|

1.

CENTRAL AND WEST AFRICA

Buyers for Chinese market are stepping up interest

Some exporters are seeing a rise in demand for peeled

veneer, plywood and sawnwood particularly in Asian

markets. Buyers for the Chinese market are stepping up

interest in bilinga, movingui andsSapelli in addition to

okoume.

In Gabon it has been reported that the supply of okoume

logs to peeler and sawmills has been disrupted by adverse

weather conditions. Olam is a major supplier of logs to

processing mills, especially those in the Special Economic

Zone. News (unconfirmed) is circulating that a large part

of the approx. 2 million hectares of concession held by

Olam has been reclaimed by the government.

Côte d'Ivoire/EU Partnership – VPA signed

On 19 February the European Commissioner for

International Partnerships, Jutta Urpilainen, Ivorian

Minister of Water and Forests, Laurent Tchagba and

Ambassador the Belgian Permanent Representative to the

European Union, Willem van de Voorde, signed a VPA.

This signing marked the end of a 10-year negotiation

process. Now the focus will shift to its implementation

which will involve setting up a verification system to

guarantee legality and traceability of timber exported as

well as timber traded locally.

See:

https://international-partnerships.ec.europa.eu/news-and-events/news/global-gateway-cote-divoire-and-eu-unite-safeguard-forests-and-combat-illegal-logging-2024-02-19_en#:~:text=C%C3%B4te%20d'Ivoire%20is%20the,a%20VPA%20with%20the%20EU.

UK and CITES collaboration

The UK Minister of State, Department for Environment,

Food and Rural Affairs has said the UK is currently

contributing funding towards a CITES study on the

conservation and trade in rosewood tree species. He

indicated the UK has in place a mechanisms through the

UK Timber Regulations (UKTR) which prohibit the

placing of illegally harvested timber and wood products on

the UK market. .

See:

https://www.theyworkforyou.com/wrans/?id=2024-02-05.HL2178.h

New Training Centre for Timber Sector

The ATIBT has reported a new vocational training centre

has been opened for the timber sector in Gabon. In

February the first group of trainee sawyers, peelers, joiners

and sharpeners began their training at the new Centre de

Formation et d'Enseignement Professionnels (CFEP) Bois-

BTP in Nkok, Gabon.

At a meeting with the private sector CFEP Bois-BTP

Director, Bon-Jean Félicien Badjyenda said the Chairman

of the Board of the new establishment will be from the

private sector.

See:

https://www.atibt.org/en/news/13448/a-new-vocational-training-centre-for-the-timber-sector-in-gabon

Guidelines on contracts and practices

The ATIBT reports it has made available updated

guidelines and recommendations on contracts and

practices for the international trade in tropical timber. 12

new reference pamphlets are available on the ATIBT

website covering guidelines and recommendations on the

uses of tropical woods in international trade.

See:

https://www.atibt.org/en/resource-categories/31/0-reference-works?resource_group_id=94#category-list

Through the eyes of industry

The latest GTI report lists the challenges identified by the private

sector in the Republic of Congo and Gabon.

See:

https://www.itto-ggsc.org/static/upload/file/20240223/1708653799120615.pdf

2.

GHANA

Research team recommends funding into

engineered

wood products

A research team from the Ghana Timber Industry

Development Division (TIDD) has signalled the need for

further research into engineered wood products and pellet

production. This came after a visit by a delegation from

the Forestry Commission research team and key industry

stakeholders to India, Vietnam and Thailand. Mr. Samuel

Mawuli Doe, the Research and Statistics Manager of the

TIDD who led a trade mission, said this had become

necessary due to the rate at which Ghana was losing

markets for its traditional wood products.

Speaking at the presentation of the team’s findings and an

‘Analysis of Ghana Timber and Wood Products Exports’

Mr. Doe said a proposal had been written for funding for

further research to be conducted and called on the industry

for support. The team also proposed the examination of

lesser used species for engineered wood products.

According to Mr. Doe, their visit to Thailand revealed that

companies in Thailand are very successful with processing

and marketing rubberwood and acacia whereas in Ghana

acacia is used only for firewood. He said the team also

learnt about the need to prioritise value addition especially

for teak optimising machinery and total productivity,

tissue culture and development of fast-growing varieties.

See:

https://www.ghanabusinessnews.com/2024/01/25/research-team-calls-for-special-attention-for-wood-products-pellets-production/

Government action could undermine private sector

access to credit

Dr. Richmond Atuahene, a banking consultant, says

government’s constant borrowing could put Ghana on a

trajectory to recession. Atuahene emphasised that the

practice could significantly impede private sector access to

credit. According to him, recent data from the Bank of

Ghana showed that credit to the private sector has declined

by 10% in real terms.

He added that if the private sector does not have funds

then it cannot compete which would lead to the crowding

out of businesses and enterprises. Access to bank credit

facilities is one of the myriad of problems faced by the

Association of Ghana Industries (AGI) whose members

are in the manufacturing and industrial sectors including

timber-processing companies.

See:

https://www.ghanabusinessnews.com/2024/02/15/ghana-on-recession-trajectory-due-to-t-bill-borrowing-banking-consultant/

Ministerial reshuffle

A statement from the government details changes in

ministerial portfolios. The Ghana President announced a

reshuffle of ministerial appointees. Ken Ofori-Atta has

exited his role as Ghana's Minister of Finance and

Economic Planning after seven years to be replaced by Dr.

Mohammed Amin Adam who served as Minister of State

in charge of Finance.

The reshuffle also affected the position of Deputy Minister

of Lands and Natural Resources and now Akwasi Konadu

is the new Deputy Minister for the Lands and Natural

Resources. According to the presidential press release the

reshuffle takes immediate effect.

See:https://gna.org.gh/2024/02/ministerial-reshuffle-full-list-of-president-akufo-addos-changes-to-the-executive/

Investment Promotion Center needs review of funding

structure

The Ghana Investment Promotion Center (GIPC) has

disclosed a deficit in its operations over the past two years

raising concerns about the organisation's sustainability.

The Chief Executive Officer, Yofi Grant, mentioned these

challenges during the vetting of the Center by the

parliamentary Public Accounts Committee. Grant

attributed the deficit to the GIPC's heavy reliance on

internally generated funding and emphasised the difficulty

in raising the necessary revenue under the current

economic challenges facing the nation. He called for a

review of the funding structure of GIPC.

See:

https://www.myjoyonline.com/gipc-complains-of-financial-difficulties-due-to-economic-headwinds-records-low-fdi-inflows-in-2-years/

3. MALAYSIA

Economy grew 3.7% in 2023

Malaysia recorded a GDP growth of 3.7% in 2023 after an

expansion of 3% in the fourth quarter of the year

supported by continued recovery in economic activity and

labour market conditions.

Bank Negara Malaysia (BNM) said growth moderated

amid a challenging external environment last year

following the strong growth of 8.7% in 2022. Exports,

however, remained subdued due to prolonged weakness in

external demand and the stronger imports.

See:

https://theborneopost.pressreader.com/article/282303915056083

In related news, with the Malaysian currency weakening

close to a level last seen during the Asian financial crisis

25 years ago the government has ramped up its verbal

support for the ringgit. The Malaysian currency has been

under pressure from the strong US dollar and has suffered

because of tensions in the Middle East and the attempted

Russian invasion of Ukraine. In late February the ringgit

traded at 4.77 to the dollar, not far from the 4.885 level in

January 1998. The Malaysian currency has declined by

about 4% already this year.

Logging firm recognised

A Sabah logging company, Usahawan Borneo

Greenwood, has become the first to receive Yayasan

Sabah’s Appreciation Certificate as the Best Performing

Partner of Rakyat Berjaya for Integrated Mosaic Planting

in the Yayasan Sabah Concession Area (SFMLA 09/97).

Yayasan Sabah Group Group Forestry Division Manager,

Dr. Esther Li said this certificate is a way to recognise the

company for their good performance and to motivate them

to continue and at the same time, it is to encourage others

involved.

See:

http://theborneopost.pressreader.com/article/281487871275137

Preventing peat swamp fires

Peat swamp forests constitute a significant component of

the Malaysian forest and extend to around 1.54 million

hectares with most (70%) being in Sarawak, less than 20%

in Peninsular Malaysia and the balance in Sabah.

The Ministry Natural Resources and Environmental

Sustainability is currently implementing a ‘Sustainable

Management of Peatland Ecosystems in Malaysia’

(SMPEM) project as one of the initiatives to prevent

peatland fires.

See:

http://theborneopost.pressreader.com/article/281505051144321

Agarwood management

The Malaysian Timber Industry Board (MTIB) has been

appointed as a Management Authority responsible for

managing the registration of Scheduled Species for

Planters (Karas) in Peninsular Malaysia and the Federal

Territory under Act 686 (International Trade in

Endangered Species of 2008).

Agarwood is also known as Karas in Malaysia. Currently,

there are approximately 288 companies that have

registered as Karas planters covering 2,706 hectares.

The MTIB recently held a Karas Tree Identification and

Karas Plantations Auditing Workshop.

The objectives of the workshop were as follows:

Updating the list of existing auditors and

appointing new auditors

Providing updates to officials involved in the

auditing of Karas plantations of Act 686 in line

with the amendment of the 2022 Guidelines for

the Registration of Karas Planters

Ensuring that the auditing process of Karas

plantations is implemented more effectively

See:

https://www.mtib.gov.my/muaturun/eMaskayu_Publication/eMaskayu_2023/eMaskayu%20Vol%208_2023.pdf

Malaysian port in top 20 for container traffic

Port Klang in Selangor and Johor's Port of Tanjung

Pelepas (PTP) remain among the busiest global ports. Port

Klang recorded the highest throughput of containers last

year at 14 million twenty-foot equivalent units (TEU)

compared to 13 million TEU in 2022. PTP meanwhile

processed some 10 million TEU last year.

See:

https://www.thestar.com.my/news/nation/2024/02/23/port-klang-ptp-among-the-top-20-busiest-ports-in-the-world-says-loke

Through the eyes of industry

The latest GTI report lists the challenges identified by the private

sector in Malaysia.

See:

https://www.itto-ggsc.org/static/upload/file/20240223/1708653799120615.pdf

4.

INDONESIA

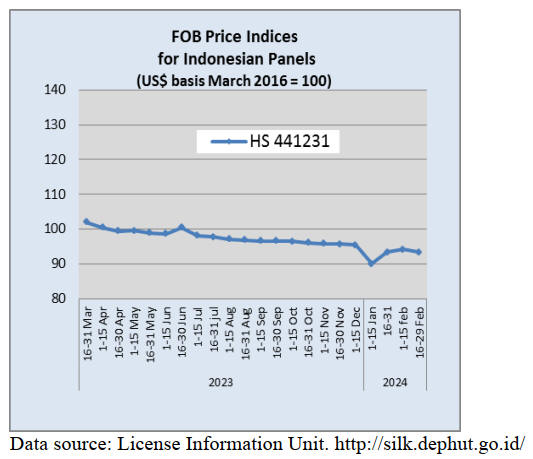

Furniture and craft industries need to adopt

advanced

technologies

Competition in international markets for furniture and

handicraft industries is getting tougher as Vietnam and

Malaysia strive to expand market share. The Chairman of

the Indonesian Furniture and Crafts Industry Association

(HIMKI), Abdul Sobur, stated that given the state of the

global economy it is very important to improve the

competitiveness of the national handicraft and furniture

industries.

According to him, one of the things that must be done to

improve competitiveness of the national furniture and

handicraft industry is adoption of advanced technologies.

The HIMKI has asked the Ministry of Industry to provide

subsidies for the rejuvenation of technologies in the

furniture and handicraft industry in the country.

The HIMKI is optimistic that the wood processing

industry can grow by 5% -6% this year even though

several main export markets such as the UK and Japan are

facing economic downturns. Abdul Sobur, said that his

Association has developed strategies to realise market

growth and one aspect is exploring exports to non-

traditional markets.

Japan and the UK have been one of the main markets for

furniture and craft although the market share for furniture

exports to the United States is larger. Statistics Indonesia

(BPS) noted that the value of furniture exports (HS 94) to

Japan decreased from US$174.71 million in 2022 to

US$141.15 in 2023. Meanwhile, furniture exports to

England also decreased from US$58.34 million in 2022 to

US$45.76 million last year.

See:

https://ekonomi.bisnis.com/read/20240221/257/1742913/duh-resesi-jepang-dan-inggris-ancam-ekspor-mebel-ri.

Support programme for machinery in wood processing

industry

The Ministry of Industry is working to enhance

productivity and competitiveness in the furniture industry.

The sector's export performance in 2023 was recorded at

US$1.8 billion. Moreover, the Industrial Performance

Index (IKI) for the furniture industry stood at 52.4 in

January 2024, which represented an expansion that

suggests that furniture companies are confident about

business conditions.

One of the efforts made by the Ministry of Industry is to

continue the restructuring programme for machines and/or

equipment in the wood and furniture processing industries.

The Director General of Agro-Industry, Putu Juli Ardika,

said the Ministry is implementing a restructuring

programme for machinery and/or equipment in the wood

processing industry, in the form of providing partial

reimbursement for purchases based on certain criteria.

Since 2022 twentyfour companies have participated in the

restructuring programme for machinery and equipment

used in the wood and furniture processing industry. Nine

companies joined the programme in 2022 while 15

companies joined in 2023.

In 2024, the budget allocated for the restructuring

programme for industrial machinery and equipment

reached IDR7.5 billion and targets 10 companies.

According to one company's report for the 2022 fiscal

year, this programme had increased the company's

efficiency by 10-30%, improved product quality by 10-

30% and increased productivity by 20-30%.

See:

https://www.msn.com/id-id/berita/other/kemenperin-gencarkan-program-restrukturisasi-mesin-di-industri-furnitur/ar-BB1iydpW

and

https://www.msn.com/id-id/berita/other/restrukturisasi-mesin-naikkan-produktivitas-sektor-furnitur-30-persen/ar-BB1iwu9R

Sustainability with environmental, social and

governance pillars

The Ministry of Environment and Forestry (KLHK)

continues to develop the forestry sector to uphold the

principles of sustainability with the Environmental, Social

and Governance (ESG) pillars. Acting Director General of

Sustainable Forest Management, Agus Justianto, stated

that this was to answer the challenges of the complexity of

environmental issues, social problems and economic

utilisation in development.

He continued saying “challenges that were initially limited

to problems of environmental damage, then spread to

social problems in accessing natural resources which are

also required to provide economic benefits for

development”.

According to Agus, the government has adopted various

approaches, from interventions through regulation, control

and supervision, law enforcement and capacity building to

developing an inventory and monitoring system.

The approaches that have been developed are implemented

based on various policy instruments, both in the form of

government regulatory instruments, as well as instruments

that apply on a global scale such as the Sustainable

Development Goals (SDGs), UN-CBD, Convention on

Biodiversity, Nagoya Protocol, and Paris Agreement.

See:

https://nasional.sindonews.com/read/1324003/15/komitmen-pembangunan-lingkungan-hidup-klhk-pegang-teguh-prinsip-esg-1708250552

Ministry reports - deforestation down, sustainable

forest utilisation up

The government continues to reduce deforestation and

utilise forests in a sustainable manner, said Agus Justiant,

adding "achieving a low deforestation rate is a key

performance indicator for the forestry sector".

Data from the Ministry shows that Indonesia's net

deforestation fell to 104,000 hectares in 2021–2022, down

from 113,500 hectares in 2020–2021.

Justianto highlighted the government's ongoing efforts to

transform forest utilisation through schemes like multi-

business forestry which emphasises not just wood

production but also landscape-based management. This

integrated approach fosters increased land productivity by

encouraging diverse forestry businesses focused on

environmental products and services. The government is

also expanding access to forest use not only to

corporations but also to the community through social

forestry schemes, he noted.

See:

https://en.antaranews.com/news/306294/deforestation-down-sustainable-forest-utilization-up-klhk

and

https://www.pikiran-rakyat.com/nasional/pr-017729477/hpn-2024-deforestasi-indonesia-terendah-dalam-sejarah-kehutanan-tertinggi-tahun-1996?page=all

Private sector and community partnership for forest

restoration

Companies holding Forest Utilisation Business Permits

(PBPH) are encouraged to become responsible for

environmental restoration by involving local communities

through forestry partnership schemes.

"With good planning and good management sustainable

forest management can provide benefits from economic,

social and environmental-ecological aspectsaccording to

Agus Justianto.

In early February, Agus visited PBPH PT Kandelia Alam

in Kubu Raya Regency, West Kalimantan. Agus saw how

the management of PT Kandelia Alam carried out

mangrove restoration by involving the communities

around the concession area.

Now the community also benefits from the involvement in

efforts to restore mangroves and forest management,

including the use of forest products such as honey and

silvo-fisheries a traditional aquaculture system that

combine fisheries business with mangrove planting,

See:

https://forestinsights.id/pemulihan-hutan-libatkan-masyarakat-dirjen-phl-klhk-perusahaan-harus-jadi-contoh/

Strengthen implementation of the Economic Value of

Carbon plan

To achieve emission reduction targets the Ministry of

Environment and Forestry (KLKH) is supporting efforts to

strengthen the implementation of the Economic Value of

Carbon (NEK) plan, one of which is by strengthening

Human Resources through workshops and training.

The Minister of Environment and Forestry, Siti Nurbaya,

said that the high level of public euphoria and interest in

NEK needs to be accompanied by regulatory and policy

information as well as its implementation by

administrators and regulators.

When opening a Workshop on Implementing NEK she

said "through training and this workshop I hope that we

can all better understand the strategic and operational

policies for implementing NEK to support the

achievement of NDC and controlling GHG emissions to

support national development". To achieve this it will be

necessary to monitor the introduction the carbon economy

implementation concepts and adapt national policies and

standardswhile remaining in line with national interests.

See:

https://www.antaranews.com/berita/3971595/klhk-dukung-upaya-perkuat-implementasi-nilai-ekonomi-karbon

and

https://forestinsights.id/dukung-penyelenggaraan-nilai-ekonomi-karbon-klhk-gelar-lokalatih-penguatan-sdm/

Through the eyes of industry

The latest GTI report lists the challenges identified by the private

sector in Indonesia.

See:

https://www.itto-ggsc.org/static/upload/file/20240223/1708653799120615.pdf

5.

MYANMAR

Timber exports set to be lowest ever recorded

In the first three quarters of the 2023-24 financial year

timber exports stood at just US$50 million which, if the

pace of exports continues at the current rate, the year will

end with the lowest ever level of timber exports. Although

the Myanmar currency has depreciated sharply exporters

could not benefit from this to boost exports.

The market exchange rate is between 3,400 to 3,600 kyats

to the US dollar but exporters only receive 2,100 kyats

when, by law, they must exchange incoming hard currency

payments.

See:

https://www.gnlm.com.mm/kyat-depreciates-beyond-k3600/ )

International trade balance

According to the Ministry of Commerce Myanmar’s

international trade amounted to US$25.5 billion over the

past ten months of the current financial year 2023-2024,

beginning 1 April and comprised exports worth US$12.1

billion and imports worth US$13.4 billion.

Myanmar’s seaborne trade value was estimated at

US$18.8 billion while US$6.7 billion from border trade.

Myanmar exports agricultural products, animal products,

minerals, forest products and finished industrial goods

while it imports capital goods, intermediate goods, raw

materials and consumer goods.

See:

https://www.gnlm.com.mm/myanmars-foreign-trade-exceeds-us25-bln-in-ten-months/

First announcement for MyanmarWood Fair

MyanmarWood, recognised as a specialised trade fair for

the woodworking industry, will take place at the Yangon

Convention Centre, Myanmar. Organised by Chan Chao

International Co., Ltd., This fair has established itself as a

central meeting point for industry experts and companies

specialising in woodworking and related technologies.

MyanmarWood runs 13-16 December 2024.

See:

https://www.tradefairdates.com/MYANMAR+WOOD-M13687/Yangon.html

6.

INDIA

Few ready for new BIS

rules – calls for extending

implementation deadline

The correspondent in India writes “the new regulations

from the Bureau of Indian Standards (BIS) are still a

burning issue with international and domestic panel

manufacturers as the deadline is looming but, so far, there

has been no announcement from the government on an

extension”.

He adds “local manufacturers are eagerly awaiting a

decision from the government. If there is no extension

then it is anticipated panel prices will jump in the local

market because of lower imports which will mean

competition from imported panels weaken. If this happens

there could be a rise in imports from shippers which have

satisfied the BIS regulations”.

Overall, the economy is stable but demand has become

slower, however, the outlook is that India is doing well

and that this is a favourable time for domestic

manufactutrers to increase in sales.

Domestic woodbased panel producers set to do well in

2024

Plyreporter has said during 2023 it has been estimated that

MDF consumption was around 7,000 cubic metres per day

and looking ahead it is anticipated that the organised

sector will expand capacity as the market outlook is

positive.

The production capacity for MDF is expected to grow at a

faster rate in 2024 compared to 2023 fuelled by the arrival

of bigger plants and new production lines. Additionally, it

is anticipated there will be increased consumer acceptance

of domestically produced MDF products, in part stemming

from the implementation of BIS regulations on quality

effective from February 2024.

There is a steady demand for particleboard in India and

production capacity has grown but, as stated in a

Plyreproter analysis, “the industry has seen very good

growth in 2023 in terms of capacity addition but the

market of particleboard did not show good demand

especially in the retail segment”.

The price of particleboard in the domestic market

experienced a sharp decline in 2023 and manufacturers

know there must be more effort directed to promotion

particularly among the burgeoning ready-made office

furniture markers where the particleboard industry can

make an impact and lift sales.

With BIS panel regulations coming into force, imported

particleboard will face a hurdle that will also create a

space for the domestic particleboard industry in India. It is

anticipated that improved awareness of particleboard

quality standards will rise among consumers driving

demand higher.

See: ttps://www.plyreporter.com/article/93401/the-particle-board-capacity-will-increase-by-20-in-2023-ply-reporter-prediction-2023

Eased cross-state transport of forest products

The Ministry of Environment, Forest and Climate Change

has introduced a National Transit Pass System (NTPS) as

a “One-Nation-One-Pass” to facilitate unrestricted transit

of timber, bamboo and other forest products throughout

the country.

India has many States and Provinces and until now transit

permits were issued by different States based on their own

transit rules which meant to move forest products separate

transit passes had to be obtained for cross State transport

(known locally as the ‘Jungle Pass’). This process was

time-consuming and frequently caused delays in transport

and production.

The new system will serve as a bridge between the rural

and urban economy. Under the new system the QR coded

transit permits will help check-gates across various states

verify the validity of the permits and allow seamless

transit. This new system will not only facilitate smooth

transportion but will also help curb illegal wood

transportation.

See:

https://timesofindia.indiatimes.com/india/government-launches-one-nation-one-pass-regime-for-seamless-transit-of-timber-and-other-forest-produce/articleshow/106386236.cms

7.

VIETNAM

Wood and Wood Product (W&WP) trade highlights

According to Vietnam’s Customs Office in January 2024

W&WP exports were valued at US$1.4 billion, up 4.6%

compared to December 2023 and up 75% compared to

January 2023. In particular WP exports stood at US$924

million, down 3% compared to December 2023 but up

87% compared to January 2023.

Vietnam’s exports of wooden furniture in January 2024

amounted to US$884 million, up 4.7% compared to

December 2023 and up 99% compared to January 2023.

W&WP exports to the EU market in January 2024

contributed US$63 million, down 6% compared to

December 2023 but up 5% compared to January 2023.

W&WP exports to the US market in January 2024 were

recorded at US$781 million, up 4.6% compared to

December 2023 and up 15% compared to January 2023.

Vietnam’s W&WP imports in January 2024 reached

US$250 million, up 35% compared to December 2023 and

up 108% compared to January 2023.

In December 2023 Vietnam imported 45,900 cu.m of pine

worth US$10.5 million, down 37% in volume and 35% in

value compared to November 2023. However, compared

to December 2022, imports increased by 21% in volume

and 13% in value.

In 2023, pine imports amounted to 705,400 cu.m worth

US$155.0 million, down 24% in volume and 39% in value

compared to 2022.

Ash wood imported into Vietnam in December 2023

amounted to 32,300 cu.m worth US$8.5 million, down 4%

in volume but up slightly in value compared to November

2023. Compared to December 2022 imports were down

34% in volume and 36% in value. Overall, in 2023 ash

wood imports were 497,400 cu.m, worth US$127.9

million, up 0.3% in volume but down 3% in value

compared to 2022.

Imports of logs and sawnwood from the US in December

2023 were reported at 41,920 cu.m at a value of US$17.16

million, down 15% in volume and 20% in value compared

to November 2023 and down 5% in volume and 111% in

value compared to December 2022.

In 2023, imports of raw wood from the US to Vietnam

totalled at 522,010 cu.m at a value of US$223.62 million,

down 24% in volume and 32% in value compared to 2022.

Vietnam’s imports of raw wood from Africa in December

2023 amounted to 45,020 cu.m at a value of US$17.47

million, down 30% in both volume and value compared to

November 2023 and down 69% in volume and 67% in

value compared to December 2022.

In 2023 imports of raw wood from Africa amounted to

720,060 cu.m at a value of US$281.81 million, down 46%

in volume and 43% in value compared to 2022.

Optimism after good start to 2024

The industry in Vietnam faces a tough road to recovery

and industry attendees at the 2024 Vietnam International

Furniture an Home Accessories Fair (VIFA EXPO) were

vocal in discussing the hurdles which included diminished

order volumes, the relentless quest for innovation in

design and the logistical nightmares fueled by rising costs

and geopolitical tensions.

Yet, amidst these challenges the rise in wood product

exports in January was encouraging and hopefully signals

a reminder of the industry's capability to bounce back.

With over 600 exhibitors from 17 countries, VIFA EXPO

offered the opportunity for companies to network, see

innovative designs and a platform for businesses to

identify new markets.

The perception in the trade is that there are positive

several factors that signal a possible recovery. The easing

inflation in the US could drive demand for Vietnamese

wooden products.

Manufacturers are aware they musy diversify markets,

enhance productivity and constantly examine design

trends to be successful.

See:

https://bnnbreaking.com/world/asia/vietnams-wood-industry-sees-rays-of-hope-a-resilient-comeback-in-2024

W&WP export target at US$16 billion in 2024

Vietnam has targeted earning US$16 billion from the

export of wood and wood products this year given the

prospects in certain markets according the Ministry of

Agriculture and Rural Development (MARD).

Vietnam’s key markets include China, the US, Japan,

South Korea, the EU and China. In the first month of this

year wood and wood product exports to Europe saw

positive growth. Those to the Netherlands fetched US$9.2

million, up 5% against December and almost double that

in January 2023.

Wood exporters remain concerned about rising

transportation costs as tensions in the Red Sea forced

shipping lines to divert vessels to ensure safety.

Transportation costs to the EU and the US have, however,

begun to ease over the past few weeks. Chairman of the

Vietnam Timber Forestry Products (VIFOREST), Do

Xuan Lap, said transportation costs for a 40-foot container

from Vietnam to the EU have come down to US$3,786.

See:

https://vneconomy.vn/2024-wood-and-wooden-product-exports-targeted-at-16bln.htm

Expanding plantations

The Ministry of Agriculture and Rural Development

MARD has announced plans to cultivate approximately 1

million hectares of large-sized plantation trees by 2030 to

support economic growth, enhance environmental

protection and ensuring a sustainable timber supply for

both domestic and international markets.

The goal is to maintain the current 500,000 hectares of

commercial forests and expand this to 1 million hectares

with acacia and eucalyptus. The aim is to achieve an

average yield of 20 cubic metres per hectare annually by

2025 and 22 cubic metres by 2030.

See:

https://bnnbreaking.com/world/vietnam/vietnams-green-vision-aiming-for-1-million-hectares-of-timber-forests-by-2030

8. BRAZIL

Sustainable forest

management supported by reliable

financing

In Mato Grosso the 2023/2024 Harvest Plan (through

sustainable forest management) is forecast to capture

around 17% of the R$5.8 billion in available forest

resources. The forest-based sector in the State is huge and

there are 620 industries associated with the Centro das

Indústrias Produtoras e Exportadoras de Madeira do

Estado de Mato Grosso (CIPEM).

In the State there are more than 4.7 million hectares of

managed forests protected against deforestation. The

timber sector generates approximately 10,000 direct jobs

and is the 4th largest in formal jobs creation among

manufacturing industries in the State. In several

municipalities, timber companies are the main source of

employment, revenue and taxes and contributed R$66.2

million to the State in 2022.

The flow of finance is esstial for industries and the

"Renovagro" credit line is a primary lender for the sector

having released around R$1 billion in the first five months

of 2023. The Bank of Brazil (Banco do Brasil) has also

increased its financing for forest management.

See:

https://noticiaexata.com.br/geral/manejo-florestal-producao-sustentavel-em-destaque-no-plano-safra-2023-2024/#:~:text=No%20contexto%20do%20Plano%20Safra%202023%2F2024%20em%20Mato,os%20financiamentos%20para%20manejo%20florestal%2C%20atingindo%20R%24%205%2C1

No harvesting until April in Mato Grosso State

The timber sector in the State of Mato Grosso, one of the

main tropical timber producing states in the Amazon

region, is currently restricted from felling, hauling and

transporting logs under an ordinance in effect until 1

April.

The measure, which came into force 1 February, aims to

protect the soil during the rain season and covers around

6% of the State land, equivalent to 52,000 sq.km that

include areas with Sustainable Forest Management Plans.

During this period it is only possible to obtain permits to

transport timbers stockpiled in registered timber yards.

The restriction follows the guidelines of the National

Environment Council (CONAMA) resolution and is

regulated by the Mato Grosso Forestry Technical Chamber

through Resolution No. 10/2017 which establishes the

prohibitive period for logging under the low-impact

Sustainable Forest Management regime.

See:

https://forestnews.com.br/periodo-proibitivo-manejo-florestal-mt-abril/

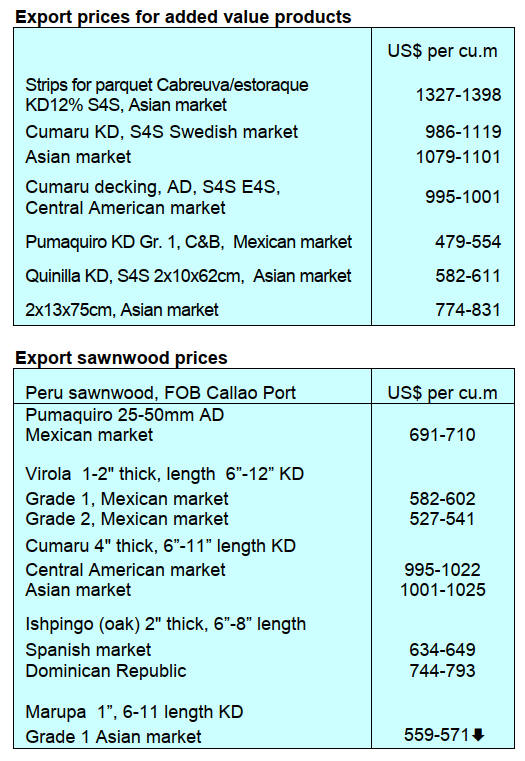

Export update – January 2024

In January 2024 Brazilian exports of wood-based products

(except pulp and paper) increased 13% in value compared

to January 2023, from US$266.6 million to US$300.3

million.

Pine sawnwood exports increased 8.5% in value between

January 2023 (US$44.6 million) and January 2024

(US$48.4 million). In volume, exports increased 16% over

the same period, from 192,400 cu.m to 222,400 cu.m.

Tropical sawnwood exports decreased 16% in volume,

from 29,500 cu.m in January 2023 to 24,700 cu.m in

January 2024. In value, exports decreased 28% from

US$15.7 million to US$11.3 million, over the same

period.

In contrast pine plywood exports increased almost 4% in

value in January 2024 (US$58.2 million) compared to

January 2023 (US$56.2 million) but in terms of volume

exports decreased from 189,500 cu.m (January 2023) to

188,600 cu.m. (January 2024)

Tropical plywood exports decreased in volume 51% and in

value 39%, from 3,500 cu.m and US$1.8 million in

January 2023 to 1,700 cu.m and US$1.1 million in January

2024, respectively.

As for wooden furniture, the export value increased from

US$34.6 million in January 2023 to US$38.6 million in

January 2024, an increase around 12%.

Reducing bureaucratic obstacles to speed shipments

The Federation of Industries of Mato Grosso (FIEMT)

together with the Center of Timber Producing and

Exporting Industries of Mato Grosso State (CIPEM) and

the National Forest-Based Forum (FNBF) met with

representatives from the Senate and Brazilian Institute of

Environmentand Renewable Natural Resources (IBAMA)

with the aim of reducing bureaucratic obstacles for exports

from the forest-based sector in the State of Mato Grosso.

In particular the aim was to resolve issues such as shipping

delays at ports due to the lack of IBAMA inspection

agents. One of the requests to IBAMA was to make

officials available for work at the Cuiabá Dry Por, to

resolve these demands and speed up exports. Mato

Grosso's forestry sector plays a crucial role in the

economy, with trade transactions with 62 countries in

2023, totalling US$104.6 million in exports, especially to

the United States, India and China.

See:

https://cipem.org.br/noticias/fiemt-e-setor-de-base-florestal-de-mato-grosso-se-unem-para-destravar-exportacoes-do-segmento

Furniture exports - promoting differentiation and

design over price

In 2023 the Brazilian furniture industry faced tough

challenges as reflected in export earnings which fell by

11% compared to 2022 (US$735.3 million compared to

the US$ 830.7 million in 2022). Global economic

instability has had an impact on exports, particularly a

decline in demand from the United States which

accounteds for 32% of total furniture exports in 2023.

Despite this, the sector's trade balance remained positive

with a surplus of more than US$500.9 million. Market

diversification strategies and participation in international

events, such as the ICFF (International Contemporary

Furniture Fair) in New York, are planned to boost exports

in 2024.

Although the national furniture sector faced challenges in

2023 it plans innovative strategies for 2024 that

differentiate Brazilian products with the aim of increasing

international competitiveness. Brazil, renowned for

producing quality furniture, is aiming for long-term

growth in exports and promotes the high level of

differentiation and design rather than just competing on

price.

The New Year has brought some optimism but export

projections depend on the economies in target markets and

specifically inflation control in the furniture production

chain and the global geopolitical situation which have a

direct impact on international commodity prices.

See:

http://abimovel.com/balanco-2023-exportacoes-brasileiras-recuam-no-setor-de-moveis-diante-de-obstaculos-no-mercado-internacional/

Through the eyes of industry

The latest GTI report lists the challenges identified by the private

sector in Brazil.

See:

https://www.itto-ggsc.org/static/upload/file/20240223/1708653799120615.pdf

9. PERU

Shipments of wood

products dropped in 2023

Peruvian wood exports in 2023 reached US$100.9 million,

a drop of 20% compared to the previous year (US$126.5

million) and represented just 0.1% of total national export

shipments to the world according to the Association of

Exporters (ADEX).

The manager of the ADEX Services and Extractive

Industries unit, Lucía Rodríguez Zunino, highlighted the

need to implement measures that encourage investment to

take advantage of the full potential of resources in the

Amazon region of the country.She added “regulations are

required to promote the development of the timber sector

as it is one that generates the most jobs per million dollars

exported.

Last year there were around 20,000 jobs supported by the

sector in areas far from cities and the industries there

added value to Peruvian forests which, she added, is the

best way to ensure their survival.

According to data from the ADEX Data Trade Intelligence

System, despite suffering a 16% drop sawn wood

(US$42.3 million) was the main product exported,

accounting for 42% of the total. In second place were

semi-manufactured products (US$34.8 million) but export

earnings were down 38% in 2023. The main item in this

category was profiled wood except Ipé (US$15.3 million).

Others categories were construction products (US$5.5

million), firewood and charcoal (US$5.4 million),

manufactured products (US$4.3 million), furniture and its

parts (US$4.1 million), veneer and plywood (US$2.4

million), among others.

The most notable destinations were China (US$19.9

million), France (US$13.9 million), Mexico (US$13.7

million), Dominican Republic (US$11.8 million) and the

USA (US$ 9.5 million). Completing the top ten export

destinations were Vietnam, Ecuador, Belgium, Denmark

and Chile.

OSINFOR/USAID work on sustainable forest

management

Within the framework of strategic collaboration through

international cooperation the Forestry and Wildlife

Resources Supervision Agency (OSINFOR) received

technological support from the USAID ‘Prevent Project’

that will contribute to the capacity for further development

of the forest management model promoted by both

institutions to strengthen governance and legality in the

sector.

For this purpose, ‘Prevent’ delivered drones that will be

used in the monitoring and supervision of harvesting

permits in order to collect evidence of change of use,

degraded areas, as well as over exploitation.

Between June 2022 and September 2023, OSINFOR has

monitored more than three million hectares of forest using

the Optimized Supervision methodology and detecting

four million board feet of unauthorised extraction.

See:

https://www.gob.pe/institucion/osinfor/noticias/904247-osinfor-y-prevenir-de-usaid-unen-esfuerzos-para-contribuir-a-una-gestion-forestal-sostenible

SERFOR campaign to prevent forest fires

The National Forestry and Wildlife Service (SERFOR)

began an information campaign on ‘Risk management for

the prevention of forest fires’ in the Department of Cusco.

Specialists from SERFOR's Cusco Technical Forestry and

Wildlife Administration (ATFFS) provided knowledge on

conceptual aspects and legal framework related to forest

fires.

The Technical Administrator of SERFOR's ATFFS in

Cusco reported that 40 members of the immediate reaction

force from the 5th Mountain Brigade participated in the

workshop because they have a specific and temporary

function in fire management.

“There is an alliance established with this military

institution, whose members intervene in the control and

combat actions of forest fires when requested” said the

Technical Administrator. In 2022, Cusco registered 1,269

forest fires that affected around 126,230 hectares.

See:

https://www.gob.pe/institucion/serfor/noticias/906962-cusco-serfor-inicia-campana-para-la-prevencion-de-incendios-forestales

|