economies have a total of

2,190 million hectares of forests which represents more

than half of the world's forest area and account for a major

share of exports of tropical wood and forest products.

The Head of SERFOR indicated that hosting APEC for the

third time is a great honour for Peru and for the forestry

sector it is very important because it is an opportunity to

highlight the progress made in the management of Peru’s

and forests in APEC countries such as the use of

technology to monitor and trace wood from its origin to

the market.

See:

https://www.gob.pe/institucion/serfor/noticias/913624-apec-2024-serfor-participa-en-grupo-de-expertos-de-21-economias-para-promover-productos-forestales-de-origen-legal

|