Japan

Wood Products Prices

Dollar Exchange Rates of 25th

Feb

2024

Japan Yen 150.49

Reports From Japan

Most

companies ready to raise wages

Most major Japanese companies have agreed to fully meet

their labour union wage demands in this year's spring

wage negotiations to bring relief to workers amid inflation

and retain workers in the tight labour market.

The quick responses were possible partly to strong

corporate earnings, the labour shortage is another factor. A

survey of corporate views on wage trends by a domestic

research group indicated the share of companies that

expect pay to improve was the highest since polling began

in 2006. The most commonly cited reason among these

respondents was securing and retaining workers.

While the momentum for wage increases is picking up

at

large companies the question remains whether the same

will happen among the small and midsize enterprises that

employ around 70% of Japan's workforce.

Japanese businesses as a whole raised pay by 3.6% in last

year's spring wage negotiations but those enterprises with

300 or fewer union members lagged behind at 3.2%

according to the Japanese Trade Union Confederation.

It has been estimated by the government that, to create real

wage growth, it will require wage increases of around 4%

by large companies and in the high 3-4% range in smaller

businesses.

As household struggle with rising costs some full-time

employees in Japan are turning to side jobs to increase

their annual income in response to the effective wage drop

due to price hikes and rising social insurance premiums.

See:

https://asia.nikkei.com/Business/Business-trends/More-Japan-business-leaders-expect-5-wage-hikes-in-2024-poll

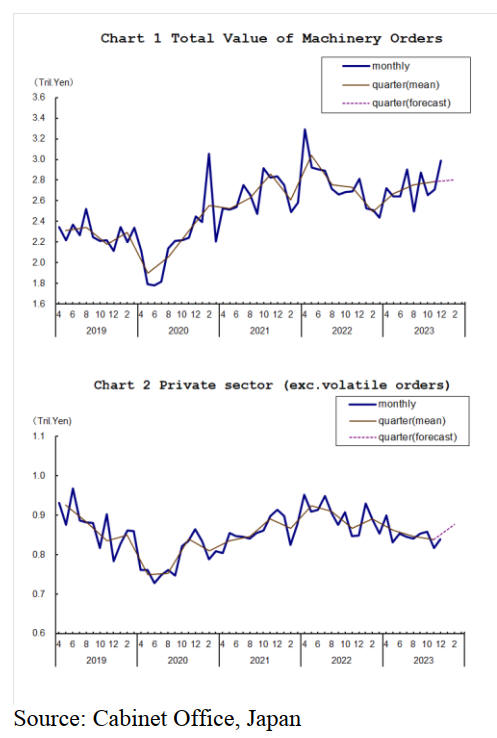

Processing machinery orders on the rise

The total value of machinery orders received by the 280

manufacturers operating in Japan and included in the

survey increased by 10.3% in December from the previous

month. In the third quarter 2023 orders increased by

almost 1% compared with the previous quarter.

In the 2024 January-March period the total value of

machinery orders was forecast to increase by 0.8% and

private-sector orders, excluding volatile ones, were

forecast to rise by 4.6% from the previous quarter.

Economists confident negative rates will end

this year

Many analysts are convinced 2024 will be the year the

Bank of Japan (BoJ) ‘normalises’ policy and raises interest

rates above zero. Negative interest rates have been the

corner stone of Japanese monetary policy since 2016 with

the BoJ maintaining ultra-easy policy to conquer deflation.

However, with inflation having exceeded the BoJ 2%

target for over a year and the anticipated wage increases,

economists are confident of an end to negative rates this

year.

In its policy meeting on 23 January the BoJ maintained its

policy pointing to “extremely high levels of uncertainties”

but there were hints that conditions for a policy change

were falling into place.

Japan’s GDP contracted at an annualised rate of 0.4% in

the December quarter which, following the previous

quarter’s revised 3.3% decrease meaning Japan fell into

recession. Both private consumption and capital

expenditure declined in the December quarter, although

exports rose.

The Cabinet Office report also showed Japan losing its

third-placed global economic ranking to Germany. Japan’s

nominal GDP stood at $4.21 trillion in 2023, below

Germany’s $4.46 trillion, with a weak yen contributing to

the decline.

See:

https://thediplomat.com/2024/02/the-bank-of-japans-year-of-living-dangerously/

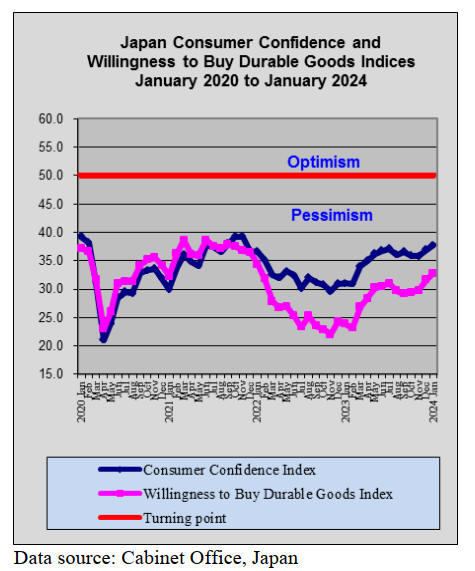

In February and for the first time in three months the

government downgraded its view on the economy citing

weak consumer spending. With private consumption

contributing around 60% to GDP, the road out of the

current recession will be long. Hopes are high that the

wage hikes promised by companies will drive a recovery

to give the Bank of Japan the opportunity exit its ultra-

easy policy this year.

2023 real estate price index trended higher

The Ministry of Land, Infrastructure, Transport and

Tourism publishes a property price index every month

calculated from information from approximately 300,000

real estate transaction prices.

The 2023 Japan’s real estate price index was on an upward

trend for both residential and commercial land and it is

anticipated that the upward trend will continue in 2024 due

to the rising cost of building materials and the inflow of

investment from foreign investors.

See:

https://www.realestate-tokyo.com/news/market-trends-japan-2023/

The real estate price index can be found at:

https://www.land.mlit.go.jp/webland_english/servlet/MainServlet

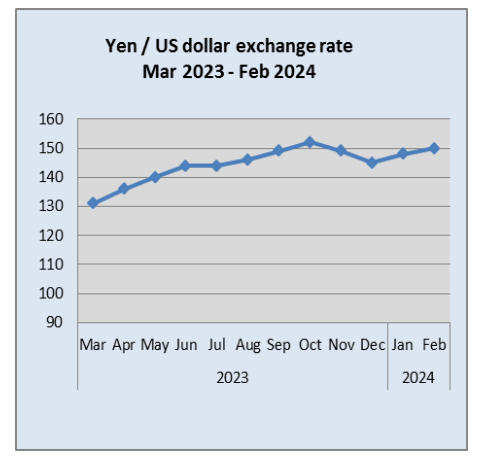

Yen likely to slip to 154 against the US dollar

On 27 February a writer for the Nikkei Asia suggested the

yen looks likely to continue to depreciate against the US

dollar and this has more to do with technical indicators

rather than the overselling that was the main driver during

other periods of weakness.

In February the Japanese currency was at the low 150

range against the dollar where it has remained for about 7

days. This marks a third consecutive year in which the yen

has crossed the 150 threshold. It did so in October 2022

and in early October 2023. A senior currency strategist at

Daiwa Securities sees the yen potentially falling as far as

154 against the dollar.

See:

https://asia.nikkei.com/Business/Markets/Currencies/Yen-seen-sliding-as-far-as-154-to-dollar-as-charts-show-steady-selling

Import update

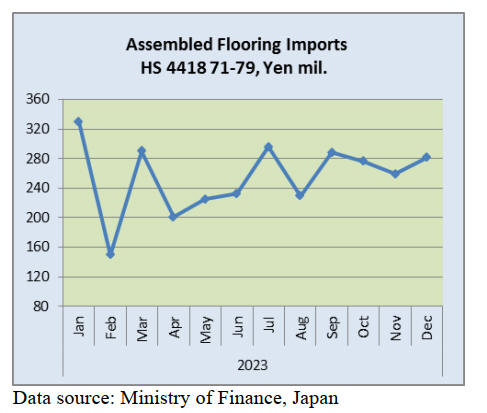

Assembled wooden flooring imports

The value of Japan’s December 2023 imports of

assembled flooring (HS441871-79) rose around 8% from a

month earlier and year on year the value of imports was up

47%. It should be borne in mind that the Yen/US$

exchange rate in early 2022 was around 120/US$ since

then the yen has weakened considerably to around 145-

150/US$ and this weakness has driven up the cost of

imports.

In December 2023 the main category of assembled

flooring imports was HS441875 accounting for around

67% of the total value of assembled flooring imports. The

second largest category in terms of value was HS441873

exceeding that of HS 441875.

The main shippers of HS441875 in December were China

52%, up from slightly from a month earlier, Malaysia

(12% cf. 8% in November), and Vietnam 10% with a

further 7.5% being shipped from Italy.

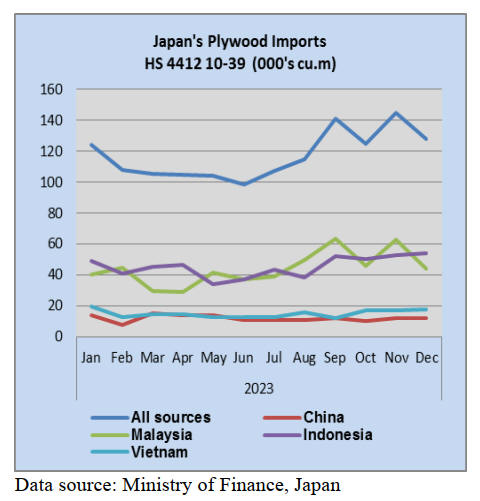

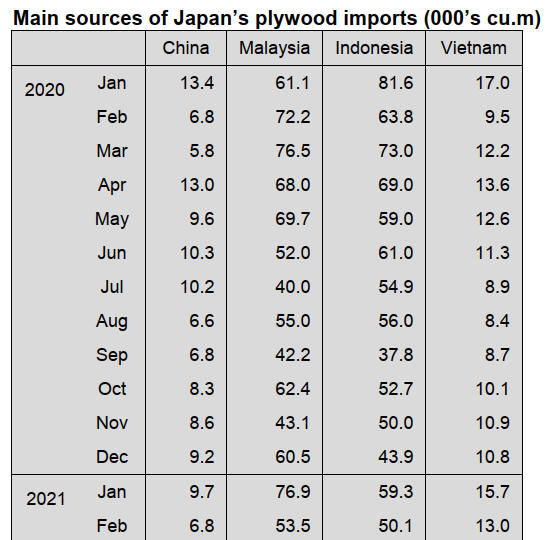

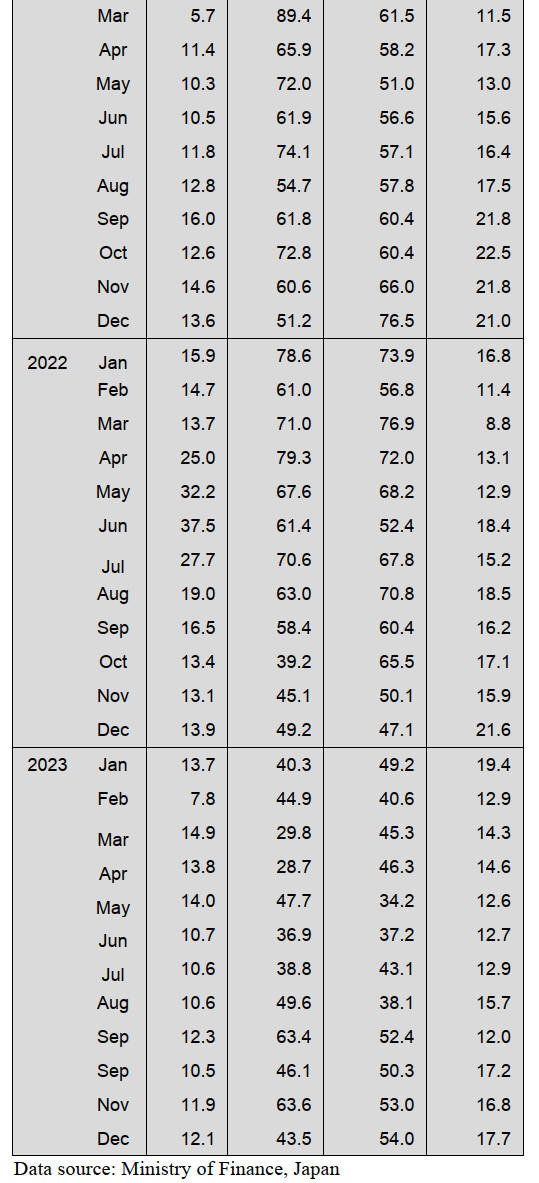

Plywood imports

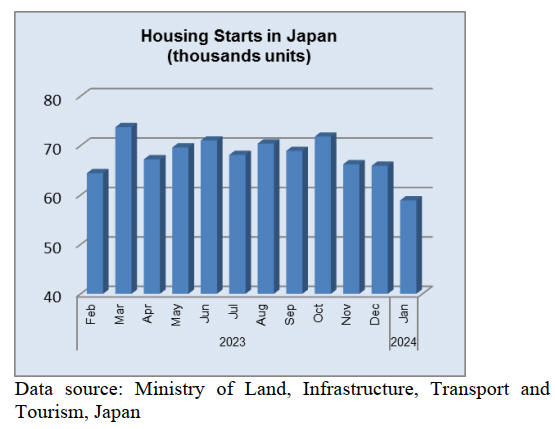

Building activity slows during the winter months in Japan

and this, along with the New Year holiday’s taken by

construction workers, means consumption of plywood

drops. December plywood imports into Japan were down

12% compared to a month earlier and were also down

(5%) year on year.

The volume of shipments by three of the main suppliers,

Indonesia, Vietnam and China in December were little

changed from a month earlier but shipments from

Malaysia dropped sharply (around 30%).

Of the various categories of plywood imported 86% was

HS441231 in December with HS441233 and HS441234

accounting for around 5% each. The trade data published

by the Ministry of Finance in Japan includes the names of

other exporters of plywood such as Taiwan P.o.C. South

Korea, Gabon and some EU producers but there are no

volumes shown for imports from any shipper other than

the top four mentioned above.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

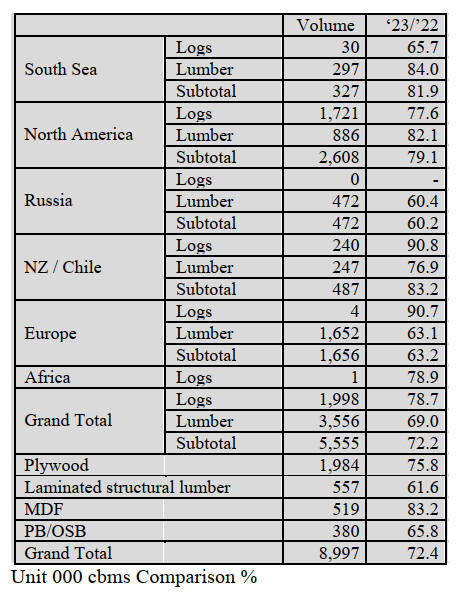

Total volume of imports in 2023

Total volume of imported South Sea products, North

American products, Russian products, NZ / Chilean

products and European products is 5,550,000 cbms. The

result is close to the result in 1960, when the new starts

were 5,450,000 units. North American products decrease

20 % from 2022. European products decrease 37 % from

the previous year. A decrease of all imported products is

2,140,000 cbms from 2022. Volume of wooden boards and

laminated structural lumber is 1,280,000 cbms less than

last year. Plywood and laminated structural lumber are

980,000 cbms decreased from the previous year.

In 2023, there was an influence of the third wood shock

and an adjustment was needed for demand and supply.

Since the new starts fell under 820,000 units, demand for

lumber also fell. Especially, the volume of European

lumber and European laminated structural lumber plunged.

Also, the fire at Chugoku Lumber Co., Ltd.’s plant in

August, 2023 influenced the supply for North American

lumber and the demand for North American logs. Volume

of Russian lumber is zero for the first time in seventy

years. NZ logs are popular for China and the price of NZ

logs is high so demand for NZ logs is less than domestic

logs. Imported plywood is under 2,000,000 cbms. MDF,

particleboards and OSB are 900,000 cbms.

Demand and supply of South Sea logs are balanced

There has been a stable demand for blocks from iron and

steel companies. South Sea logs will arrive to Japan in

February. Movement of South Sea lumber and Chinese

lumber is sluggish.

Once the inquires were lively at the end of the year due to

the strong yen but the inquiries were less as the yen was

weak. Japanese buyers do not buy a lot of lumber.

There was not a huge movement in China and Indonesia

because of the Chinese New Year holiday. Usually,

Chinese or Indonesian sellers lower the price of lumber

positively to get cash before the holiday but this year, a

Chinese manufacturer raised the price of the lumber due to

the increased labor costs and production costs.

South Sea lumber plants struggle with less South Sea logs

but demand for South Sea logs in Japan is low so there is

no problem for supplying.

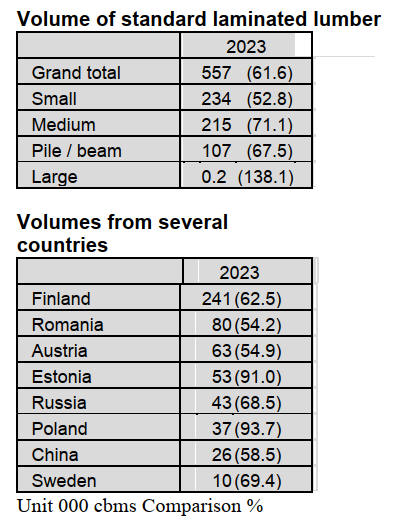

Structural laminated lumber import in 2023

Total import of structural laminated lumber in 2023 is

557,853 cbms, 38.4 % less than 2022. This is for the first

time in thirteen years to be a level of 500,000 cbms. There

had been too much inventories of imported structural

laminated lumber and lamina for laminated lumber since

summer in 2022 until autumn in 2023. To control the

supply, the contracts were reduced.

Total imports are 37.54 billion yen, 65.2 % down from the

previous year. In 2010, the new starts were 813,126 units

and the new starts in 2023 are 819,623 units, 4.6 % down

from 2022. Imported structural laminated lumber was in a

shortage in 2010 and the price increased.

However, the imported structural laminated lumber in

2023 was overstocking so the price went down. Some

reasons for the decrease in the price were an expansion of

producing domestic laminated cedar post and demand for

beam were changed to Douglas fir lumber.

Volume of medium sized laminated lumber is 28.9 %

down from 2022. Volume of small sized laminated lumber

is 47.2 % less than last year. Volume of pile / beam is 32.5

% down. Demand for whitewood / redwood laminated

post had changed to domestic laminated cedar post.

Imported lumber from Finland is 241,110 cbms, 37.5 %

less than last year. Imported lumber from Romania and

Australia are 45 % less than the previous year.

HS Timber Group had reduced producing laminated

lumber at Radauti plant in Romania after April, 2023 and

it influenced the volume of lumber from Romania. HS

Timber Group got the certification of JAS for laminated

lumber at Kodersdorf plant in Germany in May, 2023.

Then, the volume of lumber from Germany is 1,757 cbms

at the second half of 2023.

Volume of lumber from Estonia is 9 % down and from

Poland is 6.3 % down. The decrease is a small amount.

The average unit price of total imported lumber is 67,301

yen, per cbm. The average unit price of total imported

lumber in 2022 was 119,190 yen, per cbm. In 2020, the

average unit price of total imported lumber was 46,175

yen, per cbm.

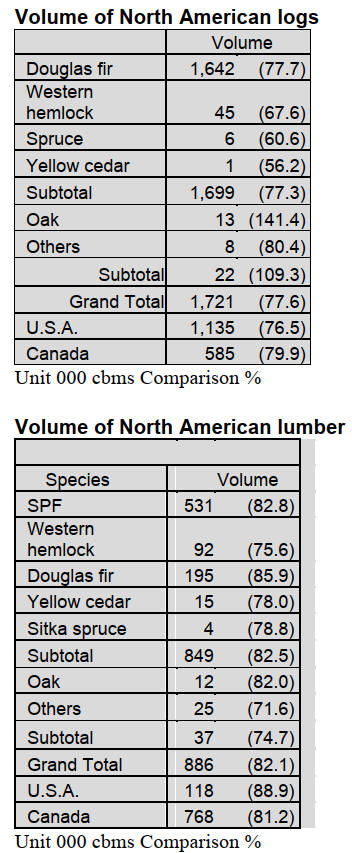

North American lumber import in 2023

All kinds of North American logs and lumber decrease by

20 – 30 % from 2022 except hardwood logs.

Volume of North American logs is under 2,000,000

cbms

for the first time in three years. A major Japanese Douglas

fir lumber company did not purchase a lot of Douglas fir

logs due to low demand.

The monthly average of arrival volume after

September,

2023 is 107,872 cbms. This is about 30 % less than the

monthly average of arrival volume during January to

August, 2023, which is 151,431 cbms. One of the reasons

for the decrease is that Chugoku Lumber Co., Ltd. stopped

an operation due to the fire occurred at one of its plants at

the end of August. Also, there had been less inquiries for

Doulgas fir logs for plywood and plywood manufacturers

in Japan kept reducing production of plywood.

On the other hand, volume of hardwood logs rise from

2022. Since Russia had invaded in Ukraine, there had been

less hardwood logs from Eastern Europe and consumers

were very active to purchase hardwood logs from other

areas.

Volume of North American lumber is under 1,000,000

cbms. One of the reasons is that Chugoku Lumber had

limited accepting orders for North American lumber due

to the fire and consumers started to purchase imported

lumber instead of Douglas fir lumber.

|