|

Report from

Europe

UK tropical wood and wooden furniture imports 30%

below long-term average

The trajectory of UK imports of tropical wood products

continues sharply downwards. In fact, the latest trade data

shows that imports in the closing months of 2023 were

heading towards an all-time low. In the January to

November period last year, the UK imported tropical

wood and wooden furnitureproducts with total value of

US$874 million, 35% less than the same period the

previous year. In quantity terms, the UK imported 374,200

tonnes of these products during the eleven-month period,

15% less than the same period in 2022.

These are very low figures, in tonnage terms the lowest

level of UK tropical wood products imports for an eleven-

month period ever recorded, or at least since the 1980s and

probably well before then. It is 7% below the previous

record low which came in the first eleven months of 2013

at the end of one of the longest periods of economic

stagnation on record in the UK. It is 10% less than

recorded in the first eleven months of 2020 when the

country came briefly to a complete standstill at the start of

the COVID pandemic.

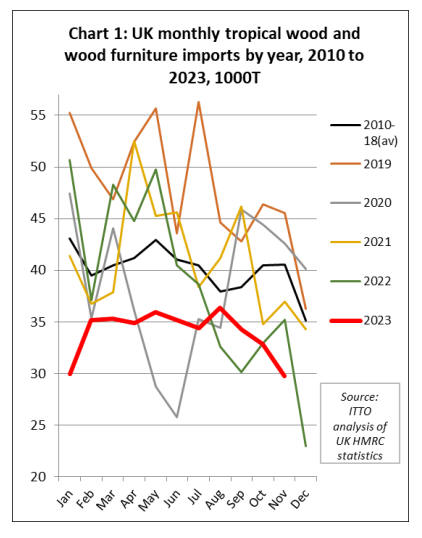

The latest monthly data shows that the total tonnage of UK

imports of tropical wood and wooden furniturefell to an

extreme low of only 22,000 tonnes in December 2022

before crawling back to 36,000 tonnes in August 2023.

Imports then began to slide again, falling below 30,000

tonnes in November last year. That is around one third less

than the long-term average for that time of year (Chart 1).

The backdrop to these historically low import levels is a

continuing slow-moving economy and weak consumer

confidence. The UK economy fared better than forecast in

2023, with KPMG estimating GDP increased 0.5% rather

than contracting the 1% forecast earlier.

KPMG now predicts UK growth in 2024 will hover

around the same figure and only reach 1% in 2025.

The GfK Consumer Confidence indicator for the UK, after

hitting an all-time low of nearly -50 in the second half of

2022, did rise last year but remains in negative territory

which means that most respondents are still pessimistic

about the economy. The index was at -19 in January this

year, up from -22 in December and the third consecutive

month-on-month increase.

The persistent gloomy mood is linked to the Bank of

England maintaining interest rates at 5.25% for longer

than hoped in response to stubbornly high inflation.

Predictions are that the first 2024 interest rate cut of 0.25%

won’t be until August, with a second to 4.75% in

November.

Key for the hardwood and wider timber sector, of course,

are forecasts for the impacts of a sluggish economy on

construction. In its Winter Forecast, published January,

the Construction Products Association predicts the

industry’s output will contract 2.1% this year due to falls

in private housing new build and repair, maintenance, and

improvement – the largest construction sectors.

One hardwood importer interviewed by the ITTO

Correspondent earlier this month observed that “in the

current economic environment, customers are cautious.

They’re taking more time over finalising projects, or

delaying them, and an upcoming election creates more

uncertainty.”

UK import value of tropical wooden furniture down

45%

Of all wood products imported into the UK from the

tropics, wooden furniture declined the most last year. The

UK imported US$386 million of tropical wooden furniture

products in the first eleven months of 2023, which is 45%

less than the same period in 2022. In quantity terms,

wooden furniture imports were 106,200 tonnes during the

eleven-month period, 26% less than the same period in

2022.

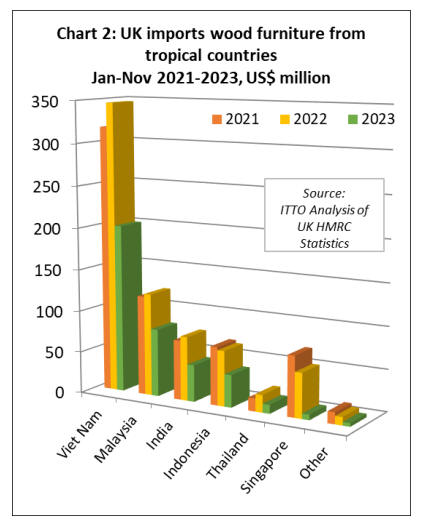

In the first eleven months of 2023 compared to the same

period in 2022, UK import value of wooden furniture from

Vietnam was down 42% to US$201 million, Malaysia was

down 34% to US$81 million, India was down 43% to

US$44 million, Indonesia was down 41% to US$39

million, Thailand was down 49% to US$11 million, and

Singapore was down 88% to US$6.5 million (Chart 2).

Across the board decline in value of all tropical wood

product imports

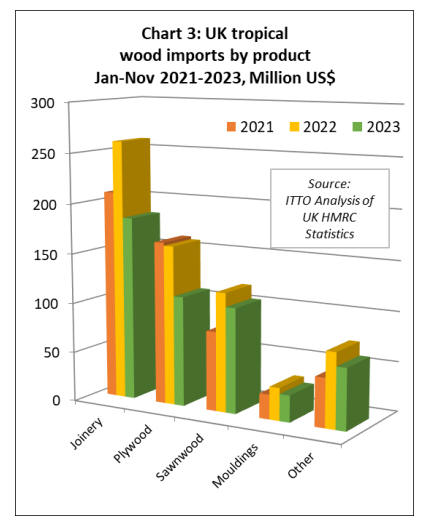

Total UK import value of all tropical wood products in

Chapter 44 of the Harmonised System (HS) of product

codes was US$488 million between January and

November last year, 25% less than the same period in

2022. In quantity terms imports decreased 10% to 268,000

tonnes during the period.

Compared to the first eleven months of 2022, UK import

value of tropical joinery products decreased 29% to

US$184 million, import value of tropical plywood

decreased 31% to US$110 million, import value of

tropical sawnwood decreased 12% to US$105 million, and

import value of tropical mouldings/decking decreased

18% to US$27 million (Chart 3 above).

UK switches to indirect imports of tropical sawnwood

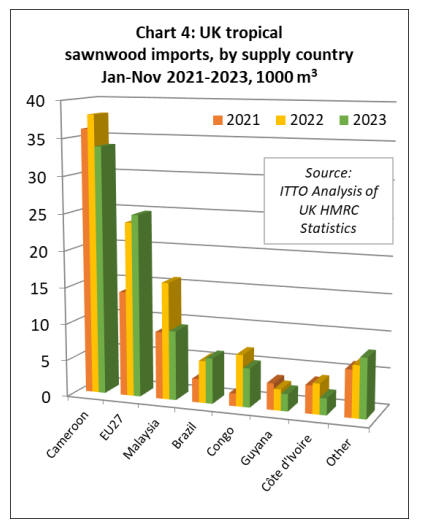

UK imports of tropical sawnwood were 92,346 cu.m in the

first eleven months of last year, 12% less than the same

period in 2022. Although UK imports of this commodity

held up reasonably well compared to other tropical

products in 2023, a larger share was sourced indirectly

from the EU rather than direct from the tropics (Chart 4).

The large majority of sawnwood sourced directly from the

tropics by UK importers now comes from Cameroon. UK

imports of tropical sawnwood from Cameroon were

33,800 cu.m in the first eleven months of 2023, 11% less

than the relatively high level in the same period in 2022.

UK tropical sawnwood imports from Malaysia, which

revived to some extent in 2022 after many years of

decline, fell by 41% in the first eleven months of 2023 to

just 9,500 cu.m. UK imports of tropical sawnwood from

Brazil were 6,200 cu.m in the first eleven months of 2023,

a gain of 8% compared to the same period in 2022.

Imports from all other leading tropical supply countries

declined including Republic of Congo (-25% to 5,300

cu.m), Guyana (-19% to 2,300 cu.m), and Cote d’Ivoire (-

45% to 2,300 cu.m).

Indirect UK imports of tropical sawnwood via the EU

were up last year despite the economic slowdown and

Brexit disruption, increasing 5% to 24,900 cu.m in the first

eleven months. To some extent, UK’s continuing

dependence on indirect imports of tropical sawnwood

from the EU is due to a shortage of kiln drying space in

African supply countries combined with lack of any

hardwood kiln drying capacity in the UK.

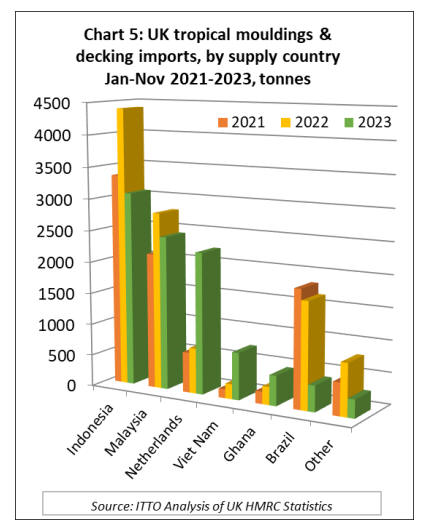

UK imports of tropical hardwood mouldings/decking fell

12% in the first eleven months of 2023 to 9,670 tonnes.

Imports of 3,100 tonnes from Indonesia were 30% less

than the same period in 2022.

Imports from Malaysia totalling 2,400 tonnes were down

13% during the same period. Imports of this commodity

group from Brazil were recorded just over 400 tonnes in

the first eleven months of 2023, 76% less than the same

period the previous year. In contrast, imports of

decking/mouldings increased three-fold from both the

Netherlands (to 2,200 tonnes) and Vietnam (to 750 tonnes)

(Chart 5).

Hardwood traders comment on “limp” UK market

Interviews with sawn hardwood traders in the UK by the

ITTO Correspondent sum up the prevailing market mood

as one of uncertainty and caution. One UK hardwood

importer-distributor described the market going into 2024

as ‘limp’. Another commented that there is plenty of stock

on the ground and no significant shortages. Sales volumes

were consequently down and margins ‘a bit squeezed’.

An importer-distributor said it’s been more a case of

managing the market rather than developing it. Forward

ordering is down and, freight rates are back on the rise.

“Generally, there’s no great consideration being given to

forward price in a quiet and nervous market,” they said.

They thought high mortgage rates were less an issue in the

hardwood market, given it is less dependent on new build.

“But customer confidence is an issue generally, with

people holding back on spending more widely, leading to

this slowdown.”

An importer felt that where continuing relatively high

interest rates were also impacting businesses was in

managing day-to-day trading. “We’re in a strong cash

position, but companies borrowing to buy stock must be

finding business more painful,” they said. They added that

their prime customer sector, joinery, had slowed. “Joinery

businesses are reporting volumes down and staircase

producers, in particular, are cooler due to projects being

delayed,” they said. African prices are reported to be

generally stable, although with iroko in tight supply and

firming and sapele, of which one importer remarked there

was plenty available, ‘tending towards softening’.

In TTJ’s recent tropical wood focus, one large tropical

supply company with operations in Africa and Latin

America said that in the slower global hardwood market,

they had cut back on African secondary tropical species. A

UK importer reported the same, although another said

lesser-known species still weren’t figuring highly in the

UK in any market conditions. “Despite environmental

arguments for using them, to take supply stress off more

widely used species and make sustainable forest

management more economically viable, they’re not part of

the customer conversation,” they said.

A project supported by the ATIBT is undertaking life

cycle assessment of tropical timber value added goods to

develop environmental product declarations (EPDs).

Called Dryades, the aim is to increase their appeal in

increasingly environmentally focused consumer markets.

And a UK importer said more of their African suppliers

were now providing EPDs. “It’s suppliers of lumber,

including sapele and utile, as well as engineered wood

products,” they said. “For most customers it’s probably a

nice to have rather than a must. But larger buyers like it

for corporate social responsibility reasons.”

The key topic raised with regards Asian hardwoods is

freight rate resurgence. The latest Drewry World

Container Index of $3,786 per 40ft container compares to

a low of $1,342 in October last year. While the index is

still well below the record of $10,377 set in September

2021 during the pandemic, it is 167% more than the

average 2019 (pre-pandemic) rates of $1,420. “And with

the Suez situation, plus some opportunism on the part of

shipping countries, rates are expected to increase further,”

said an importer-distributor.

Looking at North American hardwood supply, an

importer-distributor said that they had seen prices recently

‘firming modestly across the board’. The outlier was white

oak, which had jumped 10-15% in the last three months.

Some feel upward price pressure on the species may

continue.

Demand from the US barrel stave industry remains robust,

and, while Deloitte predicts just a modest rise in house

building, the Dodge Construction Network is forecasting

an overall increase in US construction starts of 7% in

2024. At the same time the US Federal Buy Clean

Initiative, says Deloitte, should underpin specification of

lower carbon construction materials, including timber.

Also expected to keep US hardwood prices firm, said an

importer, is ‘a lack of available logs going through the

system’.

“There are predictions of further consolidation among US

mills too, which could push up prices,” said an importer-

distributor. They attributed this continuing concentration

of the sector in part to generational issues. “It seems to be

small to medium size mills not having succession plans or

exit strategies,” they said. “The market was very turbulent

for the last 18 months, so it’s not easy to enter with

confidence.”

European oak prices and supply, say hardwood traders, do

not seem to have been significantly affected by European

embargoes on Russian and Belarusian imports, or supply

cutbacks from Ukraine due to the war. “There have been

no impacts that we’ve seen,” said an importer-distributor.

“If our [European oak] suppliers have, they’re not saying.”

“The European oak business remains generally stable,”

said another importer. “And we’ve heard rumours that

there is also still pre-conflict Russian timber on the

market. Where the war has had greatest impact is on larch,

but rather than increasing demand for more expensive

hardwoods and clears, customers are opting instead for

[treated] white wood.”

Demand for both temperate and tropical engineered wood

products is said to be increasing in the UK. One importer

distributor described their performance as positive,

although they still required ‘persistence, [more] product

knowledge and market identity.

Another said they were seeing engineered growth across

species, including in US white oak, European oak,

Uruguayan grandis and sapele. In the latter, however, they

felt African producers were over pricing. “We’re buying

our engineered sapele from Malaysian suppliers. They’re

still competitive despite shipping the lumber across the

world,” they said.

Modified wood is also in the ascendant again, thanks

largely to improvement in Accoya supply after expansion

work at the Arnhem production facility reduced output.

“We’re not back to previous peaks, but we’ve doubled

monthly sales compared to the low point during the

expansion,” said an importer-distributor.

On the UK hardwood sector’s radar too, of course, is the

EU Deforestation Regulation, which comes in for large

EU businesses at the end of this year and six months later

for SMEs. It covers all timber placed on the EU market

and EU exports, stipulating that operators and larger

traders undertake due diligence to ensure no goods are

implicated in deforestation and forest degradation.

That includes providing geolocation coordinates for the

individual “real estate properties” from which wood may

have been derived.

The general view is that there are still a lot of unknowns

about the EUDR and how it will impact on the UK. One

importer commented: “It will be interesting to see how the

UK navigates the volume of West African hardwood

which enters the market via trade kilns in the EU.”

Another raised the issue of Northern Ireland, which

remains in the EU single market, and whether timber

shipped there from Great Britain and not destined for

transhipment to the Irish Republic would need EUDR

conformance information.

Importers are also following developments in the US.

While the UK is now the largest European export market

for American hardwood, large volumes are also destined

for the EU, particularly to Italy, Germany, and Spain.

However, at least 70% of US hardwood supply derives

from private non-industrial forest owners, of which there

are over nine million with average holding size of no more

than 9 hectares.

A typical hardwood mill will purchase logs from several

hundred non-industrial owners each year and a completely

different set of small owners in the following, each

supplying a varied mix of species and grades in very small

quantities. This wood must pass through several stages of

aggregation, sorting, mixing, and processing to build

consignments of specific species, size, and grade to the EU

market. This makes provision of geolocation coordinates

for the origin of their timber particularly challenging.

Consequently, the American Hardwood Export Council

(AHEC) is working on a new procedure linking

comprehensive legality risk assessment with regular AI-

based analysis of satellite images and a chain of custody

standard to verify that US hardwood derives from

deforestation-free geolocations.

At present AHEC is only saying this is ‘potentially’ a

solution for EUDR conformance, given that EU regulators

will have to accept the approach. But, adds AHEC, it will

also enable US hardwood suppliers to make a ‘global

legality and deforestation-free claim’.

The general view of the UK hardwood sector is that 2024

will be challenging, with multiple significant issues to

keep tabs on. “Interest rates are still 5.25%, household

budgets are stretched, and government spend is down

across the board,” said one importer-distributor, “so we

need to be careful with inventory. Speculation can wait for

another day.”

Another agreed, saying the number of unknowns ahead

made forecasting tough, but with the high cost of money

and tight margins, smaller companies particularly could

find life challenging.

“We’ve done our budgets for 2024/2025 and see key

strategies for the year ahead as, of course, as maintaining

service levels, but also nipping at competitors’ market

share,” they said.

“We won’t be jumping out the window but nor putting out

the bunting.”

German forest industry takes issue with EUDR

In an open letter to the German Federal Government, the

German forestry and wood products sector argue that the

“the impending bureaucratic hurdles and high technical

requirements” of the EU Deforestation Regulation

(EUDR) “will prevent all market participants from

maintaining free access to the markets and small private

forest owners will be left behind”. They also complain that

“the documentation, digitisation and administrative effort

for large and medium-sized companies in the forestry and

wood industry will be disproportionately high in relation

to the benefit of the regulation”.

The challenge to the EUDR came in an open letter issued

by the Plattform Forst und Holz (PFH - Forest & Wood

Platform) on 26 January to the German Federal

Government “regarding the implementation of the EU

Deforestation Regulation” calling for “an unbureaucratic

and practical implementation of the Regulatory

Framework in German State, Private, and Municipal

Forests, as well as in the Wood Industry Operations”.

PFH is collaboration between the German Forestry

Council (DFWR) and the German Wood Industry Council

(DHWR) which represents the “common interests of the

Forest and Wood cluster as a wood industry chain from

the forest to the end product”. The letter notes that “with

an annual total turnover of €181 billion, 128,000

companies, and 1.1 million employees, wood-based value

creation plays a significant role in the economic strength

and employment in Germany, particularly in rural areas”.

The letter was addressed to three Ministers of the German

Federal government, respectively: Cem Özdemir, Minister

for Food and Agriculture; Steffi Lemke, Minister for

Environment, Nature Conservation and Nuclear Safety;

and Robert Habeck, Minister for Economic Cooperation

and Development. It was copied to all Members of the

Federal Government, Members of the German Bundestag,

and German Members of the European Parliament.

While welcoming in principle the EU's efforts to reduce

global deforestation to preserve biodiversity and achieve

climate goals, the PFH notes that “the practical

implementation of the EU regulation against deforestation,

especially the implementation and compliance with due

diligence, and the preparation of due diligence

declarations, will incur significant bureaucratic and

economic expenses.

This is particularly true for small private forests, forestry

associations, and the wood industry, as many of the

required pieces of information are not currently collected

and/or not available in digitized form”.

On the question of EUDR’s “proportionality”, the PFH

observes that “a comprehensive implementation of the

EUDR in member states with low deforestation risks will

not improve the global deforestation situation, as the

problem of illegal deforestation does not exist in these

member states”.

PFH goes on to suggest that “To maintain proportionality,

a differentiated implementation of the regulation should be

pursued, taking into account the deforestation risk of each

member state. An undifferentiated implementation of the

regulation leads to significant additional bureaucratic

overhead, unnecessary and avoidable concerning wood

production due to existing forest laws, widespread

functioning forestry administrations, and a high level of

voluntary certification in Germany”.

PFH suggest that “based on the current knowledge, a

rather bureaucratic and impractical implementation of the

regulation at the national level is emerging” and goes on to

formulate various of “points of criticism”. The first is that

in Germany the “protection of forests against damage and

illegal logging is already fully covered by established

control mechanisms”.

The second is that “compliance with the EUDR will fail

due to the lack of IT capabilities of smaller companies and

individual forest owners, thus excluding them from the

market”. PFH comment that “There are numerous forest

owners, especially in small private forests, and affected

wood companies that cannot currently implement the

requirements of the EUDR due to a lack of IT capabilities.

As a result, they will lose market access at the end of the

transition period. This will lead to the discontinuation of

the management of these forest areas”.

A third “point of criticism” is that “Contrary to the efforts

of the German government to reduce bureaucracy, the

national implementation of the EUDR will result in an

enormous bureaucratic burden. This affects not only forest

owners but also the federal states and the federal

government itself.

The effort required for data collection and entry, the

necessary human resources for documentation and control,

as well as the overall effort for the implementation of the

regulation, are not necessary in Germany and other

member states with a low deforestation risk. Additional

measures in these countries do not improve the global

deforestation situation”.

Another “point of criticism” is that the “trial run of

companies using the EU Information System (IS) reveals

significant deficiencies in technical implementation.

Several companies in the forestry and wood industry

participating in the test phase of the EU Information

System (IS) sent a clear signal: the technical

implementation as envisaged will not be feasible. The

system has major deficiencies in data input, processing

capacity and clarity.

The EUDR will lead to a large number of different raw

material sources in Germany resulting in a significant

number of initial declarations and reference numbers.

Only a fully automatic interface will be able to handle the

expected workload, especially for large companies”.

The PFH conclude “We urgently call on the Federal

Ministry of Food and Agriculture to advocate for a

differentiated implementation of the EUDR, avoiding

additional bureaucracy, ensuring that no forest owner loses

market access and is overwhelmed and preventing

additional control efforts for the forestry authorities of the

federal states. The practicality of the regulation is

currently not given. In this regard, we refer to similar

statements from other EU member states”.

“A country demonstrating no objections in the last 10

years regarding the main objective of the EUDR, namely

preventing illegal deforestation, should be exempted from

implementing the corresponding processes. In our view,

this ensures the necessary WTO conformity while

avoiding unnecessary bureaucracy and associated costs”,

according to PFH.

To support their proposal, PFH observe that “Germany,

with 11.4 million hectares, is one-third forested and the

wood stock in the country's forests is larger than in any

other European Union (EU) country. For decades, the

forest area in Germany has been steadily increasing,

secured by proven sustainable forest management, existing

federal and state forest laws, and various certification

systems (80% of the forest area is certified).

Normative, legal, and voluntary restrictions exist,

ensuring effective sustainable forestry without

deforestation and forest damage in Germany, thus securing

the provision of ecosystem services in the long term”.

|