Japan

Wood Products Prices

Dollar Exchange Rates of 25th

Jan

2023

Japan Yen 148.16

Reports From Japan

No change in Bank of

Japan policy

As anticipated the Bank of Japan (BoJ) left its negative

policy rate unchanged due, in part, to uncertainty over how

the magnitude 7.6 earthquake that struck Ishikawa

Prefecture on 1 January will impact the economy.

Observers are closely watching for when the BoJ will start

exiting negative rates and get Japan back and in cinque

with the rest of the world.

See:

https://asia.nikkei.com/Economy/Bank-of-Japan/BOJ-chief-vows-to-limit-disruption-after-raising-policy-shift-hopes

Relief as cost of imports decline

Japan’s customs-cleared trade deficit halved from the

previous year to yen 9.29 trillion in 2023 after lower

resource prices pulled down the value of imports

according to the Ministry of Finance Ministry. Japan

reported a trade deficit for the third straight year but the

2023 deficit was down from the yen 20.3 trillion in 2022.

In 2023 imports dropped 7.0% as imported energy costs

fell.

See:

https://japannews.yomiuri.co.jp/business/economy/20240124-164306/

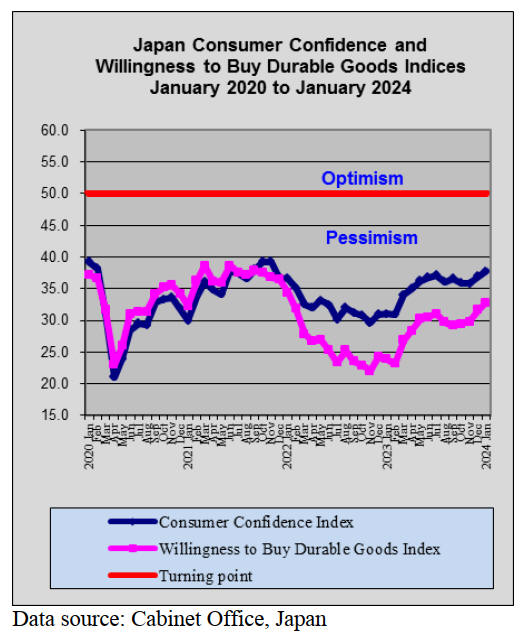

OECD calls for boost in productivity

A press release from the OECD points out that

Japan’s economy has recovered from

the Covid pandemic but faces new

challenges from weak global trade prospects. Saying,

policy should now focus on ensuring fiscal

sustainability, boosting productivity growth and

addressing the economic and social impacts

of rapid population ageing. The latest OECD Economic

Survey of Japan says that GDP grew by 1.9% in

2023 and will continue to steadily grow by 1.0% in 2024

and 1.1% in 2025, mostly driven by domestic demand as

global uncertainty weighs on external demand.

Consumer price inflation is projected to slowly come

down to 2.6% in 2024, from 3.2% in 2023 and stabilise

at 2% in 2025 as government subsidies end and wage

growth gains traction.

The positive outcome of the 2023 wage negotiations, the

highest in three decades, points towards a virtuous

cycle where rising prices contribute to growing wages and

consumption.

The OECD warned that uncertainty around Japan’s

inflation outlook was “exceptionally large.” While a

slowdown in the global economy could weigh on wages, a

tighter labour market could lead to higher-than-projected

wage growth, it said.

Capital spending trending lower

Capital spending by the private sector is one of the key

drivers of Japan's economy and a major indicator of

business confidence. According to Cabinet Office data

machinery orders fell 4.9% in November from the

previous month underscoring the uncertainty about

domestic and global economic outlook.

Year-on-year, core orders, which excludes shipping and

power utilities, declined 5.0% versus a forecast for 0.2%

growth. In response the government retained its view that

machinery orders had "stalled" for 13 straight months.

Orders from manufacturers fell 7.8% in November from

the previous month, pulled down by a drop in orders for

general-purpose production machinery.

See:

https://www.japantimes.co.jp/business/2024/01/18/economy/japan-machinery-orders-fall/

Rate of inflation slowing

According to the Ministry of Internal Affairs and

Communications, the consumer price index in Japan

climbed 3.1% in 2023 marking its biggest gain since 1982.

The rise was largely caused by rising food costs and the

high cost of imports because of the weakening yen

exchange rate.

The December's data showed a slight slowing in the pace

of inflation as the pace of cost domestic logistics and

labour costs eased. The inflation data is in support of

government calls for businesses to raise wages.

See:

https://japannews.yomiuri.co.jp/business/economy/20240119-163039/

In related news, a private think tank estimates Japanese

companies will need to raise wages by around 4% this

year to keep real wages from falling, this will be tough for

smaller businesses struggling to pass on higher costs to

customers. Year on year, November nominal wages

increased by just 0.2% according to the Ministry of

Health, Labor and Welfare while. Consumer prices rose by

3.3% over the same span, resulting in a 3% decline in real

wages. The wage increase for companies with 1,000 or

more employees in 2023 was 3.6%, according to the

Minstry.

https://asia.nikkei.com/Economy/Japan-s-pay-needs-to-grow-3.6-to-outpace-inflation-think-tanks-say?utm_campaign=GL_JP_update&utm_medium=email&utm_source=NA_newsletter&utm_content=article_link

Business federation says businesses have a social

responsibility to raise wages

Business executives and union leaders across Japan have

begun wage negotiations for the new fiscal year. High

price inflation and strong corporate earnings has raised

hopes for major pay increases.

The Japan Business Federation (Keidanren) recently held

its annual labour and management meeting at which the

chairman, Masakazu Tokura, said that companies "have a

social responsibility" to raise wages so they keep up with

inflation.

The Japanese Trade Union Confederation (Rengo) wants

at least a 5% increase for its members this year. Last year's

wage negotiations resulted in an average wage increase of

about 3.6%, a 30-year high.

See:

https://mainichi.jp/english/articles/20240125/p2a/00m/0op/008000c

Two months needed to assess quake damaged homes

Work has started on assessing the damage caused to

homes by the powerful Noto Peninsula Earthquake in

Ishikawa Prefecture. The assessments are required for the

issuance of a disaster victim certificate which is used to

calculate the amount of financial support the central

government and others will provide to victims of the

disaster.

About 30,000 buildings in Wajima alone need to be

assessed, a process which the city government estimates

will take two months to complete.

According to the prefectural government, it has

determined (as of 19 January) that 29,489 homes in

Ishikawa had been damaged. This does not include homes

in Wajima and Suzu, the two cities that experienced the

worst of the earthquake.

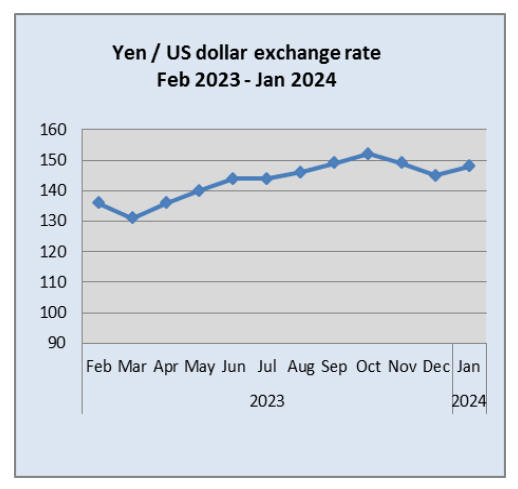

Yen continues to weaken

Towards month end the US dollar fell against the Japanese

yen after the Bank of Japan maintained its ultra-easy

policy as expected but signaled an April exit from negative

interest rates.

However, the dollar then gained against the yen. The yen

exchange rate is sensitive to differentials between Japan

and other major currencies and has lost nearly 5% against

the dollar this year.

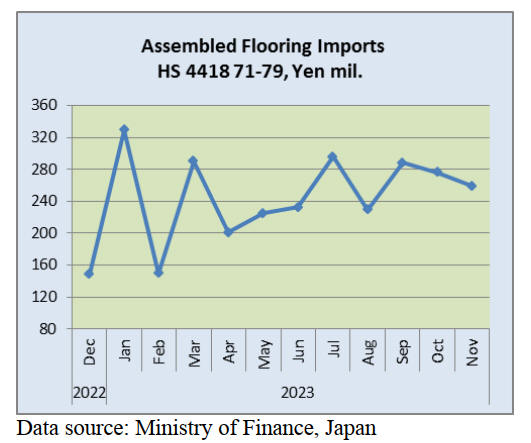

Import update

Assembled wooden flooring imports

In November the main category of assembled flooring

imports was HS441875 accounting for just over 70% of

the total value of assembled flooring imports. The second

largest category in terms of value was HS441879.

The main shippers of HS441875 in November were China

42%, down slightly from a month earlier, Malaysia (8%)

along with Austria and Lithuania also at around 8% each.

The value of Japan’s November imports of assembled

flooring (HS441871-79) dropped slightly (6%) compared

to the value of October arrivals. Year on year the value of

November assembled flooring imports rose around 7%.

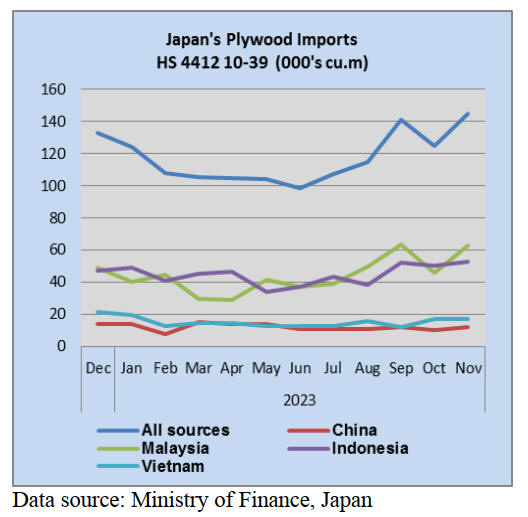

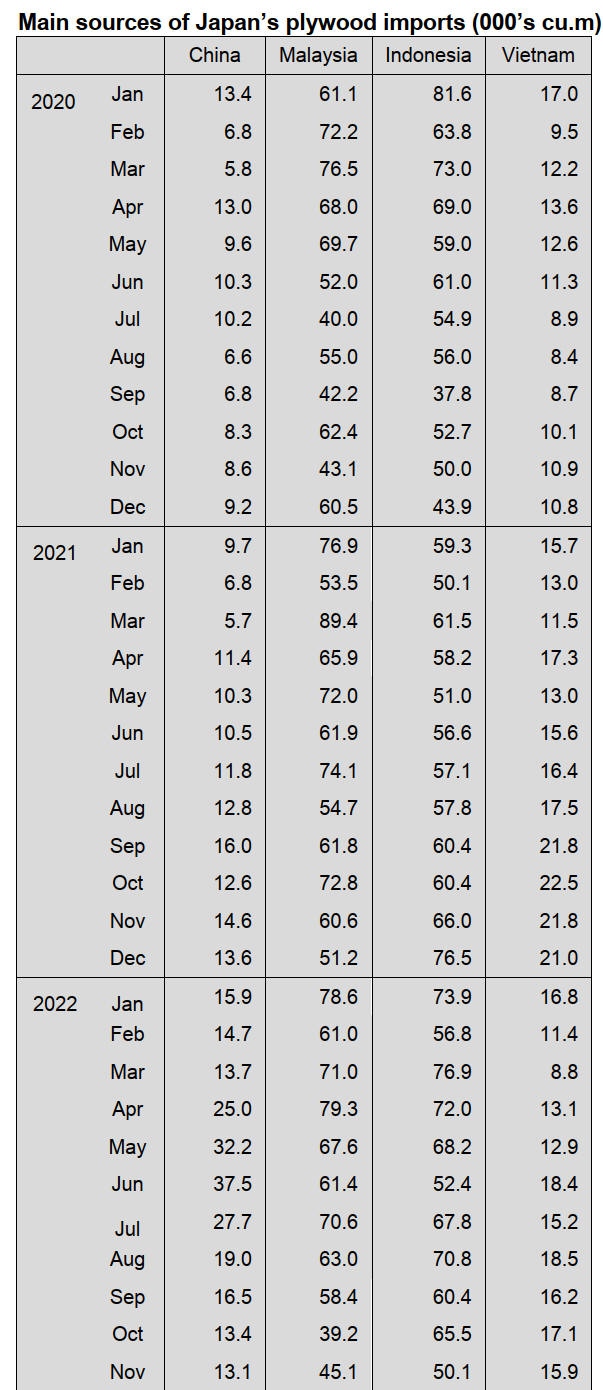

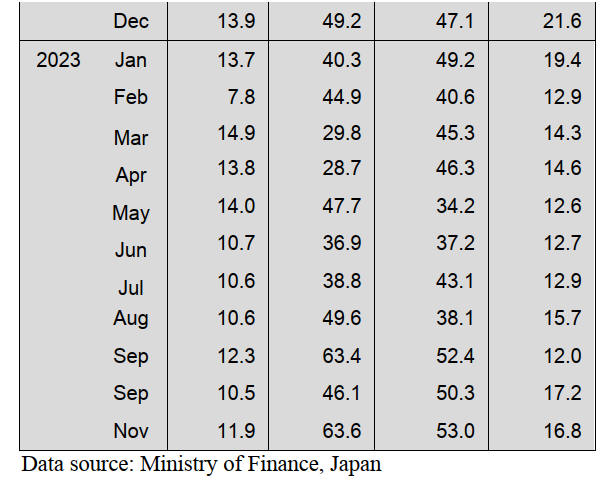

Plywood imports

There was a sharp turn-around in the volume of plywood

imports in November. Compared to a month earlier

November imports were 16% higher than in October and

year on year November import volumes jumped 15%.

Of the two main shippers, Malaysia and Indonesia, it was

only Malaysian shippers that scored in November and

Malaysian exports in November were almost entirely the

reason for the jump in monthly import volumes.

The volume of imports from Indonesia, Vietnam and

China in November were little changed from a month

earlier.

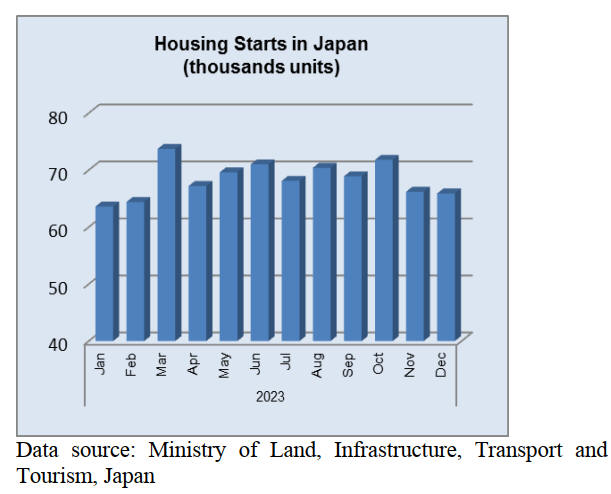

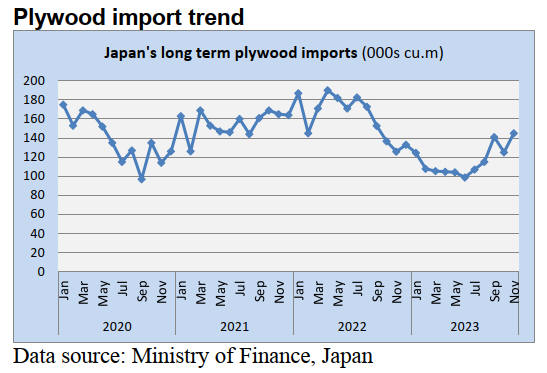

Plywood imports began to recover in 2021 and were fairly

consistent in the first half of 2022 but the combined effect

of the weak yen and a dull housing market resulted in a

slowing of imports, a trend that continued until mid 2023.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Domestic logs and lumber

Movement of domestic lumber settled down after the New

Year holiday. Usually, movement of domestic lumber is

very slow in January to March due to low demand.

An operating rate at some precutting plants has decreased

by 60 – 70 %. Then, there were not a lot of inquiries at

lumber markets. Demand and supply for logs in the

northern part of Kanto region are balanced now. KD cedar

post was around 65,000 yen, delivered per cbm in

December, 2023 and the price is 63,000 – 65,000 yen,

delivered per cbm now except Western Japan. KD cedar

stud is around 65,000 yen and this is leveled off.

Cypress sills and cypress logs were 85,000 yen in

December, 2023 and they are 80,000 – 85,000 yen now.

Demand and supply for logs and lumber are different in

several areas in Japan. For example, there are a lot of

inquiries for cypress lumber instead of Douglas fir lumber

in Kyushu region and Chubu region. However, there are

not enough cypress logs.

In Shikoku region, cypress logs are popular and the price

of 4 m cypress log is around 25,000 yen. Cedar logs used

to be around 10,000 yen but the price of 3 m cedar logs is

around 12,000 yen. 4 m cedar logs are around 15,000 yen.

The price of cypress logs is around 22,000 yen in

Kumamoto Prefecture and this price decreased from

26,000 yen last autumn. 3 m cedar log is around 17,000

yen. The price of 3 m cedar log in the northern part of

Kanto region is around 16,000 yen.

In related news, a supplementary budget for

measures of

afforesting forest with less pollen is six billion yen and

one of measures becomes clear.

The measure is to support forest owners to

outsource

logging and transplanting to forestry organizations. Also,

the Ministry of Agriculture, Forestry and Fisheries will

deliver promotion expenses for transplanting to forest

owners.

Plywood

There was shipment of domestic softwood plywood from

trading companies and wholesalers during last autumn till

the end of 2023. On the other hand, shipment of structural

plywood is bearish. 12 mm 3 x 6 structural plywood is

1,450 – 1,480 yen, delivered to wholesalers per sheet and

it is 20 yen lower than the previous month. A decrease in

the price settled down. Also, consumers hesitate to request

the plywood companies in Ishikawa Prefecture to lower

the price because there was a huge earthquake in January,

2024 and plywood plants are unable to produce plywood.

Some South Asian shippers raised the price of South Sea

plywood because the log price has been rising in South

Asia. 2.4 mm 3 x 6 plywood is around US$950, C&F per

cbm. 3.7 mm plywood is around US$880, C&F per cbm.

5.2 mm plywood is around $ 850, C&F per cbm. Form

plywood is around US$580, C&F per cbm. Structural

plywood is US$500– 570, C&F per cbm. 12 mm 3 x 6

painted plywood for concrete form is US$670 – 680, C&F

per cbm. The prices are almost the same prices from last

month.

Since the yen had depreciated against the dollar until last

autumn, Japanese sellers expect to raise the price of South

Sea plywood.

However, once, the yen appreciated to 140 yen against the

dollar in December, 2023 and the movement of domestic

softwood plywood was bearish so it is difficult for

distributors to raise the price. 2.5 mm plywood is 780 yen,

delivered to wholesalers per sheet. 4 mm plywood is 1,000

yen, delivered to wholesalers per sheet. 5.5 mm plywood

is 1,200 yen, delivered to wholesalers per sheet.

Structural plywood is 1,800 yen, delivered to wholesalers

per sheet. 12 mm 3 x 6 painted plywood for concrete form

is 1,990 – 2,000 yen, delivered to wholesalers per sheet.

The receipt of South Sea plywood has been declining since

last year and the inventories at ports in Kanto area has

been declining. Some items are in short supply but some

trading companies or distributors are unable to order a

large amount of South Sea plywood. One of reasons is that

fiscal year-end is in March.

South Sea log and products

The price of South Sea logs in South Asia is still high. One

of the reasons is that a plywood company in Sarawak,

Malaysia reduced cutting down the trees. South Sea

lumber made in Japan is used as blocks for mainly steels

or shipbuilding. Consumers need durable South Sea

lumber such as Keruing to hold heavy materials.

The yen appreciated against the dollar at the end of 2023

and some Japanese distributors purchase South Sea lumber

and Chinese lumber.

However, Japanese distributors did not purchase a lot of

lumber because demand in Japan has been still low.

Merkusii pine lumber isUS$770 – 780, C&F per cbm in

Indonesia. Red pine lumber is US$790 – 820, C&F per

cbm in China. This is US$20 – 30 higher than the previous

time.

Chinese sellers will raise the price because there will be a

Chinese New Year holiday in the beginning of February,

2024. Since the rupiah is weak, Indonesian sellers are

unable to raise the price even though they expected to.

There has been some inquiries for decks. The inquiries for

truck bodies have been still firm.

North American logs

Trading companies and distributors in Japan are unable to

grasp the situation for the correct import cost of Doulgas

fir logs. Demand for Douglas fir lumber has been sluggish

in Japan and also there has been less inquiries for Douglas

fir lumber.

Usually, demand for all kinds of lumber in Japan is very

low in February and March so the distributors do not buy a

lot of lumber. In this season, consumers bought domestic

lumber or European lumber instead of Douglas fir lumber.

Radiata pine logs and lumber

Radiata pine logs shipped to Japan in December, 2023

from New Zealand are $ 170 – 175, C&F per cbm. This is

US$10 higher than November, 2023. According to the

Japanese importers, the log price wasUS$15, C&F per

cbm higher than the previous time but the freight declined

slightly from the previous time. That is the reason for $ 10

up.

The log price for Chin is around $ 130, C&F per cbm and

this is US$5 – 10, C&F per cbm higher than last time so

shippers in NZ were very aggressive about the price hike

to Japanese importers.

The negotiation for radiata pine lumber from Chili in

February, 2024 ended in the middle of January, 2024. Thin

boards and squares areUS$350 – 355, C&F per cbm and

the prices are stabilized from last time. Wholesalers in

Japan decided not to raise the price because the price of

radiata pine lumber is unchanged from last time and the

yen appreciated against the dollar temporary.

|