Japan

Wood Products Prices

Dollar Exchange Rates of 10th

Feb

2023

Japan Yen 149.18

Reports From Japan

Investment

in real estate at a five-year low

Uncertainty on when interest rates will change is

discouraging foreign funds and businesses from investing

in the real estate sector such that total investment was at a

five-year low in 2023. Foreign investment in Japanese real

estate fell around 30% to US$6.7 billion in 2023.

Investors worry that, once interest rates start rising,

borrowing costs will increase and squeeze returns on

property investments. With Japan's real estate market seen

nearing its peak, investors are now moving to lock in

profits.

See:

https://asia.nikkei.com/Business/Markets/Property/Japan-real-estate-loses-shine-with-foreign-investors

Tokyo Metropolitan Government-sponsored Wood

City

Wooden buildings are being built across Tokyo as

investment grows in high-tech construction timbers to

replace steel and concrete-based mid-rise and high-rise

buildings. Examples can be found in the AEAJ Green

Terrace, which was awarded the ‘Grand Prize’ in the

Tokyo Metropolitan Government-sponsored Wood City

Tokyo Model Architecture Awards.

AEAJ Green Terrace was designed by Kengo Kuma who

also designed Japan’s 2020 Olympic stadium. The Green

Terrace is 3-storey hybrid building.

According to Kuma, the complex timber structure made

from cedar and cypress “reflects the very essence of the

building’s mission – promoting well-being through the

power of aromas”.

See:

https://www.designboom.com/architecture/kengo-kuma-aeaj-green-terrace-tokyo-japan-02-08-2024/

Sharp drop in ‘real’ wages

Ministry of Internal Affairs data show household spending

in Japan fell in 2023 for the first time in three years.

Families cut back on food purchases in the year as

inflation drove up prices from 2022.

Japan's real wages dropped 2.5% in 2023, the second

straight year of decline as salary increases failed to keep

up with inflation. The decrease in real wages, the sharpest

since a 2.8% decline in 2014 when the country's

consumption tax was raised to 8% from 5%, came despite

repeated calls by the Prime Minister for wage increases.

The continued drop in real wages came even after major

Japanese companies raised wages by 4% on average last

year, the biggest increase in 31 years, indicating the move

has not spread to smaller enterprises, which hire nearly

70% of workers.

See:

https://www.investing.com/analysis/japanese-yen-extends-losses-spending-and-income-next-200645799

and

https://www3.nhk.or.jp/nhkworld/en/news/20240206_16/

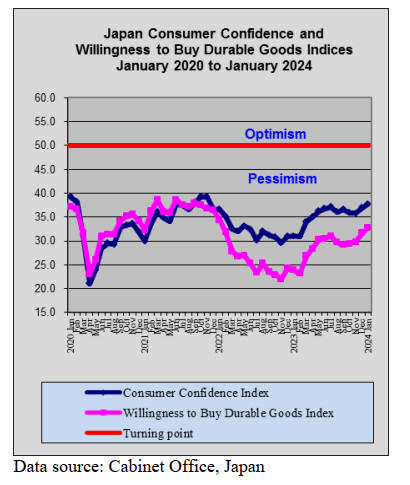

Four straight months of rise in consumer confidence

index

Japan's consumer confidence improved in January for the

fourth straight month, hitting its highest level in over two

years as high consumer prices began to steadily ease. The

index indicates consumers' economic expectations for the

next six months with a reading below 50 suggesting that

pessimists outnumber optimists.

In light of the trend in consumer confidence the Cabinet

Office upgraded its assessment of sentiment saying

consumer confidence is "improving. In December, it said

it continues “to pick up”.

Among the survey's four components, consumers'

assessment of livelihoods grew to 36.5 following a 1.6

point rise in December, while their readiness to buy new

durable goods increased 1.4 points to 32.8 from the

previous month. However, both indices are below 50.

See:

https://mainichi.jp/english/articles/20240131/p2g/00m/0bu/046000c

Price increases lift profits for big companies

The domestic press has reported net profits for listed

Japanese manufacturers grew more than 20% year on year

between April and December last year mainly on the back

of price increases and strong auto and machinery sales,

especially to the US. Of the 285 listed companies, 52%

increased profits, up from 47% in the same period of 2022.

Net profits grew at 56% of food makers, 21% in non-

ferrous metals and 3% in electrical machinery.

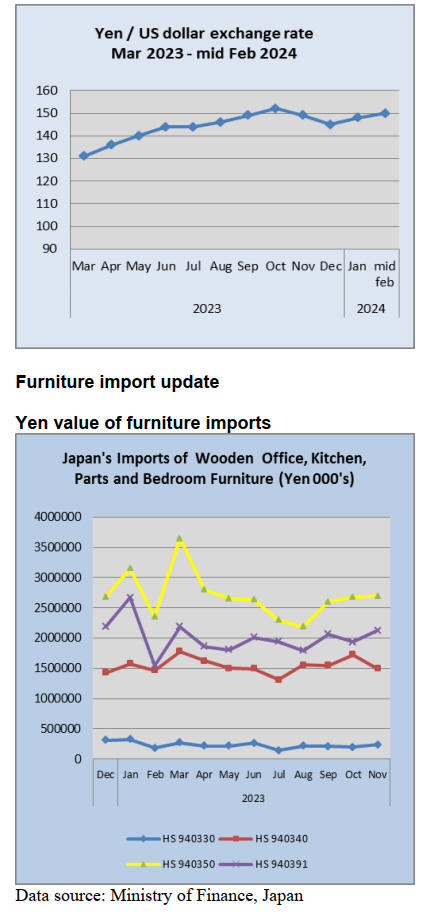

The average exchange rate during the period was about

143 yen to the dollar, a depreciation of around 7 yen,

which also contributed to improved yen incomes but price

increases were a major factor. On the flip side, companies

with significant sales to China are struggling as investment

and consumer spending is falling.

See:

https://twitter.com/NikkeiAsia/status/1756827754043949099

Hints of action to stem fall in yen exchange

rate

Japan's Masato Kanda, Vice Minister of Finance for

International Affairs said appropriate action will be taken

on the exchange rate if the authorities see the fall in the

yen will undermine the economy.

He added "recent currency moves are rapid. The yen has

weakened by nearly 10 yen over the period of one month

or so and such a rapid move is not good for the economy,".

See:

https://asia.nikkei.com/Business/Markets/Currencies/Japan-will-take-appropriate-actions-on-forex-if-needed-Kanda-says

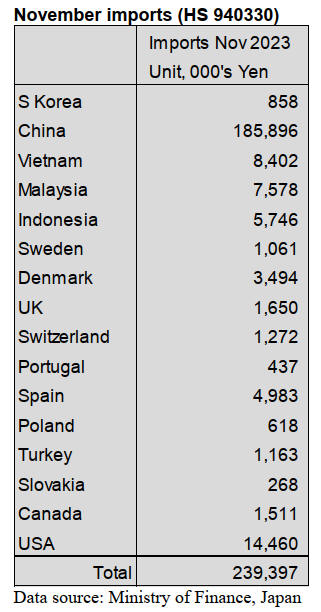

November wooden office furniture imports (HS

940330)

China remained the top supplier of wooden office

furniture in November followed by the US which tilted

shipments from Vietnam into third place. The value of

shipments from China recovered from the slight drop

recorded in October with November shipments accounting

for around 78% of all wooden office furniture imports in

the month.

Malaysia and Indonesia were the two other main

shippers

in November and accounted for 2-3% of monthly imports.

Year on year, the value of November imports of wooden

office furniture was down 28% marking the third straight

year on year decline, however, compared to October there

was an over 20% rise in the value of November imports.

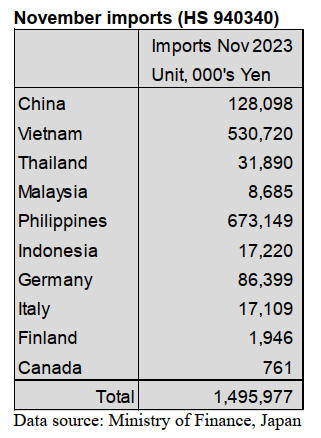

November kitchen furniture imports (HS 940340)

In November there was a year on year drop of around 14%

in the value of wooden kitchen furniture, there was also a

similar decline in the value of imports compared to

October, the first dip in imports since July.

As in previous months shippers in the Philippines

(45% of

total imports) and Vietnam (35% of total imports) together

accounted for most of Japan’s imports of wooden kitchen

furniture.

In November the top three shippers were the Philippines,

Vietnam and China (8% of total imports). Of the other

shipper,s Germany and Italy topped the list.

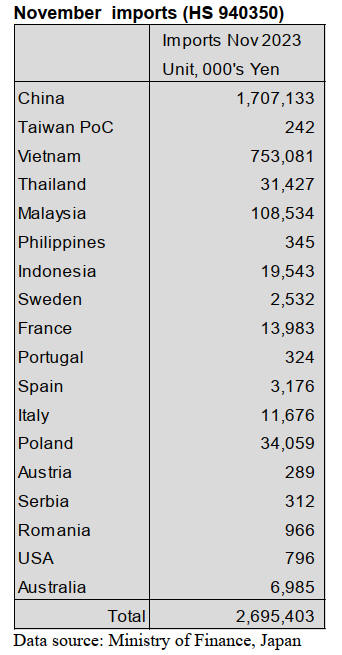

November wooden bedroom furniture imports

(HS 940350)

After the steady decline in the value of wooden bedroom

furniture in the first half of 2023, beginning in September

there was a sharp recovery and the upward trend continued

with November imports trending slightly higher than in

October and around the same level as in November 2022.

In November, China and Vietnam, once again, secured

their spot as the first and second ranked shipper in terms of

the value of imports. Shipments from China, at 63% of

total imports values, were up compared to October but, at

28% of the total value of November arrivals, shipments

from Vietnam were down.

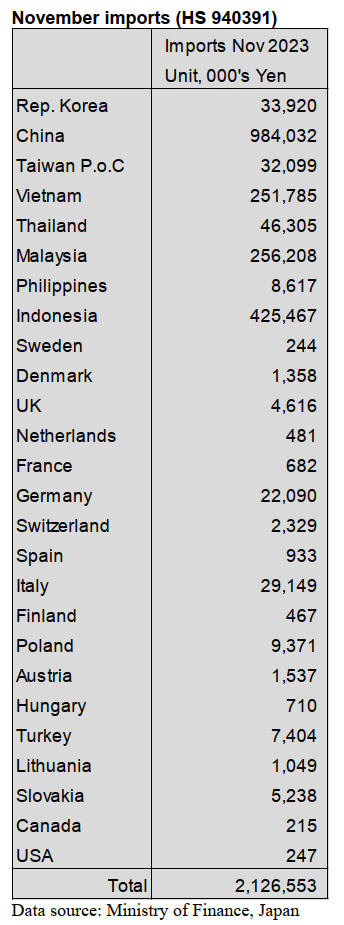

November wooden furniture parts imports (HS 940391)

The sources of wooden furniture parts are very diverse,

more so than with imports of assembled furniture. In

November shippers in China accounted for 45% of the

value of Japan’s wooden furniture parts imports followed

by Indonesia at 20% and Malaysia and Vietnam at around

12% each.

Since mid 2023 there has been a slight upward trend

in the

value of wooden parts imports. While year on year the

value of imports has not moved compared to a month

earlier November imports were up around 10% and this

builds on the gains seen in the previous few months.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

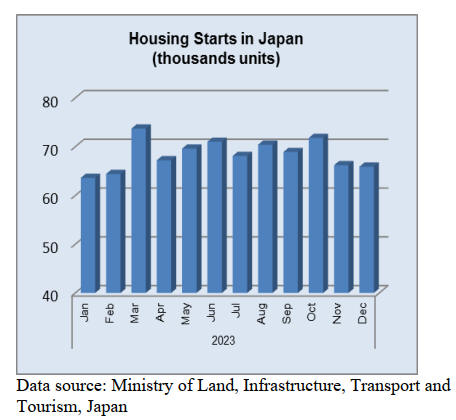

Volume of composite wood flooring in 2023

According to Japan Acoustic & Laminated Flooring

Manufacturers Association, the product and the sales

amount of composite wood flooring in 2023 decrease from

2022. The product is 17,824,000 tsubo, 8.8 % down from

the previous year.

Shipment is 18,332,000 tsubo, 5.9 % down from the

previous year. For surface dressed lumber, a ratio of sheet

is 76 %, 1 point up from last year.

The produce and the sales amount of composite wood

flooring decrease as the new starts decrease. Also, the

price of a house increased so one-story house was more

popular than a house. Monthly product of composite wood

flooring does not exceed the result of every month last

year. Monthly sales amount of composite wood flooring

exceeds only March, 2023.

The product of OEM exceeds the previous year’s result.

The product of MDF and imported plywood is around the

previous year’s level. The sales amount of MDF and

domestic plywood occupies 40 % of the total sales amount

of 2023 but this is 2 points less than 2022.

On the other hand, the sales amount of MDF and imported

plywood occupies 26 % of the total sales amount of 2023

and this is 2 points up from 2022. The price of hardwood

lumber has been increasing in the world and the weak yen

influences the purchase price.

The sales amount of soundproof floor LL45 occupies 80 %

of the total sales amount of 2023. The sales amount of

soundproof floor LL40 is 95,000 tsubo, 3.6 % down from

the previous year. LL45 is 1,967,000 tsubo, 2.1 % up from

the previous year. LL50 is 17,000 tsubo, 10.3 % more than

the previous year. Soundproof floor for non-housing

buildings is 76,000 tsubo, 28.6 % less than 2022

100 % cypress plywood

Japan Kenzai Co., Ltd. in Tokyo Prefecture and Nisshin

Co., Ltd. in Tottori Prefecture had developed 4 mm

cypress plywood together. All layers of this 4 mm cypress

plywood are cypress layers. They started selling this new

cypress plywood at 98 business offices in Japan as of

February, 2024.

The new cypress plywood is able to be used for interiors

and foundations. The size cypress plywood is 4 mm 3 x 6.

The cypress plywood has 3 layers. The quality of 4 mm

cypress plywood is as same quality as imported plywood.

The new plywood is able to be used for padded floors.

The companies accept small lot orders. Usually, the 4 mm

imported plywood is sold by 350 sheets as a pack but the

companies sell 140 sheets as a pack.

Japan Kenzai and Nisshin had developed 5.5 mm plywood

together in 2021 and there had been a lot of demand for

4.4 mm plywood so they started developing 4.4 mm

plywood. The new cypress plywood is an eco-friendly

product. Also, carbon stocks will be printed on bills.

The companies will promote on using more domestic

lumber and will expect to contribute circular forest and

regions.Since the foreign exchange is unstable, it is hard to

estimate the costs. Purchasing domestic plywood instead

of imported plywood will reduce risks of costs.

Orders for house builders

New orders for house builders in Decembe, 2023 exceed

December 2022’s result. Ther reasons are that the selling

price of houses had increased and there is more orders for

non-housing buildings than houses. A number of custom-

built houses is low. Orders for unit built for sale,

apartment buildings and renovation of a house are firm.

Some house builders feel that the orders for houses are not

recovered yet. On the other hand, another house builder

had good results because they held housing events in last

autumn. Also, the house builders explained to customers

that the Japanese government increased the budget of 2024

for purchasing houses. However, the customers still

hesitate to purchase houses. There is a possibility that the

custom-built housing market will be a tough situation in

2024.

The results of unit built for sale at many house builders

exceed custom-build houses in December, 2023 and the

results in December, 2022. Many house builders will keep

strengthen their unit built for sale business.

The house builders promote saving energy and high-

performance of apartment buildings and the price of

apartment buildings has raised.

Energy-efficiency renovations, which reduce utility

expenses, are popular than renovations of exteriors.

However, there will be a support for renovations of

exteriors from the Japanese government so major house

builders will strengthen in recommending renovations of

exteriors to the customers.

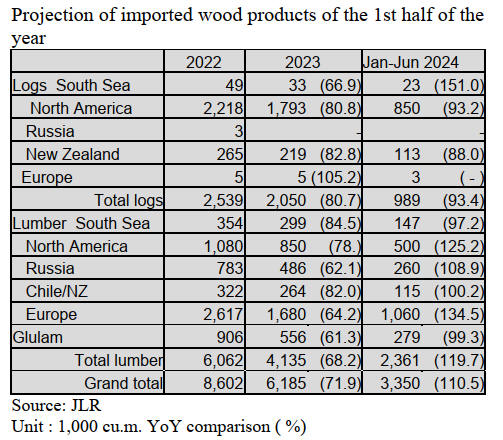

Projection wood product of imports

The Japan Lumber Importers Association disclosed

projection of imported wood products for the first half of

2024. Volume of logs will decrease as same as the first

half of 2023. Volume of lumber will rise.

Total volume of logs and lumber will be 10 % more than

the first half of 2023. However, volume of logs will

decrease by 6 % and volume of lumber will rise by nearly

20 %.

Volume of North American logs and NZ logs will occupy

97 % of the total volume.

Consumption of Douglas fir logs at Chugoku Lumber Co.,

Ltd. will be 30 % lower than before due to the fire

occurred at one of Chugoku Lumber’s plants in August,

2023. This situation would influence the volume of

Doulgas fir logs in the first half of 2024.

Japanese lumber companies would use cedar logs instead

of NZ logs because the price of NZ logs for China had

increased and then also the price had increased for Japan.

Volume of South Sea logs will be limited because supply

environment in South Asia is not good and also

consumption of South Sea logs in Japan is small.

Volume of lumber will increase because it was very

small

volume in the first half of 2023. The reason is that

Japanese importers did not purchase a lot of imported

lumber due to the end of the woodshcok. European lumber

will be 35 % up.

|