|

Report from

North America

US imports slowed again in November

US imports of tropical hardwoods and related products

slowed once again in November as imports in most

categories headed into the final month of 2023 well behind

their 2022 pace.

Imports of sawn tropical hardwood fell in November to

their lowest volume in more than two years; imports of

hardwood plywood declined by 14%; hardwood veneer

imports fell 18% and hardwood flooring imports fell by

12%.

The news was not all bad as imports of assembled flooring

panels rose by 6% and wooden furniture imports were able

to stay elevated after a sharp October gain, shedding less

than 2% in November.

Imports have been trending downward for much of the

year leaving US imports of sawn tropical hardwood,

hardwood plywood, hardwood moulding and assembled

flooring panels all at 30% behind 2022 imports through

November.

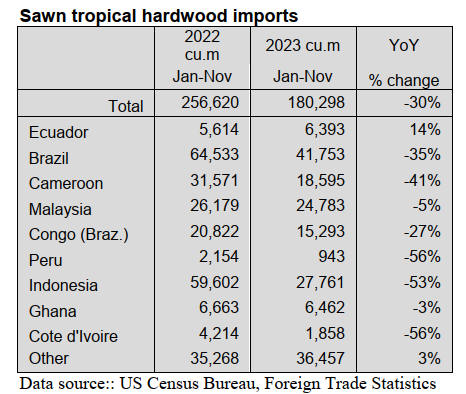

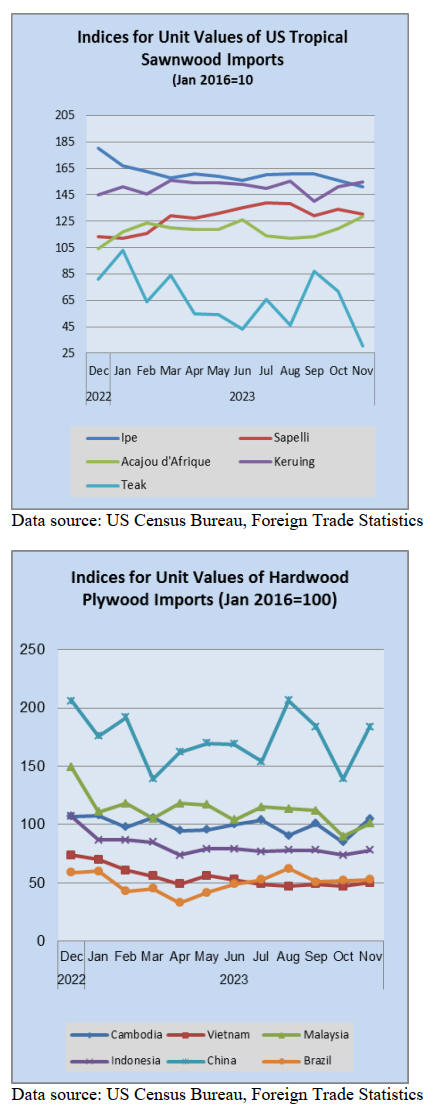

Imports of sawn tropical hardwood hit yearly low

US imports of sawn tropical hardwood fell to their lowest

volume in over two years in November. The 12,022 cubic

metres imported in November was 30% less than the

previous month’s total and 35% less than that of

November 2022. Imports from top suppliers Brazil,

Indonesia, and Cameroon all fell by more than 50%.

Imports of Mahogany and Cedro showed gains while

imports of all other tropical hardwoods retreated. For the

year so far, Keruing imports are up 5% over last year

while all other woods are trailing last year’s pace.

Versus 2022, imports of Ipe are down 48%, imports of

Sapelli are behind 21%, and imports of Acajou d’Afrique

are off 46%. Through November, US imports of sawn

tropical hardwood are down 30% versus 2022 totals.

Canadian imports of sawn tropical hardwood fell 20% in

November to a level 36% below that of the previous

November. Imports from Congo/Zaire dropped by 84%

while imports from Bolivia were up by 138%. Total

imports for the year so far are down 18% versus 2022.

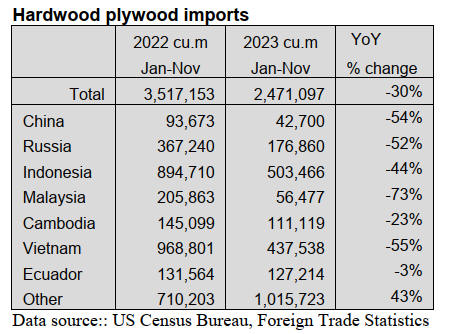

US hardwood plywood imports retreat

Following an October surge, US imports of hardwood

plywood fell 14% in November. Despite the decline, the

275,890 cubic metres of plywood imported in November

was 25% higher than the volume of wood imported in

November 2022. Imports fell from nearly all major

trading partners including Indonesia (down 31%), Russia

(down 60%), and Vietnam (down 7%).

This year has seen weakening volume from nearly all

major suppliers as the US has turned to other countries for

its hardwood plywood needs.

With only December’s data outstanding, imports from

China, Russia, Malaysia, and Vietnam for the year to date

are all less than half of what they were at this time last

year. Meanwhile, imports from countries other than the

chief supplying countries are up 43% for the year so far.

Total US hardwood plywood imports are down 30%

versus 2022 through November.

US veneer imports fall 18%

Imports of tropical hardwood veneer for November were

35% below that of imports for November 2022. Imports

fell 18% in November from the previous month as

shipments from countries that have made gains so far this

year began to tail off.

While imports from Cameroon, Cote d’Ivoire, Ghana, and

China are all up significantly for the year so far, imports

from each of these countries declined sharply in

November with imports from China and Cote d’Ivoire

each falling by more than two thirds.

Meanwhile, imports from Italy and India are trending in

the exact opposite fashion. Italy and India in recent years

have been the top suppliers of tropical hardwood veneer to

the US but imports from the two countries are down for

the year by 75% and 21%, respectively.

In November, imports from Italy rose 72% while imports

from India were up 432%. Overall US imports of tropical

hardwood veneer are down 5% for the year through

November.

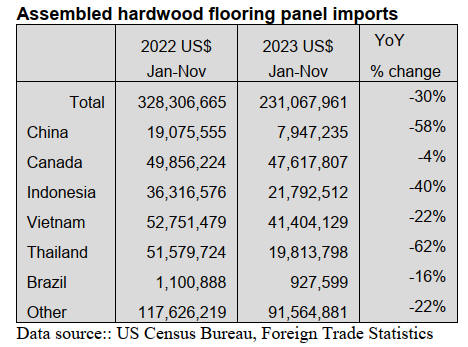

Hardwood flooring imports mixed in November

US imports of hardwood flooring fell 12% in November.

A large shipment from Brazil (up 170%) nearly made up

for declining imports from nearly all other trading

partners. Imports from Indonesia were off by 48% while

imports from China fell by 59%. Despite the decline,

imports for the month were 6% higher than in November

2022. Imports of assembled flooring panels rose by 6% in

November, rising to a level 2% higher than the previous

November.

The rise was fueled by an 88% increase in imports from

Vietnam which more than offset a 33% decline in imports

from China. Through November, imports from nearly all

trading partners are down versus 2022 totals with imports

down 30% for the year so far.

Moulding imports dip

US imports of hardwood moulding declined for the second

straight month in November, falling 6% from the previous

month. The US$10.4 million in imports was 26% less

than that of November 2022.

Imports from China and Brazil both fell more than 40% in

November while imports from Malaysia rose 33%. Total

imports for the year are 30% less than 2022 through

November.

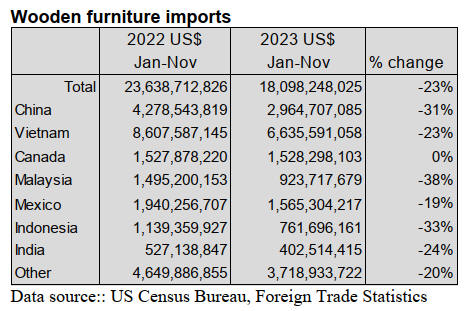

Wooden furniture imports hold steady

US imports of wooden furniture remained relatively steady

in November, falling by less than 2% from the previous

month. The US$1.71 billion in imports was 5% less than

the previous November’s total.

Imports from Vietnam, the top trading partner, were up

3%, but imports from most other countries lagged and

imports from Canada sank by 12%. With the decline, year-

to-date imports from Canada are now only ahead of last

year by less than 1% while imports from most all other

trade partners are down for the year by 20% or more.

Total wooden furniture imports are behind last year’s pace

by 23% through November.

US kitchen and bath remodelers see challenges ahead

According to a nationwide survey conducted by Kitchen &

Bath Design News, remodeling dealers and designers,

although forecasting modest revenue gains in 2024,say

that they harbour nagging concerns about economic

conditions impacting sales revenue, business operations,

and profit margins in the coming year.

When asked about current economic conditions impacting

their business in 2024, 93% of those surveyed told KBDN

that they are either ‘somewhat concerned,’ ‘very

concerned,’ or ‘extremely concerned.’ When it comes to

kitchen and bath remodeling projects, roughly 58% of

those surveyed also reported that pricing is generally more

critical to clients than it was at the same time a year ago.

Price increases for products and raw materials, followed

by a shortage of labor, head a list of challenges facing

kitchen and bath design firms, survey respondents

told KBDN. Other top challenges include long lead times

for products, persistent production and shipping delays,

and customers postponing or canceling projects due to

increased costs.

See:https://www.kitchenbathdesign.com/2024-outlook-dampened-by-market-headwinds-kbdn-poll/

US hardwood lumber exports fell in 2023

US exports of sawn hardwoods declined sharply in 2023

as exporters struggled to compete on price against

alternative species. Sawn hardwood exports had fallen fell

to 1.56 million cubic metres as of August 2023 a 21% year

on year decline. If his pace of decline 2023 exports will

decline be the lowest volume since 2011.

Exports to China fell by 10% and for 2023 it would appear

shipments to China are on pace to decline for a third

consecutive year after peaking in 2020. Sales to other

Pacific Rim markets fell at a steeper rate compared to

China. Shipments to Vietnam declined 23%. The

downward trend in exports was also evident in Europe.

Exports to the United Kingdom, the largest European

market for US hardwoods had plunged 37% up to August

2023.

See:

https://timberlinemag.com/2024/01/u-s-hardwood-exports-fall/

|